How We Approach Editorial Content

Maintaining independence and editorial freedom is essential to our mission of empowering investor success. We provide a platform for our authors to report on investments fairly, accurately, and from the investors point of view. We also respect individual opinionsthey represent the unvarnished thinking of our people and exacting analysis of our research processes. Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research.

Read our editorial policy to learn more about our process.

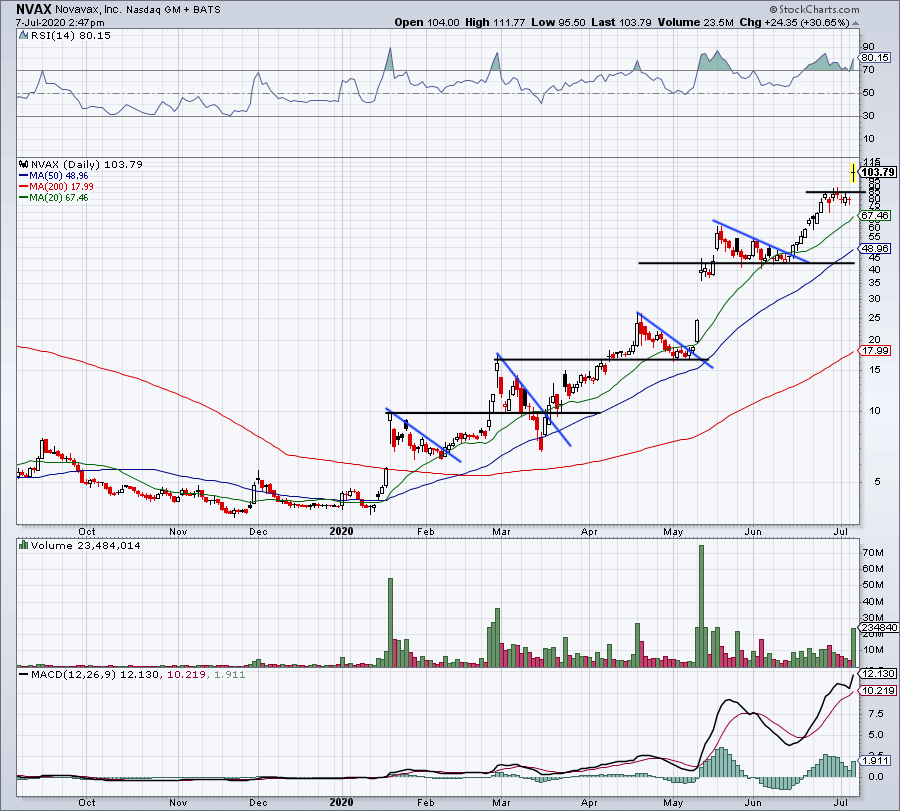

Technical Analysis Of Nvax Stock

Variant news has impacted Novavax stock.

Novavax stock has a poor Relative Strength Rating of 3. The RS Rating pits all stocks, regardless of industry group, against one another in terms of 12-month price performance. On this measure, NVAX stock ranks in the bottom 3% of all stocks. Leading stocks tend to have RS Ratings of at least 80.

NVAX stock isn’t currently forming a definitive chart pattern, shows. On Oct. 31, shares were below their 50-day moving average and 200-day line.

Invest In Novavax Inc On Stash

To buy fractional shares

Disclaimer: Any investment youâve selected here, which may be available to Stash customers on the Stash platform, is intended to be used for informational purposes only, should not be relied upon as the sole basis for making any investment decision, and is not intended to be a recommendation or advice by Stash that is based on your investment time horizon and/or risk tolerance. This information should not be relied upon by the reader as research or investment advice regarding any issuer or security in particular. Investors who become Stash customers are offered investment advice and recommendations through various digital features such as Diversification Score Analysis based on what they tell us about their time horizon and risk tolerance. Investing Involves Risk.

Stash resources for confident investing

Read Also: How To Decide What Crypto To Invest In

Revenue Is Right Around The Corner

has taken investors on quite an exciting ride since it entered the coronavirus vaccine race. The biotech leaped into the spotlight in the early days of the pandemic when it won $1.6 billion in support from the U.S. government. And the company finished 2020 with a gain of more than 2,700%.

