An Ldi Implementation Journey

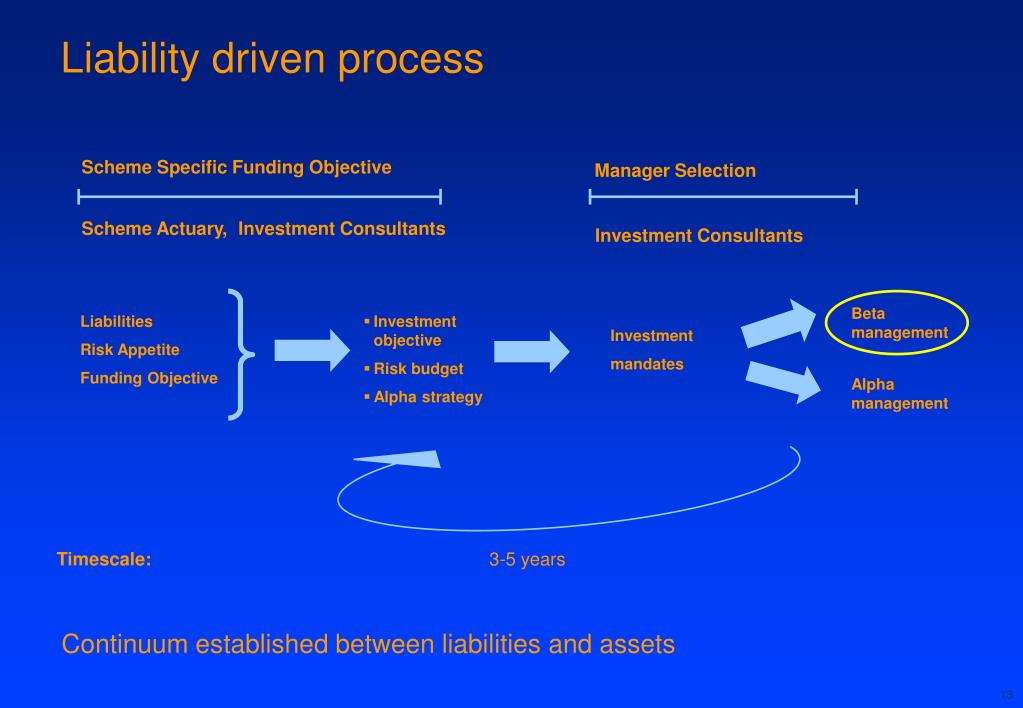

With a long-standing tradition of designing LDI solutions for plan sponsors, we see LDI implementation as a journey, starting with simpler programs that better align assets with the plans liability profile, then moving to more customized and refined approaches over time. These custom investment strategies often involve converting plan liabilities into a custom liability benchmark, offering various benefits.

Supports reporting and monitoring framework

How Are Returns Generated In An Ldi Strategy

In an LDI approach, a portion of the portfolio is typically built upon liability-hedging strategies to reduce interest-rate risk. These strategies may employ the use of Treasury STRIPS, long government and credit bonds and derivative exposures. Leading LDI solutions providers typically employ hedging strategies that are capital-efficient, and we believe that the best ones also offer dynamic portfolio management in order to exploit market opportunities.

Most liability-driven investing strategies will also involve defining the plans non-LDI assets as return-seeking assets, and then implementing an asset allocation designed specifically to close the shortfall in the plans funded status. This can include shifting the plans return-seeking exposure toward a global equity orientation, including exposure to listed real assets and private equity where appropriate. These asset classes may offer more resilient cashflows, helping assets grow faster than liabilities in volatile markets.

State Of Qatar Excluding The Qatar Financial Centre

Access to this Site is intended for the use of professional and qualified investors only. It is not intended for use by individuals.

Nothing on this Site constitutes, is intended to constitute, shall be treated as constituting or shall be deemed to constitute any offer or sale of financial products or services in the State of Qatar, or the inward marketing of any financial products or an attempt to do business, as a bank, an investment company or otherwise in the State of Qatar.

