Ask Family Relatives Or Friends

When many new entrepreneurs seek investors, the first contacts they reckon are their relatives and friends. Its also usually more cost-effective because family and friends are more likely to offer you money at a better rate than a professional financier or bank.

Although persuading friends or family to invest in your business may be effortless, certain measures must be met. Its advisable to approach them like conventional investors and thoroughly explain your plans and the risks involved with your company.

You must specify if you want to request a loan or a direct investment, which usually entails granting them a share of potential profits. Keeping professional relationships with your friends can have unintended repercussions if you dont communicate with them effectively at all times.

A Good Reason For The Investment

Your investors arent just going to hand you the cash you want and walk away. Again, theyre in this for the return. So theyre going to want to know exactly why you need the cash and exactly what you plan to do with it. Theyll also want to know when they can expect a return that should be a part of your business plan.

Investors will also be looking for an exit strategy, and you need to think about that in advance. When they want to sell, will you buy them out? Can they sell to another party? If they dont know that they can get their money out if things start to go south, theyre not going to want to put it in in the first place.

Post Your Business On Online Fundraising Sites

Also Check: 15 Or 30 Year Mortgage For Investment Property

Clear Detailed Marketing Plan

Whether you are starting your business or need to secure startup investor funding to get to the next level, investors want to see a marketing plan demonstrating two things: you know your audience and how to reach them. Investors may want to know about the software you use daily.

Are you using a robust, all-in-one marketing tool? Or several software platforms? At the minimum, prepare to have an email platform, social media scheduling program, website performance software like Google Analytics, SEO software, and a CRM. Along with a well-defined tech stack, a clear, detailed marketing plan should include the following:

- Targeted campaign strategy

- A lead and email nurture strategy

- Social media strategy

- Conversational marketing strategy

- Regular reporting

Present your marketing plan to investors and show them the channels you plan to use to increase your visibility in the market.

Ask Family Or Friends For Capital

This may be the easiest and most cost-effective way of raising money for your startup. Talk to your family and friends about your businesss needs. Decide if you just want a loan from them, or if you want investment funds. A loan may be easiest for both parties – you just pay it back over time, with interest.

An investment means family or friends would hold a stake in your company, and share the risks with you. However, with an investment, you might be able to get more money upfront, and unlike a loan, you will not be paying it back in installments. Investors will get money only if your business becomes profitable.

But dont be too casual about the way you approach this with family or friends, or assume that its a done deal just because you know these people. Do a proper pitch and let them know when they can expect to make their money back. If theyre investors, explain the risks.

There is a downside to family and friends who become investors, as you are mixing business with pleasure. If the business fails, and their money is lost, the relationship may be strained, forever.

Don’t Miss: Bank Of America Investment Company

What You Need To Know Before You Take On An Investor For Your Business

When Tina McGonagill wanted to expand her food container business, she took on an investor she met at a trade show.

For $50,000, she gave Trent Lowenstein a 20% stake in Big Fat Lunch. Yet before she spent the money, the two were at odds over the best strategy to increase profits.

McGonagill wanted to order more stock and was hoping Lowenstein would use his charismatic personality to get the product into retail stores.

“Without stock we have no business, because at the end of the day when you own a product your biggest priority is to get into retail,” she told CNBC’s “Money Court.“

More from Invest in You:Americans are behind on saving for retirement. How to get on track

Lowenstein, on the other hand, wanted to turn to social media and influencers to increase direct-to-consumer sales. With lower margins, there is increased profit on each product sold, he argued.

The dispute shows the importance of having a smart governance structure, such as a board, and understanding the rights an investor has in company decisions, said Michael Goldberg, executive director of the Veale Institute for Entrepreneurship at Case Western Reserve University.

“If you’re an entrepreneur managing a small business, dealing with investors and their input can be really time-consuming and counterproductive,” he said.

Build A Mission Statement That Gets Employee Buy

In todayâs workforce, employees are looking for more than just any way to pay the bills. They want to make a difference and have a greater societal impact, particularly millennials. While 50 percent of millennial employees say pay is the most important factor in a job, 50 percent are also willing to take a pay cut for a job that matches their own values.

