What Are Some Risks Associated With Mutual Funds

There are a couple of potential risks associated with mutual funds:

Mutual Fund Vs Fixed Deposit

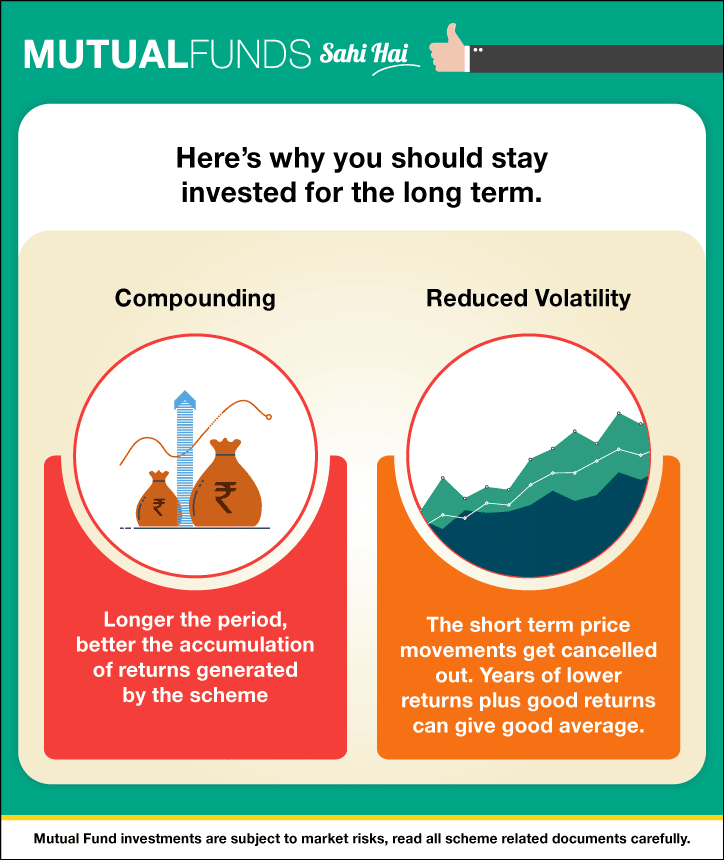

In a Fixed Deposit , the returns are pre-determined. The FD bank rates does not change throughout the tenure for which the money is deposited. While in Mutual Funds the scope of earning is unlimited. The longer the tenure the higher the return.

However, you must estimate your expected interest earnings for better planning by using Scripboxs FD calculator. Our FD calculator is easy to use, accurate results with a detailed guideline on fixed deposits

The returns on Fixed Deposit are taxable at the tax slab of the investor. In a Mutual Fund the taxation mainly depends on the holding period. The tax implication on short term and long term are different for Mutual Funds.

Think Of Mutual Funds As Offering The Convenience Of Something Youre Familiar With: Eating Out

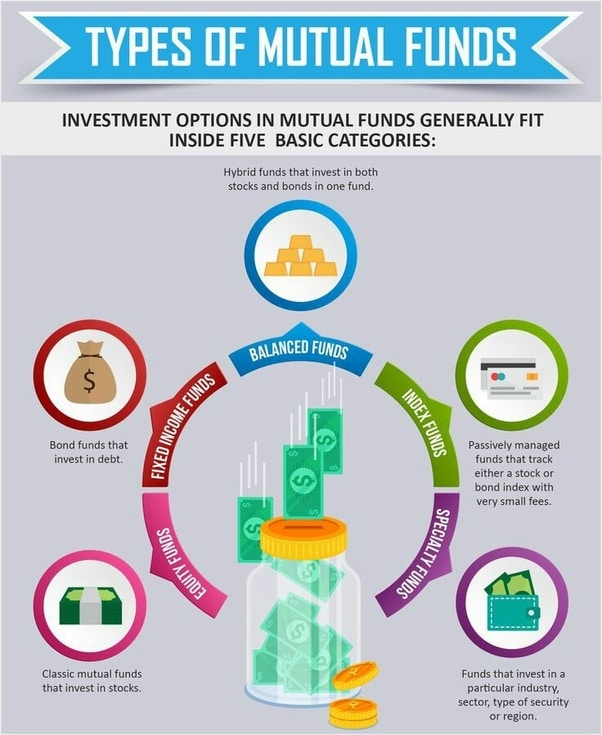

Someone else has done all the work of developing the recipes, shopping for quality at the best prices, and cooking and assembling the dinners so that foods that go well together are served in the right proportions. For mutual funds, thats the job of the professional portfolio managerhe or she develops his strategy, shops for the right securities at the best prices, and then assembles the portfolio with an appropriate amount of diversification. And the analogy doesnt stop there. Just as there are many different dinner entrees to choose from at most nice restaurants, there are also many kinds of mutual funds to choose from at most fund organizations. Each kind has its own flavor.

