Bonus Idea: Real Estate Hard Money Loans

Potential interest rate: Varies

Real estate hard money loans work differently than traditional mortgage lending, mostly because the borrowing requirements are looser than a traditional home loan. This means the investor buying a property can get their hands on their loan funds considerably faster , yet they pay a higher interest rate and have a much higher down payment requirement.

Investors who put their money into real estate hard money loans take on considerably more risk as a result. That said, the returns can be exceptional for investments that pay off.

Also note that real estate hard money loans usually last for just a few years, which makes them unique from traditional home loans that last 15 to 30 years. That said, investors who take on these loans wont get their money back until the borrower pays their loan off, so theyre not nearly as liquid as other investments options.

- Transactional Costs: Varies

How To Find Individual Companies Worth Buying

The best stock picking services consider all of the variables discussed above when making their selections to subscribers. Have a look at two Motley Fool stock research services subscribed to by close to a million investors.

We think either subscription makes for a great short-listing system to find good stocks worth investigating yourselfand possibly even buying for your portfolio for the long-term.

Both services recommend buying and holding for no less than three to five years, departing with some of the other swing trade alerts services people use to find short-term profit potential in the stock market.

1. Motley Fool Rule Breakers: Best for Long-Term Investors Looking for Growth Stocks

- Best for: Buy-and-hold growth investors

- Price: Discounted rate for the first year

Motley Fool Rule Breakers focuses on stocks that they believe have massive growth potential in emerging industries. This service isnt fixating on whats currently popular, but rather always looking for the next big stock.

The service has six rules they follow before making stock recommendations to subscribers:

Pros:

Places To Put Your Cash Now

With inflation spiking and the Fed raising interest rates, it’s time to rethink your savings strategy

Inflation isnt just making everything you buy more expensive. Its also taking a huge bite out of your savings.

While the cost of living is climbing at an annual rate of 8.5 percentthe biggest monthly increase in close to 40 yearsmost savings rates are still well below 1 percent. That means your cash is rapidly losing value. So its time to develop a new strategy for where you keep your money.

The Federal Reserve is hiking interest rates more rapidly to slow inflation, most recently with a 0.75 percentage point increase. Banks have started to raise their own deposit rates, but they often move slowly and the increases tend to be small. The savings account rate recently has averaged about 0.13 percent.

None of this means you should pull your money out of savings accounts. No matter what rate youre getting, its important to have cash on hand in case the unexpected happens.

You should not be trying to use your savings accounts to maximize returns but to cover costs in an emergency and to help you ride out stock market downturns without panicking, says Manisha Thakor, a certified financial planner and financial educator at MoneyZen in Portland, Ore.

That said, it makes sense to get the biggest bang for your buck, especially if rates head even higher in the coming months, as many forecasters predict.

Also Check: Goldman Sachs Real Estate Investing

How Does Liquid Investing Work

Essentially, liquid investing works by providing the most access to your funds as quickly as possible. Although there are different kinds of liquid investments, the goal of easy access to your funds remains throughout.

When looking at the right liquid investment for your life, consider the risks and rewards associated with each option. Since everyones finances are different, youll have to choose which liquid investment is right for you.

On the other hand, an illiquid investment would require you to relinquish regular access to the funds in favor of a higher potential return.

What Are High Yield Investments

Investing can provide you with funds to be used in other areas of your life- it might help fund your retirement, a vacation or may even need it to pay off an emergency.

Above all, investing grows your wealthbuilding up your funds for retirement and increasing your purchasing power over time.

Owning high-yielding investments can get you to a secure financial future sooner than low-risk, low-return investments. High-yield, high-return investments are assets which can provide great earnings on your invested dollars.

They can be acquired in a variety of ways, including buying shares and bonds from companies, purchasing real estate, or even alternative investment vehicles with high interest payments.

High yield investments provide an alternative to low-risk investing options such as bonds, CDs, money markets, savings accounts and treasuries. Though, both types of investments have a place in a well-balanced portfolio.

Investing can help you grow your wealth, but smart investing also involves balancing risks with returns. Its also important to have the right knowledge and perspective about investing.

Stay on top of your debt, save up an emergency fund in case of unexpected expenses or a job loss, and attempt to ride out market fluctuations without liquidating your portfolio.

