How To Buy Ipo Stock

The SEC lists two ways for retail investors to get in on IPOs. You can participate in an IPO, or, more commonly, purchase the shares when they are sold in the days following the IPO.

To better understand the two ways to buy IPO stock, it helps to know the difference between offering price and opening price:

- Offering price: Though typically set aside for accredited investors and institutional clients with more money to invest, you can also purchase shares of the stock at its offering price if you’re a client of the IPO’s underwriter. And though it’s more difficult to get in as a retail investor, you may still be able to participate in the IPO, depending on your broker.

- Opening price: Also known as the go-public price, this price represents the value at which the public can purchase shares on an exchange. You can buy shares through your brokerage after they’re resold to the public exchanges, or you can participate in the IPO if your brokerage allows.

If you wish to participate in the IPO at offering price, here’s how to do it.

Do Your Homework Before You Invest In Ipo:

The primary step for investing in an IPO is to study and research the company that you want to apply for. The best way to get an informed idea about its business plan and its reason for going public is to go through the prospectus issued by the company. You can get the prospectus on the Securities and Exchange Board of India’s website. A lot of hype encircles the IPO, and this is what you need to avoid. Gather knowledge about the company’s performance in its past and how it plans to invest the funds raised through IPO in the future. After collecting and understanding all the information, choose wisely before investing.

What Is The Minimum Amount I Can Invest In An Ipo

There is no one size fits all answer to this question, as it can vary depending on the issuer, as well as the broker. In the case of Royal Mails IPO, this stood at a minimum of just under £750.

Kane Pepi is a British researcher and writer that specializes in finance, financial crime, and blockchain technology. Now based in Malta, Kane writes for a number of platforms in the online domain. In particular, Kane is skilled at explaining complex financial subjects in a user-friendly manner. Academically, Kane holds a Bachelors Degree in Finance, a Masters Degree in Financial Crime, and he is currently engaged in a Doctorate Degree researching the money laundering threats of the blockchain economy.Kane is also behind peer-reviewed publications which includes an in-depth study into the relationship between money laundering and UK bookmakers. You will also find Kanes material at websites such as MoneyCheck, the Motley Fool, InsideBitcoins, Blockonomi, Learnbonds, and the Malta Association of Compliance Officers.

Also Check: Should I Invest Hsa Money

Understanding The Ipo Process

With an IPO, a private company “goes public” by offering its stock for the first time on a stock exchange, like the NASDAQ or NYSE. In order to make a registered offering, a company must file a registration statement with the US Securities and Exchange Commission .

The IPO process differs from a direct public offering in which a company directly lists its stock on the market.

Companies go public primarily to raise capital or expand operations. With traditional IPOs, businesses hire an underwriter usually an investment bank who leads and directs the IPO, drafting the company’s prospects, setting the IPO price, and drumming up interest from potential investors, known as an IPO roadshow.

How To Buy Into A Stock Ipo: 6 Steps

Initial public offerings provide an opportunity to get in on a stock from the day it hits the market. Due to a history of some large IPO gains, many investors might think IPOs are a good investment, but that isn’t always the case. As with any stock, it’s prudent to research before you buy anything. Below it will be discussed how to buy IPO stock on the first day before it starts trading.

Read Also: Registered Investment Advisor Raleigh Nc

What Are New Issues

New issues are a form of IPO but more often than not these days, the term IPO refers to the floatation of a large ongoing concern such as a tech unicorn or state-owned business etc.

When smaller companies come to list or float on the stock exchange, they are referred to as being a new issue. This is particularly true of the UK, the phrase IPO being an Americanism.

The term new issue can also be used to describe an issuance of shares or debt/bonds from an existing and listed business for example, a company whose ordinary shares are listed on the stock exchange may make a new issue of convertible bonds to raise additional working capital for a project or expansion.

