Do Cd Rates Differ By State

Generally, online banks tend to keep rates consistent across states. If a bank has a brick-and-mortar location in a certain state, it may not offer an online account in that state.

Most of the purely online banks offer the same rates across the country, Stockton says. With that said, there are certainly some banks who will do promotions from time to time or have a special locally.

Its possible for a bank to have different rates in different markets because different markets have different competitive conditions, Stockton says.

All of the community banks and credit unions are typically different in different markets, Stockton says. And so banks overall have to compete with whoever’s in each of their local markets. So it may make more sense to have a higher rate in some markets where they’re competing against some really aggressive community banks or credit unions that maybe arent in their other market.

What If I Need My Money Early

While its true that locking your funds into a CD is the reason you can earn a higher return than with other savings accounts, its not impossible to withdraw your money early should you need to. Of course, doing so carries financial consequences, but the option is available if the need arises.

Every bank is required to have an established early withdrawal penalty policy, and as a potential CD depositor, you are entitled to be told what the policy is before you commit to a CD. It will also be spelled out in the official disclosures you’re provided when opening a CD account.

The most common calculation method banks use to determine how much penalty youll incur is the deduction of a certain number of months interest from your balance at the time of early withdrawal, with the number of months of penalty interest often increasing for longer CDs.

For example, Bank XYZ might deduct 3 months of interest if you cash out a 1-year CD early. But if your certificate has a 5-year term, the early withdrawal penalty may be 12 or more months of interest.

Can You Keep Depositing Into A Cd

Traditional fixed-term CDs typically don’t allow additional deposits, but certain non-traditional types may. It depends on the institution and the type of CD being offered. For example, some banks may offer a variable-rate CD with the ability to make ongoing deposits, but not all variable-rate CDs allow for that perk. And while it is possible to find CD accounts that allow for additional deposits, savers may have to sacrifice some yield in order to get that benefit. CD accounts with this feature also tend to come with restrictions, like minimum or maximum amounts for each additional deposit, minimum opening deposits and constraints on when you can deposit.

Recommended Reading: Investing In Stocks For Children

What Is A Cd Ladder Strategy

A CD ladder is a savings strategy to help maximize your yieldand provide more liquidityby opening multiple CDs with different terms and maturity dates. The goal is to take advantage of higher interest rates and lock in a variety of CDs that give you a range of yields over time. Instead of putting all your eggs in one basket with one CD and one fixed rate, a CD ladder can help you take advantage of higher yields and help avoid early withdrawal penalties. To build a CD ladder, do your research to find the best rates, terms and minimum deposits.

Cd Vs Investment Accounts

CDs are a form of investment product. Investment accounts, or brokerage accounts, are financial accounts that house your investments. You can find brokerage accounts at a number of investment companies, mutual fund companies or brokerage firms, such as Vanguard or Charles Schwab.

Brokerage accounts can hold a number of different investments, including CDs, stocks, bonds and mutual funds.

For example, you could purchase a CD through a brokerage and keep it in your investment account. In the same account, you could house a mutual fund and a stock portfolio.

Also Check: Wealth Management Vs Investment Banking

Summary Of Best Cd Rates 2022

| Certificate |

|---|

- Availability: 5%

- Available terms: 5%

CD accounts with higher APYs rose to the top of the list. Minimum deposit requirements of $10,000 or higher affected scores negatively. Accounts with daily compounding interest schedules were scored higher than those with monthly or quarterly schedules. To appear on this list, the account must be nationally available.

What Is A Cd

A CD is a type of deposit account thats payable at the end of a specified amount of time . CDs generally pay a fixed rate of interest and can offer a higher interest rate than other types of deposit accounts, depending on the market. These accounts typically provide security for longer-term savings and no monthly fees, but at the cost of access and liquidity of the funds.

Read Also: Best Crypto To Invest In On Coinbase

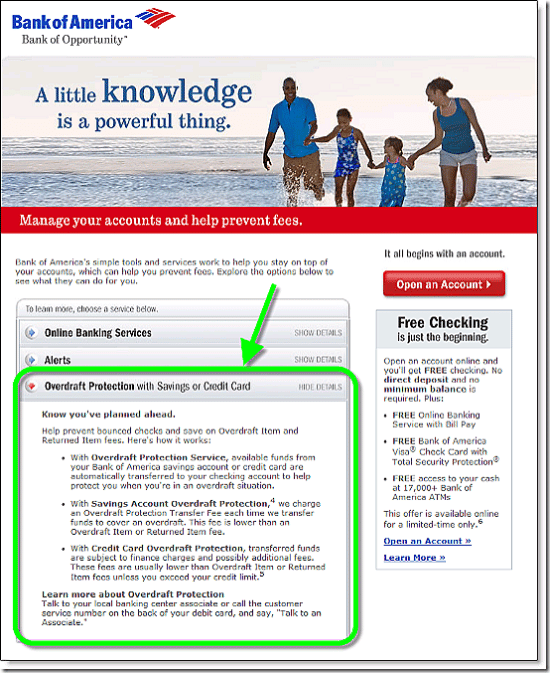

How Bank Of America Cds Rates Compare To Other Banks

As you can see below, Bank of America CD rates doesnt even come close to the rates of other banks, namely online banks like and Ally Bank. Allys one-year CD 0.55% APY outperforms Bank of Americas 0.03% substantially.

