Index Funds Dont Protect From Market Losses

Stock prices can go down, sometimes seriously. The fact that you are invested in an index fund doesnt eliminate this threat.

For example, during the stock market meltdown of 2007 2008, the S& P 500 lost about 50% of its value. In the Dot-com bust of 2000 2002, the NASDAQ Composite lost more than 80% of its value.

As we know today, both indexes have since recovered and gone on to reach new highs. But not only was the ride down in both crashes a scary one, but each also required holding onto your investment for many years before returning to the previous peak level.

Investing in index funds may prevent your portfolio from doing worse than other investors. But they provide no guarantee that youll never lose money.

How Can You Invest In The S& p 500 Index

You may invest in the S& P 500 index by purchasing shares of a mutual fund or exchange-traded fund that passively tracks the index. These investment vehicles own all the stocks in the S& P 500 index in proportional weights.

The Vanguard S& P 500 ETF , which trades just like a stock, and the Vanguard 500 Index Fund Admiral Shares mutual fund are two attractive options. Both have extremely low fees and deliver virtually identical performances to the S& P 500 index over time.

In addition, you can buy S& P 500 futures, which trade on the Chicago Mercantile Exchange. These are essentially buy or sell options that enable hedging or speculating on the index’s future value.

What Does S& p Stand For

Standard Statistics Company created the first United States stock market index. Later, the company merged with Poors Publishing, renaming the company to Standard & Poors representing the S& P.

Down the line, the index was expanded to include 500 companies, adding the 500 to the S& P 500 name. It has traded under that name ever since, although the companies included often change.

Recommended Reading: How To Invest In Wells Fargo Stock

Invest In The S& p 500 For Large

If your goal is to add large-cap exposure to your investment portfolio, you may only need one stock index to do that: the S& P 500.

The S& P 500 hits that sweet spot where you have more companies and more sectors, Fox said. Its not intentionally built to be diverse because its just the 500 largest companies. But in practice, you get a nice mix of big tech companies, financial stocks, and more. You get the broadest exposure to the U.S. equities market.

Trade Stock Indices Like Dow Nasdaq And S& p 500 On Primexbt

Now that you know all there is to know about each of these three major US stock indices, and with the key differences between them explained, its now time for you to open up a trading chart yourself, and try trading the Dow Jones, S& P 500, and NASDAQ on PrimeXBT.

The advanced trading platform features CFDs for each major stock index, represented as the Wall Street 30, USTech100, and SP500, and are available for trading with up to 100x leverage.

With how volatile these markets have been in 2020, there have never been more opportunities for profit once in a lifetime opportunities that absolutely should not be left on the table.

When the stock market is crashing, shorting these stock market indices can bring traders enormous profits, rather than holding through the storm at a loss as an investor.

Why watch paper gains disappear. Traders can instead turn falling prices into profits, then when the market turns around, long positions can ride the recovery post-recession.

The advanced trading platform features the top tools of the trade that professionals expect, all within a customizable user interface that even novices will find easy to use.

Risk management tools are also included, as well as built-in charting software, letting traders place orders directly from the price chart itself.

Lucrative referral programs round out the platforms many benefits, offering traders yet another way to grow their income, alongside their trading activities.

Risk DisclaimerRisk warning

Also Check: How To Invest In Sip Online

Are There Fees Associated With Index Funds

Index funds may have a couple different kinds of fees associated with them, depending on which type of index fund:

- Mutual funds: Index funds sponsored by mutual fund companies may charge two kinds of fees: a sales load and an expense ratio.

- A sales load is just a commission for buying the fund, and it may happen when you buy or when you sell or over time. Investors can usually avoid these by going with an investor-friendly fund company such as Vanguard, Schwab or Fidelity.

- An expense ratio is an ongoing fee paid to the fund company based on the assets you have in the fund. Typically these are charged daily and come out of the account seamlessly.

ETFs have become more popular recently because they help investors avoid some of the higher fees associated with mutual funds. ETFs are also becoming popular because they offer other key advantages over mutual funds.

Bmo Capital Markets Still Sees An Up Year For The S& p 500

Stocks’ decline starting in mid-August has been “more severe and longer lasting” than analysts at BMO Capital Markets anticipated, but investors should keep calm and carry on, the firm said in a note Friday.

