What Is Private Mortgage Insurance

If you dont have a 20% down payment on the home youre interested in, lenders will generally require that you to pay PMI. This insurance helps protect the lender in the event that your home goes into foreclosure and its value declines to the point that the sale wont cover the original mortgage.

Since having a larger down payment helps prevent this scenario, you dont need to pay private mortgage insurance if your mortgage is less than or equal to 80% of your homes value. Private mortgage insurance hardly benefits you, the borrower, except it can allow you to get into more house with less down payment. Otherwise, its simply an extra charge that will be tacked onto your monthly mortgage payment.

average return of 397%

The amount youll have to pay for private mortgage insurance varies depending on how large your loan is, how good your credit is, and how large your down payment is. But a reasonable estimate is that it will cost about 0.5% of your original loan value each year. On a $200,000 loan, that equals $1,000 per year, or $83 per month.

On most loans, PMI can be removed once your homes loan to value ratio drops below 80%. Its even tax-deductible for some people. However, avoiding this extra expense will save you money, especially if your income tax bracket is too high to qualify for the PMI tax deduction.

How A Piggyback Loan Works

A piggyback loan combines two separate home loans a larger first mortgage and a smaller second mortgage to help you buy a home more affordably. The second mortgage acts as part of your down payment. When you make a 10% cash down payment and take out a 10% second mortgage, youre effectively putting 20% down. This leads to lower interest rates and no private mortgage insurance .

A piggyback loan is often called an 80/10/10 loan due to its structure: a first mortgage for 80% of the home price, a second mortgage for 10% of the home price, and a 10% down payment.

Why Get An 80

There are two major reasons to get an 80-10-10 piggyback loan: to save money by steering clear of mortgage insurance, and to qualify for an easier-to-get conforming mortgage instead of a jumbo loan. A conforming loan is a mortgage that meets regulatory standards, including a maximum loan amount. A mortgage for more than that maximum amount is a jumbo loan.

Also Check: Chief Investment Officer Job Description Family Office

Home Equity Line Of Credit Benefits

Competitive Interest Rates

Interest rates are generally lower than for other types of credit, like credit cards and auto loans.

Funds When You Need Them

Access available funds during the draw period with a check, transfer to your Fremont Bank checking account, or withdrawal at a branch.

Flexible Payments

Only make payments on the portion you use.

Revolving Credit Line

As you pay down the balance, the credit line amount becomes available for use again during the draw period.

Read Also: Va Loan Refinance For Investment Property

Investment Property Loans That Require 10% Down Or Less

If youâre looking to purchase an investment property but canât afford to put too much money down, options like traditional mortgages may not be open to you. But there are still financing options available. There are a number of investment property loans that require 10% down or less.

So youâre considering buying an investment property but arenât sure what your loan options are?

An investment property is real estate purchased to generate revenue, either through renting it out or reselling it for a profit. Investment properties are typically residential properties with four units or less, and can be a great way to generate income and increase your equity at the same time.

Recommended Reading: How Much Money To Invest In Gold

What Are Piggyback Loans

People will do anything to save money, especially when purchasing a house. When it gets to closing time and you start crunching your monthly payment, your private mortgage insurance may seem like just the thing to toss overboard. Once itâs gone, youâll be able to loosen your belt a little and still have the house of your dreams, right? Well, youâll still have your house, but the alternative to private mortgage insurance may not be the dream youâve been hoping for.

Pay For Private Mortgage Insurance

You may just want to bite the bullet and pay for PMI, especially if PMI payments will be less than second mortgage payments. You can also cancel PMI later. Lenders are legally required to cancel PMI once you have 22% equity in your home, and you can request early cancellation when you reach 20% equity.

Don’t Miss: Real Estate Investment Opportunity Zones

Why Qualifying For A Piggyback Loan May Be Difficult

A piggyback loan might sound the better option in theory, but there are risks, so the lender will expect proof that you can handle the extra debt.

