Investing Vs Trading: Whats The Difference

by Kritesh Abhishek | Mar 11, 2020 | Essential Reading, Investment Basics |

Investing vs Trading: Whats the difference? There are two common approaches to make money from the stock market. The first one is investing and second is trading. However, the difference between them might not be easily understandable for beginners. A lot of people trade in stocks and confuse them by investing. In this article, we are going to discuss the difference between investing vs trading.

What Is Day Trading

Day trading is an extreme version of trading, where people buy shares with the intention of selling them again that very day. The objective is the same as trading: To try to predict where share prices will move next, buying shares ahead of the change, and then selling them for a profit. Traders quickly jump in and out of the market seeking to take advantage of tiny changes in price, which collectively add up to create larger profits over time.

Day traders use charts of historical price changes and the volume of shares traded to gain insights into where prices might move next. This is called technical analysis and is often enabled by special software packages.

The Difference Between Business And Investment

However, some people are still confused about choosing between business vs investment. Business requires teams, has a large capital, and gets higher risks. While the investment can be done all by yourself, with smaller capital, and has limited risk. If you are interested in starting a business or investment, it is highly recommended to start a small first.

-Profit

Business can actually be an investment tool because it is able to make profit for the owner.

-Advantage

When your business makes profit, it can be seen and used immediately.

-Performance

In terms of performance, investment and business certainly have a very clear difference. Although nowadays both investment and business can be done by online system but both clearly require different processes. Currently, investors, especially those who are beginners, are increasingly facilitated by applications and online investment services. As long as they are connected to the internet, investment can be made by anyone, anywhere and anytime.

An investment can be done alone, while a business needs a team to help managing and turning an idea into a business.

-Risk

As discussed in the difference between investing and speculation, an investor must be prepared if his capital runs out and will not return if the investment that occurred turning out to be unsuccessful.

You May Like: What Are Investment Mortgage Rates

Which One Is Right For Me

We arent financial advisers, so we cant tell you definitively what you should or shouldn’t do. However, long-term investing is the lower-risk, more sure-fire way to make returns in the long-run . If you feel that only committing to the long-term is a bit too vanilla for you, why not allocate an opportunity portfolio, a small percentage of your overall holdings, where you can take more risk? Think of investing for the long-term as a strategy of wealth building, and day trading as something to do only if you have extra money that you arent afraid to lose. And, as always, please consult a financial adviser if youre still feeling unsure about the right strategy for you.

Cryptocurrency Investing Vs Trading: Whats The Difference

This article takes a look at the differences between cryptocurrency investing vs trading, which can be deceivingly similar at first glance.

There are several ways for anyone to generate wealth in the Cryptocurrency market. You can either be a:

A) Miner

B) Investor

C) Trader

Mining is a technical process that requires someone to have background knowledge and experience in setting up sophisticated computing software and equipment to mine new cryptocurrencies. Undoubtedly, the easiest way for the general public to make money in the cryptocurrency world is through investing or trading.

The terms investing’ and trading’ has often been used interchangeably in the cryptocurrency market. However, there are fundamental differences between both concepts that is vital for you to understand and align your financial goals with. This guide will be fully dedicated in exploring the various differences.

Also Check: Mitzli Jen Gem And Mine Investments Management Ltd

Investing Vs Trading Differences

The main difference between trading and investing is that the former provides opportunity to realize profits from volatile trends in the market. In investing, short-term gains and losses are ignored for long-term gains, which are achieved as the company grows. A trader will concentrate on the perceived market value of the stock. He or she would not be interested in the financial health of the underlying company. An investor though would be thoroughly interested in the companys financial performance more than the shares trends.

Trading requires holding on to a stock or financial instrument for a day or maybe until it hits a short-term target. Investing involves holding onto a stock for longer durations. Trading involves selling off the stock/financial instrument as soon as it hits the target price or crosses the loss threshold . Investing involves ridding out the downtrends of the market and not to sell unless required.

What Is A Stock

A stock is a portion of a company that is traded on a market known as an exchange. The New York Stock Exchange is a popular stock market. When people talk about the stock market in general terms, such as the markets were strong today, theyre usually talking about a portion of the market known as an index.

Two popular indexes are the S& P 500 and the Dow Jones Industrial Average. While both of these have their own methodologies for selecting and tracking representative companies, they are widely trusted as indicators of the overall trend of the market.