“We advise investors to stay calm and disciplined and refrain from going into panic mode amid this selloff,” chief investment strategist Brian Belski siad. “Yes, the market has been volatile, and the path of least resistance has largely been to the downside in recent weeks, but we continue to firmly believe that the S& P 500 will finish the year higher than current levels with Q3 earnings results potentially being a catalyst for a more sustained market rebound.”

Last week the S& P 500 capped the September trading month, ending lower by about 9% and finding a new bear market low in the midst of the losses. That drop marked the index’s biggest monthly loss since March 2020 and its worst September since 2002.

Tanaya Macheel

Read Also: Can You Get A Loan To Invest In Stocks

Relative Strength Index Trading Differences

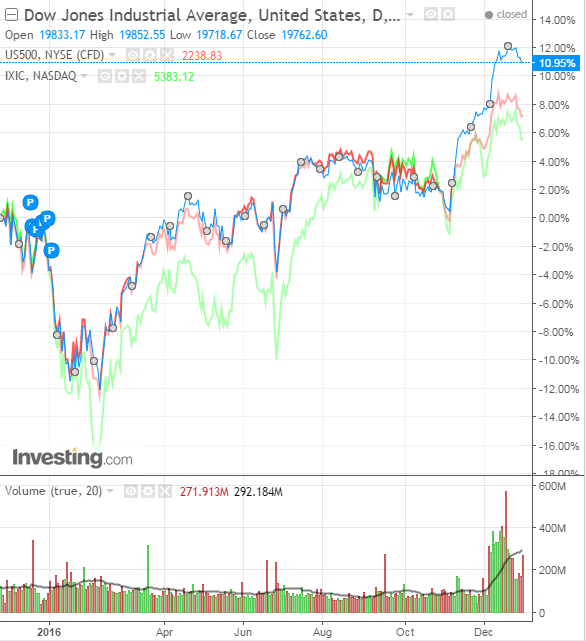

Below, comparing the three charts you can see how a trading strategy involving the RSI would need to be different across each stock index.

The RSI on both the Dow Jones and S& P 500 look strikingly similar, due to the indexes featuring similar companies.

Unlike these other two stock indices, the NASDAQ Relative Strength Index spiked above 70 again just before the major collapse occurred.

What Is The S& p Index

Short for Standard & Poor’s 500, this index tracks the performance of 500 of the most significant publicly traded stocks in the U.S. While there are many other index funds, the S& P 500 is perhaps the most famous stock market index in the United States.

A committee meets to choose the stocks in the index, and they don’t necessarily have to be the biggest 500 companies. The committee looks at things like market capitalization, liquidity, sector, and other criteria. To qualify, a company must be a large-cap company with a minimum $14.6 billion market cap .

Further Reading: How to Invest In Index Funds

You May Like: Rit Real Estate Investment Trust

Dow Jones Industrial Average Index

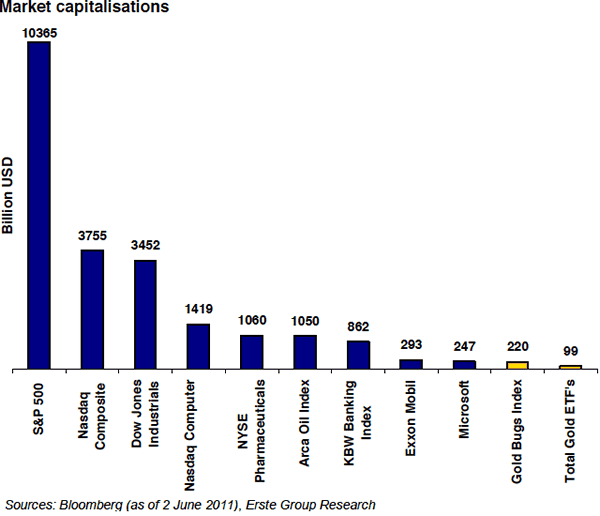

The Dow Jones Industrial Average Index is the most narrowly focused of the major indexes. However, given that it represents stocks of the largest companies in the US, it remains a popular index.

Interestingly, with just 30 stocks, the DJIA Index represents approximately 25% of the total market capitalization of all US stocks. This demonstrates the degree of concentration of capital invested in the largest companies.

In recent years, the DJIA Index has underperformed the S& P 500 and the NASDAQ Composite indexes, and by a surprisingly large margin. This owes to the fact that the 30 component stocks represent well-established companies that dominate their respective industries, and have far less growth potential than many of the companies included in the other indexes.

