Are Investment Apps Safe

Investment apps tend to be very safe. They will normally require passwords, PINs as well as biometric identification, making it hard for someone to access them even if you lose your phone of its stolen.

But some of them will allow you to do without the biometric security. If youre only protecting access with a password or PIN, dont write it down anywhere, and use a secure password that cant be guessed.

If your phone is stolen, let your investment platform know right away and login on another device to change your passwords.

Bonus: Best Money Tracker

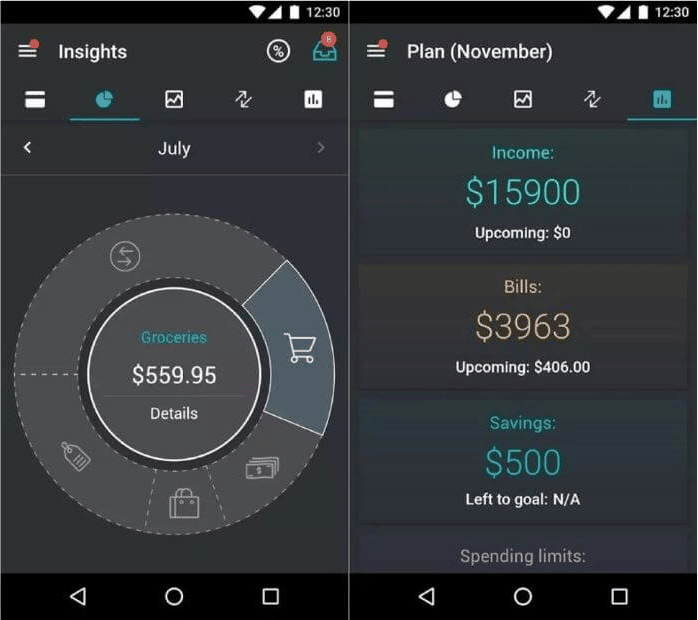

All the apps mentioned above are great ways to save or invest without having to put in much extra effort, however, to save significant sums of money, its essential to figure out where yours is going and to have some accountability. Although there are lots of different apps that offer this feature, none quite measure up to Personal Capital.

You can connect all your accounts in one place, including current accounts, credit cards, and even investments. Personal Capital also allows you to analyze your investment in sophisticated ways: you can check how well your portfolio is performing and find out if youre paying unnecessary fees. Its kind of like a bill checker and a budgeting app all in one.

The basic platform is available for free, but theres a charge to receive professional advice from finance experts if your portfolio is worth $100,000 or more.

Don’t spend your entire life working a job you don’t love so that you can maybe retire at 65.

Most of what’s published and shared about money is either wrong or so old school that it’s obsolete.

The challenge isn’t how to make more money, it’s how to make and use money to live a life you love, with time and space for yourself.

And that’s the heart of Millennial Money: stop hustling yourself into a breakdown and stop wasting time by managing money poorly.

Let’s stop the grind, together.

Get free access to Grant’s best tips along with exclusive videos, podcasts, courses and way more.

Webull Popular Investment App For Trading Us Stocks

Webull offers a popular investment app for both iOS and Android users. The app is free to download and it takes just minutes to register a new account. After getting verified, Webull then allows its users to deposit funds with ACH or a domestic bank wire. Its best to opt for the latter which is free.

Otherwise, when opting for a domestic bank wire, Webull will charge an $8 transaction fee. There is no minimum deposit requirement stipulated by Webull on standard trading accounts. Webull is perhaps the best investment app for those looking to buy and sell US-listed stocks.

Across thousands of companies listed on the NYSE and NASDAQ, Webull users can trade stocks at 0% commission. The minimum stock trade requirement is just $5, so diversification is simple and cost-effective. Those looking to invest in stocks listed overseas will be disappointed, as Webull only supports a few hundred ADRs.

