Whats Your Risk Profile

Risk profile refers to a persons willingness to take risks. Its typically used in determining a persons investment allocation strategy.

For example, a high-risk profile has more tolerance towards high volatile stocks that can reach dramatic gains yet at the expense of a higher chance of incurring a loss. Its a Win Big or Go Home mindset.

Conservative profiles tend to favor safer investments with the trade-off being the slower growth pace of gains. Some use a mix of both, combining both risk-heavy and conservative stocks in their portfolio.

How Much Money Do I Need So That I Can Start Investing

Perhaps, even before, you are already interested to learn about the stock market. However, you are intimidated by it or are apprehensive about it due to the cost of investment. But no worries, you dont need to have hundreds of thousands or millions of pesos just so you can start.

Actually, how much money you need depends on only two things:

- Company price per share

- Number of shares you are willing to buy

Just take another instance, Jollibee Foods Corporation, the actual, tangible one. As of July 28, 2017, the price per share is 220. If this is something you think you can afford, then go ahead and try to purchase.

However, stock markets do not allow you to buy a single share, as every company sells their share at multiple called board lots. Oftentimes, this means 100 shares. However, in the case of Jollibee, the minimum share you can buy is 10. Therefore, 220 x 10 = 2,200 is the minimum amount you need in order to start investing in Jollibee.

Now if you already have the money, the next thing that you need to do is to find yourself a stock broker, who is a professional individual, usually associated with a brokerage firm or broker-dealer, who buys and sells stocks and other securities for both retail and institutional clients, through a stock exchange or over the counter, in return for a fee or commission.

Now, if you want us to clarify anything or if you have any more questions, feel free to leave a message below.

The Next Step To Investing: Finding An Investment

It is critical to establish an account in order to find an investment. In general, an account with a Demat symbol is the best way to buy and sell stocks and other securities listed on the Philippine Stock Exchange without being connected to a bank. Mutual funds and exchange-traded funds can also be used to invest in.

Don’t Miss: Lee Arnold System Of Real Estate Investing

What Is A Margin Facility

This is a way for you to borrow more money from your broker to fund a stock purchase. Buying shares with borrowed money is called a leveraged trade, and it offers the opportunity to magnify your gains because all the profit from the trade goes to you. However, it also magnifies the risk. The absolute worst-case scenario in stock investing is to lose 100% of your capital. However, in a leveraged trade, you can lose more than 100% because some of your capital is borrowed.

Okay So How Can You Make Money In The Stock Market

Once youve bought shares in a company , you can make money in 2 ways: through price appreciation or through dividends.

1. Earning through price appreciation

When you own shares of a company, it is possible for the market value or price of those shares to change over time. Depending on how many people want to buy those shares and how many people are willing to sell them, the price will either go up or down. This is the concept of supply and demandhow many people want to sell vs. how many people want to buy.

For example, if a company announces that it will launch a new product or that it earned a lot of money in the last quarter, more people may want to own a share of that company. If more people want to buy shares but few people want to sell, then the demand will be greater than the supply and the price will go up. On the other hand, if there is bad news about a company like low sales or problems with their factory, then people may not want to own a share of that company anymore. If more people want to sell their shares but fewer people want to buy, then supply will be greater than demand and the price will go down.

This is a simple example, but in reality there are a lot of factors that affect supply and demand. Because the whole world is connected, what happens in other countries may also affect the Philippine economy and the prices of our stocks.

2. Earning through dividends

Also Check: How To Open Investment Account For Child

Streaming Is Moving In A Positive Direction

Apple’s streaming service, Apple TV+, undoubtedly lags behind other platforms like Netflix, Hulu, and Disney+, but there should be brighter days ahead as the company puts more resources behind the platform. In June, Apple and Major League Soccer — the world’s fastest-growing soccer league — announced they had struck a deal to show all MLS matches worldwide for 10 years beginning in 2023.