Don’t Miss: How Soon Can You Refinance An Investment Property

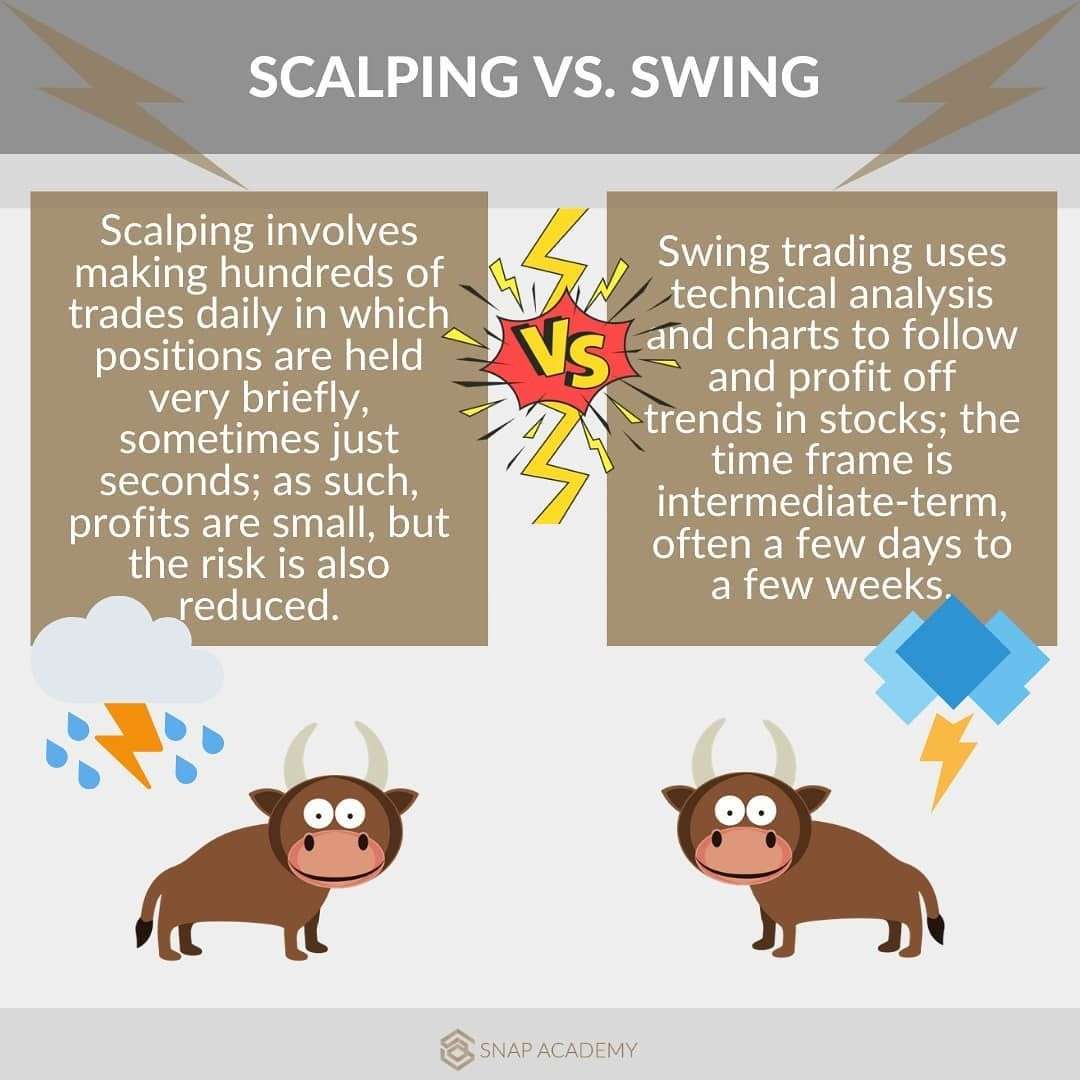

Is Day Trading Better Than Swing Trading

Day Trading is faster than swing trading because you get the results within a day. In swing trading, the trader retains the position for a few days before closing it.In day trading, the profit margins may be limited because the positions held close before or by the end of the market hours. In swing trading, the trader gets enough time to analyze the movement of the stock and accordingly plan the moves.In short, Swing trading is less risky but more time-consuming than day trading.

Why Trade Shares With Fxcm

- $0.00 Commission*

- Trade duration: The length of time allotted to an open position in the marketplace is a key difference between trading and investing. Investments are often given years or decades to reach maturation, while a specific trade may last only a few seconds.