Webull, does, however, support stock trading options on its investment app. This allows users to gain exposure to US-listed stocks without needing to outlay the full capital requirement. Thus, this is an indirect way to obtain leverage. With that said, the Webull investment app also offers margin trading accounts to eligible users which requires a minimum balance of $2,000.

| Minimum Deposit |

Your capital is at risk

Recommended Reading: Roth Ira Vs Investment Account

Wealthfront Managed Portfolios From Just 025% Annually

The final provider to consider from our list of the best investment apps is Wealthfront. This option will be suitable for those that wish to invest in the financial markets but dont have the knowledge or required time to research individual assets.

This is because Wealthfront offers managed portfolios which are initially built based on the investors investment objectives and tolerance for risk. After the portfolio goes live, Wealthfront will automatically rebalance and reweight the basket of assets to ensure that it aligns with the investors goals.

In terms of fees, Wealthfront charges just 0.25% annually for its managed portfolio service. This works out at just $2.12 per month for every $10,000 invested. We also like the tax-loss harvesting feature at Wealthfront. This allows investors to find tax savings automatically when the broader market dips.

| Minimum Deposit |

Your capital is at risk. 68% of retail investor accounts lose money when trading CFDs with this provider.

Best Automatic Saving Apps

We all know saving money is important, but finding the motivation or even remembering to tuck your money away can be the hard part. We found several apps that help you save money the way that works for you. Apps that round up change, for instance, move your spare change into a savings account.

For most of these, youll need to download the app, set up a profile, and link your checking account or credit card.

Also Check: How To Invest In Cryptocurrency Mutual Funds

Read Also: Investing In Portland Real Estate

How Much Do Investing Apps Cost

Price is a big factor when choosing an investment app, so it’s crucial you know what you’re paying for. After all, any costs or fees you aren’t aware of can eat away at your investment earnings over time.

Many investment apps are free to download and offer zero-commission trades, which means that investors aren’t charged for the broker executing the trade.

Investing in mutual funds or ETFs, however, will likely require paying management fees or expense ratios.

According to Investopedia, investors should expect a “reasonable” expense ratio for an actively managed portfolio to be between 0.5% to 0.75%. For passive or index funds, the typical ratio is lower at about 0.2% and can be as low as 0.02% or even less in some cases. These are benchmarks that you can use when shopping around for an investment app.

Best Investment Apps 2022 Top Investing Apps Compared

Investment apps allow traders to buy and sell assets via their smartphones. This ensures that the investors are never more than a click away from the financial markets.

In this guide, we compare the best investment apps in the market today for supported assets, low fees, accepted payment types, safety, and user-friendliness.

Recommended Reading: How Do I Learn To Invest In Stocks

Equ8 Error The Update Requires Administrative Privileges

2022. 9. 30. ·We chose SoFi Invest as our best investment app for beginners. Other categories: best for automated investing, … 2022-09-30T17:46:27Z A bookmark. The letter F. An envelope. It indicates the.

3. Kraken: Best crypto appforbeginners 4. eToro: Best crypto investmentapp 5. FTX.US: Best crypto trading app 6. Gemini: Best crypto appfor earning 7. Trust Wallet: Best mobile crypto wallet app 8. Robinhood: Bestappfor stocks and crypto 9. Binance.US: Best crypto appfor low fees How to choose the best crypto app in the US Risks.

At $3 a month, the fee can quickly eat up a big chunk of your returns if you’re only investing a few bucks a month. Acorn’s app is available to download for free in both the App Store (for iOS. Here are the main steps you will have to take if you want to buy Twitter stock now: Open an online brokerage account. Fund your brokerage account. Research your stock pick, i.e. Twitters performance. Confirm your investment amount. Search for TWTR. Place an order for Twitter stock. Review your Twitter stock investment.

samsung waterwall dishwasher recall

We have brought you here the 9 bestinvestmentappsforbeginners 1. SoFi Because of its simple-to-use interface and low pricing, SoFi is a great choice for novices. SoFi Invest allows you to start investing with just $1, and there are no trading charges or ongoing account fees.

Acorns Automatically Invest Spare Change

Acorns is an investment app used by over 9 million clients. It offers a super innovative concept, whereby everyday transactions can be rounded up to the nearest dollar and subsequently invested into the financial markets. For instance, lets suppose that an Acorns user buys a cup of coffee for $3.40.

