How Much Interest Will I Pay On A Commercial Loan

The interest paid on a commercial real estate loan will depend on the interest rate charged, the length of the term, and the amortization schedule. To see the total interest charged over time for any type of commercial loan, visit our calculator on this page and look at the “Total Interest” under the Payment Summary chart after inputting your loan amount, interest rate, and amortization.

Commercial Property Loan Calculator

Once an appraiser conducts a standard actual estate appraisal, he seems at the market worth of the house or property. The market worth is predicated off of what different properties in the same worth vary are promoting for.

If you abruptly find yourself unable to meet the phrases of a mortgage agreement, in particular an upcoming balloon fee, the very first thing you need to do is contact your lender. Your lender could possibly talk about reimbursement or loan restructure choices with you. You can also be eligible for refinancing so that you can remove the balloon payment and get right into a loan settlement thats inexpensive for the long term. You will have to find out if there are specific stipulations on the loan. In some mortgage phrases youll be able to repay the steadiness of the loan minus the balloon fee if the balloon is not due throughout the subsequent few funds.

There are additionally 7 and 504 loans available via the small enterprise administration. These loans assist with financing for actual property, inventory, tools, enterprise acquisition startup prices and partner buyouts. Generally, once you begin the applying process, you possibly can expect to receive a preliminary answer or preapproval that very same day or the following business day.

Documentation Needed To Acquire A Commercial Loan

Part of inching closer to closing on your commercial loan, means you will have to provide proofs and documentation before the loan can be finalized. While these are the general criteria requirements for the loan, your loan officer may ask for more or less documentation depending on their loan practices.

Read Also: Commercial Real Estate Analysis And Investment Mit

Commercial Mortgage Calculator Results

Once you enter the values required for each of the three methods above, then our commercial mortgage calculator will instantly display the calculations for each method. Finally, the commercial mortgage calculator will calculate the maximum commercial loan amount that the lender would extend based on the lesser of the three methods. Once you are finished with your analysis, you can copy and paste the sharable link to send a copy of the commercial mortgage calculator so you can share your results.

Understanding Risk For Each

From a bank’s perspective, this subject is cut and dry. Roughly eight out of 10 businesses fail. A company that fails obviously cannot pay its bills. The national foreclosure rate for the United States is 1.04 percent. In other words, businesses are several exponents more likely to fail than consumers are to fail to pay their bills.

Don’t Miss: Invest In Penny Stocks Online

Commercial Mortgages Vs Home Loans

Understanding the difference between commercial mortgages and home loans can seem tricky. After all, the rules of business are different from the ones for an individual. While both parties have to pay the bills to keep the lights on, money lenders understand that there is nuance between these two types of loans. Here is what you need to know about the similarities and differences between commercial mortgages and home loans.

Commercial Mortgage Loan Package

If you need to put together a commercial loan package to submit to a lender then you might consider using our Proforma software. Our Proforma app helps you create and share a multi-year commercial real estate proforma for simple and complex property types. We include functionality for complicated leases, reimbursement structures, market leasing profiles, inflation profiles, and lots more. Plus, you can not only calculate a maximum loan analysis, but also common financial ratios, an amortization schedule, loan draws for a construction loan, a discounted cash flow analysis, and more.

Don’t Miss: 15 Year Or 30 Year Mortgage For Investment Property

Differences In Early Payment

In most instances, lenders do not mind early repayment of home loans. Occasionally, a contract includes a clause that there will be a slight penalty, but such a situation is the extreme exception. Lenders are in the business of poaching clients from one another via refinancing. Clauses that add to the difficulty of such transactions are bad for business.

Commercial mortgages operate with much differently. Lenders provide loans predicated upon the expectation that they will receive all anticipated interest over the life of said loan. With so many risks inherent to these transactions, banks want to ensure that they will get their money. As such, including early repayment penalties happens in virtually every commercial mortgage.

