Strategy: No : Adjust Your Risk Profile

During a bear market, one of the best safe investment options is to continue your current strategy but update your risk profile. By this, I mean that you should pivot to more risk-averse investments. Here are a few examples of what this could look like:

- More blue-chip stocks and fewer startups or IPOs.

- Fewer stocks altogether and more safe assets such as bonds and real estate.

- Hold a higher percentage of your portfolio in cash.

- Exiting margin positions.

- Hedging your portfolio to protect against downturns.

This is a good time to remind you that Im not a financial advisor. These are just general tips. The best asset allocation for you will depend on your risk tolerance. If you feel the need, please speak with a financial advisor before making any investment decisions.

However, in general, the biggest rule of thumb is to hold cash during a bear market. Yes, its true that inflation is eating away at your cash. But, youll lose much less money through inflation than you can lose during a down market. You want to have cash on hand so that you can purchase stock once you feel that the market has overcorrected.

Holding cash also serves a double purpose of giving you a sense of financial stability. Finally, one of the last best safe investment options is actually to take a break from investing in traditional assets altogether.

Top Investment Options In India In 2022

Listed below are some of the best investment options in India for 2022:

1. Fixed Deposits and Recurring Deposits

2· Mutual Funds

4· Post Office Saving Scheme

5· Bonds

6· National Pension Scheme

7· Unit Linked Insurance Plans

8. Liquid Funds

9· Public Provident Funds

10. Senior Citizen Savings Scheme

Let us look in detail at some of the best investment options available in India for growing your money:

Launching Your Own Enterprise

When you have self-discipline and a product or service you can sell, starting your own business can be both profitable and fulfilling. Consider first what skills and expertise you possess that you can use in your business. You dont need a eureka-type idea or invention to start a small business. Millions of people operate successful businesses that are hardly unique, such as dry cleaners, restaurants, tax preparation firms, and so on.

Begin exploring your idea by first developing a written business plan. Such a plan should detail your product or service, how youre going to market it, your potential customers and competitors, and the economics of the business, including the start-up costs.

Of all the small-business investment options, starting your own business involves the most work. Although you can do this work on a part-time basis in the beginning, most people end up running their business full-time its your new job, career, or whatever you want to call it.

Ive been running my own business for most of my working years, and I wouldnt trade that experience for the corporate life. Thats not to say that running my own business doesnt have its drawbacks and down moments. But in my experience counseling small-business owners, Ive seen many people of varied backgrounds, interests, and skills succeed and be happy with running their own businesses.

Recommended Reading: Investing In Real Estate Rentals

Can You Lose Money In A Bond

While bonds tend to be safer than stocks and other market-based investments, you can still lose money investing in them. Here are some of the most common ways to lose money in a bond:

- Selling before maturity. Bond prices fluctuate, depending on many factors, but especially the prevailing interest rate environment. If you have to sell the bond when its price is down, you might not get the price you paid for it. However, if you hold until maturity, you are likely to get the face value of the bond.

- Buying bonds at a premium. A bond price can rise above its par value the price youll receive at maturity if prevailing interest rates fall. So if you buy at a premium, the bond will pay higher income than you might receive elsewhere. But that higher income comes at a cost: a higher bond price. As the bond approaches maturity, its price will fall closer to par value as fewer of these relatively higher bond payments remain. Eventually at maturity, the bond price will be redeemed at par value.

- The issuer goes bankrupt or defaults. If the issuer defaults on payment of the bond, the bond price could plummet. If the issuer goes bankrupt , the bond may become totally worthless, depending on the companys financial situation.

How Big Should The Fund Be

An emergency could be in any form a small one like car breakdown and a big one like job loss, which may continue for several months. In such a situation you will not only have to manage your household expenses but also continue paying your labilities like EMIs and credit card dues. Therefore, one should at least build an emergency corpus which can at take care of 6-9 months of family expenses.

Recommended Reading: Private Equity Investments For Small Investors

What’s The Difference Between Stocks And Options

The biggest difference between options and stocks is that stocks represent shares of ownership in individual companies, while options are contracts with other investors that let you bet on which direction you think a stock price is headed. But despite their differences, these assets can complement one another in a portfolio.