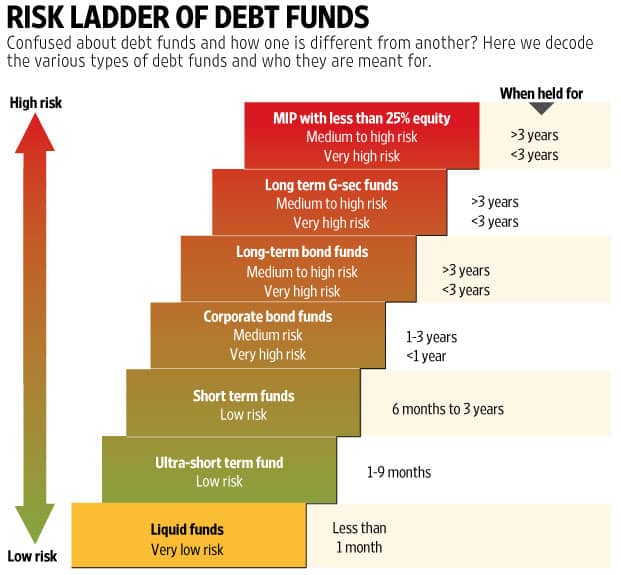

The following list below goes from the safest to riskiest investments. Consider each and how they might fit into your well-rounded investment portfolio.

You May Like: Where To Go To Invest In Cryptocurrency

What Happens To Bonds When Interest Rates Go Up Or Down

Bond prices have an inverse relationship to interest rates. When interest rates rise, the demand for bonds falls. The price of a bond usually goes up when there is high demand for it because it pays a higher rate of interest than the prevailing market opportunities.

While seemingly illogical at first glance, this negative correlation for bond prices and yields makes complete sense.

If a bonds stream of payments remain fixed over time and interest rates available in the market change, this income generated becomes either more desirable or less so .

Unsurprisingly, bond investors try to get the best return on their investment. Because of this, they need to keep tabs on fluctuating borrowing costs offered by the market.

If they care about price appreciation, they want to buy longer-term bonds in a falling rate environment because this exposes them to the most interest rate risk and potential upside.

Likewise, to avoid the pinch of rising rates, bond investors should focus on short-term bonds because these are the least susceptible to interest rate movements.

What Are The Tax Implications Of These Investment Options

When you purchase a capital asset be it a stock, bond, house, widget, Bitcoin, or other investment you establish a basis equal to your cost to acquire it.

When you sell, you compare your sales proceeds to the basis to determine whether you have a capital loss or a capital gain.

If your proceeds exceed your basis, you have a capital gain. If reversed, you have a capital loss.

Youll also need to consider the time period for which you held the asset.

Depending on how long you hold your cryptocurrency, your gains or losses will be considered short-term or long-term.

That distinction will also play a big role in how much you have to pay in crypto taxes.

Also Check: Global Trends In Renewable Energy Investment 2020

Real Estate Investment Trusts

Potential interest rate: Varies, but tends to be higher than other short-term investments

Real Estate Investment Trusts offer another way to invest for the short-term with less risk than the best long-term investments. This type of investment is made up of companies that own income-producing real estate that may be commercial, residential, or industrial in nature.

Investing in REITs lets you get exposure to returns from the real estate market without the added stress or gruntwork of being a landlord. REITs also let you invest in real estate with a lot less capital than you need to invest in physical property. For example, a company called Fundrise sells private equity REITs, and investors can open an account and start building a real estate portfolio with as little as $10.

Just keep in mind that returns are not guaranteed with REITs, and that you have the potential to lose money in the short-term. However, Fundrise has performed well since the companys inception in 2010. After achieving average investment returns of 7.31% for their customers in 2020, the company returned clients 22.99% on their investments in 2021. During the first quarter of 2022, Fundrise investors have earned average returns of 3.49% on their investment.

Its also important to note that some REITs are more liquid than others. In fact, funds invested with Fundrise may be difficult to liquidate if you need your money quickly.

- Stability: Medium

How To Choose The Right Guaranteed Investments

Now that you know some of the most popular investments with guaranteed returns, here are a few tips for how you can choose the right investment.

Read Also: Guide To Investing In Gold And Silver

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

You Want Safety And Maximum Interest On Funds You Access Regularly

Online savings accounts are among the safest savings vehicles, with federal insurance covering up to $250,000 in deposits per holder, whether through a bank or a credit union.

You can find the rates offered for these high-paying accounts on websites such as Deposit Accounts and Bankrate. Check the minimum deposit, fees, and features, such as ATM access and check writing. And note the limitations, such as the number of free monthly withdrawals.

You can also review the accounts rate history on Deposit Accounts . If the account has been around for several years, theres less likelihood that the current APY is a teaser rate that will drop later, says Ken Tumin, founder and editor of Deposit Accounts.

Money market accounts offer yields similar to savings accounts but with some additional benefits and restrictions. Offered by banks and credit unions, theyre insured like savings accounts, up to $250,000 per individual holder. Institutions are able to provide higher rates on these accounts by investing your money in secure, short-term Treasury debt.