The lender’s contract generally works on a sliding scale. The early repayment fee is highest at the start of the loan. The fee reduces on an annual basis as the bank acquires more of the promised interest. Were lenders to pass on such fees, they would frequently lose out on potential gains in a risk-intensive industry, which is counterproductive to their goals.

Owning a home and owning commercial property are very different things. Home mortgages are relatively safe investments for lenders while commercial loans are chaotic and risk intensive. Understanding the differences between the two transactions should empower you as a potential borrower in either capacity.

Residential Mortgages Before The Great Depression

In the early 1920s before the Great Depression , mortgage lending was largely dominated by commercial banks, life insurance companies, mutual savings banks, and thrifts . Most residential mortgages were commonly structured in 5-year balloon mortgages, while others were 11 to 12-year fully amortizing mortgages. Many borrowers also took a form of hybrid mortgage, financing 50 percent of the houses value with an interest-only balloon loan, then later refinancing the remaining debt with an amortizing loan to extend the term.

The early payment structure was based on the assumption that borrowers would have enough available credit to repay the mortgage. Lenders and borrowers expected asset prices to rise infinitely, and tended toward refinancing their loans. It left homeowners with no choice but to make large payments, most notably by the end of the term. If they could not pay the large sum, they kept on refinancing. This made consumers vulnerable to default and the risks of tightened credit, which eventually led to mass foreclosures. By 1933, around 40 to 50 percent of all residential mortgages in the United States were in default.

The Creation of Fannie Mae and Freddie Mac

Read Also: Piggyback Loan For Investment Property

Understanding Our Commercial Property Mortgage Calculator

Simply put, theres no support item more convenient and more versatile than the Clopton online commercial mortgage calculator, also offered to you for free in iOS and Android mobile formats. It is easily located by searching commercial mortgage calculator in either the App Store or Google Play. Whichever way you decide to throw your numbers around the 3 versions all work the same way allowing you to effortlessly input your information for split-second results. Try it today as the starting point for building a commercial leverage plan that centers on such key items as ROI, monthly payments and effective interest rates.

Heres how it works:

Simply input your purchase price and loan to value amount and the easy to use commercial mortgage calculator will give you pertinent data including:

- Cash Flow After Debt Service

- Return on Investment

We are cognizant of the way private investors, business owners, small/middle market real estate entities, and family offices everywhere in the US function, and we know that an on-the-go lifestyle features most of the time. So we structured our Commercial Loan Calculator to be easy to use wherever you are: seated in an investment meeting perhaps, or possibly touring a property. By conveniently putting a live pocket geek in your hand we can help you understand your position at a moments notice.

What a Commercial Real Estate Mortgage Calculator Cant Tell You

Contact Clopton Capital

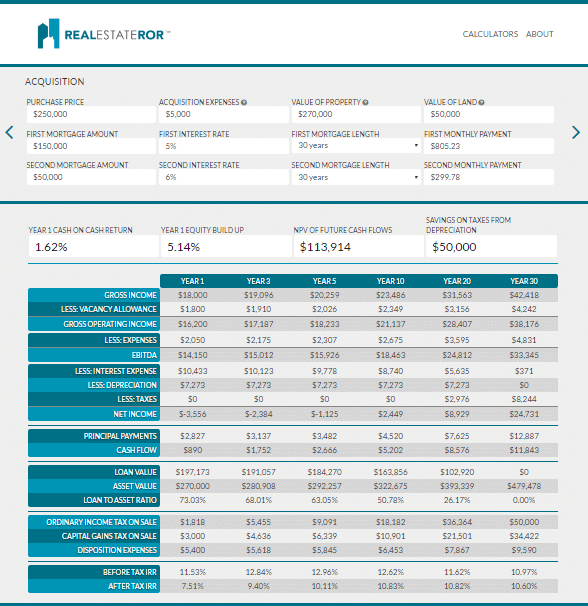

Internal Rate Of Return

Internal rate of return or annualized total return is an annual rate earned on each dollar invested for the period it is invested. It is generally used by most, if not all, investors as a way to compare different investments. The higher the IRR, the more desirable the investment.