The MLS deal, worth at least $2.5 billion, is the first time a major American sports league has moved all of its games to a streaming platform. It’s also the first time in major professional sports history that the games won’t have any restrictions or local blackouts. It’s a step that shows Apple is becoming more serious about making investments to become more competitive in the streaming space.

Will Apple TV+ ever grow to become a top three streaming service? It’s not likely in the foreseeable future. But you can bet it will continue to grow and slowly but surely begin to gain some market share.

How Does It Differ From Other Online Trading Platforms

First Metro Secs website touts their PRO platform as the most advanced trading system in the Philippines right nowand as youll see in a bit , those are not mere claims.

The combination of deep technical analysis features and highly intuitive user interface is sure to satisfy both experienced and newbie traders alike.

FirstMetroSec is the only online stock brokerage house in the Philippines that boasts of an Automated Chart Pattern Recognition featureit identifies buy/sell signals and support/resistance levels for helping users plan their trades.

Overall, the learning curve is fairly easy, you can start buying and selling stocks after a few minutes of navigating the PRO platform.

Read Also: How To Invest In P2p Lending

What Is The Cheapest Franchise In The Philippines

If you’re on board with starting a franchise business, here are the 10 cheapest franchise business opportunities you can get into in the Philippines.

Understand Your Investment Goal

Prior to making any form of investment, you must determine your investing goal. What are your aspirational goals? And, because this is a goal, it must have a deadline.

List all of your goals and objectives, as well as the timeline during which you hope to achieve or realise them. For example, when do you intend to retire? What amount of money do you need to save for retirement while maintaining your current standard of living? How many years do you have till you plan to retire?

These questions will assist you in determining how much money you actually require and how much time you have to achieve your financial objectives.

Also Check: Best Low Cost Investment Apps

Is Your Money Sleeping In The Bank

Here comes the more interesting part.