But the Novavax story became more complicated last year. Investors expected Novavax to apply for U.S. regulatory authorization in the first half. Instead, troubles with a manufacturing ramp up got in the way. The stock has dropped nearly 60% from highs reached in February of last year. Novavax has since resolved its production issues and today is on track to apply for U.S. authorization in about a month. Now the question is whether we should hang on to hopes and buy or hold the shares — or whether we should sell. Let’s take a closer look.

Image source: Getty Images.

Does This News Make Novavax A Buy

This recent news does improve the prospects for the healthcare company but it will still come down to how many people end up taking Novavax’s vaccine. At this point, there’s still uncertainty as to whether people who haven’t received boosters or primary doses have been waiting for Novavax’s shot or if they’re holding out for other reasons.

Until there’s more clarity around that, this will remain an ultra-risky stock to buy. The news for Novavax is great, but it still needs to translate into sales. And because that’s by no means a guarantee, the best option for investors is to simply hang tight and wait and see if that happens before buying shares of Novavax.

David Jagielski has no position in any of the stocks mentioned. The Motley Fool recommends Moderna Inc. The Motley Fool has a disclosure policy.

You May Like: How To Invest Money In Us Stock Market

Can This Turn The Stock’s Fortunes Around

is a beaten-down COVID stock that has seen its shares plummet 85% since the start of the year. Mounting losses and drastically slashed guidance, plus a COVID-19 vaccine market that looks to be diminishing in size, are the key reasons why investors have been bearish on the stock this year.

However, the company did receive good news recently. The Food and Drug Administration granted its vaccine Emergency Use Authorization as a booster for adults. And the Centers for Disease Control and Prevention gave people 18 years of age and older the green light to use it as a booster, even if they’ve received Moderna or Pfizer shots as their primary doses.

It’s a win for the company. But does this news make Novavax’s stock a buy, or is it simply too little, too late?

There’s Good News And There’s Bad News

NVX-CoV2372 was also 100% effective at preventing severe cases of COVID-19, no matter the viral strain. This year, the company expects to produce 2 billion doses of the vaccine, contingent on approval.

Having an annual production capacity of 2 billion might sound like a lot at first. On a closer look, however, the problem of actual fulfillment becomes an issue. Out of that amount, only about 300 million or so have been preordered by developed nations like the U.S., Canada, Australia, New Zealand, etc, at a price of $16 per dose. That’s about $4.8 billion in revenue for a company with a market cap of $14 billion, giving the stock a price-to-sales ratio of just 2.9. Not bad, right?

Unfortunately, Novavax is having trouble turning a profit after those initial lucrative preorders. For starters, it’s donating up to 1.1 billion doses of its experimental vaccine to developing nations.

Secondly, the company is now delaying a 200 million-dose supply agreement with the EU due to a U.S. export ban on the vaccine’s raw materials. Novavax has eight production facilities/contract manufacturing organizations around the world to assemble NVX-CoV2373. The largest of these is the Serum Institute of India, which promises to make over 1 billion doses of Novavax’s vaccine candidate each year.

The only issue? There are many flu vaccines available, all eyeing a meager $6.5 billion global market.

Don’t Miss: Investing In Real Estate Fundrise

Why Moderna Stock Dropped Today

What happened Shares of Moderna fell 7.9% on Wednesday after health regulators authorized Novavax’s COVID-19 vaccine, Adjuvanted, as a booster for adults. So what The Centers for Disease Control and Prevention will allow Novavax’s vaccine to be used as a first booster shot for people aged 18 and older who would rather take it than initial boosters offered by Moderna and Pfizer .

Grading Novavax Inc Stock

Stock evaluation requires access to huge amounts of data and the knowledge and time to sift through it all, making sense of financial ratios, reading income statements and analyzing recent stock movement. To help individual investors with that daunting task, AAII created A+ Investor, a robust data suite that condenses data research in an actionable and customizable way suitable for investors of all knowledge levels.AAIIs proprietary stock grades come with A+ Investor. These offer intuitive A-F grades for each of five key investing factors: value, growth, momentum, earnings revisions and quality. Here, well take a closer look at Novavax, Inc.s stock grades for value, growth and quality.