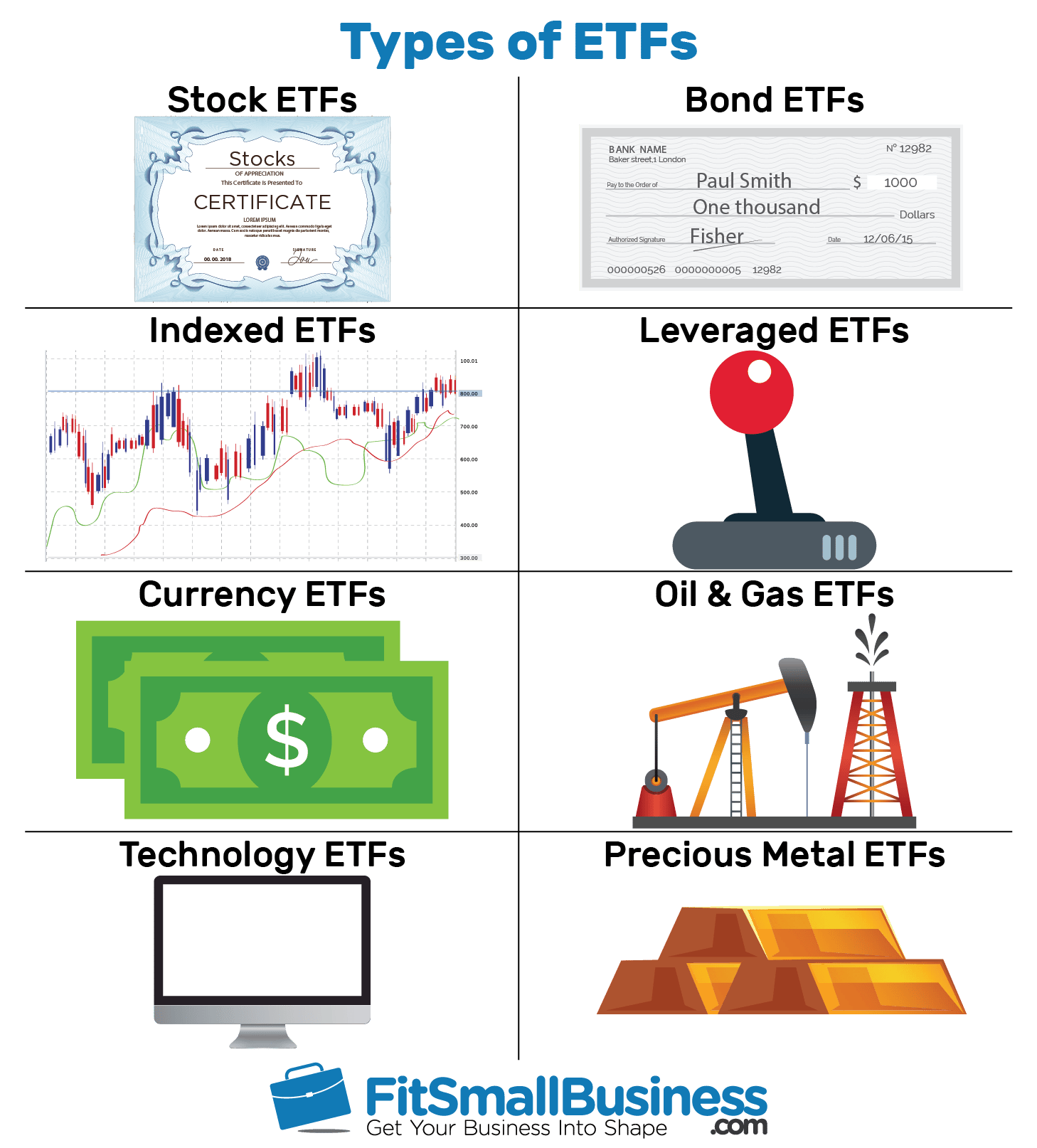

One thing to note: Finding potentially lucrative investments within the stock or options markets might sound exciting, but before you dive into day trading or options trading, you may want to explore low-cost index funds and exchange-traded funds. These instruments bundle a number of assets together, letting you diversify your portfolio through a single investment. Experts often recommend that investors use these funds to form the basis of a long-term portfolio and they can serve as a good entry point for beginner investors.