The price you pay for your shares is based on the worth of the securities in the pool on the day you buy in. Typically, the closing price is used for establishing their market value. For this reason, mutual funds are usually bought or sold only at the days closing prices. This means that it doesnt matter what time of day the fund receives your order early or late youll still get that days closing price.

You can profit from your shares in three primary ways.

1. First, the dividends paid by the stocks in the portfolio will be paid out to you periodically, usually quarterly.

2. Second, if the portfolio manager sells a stock for more than he paid for it originally, a capital gain results. These gains will also be paid out periodically, usually annually.

Also Check: What Is A Spdr Investment

Stable And Consistent Returns

A large cap fund meaning implies that such funds offer stable and steady returns to investors over time. It is because the funds are majorly invested in companies with better track records and market reputations.

These funds are rarely impacted by market downturns, thus offering stability to your mutual fund portfolio.

Advantage #1: Mutual Funds Handle Your Paperwork For You

Capital gains and losses from the sale of stocks, as well as dividend- and interest-income earnings, are summarized into a report for each shareholder at the end of the year for tax purposes. Funds also manage the day-to-day chores such as dealing with transfer agents, handling stock certificates, reviewing brokerage confirmations, and more.

Recommended Reading: Best Investment Property Loan Rates

Advantages Of Investing In A Gold Etf

a. Purity: Purity can be considered a given factor. Each unit of gold ETF represents 1 gm of gold of the highest priority.

b. Convenience: As opposed to physical gold, here you would be holding the gold in dematerialized form. Keeping gold in electronic form saves a lot of hassle of storage, like security and handling.

c. Ease of trading: You can buy or sell gold ETF units from your Demat account at the click of a button. Gold ETFs are much easier to liquidate in the market.

d. No loads: There are no entry or exit loads in the gold ETFs. It means there is no deduction of any amount from your investment at the time of investment or during withdrawal.

e. Tax benefits: Long-term investments in gold mutual funds are taxed at 20% after indexation. The long-term implies investment for more than three years.

f. Pledging: One can pledge gold ETF units as collaterals for obtaining loans.

Absence Of Top Performers

Although a mutual fund family may have a great reputation based on the performance of a few of its mutual funds, other funds within the family in different categories may not rise to that level of quality. It is inconceivable that any fund family would have all of the top performers across every category. For this reason, selecting a fund family because of its reputation for large-cap stock funds may commit you to the less-than-stellar performance of its bond funds for your bond investments, for example.

Recommended Reading: Best Hard Assets To Invest In

Advantage #: The Past Performance Of Mutual Funds Is A Matter Of Public Record

Advisory services, financial planners, and stockbrokers have records of past performance, but how public are they? And how were they computed? Did they include every recommendation made for every account? Mutual funds have fully disclosed performance histories, which are computed according to set standards. With a little research, you can learn exactly how various mutual funds fared in relation to inflation or other investment alternatives.

Mutual Funds Are Versatile

All of the plusses of mutual funds combine to offer flexibility. They’re simple enough to be understood and used by beginners. Yet, they are also varied enough to be used by professional money managers, who often use them to build portfolios for clients.

As a new investor, you may buy your first fund to start saving for retirement. A large investment firm might use the same fund in a portfolio of funds for a major client, such as a wealthy trust client or an endowment fund used by a major university or non-profit organization.

Disclaimer: The information on this site is provided for discussion purposes only and should not be misconstrued as investment advice. Under no circumstances does this information represent a recommendation to buy or sell securities.

