Collateral Needed For Personal Loans

The majority of personal loans are unsecured. For comparisons sake, business loans might require you to put up collateral or sign a personal guarantee. Unsecured loans are considered higher risk than loans secured by specific collateral, which means that they typically carry higher interest rates and fees to account for the additional risk. That said, it is possible to find secured personal loans if you have something youre willing and able to use as collateral.

You Have Difficulty Making Payments On Time

Debt is called a “liability” for a reason. No matter how you use a loan, it creates a burden of repayment that can put your personal finances at risk. This is especially concerning in todays uncertain economy. If you were to lose your job, your personal loan payment would likely put an unnecessary strain on your budget.

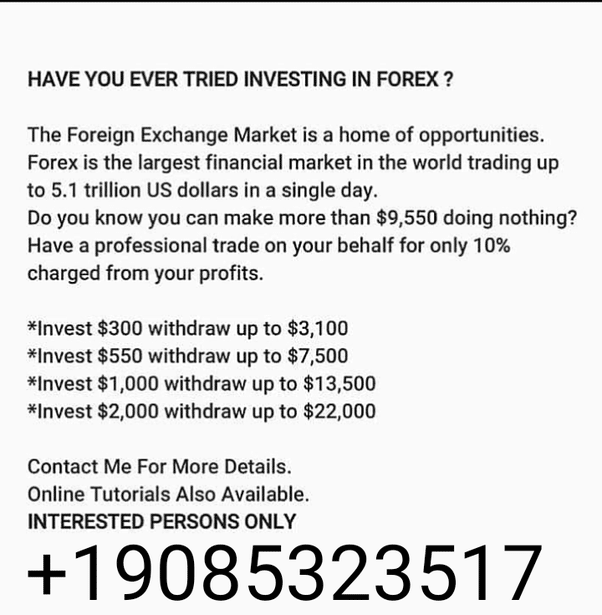

The pros of borrowing to invest? You invested in Tesla when it was 30, says Erika Safran, certified financial planner with Safran Wealth Advisors in New York City. The cons: You invested in commercial real estate in January 2020. The rate of return on your investment is not guaranteed but your debt is there until you pay it off. From the prudent perspective of making smart financial decisions, this is not one of them.

Borrowing to invest is filled with risk. If you decide to seek out a personal loan, its critical to shop around for the best rates. Compare personal loan lenders on a site like Credible to help increase your chances of getting the best offers and the best return.

What Credit Score Do You Need To Get Personal Business Loans

Most personal lenders weve seen ask for a credit score in the 600s. That said, you can find lenders that go lower. Rocket Loans, for example, accepts credit scores as low as 540.

Disclaimer

At Business.org, our research is meant to offer general product and service recommendations. We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services.

Recommended Reading: How To Invest In Share Market Online

Good Debt May Help You Accomplish Your Objectives

Student loans are probably the most common example of good debt, given the correlation between a college degree and higher earnings throughout your career.3 But thatâs just the start. âGood debt can help borrowers accomplish an objective or help them avoid a bad outcome,â says Mook.

When it comes to accomplishing your objectives, consider another common example of good debt: taking out a mortgage on a new house. For most people, itâs not possible to pay for a house outright. However, even if you were able to pay for it in one large payment, there are benefits to taking on debt for a home. Paying down a mortgage results in equity in a home as well as potential tax advantages. Plus, if you know youâll be able to make your monthly payment, there is the additional benefit of improving your credit score by making the payments consistently.

Depending on your circumstances and risk tolerance, leveraged investing can be another good debt strategy. Say youâre investing $100 with an expected 10% rate of return. If you invested your own money, you would earn $10. But if you were to invest half your money and borrow for the other half, you could earn more, if the interest on the loan is less than 10%. In this example, says Mook, âyou leveraged your return.â

Youre Confident About Your Return Potential

Some financial experts might say that personal loans for private investors only make sense when theyre guaranteed to get a return that outpaces what theyll pay in interest. But trying to predict a stock or exchange-traded funds future performance is an inexact science and not a recommended practice.

For that reason, its important to consider how confident you are about an investment paying off. This is where you may need to do some research to understand what an investments risk/reward profile looks like, how well its performed in the past, whats happening with the market currently, and where it might be headed next.

In other words, youll want to perform some due diligence before using loans for investments. Looking at both the upsides and the potential investing risks can help with deciding if you should move forward with your personal loan plans.

Read Also: Deal Machine For Real Estate Investing

Who Qualifies For A Personal Loan

First, to qualify for most personal loans, youll need a good credit score. You will also need some form of regular income to reassure the lender that you can afford repayments.

Although there are bad credit loan options available, these typically come with higher interest rates. These kinds of loans may also come with more restrictions, so borrowers may not be allowed to use these funds for business purposes.