Bank of Americas closest big bank competitor is Chase. Here you can see that Chase offers incredibly low standard rates. Chase does, however, offer the chance to earn better relationship rates when you link your CD to a Chase checking account and have higher balances.

| CD Account |

| 0.60% |

Cds Vs Money Market Accounts

The gap between interest rates tied to CDs and savings accounts has narrowed. But CDs are more likely to pay a higher yield than savings accounts or money market accounts.

CDs and money market accounts have some similarities. Both are types of savings products that banks and credit unions offer. Both are considered safe, as long as theyre insured by the FDIC at banks or the NCUSIF at credit unions. Savers opening a CD or money market account might have to meet higher minimum deposit requirements than they would with a savings account.

However, money market accounts offer more liquidity than CDs, often providing the ability to write a limited number of checks per month directly out of the account. Some money market accounts offer a debit card. Those liquidity features aren’t something you’ll find with CDs.

In exchange for less liquidity, however, CDs typically offer a higher interest rate than money market accounts.

Recommended Reading: What Can You Invest In With A 401k

Bank Of America Intelligent Receivables Upgraded With Ar Forecasting Capabilities And Enhanced Reporting

The AI Solution Is Also Now Available In Brazil, Completing Global Roll Out

Bank of America today announced that it has enhanced its accounts receivables matching solution Bank of America Intelligent Receivables⢠with additional reporting and new forecasting capabilities, providing clients with insights based on historical trends and their customersâ behaviors. The bank also announced that it has completed the global roll out of Intelligent Receivables with the productâs launch in Brazil.

Intelligent Receivables uses artificial intelligence and advanced data capture technology to bring together payment information and associated remittance detail from various payment channels, whether electronic or paper based. With its ability to grab data from multiple sources , Intelligent Receivables will seek to match payments to outstanding invoices and thereby help to meaningfully reduce the costs normally associated with manual processing while speeding up the posting of revenue.

âThe new capabilities are a natural extension of a tool that constantly interacts with data,â said Liba Saiovici, head of Global Receivables in Global Transaction Services at Bank of America. âThe new dashboards give clients a more comprehensive view into their total collections and outstanding receivables from which they can dig further to better understand their customerâs behavior around timeliness and preferred mode of payment.â

Bank Of America Cd Reviews And Complaints

Bank of America is accredited with the Better Business Bureau and has been in business for over 70 years. However, the bank does garner an overall low customer rating. On the BBB site, customers rate it with 1 out of 5 stars. Over 1,300 customers fulfill the banks 1.4 out of 5 stars on Trustpilot.

Customer complaints dont center around its CDs directly, but many report problems with the banks customer service. Customers say that theyve dealt with closed accounts, misreporting of funds deposited and getting charged bank fees that the customer didnt know existed.

On the positive side, some customers have dealt with banking problems where the rep solved the problem on the phone step by step. Others have been impressed with the bank catching fraud, saving the customer thousands of dollars.

Read Also: How Much To Invest In Gold

What Is A Cd Ladder

Longer-term CDs tend to pay higher yields. They also require you to lock up your money for an extended period, unless youre willing to incur an early withdrawal penalty. One way to get the best of both worlds is to use a CD ladder strategy. Savers ladder their investment by spreading their money across different CDs with varying terms. A portion of the money goes toward short-term CDs, while another portion of the funds is allocated to longer-term CDs.

As one of the shorter-term CDs matures, the money might be reinvested in a new five-year CD. Eventually, youd have a five-year CD maturing each year. This would enable you to have some access to your money and, at the same time, keep it in a higher-yielding savings vehicle.

CDs may not provide a double-digit return right now, but you can get a higher rate if you are willing to shop around. Thanks to the increased competition in the marketplace, consumers have many options from traditional banks and their online brethren.

Banks and credit unions of all kinds want your business and will pay for it with attractive returns, making comparison shopping a must when purchasing a CD or share certificate.

How To Open A Bank Cd

Opening a certificate of deposit generally follows the same steps as opening any new bank account, and will involve more or less steps if you are a new customer of the bank or an established one.

Youll first need to fill out an application. This is usually accomplished online, but can be done in-branch if youre opening the certificate at a bank that operates in your community. Some banks also allow paper applications to be sent via U.S. mail.

If youre not already a customer of the bank, youll need to prove your identity with photo identification. And youll be presented with various written account terms and disclosures that youll need to sign off on.