Component companies include some of the best-known names in American industry, including:

- American Express.

Nasdaq Composite Vs S& p 500 Vs Dow Jones: An Overview

There are three main points of difference among the Nasdaq Composite, the S& P 500, and the Dow. The first one relates to their coverage universe and the sectors that are part of the index. The Nasdaq Composite and the S& P 500 cover more companies in different sectors than the Dow does.

The second difference is their method of assigning weights to individual companies in their index. The Nasdaq Composite and the S& P 500 weigh their constituents based on , while the DJIA uses each constituent stocks price to determine its weight in the index.

The final difference is the criteria used to select constituents of the respective indexes. The Dow is more value-oriented and uses a mix of quantitative and qualitative factors to determine whether a given stock should be included in its index compared to the other two.

Also Check: Vanguard Short Term Investment Grade Bond Fund

Research And Analyze Index Funds

Your first step is finding what you want to invest in. While an S& P 500 index fund is the most popular index fund, they also exist for different industries, countries and even investment styles. So you need to consider what exactly you want to invest in and why it might hold opportunity:

- Location: Consider the geographic location of the investments. A broad index such as the S& P 500 or Nasdaq-100 owns American companies, while other index funds might focus on a narrower location or an equally broad one .

- Business: Which industry or industries is the index fund investing in? Is it invested in pharma companies making new drugs, or maybe tech companies? Some funds specialize in certain industries and avoid others.

- What opportunity does the index fund present? Is the fund buying pharma companies because theyre making the next blockbuster drug or because theyre cash cows paying dividends? Some funds invest in high-yield stocks while others want high-growth stocks.

Youll want to carefully examine what the fund is investing in, so you have some idea of what you actually own. Sometimes the labels on an index fund can be misleading. But you can check the indexs holdings to see exactly whats in the fund.

What To Consider While Buying Etfs Or Index Funds In Us

One must look at buying the ETF or Index fund from the right manufacturer. An ETF or index fund from a manufacturer like Vanguard should be preferred as Vanguard will add a value to it because of their rich experience in managing ETFs. These ETFs will have more liquidity, explained N K Purohit. Second, in any type of investing, platform is more important and you need a platform which can help you discover, execute, track and manage your investments.

