The 6 Best Portfolio Analysis Tools For 2022

This blog has partnered with CardRatings for our coverage of credit card products. This site and CardRatings may receive a commission from card issuers. Opinions, reviews, analyses & recommendations are the author’s alone and have not been reviewed, endorsed or approved by any of these entities.

As an Amazon Associate, I earn from qualifying purchases. More information

Have you ever wanted to look at all of your investment portfolios in one place and give them a thorough analysis to see if youre making the right decisions?

If youre fortunate to have all of your holdings with one brokerage, its not difficult to analyze your investments. If you have several accounts, as many people do, its much harder to load them all into a single portfolio analysis tool to review them all together.

And its not like moving funds and stocks around is easy , so moving them all to one place isnt always feasible.

What if I told you there are portfolio analysis tools out there that can analyze your holdings across multiple accounts to give you a better study of how you are set up? If perhaps youre overexposed in some areas or underexposed in others? If your asset allocation is what you intended it to be?

There are many portfolio analyzers out there and many are free but which ones are worth using?

Here are the best portfolio analysis tools right now:

What They Are Saying About Gravitys True Diversification Network

Your graphics are spectactular and diversification maximization may be the next hot thing. Harry Markowitz, 1991 Nobel Laureate in Economics

Absolutely no other program today can create a truly diversified optimal portfolio! You will regret not having it when you see your competition using it with your clients! Key Financial Advisor 40 year industry veteran

With Gsphere I close 30% more business and 50% more high-net-worth business. Financial Advisor, Florida, 30 million AUM

Gravity Investments is an Institutional RoboAdvisory company that works with Registered Investment Advisors, Broker/Dealers and Institutional Investors, in a collaborative fashion, to optimize and automate custom portfolio solutions helping them to offer a white label robo advisor solution to their clients.

The cornerstone of Gravity Investments is Gsphere, an automated digital advice platform and hybrid robo advisor born from a history of advanced analytics and portfolio optimization. The core Diversification Optimization engine produces Diversification Weighted® strategies and can support and improve nearly any asset type or strategy.

The Best Investment Tracking Apps

These are the best investment tracking apps available right now. Each does at least one thing really well, from providing sophisticated financial insights without an expensive advisor to replicating the experience of spreadsheet tracking without all the work.

Our top overall pick has the best array of features and capabilities for both DIY and hands-off investors, and its free version is impressively comprehensive.

Read Also: Is Buying Gold Now A Good Investment

Easier Ways To Track And Analyze

The fact that you have investments does not mean that you have to lay out serious money on managing your assets. In fact, powerful, free portfolio analysis tools are available that will track your net worth, track investment performance, and stay up to date with market trends.

Free portfolio tools like the ones listed here can make a big difference in the way you manage your assets, giving you advantages that you thought youâd never be able to haveâand for free!

What Is A Stock Portfolio Tracker

First, what are we talking about when we ask for the best stock portfolio trackers? We want a tool that can collect all of our investments and give us an understanding of how it is performing. Much like personal finance apps, we want it to be as seamless as possible and give us the ability to quickly analyze our holdings in a variety of ways.

As we list the best options below, we take into account the cost of the subscription , as well as the speed and usability of the platform.

Also Check: Best Green Funds To Invest In

Fund And Portfolio Analysis For Free Anytime Anywhere

FundVisualizer is an advisor-only tool that provides intuitive controls and engaging visuals that simplify your research. Use it to evaluate more than 30,000 funds, ETFs, and indexes, from across the industry. There is no requirement to include a Putnam fund when using FundVisualizer.

To begin using the tool, log in with your business email address and click Compare.

Enter the funds name or ticker and click Add. When done adding funds, click Create Comparison.

When the screen loads, choose from any of the interactive charts displayed to see a comparison of your selected funds. These charts enable you to rearrange the fund display order or to change the representation of various data within the charts.

As you view your charts, add them to your Saved folder, or add them to the PDF Creator and share directly with your clients.

To learn more about how to use the tool, read our other posts or begin using FundVisualizer now.

Registered users have unlimited access to Putnam content.