Also Check: What Is A Good Ira To Invest In

Fda Authorizes Novavax Covid

The Food and Drug Administration granted emergency authorization to Novavax Covid-19 shot as a booster for adults. The shot targets the original strain of the virus, whereas the updated booster shots from Moderna and Pfizer and its partner BioNTech SE authorized in August by the FDA, target both the original strain and newer Omicron strains. The Novavax shot also uses a protein platform, whereas the other two companies boosters use messenger RNA, a newer technology.

Now Is A Great Time To Open A Position

While the market is highly negative on Novavax stock right now, I see a lot of positives. Novavax’s stock is very cheap relative to its strong cash position. The market values Novavax as essentially worthless as a drug company, since its market cap and its cash balance are the same number.

This negativity overlooks the fact that Novavax has a blockbuster drug on the market, one that’s already brought in over $1 billion in revenues . While I hope that COVID-19 disappears into nothing, in reality, I suspect that we will be vaccinating against this threat for years to come.

This article was written by

Disclosure:I/we have a beneficial long position in the shares of NVAX either through stock ownership, options, or other derivatives.I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it . I have no business relationship with any company whose stock is mentioned in this article.

Recommended Reading: How Do I Invest In Disney Stock

Is Trending Stock Novavax Inc A Buy Now

has been one of the most searched-for stocks on Zacks.com lately. So, you might want to look at some of the facts that could shape the stock’s performance in the near term.

While media releases or rumors about a substantial change in a company’s business prospects usually make its stock ‘trending’ and lead to an immediate price change, there are always some fundamental facts that eventually dominate the buy-and-hold decision-making.

Earnings Estimate Revisions

Here at Zacks, we prioritize appraising the change in the projection of a company’s future earnings over anything else. That’s because we believe the present value of its future stream of earnings is what determines the fair value for its stock.

Our analysis is essentially based on how sell-side analysts covering the stock are revising their earnings estimates to take the latest business trends into account. When earnings estimates for a company go up, the fair value for its stock goes up as well. And when a stock’s fair value is higher than its current market price, investors tend to buy the stock, resulting in its price moving upward. Because of this, empirical studies indicate a strong correlation between trends in earnings estimate revisions and short-term stock price movements.

For the current quarter, Novavax is expected to post earnings of $4.11 per share, indicating a change of +195.4% from the year-ago quarter. The Zacks Consensus Estimate has changed -15.8% over the last 30 days.

12 Month EPS

Valuation

Oprah Endorses Fetterman Despite Oz Historywhy Her Support Might Sway Voters And Why It Might Not

Pipeline Beyond Covid-19 Vaccine

Modernas core developments as of March 2020 include eight vaccines most of which were in phase 1 or pre-clinical stage and four therapeutics. One of the companys most promising vaccines is for cytomegalovirus, currently in late phase 2 trials. Moderna indicated that this could have peak sales of between $2 billion to $5 billion, with a very high probability of launch. Novavax is focused on vaccines for infectious diseases and its flu vaccine – NanoFlu – reported positive data from its phase 3 studies a few months ago and it appears quite likely that it could go on to gain regulatory approval.

Did you know that larger pharma companies such as Johnson & Johnson and Pfizer are also developing Covid-19 vaccines? They could also offer better downside protection compared to Moderna and Novavax. Should you pick Johnson & Johnson Or Pfizer For Better Returns?

Also Check: Purchase Investment Property With No Money Down

Do Hedge Funds Think Nvax Is A Good Stock To Buy Now

Heading into the fourth quarter of 2020, a total of 36 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 100% from the previous quarter. The graph below displays the number of hedge funds with bullish position in NVAX over the last 21 quarters. So, let’s find out which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

The largest stake in Novavax, Inc. was held by RA Capital Management, which reported holding $129.9 million worth of stock at the end of September. It was followed by Citadel Investment Group with a $95.4 million position. Other investors bullish on the company included Perceptive Advisors, Point72 Asset Management, and Rock Springs Capital Management. In terms of the portfolio weights assigned to each position Discovery Capital Management allocated the biggest weight to Novavax, Inc. , around 4.94% of its 13F portfolio. RA Capital Management is also relatively very bullish on the stock, designating 2.38 percent of its 13F equity portfolio to NVAX.