But whether the new issue is from a business listing for the first time or an issue of new paper from a company thats already listed, the process is very similar to that of the IPO, but on a smaller scale. The issue will typically be underwritten permission to list the new securities is sought from the exchange and offer documents are prepared. The underwriters and their associates will gauge demand and applications for the new shares or bonds are invited from investors and the new issue is listed on the exchange.

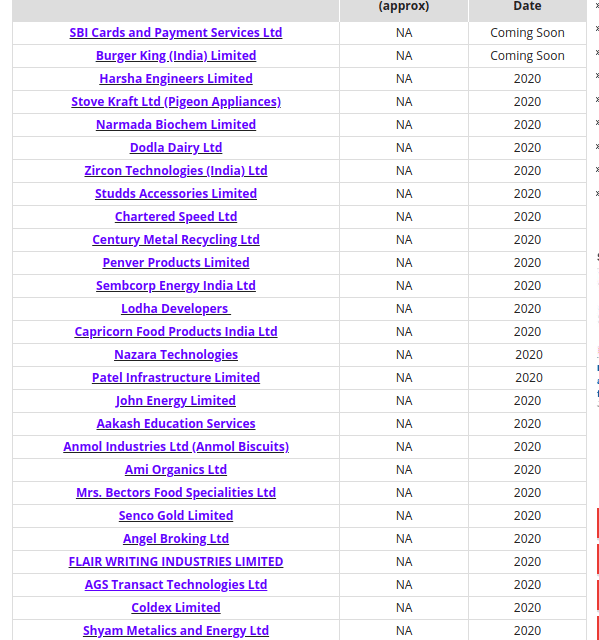

Ipos Launching On The Asx

Here are a few companies looking to make their Australian stock market debut in the few next months:

Southern Cross Gold Ltd | Bellavista Resources LimitedTG Metals LimitedAurora Energy Metals LimitedDemetallica LimitedBindi Metals Limited The Lottery Corporation LimitedSouthern Palladium LimitedSynergen Met LimitedOceana Lithium Limited Uvre LimitedKingsland Minerals LtdMOVE Logistics Group Limited Cavalier Resources Limited

Recommended Reading: How To Manage Your Investments

New Offer Versus Follow

The term IPO is actually a generic term that encompasses a variety of sub-items. For example, if the company is raising funds from the IPO market for the first time and getting the stock listed, then it is a new offer. The new offer leads to a listing and to the expansion of the capital base of the company. Then there are Follow-on offers wherein the company is already listed but is looking at the IPO market for raising additional funds. Such companies are already listed on the exchanges and the IPO is just a means of raising additional funds for their plans. Finally, there is something called an offer-for-sale where the existing promoters and anchor investors hive off part of their holdings through an IPO. Most of the disinvestments undertaken by the government are in the form of offers for sale. In an OFS, the share capital of the company does not increase but it is only the ownership pattern that changes. An OFS is often used by companies to also list the company in the bourses. So, how to invest in IPO in India and how to subscribe IPOs online?

Find An Ipo Research Invest

A comprehensive list view to browse active and upcoming offerings

Filter offerings by active, upcoming, IPO, Secondary, and Spot

Follow offerings to stay up-to-date with just a single click

Get instant alert notifications for new and updated offerings

Easily access the prospectus to research offering data directly inside the app

How do we get IPOs?

How do we make money?

How are allocations determined?

How much do IPOs cost?

Are all IPOs available to order?

How many shares will I receive or be allocated?

Also Check: Buy Rental Property Or Invest In Stock Market

What Do I Need To Know

First, you’ll need to meet at least one of the following eligibility requirements for participating in an IPO:

- Either $100,000 or $500,000 in household assets , 403, and annuity contracts), or

- You’re a Premium or Private Client Group customer.

If you meet the eligibility requirements, you need to sign up for Fidelity Alerts so we can keep you updated on the offering. Your next step is to read the offerings prospectus . You can access the prospectus from the Initial Public Offerings page. Under the Current Offerings Calendar, find the offering you want to participate in, and then select Prospectus and Download.