One important thing to keep in mind is that the mortgage lender will look at your debt-to-income ratio when qualifying you for the loans. Since youre essentially taking out two loans for a home, this means youre taking on more debt, so you will need to have a higher income to cover both.

Your DTI should be no more than 28%, meaning the total monthly cost of both of your loans cant total more than 28% of your gross monthly income. If you bring home $6,000 in monthly pre-tax income, for instance, you wont qualify for a piggyback loan that costs more than a combined $1,680 per month.

Additionally, since taking on two separate loans at once is particularly risky, youll need good credit to qualify for a piggyback loan. Each lender has different requirements, but the standard is a credit score of at least 680.

Fha Loans: 35% Down Payment

FHA loans are government-backed loans that make homeownership possible for borrowers who are usually seen as high risk. Despite a low credit score and income, borrowers can use an FHA loan to purchase property with four units.

Perhaps the downside of an FHA loan is that youre limited in how much you can borrow based on the propertys location.

Don’t Miss: Crawl Space Encapsulation Return On Investment

Glossary Of Landlord Loan Terms

ARV: After repair value, or the value of a property after all renovations are complete.

DSCR: Debt service coverage ratio. The ratio between a rental propertys gross income and the full loan payment. For example, if the rental income is $1,000, and the monthly loan payment is $800, then the DSCR is 1.25 . Different lenders sometimes use different calculations, and may use net or gross rental income.

DTI: Debt-to-income ratio. There are two ratios used: a front-end ratio, which only looks at the loans monthly payment compared to your gross monthly income, and a back-end ratio, which takes all of your debt into account. This is used primarily by traditional banks and lenders, but not used as frequently by landlord lenders.

HELOC: Home equity line of credit. A rotating line of credit that you can draw against, secured with a lien against real property .

Lien: The legal attachment of a debt to a property, to serve as collateral. When you take out a home or rental property mortgage, the lender attaches a lien against your property, allowing them to foreclose on it to recover their funds if you default.

LTV: Loan-to-value ratio. The percentage that the lender will lend against the value of the property .

PITIA: The full monthly mortgage payment, including principal, interest, taxes, insurance and HOA or condo association fees .

Commons Photo Credit:

Recent Posts

Piggyback Loans Vs Pmi Vs Fha Loans

In a three-way match-up, which mortgage product comes out on top? Lets look at an example of a home purchase of $250,000 with 10% down.

$250,000 Home |

|

$1,360 |

$1,425 |

*Rates are only examples and are not taken from current rate sheets. Your rate may be higher or lower. Click here to request current rates.

In this scenario, the piggyback mortgage saves the buyer $60 per month compared to getting one 90% loan with PMI and $125 per month compared to FHA.

Also Check: Where Should I Invest In Real Estate Now

How Does An 80/10/10 Loan Work

Usually, a 2nd mortgage or a Home Equity Line of Credit is offered up to 90% of the home value. Such kinds of loans are popularly known as 80/10/10 loans, where the first mortgage is 80 percent of the home value, the second mortgage or Home Equity Line of Credit is 10 percent and the rest 10 percent is the down payment by the borrower.

From Traditional Mortgages To Todays Alternatives

This traditional arrangement served homebuyers well for many years, and mortgage liens and foreclosure still follow tradition. But rising home prices have made the traditional arrangement, with its 80% loan-to-value ratio, untenable for many buyers today.

So what, you ask. Havent incomes risen just as fast?

Not quite. At the end of 1995, when the median U.S. home price was $138,000, a 20% down payment was only $27,600. By the end of 2020, the median home price had reached $358,700, yielding a 20% down payment of $71,740. Thats 260% of the 1995 down payment. Meanwhile, the Census Bureau estimates that, in current dollars, median income rose from $34,076 in 1995 to $67,521 in 2020. Thats just 198% of the median income in 1995. Since 1995, income has not risen as rapidly as home prices.

Why play with the percentages rather than just compare dollar figures? The Census figures adjust income to current dollars. By converting both series of figures into percentages of their 1995 values, we get just a sense of how each has changed relative to where it started. This lets us compare the rates of increase without worrying about the dollar amounts.

