Treasury Bills And Commercial Paper For Short

For example, you might want to consider a Treasury bill : a U.S. government debt security with a maturity of less than one year. T-bills are one of the most marketable securities, and their popularity is mainly due to their simplicity. The maturity for a T-bill is either three, six, or 12 months, and new ones are typically issued on a weekly basis. The constant issue of new T-bills and the competitive bidding process mean that T-bills can be easily cashed in at any time. Furthermore, banks and brokerages traditionally charge a very low commission on trading T-bills. You can purchase Treasury bills in the U.S. through any of the 12 Federal Reserve banks or 25 branch offices.

Commercial paper is another investment you might want to consider. It is an unsecured, short-term loan issued by a corporation, typically for financing accounts receivable and inventories. It is usually issued at a discount to reflect current market interest rates. Maturities usually range no longer than nine months and, because of their slightly higher risk, they usually offer a higher rate of return than a T-bill.

How Can I Be Sure Im Purchasing A Safe Bond

As with any investment, buying bonds carries risk. However, you can research the quality of the short-term bonds youre interested in purchasing before making a decision.

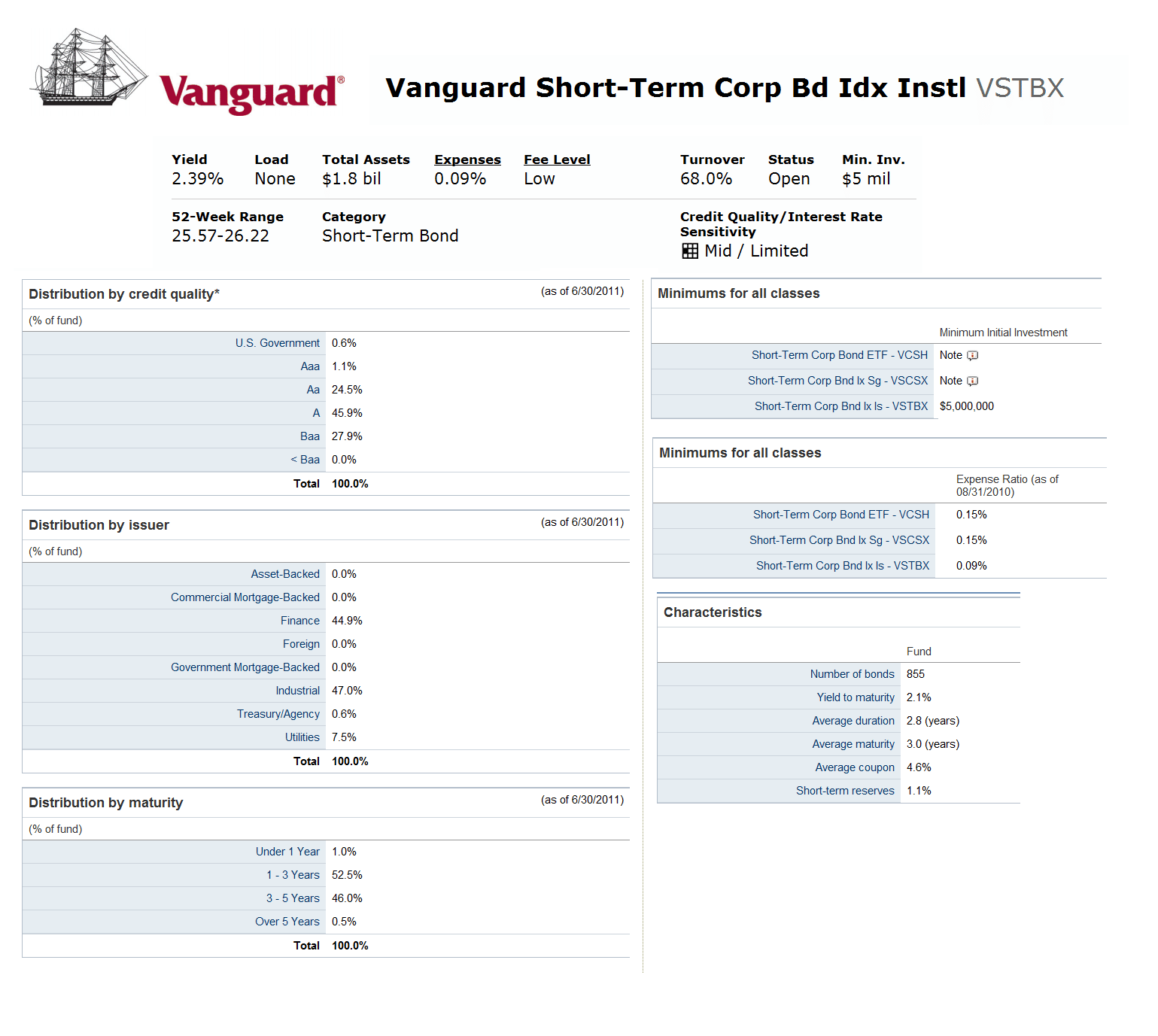

Bonds have ratings, or grades that indicate their quality, to help investors determine whether each bond is a wise investment. Various rating agencies such as Moodys, Standard and Poors, Fitch Ratings and DBRS assign ratings to a firms bonds. Those ratings are based on the bond issuers financial strength, growth potential and ability to repay its obligations.