Take some time to write a mission statement for your business and ask your current employees to contribute. What do they find fulfilling about their roles personally? What impact are they seeing or hearing from customers each day? Combining their experiences into your business values gives employees a sense of ownership in their work and the businessâs overall successâleading to more engagement, more motivation, and better performance.

Don’t Miss: Cbiz Investment Advisory Services Llc

Money In The Bank In As Little As 30 Days

Apply

Securities offered through Honeycomb Portal LLC or Honeycomb SMB LLC have not been recommended or approved by any federal or state securities commission or regulatory authority. Honeycomb does not provide any investment advice or recommendation, and does not provide any legal or tax advice with respect to any securities. All securities listed on this site are being offered by, and all information included on this site is the responsibility of, the applicable issuer of such securities. In making an investment decision, investors must rely on their own examination of the issuer and the terms of the offering, including the merits and risks involved. Securities sold under Title III are speculative, illiquid, and investors can lose all of their money.

How To Say No

Be compassionate but firm when declining to fund a family members business.

Saying no is rarely easy, especially when it comes to family. Soften the blow by thanking your loved one for thinking of you as a potential investor. Be forthright, and dont beat around the bush. If its not a good fit, tell them so they have time to find funding elsewhere.

Dont be surprised if your loved one wants to know why you wont helpwhich can be a delicate situation to navigate. If your reason is purely financial, they have no room to argue. However, if you have doubts about the viability of the company or the trustworthiness of the person asking for help, try to explain with honesty and compassion.

Of course, if you see holes in the business strategy and are comfortable providing feedback, you could help your loved one succeed. Constructive criticism is meant to offer guidance and solutions by building on your loved ones ideas, not tearing them down. You might even decide to reconsider their proposal once theyve addressed your concerns.

Be compassionate but firm when declining to fund a family members business.

Saying no is rarely easy, especially when it comes to family. Soften the blow by thanking your loved one for thinking of you as a potential investor. Be forthright, and dont beat around the bush. If its not a good fit, tell them so they have time to find funding elsewhere.

Read Also: Are Shield Annuities A Good Investment

Spend Time On A Polished Presentation

A pitch with a potential investor is definitely not the time to wing it. Not only do you risk losing the investment, but you could also damage your reputation, which can have long-term implications for your business.To avoid this, prepare for your pitch and practice your presentation thoroughly. Ideally, you should practice it in front of a knowledgeable audience that can provide constructive feedback.Demonstrate that youre a professional and that you believe the investors time is valuable. This will make them much more confident about going into business with you.

Once youve absorbed this advice and put it into action, youll be more than equipped to start approaching backers. However, dont be dismayed if youre not immediately successful. Persistence is key, and with time and hard work, youre bound to find the perfect investor for your project.

What Are The Pros And Cons Of Working With Angel Investors

Among the reasons you may want to seek funding from angel investors include:

- Angel investors may take larger risks. Unlike traditional debt financers, angel investors arent beholden to banks or other institutions. This allows them to invest their money much more freely. As such, angel investors may be more likely to take investment risks virtually unheard of among banks and traditional debt financing providers.

- Your company can take less risk. Often, angel investors dont require repayment if your company fails. This arrangement is far less risky than funding your company through business loans or other debt financing routes that require repayment no matter how your company fares.

- Angel investors are knowledgeable. Most angel investors didnt just magically acquire their massive amounts of money they had to learn a ton along the way to grow their wealth. When an angel investor funds your company, you get access to the knowledge your investor has accrued and can use it to grow your own company. This background can prove especially helpful if your company is a startup: Although 9 in 10 startups fail, angel investor knowledge can make your company the one success story.

Also Check: What Is A Passive Investment Strategy

Show That There Is A Substantial And Growing Demand For Your Product/service

Use statistics from census reports, economic reports, the Internet, and relevant news articles to illustrate the need for your product/service.

If, for example, you want to get a new catering business funded, you might write something like this: The National Catering Association estimates that, in the past year alone, more than $50 million was spent on catering in our target area. Despite the sluggish economy, the number of events that are traditionally catered including weddings, graduations, and bar mitzvahs is not expected to decrease. However, people are looking to keep expenditures down. Which means that our discount pricing and quality service should give our business a strong competitive edge.