» Get started: Learn how to invest in index funds

If youre intent on diving into the market via stocks or options, the guidelines below can help you make the right choice. Lets start with a basic breakdown of the differences between stocks and options:

|

Stocks |

||

|---|---|---|

|

May be a good fit for |

Beginners and long-term investors |

Active traders who want flexibility |

|

Potential drawbacks |

Effort, additional risk and cost |

|

|

Type of investment |

Derivative |

Fixed Deposits And Recurring Deposits

Fixed Deposits and Recurring Deposits have continued to be a popular investment among many investors especially those who seek guaranteed returns with minimal risk. FD and RD accounts can be easily opened with leading banks and Non-Banking Financial Companies as well as the post office. Key features that make FD and RD a popular investment choice for 2022 include:

- Assured returns

- Minimal risk to principal invested

- Flexible investment amount

- Option of loan against FD in an emergency

- Simple renewal and withdrawal facility

Related Articles

While FD and RD investments in India offer comparable returns, fixed deposits are better suited to grow a lump sum investment with interest earnings. Recurring deposits, on the other hand, are better suited to inculcate a savings habit and steadily through regular monthly investments into the account along with interest earnings.

Recommended Reading: Using Va Loan For Real Estate Investment

Investment Ideas Other Than Stocks

Once you have secured yourself through insurance and have put aside a substantial amount of savings, then it is high time to look for ways to grow your money.

Investment in stocks through mutual funds and government bonds is always a good idea. However, it is important that people diversify their funds and resources.

The stock market is a very promising source of fortune but the stock market is very volatile and it can be precarious. It would be nice to have a part of your money invested in other places. So after you have learned how to invest in stocks, you should learn other investment ideas that would make your hard-earned and carefully-saved money grow.

Below are a few options other than the stock market.

Treasury Notes Treasury Bills And Treasury Bonds

If you want to earn a slightly better interest rate than a savings account without a lot of additional risk, your first and best option is government bonds. Right now, treasurys are yielding 2.22% for a duration of one month, up to 2.93% for a duration of 30 years .

Bonds issued by the U.S. Treasury are backed by the full faith and credit of the U.S. government, which carries a lot of weight. Historically, the U.S. has always paid its debts. This makes government debt reliable and easier to buy and sell on secondary markets, if you need access to your cash before the debt is mature.

This stability, however, means bonds may have lower yields than you might earn from bonds where the debt was less likely to be paid back, as is the case with corporate bonds.

You May Like: Non Profit Real Estate Investment

Investing In Someone Elses Small Business

Are you someone who likes the idea of profiting from successful small businesses but doesnt want the day-to-day headaches of being responsible for managing the enterprise? Then investing in someone elses small business may be for you. Although this route may seem easier, few people are actually cut out to be investors in other peoples businesses. The reason: Finding and analyzing opportunities isnt easy.

Are you astute at evaluating corporate financial statements and business strategies? Investing in a small, privately held company has much in common with investing in a publicly traded firm , but it also has a few differences. One difference is that private firms arent required to produce comprehensive, audited financial statements that adhere to certain accounting principles. Thus, you have a greater risk of not having sufficient or accurate information when evaluating a small, private firm.

Another difference is that unearthing private, small-business investing opportunities is harder. The best private companies who are seeking investors generally dont advertise. Instead, they find prospective investors through networking with people such as business advisors. You can increase your chances of finding private companies to invest in by speaking with tax, legal, and financial advisors who work with small businesses. You can also find interesting opportunities through your own contacts or experience within a given industry.

Are Alternative Investments Right For You

Many types of alternative investments are only accessible to investors with a high income or high net worth. Regulatory requirements may require you to be an accredited investor, meaning that either your net worth — excluding your home — is greater than $1 million or your earned income exceeds $200,000 per year.

Investing in alternative assets often requires a lot of capital, and the investments can be illiquid, so theyâre not easily bought or sold. Many online marketplaces for alternative investments have multi-year minimum holding requirements for the alternative assets.

Owning alternative assets is best suited for investors whose portfolios are already diversified. If you are happy with your allocations to traditional securities such as stocks, bonds, and exchange-traded funds , then allocating money to alternative assets may be a good fit.

As for which alternative investment types to choose, you can consider your appetite for risk, your investing time horizon, and how much time you have to devote to investing. Once you’ve considered these elements, you can identify the specific alternative investments that most appeal to you.

You May Like: How To Invest In Gold Stock Market

Real Estate Development And Resale

Colloquially known as “flipping,” buying and improving properties and then reselling them can be more profitable than simply collecting rent. Real estate that is flipped is often purchased at a significant discount, usually because it needs substantial improvements or repairs.

