Take The First Step To Property Investment

Whether youre a first-time or experienced investor, ooba Home Loans, South Africas leading home loan comparison service, can boost your chances of achieving a favourable deal by applying to multiple banks on your behalf, giving you the opportunity to compare deals.

They also provide a range of tools that can make the investment process easier. Start with their Bond Calculator, then use the ooba Home Loans Bond Indicator to determine what you can afford. Finally, when youre ready, you can apply for a home loan.

Get a free home loan comparison

Multiple quotes from the big banks to compare.

The Irs And How Many Mortgages Can You Have

The other issue with how many mortgages can you have is with the IRS and the laws surrounding it.

The United States has a law stating that you can only have 10 mortgages for yourself as an individual.

So, you can theoretically get more than 4 mortgages on your own personal name by law, but getting banks to lend to you, that is a different story.

Crowdfunding A Real Estate Investing Startup

Real estate crowdfunding is a relatively new approach to investing in real estate.

Real estate investment platforms link individual investors with real estate developers and other real estate professionals who want exposure to the sector without dealing with buying, funding, and managing properties.

Here is a list of real estate crowdfunding sites that may be suitable for your needs:

Also Check: How To Create An Investment Deck

Option : Tapping Home Equity

Drawing on your home equity, through a home equity loan, home equity line of credit , or cash-out refinance, is a fourth way to secure an investment property. In most cases, itâs possible to borrow up to 80% of the homeâs equity value to use toward the purchase, rehabilitation, and repair of an investment property.

Using equity to finance a real estate investment has its pros and cons, depending on which type of loan you choose. With a HELOC, for instance, you can borrow against the equity the same as you would with a credit card, and the monthly payments are often interest-only. The rate is usually variable, however, which means it can increase if the prime rate changes.

A cash-out refinance would come with a fixed rate, but it may extend the life of your existing mortgage. A longer loan term could mean paying more in interest for the primary residence. That would have to be weighed against the anticipated returns that an investment property would bring in.

The Bottom Line: You Can Invest In Real Estate With Bad Credit Or No Money

One of the best things about real estate investing is that itâs open to everyone. You donât have to have millions in the bank or a good credit score.

You need passion, perseverance, and desire. If you can package that, thereâs no ceiling to your success.

Get creative, make connections, and focus on finding the funding to close deals without good credit.

Recommended Reading: Investing 10 Dollars In Bitcoin

Approach A Private Lender

Otherwise known as angel investors these are private individuals who are willing to support your property investment. Of course, you dont just want to ask any random person to do this, it helps if there is a degree of trust. Either way, the private investor will need assurances that you are a worthy investment and that their reward will be worthy of the risk.

Usda Rural Programs Rentals

The United States Department of Agriculture provides a number of programs to help people in rural areas. Not all of these areas remote areas some are even well populated. If you are elderly or disabled and your income is considered low and you cant find rent that is no more than 1/3rd of your earning, then you might qualify for their Rental Assistance Program.

You May Like: Favr Car Allowance Calculator

Read Also: Raise Money For Real Estate Investment

Importance Of Real Estate Financing And Why You Should Consider It

Real estate financing is growing at a minimum of 30% CAGR. At this rate, the business is doubling and the profit is increasing every 2.5 years.

RERA and Aadhaar have bound to main-stream the business of real estate in India. This will further bring more organized real estate players into the market, thus allowing higher and safer businesses for home finance companies.

Greater the development of a country, the lesser the interest rates . The present time is therefore the best time to invest in real estate with loan offers of great profitability.

The net NPA levels are lesser in home finance companies as compared to the banking sector.

Due to the need and push for affordable housing the housing finance domain anticipates the highest growth potential followed by services, technology, and trading. It also guarantees fixed income, as investors are bound to get three times more of the sum than their 20-years loan from home finance.

Commercial realty has also emerged as a resilient segment and substantial traction is witnessed towards the Grade A office space. Positive investment growth is also anticipated in the leasing of coworking spaces.

Dip Into Your Home Equity

Home equity refers to the portion of your home that you already own, or in other words, the portion of capital in your home loan that you have already paid off. Market forces can also affect home equity by raising the value of your home.