U.S. government bonds are backed by the faith and credit of the U.S. government, so they offer the most security and least riskbut they typically pay interest rates that are lower than other short-term bonds. For instance, corporate bonds typically pay the highest interest rates, but the interest is fully taxable. Interest on short-term municipal bonds is exempt from federal income taxes, but the interest rate is usually lower than that of corporate bonds.

What I Look For In A Short

There are all kinds of ways to invest your money for the short-term, but you should definitely be picky when it comes to money you may need in the next few years. After all, you want to make sure you arent taking on too much risk, especially when it comes to risking substantial loss of capital. Yet, you also need to ensure your money will be somewhat easy to access when you need it.

The main factors I look for when comparing short-term investments include:

- Stability: The best short-term investment options tend to have a low risk of losing money over the short-term, or at least not over any period of three to five years.

- Liquidity: Short-term investments should also be somewhat liquid, or at least accessible within a one to five-year timeline.

- Low Transaction Costs: Short-term investments shouldnt require you to pay exorbitant fees to access your money or to invest in the first place.

All the short-term investments we have outlined in this guide fit this criteria to a certain extent, although there are certainly some pros and cons to consider with each option we recommend. For example, investing in Series I Savings Bonds gets you a guaranteed return of 9.62%, yet you wont be able to access your money for a least one year and youll give up three months in interest if you cash out your bonds within the first five years.

Also Check: How To Invest Hsa Funds In Stocks

What Returns Can I Expect With Short

Shorter terms translate into lower risks for investors. And that usually means lower returns. When everything else is equal, a bond with a longer term to maturity will usually pay a higher interest rate than a shorter-term bond. For example, 30-year U.S. Treasury bonds often pay one or two full percentage points higher than five-year Treasury notes.

Thats because when you buy a bond with a shorter maturity date, your money wont be tied up as long as with a longer-term bond. With a long-term bond, there is more risk that higher inflation could reduce the value of payments, as well as greater risk that higher overall interest rates could cause the bonds price to fall.

Because of those additional factors, the returns on bonds arent just dependent on the length of time until maturity. Bond returns also are influenced by current interest rates. When interest rates are rising, for instance, short-term bonds usually provide better total returns than their long-term counterparts. When interest rates are falling, longer-term bonds usually provide stronger total returns than short-term bonds.

What Are Short Term Investments

Home » Accounting Dictionary » What are Short Term Investments?

Definition: A short-term investment, also called a temporary investment or marketable security, is a debt or equity security that is expected to be sold or converted into cash in the next 3 to 12 months. In other words, its a stock or bond that management holds to earn a quick return and plans on selling in the current accounting period.

Recommended Reading: How To Invest In Cryptocurrency Stocks

Where Do Millionaires Keep Their Money

Many millionaires keep a lot of their money in cash or highly liquid cash equivalents. They establish an emergency account before ever starting to invest. Millionaires bank differently than the rest of us. Any bank accounts they have are handled by a private banker who probably also manages their wealth.

List Of Short Term Investment Options In India

1. Savings account

A savings account is a popular investment option that is preferred by many individuals. Most individuals find it easy and convenient to hold money in a savings bank account. A savings account is usually held with a bank or any other financial institution. The depositor deposits money and earns interest on the deposit amount. These accounts are known for their liquidity, as one can withdraw the money whenever they want.

The interest rates for savings accounts vary from institution to institution. The rates range from 3.5% to 7% per annum. Also, there is no limit with respect to the deposit amount, and many banks offer zero balance savings accounts.

2. Bank fixed deposits

Bank fixed deposits are one of the popular short term investment options as they offer guaranteed returns. These are also the safest investment options. The returns on bank FDs are fixed and dont change with market movements. Banks offer a 3-7% return on FD investments for varying tenures. Moreover, senior citizens get preferential FD rate. Investors can calculate their potential returns from FDs using a fixed deposit calculator. The tenure for a bank FD ranges from 7 days to 10 years. Also, investors can choose from the existing tenure options offered by the bank.