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Novavax, Inc. but similarly valued. We will take a look at Ionis Pharmaceuticals, Inc. , Athene Holding Ltd. , Adaptive Biotechnologies Corporation , CF Industries Holdings, Inc. , Casey’s General Stores, Inc. , ACADIA Pharmaceuticals Inc. , and Tata Motors Limited . This group of stocks’ market valuations are similar to NVAX’s market valuation.

Nearly Half Of Eligible Adults Haven’t Received A Booster Yet

There’s a significant opportunity for Novavax to reach a huge portion of the market. Data from the CDC suggests that close to half of people who have obtained both of their primary COVID-19 vaccine shots still haven’t obtained a booster. And because the CDC has given the OK to mixing and matching, that means Novavax isn’t limited to people who have obtained its vaccine.

There are some restrictions in place on the authorization, however. The FDA says the shot should be administered to people who aren’t able to access an approved mRNA-based bivalent COVID-19 booster, or where the mRNA booster isn’t “clinically appropriate” for them. But Novavax’s booster can also be accessible to adults who simply choose to receive the shot, “because they would otherwise not receive a booster dose of a COVID-19 vaccine.”

Earlier this year, Novavax obtained an EUA for its vaccine as a primary two-dose series for people who haven’t yet been vaccinated. With 68% of the U.S. population fully vaccinated, there is still room for Novavax’s shots to be used as primary doses. But it ultimately comes back to the same question as boosters — whether individuals who haven’t received doses are waiting for a traditional vaccine like the one from Novavax or if there are other reasons holding them back.

Also Check: Best Investment Companies For College Students

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

So Is Novavax Stock A Buy Or A Sell

On Oct. 31, Novavax stock wasn’t a buy. Shares were a sell on Aug. 9 when they tumbled below their 50-day line in high volume following the disappointing second-quarter report and guidance cut a bearish sign. Previously, NVAX stock had mostly closed above or in line with that key mark since late June.

Also Check: Can H1b Invest In Fundrise

Is Novavax A Better Investment Than Moderna

This April 28, 2009 photo shows Novavax, a Rockville, Maryland, company that in 2005 turned its … attention to flu vaccines, is testing cell-based technologies to enable it to produce a flu vaccine in as little as three months, half as long as traditional flu vaccine makers, which use an egg-based process. Shortening the process is key, because flu can mutate rapidly. As concern spread about a swine flu virus outbreak, investors saw opportunity in shares of companies that make or hope to make anti-flu drugs, with Novavax shares leap 80 percent. AFP PHOTO/Paul J. Richards

AFP via Getty Images

The U.S. government has awarded biotech company Novavax $1.6 billion towards trials, commercialization, and manufacturing of its potential Covid-19 vaccine candidate NVX-CoV2373. This marks the largest award yet under Operation Warp Speed a federal government program that intends to accelerate the development and deployment of vaccines and treatments for Covid-19. While Novavax was seen as an underdog in the race for a Covid-19 vaccine thus far, this vote of confidence from the U.S. government bodes well for the company. So how does Novavax compare with Moderna – which is seen as a leader in the race for a Covid-19 vaccine?

Our dashboard Trefis Theme: Covid-19 Vaccine Portfolio details key financial, valuation, and returns metrics for key U.S. listed companies working on Covid-19 vaccines.

Vaccine Technology & Clinical Trials

Financial Position

What Does History Say About Novavax Stock

In 2011, the U.S. Department of Health and Human Services’ Biomedical Advanced Research and Development Authority gave Novavax $179 million to develop a flu vaccine. Nine years later, that flu vaccine succeeded in the final-phase test. The next day, Novavax stock popped 4%.

But its vaccine to treat respiratory syncytial virus hasn’t had the same luck. The biotech company received $89 million from the Bill & Melinda Gates Foundation in 2015 to develop the vaccine. A year later, the vaccine didn’t meet its primary or secondary goals in older adults and nearly a third of its staff.

In 2019, the respiratory syncytial virus vaccine failed in pregnant women and Novavax announced a reverse stock split to avoid delisting from the Nasdaq. The biotech company also sold some manufacturing facilities to Catalent to raise $18 million in cash.

That year, NVAX stock plunged 89%.

Recommended Reading: How To Invest To Become A Millionaire In 10 Years