The third-party information accessible through this site was prepared by, and is the sole responsibility of, independent providers who are not affiliated with Putnam. Putnam has not reviewed the information and does not warrant that the information is accurate, complete, or timely.

For informational purposes only. Not an investment recommendation.

© 2023 Putnam Retail Management, a member of FINRA and SIPC

What’s A Portfolio Tracker

A portfolio tracker is a program or service that allows you to trace the movements of your individual holdings. You can see how your current allocation stacks up with your long-term goals and get an idea of how your portfolio is doing compared to the rest of the market.

You can add portfolios from your investment accounts or create manual portfolios to test out particular strategies. Remember, checking your investments too frequently can lead to excessive trading, but if you want to keep your asset allocation on the right path, a portfolio tracker is a simple and effective way to monitor it.Most brokerages have some sort of tracking and research tool, but you can only use accounts affiliated with that broker.

If you have a 401 with TD Ameritrade and an IRA with Vanguard, youll get access to great research but you wont be able to combine the accounts and form an overall snapshot. With a portfolio tracker, you can better analyze your total allocation and formulate a more pointed strategy.

Recommended Reading: Refinance Mortgage To Buy Investment Property

Best Net Worth Tracking: Kubera

Kubera is a premium net worth and portfolio tracking tool that probably has the most banking, investment, and even cryptocurrency connections available today.

In fact, if you own alternative assets , Kubera is one of the few asset tracking platforms available that actually works with the rest of your portfolio. It’s also one of the only tracking platforms that can track your DeFi assets.

Kubera has quickly become our personal favorite because, along with valuing your alternative assets along-side your equities, they value privacy. It is a premium product, but as a result of paying, your information is not being sold for marketing purposes.

They also have some differentiated features, such as a heartbeat check to send information to your beneficiaries, insurance tracking, and a file vault.

- Many Connections: Connects to just about every bank, brokerage, and even crypto wallets

- Privacy Focus: Your information is private and not used for marketing purposes

- Modern Customizable Interface: Modern, easy to customize interface lets you display your assets how you want to see them.

- Insurance Tracking: One of the only net worth trackers that includes a section to monitor your insurance policies as well.

Cons

- No Mobile Version: There is no mobile version . It’s on the roadmap so we hope this is resolved in the next few months.

- Premium Price: Kubera does have a premium price tag at $15 per month.

Tools Used In Portfolio Analysis

Some of the top ratios used are as follows

1) Holding Period Return

It calculates the overall return during the investment holding period.

2) Arithmetic Mean

It calculates the average returns of the overall portfolio.

R = Returns of Individual Assets

3) Sharpe Ratio

It calculates the excess return over and above the risk-free return per unit of portfolio risk.

4) Alpha

It calculates the difference between the actual portfolio returns and the expected returns.

5) Tracking Error

It calculates the standard deviation of the excess return concerning the benchmark rate of return.

Rp = Return of Portfolio, Rb = Return on Benchmark

6) Information Ratio

Rp = Return of Portfolio, Rb = Return on Benchmark

7) Sortino Ratio

It calculates the excess return over and above the risk-free return per unit of negative asset returns.

Sortino Ratio FormulaSortino Ratio FormulaThe Sortino ratio is a statistical tool used to evaluate the return on investment for a given level of bad risk. It is calculated by subtracting the risk-free rate of return from the expected return and dividing the result by the negative portfolio’s standard deviation .read more = / d

Rp = Return of Portfolio, Rf = Risk-Free Rate, d = standard deviation of negative asset returns

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Portfolio Analysis

Also Check: Best Investment High Interest Rates

Whats The Difference Between A Portfolio Management App Vs An Investment Tracking App

It depends how you define portfolio management.

The name implies actual management of investments stocks, ETFs, mutual funds, bonds, and so on. After all, human portfolio managers actually manage real money held in investment accounts.

But many platforms that call themselves portfolio management apps are basically investment tracking apps. Thats why many of the apps on our list here can also be found on other lists of top portfolio management apps.

Examples Of Portfolio Analysis

Lets understand this concept in more detail with the help of a few examples by making use of these popular tools as discussed.