3. Recurring Deposits

4. Treasury Securities

5. Debt funds

6. Large Cap mutual funds

Check out: Capital Gain Calculator

7. Post Office Time Deposits

8. National Savings Certificate

READ MORE:

Don’t Miss: How To Invest In The Stock Market As A Teenager

Do I Pay Taxes On Stocks I Dont Sell

If you sold stocks at a loss, you might get to write off up to $3,000 of those losses. And if you earned dividends or interest, you will have to report those on your tax return as well. However, if you bought securities but did not actually sell anything in 2020, you will not have to pay any stock taxes.

What Are The Similarities Between Long

The similarities between long-term and short-term investments are that they are both types of investments, and they both have the potential to help investors build wealth.

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

Home Loans General Support:

- Mon-Fri 6:00 AM 6:00 PM PT

- Closed Saturday & Sunday

- Mon-Thu 8:00 AM 8:00 PM EST

- Fri 8:00 AM – 7:00 PM EST

- Closed Saturday & Sunday

- Mon-Thu 5:00 AM – 7:00 PM PT

- Fri-Sun 5:00 AM – 5:00 PM PT

You May Like: How Does Fisher Investments Rank

Top 10 Best Short Term Investments Types

Each of the following options can yield from 0.5% to 100% per annum or more in one day or in a few months. They all belong to short-term investments and are characterized by different risk levels.

Short-term investment options:

1. Short-term bank deposits, call deposits, high-yield savings accounts. One-week or one-month deposits that can be immediately withdrawn at a client’s request.

Pros:

- Reliability. Fixed bank deposits are insured. In the USA, it’s Federal Deposit Insurance Corporation that underwrites bank deposits.

- Low entry threshold.

- Low profitability that sometimes can’t cover inflation.

Another example of short-term investments is certificates of deposit. They are securities issued by banks.

2. P2P lending. There exist micro-financial companies and platforms where physical persons lend money to other physical persons. An investment period lasts from a few days to a few months.

Pros:

- Profitability is much higher as compared with bank deposits.

Cons:

- High risk. Such deposits aren’t insured, and there’s a high chance of not getting money back. Such platforms can go bankrupt, or they can be financial frauds.

Crowdlending can be an alternative to P2P lending. Investors are physical persons, and borrowers are legal entities there. You are likelier to have your money back with profits than with P2P lending. However, the investment period is longer and starts at one month.

3. Treasury bonds, government, and municipal bonds.

Pros:

Cons:

Pros:

Cons:

Pros:

Cons:

Pros:

Cons:

What Is The Capital Gains Rate For Retirement Accounts

One of the many benefits of IRAs and other retirement accounts is that you can defer paying taxes on capital gains. Whether you generate a short-term or long-term gain in your IRA, you dont have to pay any tax until you take money out of the account.

The negative side is that all contributions and earnings you withdraw from a taxable IRA or other taxable retirement accounts, even profits from long-term capital gains, are typically taxed as ordinary income. So, while retirement accounts offer tax deferral, they do not benefit from lower long-term capital gains rates.

Don’t Miss: How Much To Invest In Gold

Common Profile For A Short Term Investment

As noted above, short term investments are financial instruments that you hold for less than a year. Most traders will hold a short term investment for several months at the most, looking to profit off volatility and near-term gains.

While any asset can technically be a short term investment, most will share a few common features. They will typically be volatile assets, letting the price move quickly enough for investors to profit off the asset within a brief period. They will generally have relatively small price movements. Finally, a short term investment will also generally be highly liquid, allowing investors to sell the asset fairly quickly.

Common short term investments include products such as stocks, options and ETFs, all volatile assets with existing markets that allow rapid sale.

In particular, day traders and active traders often hold significant short term investments.

What To Consider Before Short

Before you make a short-term investment, ask yourself two questions:

-

What are your investment goals?

-

What is your risk tolerance?

-

What do you know about investment strategies?

Your investment goals will determine which type of investment you make. Some investors may want to create a passive income, while others may want to amplify the cash thats sitting in their bank accounts.

Dror Zaifman, a finance professional & a seasoned director for iCASH, offers this advice, Before investing, think about what you will need the money for. If you need it within a year, then you should invest in short-term instruments such as cash and near cash investments. If you need the money in a few years, then you can consider investing it in longer-term instruments such as stock markets or fixed income securities.

As you consider where you want to go, think about your ideal timeline. Do you want to bolster your monthly income? Or, are you trying to save for a down payment over the next year? These questions will help as you review the variety of short-term investments below.

You should also determine your risk tolerancein other words, how much of a loss are you willing to take? Remember, no investment is guaranteed and theres always some amount of risk even in investments that are considered safe.