Start with this top-level course from Early to Rise University:

How To Get People To Invest In Your Company

Securing investors for a company can be a difficult task. However, every year billions of dollars are invested in businesses in the hopes of creating the next great company. Getting people to invest in your company requires a passion for what you are doing and the ability to show the visible risk you are making. This personal investment should be of your time, and more importantly, your own capital. Personal investment will demonstrate your desire to make your company succeed.

Read Also: American Enterprise Investment Services Phone Number

Attract Them Through Networking

Networking is one of the best ways to attract investors. Most newbie entrepreneurs get success via networking only.

You must actively participate in gatherings, seminars, meetings, and other events. Make sure potential investors in such events learn about your business idea.

The soft sell strategy is what you should follow while approaching investors through networking. The best thing about this strategy is that your business idea gets promoted without the use of any aggressive sales language.

If a business idea is promoted the right way through networking, you may get a potential investor much before your expectations.

What Is An Angel Investor

Angel investors are individuals or groups who invest in early-stage or startup companies in exchange for an equity ownership interest. Finding an angel investor is only half the battle, though. Once you connect, youll have to successfully pitch your company to secure funding.

Often, but not always, angel investors are accredited by the Securities Exchange Commission . To be accredited, angel investors must have either:

- Annual earnings of at least $200,000 per year over the past two years and projected similar near-future earnings. This annual salary minimum increases to $300,000 if the angel investor files taxes jointly with their spouse.

- A total net worth of at least $1 million.

Editors note: Need financing for your business? Fill out the below questionnaire to have our vendor partners contact you with free information.

Also Check: How Do I Invest In Something

Work Out How To Get In Front Of An Investor

Cold-emailing may not be the best way to get infront of an investor. James recommends looking for people in your network and seeing if there are any who know the right investors for you and could make a warm introduction.

In the UK, funds are increasingly developing “Scout Programmes” to find start-ups which are a great initial point of contact.

“You get more information on what type of companies they typically invest in or maybe give a casual, but more in-depth pitch to the scout where you wouldnt be able to with the fund themselves,” says James.

“As a third option – look for communities who are working with funds – at YSYS we are working hard to help funds be accessible to entrepreneurs from different backgrounds,” he says.

Ways To Invest In A Family Members Business

Raising capital is often the biggest barrier to launching a new business, so its not uncommon for budding entrepreneurs to turn to their families and friends for help.

If youre approached with such a request, your first instinct may be to lend a hand, no questions askedespecially if your child is doing the asking. But such assistance should be viewed as a financial transaction like any other.

Even a small home business can cost a few thousand dollars to get off the ground. Before you provide seed money, youll want to answer all questions up front, meeting with an attorney or tax specialist to discuss any financial obligations or implications involved. You should make sure the recipient understands, as well.

To keep the personal from bleeding into the professional, try to firmly separate the two from the start. Make clear that your questions and feedback are meant to foster productive discussions rather than to criticize or micromanage your family member.

Once youve set the terms of engagement, have your loved one walk you through the business plan, including short- and long-term goals and the outlook for turning a profit. Ifafter reviewing the details and satisfying all your questionsyou do decide to help, there are three basic options for funding a family members business: a gift, a loan, or a direct investment. Heres what to consider with each.