Since income hasnt kept up with home prices and the down payments that go with them, alternative financing arrangements are essential to many buyers.

You May Like: How To Invest In Lyft

How Does A Piggyback Loan Work

In an 80/10/10 setup, the first mortgage is for 80 percent of the propertys value, and the second the piggy on the back, so to speak is for 10 percent. Then, as the borrower, youll need to make a 10 percent down payment.

Lenders also sometimes offer an 80/15/5 loan, says Greg McBride, CFA, chief financial analyst at Bankrate, which shrinks your down payment obligation to just 5 percent.

Types Of Piggyback Loans

Piggyback loans come in a few different flavors:

- Taking out a second mortgage: In a traditional piggyback loan, youll have two mortgages. That means two sets of closing costs with two different sets of terms. It might even mean using two different lenders.

- Home equity loan: If youre currently living in a home that youve paid off , you can take out a home equity loan, a lump sum of cash that you can put on the back of a mortgage for 80 percent of the purchase price.

- HELOC: A HELOC is similar to a home equity loan, except that the rate on a HELOC is variable, so your monthly payments can change, and youll draw down funds rather than take out a big chunk at one time.

Also Check: Jp Morgan Investment Banking Internship

Some Of The Additional Guidelines For The Heloc Is Mentioned Below:

- No foreclosure, deed-in-lieu, short sale, or real estate account paid for less than full balance within the last 5 years. No bankruptcy filing within the last 8 years.

- First 10 years draw period, next 20 years repayment period

*The 80/10/10 loan is not available in all the states*

Email us at if you have any questions about an 80/10/10 loan

A Path Forward For Rental Investors

While every real estate investor follows a different path, heres a sample outline for how a rental investor might finance their first rental properties:

Property 1: House hack a 2-4 unit property with conventional or FHA financing .

Property 2: Use either a conventional bank or online landlord lender .

Properties 3-4: If youre getting more ambitious with the renovations, use either an online buy-and-rehab loan, a community bank loan, or a hard money loan for the purchase and renovation. Then refinance it using an online investment property mortgage.

Properties 5-8: Start raising some capital from friends and family. Use this to help with the down payment and/or renovation costs. Use either a local community bank or an online landlord loan for long-term financing.

Properties 9+: Try to increasingly use private funds. To free up some of the private funds tied up in your existing portfolio, consider refinancing several of your properties under a blanket loan to cash out and use the money towards new acquisitions. Use either community banks or online landlord lenders for financing as needed.

Also Check: How To Invest In Otc

Q: What Is The 10% Rule In Real Estate

The 10% rule has three parts to it:

- Never put down more than 10% on property: If you buy a property for $500,000, you should only pay $50,000 as a down payment.

- Avoid properties that are more than 10% under market value: When buying an investment property, its a good idea to find properties priced lower than market value. Youre already breaking even if you put 10% down, and the property is worth 10% more than you paid.

- Never pay more than 10% interest: This rule is somewhat outdated because, even as inflation and interest rates increase, 10% interest on a mortgage is far-fetched, considering todays interest rate is 4.99% for a 30-year fixed-rate mortgage.

Why Qualifying For A Piggyback Mortgage Can Be More Difficult

Piggyback loans might help you get around some of the requirements of a jumbo loan, but these are by no means easy approvals, either. You still need an excellent credit score, and the need to borrow more money can raise eyebrows from lenders. Expect to have your personal finances scrutinized to verify that you can indeed pay back both loans. If youre thinking about trying to get a piggyback loan, its wise to reduce your debt-to-income ratio as much as possible before applying.

