What Should My Roth Ira Be Invested In

IRARoth IRAinvestmentsinvestmentRoth IRAinvest

Overview: Top Roth IRA accounts in March 2020:

- Charles Schwab: Best overall.

- Interactive Brokers: Best for active traders.

- Fundrise: Best for alternative investments.

- Vanguard: Best for low costs.

- Merrill Edge: Best for in-person help.

Subsequently, question is, how does money grow in a Roth IRA? Roth IRA GrowthWhenever the investments in your account earn a dividend or interest, that amount is added to your account balance. Your account can grow even in years in which you aren’t able to contribute. You earn interest, which gets added to your balance, and then you earn interest on the interest, and so on.

Likewise, people ask, how do I manage my Roth IRA?

How much should I put in my Roth IRA monthly?

IRA Contribution LimitsFor both 2019 and 2020, the standard contribution limit for both traditional and Roth IRAs is $6,000. If you’re 50 years of age or older, the IRS provides a catch up feature that allows you to contribute an extra $1,000 each year for a total of $7,000.

- Savings Account.

- Precious Metals.

youallyour Roth IRA moneyyoulose allyour moneycan loseVanguard Roth IRAVanguard’sRoth IRAsRoth

How Does A Roth Ira Make Money

A Roth IRA is really just a special home for your savings that helps you minimize your taxes. It doesn’t actually make money for you. Your retirement savings grow through a combination of your contributions and investment earnings.

Obviously, the more you contribute to your Roth IRA, the more it will be worth, assuming you’re not also withdrawing funds from the account. Contributing routinely is ideal, but you must stay mindful of the annual contribution limits: $6,000 in 2021 and 2022, or $7,000 if you’re 50 or older. However, Roths IRAs have income limits, which means certain high-income earners may have lowered contribution limits or may not be able to contribute money directly to a Roth IRA at all.

You place your Roth IRA contributions in various investments that will hopefully increase in value over time and earn you dividends or interest, which you can withdraw tax-free later. This can happen even when you’re not actively contributing to your Roth IRA. That compounding growth could be worth thousands of dollars by the time you’re ready to retire.

How much your Roth IRA will grow every year depends on how much you’re contributing and what you’re investing in. It’s impossible to predict because the stock market can be volatile, and past performance doesn’t guarantee future returns.

Prohibited Transaction Limitations For Iras Owning Small Businesses

As noted earlier, in order to enjoy the benefit of IRAs, taxpayers must abide by a variety of rules. One set of rules to which IRA owners must adhere are the Prohibited Transaction rules of IRC Section 4975. The Prohibited Transaction rules restrict an individual from using their IRA to engage in various types of transactions with certain Disqualified Persons.

Failing to abide by the Prohibited Transaction rules can land an IRA owner in hot water. Specifically, when an IRA owner causes their own IRA to engage in a Prohibited Transaction, the entire IRA is deemed to be distributed as of January 1 of the year the Prohibited Transaction occurred. Income tax is imposed on the pre-tax portion of the distribution , and if the IRA owner is under 59 ½, the 10% early distribution penalty applies as well. Furthermore, all interest, dividends, and capital gains earned by the investments after the deemed distribution date are considered to be earned in a taxable account, thus further adding to an impacted individuals tax woes.

IRC Section 4975 outlines the various Prohibited Transactions. Specifically, the following types of transactions are prohibited, whether they are engaged in directly or indirectly:

sale or exchange, or leasing, of any property between a plan and a disqualified person

lending of money or other extension of credit between a plan and a disqualified person

furnishing of goods, services, or facilities between a plan and a disqualified person

Don’t Miss: Best Short Term Investment Grade Bond Funds

How Risk Tolerance Affects The Amount Allocated To Stock

With creating your asset mix, you should feel comfortable that the ups and downs of the stock market won’t undermine your ability to reach your long-term goals. That way you’ll be less likely to panic and sell when stocks fallbecause doing so can lock in losses and could make it harder to recover and reach your goals.