You can leverage your home equity for a loan, which you can then use to fund a second home loan for your investment property, or at least the deposit for that property. Over time, if all goes according to plan, the rental income on your investment property will enable you to pay off the loan. Bear in mind that there are tax implications as an investor if you choose this option, so best consult with your tax expert first.

Read Also: Is It A Good Investment To Buy Gold

People You Need To Have In Your Life As A Real Estate Investor

As a prospective real estate investor, it is important to have a solid team of trustworthy professionals around you. Whether you are wholesaling, house-flipping, or aiming to create a long-term investment as a buy-and-hold investor, your team can help you identify your blind spots and make the difference between your success or failure as an investor.

Real estate investors may need these people for successful transactions:

- A realtor or real estate agent is important to help locate available properties and to assist you when it comes time to sell. They could help you with local knowledge of property values and neighborhood trends.

- Mortgage brokers search for the best financing options when buying a property or refinancing it. Because a mortgage broker does not work for one bank, they have the ability to show you rates, financing options, and mortgage payments from multiple banks to help you secure your best deal.

- Escrow officers and title companies are part of the buying and selling process. The escrow officer collects information from the buyer and seller and distributes the money when the transaction is complete. Title companies search for liens on the property to ensure you don’t end up owing money for a loan or tax lien once you close.

- Real estate attorneys help you structure deals and review contracts. Additionally, they would be in your corner if you have a dispute relating to a property and need legal advice.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Also Check: Where Do I Go To Invest In Stocks

How To Fund Real Estate Investing

One of the initial steps new investors in real estate need is to build pools of available money to purchase properties. Unless you have an established business or experience in real estate, getting a bank loan to buy properties may be a challenge.

Depending on the type of investing you want to do and the properties you are targeting, different funding sources may be available to you. For example funding for flipping houses might be different than funding for other types of investment properties.

But What About Real Estate Investors

The good news is: there is much more flexibility when it comes to real estate investing.

Is it easier to get a traditional loan when your credit score is off the charts? Absolutely.

But even if your score is on the low side, you still have a host of other options for investing in real estate.

If you are serious about real estate investing, the first thing to learn is that there are unlimited ways to fund any deal.

So have no fear.

Here are 10 ways to invest in real estate with no money and bad credit.

SPECIAL OFFER:

Don’t Miss: Mutual Funds That Invest In Startups

Loans From Friends & Family

Like so many other options on this list, you cant borrow money for a down payment if youre using a conventional loan. But portfolio lenders usually allow it.

Your parents, siblings, aunts, uncles, friends, grandparents are all viable sources to borrow from, to help you accumulate the down payment for your next investment property.

These private lenders probably wont rake you over the coals on interest or fees either. Probably. As with seller financing, all terms are negotiable. Your friends and family probably wont lend you a 30-year loan, but you can arrange interest-only loans or other favorable loan terms.

One other perk: the debt wont appear on your credit report, and your other lender may not include it when calculating your DTI. If they bother calculating it at all, which many portfolio lenders dont.

Just make sure you confirm that the portfolio lender youre using allows it, before begging your family and friends for a private loan!

Who Qualifies For Housing Grants

Housing grants can be used for a wide range of people with a wide range of needs: from first-time homeowners to people who have owned in the past to those interested in seniors-only communities. Free government housing grants exist for families, two-member households, and one-member homes.

Unlike a home loan, grants are not strictly based on your financial security and credit rating. People with lower income and even poor credit are encouraged to apply for free government housing grants.

- Average annual returns: 4.5% to 8%

- Total Investor distributions: $136 million

- Investment options: REITs, individual properties , and 1031 exchanges

- Accredited investors only: No

Since its inception in 2012, more than 219,000 investors have joined RealtyMogul to access its REITs and private market offerings. Known for its exemplary due diligence, the company vets every potential property in person and scrutinizes each deal using propriety methods and models.

The company looks for well-leased properties or those with existing leases, and it works only with real estate partners with proven track records and experience managing assets. It does not invest in non-cash-flowing investments, such as raw land or ground-up construction. Investors can choose from three objectives: passive income, growth, and diversification.