Note: In addition to the eligibility requirements, you’ll also need to answer a series of qualifying questions before you can participate in the IPO. FINRA rules prohibit “restricted persons” from participating in the purchase of new issue offerings.

If you decide to participate, next to the desired offering, select Participate. You’ll see a page asking you to select the account you want to use choose your account and then select Enter New Indication of Interest or Bid, and Submit. The Select Offering page appears, then next to the IPO, select Participate. Heres where you’ll need to complete the qualifying questions by answering yes or no. After you answer the questions, you’ll be asked to enter an indication of interest . To complete your participation, review your selection and then Submit.

Decide How Many Shares You Want

Depending on your financial goals and the money you want to invest, you can choose the number of shares you want to buy. The easiest way to decide this is by dividing your investment budget with the price of the stock.

For instance, if you have $1,000 to invest and the price of the IPO is $10, you can buy up to 100 shares of the stock. After that, complete the following criteria:

- Order type. Based on your trading strategy, you can choose the type of order you want to execute.

- Bid. The bid is the price at which you want to buy the shares. If you have limited money to invest, you can consider investing in stocks under $20 such as iHeartMedia . Lets say the stock quote of IHRT is $7. You can set the bid price for $6 and as soon as the stock price drops to that price, the order gets fulfilled.

- Ask. The ask is the price at which you want to sell the shares you own. Ford is one of the best stocks under $10 to invest in. In this case, you can set the ask price for Ford at $7 and the order gets executed when the stock price rises to that value.

- Spread. The spread is the difference between the bid and the ask price of the stock. If the bid price of Intel is $58.5 and the ask price is $59.5, the spread is $1. Stocks under $5 tend to have lower spreads.

- A market order lets you buy or sell shares at the price of the stock quote. Although you cant control the price at which you trade, a market order has a 100% chance of being fulfilled.

Read Also: Does Vanguard Offer Robo Investing

How To Buy Pre

Steve Rogers has been a professional writer and editor for over 30 years, specializing in personal finance, investment, and the impact of political trends on financial markets and personal finances.

Traditionally its been difficult for individual investors to buy into an IPO and almost impossible to buy pre-IPO stocks. That has certainly changed in recent years. If you know how to buy pre-IPO stock, you may be able to acquire shares in companies with high potential at bargain prices.

Pre-IPO investing comes with significant risks and several potential restrictions. Youll need to study the company carefully and be sure you want to invest. In the US, you may need to meet the SECs accredited investor criteria to qualify. Pre-IPO stocks may not be available for all companies that are going public. Read our guide on pre-IPO investing for more information on how pre-IPO stocks work and the potential risks and rewards that they present.

Things You May Also Like To Know

It is a good investment option, but you must know that not every IPOs are worth investing. Here are a few things to remember while considering an IPO.

- Do a complete background check

- Read the prospectus carefully

- Pick companies that are backed by reliable underwriters

- Get clarity over vividness bias. IPOs can create an illusion of strong performance, long-term success, and such. Get the facts before investing

