Best For Gold Coins: Bgasc

BGASC

As its name implies, BGASC is one of the best sources for gold bullion coins sold at reasonable prices, making it our choice for the best online gold dealer for coins.

-

Best selection of gold coins

-

Competitive pricing on gold coins

-

Excellent customer support

-

Three-day return policy

Although BGASC offers a complete lineup of gold products, its primary focus is on selling gold bullion coins. Their selection of coins is vast, prices are highly competitive, and customer service is excellent, which is why BGASC is our choice for the best online gold dealer for coins.

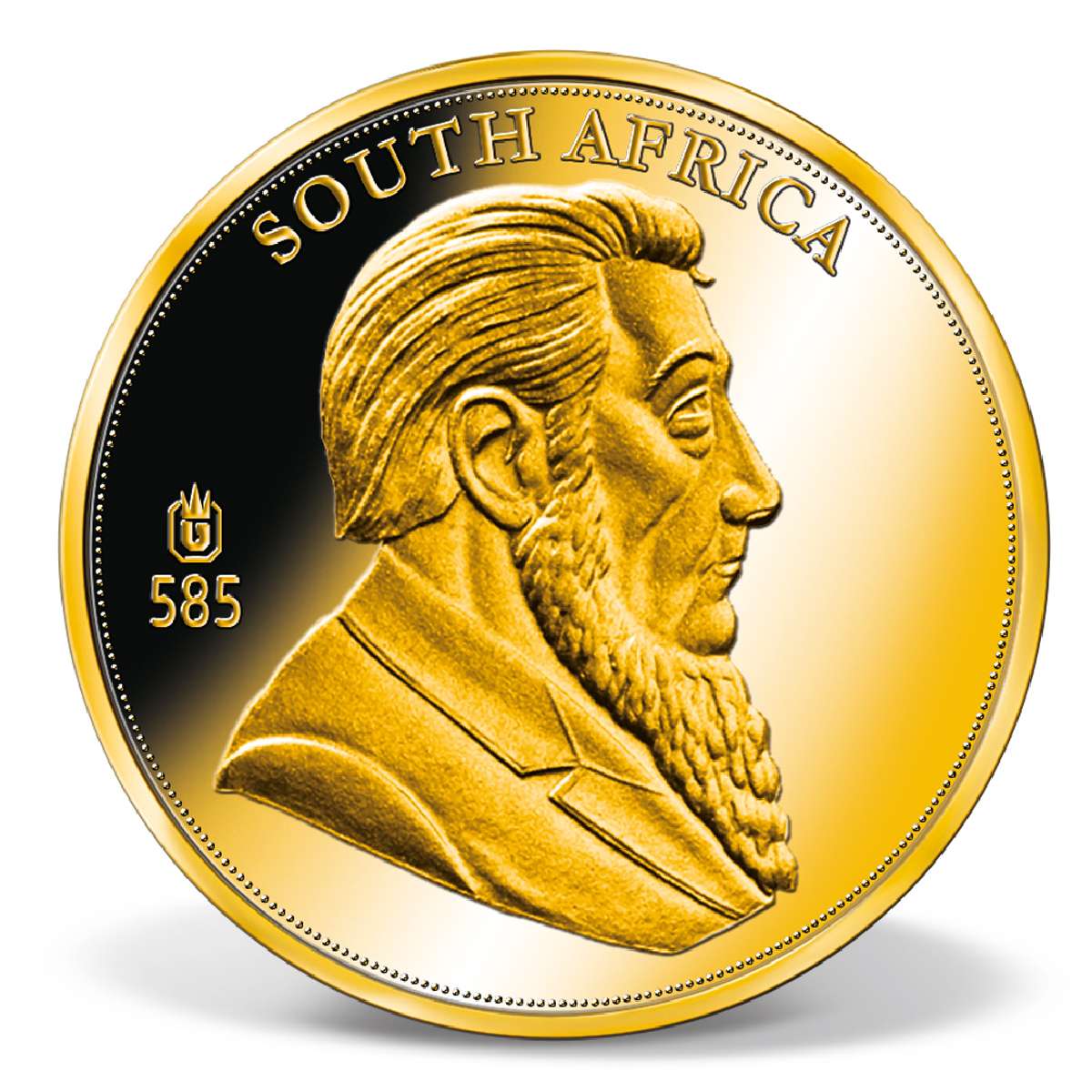

BGASC have managed to build a solid reputation, especially as a gold coin dealer. In addition to a great selection of all the essential standbyssuch as American Eagles, Canadian Gold Maples, South African Krugerrands, Pre-1933 U.S. Gold, and Australian Gold Kangaroosthey maintain an extensive inventory of premium and rare numismatics. It also offers silver and platinum products. They do offer gold bars in all the standard sizes.