This Site and the content thereon have not been approved, registered or licensed by the Qatar Central Bank, the Qatar Financial Centre Regulatory Authority, the Qatar Financial Markets Authority or any other regulator in the State of Qatar.

Neither this Site nor any information or documents made available through it have been reviewed or approved by the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank.

No transaction will be concluded within the jurisdiction of the State of Qatar. Recourse against us may be limited or difficult and may have to be pursued in a jurisdiction outside the State of Qatar.

Any distribution of the content of this Site by the recipient to third parties in the State of Qatar is in breach of the terms hereof is not authorised and shall be at the liability of such recipient.

We are not licensed or authorised to carry on any regulated activity in the State of Qatar.

Recommended Reading: How To Invest In Stocks With Etrade

A Customized Ldi Solution

Adopting an LDI strategy can be quite effective at achieving plan sponsor risk reduction goals. However, there is no one size fits all solution for investors seeking to align plan assets more closely to their liabilities. At LGIM America, our first step in any engagement is to better understand the plan sponsors situation. Consistent with our client-led framework, we advocate letting the unique plan details dictate to us how the investment strategy should be designed. Because the actual implementation of each plan sponsors liability driven investing strategy varies considerably, we offer a range of capabilities that can be tailored to each situation.

How Do You Manage The Risk Of Unfunded Liabilities

We know what’s at stake. Real people are depending on the future payouts of your pension plan in order to fund their retirement years. As a fiduciary, it’s your responsibility to manage your organization’s pension fund in the context of the promises made to your employees and pensioners. A liability-driven investment strategy – matching assets to liabilities – is an efficient means to manage the risk of not meeting those obligations.

Defining LDI

Recommended Reading: How To Invest In Stocks With Cash App

Dubai International Financial Centre United Arab Emirates

This Site is intended for the use of Deemed Professional Clients only, as defined by the Dubai Financial Services Authority Conduct of Business Rulebook. It is not intended for use by individuals.

The content provided on this Site is for information purposes only. None of the information, opinion, reports, or other documents contained or made available on this Site shall be construed as an offer, invitation, solicitation, advice or a recommendation for subscription or purchase by Legal & General to acquire or sell any products or services.

Neither the Dubai International Financial Centre Authority nor the DFSA has any responsibility for reviewing or verifying this Site or information published thereon. Accordingly, neither the DIFCA nor the DFSA has approved this Site or taken any steps to verify the information set out on this Site and has no responsibility for it.The “Telephone Recording” paragraph shall be deleted and replaced with “Legal & General will record all telephone and electronic communications and conversations with you that result or may result in the undertaking of transactions in financial instruments on your behalf. Such records will be kept for a period of five years and will be provided to you upon request.”

We are not licensed or authorised to carry on any regulated activity in the Dubai International Financial Centre.

If you do not understand the contents of this Site, you should consult an authorised financial advisor.