Good Debt May Help You Avoid Bad Outcomes

Mook relates the story of a client who owed a large tax payment on April 15, well before June when he was expecting to receive a cash payment. The client could have sold off some assets in his portfolio to pay the tax bill, but that would have required reconstructing his portfolio afterward, not to mention paying transaction costs and potentially more taxes. Instead, the client decided to take out a loan to pay the tax bill and then repaid the loan in June. âAvoiding disruption in your portfolio is an example of using debt effectively,â explains Mook.

You may want to consider using income generated from diversified investments to pay down bad debts. After assessing the amount of your bad debts, you may find that it makes financial sense to sell off an asset to quickly pay down your debts. This is where your personal debt tolerance comes in.

Recommended Reading: Use Credit Card To Invest

Should I Use A Personal Loan To Invest

Even if you can get a personal loan from a lender that allows you to invest the funds, there are a number of items youll want to consider before you proceed.

- Your credit If you have strong credit and can get a low enough interest rate to make the investment worthwhile, you may want to consider it. If you have bad credit, youll have a hard time getting a low enough interest rate to make it pay off.

- Your income If youre investing in yourself by pursuing a professional certification that could improve your career options or income, it could be worth borrowing money to make it happen. The same may be true if you want to invest in your small business.

- You can afford the risk Virtually no investment opportunity comes without risk, so even if youre confident in the likelihood of a solid return, its important to prepare for a loss. If you can financially take that loss without missing a beat on your monthly payments, it could be a way to leverage your money.

That said, there are quite a few potential pitfalls to watch out for.

If youre thinking about using a personal loan for investing, its crucial that you think about both the benefits and the risks before you apply.

Drawbacks Of Using A Personal Loan To Start A Business

May not receive a full tax deduction: Interest paid on a personal loan is typically not tax deductible, unlike interest paid on business loans. However, theres an exception for when you use a personal loan to cover business expenses. To get the full deduction, youll need to make sure no portion of the loan is used for another type of expense.

Personal credit or assets could be at risk: If you take out an unsecured personal loan and fail to repay it, your credit may take a hit. This will make it harder to access affordable financing in the future. If you take out a secured personal loan and tie it to an asset like your car or home, the lender can seize that asset if you default.

Small loan size: Personal loans tend to have smaller loan amounts ranging from about $1,000 to $50,000 for most lenders than business loans. For a small startup, the size might be just right, but if you own a more established company or plan on making big purchases, youll want to look for loans that offer more financing.

Shorter repayment terms: Most personal loan terms range from one to seven years, so if you need a longer repayment term, youre better off looking at other small-business financing options. SBA loans tend to have the longest repayment terms, ranging from 10 to 25 years.

Also Check: Dave Ramsey Recommended Investment Advisors

How Does A Personal Loan For Business Work

When you apply for a personal loan, the lender will review your personal financial information to determine your eligibility. You can expect to present lenders with information that includes:

- Your personal income

- Your credit history

- Your personal assets

Personal loans are usually unsecured, which means you wont have to put up your house as collateral. The loan is usually between $1,000 and $50,000, though some lenders may provide even larger amounts depending on your credit and financial history.

The loan can last between 12 and 60 months, but dont forget that since this is a personal loan, youll be held personally liable for the loan regardless of whether your business succeeds.

When It Makes Sense To Use A Personal Loan

A personal loan is great for businesses that:

- Need less than $50,000

- Have the means to pay back the debt on time

- Are just starting out and lack the credit for a business loan

Since personal loans are also easier to acquire, business owners can usually count on having working capital sooner with a personal loan than a business loan, which is helpful if you need to fund a time-sensitive project.

Read Also: Real Estate Investing In Southern California

Property Appraisers And Assessors

– Annual median wage: $61,340

– Employment: 58,340

Property appraisers and assessors provide an estimate on the value of real estateoften necessary to obtain a mortgage, for exampleand on personal and business property. They will likely have a bachelor’s degree but also extensive on-the-job training. Growth in the field through 2031 is projected at 4%, nearly as fast as the national average. There are expected to be about 6,800 openings each year over the decade, replacing those who leave the field or retire.

What Do I Need To Qualify

To get the cheapest personal loans, youll generally need to have a good credit score. Applying is fairly easy through the lenders website.

When applying for a personal loan, have your personal information and financial details to hand. Depending on the lender, your application could take as little as five minutes to complete.

What if I have bad credit?

You can improve your credit by doing things like reducing your debts and keeping up with your payments.

But not everyone has time to raise their credit score. You could also apply for a bad credit personal loan. Bad credit personal loans should be weighed carefully, as they tend to carry higher interest rates and costs. They also may not be approved for business purposes.

Read Also: Real Estate Finance & Investments Risks And Opportunities

Determine The Source Of Personal Funds

There are several ways you can use personal money to fund your business. Each of these paths has varying levels of complexity and potential risk, as youre utilizing your personal assets. When deciding on the best funding option, it helps to make a list of your assets, liabilities, income, likely investors, and your current credit score. You can use our assets and liabilities worksheet to assist. Once you complete the list, evaluate it to determine which option is best for putting personal money into your business.