-

Monthly auto-investing in REITs starting at $250 per month

-

Different fees associated with each investment

-

Investments not easily sold or traded

-

Some long hold periods

Recommended Reading: How To Invest In The Right Cryptocurrency

Friends And Family Investing

Family always comes first. This is probably the main reason for you to confide in them and even ask for their help when looking for funding on your investment deals. If no one in your immediate family and circle of friends is financially capable of helping you in this regard, there are always acquaintances that they may be on good terms with.

A very positive point with this source of funding is that you can always count on it even if something doesnt go as planned. On the flip side, this same point can quickly turn into a lot of negativity and may even harm your relationship with the involved party. Another benefit you may get from this particular source of funding is that if it comes from an immediate family member, they may not want much in return. At the very least, they might not expect to collect interest on their loan.

The Friends & Family Plan

After your first few deals, you may start to hear from friends and family members who are curious about your real estate investments.

Yes, theyre interested in your life because they like you. But chances are, theyre also genuinely interested in your investments and your results.

The Average Joe is intrigued by real estate as an investment in a way that cant be said for stocks, bonds, ETFs or REITs. Those are paper investments. They may perform well, but theyre also conceptual. Most people only grasp them in a vague, nebulous way.

But real estate is, well, real. Its tangible and physical you can walk up and touch it. You can watch it transform and improve with your own eyes.

For that matter, you can make it transform and improve with your own hands.

Right around the point where you hit the ceiling on conventional residential mortgages, your friends and family may be willing to start entrusting you with their money. It might be small at first $1,000 here, $3,000 there but if you stack up enough small investments, it may provide enough funding to buy your next investment property .

Using borrowed funds for a down payment may cause issues with most conventional lenders, but hard money lenders, on the other hand, tend to be much more flexible with allowing you to have partners and investors.

Recommended Reading: How To Invest In Hyundai

Private Lending Or Hard Money

Hard Money is not ideal for many investors because it is very costly. Private Lending also comes with strings attached. However, both of these are feasible options to get funding for your next deal WITHOUT tolerating the dreaded 80% LTV rule.

Buy the property, stabilize the property, and do a cash-out refinance after the fact .

Investment Options For Real Estate

Buying a property is not an easy task, and is definitely a costly affair. While buying real estate bank loans, or investing through REITs is the best possible choice, India offers several investment options for real estate. Following are some of the possibilities:

Primary sources such as Mutual Savings Banks, Commercial Banks, Savings and Loan Associations, Life Insurance Banks. You may also consider investment options through Financial Middlemen such as Mortgage Bankers, Mortgage Brokers or through other sources such as Finance Companies, Pension Funds, Credit Unions, Real Estate Investment Trusts, Foreign Funds, Individual Investors, and Farmers Home Administration. There is also the lucrative investment possibility of the Secondary Mortgage Market.

Lets consider a few of these options closely:

You May Like: How To Sell Investment Property Quickly

Here’s Howfrom Buying Rental Property To Reits And More

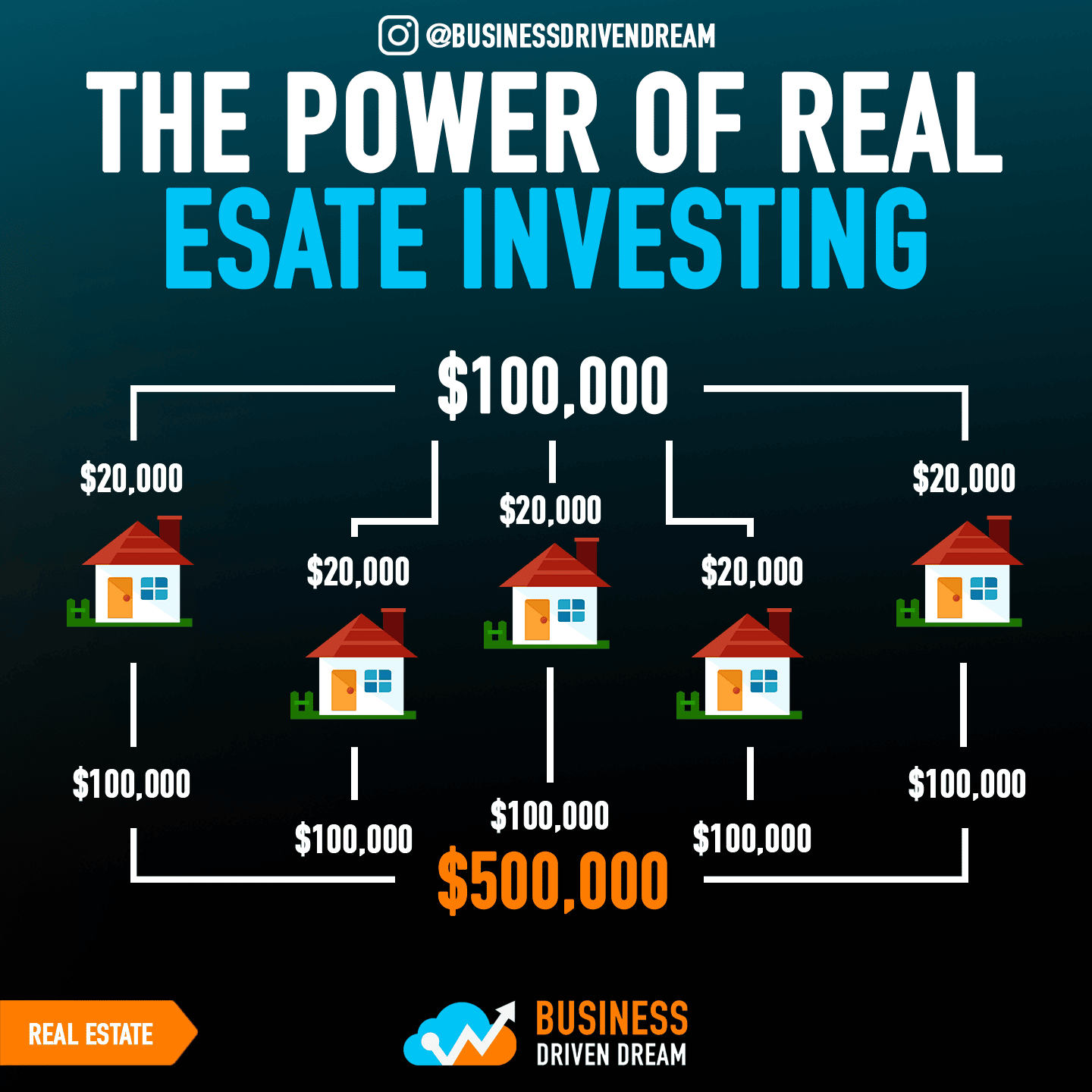

Buying and owning real estate is an investment strategy that can be both satisfying and lucrative. Unlike stock and bond investors, prospective real estate owners can use leverage to buy a property by paying a portion of the total cost upfront, then paying off the balance, plus interest, over time.

Though a traditional mortgage generally requires a 20% to 25% down payment, in some cases, a 5% down payment is all it takes to purchase an entire property. This ability to control the asset the moment papers are signed emboldens both real estate flippers and landlords, who can, in turn, take out second mortgages on their homes in order to make down payments on additional properties. Here are five key ways investors can make money on real estate.

Other Crowdfunded Real Estate Sites

There are numerous other crowdfunded real estate platforms out there, and more are popping up every single year. We will do our best to maintain this list and update it a few times per year.

Here is a brief summary of a few of the other platforms out there today. Most of these sites have very similar offerings, but you will find some differences when it comes to specific investments and fee structures.

As we do more research on each of these platforms, we will update our list above.

Also Check: How To Invest In Ira

Read Also: Financial Advisor Vs Self Investing

Huge Tip To Get More Than 10 Mortgages

The rule from the IRS is that you can have 10 mortgages for yourself.

Now, you can have another person get another 10 mortgages for themselves and be a part of your business.

If you are married, get 10 in your name and 10 in your spouse’s name. If you have a partner, get 10 in your name and 10 in your partners name.

Be creative on how you get financing for your rental property deals.