IRR is one of, if not the most important measure of the profitability of a rental property capitalization rate is too basic, and Cash Flow Return on Investment does not account for the time value of money.

Don’t Miss: Investing In Real Estate Rentals

What Are 15 Year Balloons Used For

A 15-year balloon mortgage is a form of financing where the homeowner makes principal and interest payments for 15 years. Subsequently, at the conclusion of the 15 year term, they are required to pay the amount of money still owed. The 15 year has also become a preferred loan choice for a second mortgage in a piggyback agreement. Its become more and more common for borrowers that put less than 20% down to opt for piggyback options instead of purchasing mortgage insurance.

A piggyback can be a first mortgage for 80% of the homes value and a second mortgage for 5% to 20% of value, depending upon how much the borrower puts down as a payment. In some cases the second mortgage is an adjustable rate however an increasingly common option is the 15 year balloon.

Less Liquid But Highly Relevant

Though there are loans backed by the government, commercial mortgages take up a smaller percentage of the real estate market. Generally, commercial real estate loans are much less liquid. Residential mortgages, on the other hand, receive more government backing which further stimulates liquidity. Nonetheless, commercial real estate loans are essential and highly valuable for economic growth.

Business owners can take advantage of commercial mortgages for the following objectives:

- To purchase business property

- Secure land development ventures

- Purchase buy-to-let property and rent them out

Similar to residential loans, commercial mortgages allow you to borrow money which is secured against the property. But instead of obtaining homeownership, commercial loans function as the principal resource for financing a business. Its designed to benefit private lenders and business owners alike.

Private lenders seek security from lending commercial mortgages. Meanwhile, business owners can own commercial property and do away with the long-term cost of renting. Likewise, they utilize the loan to build their company.

Read Also: Buying Investment Property For Airbnb

How Long Is A Typical Commercial Mortgage

Typically, the term of a commercial mortgage can be anywhere from 1-10 years, with limited exceptions for longer terms on self-amortizing loans such as SBA loans , insurance or Fannie Mae loans , or FHA loans . However, the amortization schedule is typically longer than the 1-10 year loan term in order to keep the monthly payments affordable for the borrower.

We’ve Gone Ahead And Gathered Some Useful Terms And Definitions To Help You On Your Way To Acquiring The Right Commercial Real Estate Loan To Suit Your Needs:

-

Prime Rate: This standard of comparison for interest rates offered by lenders is essentially the interest rate given to a lender’s most creditworthy clients. Also known as the prime lending rate, it is based on the verifiable assumption that these larger commercial borrowers have a much lower risk of defaulting on a payment.

Also Check: Best Place To Invest My 401k

Documentation And Processing Time

Ask your lender about the required documents before applying for a commercial loan. Lenders typically require your companys tax returns and financial statements in the last 3 to 5 years. They review this to evaluate the stability of your business.

Gather the following documents for your application:

- Corporate financial records

- Financial history and profiles of business partners

In addition, they may ask for other documents apart from those mentioned above. Be sure to supply the requested paperwork to avoid delays. Understand that more documents will take a longer time. Lenders perform thorough verification before they approve commercial mortgages.

Conduit Or Cmbs Loans

A conduit loan, also called a commercial mortgage backed security loan, is a kind of commercial real estate loan backed by a first-position mortgage. Conduit loans are pooled together with a diverse set of other mortgages. Then, they are placed into a Real Estate Mortgage Investment Conduit trust and sold to investors. Each sold loan carries a risk equivalent to its rate of return. This type of loan is also used for properties such as retail buildings, shopping malls, warehouses, offices, and hotels.

Conduit loans can provide liquidity to real estate investors and commercial lenders. They are package by conduit lenders, commercial banks, and investment banks. These loans usually come with a fixed interest rate and a balloon payment by the end of the term. Some lenders also allow interest-only payments. Conduit loans are amortized with 5, 7, and 10-year terms, as well as 25 and 30-year terms.