How much risk can you stomach? Take a look at the worst case market scenarios for the 4 different investment mixes shown below. During the worst market year since 1926, the conservative portfolio would have lost the least17.67%, while the aggressive portfolio would have lost the most60.78%. The chart also shows how each investment mix performed over a long period of time, in different markets. The average return: 5.93% for the conservative vs. 9.77% for the aggressive mix.

Choose an investment mix you are comfortable with

Past performance is no guarantee of future results.

Other Reasons To Favor A Roth

Your tax owed on withdrawals isnt the only reason to be aware of the implications of asset location.

The tax characteristics of the investments themselves is another factor to weigh. For example, an investment that generates interest income thats already exempt from taxes doesnt need the coverage the Roth offers. Dividends paid on municipal bonds, for example, are already exempt from federal taxes.

Dividends paid out by REITs , on the other hand, are not sheltered from the IRS reach. And because REITs are known for generous dividends, the Roth makes an ideal home for this type of investment.

For active traders, a Roth IRA is ideal.

Another consideration is the frequency of trading activity that takes place within the account and within the investments held in the account.

In a regular, taxable account, investors who trade in and out of positions frequently expose themselves to capital gains taxes. Investments that are held in a taxable account for less than a year are subject to short-term capital gains, which are taxed at a higher rate than long-term capital gains.

For active traders, a Roth IRA is ideal: The IRS doesnt even require you to report capital gains taxes each year. And, of course, qualified distributions in retirement are tax-free.

For the same reason, actively managed mutual funds with high turnover rates are well-suited to the Roths tax protections.

Also Check: Tax Efficient Real Estate Investing

What Do Roth Iras Invest In

What you can invest in depends on which type of Roth IRA you open and which custodian you use. Most Roth IRAs enable you to invest in the following:

- Stocks: When you invest in a stock, you’re purchasing part ownership of a company. Stocks are known to generate larger returns than bonds over the long term, but they can be volatile in the short term.

- Bonds: Bonds are debt. When you buy one, you’re lending money to a company or government organization that pays you back over time plus interest. They offer lower, but more predictable, returns than stocks.

- Mutual funds: Mutual funds are baskets of stocks and bonds that you purchase as a bundle. They enable you to quickly diversify without purchasing a bunch of individual stocks and bonds.

- Exchange-traded funds : Exchange-traded funds are similar to mutual funds, except ETFs are traded like stocks, whereas you can only buy mutual funds at their price at the end of each trading day.

- Certificates of deposit : A CD is a special type of savings account most banks offer that requires you to leave a sum of money untouched in your account for several months or years in exchange for a high rate of interest on those funds.

- Money market accounts: A money market accounts is another type of savings account that offers an above-average rate of interest and limits your monthly withdrawals, though if you’re keeping the money in a Roth IRA, you probably aren’t intending to withdraw funds until retirement.

The Best Investments For Your 30s

If you’re in your 30s, you have 30 years or more to profit from the investment markets before you are likely to retire. Temporary declines in stock prices won’t hurt you as much because you have years to recoup any losses. So if your stomach can handle the volatility of stock prices, now’s the time to invest aggressively.

Also Check: Best Real Estate Markets To Invest In Right Now

Can You Choose Your Own Investments In A Roth Ira

Yes, you can choose your own investments in a Roth IRA when you open it with an online brokerage. Most of the major brokerages make this process simple.

You can search for whichever stock, ETF, mutual fund, or other investment youre interested in and place an order.

Often, there will be additional information available for you to look over before making decisions.

Bonds And Fixed Income

Bonds refer to a wide variety of financial instruments. Rather than a single bond, there are a variety of interest-bearing securities. Bonds can be classified into five types: Treasury, savings, agency, municipal, and corporate. A bond has its own seller, purpose, buyer, and level of return vs. risk.

In contrast to stocks, which are shares of ownership in a company, bonds are debt securities, so their growth potential is limited. The loan is issued for a fixed amount with a fixed interest rate and is fully repaid upon maturity.

In theory, bonds maintain the same value over time. As a result, they protect the principal and reduce overall portfolio risk.

An investment portfolio composed of 80% or 90% stocks and 20% or 10% bonds, for example, is less volatile than one composed entirely of stocks.