Our Specialist Ldi Team

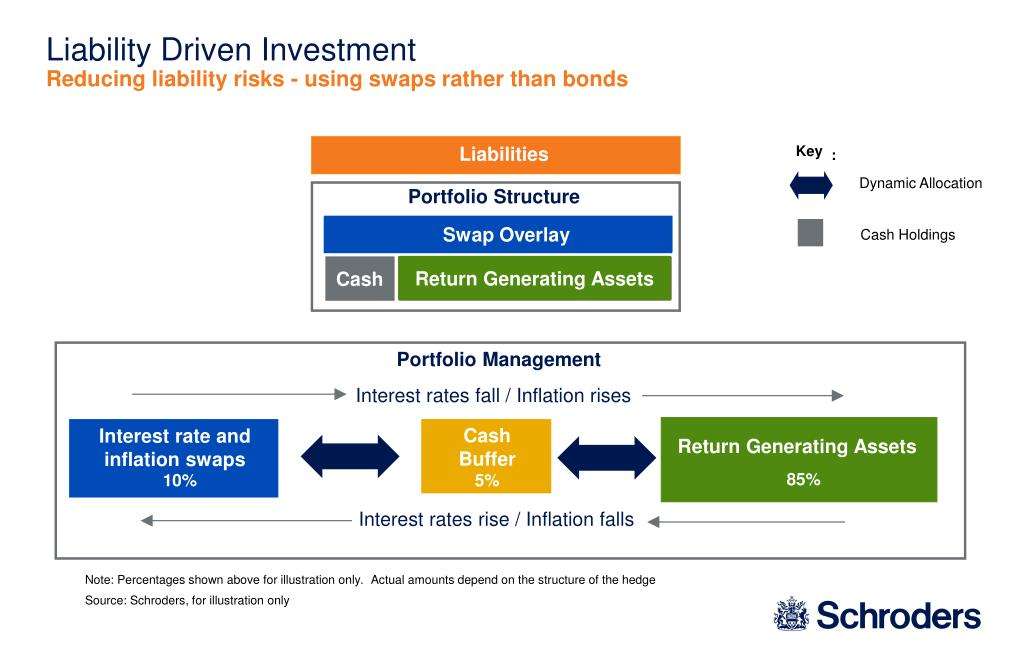

Schroders LDI is underpinned by a specialist group of investment professionals with a wealth of experience and expertise in managing pension scheme risk:

- The LDI and Strategic Solutions teams consisting of actuarial, investment banking and investment consulting expertise

- The Structured Solutions team with many years experience of structuring and executing a wide array of derivatives on behalf of UK pension schemes

- An investment management pedigree that also provides clients with access to a wide variety of other products and strategies in multi-asset, alternatives, equity and fixed income investment to complement LDI solutions where appropriate

- Comprehensive support from Schroders in-house specialists in legal collateralisation cash management

Compliance statement

Please note this website is for professional investors and their advisers, trustees of pension schemes and consultants in the UK only and should not be read, used or relied upon by retail clients or members of the public. Retail clients should refer to the UK Investor Centre. Reliance should not be placed on the views and information on the site when taking investment and/or strategic decisions.

Nothing in this site should be construed as being personal financial advice. Should you have any queries about your application or the suitability of any of the investments included on this website for your personal circumstances, you should contact your Financial Adviser.

We recommend you read the Important Information

You May Like: Buying Gold Bullion As An Investment

A Simplified Liability Driven Investing Examples

Say, for example, a company has $10 million in annual pension liabilities. Instead of paying them out from its revenues, itll develop a liability driven investing strategy. The company will fund an investment portfolio designed to generate at least $10 million in annual returns. When the time comes to pay out to the pension, the company will rely on its portfolio gains.

Individual investors can also develop these plans. If a person wants to retire with an income of $100,000 annually, they may purchase bonds that generate $15,000 in coupon payments annually. They can do this if the combination of social security and 401 distributions only pay out $85,000 per year.

The Balance Between Greed And Fear

Theres a big difference between conventional investing and liability driven investing. In the former, the goal is to accumulate wealth. In the latter, the goal is to cover future costs you know youll collect. Overall, this changes the investing dynamic significantly. Its not about investing for profit. Its about investing to prevent debt. With that in mind, these plans are typically more strategic.

And as an investor, its important to have an understanding of these investing practices. In fact, it can help you build wealth through smart investments. To learn more, sign up for the Liberty Through Wealth e-letter below! Youll receive tips and tricks from leading market experts.

The nature of liability driven investing makes it important to focus on both portfolio profitability and risk mitigation. Unfortunately, its impossible to do this in a single portfolio without controversy. Therefore, the dual portfolio strategy of modern investments strikes an important balance between greed and fear. One that gives companies and individuals the results they need to cover future debts. The key in any liability driven investing strategy is peace of mind with the knowledge that future expenses wont become future debts.

Recommended Reading: How Do The Ultra Wealthy Invest

How Does Ldi Differ From A Traditional Investing Strategy

The funded status of a corporate pensionor defined-benefit plan is calculated by subtracting the plans liabilities from its assets. Traditional investment strategies for DB plans focus on generating a specific rate of return for the plans assets. This rate of return is typically based on a benchmark from a broad-based equity index, such as the S& P 500® Indexwith a goal of generating returns in excess of the benchmark.