- Frequency: As a general rule, an investment is executed much less frequently than a trade. Many forms of trading involve carrying out hundreds of individual trades per session, while a typical investment strategy may involve only a few transactions per year.

- Perspective: Perhaps the largest difference between trading and investing is the perspective by which the markets are viewed. Traders typically view the markets in terms of what is happening right now, while investors interpret market behaviour on a much longer timeline. Investors place impetus upon fundamental analysis when identifying opportunity, while traders look to technicals for cues regarding market entry and exit.

- Return on capital: Depending upon the asset class involved, a common rate of return desired by investors is upwards of 6% annually. Traders, on the other hand, look to make in the neighborhood of 10% per month in order to produce an adequate cash flow to cover living expenses.

Don’t Miss: Capital One Investing For Good

Buy And Hold Through The Ups And Downs

Investing through periods of stormy share market weather can be nauseating, but its a crucial part of long-term investing. This strategy is called buy and hold and you need to make this commitment from day one of your investment. Even when big storms hit, your plan must be to hold your shares.

Why? Because you may initially buy your shares when times are good, but share markets can be volatile and they do fall regularly. Historically, share markets endure a fall of 20% or more every 4 to 5 years. In times like this, that horrible feeling in the pit of your stomach can be a compelling reason to sell everything and make for the hills.

Share markets can also become stagnant for long periods. Youll feel like your investments are going nowhere. Between December 2010 and December 2012, the S& P/ASX 200 Index fell by 4%. In these times, selling and investing somewhere else often seems like an appealing idea. But dont give up! The Motley Fool CEO, Tom Gardner puts it best: If you invest for the long term, you dont give up in the short term.

What Are The Risks Of Online Trading

There is risk of loss associated with investing in securities regardless of the method used. New investors need to understand the principles of investing, their own risk tolerance, and their investment goals before venturing into the market. In addition, online investors may want to consider these other risks. High Internet traffic may affect online investors’ ability to access their account or transmit their orders. Online investors should be skeptical of stock advice and tips provided in chat rooms or bulletin boards. Investors should do their own research before acting on these tips. Also, for some online investors, there is a temptation to “overtrade” by trading too frequently or impulsively without considering their investment goals or risk tolerance. Overtrading can effect investment performance, raise trading costs, and complicate your tax situation.

Read Also: How Can I Invest 2000

Trading Vs Investing: What’s The Difference

TheStreet

Trading and long-term investing are both viable forms of playing the market that bring their own unique benefits and risks to the table.

If you’re new to the world of the stock market and looking to dip your toes into the water, you might be surprised to find that you have more options than you realized. There’s far more than one way to try and play the market.

Two ways to do it, arguably the most common, are investing and trading. You may have conflated the two or assumed that they’re basically the same thing. But they’re not synonymous with one another. Trading and long-term investing are very different things that can have different pros and cons for different investors. So it’s important to recognize the distinction between the two and the various ways in which they differ.

What is the difference between trading and investing, and is one better for you?

What Is Stock Market Trading

Stock trading is a sophisticated art of finding short-term mispricings in the market prices and capitalizing on them. Traders make short-term positions in stocks that range from seconds to months.

The T20 innings of Virender Sehwag are a classic example of a trader. The approach is consistently aggressive, and a trader constantly searches for opportunities to score at every instance, just like a T20 batsman. The risk with trading is much higher than with investing because of a reduced margin for error.

You May Like: Real Estate Investment Jobs Nyc

Which Is Better: Trading Or Investing

Well, this completely depends on you as an investor. There are obviously very successful people on both sides of the coin. Warren Buffett is a billionaire investor that started of value investing and now runs an incredible Investment Firm, Berkshire Hathaway.

John Paulson on the other hand made his fortune trading against the real estate market in 2007 and profited $3.7 billion.

There are success stories on both sides but as far as risk goes, generally, you will be taking on much more risk as a trader than as an investor. Investing offers steadier growth backed by the performance history of all major indexes.

Trading can be very lucrative also but requires a lot of discipline. A carefully implemented trading plan can be effective as long as the emotion is left behind. Making calculated, risk-defined trades seem to work for most successful traders.

I personally consider myself an investor but I will occasionally make trades that are risk defined and usually, the trades I make would be considered swing trades or position trades. I consider myself a more active investor though and keep an eye on all of my stock positions. I currently have positions in about 20 different stocks and none of my single holdings makes up more than 5% of my entire portfolio. Balance is key and I believe having a diverse portfolio minimizes risk as well.