Example #1

Ryan invested in a portfolio of stocks, as discussed below. Based on the information, calculate the holding period return of the portfolio:

Holding Period Return=/Beginning Value

Below is the use holding period return formula.

Example #2

- Venus investment is trying to undertake a portfolio analysis of one of its funds, namely growth 500, using certain performance measures. The fund has an information ratio of 0.2 and an operational risk of 9%. The funds are benchmarked against the S& P 500 and have a Sharpe ratio of 0.4 with a standard deviation of 12%.

- Venus investment has decided to create a new portfolio by combining the growth 500 and the benchmark S& P 500. The criteria are to ensure a Sharpe ratio of 0.35 or more as part of the analysis. Venus has decided to undertake the portfolio analysis of the newly created portfolio using the following risk measure:

Sharpe Ratio

Optimal Active Risk of the New Portfolio = *Standard Deviation of Benchmark S& P 500

Accordingly Sharpe Ratio of the New Portfolio =

Thus the Sharpe ratio is less than 0.35, and Venus can not invest in the said fund.

Example #3

Raven investments are trying to analyze the portfolio performance of two of its fund managers, Mr. A and Mr. B.

The following details enumerated below are used to measure the information ratio for portfolio analysis purposes:

Also Check: Should I Invest In Stocks Or Roth Ira

The 6 Best Investment Tracking Apps For Portfolio Management In 2023

Quick whats your investment account balance? And what are your top five equity positions as a percentage of total portfolio value?

If you cant answer these questions from memory, youre not alone, especially if youre a hands-off investor who relies on a robo-advisor or human financial advisor to manage your money.

But theres no reason you shouldnt be able to keep close tabs on your investments. An investment tracking app can help but not all are created equal. Some are clearly superior to the rest.

Free Tools To Supercharge Your Investment Portfolio

I’ve hosted the Dough Roller Money Podcast for nearly four years. During that time I’ve received thousands of questions from listeners. By far the most common question is to examine their investment portfolio. They want to know if the mutual funds they’ve selected are the right way to go.

Given the importance of our investments, many are naturally concerned that they are making a serious mistake. They want some comfort that their investment choices are, if not the best, at least reasonable. In response, I recorded a show on how to evaluate an investment portfolio . I’ve also evaluated many portfolios that listeners send to me.

A woman uses a magnifying glass to look at her tablet screen as she monitors stock prices at a… brokerage house in Beijing, Tuesday, Jan. 26, 2016. Asian stock markets sank Tuesday, led by a plunge in the Shanghai index, after a renewed slump in the price of oil kept investors on edge about the global economy.

Through this process, I’ve discovered a number of tools and resources that can help any investor evaluate his or her own portfolio. These tools should not be treated as sacred. Asset allocation is as much art as it is science. But any investor can learn from each of these tools. Note that Future Advisor and Personal Capital are advertisers on my personal finance blog. With that, let’s take a look at what these tools and resources have to offer.

Future Advisor

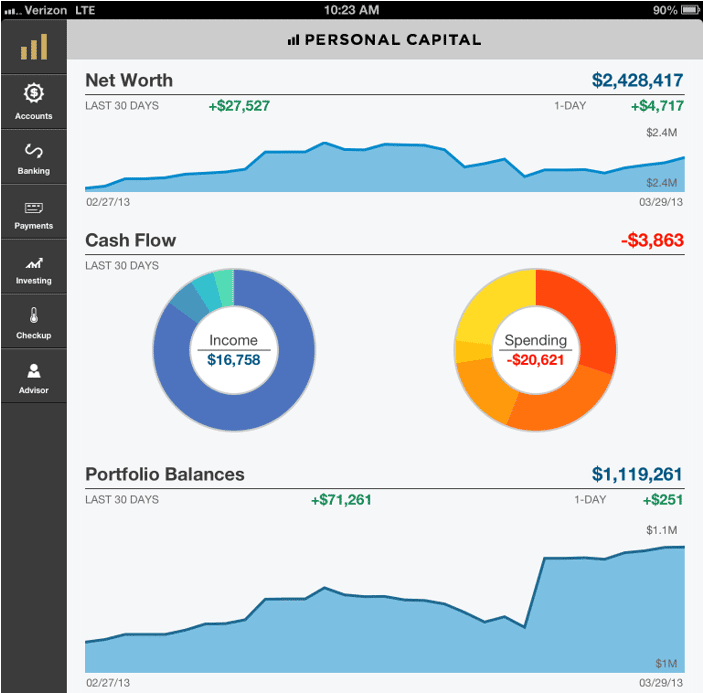

Personal Capital

Screenshot of Personal Capital’s Investment Checkup.