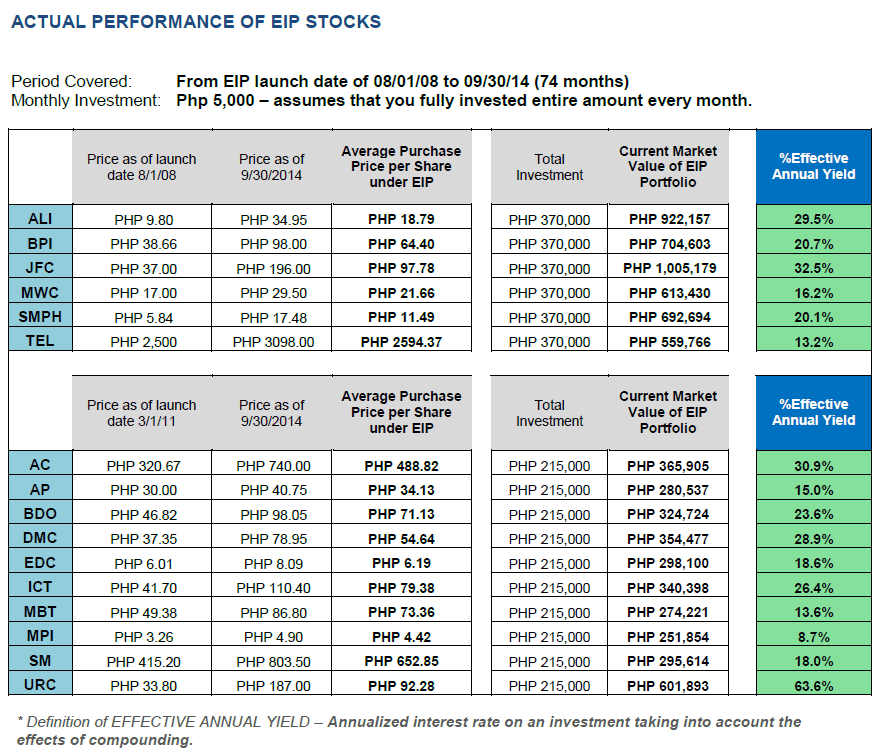

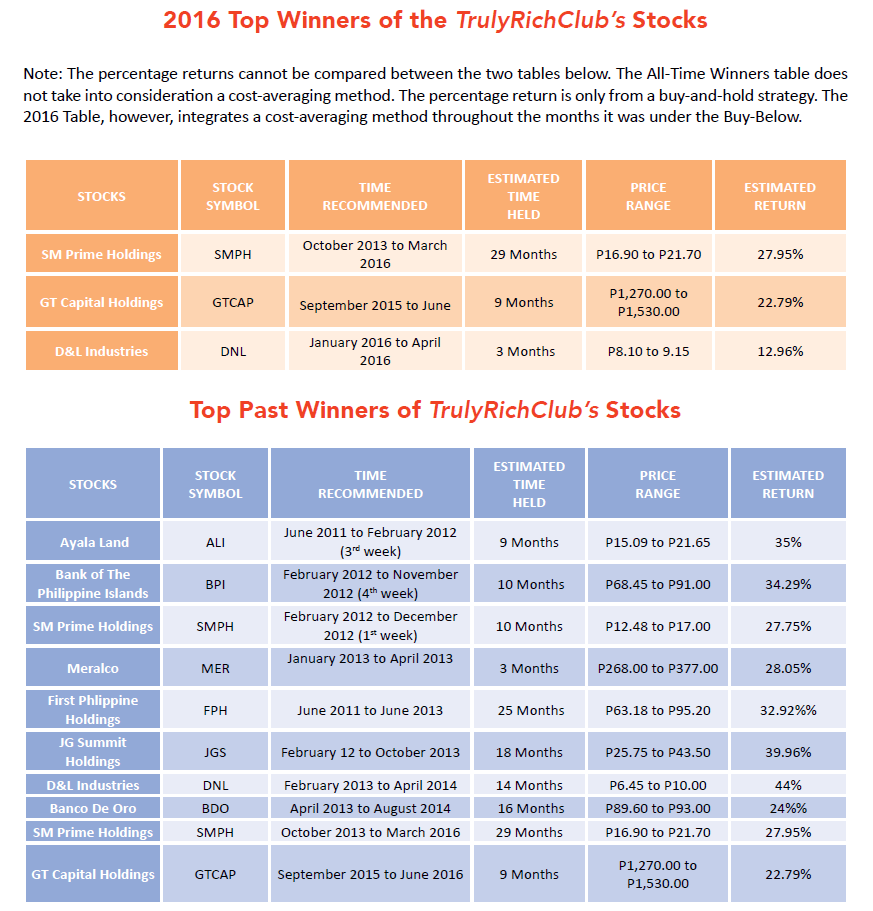

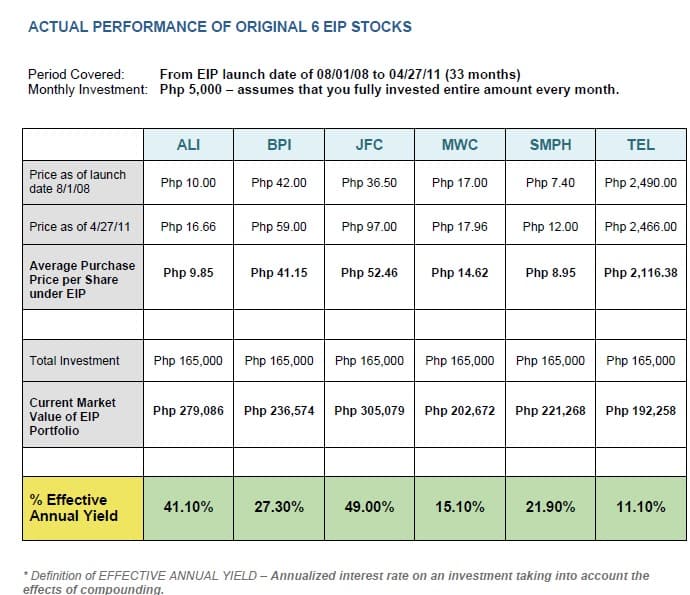

You can check the prices of the stocks mentioned above and youll find out how the stock market could be a GREAT OPTION when it comes to growing ones wealth for the LONG TERM.