Read Also: Enterprise Trust And Investment Company

Types Of Investment Property Loans

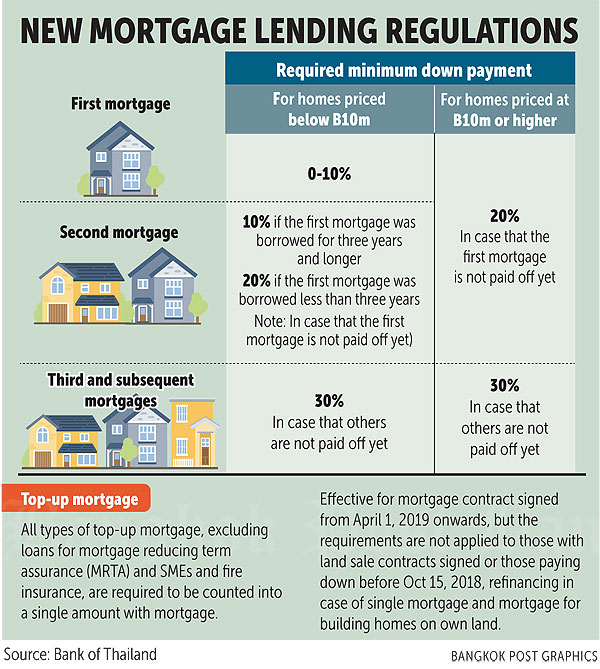

Getting an investment property loan is harder than getting one for an owner-occupied home and usually more expensive.

Many lenders want to see higher credit scores, better debt-to-income ratios, and rock-solid documentation to prove youve held the same job for two years.

Additionally, most will insist on a down payment of at least 20%, and many want you to have six months of cash reserves available.

If you already have four mortgages, youll need some savvy to get a fifth. Most banks wont issue new mortgages to investors who already have four, even when the loans will be insured by a government agency.

But just because its harder to get investment property loans doesnt mean you shouldnt try. Although you might not qualify for a conventional mortgage, you might get one backed by the Federal Housing Administration or Veterans Administration . You could also opt for a hard money loan or a home equity line of credit .

Some lenders wont even care about your credit or employment history, as long as they see lots of potential profits in the investment property youre considering.

The Steps To Obtaining A 80

Both the primary mortgage and the secondarymortgage have to be applied for in order to obtain an 80-10-10 mortgage.Separate lenders may be needed for each loan in some instances. In these cases,the primary mortgage loan officer can provide referrals for a secondary loanmortgage lender while you apply for the primary mortgage. Financial documentgathering, application filing, and closings must be done for each of the loansthat will be applied to for the 80-10-10 mortgage. The loan that takes 80% ofthe homes price into account will be a conventional loan, while the 10% priceloan will be a line of credit or equity loan.

Recommended Reading: Can Financial Advisors Invest Their Own Money

Why Get A Piggyback Loan

A piggyback loan is generally used to help prospective homeowners avoid the need to pay extra for private mortgage insurance. In short, private mortgage insurance or PMI is the insurance policy that lenders require you to take out if youre putting less than a 20% down payment down on the home. In this way, the lender is able to recoup the money theyve lost if you default on your home loan.So that begs the question of whether or not an 80-10-10 loan or private mortgage insurance is better in your case. For that, its a good idea to consult with a professional who understands the details of different types of home loans and who can help you find the best option for your unique needs.

Take appointment for your

How Much Do You Need To Put Down On An Investment Property

Qualifying for investment property financing can be more challenging than you might expect, especially if youre a new property investor. Many first-time real estate investors are surprised to learn that a 20% down payment on a rental property loan is considered normal.

A 20% down payment can be a sizable amount, depending upon the purchase price of the property. Imagine you want to buy a $500,000 multifamily dwelling. If the lender requires 20% down, youd need to come up with $100,000 in cash to seal the deal.

You May Like: Which Is The Best Blockchain To Invest

Real Estate Investment Trusts

REITs are companies that own large commercial buildings like hotels, casinos, malls, and office buildings. When investing in REITs, you are investing in the real estate owned by the companies without dealing with the risks of actually owning the real estate properties.

REITs must return at least 90% of taxable income to their shareholders each year. This means investors receive annual dividends while benefitting from a diversified portfolio. Also, if you need cash, you can sell your shares on the stock exchange.