- Wait for the lock-in period to get over

Read Also: Where Can I Get Investment Advice

Ipos Direct Listings And Spacs The State Of The Ipo Market

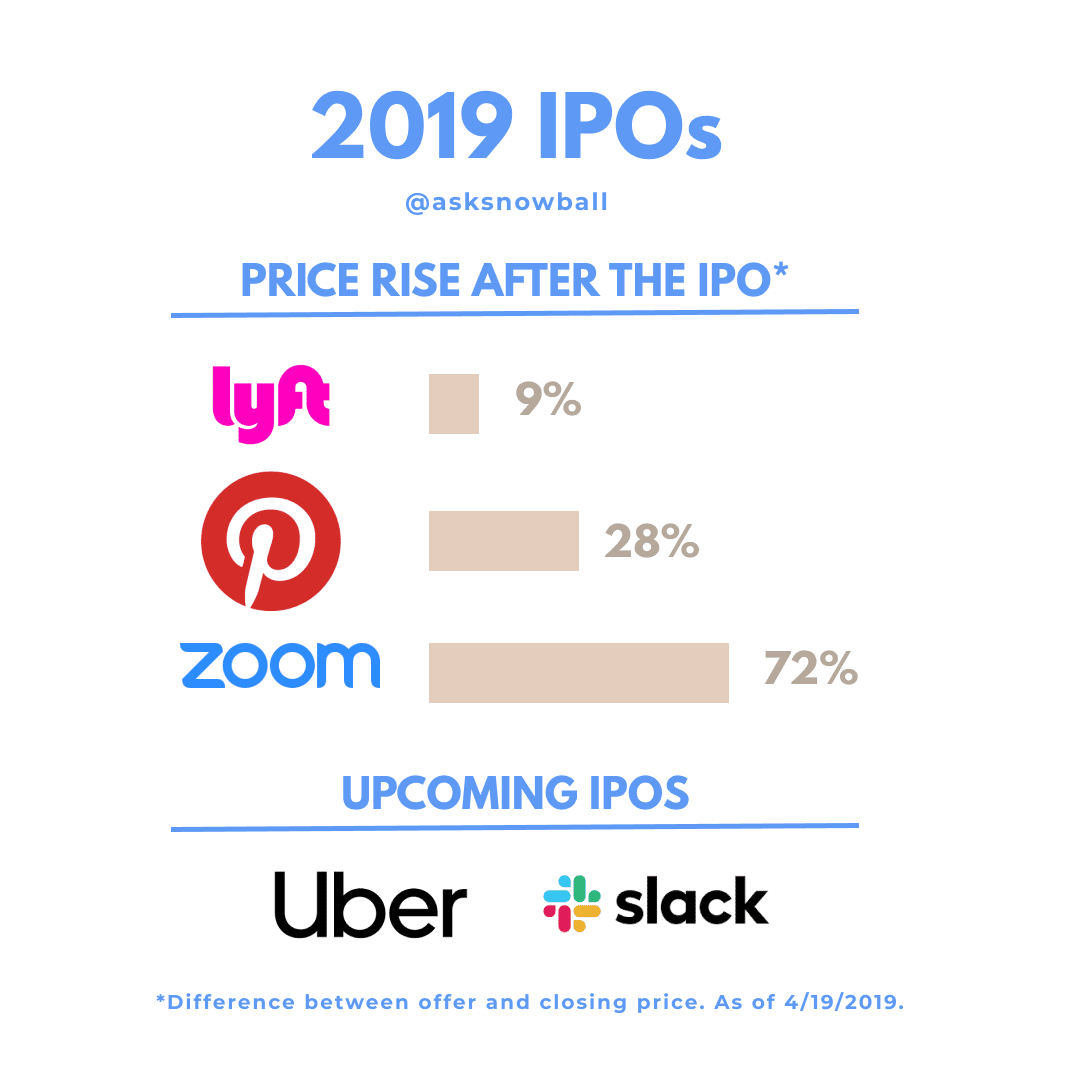

2020 was a banner year for IPOs. The IPO market reached a new record high in 2020 with the number of listings on the US stock market more than doubling, driven by the health care and tech sectors. According to Stock Analysis, there were 481 IPOs last year, compared to 233 deals in 2019. This is 20% higher than the previous record of 2000, which saw 397 offerings.

Number of IPOs per year on the US stock market

2020 was also a boom year for alternative ways of going public, as companies increasingly look for new ways to tap into capital markets. These options include direct listings and SPACs .

Regulated Pre Ipo Brokers

EquityZen is one example of a regulated broker that has provided a platform for accredited investors to be invited to early-round funding. Several platforms such as EquityZen provide a marketplace for investors and shareholders. But investors need to be cautious and ensure they buy stocks with a regulated broker.