Also Check: Best Way To Invest In Digital Currency

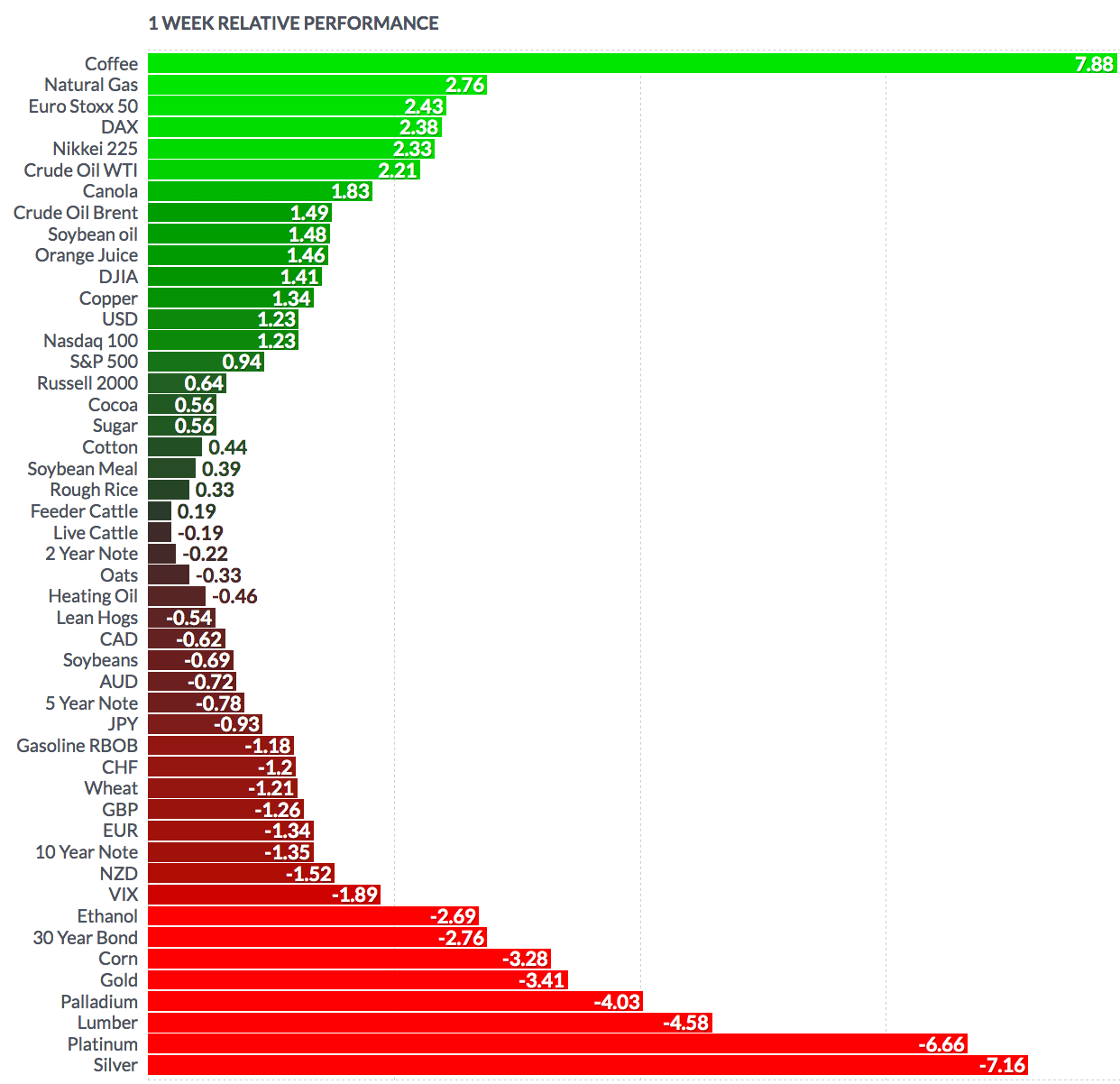

The Only Bull Market This Week Might Just Be In The Energy Complex

Asset prices may feel soft everywhere this week, but not in the oil patch. Maybe it has to do with OPEC+ agreeing midweek to cut future crude oil production.

Early Friday, before September’s nonfarm payrolls were reported, November West Texas Intermediate crude oil contracts had risen above $90 a barrel and were 13% higher on the week. That means WTI was on pace for the biggest weekly gain since early March, shortly after Russia attacked Ukraine on Feb. 24.

Look at individual stocks early Friday. Premarket, Exxon Mobil was higher by 17.6% in just the first four days of this week, on pace for its best week since at least 1972. That was the same year Standard Oil of New Jersey changed its name to Exxon.

The Energy Select Sector SPDR ETF had gained 15% week-to-date, on track for its best week since November 2020. November heating oil futures contracts were up almost 17% week-to-date and were on pace for the strongest weekly gain since late April.

Scott Schnipper and Gina Francolla

How To Invest In The S& p 500 In Four Steps:

To invest in the S& P 500 you can buy stocks of the individual companies in the index, or invest in index funds or exchange-traded funds that replicate the index. In order to buy either, you’ll need to open a brokerage account to purchase those investments from.

Open an investment account where you can purchase S& P 500 stocks or funds. It may be advantageous to consider what type of investment account you want to open, since some have significant tax benefits.

Fund your account. You’ll need to decide how much to invest, and this will depend on your investment goals.

Choose your investments. Do you want to invest in individual stocks included in the S& P 500, or a fund that is representative of most of the index? Investing in an S& P 500 fund can instantly diversify your portfolio and is less risky. Here are some of the top-performing S& P 500 index funds.

Buy your investments. Follow the instructions within your brokerage account to purchase. Stocks are purchased at the share price, so if you have $200 to invest, and a stock’s share price is $100 per share, you would be able to purchase two shares. Funds may have investment minimums, but they tend to be low. Funds also have expense ratios, fees charged based on how much money you have invested.

In my view, for most people, the best thing to do is own the S& P 500 index fund, legendary investor Warren Buffett said at one of Berkshire Hathaways annual meetings.

Don’t Miss: High Net Worth Investment Advisors

Diversification May Not Be As Wide As Expected

The primary reason for investing in an index is achieving a greater level of diversification. Thats easier to do when you invest in a fund tied to an index that represents hundreds or thousands of individual stocks.

