Global Renewables Outlook: Energy Transformation 2050

Newsletter

Browse by theme

Key findings available in:

The Global Renewables Outlook shows the path to create a sustainable future energy system. This flagship report highlights climate-safe investment options until 2050, the policy framework needed for the transition and the challenges faced by different regions. As the world seeks durable economic solutions, accelerated uptake of renewables promises to drive sustainable development, boost well-being and create tens of millions of new jobs.

The key findings are also available in Arabic,Chinese ,French ,German ,Japanese ,Russian ,Spanish .

This comprehensive analysis from the International Renewable Energy Agency outlines the investments and technologies needed to decarbonise the energy system in line with the Paris Agreement. It also explores deeper decarbonisation options for the hardest sectors, aiming to eventually cut carbon dioxide emissions to zero.

Raising regional and country-level ambitions will be crucial to meet interlinked energy and climate objectives. The report presents findings on the specific transition prospects for ten regions around the world.Comprehensive policies could tackle energy and climate goals alongside socio-economic challenges, fostering the transformative decarbonisation of societies.

Among other findings:

Falling Clean Energy Costs Provide Opportunity To Boost Climate Action In Covid

Angus McCrone, Ulf Moslener, Francoise dEstais, Christine Grüning, Malin Emmerich

As COVID-19 hits the fossil fuel industry, the GTR 2020 shows that renewable energy is more cost-effective than ever providing an opportunity to prioritize clean energy in economic recovery packages and bring the world closer to meeting the Paris Agreement goals.

Governments and companies around the world have committed to adding some 826 gigawatts of new non-hydro renewable power capacity in the decade to 2030, at a likely cost of around $1 trillion. Those commitments fall far short of what would be needed to limit world temperature increases to less than 2 degrees Celsius. They also look modest compared to the $2.7 trillion invested during the 2010-2019 decade, as recorded by this Global Trends report.