Liability-driven investing, by contrast, focuses on aligning the plans assets with the projected benefit obligations, or liabilities, due to plan participants. There is typically a mismatch between assets and liabilities in defined-benefit plans, due in large part to the impact of interest-rate changes on both. In a standard pension plan, liabilities are typically far more sensitive to rate fluctuations than assets are. This causes a plans liabilities to grow or shrink at a much greater rate than its assets as interest rates change. Liability-driven investing aims to eliminate the difference between the two, matching assets with liabilities in order to better manage the plans risk of not meeting obligations to employees and pensioners.

How Does Our Ldi Solution Help Solve The Problem

Delivering a customized liability-driven investing solution

While LDI has become a well-known approach, it is most certainly not a one-size-fits-all solution. The portfolio needs of each Defined Benefit plan sponsor are driven by specific circumstances related to funded status, plan status, institution type and the overall health of the organization. Our flexible implementation platform and broad actuarial and advisory capabilities offer clients a robust range of liability-driven investing solutions tailored to a clients current situation and designed to evolve as those needs progress.

Drawing on decades of experience working with some of the worlds leading pension plans, we will work alongside your team to develop a tailored LDI strategy that focuses on the behavior of the total asset portfolio, fits your organization and delivers real, lasting value for your pension plan.

Our specialists will:

1. Use innovative tools

To fully and deeply understand your situation and then identify and articulate your plan goals and objectives.

2. Analyze and model key risk factors

Such as interest rate, inflation and duration riskson projected future liability cash flows. Ensure that downside risks are understood and acceptable.

3. Construct a liability benchmark

To more closely match the duration of your plan liabilities so you can better determine whether plan assets are generating sufficient returns to meet obligations to current and future retirees.

What sets us apart

Also Check: Best Online Courses For Investment Banking

The Modern Approach To Liability Driven Investing

The goal of liability driven investing is to cover future expenses. To do that, however, investments need to generate adequate returns. But at the same time, they also need to mitigate risk. As any investor knows, risk and reward operate opposite each other. Therefore, its important to maximize both without sacrificing either. This can be done if investors and advisors turn to a dual portfolio strategy.

The modern approach to liability driven investing involves two separate portfolios. It involves an aggressive portfolio and a defensive portfolio. By separating these objectives, investors can focus on one strategy per portfolio. And they can do this without compromising the overall investment goal.

Why Choose Russell Investments For Liability

Good strategy requires effective implementation that can both contribute to returns and reduce risk. This is where we excel. We bring a unique combination of plan management experience and expertise with robust implementation capabilities as an asset manager. The strategies we design and recommend to our clients are made with full knowledge of how these strategies can be put to work effectively and efficiently in the market. And then we dynamically manage these strategies, looking out for our clients best interest as their plans evolve over time.

From strategy to execution, we will align ourselves with the best interests of your organization and deliver an end-to-end solution that aims to improve the total portfolio outcome for your plan.

CLIENT STORIES

Also Check: Etrade Roth Ira Investment Options

The Bottom Line: What To Look For In An Ldi Solutions Provider

Each organization has its own unique set of challenges and circumstances, which evolve and change over time. This is why we believe its vital for liability-driven investing strategies to be flexible by design, allowing for easy customization and adaptability in the face of shifting internal and external factors. Ultimately, we believe that a uniquely tailored LDI solution, bolstered by a flexible implementation platform and broad actuarial and advisory capabilities, is best equipped to create real, lasting value for pension plans.

What Is Liability Driven Investment

A liability-driven investment, otherwise known as liability-driven investing, is primarily slated toward gaining enough assets to cover all current and future liabilities. This type of investing is common when dealing with defined-benefit pension plans because the liabilities involved quite frequently climb into billions of dollars with the largest of the pension plans.

Don’t Miss: Cook Investments Northwest Oregon Llc

Ldi Strategies For Individuals Vs Pension Funds

The LDI strategy isnt exclusively for large pension plans. Individual investors may adopt the approach to meet specific cashflow needs in retirement. The most important step is calculating ones liability. If youre planning for retirement, this will be how much cash you need on an annual basis beyond Social Security benefits and any other potential retirement income. An individual using the LDI strategy will likely compile a bond-heavy portfolio to match their cash flow needs.