But diversification is not always achieved. For example, though the NASDAQ Composite includes nearly 3,000 stocks, about 40% of the market capitalization of the index itself is represented by just six companies.

Those companies include Apple, Microsoft, Amazon, Tesla, Facebook, and Google. The remaining 2,913 stocks comprising the index represent the other 60%.

S& p 500 Vs Nasdaq : Which Index Is Better

4 min read

I recently read an interesting post from Freddy Smidlap that compared the performance of a total stock market index fund to a Nasdaq 100 index fund from October 1, 2001 to October 1, 2018. The results were astounding. During that time period, QQQ rose by 402% compared to just 191% for VTSAX:

Link:QQQ vs. VTSAX Chart

This made me curious, has the Nasdaq 100 always beaten a broad stock market index fund historically?

To answer this question, I compared historical returns for both the Nasdaq 100 and the S& P 500 since 1972. I realize that the S& P 500 only contains the largest 500 publicly traded companies in the U.S. and VTSAX contains every publicly traded company in the U.S., but these two indices have nearly identical annual returns:

Since I was able to easily find historical data for the S& P 500, Ill be using it for this comparison instead of VTSAX.

Recommended Reading: Seeking Real Estate Investment Partners

Other Considerations For Investing In The S& p 500

Dont get stuck on holding the S& P 500 as the majority of your portfolio. There are other areas of the market you need in order to build a diversified portfolio, such as small-caps, mid-caps and international stocks, says Favorito.

Building that diversified portfolio also means complementing an S& P 500 fund with bond holdings. Check out our listing of the best total market bond index funds to figure out how best to build your two- or three-fund portfolio.

Employment Data Unlikely To Push Fed Off Course Economist Says

Friday’s employment data shows the job market is heading in the right direction, said Andrew Hunter, senior U.S. economist at Capital Economics. But he doesn’t see it as convincing to the Federal Reserve to change course from its strategy of raising rates as a means to fight inflation.

“The 263,000 gain in non-farm payrolls in September is another signal that labor market conditions are cooling,” Hunter said. “But with the unemployment rate dropping back to 3.5% the report is unlikely to significantly alter the Fed’s view that the labor market is ‘out of balance.'”

Alex Harring

Read Also: Who Has The Best Mortgage Rates For Investment Property

Oil Hits $90 Per Barrel Heating Oil Also Jumps

Oil prices are surging following OPEC+ major production cut announced Wednesday.

West Texas Intermediate crude for November delivery hit $90 per barrel, the highest level since Sept. 14. The commodity is up almost 13% this week and is on track for its best week since March 4. Brent crude is also higher today, up 1.35% at $95.69 per barrel.

Heating oil has also jumped, hitting 3.9478, its highest level since Aug. 30. Heating oil is up nearly 17% this week, on pace for the biggest weekly gain since April 29.

Exxon is up 17.62% this week, its best weekly performance since 1972. Marathon Oil is up more than 26% this week, and Halliburton is up more than 22% in the same timeframe. It’s both company’s best week since June 5, 2020.

Carmen Reinicke, Gina Francolla

Dow S& p 500 Nasdaq: What’s The Difference

& #151 — Q: How can investors better understand the differences between the Dow Jones industrial average, Standard & Poor’s 500 and Nasdaq?

A: Investors often group the different market measures together and assume they’re interchangeable. After all, the Dow Jones industrial average, Standard & Poor’s 500 and Nasdaq composite all measure the value of stocks, right?

Wrong. While the basic mission of these three market measures is similar, the way they go about the task is very different. And for that reason, all three measures can give you a completely different take on how stocks are doing.

And that’s been the case already this year. The Dow has been leading the Standard & Poor’s 500 index this year, despite the fact both measure the value of U.S. stocks.

The more you learn about the different market indexes, the more you can see why they often don’t move in lock step. The key parts of each index you must understand include:

The calculation methodology. The value of a market measure is the result of a mathematical calculation. And the differences can be big between indexes. The Dow Jones industrial average gives greater weight to stocks with the highest per-share price. That means that IBM, trading for nearly $200 a share, has a much greater weighting than Bank of America, which trades for less than $10 a share.

If you’re still interested in learning more, you can get more detail on each market measure at the operators’ websites, the Dow, the Nasdaq, and the S& P 500.

Also Check: Borrow Against House To Invest