Iii Effective Practices For Managing Conflicts Of Interest

Turning from how regulators approach conflicts to how firms can assess and mitigate conflicts, I believe that an effective conflicts risk governance framework includes three broad considerations.

2. The second broad consideration, I believe, is to have a good compliance and ethics program tailored to address the conflicts of interest the firm has identified and prioritized. This is a topic of concern to every broker-dealer and investment adviser, given their supervisory obligations under the federal securities laws.17 Under the securities laws, registrants are expected to have effective written policies and procedures to prevent violations of the securities laws, and to periodically review the adequacy and effectiveness of those policies and procedures. For instance Rule 206-7 under the Investment Advisors Act and Rule 38a-1 under the Investment Company Act establish such requirements for investment advisors and investment companies. Similar requirements also exist for broker-dealers under FINRA rules.18 In my view in order to be adequate and effective these compliance and supervisory policies and procedures must include processes to identify, assess, mitigate and manage conflicts of interest.

Tips For Growing Your Financial Advisory Business

- Let us be your organic growth partner. If you are looking to grow your financial advisory business, check out SmartAssets SmartAdvisor platform. We match certified financial advisors with right-fit clients across the U.S.

- Expand your radius. SmartAssets recent survey shows that many advisors expect to continue meeting with clients remotely following COVID-19. Consider broadening your search and working with investors who are more comfortable with holding virtual meetings or spacing out in-person meetings.

Understanding Conflicts Of Interest

The investment industry has launched a new set of regulations called Client Focused Reforms. One key requirement relates to how advisors and firms deal with conflicts of interest. In particular, firms must implement policies, procedures and controls to demonstrate that they have addressed these material conflicts of interest in the best interest of the client. This communication highlights how Edward Jones addresses these items, ensuring that we continue to put your interests first.

Conflicts of interest exist in all lines of business. In the investment industry, conflicts of interest or potential conflicts of interest arise when the interests of a client differ from those of a financial advisor or firm. Conflicts of interest represent potential risks to clients because conflicts may influence the firm or financial advisor to put their own interests ahead of clients interests.

At Edward Jones, our first core value is our clients’ interests come first. Accordingly, we address all conflicts of interest in the best interest of the client. Where we cannot address a conflict of interest in the best interest of the client, we avoid the conflict entirely.

For financial advisors and firms, some of the most common potential conflicts of interest stem from compensation and incentive programs, personal financial dealings, outside activities, and referral arrangements.

Read Also: Etf Investing What Is It

Mitigating Conflicts Of Interest

What factors are relevant to a firms approach to mitigating conflicts of interest?

SEC Staff believe that appropriate mitigation measures will depend on the firms specific business model, but may include sources of compensation, affiliate relationships, the use of incentives, the extent compensation depends on product, the firms size and structure, dual licensing and outside business activities, characteristics of the firm’s retail investor base and the complexity of recommended investment strategies.

Guidance On Product Menus

The bulletin devotes a section of its conflict of interest guidance to firms that make recommendations based on a product menu. A product menu may limit offerings to, for example, proprietary products, a specific asset class, or to products that involve revenue sharing or third-party arrangements . The recommendation is for firms to

consider establishing product review processes for these menus. Such processes would, among other things, identify and mitigate conflicts associated with products offered through them evaluate the use of preferred lists establish training requirements for financial professionals as to certain products and establish periodic product reviews. The SEC notes that broker-dealers must identify and disclose any material limitations placed on the securities or investment strategies that may be recommended to a retail customer and any conflicts of interest associated with such limitations. Further, the guidance states that a dual registrant should disclose any circumstances under which its advice will be limited to a menu of certain products offered through its affiliated broker-dealer or affiliated investment adviser.

Don’t Miss: How To Invest In Triller

Facts To Disclose In Various Conflict Scenarios: Recommendations

Compensation Arrangements:

Firms should disclose facts about the nature and extent of the conflict how the conflict could affect the recommendation the source and scale of compensation how the firm is compensated and the costs and fees to be incurred by the investor as a result.