As per the users account settings, Acorns will deduct $4 from the linked debit card, with the $0.60 balance being used to buy ETFs. This means that users can invest bits and pieces into the markets without a second thought. This is also a great strategy for dollar-cost averaging purposes.

The portfolios that Acorns offer are hand-picked by industry experts and are aimed at long-term investors. Rebalancing is done on behalf of account holders, so this offers a passive way to invest. There are five portfolio strategies in total, ranging from conservative to aggressive. When it comes to fees, Acorns charges $3 on personal accounts.

Family accounts which include children, costs $5 per month. All account types offer additional perks, such as free educational material, the ability to receive a salary two days early, and fee-free access to over 55,000 ATMs. Retirement plans can also be accessed on the Acorns investment app.

| Minimum Deposit |

- Users are unable to invest in individual stocks

- Too basic for serious investors

Also Check: Investment Property Refinance Rates 15 Year

D2 Merc Dying With Treachery

Bestfor long term savings, ISAs. Nutmeg is my personal favorite for long-term investments in ISAs. One for UK investors and accounting for over 185,000 users, the Nutmeg app can be used to manage. 2021. 12. 28. ·Selecting the perfect funding app could be a robust resolution. In spite of everything, there are so much to select Best Investment Apps 2022 | For Beginner or. BlackRock Investments. BlackRock is a multi-national investment company based in New York City. It was founded in 1988 as a risk management company and eventually became an institutional asset manager in the field of fixed income. As of January 2022, it managed US$10 trillion in assets. This makes BlackRock one of the largest asset management. 2022. 6. 28. ·Robinhood was established by Vladimir Tenev and Baiju Bhatt in 2013 and is currently headquartered in Menlo Park, California.. The platform is a true pioneer in the no.

The best investing appsfor2022: Acorns: Bestfor investing with little money. Stash: Bestforbeginners. Robinhood: Bestfor low cost. TD Ameritrade: Bestfor investor education. 2022. 10. 23. ·Best savings and investment apps and platforms, compared and reviewed by our experts. Best for beginners, intermediate investors and pros. Compare fees, assets available and read reviews. Compare Banks. Personal Businesses.

2022. 10. 23. ·List of Top 5 Best Mobile Trading Apps for Beginners in India 2022: Sl.no. Trading App for beginners. Ratings. 1. Zerodha Kite App. 9.81/10. 2. Upstox PRO App.

How Do I Start Investing With Little Money

The good news is that you can start investing with spare change. Look for an investment platform like Acorns that has no minimum required deposit, and that will let you set up an automatic transfer of a small amount. For example, you might be able to set up a transfer of as little as $5 per week, which makes it easy to start investing even if you dont have a lot of money. Some platforms also allow you to set roundups, so you can round up your purchases and automatically invest the difference.

Look for platforms that allow you to use this type of micro-investing to get started.

You May Like: Chuck Hughes Investment Software Systems Inc

Desktop Vs Mobile Experiences

Desktop trading platforms still have a strong customer base because of the superior trading experience they provide. Thanks to the growth of app-only retail investors, however, brokers cant focus solely on the desktop experience. Mobile-first and mobile-only brokerages already exist, and established brokers are having to simultaneously develop their desktop and mobile platforms to keep up.

To do this, many brokerages have changed their product approach to focus on creating a consistent experience across multiple devices. This means you can usually find similar workflows and key tools regardless of which platform you are on. This comes with a trader-specific caveat, as many desktop platforms intended for active traders have to cut out a lot more when transitioning to mobile when compared to brokerages with platforms aimed at average investors.

The extent of this feature reduction has been lessened as the smartphone technology running these trading apps has improved, however, and more brokers are aligning and synchronizing key features across both the mobile and desktop workflows such as analysis, research, screening tools, money movement, and charting. More recently, complex trading strategies originally reserved for desktop experiences like multi-leg options trades and contingent orders have been enabled on apps as well.