This does not include yet the dividends given for the last 3+ years. This gives us an insight as to the common observation that the rich get richer. The truth is that there are many available vehicles to ride on that make wealth building and protection a lot easier. And investing in the stock market is just one of them.

Now digest all those figures and start your imagination. Henry Sys BDO and Ayalas BPI will never ever offer such interest rate in your savings accounts.

What they would skillfully try to do instead is to attract every individual employee to deposit their hard-earned money in the form of savings, time deposit accounts, checking accounts or any other fancy name, invest them wisely to buy shares just like what I did, obtain that 10%-20% gain in a matter of DAYS with their trading skills, and as a sign of respect and thanksgiving after leveraging on your money, give you a 0.5-2.5% ANNUAL interest as consolation and solace. Now you know how they can afford to build and maintain those large air-conditioned buildings and pay all their bankers and managers.

Bank Of The Philippine Islands

Industry: BankingDate Founded: August 1, 1851Headquarters: Makati CityWhat they do: Provision of commercial banking servicesBusiness Segments: Consumer Banking, Corporate Banking and Investment Banking10 Year Return:

What they do: Manufacturer and distributor of consumer food products.Business Segments: Branded Consumer Foods, Agro-Industrial Products, Commodity Food Products, and Corporate Business10 Year Return:

Also Check: PSE Stock Price: Complete List of Philippine Stocks

Also Check: Best App To Start Investing

Apple Is As Reliable As They Come

Even while being down over 18% year to date , Apple is the world’s most valuable public company, with a of over $2.3 trillion. For perspective, that’s more than Alphabet and Amazon combined. Apple didn’t reach this size by luck, either — it’s well-deserved.

Between its world-class products and brand loyalty that’s second to none, Apple is a force to be reckoned with. Here are three reasons you should buy Apple stock in 2023 and never sell.

From What Is My Wealth Primarily Built From

With regard to how much money you make, you should know that your wealth is built primarily from:

Read Also: How To Transfer Money From Chase Investment Account

Stock Market Strategies For Beginners

Investing in the stock market in the Philippines shouldnt be intimidating for a beginner investor. You just need basic education about stock trading, enough funds, and dedication to begin your investing journey.

But remember that stock trading can be a long, hard gain. It could take months to years before you see a sizable increase in your investment, especially if you started small.

On the other hand, if you want to trade in leverage and higher chances of sizable profit, then stock CFDs might be better for you.

You could immediately double your investment in just a few days. However, that also means the risks are just as high as the gains.

Never invest money you cannot afford to lose

Stock trading is a volatile market, and there is a huge possibility of making profits as there are losses. The PHP 20,000 you invested today could turn into PHP 40,000 or PHP 0 in weeks or months. So, dont put your hard-earned money into stocks, just invest what little money you can afford to lose. Then, build your investments from that.

Always diversify your portfolio

Never invest in just one stock since that could lose you all your money faster than if you diversified your investment into multiple stocks.

Always set a stop loss

People who do not use stop losses always learn the hard way after losing a couple of hundred pesos. But why wait for that when you can do that now?

Choose a good and reliable broker

——————

What Does Mitrade Platform Include?

Takeaway: How To Invest In Philippine Stock Market 2023

In conclusion, investing in the Philippine stock market in 2023 can be a lucrative endeavor. With the right research and guidance, anyone can take advantage of the opportunities that will be present. The most important thing is to start early and to be patient. With time and patience, anyone can be a successful investor.

Investing in the Philippine stock market is a great way to make money. The first step is learning how to invest in the Philippine stock market. There are many different ways to do it, and there are many different investment opportunities available. With a little research, anyone can find a way to invest that suits their needs and their budget.