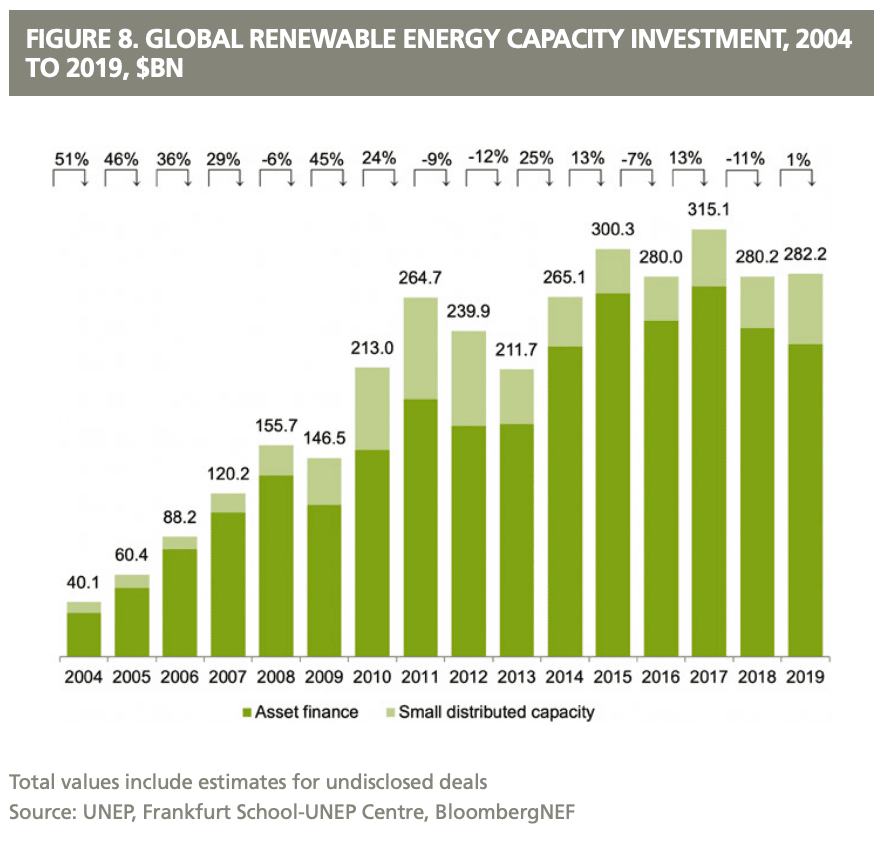

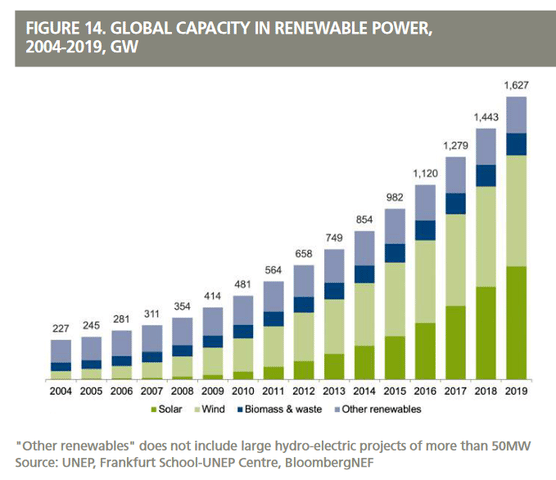

In 2019, the amount of new renewable power capacity added was the highest ever, at 184 gigawatts, 20GW more than in 2018. Falling costs meant that this record commissioning of green gigawatts could happen in a year when dollar investment in renewable energy capacity stayed almost flat. In 2019, renewable energy capacity investment was $282.2 billion, just 1% higher than the previous year.

Megatrend : Promising Prospects For The Decentralisation And Digitalisation Of Electricity

The decentralisation of energy, particularly in the electricity sector, is set to rise in the next decade, especially in regions that still lack access to electricity, such as Africa.

This megatrend would be stimulated by several factors: the falling costs of renewable energy technologies, which are an important component of distributed grids the emergence of new technologies for efficient management of distributed grids and the fact that decentralised systems are in some cases more cost-efficient than centralised grids, especially in areas with low population density. Therefore, the trend for the next decade is to replace the systematic resort to upsizing centralised grids with decentralisation, when it is cost-effective, while at the same time developing distributed network management technologies. This scenario emphasises the crucial role of geospatial analysis in order to determine the areas most suited for decentralised off-grid solutions, while extending the main grid at the same time.8

Also Check: How Do I Invest In Nike Stock

World Energy Investment 2020

The energy industry that emerges from the Covid-19 crisis will be significantly different from the one that came before

Flagship report

IEA , World Energy Investment 2020, IEA, Paris https://www.iea.org/reports/world-energy-investment-2020, License: CC BY 4.0

About this report

Explore online contents

Breakdown Of Renewables In The Energy Mix

In the section above we looked at what share renewable technologies collectively accounted for in the energy mix.

In the charts shown here we look at the breakdown of renewable technologies by their individual components hydropower, solar, wind, and others.

The first chart shows this as a stacked area chart, which allows us to more readily see the breakdown of the renewable mix, and relative contribution of each. The second chart is shown as a line chart, allowing us to see more clearly how each source is changing over time.

Globally we see that hydropower is by far the largest modern renewable source . But we also see wind and solar power are both growing rapidly.

How you can interact with the stacked area chart

- In these charts it is always possible to switch to any other country in the world by choosing Change Country in the bottom left corner.

You May Like: Using Va Loan For Investment Property

Megatrend : Oil Proves Resilient Despite The Crisis

In spite of the very optimistic outlook for renewables and the major developments they have witnessed in terms of technology and costs, oil will likely continue to dominate energy use and production in many developing regions of the world, unless major policy changes are made now.

Global oil demand is expected to account for 30% of global energy demand by 2030, followed by coal and natural gas . Oil demand is projected to increase mainly in developing countries, by an annual average of 0.9 million barrels a day between 2018 and 2030, whereas it should decrease in developed countries. Even though oil will remain the dominant fuel, its growth in overall global demand is expected to slow down during the 2030s, without it necessarily hitting a peak in overall use. As for oil production, North America is expected to account for the largest share by 2030 , followed by Eurasia . Russias share in global oil production should slightly fall, while that of smaller producers like Brazil and Guyana should increase. These developments have far-reaching consequences for OPECs share of total production, which is expected to decrease to 37% in 2030, compared with 41% in the mid-2000s. Nevertheless, continued investment in new sources of supply in OPEC and Russia is still essential for the long-term stability of the oil market.

Why Are These Trends Important For Nato

Energy security is an essential element of resilience, which has become increasingly important in recent years due to the new security environment. The changing global energy landscape, and the risk of energy-supply disruptions, could thus affect the security of societies of Allies and partners, and have an impact on NATOs military operations. NATOs role in energy security was first defined in 2008 at the Bucharest Summit and has since been strengthened. And in 2014 NATO adopted its Green Defence framework, which aims to further develop NATOs competence in supporting the protection of critical energy infrastructure and continue to work towards significantly improving the energy efficiency of their military forces.10 In light of the megatrends discussed in the previous sections, the tightening of the global oil market and the recent oil price disruptions, not to mention the threat of terrorist attacks on critical infrastructure, have once again made energy security an issue of strategic importance.

Don’t Miss: Use Your Home Equity To Invest

Global Investment In Clean Energy And Efficiency And Share In Total Investment 2015

The Covid-19 pandemic has brought with it a major fall in demand, with high uncertainty over how long it will last. Under these circumstances, with overcapacity in many markets, a cut in new investment becomes a natural and even a necessary market response.