Best Investment Apps For Beginners In 2022

Time constraints are one of the biggest obstacles for aspiring investors and even experienced investors trying to grow their portfolios. A packed schedule gets in the way of the research and management required to develop a successful financial portfolio. Todays best investment apps for beginners and everyday investors aim to solve that problem by making your finances accessible straight from your smartphone.

There are apps dedicated to almost every investment strategy and at every skill level. From beginners ready to make their first investment to advanced entrepreneurs looking to trade stocks on the go, the right app can make many financial actions more accessible. Keep reading to find the best investing apps and start building your portfolio straight from your phone.

Read Also: Real Estate Investing For Beginners Podcast

Which Money Saving App Is For You

Even if youre the worlds worst budgeter, its still possible to save money as long as you have a smartphone. All you need to do is download a few apps and complete some basic admin tasks before you can passively earn some extra money. cIf you want to take things a step further, here is a list we have compiled of the best money making apps.

If you cant afford to save and just want some extra cash to line your pockets, a cashback or bill-checking app can seemingly give you something for nothing. All you have to do is link your card or bills, and the app will check whether youre applicable for discounts or lower rates.

If you want to save or invest but get drawn into spending the money instead, there are apps that automatically put aside the small change from your purchases to help you reach your goals.

However, dont fall into the trap of thinking that downloading apps is all it takes to form a solid financial management plan. In reality, its just the first step: keeping a budget and tracking your spending is just as important as ever. Thankfully, theres also an app for that.

Why We Chose It

Wealthfront is our pick for the best investing app for a few reasons.

One distinction that makes Wealthfront great is that it keeps things inexpensive. There is a $500 minimum deposit to open an account, but no fee to make trades. There is a fee of 0.25% of your assets each year, but the service offered makes this fee worth paying for many customers.

Beyond being a good app for people who want to manage their own investments, Wealthfront is our pick for the best automated, or robo-advisor, investing app.

When you open an account, you can answer a few questions about your investing goals. Wealthfront automatically designs a diversified portfolio for you and can manage your investments on your behalf. All you have to do is add money when you have some extra to save. The program even claims to save more than it charges, using automated tax-loss harvesting.

People who want a more hands-on investing experience can take a more active role in managing their portfolios with Wealthfront, making it a great app for anyones investing approach.

-

96% of clients see fees offset by tax-loss harvesting

-

Cash management account available

-

You still have to pay the 0.25% annual fee if you self-manage your portfolio

-

Limited investment options

You May Like: Chartered Alternative Investment Analyst Caia

Are Investment Apps Safe To Use

Yes, investment apps are safe to use in the same way it is safe to use a brokerage firms website to invest. These apps use industry-standard security tools and protocols to keep your data safe. They also have insurance from the Securities Investor Protection Corp. , which protects against the loss of up to $500,000 in securities and cash if the member app provider winds up in financial distress.

The Perfect Investment App To Learn Investing

It wont take you long to learn the ropes when youve got Invstr by your side.

This investing app has all the tools, features, and investment demonstrators that you need to learn all about investing.

In a nutshell, Invstr is what you get when you combine real-time investing, a knowledgeable community of investors, and a shallow learning curve altogether.

After backing you up with knowledge coming directly from veteran investors, you can plunge into the world of stocks where you can seamlessly trade, invest, multiply your revenue and learn along the way.

The best part about this investing app is that it gives you a demo account or, as Invstr likes to call it a Fantasy Finance, where you can assist in managing a $200 billion digital portfolio.

Moreover, the Fantasy Finance game also gives you $1 million in digital money that you can use to learn and $5 for free whenever a new user opens and funds an account.

Plus, the apps social networking capabilities and the news feed can be leveraged to ideate new strategies and implementation to get an edge in the market.

The app also gives you the freedom to turn your fantasy picks into real-life investments by enabling you to buy fractional and whole shares in the app.

Oh, and did I mention commission-free?

Yes, the investments youll make are commission-free, so thats another great advantage of using Invstr.

You May Like: What Is The Best Free Investment App