Also Check: How To Invest In Europe

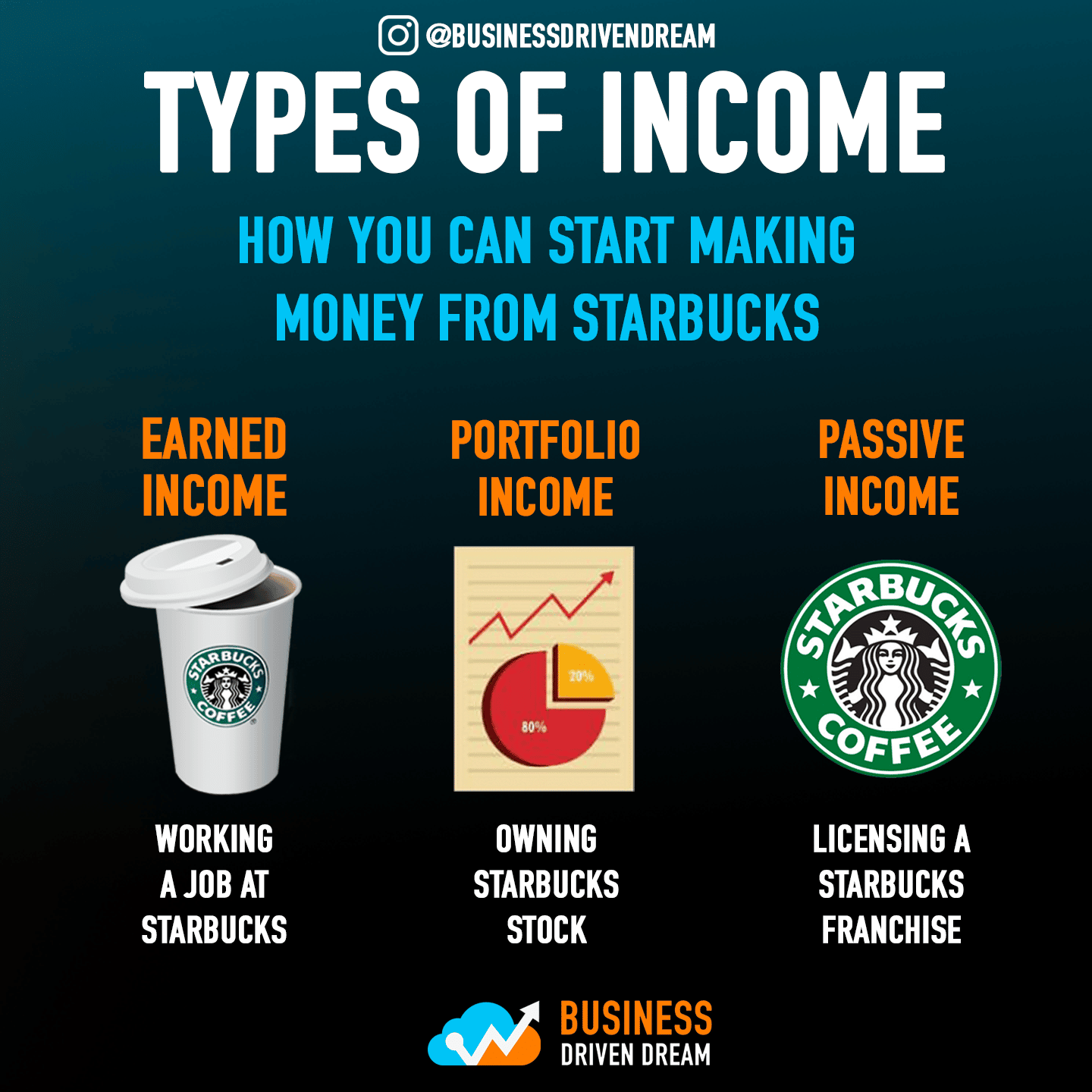

Types Of Business Funding

In general, there are two types of business funding:

-

Debt financing: You borrow money and promise to pay it back with interest, regardless of how successful your business becomes.

-

Zero-debt financing: You use savings or give someone something nonmonetary in exchange for an investment, like equity in your company or a custom piece of merchandise.

At the idea stage, zero-debt options are typically the better choice. This type of funding can be easier to qualify for if you have limited business experience, and youll avoid taking on debt that you may not be able to handle.

Debt financing may make sense once you have a detailed business plan that explains how youll earn enough revenue to pay back the amount borrowed. But try to avoid taking on debt until then.

» MORE:Debt vs. equity financing: Which is right for you?

What Is The Current Trend In Your Industry And How Do You Track Changes

Things change quickly, especially in the fashion and technology industries. The answer to this question should reveal how much you know your industry. Your investor also wants to know the data sources youll be using to top the industry trends.

So, dont limit yourself to just a verbal answer. If your investor asks this question, be ready to present relevant statistics about your industry and customers. Also, tell where and how you found and will utilize it.

Also Check: Self Directed Ira Business Investment