Real estate flipping is also one of the riskier ways to invest in real estate since your ability to generate profit requires specialized skills and experience. Real estate flippers can confidently value a property, accurately estimate the costs to improve it, and then quickly complete those improvements to make the home available for sale again. However, buying, improving, and reselling property is time-consuming, requires significant capital, and can be stress-inducing.

The Basics: Savings Bank Account Or Cash

One-month expenses as a reserve can be kept in a combination of saving bank account and cash. Though cash is highly discouraged, there are many emergencies when it is the only option. Many natural disasters like storm, excessive snowfalls etc. may impact internet connection and so digital payment options may not work. Therefore, it may be a good idea to keep some amount cash to manage 7-10 days expenses. Rest you can keep in your saving bank account.

7. Senior Citizens’ Saving Scheme 8. Pradhan Mantri Vaya Vandana Yojana 9. Real Estate10. GoldRBI Taxable BondsWhat you should do

Read More News on

Don’t Miss: How To Find Value Investing Stocks

Real Estate Investment Trust

Real estate investment trusts may be an attractive alternative for investors who prefer not to own rental property directly. As the online alternative investments website Yieldstreet explains, REITs allow investors to generate passive income by investing in real estate directly with a low barrier to entry.

There are primarily three types of REITs:

- Publicly traded REITs whose shares can be bought and sold by individual investors on the major stock exchanges.

- Public non-traded REITs that have lower liquidity and are typically not impacted by market fluctuations.

- Private REITs that are only available to accredited investors and are generally not liquid.

According to research conducted by Nareit, publicly-traded REITs have a lower overall correlation to the broader stock market. In fact, over the last few years, residential REITs have had one of the lowest historical correlations with the broad stock market, making the sector potentially a good defensive play in an uncertain economy.

Investment Alternatives To The Stock Market

Despite double-digit growth in the rebounding stock market thus far in 2021, some cautious individuals want investments other than stocks to balance out their portfolios. Fortunately, there are several other ways to invest your money, such as buying gold or exploring technology-based investments like crowdfunding. While there are many investments outside the stock market, here were covering the top five options with the greatest potential for return while taking on acceptable risk.

Also Check: How To Choose Investments For Roth Ira

The Drawbacks Of Options

Options trading requires a more hands-on approach than investing in stocks. You may wish to exercise the option before expiration, and that means youll have to keep a watchful eye on the related stocks price. You can set alerts through your online broker.

Also, some options strategies are riskier than others, so make sure you understand the trade in advance. Hint: Many experts recommend avoiding daily or weekly options, which tend to be a better fit for more seasoned traders.

The more you trade, the higher your costs.

Another downside of options trading is the related costs, which can be higher than for stocks. Options traders may pay a flat fee per trade which is typically the same as the brokers stock trading commission, if it charges one plus a per-contract fee ranging from 15 cents to 75 cents. The more you trade, the higher your costs and dont forget, you may pay fees to sell, too. Finally, as with stocks, be sure to factor in capital gains taxes. Youll be on the hook to pay taxes on profits these taxes are higher for assets youve held less than a year.

Best Investments For Any Age Or Income

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

The term investing may conjure images of the frenetic New York Stock Exchange, or perhaps you think its something only meant for those wealthier, older or further along in their careers than you. But this couldnt be further from the truth.

When done responsibly, investing is a great way to grow your money. And many types of investments are accessible to virtually anyone regardless of age, income or career. Such factors will, however, influence which investments are best for you at this particular moment.

For example, someone close to retirement with a healthy nest egg will likely have a very different investment plan than someone just starting out in their career with no savings. Neither of these individuals should avoid investing they should just choose the best investments for their individual circumstances.

Recommended Reading: How Do I Invest In Dow Jones

Best Investment Options In India For 2021

What makes a good investment option? There can be several factors to measure effectiveness of a savings plan, from its flexibility of investing, pre-withdrawal to the amount of tax exemption it allows. For most investors, if you list down, the following factors influence their investment decision more often than not:

a) Freedom to invest and withdraw anytimeb) Flexibility to invest any amountc) Safer risk-return propositiond) Custom investment periode) Tax benefits & other benefits

Depending on your goals and needs you can decide which factor holds more significance to you when investment for a long term. Also, remember you cannot have the best of all worlds every investment will have a few strong factors, while compromising on others. For instance, when you are investing for high liquidity, you might loose on the overall returns.

Also learn about – What is Investment