If you can stash a significant amount in a money market account, you may benefit from more rate stability than in an online savings account, Tumin says. Thats because some money market accounts offer higher rate tiers for balances above a certain amountsuch as $25,000and are less likely to change rates at those higher tiers later.

Read Also: Fidelity Investments Money Market Government Portfolio

Treasury Notes Treasury Bills And Treasury Bonds

If you want to earn a slightly better interest rate than a savings account without a lot of additional risk, your first and best option is government bonds, which offer yields ranging from 2.46% for a duration of one month, to 3.58% for a duration of 30 years .

Bonds issued by the U.S. Treasury are backed by the full faith and credit of the U.S. government. Historically, the U.S. has always paid its debts. This makes government debt reliable and easier to buy and sell on secondary markets, if you need access to your cash before the debt is mature.

This stability, however, means bonds may have lower yields than you might earn from bonds where the debt was less likely to be paid back, as is the case with corporate bonds.

Who Should Invest In Liquid Funds

Who Should Invest in Liquid Funds?

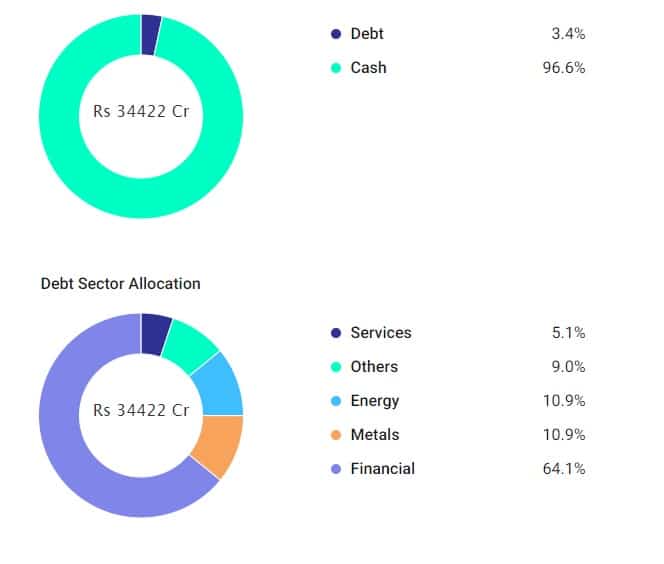

The returns offered by liquid funds are much higher than that of a regular savings bank account. Therefore, if you have any surplus funds, then you may consider parking them in liquid funds and earn better returns. As the fund mostly invests in high-quality securities, the risk-averse investors may also consider investing in liquid funds.

You May Like: Investment Property Home Loan Rates

Are Money Market Funds Safe

Money market funds are relatively safe in that they invest in low-risk securities with short-term maturities. That said, they are still an investment in securities which can lose value. Money market funds are usually considered to be sake investments, but its important to remember that these investments are intended for the the short term. With maturities of 13 months or less, the funds stay liquid and allow you better access to your money than longer-term investments. A crucial distinction investors must makes is the difference between money-market funds vs. money-market accounts.

Money market accounts are interest-bearing savings products offered by banks and other financial institutions. These accounts are FDIC-insured up to $250,000 per depositor, per insured bank. Money-market funds are not. Its important to know which option is best for you and your investment goals.

What Are The Different Types Of Investments

We will cover four main available types of investments. These investments may also fall into different asset classes, and they are each unique in terms of characteristics, benefits, and risks. Its important to understand the various types of assets and choose a good blend depending on your financial goal and risk tolerance level.

A good understanding of what you want to invest depending on your financial goals can make your money work for you.

Also Check: How To Invest In Physical Silver

How Money Market Funds Work

Money market funds are regulated by the Securities and Exchange Commission, or the SEC, and are required to invest in short-term debt securities, such as certificates of deposit, U.S. Treasury bills and commercial paper. The funds have historically tried to maintain a share price of $1 and there have only been two instances where a fund fell below that price, but theres no guarantee a fund will be able to do that.

Money market funds are required to purchase securities with maturities of 13 months or less, or in some cases 25 months if it is a government security. The weighted average maturity of a funds portfolio must be 60 days or less. These requirements help to maintain the overall liquidity of money market funds and ensure that the portfolio wont be tied up in long-term investments.

There are a few different types of money market funds based on the security the fund invests in.

- Prime funds invest in floating-rate debt and commercial paper issued by companies, U.S. government agencies and government-sponsored enterprises.

- Tax-exempt funds are typically made up of municipal bonds and are exempt from federal income taxes and in some cases state taxes.

- Government and treasury funds invest in cash and securities that are backed by the government, such as U.S. Treasury bills.