However, the slump in investment may not turn out to be proportional to the demand shock, and the lead times associated with energy investment projects mean that the impact of todays cutbacks on energy supply will be felt only after a few years, when the world may be well into a postrecovery phase. As such, there is a risk that todays cutbacks lead to future market imbalances, prompting new energy price cycles or volatility.

In addition, even before the crisis, the flow of energy investments was misaligned in many ways with the worlds future needs. Market and policy signals were not leading to a large-scale reallocation of capital to support clean energy transitions. There was a large shortfall in investment, notably in the power sector, in many developing economies where access to modern energy is not assured. Although todays crisis in some ways represents an opportunity to change course, it also has the potential to exacerbate these mismatches and take the world further away from achieving its sustainable development goals.

The implications of the current investment slump depend on the speed and sustainability of the worlds economic recovery

How Esg Went From A Focal Point To A Flash Point

The debate is heating up, and it may shed light on the future of ESG investing.

How ESG Went from a Focal Point to a Flash Point

Weve talked on previous episodes of Dry Powder about the quiet yet rapid rise of ESG investing, but the public conversation around ESG has shifted in the last few months.

You can listen to this episode of Dry Powder and catch future episodes by subscribing on Apple Podcasts, , Spotify, or wherever you may listen.

The debate about sustainability and ESG is indeed quite energetic right now, says Debra McCoy, a partner in Bains San Francisco office and our global lead for capital markets, sustainability, and ESG. But its important that we have this debate, because there havent been venues to talk about this.

Today on the show, Debra and I discuss why the conversation has been heating up and how it could shed light on the future of ESG investing.

You May Like: Stock Market Investing Jason Kelly

What Is This Report

Energy Transition Investment Trends is BNEFs annual accounting of global investment in the low-carbon energy transition. It includes a wide scope of sectors, covering renewables, energy storage, electrified vehicles and heating, hydrogen, nuclear, sustainable materials and carbon capture.

It also covers VC/PE and public markets investment in climate-tech companies, as well as thematic highlights such as sustainable debt and performance of clean energy equities.

Our data are compiled through bottom-up research on hundreds of thousands of individual deals and projects around the world, as well as aggregated estimates for deployment of small-scale, consumer-led technologies. The work is led by Bloombergs global team of analysts and leverages our latest data gathering and processing technologies.

Press ReleaseGlobal investment in the energy transition totaled $755 billion in 2021 a new record, and a 21% increase from 2020 with almost half the investment occurring in Asia.

Global Trends In Renewable Energy Investment Report

|

German Federal Ministry for the Environment, Nature Conservation and Nuclear Safety |

|

Region: |

|

Worldwide |

Project Overview

The report on Global Trends in Renewable Energy Investment grew out of efforts to track and publish comprehensive information about international investments in renewable energy. The latest edition of this authoritative annual publication covers the most recent developments, signs and signals in the financing landscape of renewable power and fuels. It explores issues affecting each type of investment, technology and type of economy.

The Frankfurt School UNEP Collaborating Centre for Climate & Sustainable Energy Finance catalyses applied research work carried out by Frankfurt School Faculty and other co-operating researchers. This is achieved by a small core team of researchers that work closely with the project activities of the FS-UNEP Centre. In the framework of its research activities, the FS-UNEP Centre publishes the yearly Global Trends in Renewable Energy Investment Report in cooperation with Bloomberg and the UN Environment Programme. The report analyses the latest trends in renewable energy for the investment categories of government/corporates, venture capital, private equity, public equity markets, mergers & acquisitions and debt markets. The report was first published by the FS-UNEP Centre in 2011 and was previously produced under UNEPs Sustainable Energy Finance Initiative.

Contact

Recommended Reading: Best Stocks To Invest In App

Carbon Value Creation Plan

Alongside creating positive environmental and societal outcomes, decarbonization can create economic value for investors when done right it can lower costs, improve revenue and multiples, and facilitate better management of capital. We can help you:

For example, we determined an updateable emissions baseline for a manufacturing company, prioritized its key decarbonization actions, aligned on a decarbonization ambition, and created a detailed plan with quick win-wins and steps to achieve long-term goals.

Global Landscape Of Renewable Energy Finance 2020

Newsletter

Browse by theme

While global investments in renewable energy have risen steadily in recent years, they remain far below the levels required to put the world on course for a climate-safe future.

This report, co-developed by the International Renewable Energy Agency and Climate Policy initiative, provides actionable recommendations for policy makers and other stakeholders to scale up investment and mobilise capital in the sector.

From about USD 300 billion globally in recent years, annual investments in renewables must triple to USD 800 billion by 2050 to fulfil key global decarbonisation and climate goals.

Renewable energy has proven resilient and flexible amid the COVID-19 crisis, as well as providing a valuable opportunity to align economic recovery with sustainable development and climate goals. By placing renewables at the centre of stimulus plans, governments can attract investments, increase investor confidence, strengthen national energy strategies and fulfil climate pledges under the Paris Agreement.

Among other findings:

See also the studys underlying methodology.

Recommended Reading: State Farm Investment Management Corporation

The Renewable Energy Sector Is Ready To Branch Out

In 2021, the renewable energy industry remained remarkably resilient. Rapid technology improvements and decreasing costs of renewable energy resources, along with the increased competitiveness of battery storage, have made renewables one of the most competitive energy sources in many areas. Despite suffering from supply chain constraints, increased shipping costs, and rising prices for key commodities, capacity installations remained at an all-time high. Wind and solar capacity additions of 13.8 GW in the first eight months of 2021 were up 28% over the same period in 2020. Many cities, states, and utilities set ambitious clean energy goals, increasing renewable portfolio standards and enacting energy storage procurement mandates.

Renewable energy growth is poised to accelerate in 2022, as concern for climate change and support for environmental, social, and governance considerations grow and demand for cleaner energy sources from most market segments accelerates. At the same time, the Biden administrations vision to fully decarbonize the US economy is helping spur activity in the renewable sector that will likely drive further growthparticularly if proposed legislation is enacted. In our renewable energy industry analysis, the following five trends are expected to move to the forefront in 2022, opening new avenues in the renewable energy growth story.

Global Trends In Renewable Energy Investment 2019

“Learn about the measures that are crucial for a global transition into a renewable energy economy.”

Clean energy is a cornerstone of the better future we are building for humanity. Neither the Paris Agreement northe 2030 Agenda for Sustainable Development will be able to fulfill their full potential unless renewable energyreplaces fossil fuel generation. Renewable energy avoids…

“Learn about the measures that are crucial for a global transition into a renewable energy economy.”

Clean energy is a cornerstone of the better future we are building for humanity. Neither the Paris Agreement northe 2030 Agenda for Sustainable Development will be able to fulfill their full potential unless renewable energyreplaces fossil fuel generation. Renewable energy avoids the greenhouse gas emissions that warm our planet,improving air quality and therefore human health. It also brings new opportunities to energy-poor communities.

This year and next are likewise crucial for climate action. This report, authored by the Frankfurt School- UNEP Collaborating Centre for Climate and Sustainable Energy Finance, provides examples of how, with smart policies that truly value the economic and societal benefits of renewable power, we can acceleratethe transition to a renewable energy economy and give people the clean energy future they deserve. To read more about the Frankfurt School and UNEP, please click here.

Don’t Miss: Qualified Opportunity Zone Investment Funds

All Our Interactive Charts On Renewable Energy

We often hear about the rapid growth of renewable technologies in media reports. But just how much of an impact has this growth had on our energy systems?

In this interactive chart we see the share of primary energy consumption that came from renewable technologies the combination of hydropower, solar, wind, geothermal, wave, tidal and modern biofuels .

Note that this data is based on primary energy calculated by the substitution method which attempts to correct for the inefficiencies in fossil fuel production. It does this by converting non-fossil fuel sources to their input equivalents: the amount of primary energy that would be required to produce the same amount of energy if it came from fossil fuels. We look at this adjustment in more detail here.

In 2019, around 11% of global primary energy came from renewable technologies.

Note that this is based on renewable energys share in the energy mix. Energy consumption represents the sum of electricity, transport and heating. We look at the electricity mix later in this article.

Two tips on how you can interact with this chart

- View the data for any country as a line chart: click on any country to see its change over time, or by using the CHART tab at the bottom.

- Add any other country to the line chart: click on the Add country button to compare with any other country.

Investment By Value Chain And M& a Transactions

The 2019 investment brought the share of renewables, excluding large hydro, in global generation to 13.4 per cent, up from 12.4 per cent in 2018 and 5.9 per cent in 2009. This means that in 2019, renewable power plants prevented the emission of an estimated 2.1 gigatonnes of carbon dioxide, a substantial saving given global power sector emissions of approximately 13.5 gigatonnes in 2019.

The Global Trends in Renewable Energy Investment report is published on an annual basis since 2007. It is commissioned by the UN Environment Programme in cooperation with Frankfurt School-UNEP Collaborating Centre for Climate & Sustainable Energy Finance and produced in collaboration with BloombergNEF. The report is supported by the German Federal Ministry for the Environment, Nature Conservation, and Nuclear Safety.

Supported by the Federal Republic of Germany

You May Like: Can You Invest In Gold In An Ira