Just like with a savings or checking account, youll be presented with various options for making your initial deposit, whether thats at the time of account opening or slightly later. Most banks offer transfers from another account at that bank, an external transfer from another bank, or a check thats mailed in or submitted via mobile deposit.

Just remember that, unlike a savings or checking account, your initial CD deposit is a one-time deal. You cannot make a small deposit to open the account and then a large deposit to complete the certificate balance later. Every dollar you want committed to the CD must typically be deposited in a singular initial deposit.

Recommended Reading: Best Platform To Start Investing

Important Disclosures And Information

- Are Not Insured by Any Federal Government Agency

- Are Not a Condition to Any Banking Service or Activity

Touch ID is a registered trademark of Apple Inc., registered in the U.S. and other countries.

“Get more rewards with your everyday banking” is a trademark and Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Select’s Picks For The Top Cds

Who’s this for? This is a good choice for beginners who want to try out a CD as it only requires locking up your money for a short period of time. If you have plans coming up in the short-term, such as a big trip, a 3-month CD can help you save your money while keeping it out of reach so you aren’t tempted to spend it.

About BrioDirect High-Rate CD: BrioDirect is the digital subsidiary of Sterling National Bank, which has branches in New York and New Jersey, and offers CDs and high-yield savings accounts online.

The national average rate for a 3-month CD is 0.07% APY, according to the FDIC. With a fixed 0.50% APY, a BrioDirect High-Rate CD offers an interest rate that’s more than 7X the national average.

BrioDirect compounds interest daily and credits it to your account at maturity. The minimum deposit is $500 to open a BrioDirect High-Rate CD, and if you withdraw your money early you’ll get hit with a penalty fee of 90 days interest, whether or not you’ve earned the interest yet.

Once your term length ends, the CD renews automatically for another 3-month term at the current rate. Otherwise, account holders have a 7-day grace period after the maturity date to withdraw funds or deposit more without penalty.

Recommended Reading: How To Set Up Your Investment Portfolio

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

Merrill Introduces Premium Access Offering To High

Expanded Investment Suite Fully Integrated to the Merrill Lynch Investment Advisory Program

Bank of America today announced Premium Access Strategies, a suite of third-party investment strategies reviewed by the Chief Investment Office, including the added benefits of access to investment management teams and the ability to request expanded portfolio customization. The new strategies are fully integrated into Merrill Lynch Investment Advisory Program to help support comprehensive planning discussions, as well as seamless implementation and inclusion in annual review materials.

âPremium Access Strategies is the latest example of Merrill offering personalized investments to align with clientsâ goals and financial situations,â said Keith Glenfield, head of Investment Solutions at Bank of America. âThe new offering is designed to address clientsâ unique needs and provide further customization, all while being fully integrated into the Merrill Lynch One Platform.â

Premium Access Strategies allow clients to enter into a dual contract relationship by signing an agreement with Merrill and entering into an investment manager agreement with the selected manager, who can provide customized, professional investment management for a personalized portfolio at a negotiated manager rate. Managers planned to be available for the November launch, include AllianceBernstein, BlackRock, Franklin Templeton, Lord Abbett, Natixis Investment Managers/Loomis Sayles, Nuveen and PIMCO.

Recommended Reading: Is Gold A Bad Investment

Promotional Content Related To Product Page

As experienced bankers, we can respond quickly to your needs without the red tape of other banks. At American Bank, you dont just open an account. You start a relationship, the way banking should be. We are committed to your success, and are here to act as your trusted business advisor on everything from your cash flow to your strategic road map.

Bread Savings : 1 Year 5 Years $1500 Minimum Deposit To Open

Bread Savings formerly known as Comenity Direct has been working behind the scenes for over 30 years on credit card programs with some of the biggest names in U.S. retail. Since 1986, it has managed many private label, co-brand, and business credit cards. Comenity Direct announced its rebrand to Bread Savings in to reflect the rebranding of its parent company, Alliance Data, to Bread Financial in .

Recommended Reading: How To Open A Charles Schwab Investment Account

What You Can And Can’t Do With A Cd

You can typically earn a higher APY with a CD than most savings accounts or money market accounts. That interest is usually compounded on a daily, monthly, quarterly or annual basis. It is usually credited to your account on a monthly, quarterly, semiannual or annual basis. You can re-evaluate the CD after the term expires. You usually have a grace period between the CDs maturity date and renewal date. This allows you to renew it, change the terms or withdraw and close it. You usually cant add money to CDs until they mature. In most cases, you can withdraw from a CD at any time, but this may result in an early withdrawal penalty. So this is something to avoid, if possible.

Cd Investments: How Much Can Cds Earn

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Certificates of deposit can be considered smart, low-risk investments for some of your money. A CD investment provides guaranteed returns and your money stays federally insured. How much interest you can earn on a CD depends on the rates, which are in a rising rate environment thanks to Fed rate increases. See what CDs can earn below.

Read Also: Benefits Of Investing Through An Llc