A defined benefit pension plan, however, may employ more sophisticated investing strategies, like hedging through options and swaps. Long-term bonds are a common liability-driven investment, but in a low-interest environment more illiquid assets like real estate and infrastructure may also be viable options for pension plans and individual investors, alike.

How To Participate In Liability

LDI is most often used by frozen single-employer pension plans. But it can be used by anyone, by following these basic two steps:

First, consider how different asset allocations interact with the liabilities. The most thorough way to do this is with an asset liability modeling study where an actuary uses sophisticated software to project your liabilities under a variety of scenarios.

You can first model your current asset allocation, while projecting how different scenarios could impact liabilities and funding needs over time. Then you can compare the current allocation to projections of alternate allocations that may better match your liabilities.

Next, choose your investment option lineup. This will be based on the outcome of the asset liability modeling study and the asset allocation that best aligns with your situation.

For help on choosing the right investments for a LDI strategy, check out www.magnifi.com. You can discover investing ideas there by using natural search. You just type in a term like low risk funds for retirement income or how to invest in climate change and instantly get relevant, tailored results without having to run screener and charts.

Also Check: Best Insurance Companies For Investment Property

Qatar Financial Centre Qatar

Access to this Site is intended for the use of professional and qualified investors only. It is not intended for use by individuals.Nothing on this Site constitutes, is intended to constitute, shall be treated as constituting or shall be deemed to constitute any offer or sale of financial products or services in the State of Qatar or in the Qatar Financial Centre, or the inward marketing of any financial products or an attempt to do business, as a bank, an investment company or otherwise in the State of Qatar or in the Qatar Financial Centre.

This Site and the content thereon have not been approved, registered or licensed by the Qatar Central Bank, the Qatar Financial Centre Regulatory Authority, the Qatar Financial Markets Authority or any other regulator in the State of Qatar or in the Qatar Financial Centre.

Neither this Site nor any information or documents made available through it have been reviewed or approved by the Qatar Financial Centre Regulatory Authority or the Qatar Central Bank.

No transaction will be concluded within the jurisdiction of the State of Qatar or in the Qatar Financial Centre. Recourse against us may be limited or difficult and may have to be pursued in a jurisdiction outside the State of Qatar or the Qatar Financial Centre.

We are not licensed or authorised to carry on any regulated activity in the State of Qatar or in the Qatar Financial Centre.

Please Select The Category That Applies To You:

- UK Corporate Pension Scheme

- Other

Schroders uses cookies to personalise and improve your site experience. You can accept all cookies by selecting ‘I agree’ and continuing to browse the site or you can “Manage cookies” to apply only the categories of your choosing. Find out more details on how we use your information in our Cookie Policy.

How we use cookies

Schroders uses cookies to personalise and improve your site experience. You can accept all cookies by selecting ‘I agree’ and continuing to browse the site or you can “Manage cookies” to apply only the categories of your choosing. Find out more details on how we use your information in our Cookie Policy.

Recommended Reading: Conventional Loan Investment Property Guidelines

What Themes Have We Been Seeing Among Corporate Pension Plans

Matt Nili, Managing Director and Head of U.S. and Canada Liability Driven Investing provides an update on recent themes we have been seeing among corporate pension plans.

To view this video please enable JavaScript, and consider upgrading to aweb browser that supports HTML5 video.

At the higher end of the fixed income allocation spectrum on the right here, lets say 70-plus percent allocations customization and focus on where on the spread curve youre allocated is a lot more important. Here piling into the same long government and credit assets that were once the belt and suspenders of the LDI portfolios should be reassessed. And depending on the liability duration profile and a plans sensitivity to concentration in long investment grade credit, theres more to explore in intermediate credit, securitized assets and customization of the rate edge. Of course, a key factor that might affect plans at any of these stages in their is the end game or partial end game strategy of a plan and by this we just mean that liquidity events like pension risk transfer and lump sum offering can have a big impact on both the allocations that you source within fixed income as well as the vehicle type of those exposures.

FIH0621U/S-1649447

FIH0621U/S-1649447