Proprietary Product Recommendations:

The SEC recommends disclosure as to whether the firm or an affiliate manages, issues, or sponsors the product, as well as any additional fees and compensationrelated to that product or incentives to sell the product, among others. In cases where conflicts arise from compensation received from third parties, staff recommends disclosure of the existence and effects of third-party incentives, any agreements with a clearing broker for products offered on their platform agreements to maintain assets with a specific custodian and arrangements where the firm is compensated through revenue sharing or product fees.

Managed Accounts and Wrap Fee Programs:

On conflicts arising from separately managed account and wrap fee programs, the bulletin recommends disclosing any compensation from program sponsors or affiliates, any higher costs to the investor for participating in the program, and any material facts on how the account is managed, including managers financial incentives,

Tips For Finding The Right Financial Advisor

- If youre still having trouble narrowing down your search, consider using SmartAssets free tool. The tool matches you with up to three vetted financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Do you seek assistance in investing, or is it estate planning or tax planning youd like help with? Before choosing an advisor, it helps to identify your risk tolerance, short- and long-term goals and time horizon. Compensation structures and disclosures are other important factors to review as you compare potential advisors.

Read Also: How To Invest Business Cash

New Guidance On Conflicts Of Interest

The new bulletin includes an examination of the practical issues arising from these duties. This guidance is organized around identifying conflicts, eliminating conflicts, mitigating conflicts and disclosing conflicts. While the guidance differentiates obligations under the two standards where applicable, the focus is directly on how to achieve these four compliance objectives.

Identifying Conflicts: Have An Ongoing Process and Procedure

The SEC acknowledges that all broker-dealers and investment advisers have at least some conflicts of interest with their retail investors, but that the nature and extent of these conflicts varies, often related to a firms business model. The bulletin lists various examples of conflicts stemming from arrangements on compensation, revenue or other benefits to the firm or its affiliates.

The bulletin emphasizes the importance of having ongoing processes and procedures to identify conflicts. The expectation is that broker-dealers develop, maintain, and periodically review policies and procedures to identify conflicts on an ongoing basis. Investment advisers must also identify other compliance factors creating risk exposure for the firm and its clients in light of the firms particular operations. They also note that disclosure of a conflict alone is not enough to satisfy the best interest or fiduciary obligations.

Eliminating Conflicts:

Mitigating Conflicts:

Disclosing Conflicts: Use Plain English

Elimination And Mitigation Of Conflicts

The Bulletin contains sections on eliminating and mitigating conflicts before a final section on disclosure. This ordering is no accident. The Bulletin warns that identifying and disclosing conflicts is not in itself always sufficient for firms to meet their obligations . It also repeatedly suggests that firms consider taking aggressive actions to address conflicts such as declining to provide advice in a certain area or modifying incentive payment programs for employees . The Bulletin raises these actions as possibilities without precisely identifying under what circumstances they might be required. Firms should anticipate Staff questions regarding any particular conflict at issue in an exam or investigation as to why the actions that the firm took were sufficient and no more extensive mitigation actions were required.

Also Check: Best Place To Invest In Index Funds

Disclosing Conflicts Of Interest

The SEC staff makes clear that disclosing conflicts of interest is not merely a check the box exercise. The staff believes that disclosures should be in plain English, specific to each conflict, and narrowly tailored to, among other things, the firms business models, compensation structure, and products offered at different firms. It is also not sufficient to state that a firm may have a conflict when the conflicts actually exists. If the conflict concerns compensation or other benefits, the disclosure should, at a minimum, describe the nature and extent of the conflict the incentives created by the conflict and how the conflict could affect the recommendation or advice provided to the retail investor the source and scale of the compensation how the firm and/or financial professions benefit from their recommendation and advice and the nature and extent of any cost or fees incurred by the retail investor as a result of the conflict, whether directly or indirectly.

Conflicts Of Interest Policy

As a portfolio management company, Committed Advisors shall take all reasonable measures ensuring the detection of conflicts of interest situations in the context of the provision of investment advisory services or the management of its funds.

CONTEXT

Relevant Persons are defined as Committed Advisors executive officers, employees as well as any individual participating, under the authority of Committed Advisors and/or pursuant to an outsourcing agreement, in the provision of investment advisory services or management of the funds managed by Committed Advisors.

Conflicts of interests may arise either between Committed Advisors, the Relevant Persons or any person directly or indirectly related to Committed Advisors, on the one hand, and Committed Advisors clients, on the other hand or between two of Committed Advisorss clients.