Don’t Miss: Barclays Investment Bank New York Ny

Investing In Mutual Funds Is Easy

Building a portfolio of stocks and bonds can be complex for novice investors. The time, effort, and knowledge you need to research and analyze a dozen or more stocks can be a huge challenge for most people. You also need to think about all the trades you’ll need to make to build your portfolio, plus the ongoing research and thought that are required to maintain it. Still, when it comes to mutual funds, you can get started with just one fund.

You’ll need to do a little research to find a fund that meets your goals and your level of risk. Decide how many years you want to invest and how much risk you can take. For instance, if you have a lot of time and can stand some risk, a stock or bond fund might be for you. If you need something with lower risk and have a date in mind for when you’ll need to use the money, you could look at a target fund. Once you find a fund, you’ll find that the choices within that fund have been made for you by an expert who has done the research for you.

Next Steps To Consider

Exchange-traded products are subject to market volatility and the risks of their underlying securities, which may include the risks associated with investing in smaller companies, foreign securities, commodities, and fixed income investments. Foreign securities are subject to interest rate, currency exchange rate, economic, and political risks, all of which are magnified in emerging markets. ETPs that target a small universe of securities, such as a specific region or market sector, are generally subject to greater market volatility, as well as to the specific risks associated with that sector, region, or other focus. ETPs that use derivatives, leverage, or complex investment strategies are subject to additional risks. The return of an index ETP is usually different from that of the index it tracks because of fees, expenses, and tracking error. An ETP may trade at a premium or discount to its net asset value . The degree of liquidity can vary significantly from one ETP to another and losses may be magnified if no liquid market exists for the ETP’s shares when attempting to sell them. Each ETP has a unique risk profile, detailed in its prospectus, offering circular, or similar material, which should be considered carefully when making investment decisions.

ETFs are subject to market fluctuation and the risks of their underlying investments. ETFs are subject to management fees and other expenses.

Also Check: Commercial Real Estate Analysis And Investment Mit

New Kyc Norms Set Up By Fund Houses

According to the new norms set by Indian fund houses, an individual would not be able to buy mutual funds in case his Know Your Customer is under process or on hold. This new rule has come into function from November, 01, 2015. Previously the fund house would process and allot the units even if this parameter wasnt met. However, according to the new norm, only customers whose KYC has been verified will be able to transact. The KYC parameters include declaration of the gross annual income or net worth and is applicable to both existing and new customers.

According to Harshad Chetanwala, head at Quantum Mutual Fund, fund houses processed requests of investors, until recently, if they had applied for KYC. In case the KYC was on hold, the concerned person was intimated about the reasons and asked to submit missing information or documents. As per the new guidelines issued by the Association of Mutual Funds in India , this is rule has been changed. Investors, whose status is displayed as on hold, will have to submit the additional documents or get a new KYC done.

6 November 2015

Advantage #1: Mutual Funds Provide A Safe Place For Your Investment Money

Mutual funds are required to hire an independent bank or trust company to hold and account for all the cash and securities in the pool. This custodian has a legally binding responsibility to protect the interests of every shareholder. No mutual fund shareholder has ever lost money due to a mutual fund bankruptcy.

Also Check: Vanguard Investment Management Development Program

Why Do People Buy Mutual Funds

Mutual funds are a popular choice among investors because they generally offer the following features:

- Professional Management. The fund managers do the research for you. They select the securities and monitor the performance.

- Diversification or Dont put all your eggs in one basket. Mutual funds typically invest in a range of companies and industries. This helps to lower your risk if one company fails.

- Affordability. Most mutual funds set a relatively low dollar amount for initial investment and subsequent purchases.

- Liquidity. Mutual fund investors can easily redeem their shares at any time, for the current net asset value plus any redemption fees.

How To Select The Right Mutual Fund For You

There are many kinds of mutual funds out there, so you may wonder what are the best mutual funds or how to choose a mutual fund. There isnt a single best mutual fund that is the right decision for everyone. Instead, what might be the right mutual fund for some people may not be the right mutual fund for you, depending on your own unique financial situation. When choosing a mutual fund, two things that youll want to consider is your time horizon and your individual risk tolerance.

Your time horizon is roughly defined as the length of time until youll need the money that you are investing today. If youre in your 20s and investing for retirement, you may be willing to accept more risk, since you might have 40 years or more until youll need the money. With that much time, the long-term upward trajectory of the overall market is likelier to make up for any short-term losses. On the other hand, if youre investing to save up for a down payment on a house or for your kids college, you may want to take fewer risks.