SigFig

SigFig

You May Like: Why Invest In Alternative Investments

My Process And Toolbox For Portfolio Analysis And Diversification

Diversification is one of those words that just SOUNDS GOOD. It practically rolls off the tongue Im going to buy bonds so I can have a more diversified portfolio. Surely these were words that were spoken by someone intelligent. But, diversifying isnt as easy as it sounds.

Ive written before about the dozens of different types of diversification, and I am sure there are dozens more that I didnt even think of. With all of the potential complexity around diversification, things can get confusing. Thats why it isnt a bad idea to pursue some professional assistance from a financial planner.

But, since I am a finance nerd I like to experiment with different model portfolios and see how different investments might help me to diversify and develop a portfolio that will perform well in the good times and the bad.

Heres the process and tools I use for portfolio analysis and diversification.

Why Should You Use Portfolio Management Software

If you just started investing and your portfolio consists of a couple stocks or ETFs held in a single brokerage account, you might not need any of the portfolio analyzers discussed here.

But as your portfolio grows in value and complexity, consider switching over. Programs like these make it much easier to manage the details and keep a bird’s-eye view of your wealth at all times.

In many cases, one of the free trackers will do just fine. At a base level, make sure the program can do the following:

- Allows you to see all of your investments in a single place

- Clearly shows the largest components of your overall portfolio

- Shows which portions are contributing the most to performance

- Pinpoints where your portfolio is getting hit the hardest by fees

For the hardcore investors with multiple brokerage accounts or someone managing money for a family, paying for one of the premium portfolio management applications, like IAM, might be worth it.

Recommended Reading: What Can You Invest In With A Self Directed Ira

Best Portfolio Analysis Tools

The best portfolio analysis tool for you isnt necessarily the perfect tool for someone else. Your best choice is likely one of the following:

- Best free portfolio analyzer and tracker: Personal Capital

- Best investment portfolio tracker app :

- Best for investment portfolio management & analysis: Stock Rover

- Best portfolio visualizer for asset allocation and sector weightings: Morningstar Portfolio Manager

- Best portfolio management software housed locally: StockMarketEye

- Best for comprehensive net worth tracking: Kubera

- Best portfolio analyzer software for money management capabilities: Quicken Premier

- Best for low-cost portfolio analysis and management: SigFig

- Best for personal finance management: Mint

Below, we cover the best portfolio analyzers and analysis tools in detail.

S To Portfolio Analysis

#1 Understanding Investor Expectation and Market Characteristics

The first step before portfolio analysis is to sync the investor expectation and the market in which such Assets will be invested. Proper sync of the expectations of the investor vis-à-vis the risk and return and the market factors helps a long way in meeting the portfolio objective. With a higher information ratio, fund manager B has delivered superior performance.

#2 Defining an Asset Allocation and Deployment Strategy

This is a scientific process with subjective biases. It is imperative to define what type of assets the portfolio will invest, what tools will be used in analyzing the portfolio, which type of benchmark the portfolio will be compared with, the frequency of such performance measurement, and so on.

#3 Evaluating Performance and Making Changes if Required

After a stated period as defined in the previous step, portfolio performance will be analyzed and evaluated to determine whether the portfolio attained stated objectives and the remedial actions, if any, required. Also, any changes in the investor objectives are incorporated to ensure portfolio analysis is up to date and keeps the investor expectation in check.

You are free to use this image on your website, templates, etc., Please provide us with an attribution linkHow to Provide Attribution?Article Link to be HyperlinkedFor eg:Source: Portfolio Analysis

You May Like: How Do The Ultra Wealthy Invest