Trading Vs Investing: What Is The Difference Between Trading And Investing

Investing and trading are the two primary methods of building equity market wealth. On the other hand, investing and trading use completely different methods to build wealth or make money through the stock market. People often get confused about Trading vs Investing. So today, we will clear all your doubts.

Consider the possibility that you and a friend purchased the same number of seeds for planting your fields, but instead of planting them, you decided to sell them to someone else for a profit. So you sell them at the current market price and earn a small profit. Your friend spread the seeds and allowed them to mature for a few months or years until they produced new ones. It took him years of sowing new seeds before he was able to sell enough to make back the money he had spent on them. Now he will make more money than you when he sells the seeds. He invested his time and efforts to make a huge profit while you sell the seeds for a small profit. This is a perfect example of trading and investing.

Now lets see the exact difference between trading and investing.

Also Check: Compare Investment Property Mortgage Rates

The Actual Time Frame

When we talk about trading, we need to mention the difference in the actual time frame compared to investing. Trading is a method of holding trades for a shorter period of time. It could be days or weeks! Traders usually hold stocks until the short term high performance.

On the other hand, investing is usually “set and forget” also known as the buy-and-hold principle. Short-term market price fluctuations are generally insignificant for the long-term investment portfolio. Trading profits are generated through buying at a lower price and selling at a higher price .

Beyond Stocks And Bonds: A Look At Asset Classes

Investing, of course, is not just about stocks. Historically, the three main classes of investable assets have been equities , fixed income , and cash equivalents, or money market instruments. Today, however, there are more asset classes including real estate, commodities, futures, other financial derivatives, and crypto investments. Within these asset classes, there are many types of investment products.

Read Also: Interest Rates For 30 Year Fixed Investment Property

What Is Better Suited For A Retail Investor

Trading involves a lot of activity and constant tracking of price movements. A trader normally has to be fully involved with the happenings of a stock market on a daily basis.

For majority of retail investors though, investing is about using savings to get a reasonable rate of return for investment in stock markets. Also, a retail investor might have a day job leaving limited time for him to dedicate to the markets on a daily basis.

Also, long-term investing is less likely to be volatile than trading and might suit the average retail investor.

Considering all these factors, it makes sense for a retail investor to follow the investing approach.

Overall, an individual should follow that he/she is comfortable with and also one that helps them get the best results from the stock market.

Differences Based On Risks Involved

Trading by nature involves more risk due to shorter time horizon. It involves predicting market movements over few hours, days or months, which is unpredictable. Although risks are high, successful traders also earn higher returns due to the volatile nature of the markets in the short-term.

Investing on other hand tends to be less risky if done over the long-term. Although returns gained through investing might seem lower than trading, the power of compounding and higher probability of success makes up for the relatively lower rate of returns.

Read Also: What Is A Family Office Investing

What Is The Similarity Between Economic And Financial Analysis

Financial and economic analyses have similar features. Both estimate the net-benefits of a project investment based on the difference between the with-project and the without-project situations. The basic difference between them is that: the financial analysis compares benefits and costs to the enterprise while.

Technical Analysis Vs Fundamental Analysis

Day trading relies more on technical analysis utilizing charts and technical indicators. Investing focuses more on fundamental analysis including earnings reports, news, financial metrics and ratios. Basically, day traders are more interested in a stock’s price action, whereas investors are more focused on the underlying company. Day traders may also utilize leverage for a higher concentration of shares to pocket a smaller relative price movement price gain.

You May Like: What Is Long Term Stock Investment

Trading: Pros And Cons

In contrast to investing, trading methodologies are based upon creating revenue in the short term. Periodic fluctuations in the value of a financial instrument are often seen by traders as the preferred avenue for achieving profit. Swing traders, day traders and scalpers all practice methodology akin to short-term trading.

Active trading affords several advantages to its participants:

- Liquidity: Traders open and close positions in a rapid manner. This enables the trading account to remain denominated in cash.

- Exposure to systemic risk: Risks associated with a total market collapse, bankruptcies and dramatic sell-offs are mitigated by an active trading philosophy. Traders are able to quickly exit ominous positions and limit account drawdowns related to unforeseeable market developments.

- Higher periodic returns: Periods of increased profitability are possible. A series of positive trades may generate excess profit that can be used to grow the trading account.

- Reduced risk capital: Through the use of leverage, smaller amounts of risk capital may be used to achieve acceptable profits.

However, in the current digital marketplace, there are several drawbacks to implementing an approach based solely upon active trading: