What Are The Benefits Of Liability

The primary advantage of liability-driven investing is that its goal is simply to meet future obligations .

It is therefore a more conservative, lower risk portfolio. The primary disadvantage is opportunity cost a more aggressive portfolio could have possibly made more money.

And whether youre a pension plan or an individual, implementing LDI is a great way to lower the market volatility component of your retirement/pension plan. This will allow you to more easily plan for your financial future many years or decades down the road.

Liability-driven investing returns significantly exceeded expectations in both 2019 and 2020, returning 14%-17% in 2019, and 12%-15% in 2020, depending on the duration of liabilities.

What Are The Factors That Can Affect The Ability Of A Pension Fund To Meet Its Commitment

Interest rates, inflation, and the longevity or life expectancy of the members can all affect a pension funds ability to meet its commitments. Lower interest rates result in increased liabilities’ current values. When inflation expectations are higher, the present value of liabilities would also be higher. Longer life expectancies will also raise the liabilities’ current value.

Our Goal Is Your Goal: Ensuring The Appropriate Level Of Risk And Return In Your Portfolio

Implementing LDI within an integrated model can provide significant benefits and efficiencies to your organization, including:

- Minimal handoffs and opportunities for error

- Full transparency of fixed income securities, for a more precise liability match

- Ongoing monitoring, integrated reporting and glidepath management

- A sophisticated, cost-efficient approach for plans, regardless of size

- A strong link between organizational goals and implementation

Recommended Reading: What Else To Invest In Besides Stocks

Blackrock Is Committed To Helping Our Clients Realise The Best Outcomes For Savers

While pension funds will always want to manage their investments in a liability-aware manner, recent UK market moves may prompt them to consider how their strategies need to evolve.

BlackRocks purpose is to help more and more people experience financial well-being. We are committed to supporting the UK pensions industry in working through this period of market volatility, to realise the best outcomes for those saving for their retirement.

Move To The New Allocation Systematically

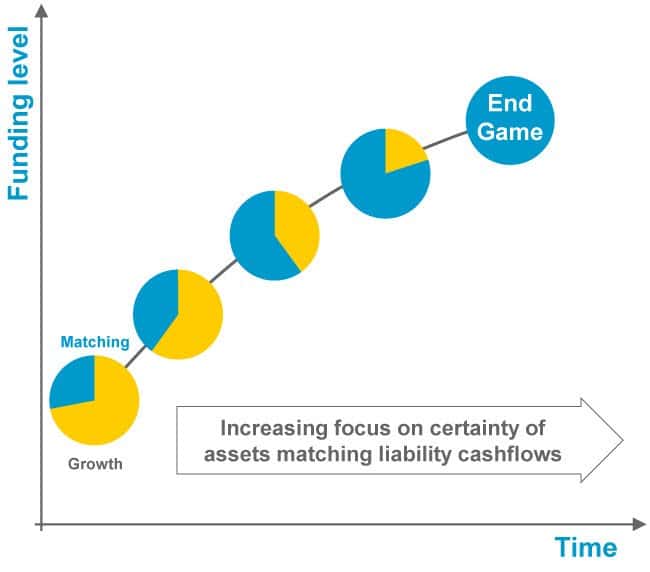

Once youve selected investment options, use a dynamic asset allocation strategy to monitor and adjust to the new allocation over time. This glidepath can help determine allocation and de-risking as funded status improves.

Sample glidepath for a hard-frozen DB plan

With a DAA strategy, the pension plan allocates more assets to fixed income investments as the plan’s funded status improves, as shown above. Investment gains are realized as they occur and then allocations shift to the fixed income side to reduce plan liabilities. This gradually reduces the portfolio risk.

Don’t Miss: Best Investment Grade Municipal Bond Funds

Schroders Alpha Matrix: A Framework For Measuring Diversification

Schroders active LDI portfolios are managed against either customized or standard market indices. Active portfolios can be managed within client-specific tracking error targets and can be managed with or without derivatives, and in tandem with completion managers as necessary.

Your browser doesn’t support HTML5 video. Here is a link to the video instead.

Please Select The Category That Applies To You:

- UK Corporate Pension Scheme

Schroders uses cookies to personalise and improve your site experience. You can accept all cookies by selecting I agree and continuing to browse the site or you can Manage cookies to apply only the categories of your choosing. Find out more details on how we use your information in our Cookie Policy.

How we use cookies

Schroders uses cookies to personalise and improve your site experience. You can accept all cookies by selecting I agree and continuing to browse the site or you can Manage cookies to apply only the categories of your choosing. Find out more details on how we use your information in our Cookie Policy.

Recommended Reading: Conventional Loan Investment Property Guidelines

Read Also: Best Investment Platforms In Nigeria

What Is Liability Driven Investment

A liability-driven investment, otherwise known as liability-driven investing, is primarily slated toward gaining enough assets to cover all current and future liabilities. This type of investing is common when dealing with defined-benefit pension plans because the liabilities involved quite frequently climb into billions of dollars with the largest of the pension plans.

Professional Investment Adviser And Investment Risk

You should consult a professional adviser on your particular financial circumstances before taking, or refraining from taking, any action on the basis of the content of our Site, and you should not rely on the material on this Site. Before making an investment, you should read the appropriate fund prospectus or other terms and conditions as may be appropriate and raise any questions you have on this documentation with your professional adviser.

All investments involve a degree of risk. In particular note:

- Past performance is not a guide to future performance

- The value of investments and the income from them may go down as well as up and you may not get back the amount invested and

- Where the investment has exposure to overseas assets, changes in exchange rates between currencies may cause the value of the investment and the level of income to rise and fall.

Recommended Reading: Florida Real Estate Investment Companies

The Modern Approach To Liability Driven Investing

The goal of liability driven investing is to cover future expenses. To do that, however, investments need to generate adequate returns. But at the same time, they also need to mitigate risk. As any investor knows, risk and reward operate opposite each other. Therefore, its important to maximize both without sacrificing either. This can be done if investors and advisors turn to a dual portfolio strategy.

The modern approach to liability driven investing involves two separate portfolios. It involves an aggressive portfolio and a defensive portfolio. By separating these objectives, investors can focus on one strategy per portfolio. And they can do this without compromising the overall investment goal.

Dynamic Derisking And The Introduction Of A Virtual Plan Manager

So far in our experiments, weve simulated outcomes in the absence of any intervention from what we might refer to as a virtual plan manager of the plans assets and liabilities. In this section of the paper, we introduce dynamic decision-making. We do this by using cutting-edge simulation technology known as multistage stochastic programming ,3 which is widely used in operations research. MSP allows for more sophisticated financial market models and realistic constraints, such as constraints on assets, transaction costs, and taxes, compared with more conventional simulation methods. It also allows us to introduce specific objectives for the plan over the 10-year simulation period, objectives that could be thought of as representing a strategy implemented by its managers.2

The objectives8 that we model are as follows:

Objective 1We assume that the plans planning horizon is 10 years and that the plans managers/sponsors would like to be in the position to afford a buyout at the end of this 10-year period.

Objective 2We assume that the plan wishes to maximise the funding ratio over the 10-year planning ratio. This means that the plans management will try to ensure that the funding ratio is as high as possible, given the other constraints.

Objective 3We assume that the plans managers wish to reduce the potential buyout cost at the end of 10 years.

Figure 5: dynamic derisking

Also Check: How Do You Get People To Invest In Your Business

Liability Driven Investing For Individual Investors

Many retail investors engage in this type of investing as they enter retirement. For example, the maximum amount Social Security will pay out is $3,148 a month . Meanwhile, Required Minimum Distributions vary depending on your age and amount. Therefore, individuals who want or need to live beyond this need to adopt this strategy to generate fixed income.

Bonds are the most common mode of liability driven investing. Coupon payments serve to generate income. Annuities are another example, as are dividend-paying stocks. However, most individual investors only need to adopt an LHP to fund their strategy. Theyll already benefit from supplemental income generated by qualified retirement funds and Social Security.

How Does Ldi Differ From A Traditional Investing Strategy

The funded status of a corporate pensionor defined-benefit plan is calculated by subtracting the plans liabilities from its assets. Traditional investment strategies for DB plans focus on generating a specific rate of return for the plans assets. This rate of return is typically based on a benchmark from a broad-based equity index, such as the S& P 500® Indexwith a goal of generating returns in excess of the benchmark.

Liability-driven investing, by contrast, focuses on aligning the plans assets with the projected benefit obligations, or liabilities, due to plan participants. There is typically a mismatch between assets and liabilities in defined-benefit plans, due in large part to the impact of interest-rate changes on both. In a standard pension plan, liabilities are typically far more sensitive to rate fluctuations than assets are. This causes a plans liabilities to grow or shrink at a much greater rate than its assets as interest rates change. Liability-driven investing aims to eliminate the difference between the two, matching assets with liabilities in order to better manage the plans risk of not meeting obligations to employees and pensioners.

You May Like: Gold Vs Silver Vs Platinum Investment

Developing Your Ldi Strategy

Our platform integrates your assets, liabilities and corporate finance. Add to that our comprehensive advisory services, supported by ongoing asset/liability studies, and youll get the full benefit of:

- A time-tested investment process for researching and identifying institutional investment managers who build portfolios designed to deliver consistent performance in a risk-managed framework

- Custom LDI and de-risking strategies

- Advanced scenario testing to help identify the potential impacts of investment decisions

- Stress testing to support risk management and monitoring

- Custom goals-based reports, including a graphical snapshot of your plans funded status and impact on enterprise financials

Why Is Ldi Preferred By Defined Benefit Pension Plans

Defined benefit pension plans need to ensure that their assets can yield returns sufficient to cover existing payouts and the value of future payments, which typically stretch out for decades, depending on the life expectancy of their members. LDI can help pension schemes to choose an investment strategy that can also cover liabilities in the future by investing to manage risks and generate growth at the same time.

Read Also: Kroger 401k Plan Investment Options

Putting Our Theory To The Test

To help demonstrate the benefits of a multicomponent LDI approach to pension plan management and to test the extent to which LDI can help improve the likelihood of meeting all retirement obligations in full and on time, we commissioned Professor Andrew Clare of Bayes Business School1 to construct a model based on the latest academic research. The results of the model form the basis of this paper.2

Their research found that:

- A key rate duration matching strategy produces better results in terms of risk management than those that can be achieved by investing in a traditional bond portfolio.

- An investment strategy that relies too heavily on the performance of equity markets, all else equal, will have a high probability of failing.

- Including Plus assets in the growth portfolio probably requires a more dynamic approach than can be achieved through straightforward annual rebalancing.

- A dynamic approach to asset allocation that combines a KRD-matching strategy and an allocation to Plus assets can improve the prospects of achieving a wide range of funding objectives.

How Do You Manage The Risk Of Unfunded Liabilities

We know what’s at stake. Real people are depending on the future payouts of your pension plan in order to fund their retirement years. As a fiduciary, it’s your responsibility to manage your organization’s pension fund in the context of the promises made to your employees and pensioners. A liability-driven investment strategy – matching assets to liabilities – is an efficient means to manage the risk of not meeting those obligations.

Defining LDI

Read Also: Etf Investing What Is It

Measuring The Liability Spread Hedge

Quantitative regression techniques can be utilized to estimate assets sensitivity to changes in the spread of the liability of the assets). The table shown in Exhibit XII expands on Exhibit X by quantifying the amount of the liabilitys spread exposure that is hedged by the assets. Note within the Fixed Income assets section that the ESD of the Long Credit Index is higher than the duration of the index by a factor of 1.2 , indicating that for a 1% change in the spread of the liability, the Long Credit spread changes by 1.2% on average. This is primarily due to the fact that the universe of bonds used to construct the liability discount curve has an average credit quality of A2/Aa, while the average credit quality of the Long Credit index is considerably lower at A3/ Baa1, and therefore has higher spread volatility. The allocation to Long Credit hedges 27% of the liabilitys exposure to Treasury rates, but it hedges 30% of the liability exposure to changes in credit spreads.

What Is Liability Driven Investing

The term liability-driven investing refers to an investment strategy. With this investment strategy, investors try to obtain enough assets to cover all their liabilities, whether current or future. As mentioned, a liability-driven investing strategy is most common in pension plans, specifically defined-benefit schemes. With these plans, the liabilities can significantly increase over time. Therefore, having enough assets to cover those liabilities is crucial.

READ OUR POSTS

Investors using the liability-driven investing strategy must estimate their current and future liabilities. Once they do so, they can work towards obtaining assets that can cover all those liabilities. For that, investors need to use asset management and allocation techniques. LDI is beneficial when investors dont want to focus on beating a benchmark. Instead, it helps them improve their portfolios, which in this case will be the pension plan.

Recommended Reading: Is It Worth It To Invest In Bitcoin

Dubai International Financial Centre United Arab Emirates

This Site is intended for the use of Deemed Professional Clients only, as defined by the Dubai Financial Services Authority Conduct of Business Rulebook. It is not intended for use by individuals.