Recommended Reading: Bitcoin Investment Trust Investor Relations

Series I Savings Bonds

Series I savings bonds are issued by the department of the treasury and pay interest every month which is compounded every six months. They offer stellar returns as far as bonds go, and even come with tax benefits although investors will have to pay federal taxes on these bonds, state and local taxes are waived in most cases.

As of early 2022, the interest rate on these bonds is slightly higher than 7%. Between such high returns and the tax benefits, its a wonder people even invest in other bondsright? Unfortunately, wrong there are a couple of drawbacks associated with these bonds.

For starters, investors can only purchase $10,000 in these bonds per calendar year. On top of that, they arent too flexible investors can cash out only after an entire year has passed, and cashing out before five years have passed comes with a penalty fee that equals three-months interest.

Still, its tough to overstate the benefits that these bonds bring to the table if these fit the desired time horizon, they can prove to be a powerful tool, and are a particularly good fit for laddering.

Investment Goals And Time Horizon

Your investment goals are your north star for choosing the right investments, followed by your time horizon . Youll want to group your high-level financial goals into time horizons of near term and long term in order to choose the investments that make the most sense.

Investors with near-term goals often choose short-term investments. Day traders who rely on their short-term trading profits may have the goal of generating income for the next week or month. Not all short-term investors are day traders, though, and some may choose investment vehicles like a one-year bond or CD if their goal is to safely grow their savings for a particular upcoming expense, like a home down payment or a vacation.

Other short-term investments like high-yield savings accounts or money market accounts may appeal to investors who want more flexible access to their funds .

On the other hand, investors looking to achieve long-term goals will select long-term investments that wont be touched for an extended period of timeeven decades. Building a retirement fund is a common long-term goal, and many new long-term investors set out to achieve it by opening an employer-sponsored retirement account like a 401 or Roth IRA.

You May Like: Best Investment Properties To Buy

Short Term Investments Explained

Short term investments are classified based on two criteria these vehicles mature in a couple of months or a few years and become saleable within a year. Therefore, any investment that fulfills these two requirements is categorized as a short-term financial investment option.

Businesses and organizations opt for such temporary investments to ensure they have enough cash to invest in other assets to grow their ventures. For example, the companies that remain in a strong financial position always aspire to retain and even move beyond what they have achieved. Investing in short-term options lets them have additional cash to spend on stocks and bonds, keeping the companys revenue or profit shares untouched.

Individuals look forward to investing in temporary options when they have frequent short term financial obligations to fulfill. However, when individuals and businesses invest in such financial options, they get a chance to enjoy the benefits of higher interest rates over a period. They make an investment, which they convert into cash or sell in a few months, reaping profits, and then repeat the process, thereby grabbing short-term profits now and then.

Short term investments on the balance sheet find a place in the current asset section.

How Short Term Investment Works

Short term investments are those securities that can be easily converted to cash. The primary goal of short term investments for both individuals and corporates is to protect capital and at the same time, generating returns. Short term investments offer higher returns than a regular bank savings account. Hence investors can park their excess funds in these investments and earn a higher return. Investors with a short term investment horizon of 1 month to 5 years can invest in these securities.

For corporates, short term investment plans help in earning additional income to meet their working capital requirements. Companies with good cash balance can afford to invest in short term investments. Usually, companies park their excess funds for a tenure ranging from 1 day to 12 months. All the investments that they make are highly liquid and can be converted into cash easily. Since the short term investment gives predictable returns, they are considered as high-quality, low-risk investments.

Furthermore, investors can also park their surplus cash to meet their short term goals. Short term goals such as buying a vehicle, going on a vacation or buying jewellery can be realized by investing in these schemes. Instead of holding idle cash for a short duration, one can invest in short term investment plans and generate some returns.

You May Like: How To Invest In Argo Ai

Real Estate Investment Trusts

Potential interest rate: Varies, but tends to be higher than other short-term investments

Real Estate Investment Trusts offer another way to invest for the short-term with less risk than the best long-term investments. This type of investment is made up of companies that own income-producing real estate that may be commercial, residential, or industrial in nature.

Investing in REITs lets you get exposure to returns from the real estate market without the added stress or gruntwork of being a landlord. REITs also let you invest in real estate with a lot less capital than you need to invest in physical property. For example, a company called Fundrise sells private equity REITs, and investors can open an account and start building a real estate portfolio with as little as $10.

Just keep in mind that returns are not guaranteed with REITs, and that you have the potential to lose money in the short-term. However, Fundrise has performed well since the companys inception in 2010. After achieving average investment returns of 7.31% for their customers in 2020, the company returned clients 22.99% on their investments in 2021. During the first quarter of 2022, Fundrise investors have earned average returns of 3.49% on their investment.

Its also important to note that some REITs are more liquid than others. In fact, funds invested with Fundrise may be difficult to liquidate if you need your money quickly.

- Stability: Medium