Recommended Reading: Websites To Invest In Startups

What Is The Psei

The Philippine Stock Exchange Index comprises 30 companies from different industries in the stock market. They are usually re-evaluated once or twice a year. Here is the list of the current companies in the PSEi.

You probably saw it on business news. The number is usually shown to determine the stock market performance. As of writing, the PSEi is at 6,538.61. Far from the all-time high of 9078.37 back in January 2018.

Video: Ofw Investing In The Stock Market How To Start For Beginners

In this video we have Patrick Miguel, a fellow Filipino who now lives in New Jersey. He wants to know how overseas Filipinos can invest in the stock market. This video is for Filipinos living abroad who would like to learn more about investing.

Here, you will learn about how to get started investing for overseas Filipino workers. The video will also talk about why Filipinos love Jollibee, Ayala Corp., and other companies so much and why you should consider investing in those companies yourself.

Questions from listeners who are confused about whether or not they should attend webinars or just invest their money will be answered.

Finally, the video will address questions from listeners who have been laid off and want to know where they can start investing their money.

You May Like: Investing In Us Stocks From Abroad

Plan Your Stock Investing Strategy

You can’t start investing in the stock market without a strategy. Some people are active traders who buy and sell stocks within a day, a week, or a month. Others are long-term investorsthey buy and hold stocks over a long period and then sell them after reaching their target date or hitting their target ROI.

Read more: 5 Things You Should Know As a Day Trader in Stock Market

Peso Cost Averaging Strategy

For stock investing beginners, the recommended strategy is peso cost averaging. It involves investing a fixed amount on profitable companies at regular intervals over a long period .

With peso cost averaging, you buy more shares of a stock when its price is low and fewer shares when the price is high. This keeps your average cost low and helps you reduce the risk while earning good returns.

Blue Chip Stocks in the Philippines

Long-term investing in blue-chip stocks is also a great strategy because of their stable and high potential for profits, as they come from top-performing companies in the Philippines.

As of this writing, here are the blue-chip stocks based on the PSE Index:

Read more:5 Stock Trading Strategies for Aspiring Traders

How Do I Start

First, you need a stockbroker. They are accredited individuals or firms by the Philippine Stock Exchange to buy and sell stocks on your behalf.

As of 2020, there are about 130 of them, 30 of whom are online stockbrokers. You can see the list here.

Individuals or retailers should choose an online broker since they offer a lower price when opening an account. Some banks also offer stock trading platforms like BDO Securities, BPI Trade, and Metrobank’s’ First Metro Sec.

Recommended Reading: Is It Better To Have Multiple Investment Accounts

Can You Get Rich From Stock Market

Investing in the stock market is one of the smartest and most effective ways to build wealth over a lifetime. With the right strategy, it’s possible to become a stock market millionaire or even a multimillionaire — and you don’t need to be rich to get started. … But investing is less risky than you may think.

Are There Risks When Investing In The Stock Market

Absolutely! The higher the risk, the higher the reward, and vice versa. So you need to have an emergency fund first. And invest only the amount you are comfortable with not touching over a long time.

We also have recessions and market crashes every few decades, like the 2020 Coronavirus Recession and the 2008 Financial Crisis.

But if you are a long-term investor, these stock market crashes are an excellent time to buy more stocks.

Also Check: How To Open An Investment Account For A Child

What Is Fundamental Analysis

Heres our key take-away, Intrinsic Value.

Fundamental Analysis is the study of the underlying factors that contribute to a companys financial health and earning performance. Why is this important?

Fundamental Analysts believe that by identifying factors like a companys earnings, growth, and value in the market is the best way of pinpointing the value of its stock.

In this investing philosophy, even external factors are considered because Fundamental Analysts believe that these two can affect current and future performance of a companys stock.

Bottomline, it uses health and performance as key metrics for determining a quantitative rating to decide if a companys stock is overvalued or undervalued.