Your individual risk tolerance speaks to how comfortable you are with risk. If you have a solid grasp of how the stock market works and are comfortable with short-term losses, you might be willing to select a mutual fund with higher average returns and higher potential short-term losses. If the thought of losing any money causes you stress and worry, you might want to choose a mutual fund that minimizes losses, even at the expense of a higher overall return.

Read Also: How To Invest In Real Estate With Little Capital

Convenience And Fair Pricing

Mutual funds are easy to buy and easy to understand. They typically have low minimum investments and they are traded only once per day at the closing net asset value . This eliminates price fluctuation throughout the day and various arbitrage opportunities that day traders practice.

As with any type of investment, the specifics of your budget, timeline and profit goals will dictate what the best mutual fund options are for you.

Things To Consider While Investing In Large Cap Mutual Funds

Key factors to consider while investing in the best large cap mutual funds:

- Risk and return ratio of large cap funds

- Consistency of the scheme over the last three years

- Only long-term investors should consider large cap mutual funds

- Asset size of the large-cap scheme

- Long-term Investment goals and amount to be invested

- Capital Gains Tax and Dividend Distribution Tax

- Understand large-cap fund meaning with respect to investment risk, including downside risk

- Mean rolling returns for the last three years

Read Also: How Many Employees Does Fisher Investments Have

How To Invest In Gold Etfs

Investing in gold ETF is relatively simple you must have a Demat and trading account with a broker. One can open Demat and trading accounts by providing essential KYC documentation like PAN and proof of address.

Once the account is active, you may select the gold ETF to invest in. The units will credit to your Demat account. When you wish to redeem, you will receive cash equivalent to the value of gold.

Aditya Birla Mutual Fund Will Bring Changes In The Debt Schemes

As per a new circular of SEBI passed in October 2017, there will be changes in the attributes of various mutual fund schemes. This circular is passed with an intent to bring a standard in the scheme categories and the characteristics of each category. As per the new circular, there will be total 36 sub-categories within the main categories like debt schemes, equity schemes, hybrid schemes, solution-oriented schemes, and several others. It is launched in order to bring a uniformity in the attributes of the same type of funds in the mutual fund sector in India.

Following the circular, Aditya Birla Mutual Fund Company has altered the attributes of some of its schemes like ABSL Cash Plus, ABSL Savings Fund, ABSL Banking and PSU Debt Fund, and others. The changes are mainly made in respect of the scheme types, investment goal, investment strategy, and asset allocation as per the regulation 18 of the SEBI Regulations regarding mutual funds, 1996. The customers of Aditya Birla MF who don’t agree to the changes can either redeem or switch their units at applicable NAV without any exit load which will be valid from 2 May 2018 to 1 June 2018 up to 3.00 pm.

18 June 2018

Also Check: Boussard & Gavaudan Investment Management Llp

Should You Invest In Gold Etf

One can say that Gold ETFs are suitable for investors looking to take advantage of the long-term appreciation in gold prices. Investment in gold ETF means investment in gold in its purest form.

In addition, gold ETFs are ideal for investors who do not want to invest in physical commodity gold. Gold ETFs still allow them to take advantage of rising gold prices by trading it on the exchange. Gold ETFs provide the opportunity to gain market exposure to the price and performance of the precious metal.

Gold-based exchange-traded funds have given good returns in the last few years. This fact makes them a perfect investment option for conservative investors looking to invest for the long term.

The expenses in gold ETFs are in the form of brokerage up to 0.5 to 1%, making them a cheaper investment option than other mutual fund schemes. It is advisable to keep the investment in Gold ETF limited to 5-10% of your portfolio to maintain the balance of risk and return in your portfolio.

What Is The Advantage Of Mutual Fund Idcw Option

In dividend option, profits made by the mutual fund scheme are paid out investors at certain intervals. The most common dividend pay-out interval is annual. However, some schemes also offer other pay-out intervals e.g. daily, monthly, quarterly etc. If you want cash-flows from your mutual fund investment you can invest in IDCW option. However, you should know that mutual fund dividends or IDCW payments are not assured and are paid at the discretion of the fund manager or fund house.

Read Also: Different Types Of Loans For Investment Properties