Read Also: Best Blockchain Technology To Invest In

Occupying Business Property Premises

A small business must occupy 51 percent of the commercial property. Not using more than half of the building will make you ineligible for a commercial mortgage. If your business cannot fulfill this condition, you should apply for an investment property loan instead.

Investment property loans are designed for rental properties. It is commonly used to buy property and rent them out for additional income. This type of financing is also used to flip and sell houses for profit.

Factoring The Closing Costs

Besides gathering a significant down payment, you should prepare your finances for other expenses associated with closing a loan. Refer to the following commercial loan fees below:

Underwriting Fees

Commercial lenders pay a fee for the time their staff dedicate to underwriting and processing a loan request. This typically costs around $500 to $2,500. That fee must be stated in the term sheet and is usually paid upfront or via deposit once the loan term is implemented.

Lender’s Origination Points

Most banks and credit unions charge 0.25 to 0.5 of the loan amount for origination fees. For independent lenders, it can be 2 percent or higher because of the higher risk involved.

Appraisal Fees

Expect appraisal cost to be anywhere between $1,000 to $10,000. Large-scale commercial projects can even cost between $10,000 to $25,000 for appraisal.

Third-party appraisal is commonly done to analyze and estimate the value of the commercial property. Though it’s not strictly imposed, appraisal is commonly practiced by many private lenders. Third-party appraisal is especially required for federally-backed commercial real estate exceeding a value of $500,000.

Title Insurance Policy

Title search and insurance costs around $2,500 to $15,000. This protects the lender from financial losses in case there are claims against the property’s title.

Property Inspections

Environmental Report

Broker’s Fee

Don’t Miss: How To Invest In Stocks And Get Rich

How Your Commercial Mortgage Payments Are Calculated

Our commercial mortgage calculator estimates your monthly commercial mortgage payments based on 4 major criteria. Loan amount, interest rate, loan term, and collateral affect your monthly mortgage payment and the total cost of the loan. Because interest rates and terms can vary depending on whether the property is an investment property or owner-occupied, we have a commercial mortgage calculator for each scenario to give you the most accurate estimates possible.

Common Sources Of Commercial Mortgage Financing

There are many sources of commercial financing in the market. Commercial loans are offered by banks, credit unions, insurance companies, and government-backed lenders. Private investors also lend commercial mortgages but at much higher rates.

The right kind of commercial loan for your business depends on the loan features you need. You must also factor in your business strategy, the type of commercial property, and your credit availability.

Below are several common types of commercial loans and where you can obtain them:

Don’t Miss: Opportunity Zone Investment Funds Vanguard

Can A Salaried Person Apply For A Business Loan

A salaried person can apply for a business loan only if they have a registered business. Many people hold on to their jobs while they run fledgling companies. Whether or not a salaried person is running it, Joseph says a lender typically wants to know that enough time is being committed and that the revenue being generated will mitigate risk. They want to know that the business will be able to support itself.

Commercial Loan Terms And Payment Structure

Commercial mortgages come in short terms of 3, 5, and 10 years. Others stretch as long as 25 years. But in general, commercial mortgage terms are not as long as most residential loans, which is usually 30 years.

When it comes to the payment structure, expect commercial loans to vary from the traditional amortizing schedule. A lender asks a borrower to pay the full loan after several years with a lump sum payment. This is called a balloon payment, where you pay the total remaining balance by the end of the agreed term.

For instance, a commercial loan has a balloon payment due in 10 years. The payment is based on a traditional amortization schedule such as a 30-year loan. Basically, you pay the first 10 years of principal and interest payments based on the full amortization table. Once the term ends, you make the balloon payment, which pays off the remaining balance in the mortgage.

Furthermore, you have the option make interest-only payments in a commercial loan. This means you do not have to worry about making principal payments for the entire term. Likewise, once the loan term is through, you must settle any remaining balance with a balloon payment.

In some cases, commercial lenders offer fully amortized loans as long as 20 or 25 years. This is how certain Small Business Administration loans are structured. And depending on the commercial loan and lender, some large commercial mortgages may be given a term of 40 years.

You May Like: Best Way To Invest In Startups