Image courtesy of eToro

Investors should do background checks on pre IPO brokers by looking at client reviews to gauge customers experience. Another important check would be the number of companies a platform offers and the total volume of transactions completed. A large number of investments closed gives investors an indication of the number of clients that have used the platform.

Recommended Reading: Compare Investment Property Mortgage Rates

Myth: Investing In An Ipo Gets Me In On The Ground Floor

This is partially true. Before going public, companies have likely gone through a few rounds of private investment. This means, IPO investors arent the first to have access. Rather, they are among the first public owners of a company.

Its important to note: There will likely be a difference between the IPO offering price and the price an individual investor will pay for the stock once the shares start trading on an exchange. The offering price, announced ahead of the IPO, is a fixed price reserved for institutional investors, employees and investors who meet certain eligibility requirements.

Behind The Scenes Of An Ipo

This is what happens behind the scenes in an IPO

This is the value pyramid where you’ve got founders who generally get in at $0.01, friends and family getting in at $0.05, private -which is industry insiders, brokers and letter writers â they come in at $0.15. Then you have the IPO where it gets handed out to the public at $0.50, and this is standard throughout the space.

A lot of people need to understand that if you’re getting into something like this, the founders and friends & family literally have a good outcome… regardless of what happens.

The stock price can drop to 2/3rds of this and they’re still making multi-bagger returns. It’s also the amount of capital that the IPO investors are putting up. It’s got a nice chart down the side with the amount of capital that has been invested for the amount of stock. The founders are putting up 2.5% of the capital and they’re getting 43% of the stock, whereas the IPO investors are putting up 80% of their capital and getting 27% of stock.

As an average investor, you can easily become a bag holder if you don’t know or trust who you’re getting involved with.

It’s important to understand where you as an individual investor sit in this inverted pyramid. Many new investors to IPOs think they are getting in first , but as you can see, that’s not really the case at all.

Also Check: Investing In A Reit Is The Same As Purchasing Property

Complete Guide: How To Invest In Ipos

You have IPO FOMO.

And itâs no mistake. Theyâre packaged as silver bullets that create overnight millionaires.

But, less than half of IPO investments have positive returns. So whatâs the real reason for all the hype?

What exactly is an IPO? How can you make money? Are they good for public investors?

How To Find The Best Pre

One of the reasons that retail investors dont buy pre IPO securities is because they dont know about them. The private sales are restricted to individuals with a lot of money or only institutional investors are invited.

Several pre IPO platforms have changed the game, as theyve enabled retail investors to get involved.

Don’t Miss: How To Invest In Stocks And Make Money Fast

What To Consider Before Investing In Ipos

Before investing in an IPO, you should read the prospectus carefully. To understand if a business is reasonably priced and could be a sound investment, consider the following:

- the long-term growth prospects

- the anticipated balance sheets strength after the float

- what the company expects to earn

- the broader sector e.g. technology, mining etc.

In the end, deciding if investing in an IPO or in a growing company is right for you will likely come down to your investment strategy . If tried and tested companies are your focus, investing in IPOs may throw you off course. However, if youre looking for stocks with growth potential IPOs are an option, although a risky one at that.

Dow Jones Futures Today

Dow Jones futures jumped 1% vs. fair value. S& P 500 futures advanced 1% and Nasdaq 100 futures climbed 0.7%.

The 10-year Treasury yield fell 3 basis points to 3.87%.

Futures got an extra lift, while yields pulled back, amid reports that the U.K. government could scrap more of its mini-budget that had roiled the British pound and debt, spurring emergency Bank of England bond buying. The BoE has said bond buys will end Friday.

The pound jumped and U.K. yields tumbled.

The CPI inflation report is sure to swing Dow futures and Treasury yields.

Remember that overnight action in Dow futures and elsewhere doesn’t necessarily translate into actual trading in the next regular stock market session.

You May Like: How To Invest In Cryptocurrency