Getting A Personal Loan To Fund Your Business 14 Things To Consider First

getty

An entrepreneur preparing to launch a new venture may find themselves short of ready cash. To get things up and running, they may consider taking out a personal loan. Its a tempting option, and not necessarily a bad decisionmany entrepreneurs have done so and gone on to establish successful businesses. However, as with anything to do with business and finance, its important to be knowledgeable about potential risks.

If youre considering a personal loan to finance your startup, take time to think through your unique situation and the accompanying benefits and risks of starting out by taking on personal debt. To help you evaluate the pros and cons, review the expert insights below from 14 members of Forbes Finance Council.

1. The Risk/Reward Characteristics Of Your Idea

Before taking out a personal loan to fund a business, it is important to understand the risk/reward characteristics of your idea, including the business model feasibility, product-market fit, monetization channels, scalability and cash burn rates. Remember that a business is a limited liability entity, while defaulting on a personal loan will directly impact your financials, credit history and credit score. – Alexey Posternak, MTS AI

2. The Liquidity Of Your Business

Forbes Finance Council is an invitation-only organization for executives in successful accounting, financial planning and wealth management firms. Do I qualify?

Read Also: Vanguard Short Term Investment Grade Bond Fund

Salient Features: Business Loans Vs Personal Loans

- Personal and business loans can be approved quickly if the credit score is good. For business loans, businesses need to showcase good turnover and financial health. In the case of personal loans, applicants need to have a minimum annual income.

- Personal loans are generally approved for lower loans, while business loan amounts can go up to Rs.2 crore.

- Business loans have longer and more flexible tenures. Personal loans generally have shorter repayment tenures.

- Personal loan schemes have higher interest rates than business loan schemes.

Your Payments Could Become Unaffordable

Debt poses a risk to your personal finances no matter how you use it. Thats because whenever you borrow money, youre making a commitment to repay it at a later date with interest.

Based on the amount you borrow and the personal loan terms you choose, youll face a fixed monthly payment until the debt is gone. The payment is an additional expense to your monthly budget that youll need to plan for until the loan is completely repaid. However, just like youre not guaranteed a return on investments, you cant always guarantee that youll be able to repay a personal loan.

Unforeseen circumstances, from everyday hardships like a job loss to national crises such as recession, can make it difficult to afford your monthly payments. This could set you up for even worse outcomes, such as defaulting on the loan and damaging your credit. Taking out a loan unnecessarily should be avoided to prevent stretching your budget too thin.

If youre wondering, Should I borrow money to invest? make sure you understand all of the risks and that youre confident in the investment. Shop around and compare offers from multiple personal loan lenders. By comparing your options, you can ensure getting the lowest possible rate, thereby maximizing the chances of your investment bringing in a positive return relative to your debt.

Recommended Reading: Investment Property Loan To Value Ratio

How Much Can You Get In A Personal Loan To Start Your Business

Personal loan amounts can vary depending on a few different factors, including by lender. Depending on where you look, you may be able to get as little as a few hundred dollars up to $100,000.

That doesn’t necessarily mean you can borrow up to the maximum amount, though. Lenders will review your credit history, income and other debts to determine how much they’re willing to lend to you. For example, if you have a relatively low credit score or a high debt-to-income ratio, you may be limited on how much you can borrow.

Fortunately, if you’re working with lenders that offer prequalification, you can usually find out what you qualify for during that risk-free process.

Can I Actually Use A Personal Loan For Business

Generally, no. There are a few lenders who will allow a personal loan to be used for funding a business, but many dont allow it. Major banks which offer both personal and business loans, for example, will prefer you to use personal loans for personal use, and vice versa.

In addition, if you find a personal loan that can be used for business purposes, consider the conditions the loan could come with. The biggest one is that your name not your business name is attached to the loan. Any missteps could become personal liabilities.

Personal loans also rely on your credit as an individual and play by rules that slightly differ from business requirements. You may have the option of a secured personal loan, but its less likely that youll need to provide collateral with a personal loan than with a business loan.

You should also be honest and upfront with your lender about the purpose of the loan. Some lenders may order you to pay back the loan immediately if they discover you misled them.

Recommended Reading: Quicken Loans Investment Property Rates

Use A Loan To Get Through Slow Temporary Periods

There are times when a business may go through a slow period. Sales may taper off in certain months.

- Do you operate in a seasonal industry?

- Or is your business dependent on a few large customers?

- Some of your big clients often delay their payments.

But you will still have to meet your fixed costs. You must pay administrative expenses such as wages, utility bills, and rent.

A loan can help you to keep your financial commitments. You can repay the borrowed amount when the business picks up.