For example, a situation of conflict of interest appears where:

Committed Advisors or a Relevant Person might receive a financial gain or avoid a financial loss at a clients expense

Committed Advisors or a Relevant Person has an interest in the outcome of a service provided to the client or in a transaction carried out on behalf of the client that differs from the clients interest

Committed Advisors or a Relevant Person is induced, financially or otherwise, to favor the interest of a client or group of clients over the interests of the client to whom the service is provided

CONFLICT REPORTING

The notification should include:

You May Like: Gold Vs Silver Vs Platinum Investment

Dynamic And Thorough Compliance Programs

Throughout the Bulletin, the Staff emphasizes the need to put in place written policies and processes to identify and address conflicts on a regular basis. It closes with an admonition that firms cannot set it and forget it and should monitor conflicts over time and assess periodically the adequacy and effectiveness of their policies and procedures . The Staff further suggests documenting how a firm identifies and addresses conflicts of interest as a way of demonstrating its compliance with its obligations .

Both broker-dealers and investment advisers should review this Q& A with care and prepare for the Staff to apply conflict-of-interest rules aggressively and broadly. The Bulletin offers no safe harbors, but firms will be best positioned to address Staff inquiries if they have thorough and thoughtful ongoing processes in place for identifying, monitoring, and addressing conflicts.

Records Of Conflicts Of Interest

The Conflict of Interest Policy will be reviewed when necessary, and at least annually by the CCO to ensure it remains current based upon the scope of Flexstones activities, its operating structure, strategic plans, applicable regulatory changes and the nature of its clients. This review should take all appropriate measures to address any deficiencies, such as over reliance on disclosure of conflicts of interest.

A register of conflicts will be maintained detailing the nature of the conflict, how it gives rise to a material risk of disadvantage to clients, the mitigating action proposed, how this complies with the conflicts of interest policy, and assurance procedures undertaken to confirm effective implementation. Responsibility for maintaining this register rests with the Affiliate CCO.

A proud part of the Natixis family

We have solid backing from our parent company, Natixis Investment Managers, one of the worlds largest asset managers. Our access to the firms global resources, professionals, and network enhances our ability to continuously deliver exceptional strategies and service.

Recommended Reading: How Do I Invest In Nike Stock

What Are Some Common Conflicts Of Interest

Advisory firms with fee-based fee structures often have affiliations with registered broker-dealers and/or insurance agencies. This allows firm representatives to earn commission-based compensation from selling insurance or investment products, creating a conflict of interest if advisors recommend securities or products that dont align with a clients best interest. Its important to note that this form of compensation is in addition to asset-based fees.

Performance-based fees can also create a conflict of interest if the advisor participates in side-by-side management of performance fee accounts and asset-based fee accounts. When it comes to investment opportunities, advisors may become incentivized to favor accounts with higher fees over other asset-based accounts with lower fees. Fiduciaries often disclose such conflicts of interest, regardless of their fee structure.

Sec Staff Publishes Guidance On Investment Adviser Disclosure Of Financial Conflicts Of Interest

The Division of Investment Management recently issued guidance on the obligation of investment advisers to disclose financial conflicts of interest in the form of Frequently Asked Questions Regarding Disclosure of Certain Financial Conflicts Related to Investment Adviser Compensation . The Guidance substantiates the positions previously articulated in the course of SEC examinations and enforcement actions, and indicates that the SEC staff will continue to expand its focus beyond 12b-1 fees and revenue sharing to evaluate how investment advisers manage conflicts of interest associated with the receipt of compensation from investments the advisers recommend to their clients.

Although the Guidance does not alter or amend applicable law, nor does it have legal force or effect, this is the first time the staff of the Division of Investment Management is affirmatively addressing disclosure obligations that have been at the heart of SEC examinations and enforcement actions preceding and resulting from the SEC Mutual Fund Share Class Selection Disclosure Initiative . Accordingly, advisers should use this as an opportunity to review and enhance their disclosure about financial conflicts of interest. In addition to the specific disclosure components discussed below, advisers should consider the following broad concepts from the Guidance:

Don’t Miss: How To Invest 1 Dollar

Sec Bulletin Highlights Need For Effective Conflicts Management

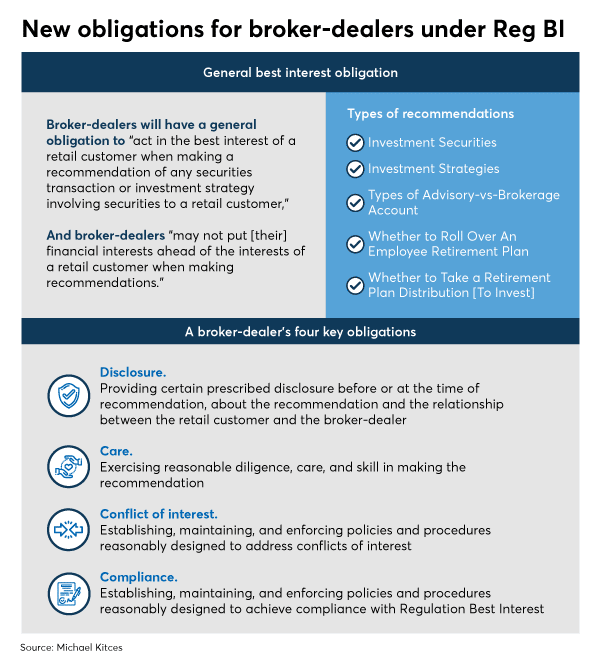

The U.S. Securities and Exchange Commission recently released the staff bulletin Standards of Conduct for Broker-Dealers and Investment Adviser Conflicts of Interest to reiterate the required standards and obligations for broker-dealers under Regulation Best Interest and for investment advisers the fiduciary duty standards under the Investment Advisers Act of 1940.

The bulletin defines a conflict of interest as any interest that might incline a broker-dealer or investment adviserconsciously or unconsciouslyto make a recommendation or render advice that is not disinterested. Or in other words, to act in their own best interests or in the best interests of the firm and not in the best interest of their clients. Read more about how conduct risk remains an ongoing priority for the SEC.

The bulletin takes the form of a question and answer document. Highlights include:

Sec Bulletin On Conflicts Of Interest For Broker

On August 3, 2022, the U.S. Securities and Exchange Commission published a Staff Bulletin providing guidance regarding conflicts of interest under broker-dealer Regulation Best Interest and investment adviser fiduciary duty standards. The Bulletin, entitled Standards of Conduct for Broker-Dealers and Investment Adviser Conflicts of Interest, signals the Staffs continued focus on conduct standards and expansive interpretation of these standards. The Bulletin also reminds firms of their obligationoften beyond disclosureto address conflicts and to have rigorous and dynamic policies in place to identify and address conflicts.

After an introductory background section summarizing conflict-of-interest rules under Reg BI and investment advisers fiduciary duty, the Bulletin takes the form of answers and guidance in response to 13 questions posed by a hypothetical firm. These questions and answers are grouped around concepts discussed in previous Reg BI guidance: identifying conflicts of interest, eliminating conflicts of interest, mitigating conflicts of interest, limited product menus, and disclosing conflicts of interest. A few themes running through the Bulletin are discussed in the article linked below.

Read Also: Best Way To Invest Money In Mutual Funds

Sample Conflict Of Interest Policy

Most nonprofit management and consulting organizations will share that a conflict of interest policy is one of the most critical policies a nonprofit board can adopt. The IRS Form 990 even asks whether or not a nonprofit has a written policy on conflicts of interest, how a nonprofit manages conflicts, and how a nonprofit determines if board members have conflicting interests. This sample document is a good start to developing a COI for your organization.

Article I

Purpose

The purpose of the conflict of interest policy is to protect ___________ interest when it is contemplating entering into a transaction or arrangement that might benefit the private interest of an officer or director of the Corporation or might result in a possible excess benefit transaction. This policy is intended to supplement but not replace any applicable state and federal laws governing conflict of interest applicable to non-profit and charitable corporations.

Article II

Definitions

1. Interested PersonAny director, principal officer, or member of a committee with governing board delegated powers, who has a direct or indirect financial interest, as defined below, is an interested person2. Financial InterestA person has a financial interest if the person has, directly or indirectly, through business, investment, or family:

a. An ownership or investment interest in any entity with which the Corporation has a transaction or arrangement,

Article III

Procedures

Article IV

Article V