Investing in short-term bonds is one of the most effective ways to keep your money safe. A money market account, a certificate of deposit, and a bond fund are all examples of this type of investment.

Generally, your retirement portfolio shouldnt be dominated by them. However, a relatively small allocation can help minimize losses during a bear market,

A longer-term investment may provide you with a higher yield than shorter-term bonds. For example, a bonds interest rate typically increases with the bonds term.

Also Check: What To Know About Investing In Gold

Tax Optimization In Action

Lets say an investor earmarks $5,500 to buy a handful of stocks with high growth potential in her Roth IRA. During the next 25 years, the companies thrive and generate an average annual return of 15% per year.

Her investments are now worth roughly $180,000. If she holds those stocks in a Roth IRA, thats $180,000 she can withdraw from the account tax-free, regardless of what tax bracket she find herself in during retirement.

House the money in a traditional IRA and shed walk away with roughly $150,000 after paying taxes . This is why its wise to stash your most aggressive growers investments with higher total return prospects in a Roth IRA.

Investments that will benefit from tax-free growth offered by the Roth include small-cap stocks and mutual funds, international stocks , high-yield corporate bonds and initial public offerings, or IPOs.

» MORE: Follow these simple steps to start investing in stocks.

On the flip side, putting investments like money markets or certificates of deposit in a Roth doesnt really pay off since these slow-growing investments earning low single-digit returns wont amount to a huge tax burden down the road anyway.

» Ready to try a Roth IRA? Check out our list of best Roth IRA account providers.

Transferring Shares When Disqualified Persons Own 50% Or More Of Outstanding Shares

When it comes to the Prohibited Transactions rules, the sad and frustrating reality is that while there are situations in which the rules clearly allow, or dont allow, a particular transaction, there is often an extraordinary broad gray area, in which a transaction may be a Prohibited Transaction. One such gray area is the treatment of a business that is already owned 50% or more by Disqualified Persons.

There is no doubt that the 50% threshold definitely removes additional owners from the pool of potential sellers to the IRA belonging to the 50% or greater owner . Specifically, as detailed above, once the 50% threshold is met , the business, itself, becomes a Disqualified Person, as does any 10%-or-more owner of that business, employee earning 10% or more of the wages of that business, or officer, director, or person with similar responsibilities of that business.

Ultimately, given the potential cost of being wrong the immediate and full distribution of an individuals entire IRA account it would seem that, in general, individuals would be best served with a better safe than sorry approach.

Read Also: Should I Invest In Chainlink

Main Benefits Of A Roth Ira

The main benefits of a Roth IRA are as follows:

- Tax-free withdrawals of income in retirement.

- Tax-free withdrawals of contribution amounts before reaching age 59½.

- The Roth IRA is not subject to required minimum distributions.

- Youre free to choose the investment trustee and the investments you will hold in your plan.

- Capital gains arent taxed, but to access them tax-free, youll need to use a qualified distribution

Where To Open A Roth Ira

One of the benefits of the Roth IRA that we discussed earlier is that you can open one wherever you want! There are many brokerages and investment firms offering Roth IRAs, but we want to make two recommendations specifically.

It is crucial to choose the right brokerage or firm to work with, as it could potentially save or cost you tens of thousands of dollars over the lifetime of the account.

Also Check: Is Fisher Investments Worth The Money

How To Open A Roth Ira Account

Even though there are numerous brokerage firms to get started, the best thing you can do as an investor is find one you like and stick with it. You dont want to waste time. Pick one and get moving.

Thanks to these online investment firms, opening a Roth IRA can take as little as a few minutes. Heres how to get started:

Find Out If Youre Eligible And Ready

First things first. Before you can open a Roth IRA, you have to make sure you meet the income limits to contribute to a Roth IRA.

In 2022, as long as your adjusted gross income is less than $129,000 for single filers and $204,000 for married couples filing jointly, you can contribute the maximum amount to a Roth IRA.1

Remember when we said your Roth IRA has a specific place in your wealth-building plan? Heres the deal: Eligibility for an IRA isnt all you should keep in mind. You also need to make sure saving for retirement fits into your budget. That means youll need to be halfway through the Baby Steps. Baby Step 1 is saving a $1,000 starter emergency fund. Baby Step 2 is getting out of debt using the debt snowball method. Baby Step 3 is saving three to six months of expenses for a fully funded emergency fund.