The content provided on this Site is for information purposes only. None of the information, opinion, reports, or other documents contained or made available on this Site shall be construed as an offer, invitation, solicitation, advice or a recommendation for subscription or purchase by Legal & General to acquire or sell any products or services.

Neither the Dubai International Financial Centre Authority nor the DFSA has any responsibility for reviewing or verifying this Site or information published thereon. Accordingly, neither the DIFCA nor the DFSA has approved this Site or taken any steps to verify the information set out on this Site and has no responsibility for it.The Telephone Recording paragraph shall be deleted and replaced with Legal & General will record all telephone and electronic communications and conversations with you that result or may result in the undertaking of transactions in financial instruments on your behalf. Such records will be kept for a period of five years and will be provided to you upon request.

We are not licensed or authorised to carry on any regulated activity in the Dubai International Financial Centre.

If you do not understand the contents of this Site, you should consult an authorised financial advisor.

Section : Glidepath Design

Many plan sponsors follow a glidepath approach to managing their asset allocation, which derisks as funded status improves by shifting assets from return seeking to liability hedging. This strategy recognizes the asymmetric risk profile associated with a pension surplus depletion of the surplus can lead to additional required contributions, but an increase in the surplus may have little value to the sponsor or plan participants. While conceptually simple, implementation of a derisking glidepath requires plan sponsors to make several decisions. Exhibit XIV summarizes some of these decisions and details a possible glidepath for the illustrative plan detailed in the previous section. Recall the plan is 85% funded based on an accounting liability discounted at the FTSE Pension Discount curve and currently allocates assets 50/50 return seeking/liability hedging. The terminal allocation for the plan is 20% return-seeking assets/80% liability hedging assets and will be reached when the plan is 100% funded.

Plans must also consider the expected return impact associated with the credit allocation decision. Plans may reasonably choose a credit allocation that does not minimize funded status volatility if the expected return pickup justifies the additional risk.

Also Check: Socially And Environmentally Conscious Investments

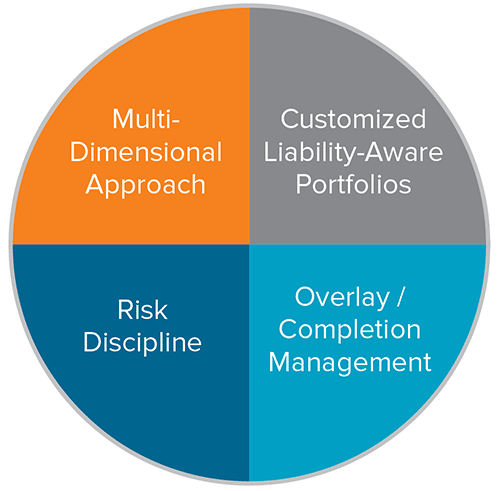

Why Choose Russell Investments For Liability

Good strategy requires effective implementation that can both contribute to returns and reduce risk. This is where we excel. We bring a unique combination of plan management experience and expertise with robust implementation capabilities as an asset manager. The strategies we design and recommend to our clients are made with full knowledge of how these strategies can be put to work effectively and efficiently in the market. And then we dynamically manage these strategies, looking out for our clients best interest as their plans evolve over time.

From strategy to execution, we will align ourselves with the best interests of your organization and deliver an end-to-end solution that aims to improve the total portfolio outcome for your plan.

Understanding Ldi: Balancing Funding Level And Risks

A pension schemes funding level can be used to determine whether it is able to meet its commitment to pay income to its members. It determines the total number of liabilities covered by the scheme.

Pension fund providers must secure investment returns or contributions to maintain or grow their funding position, which can shift over time as the value of liabilities changes.

Funding positions have become more volatile as a result of future payment values being frequently correlated with three highly uncertain and volatile factors: interest rates, inflation and the members duration on the scheme.

The lower interest rates mean higher current value of liabilities. The present value of liabilities would also be higher when the inflation expectations were higher. Higher life expectancy also increases the current value of the liabilities.

Therefore, pension funds or individuals will seek investments that link to those factors. According to BNY Mellons Introduction to Liability-Driven Investment:

This explains why LDI was an increasingly popular investment product offered by asset managers to pension funds.

According to the Investment Associations 2021 to 2022 investment survey, LDI strategies grew to almost £1.6trn from the £400bn reported in 2011.

Don’t Miss: Non Profit Real Estate Investment