And then you get to Baby Step 4investing 15% of your household income for retirement. When youre trying to figure out where to invest for retirement first, remember: Match beats Roth beats Traditional. This means you should invest in your 401 up to your match , then max out your Roth IRA. If you havent reached 15% at that point, go back and invest in your 401. And if you have a Roth 401 at work, great! You can invest your entire 15% there.

Working through the Baby Stepsand getting out of debtis the quickest right way to build wealth. So if you havent paid off all your debt or saved up an emergency fund, stop investing for now. No exceptions!

Don’t Miss: Austin Real Estate Investment Club

If You’re Strategic About Moves You Make With Your Roth Ira You Can Accumulate Even More In It

IRAs were already very useful accounts for retirement savings when Roth versions of them were introduced as part of the Taxpayer Relief Act of 1997. The key feature of Roth IRAs can make a big difference in your retirement savings — especially if you use the Roth in smart ways. Here are four Roth IRA investing tips that could earn you thousands of dollars.

IRA basics First, though, let’s review just what IRAs are, and how they work. For a wealth of in-depth resources on IRAs, you can visit our IRA Center. In the meantime, a quick overview.

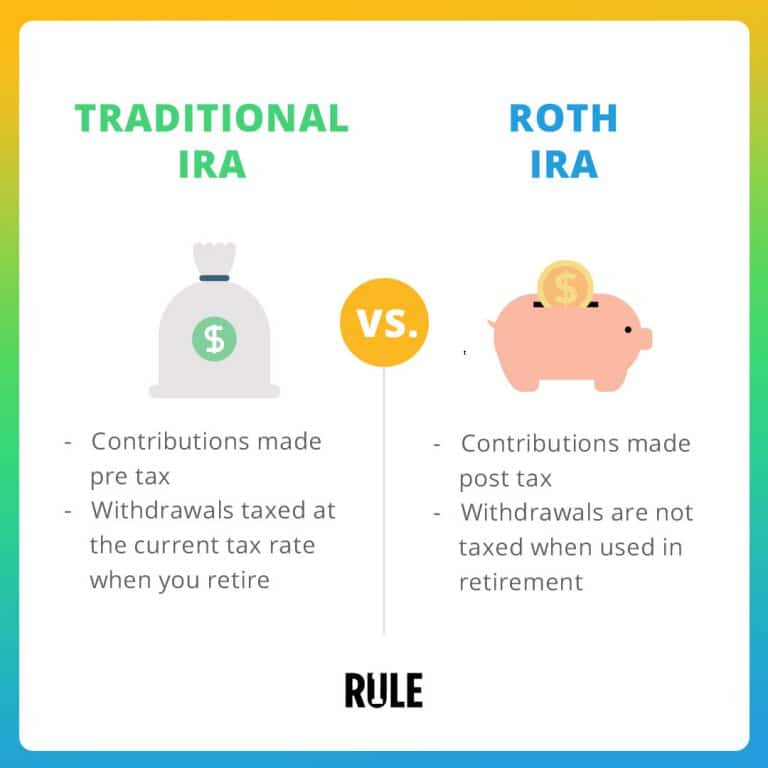

There are two main kinds of IRAs — the traditional IRA and the Roth IRA. With a traditional IRA, you contribute pre-tax money, reducing your taxable income for the year, and thereby reducing your taxes, too. The money grows in your account and is taxed at your ordinary income-tax rate when you withdraw it in retirement.

With a Roth IRA, you contribute post-tax money that doesn’t reduce your taxable income at all in the contribution year. Here’s why the Roth IRA is a big deal, though: Your money grows in the account until you withdraw it in retirement — tax free.

Now, let’s get to those savings-boosting investing tips.

Real estate investment trusts are also good for Roth IRAs. They tend to generate a lot of dividend income, but much or all of that is often not eligible for the low long-term capital gains tax rate, and is instead taxed at your ordinary income-tax rate.