Their products are priced very competitively. Their 1 oz. Gold American Eagle Coin was the cheapest of the vendors in this article.

One of the downsides of BGASC is its limited payment options. Currently, they only allow payments with paper checks , PayPal , credit and debit cards , and bank wire transfers .

Shipping is free for orders of $5,000 and over. While that may be a high bar for smaller investors, its $9.95 fee for orders under $5,000 is still affordable.

Australian Gold Coins: Perth Mint Bullion

The Perth Mint produces a bullion coin called the Australian Gold Nugget. It is part of the Gold Nugget series introduced in 1986. From 1986 to 1989, the reverse of the coin depicted a variety of Australian gold nuggets. In 1989, the design started to feature kangaroos, the internationally recognized symbol of Australia. These coins are used as both legal tender and bullion coins.

Each year brings a new design of this 24 karat coin, which means the numismatic value of certain coins may actually exceed the value of the gold they contain. They are minted in denominations that include 1/20 oz, 1/10 oz, ¼ oz, 1 ounce, 2 ounce, 10 ounces and 1 kilogram. The Perth Mint even created a one tonne coin in 2011 with a face value of $1 million! This creation broke the record for the largest and most valuable gold coin ever. There are also Australian Gold Lunar bullion coins, with .9999 purity, that feature animals from the Chinese calendar rather than the traditional kangaroo.

Gold Bullion Bar Refineries/mints

The primary benefits to gold bullion bars for gold buyers are diversity and affordability. Gold bullion bars have lower premiums over the spot price of gold when compared to gold bullion coins, and the variety of options is far more diverse. Gold bullion bars are available not only in the aforementioned weights, but also styles including cast, hand-poured, and minted ingots. Gold bullion bars are struck continuously to meet the demand for gold, with the following refineries and mints representing some of the greatest refiners of gold bars:

Recommended Reading: Using Home Equity To Invest In Real Estate

Best Overall: Money Metals Exchange

Money Metals Exchange

The combination of highly competitive prices, low shipping costs, vast product selection, and an exceptional customer experience lands Money Metals Exchange on our list as the best overall online gold dealer.

-

Free shipping on orders of $500 or more

-

Automated monthly savings plan

-

Purchasing limits apply depending on your payment method and some are very low

-

Shipping can be slow

Founded in 2010, Money Metals Exchange has quickly amassed a customer base of more than 250,000 customers. Its customer-centric focus has translated into highly competitive pricing, personalized service, a pathway for new investors, and one of the best online reputations, making Money Metals Exchange our choice as the best overall online gold dealer.

Customers can easily navigate its website to shop for coins and bullion by category and weight. Beginning investors can get their feet wet in gold investing with an automatic monthly savings plan starting at $100 a month. They advertise the price to be as low as $105 over spot pricing on a 1oz Gold American Eagle Coin.

Shipping is free on all orders over $500, which is not such a high bar considering the cost of gold. For orders under $500, the shipping charge is $7.97. Money Metals offers a three-day return policy and may apply a 5% restocking fee on credit card orders. The dealer also offers a buyback program claiming to pay the highest price among its competitors.

Where Is The Best Place To Buy Gold Online

Look no further. Whether you’re looking to buy gold bullion to invest, to build a collection, or simply for fun, Provident Metals is a secure place to begin your precious metals journey. We’ve shipped over 1 million orders through our secure online ordering process, and we are proud to maintain an A+ rating by the Better Business Bureau.

We proudly offer coins, rounds, and bars from the most trusted and respected mints around the world. With so many products to choose from at industry-leading prices, your only challenge will be deciding which one best suits your style. Start shopping with your trusted friend in the bullion industry today!

Also Check: Is It Worth It To Invest In Bitcoin

The 1794 Flowing Hair Silver Dollar

The 1794 Flowing Hair Silver Dollar may sit atop the rankings of the most expensive coin ever sold, at least for now. Some experts believe that it was the first silver dollar struck by the U.S. Mint. The front features a profile of Lady Liberty with flowing hair, while the reverse shows an American eagle. Fewer than 1,800 of these coins were ever produced, and one expert puts the number of remaining coins at between 120 and 130, so its quite rare.

The coin sold at auction for just over $10 million in 2013.

Buying Gold Investment Coins

Americans regained the right to own gold bullion on December 31, 1974. Previously, since President Roosevelts 1933 gold call-in, Americans could own only numismatic coins whose prices were determined more by collector interest than by the value of their gold content. Numismatic and collector coins sell at huge markups, sometimes at prices many times the value of their gold content. Gold bullion coins sell at small markups over the value of their gold content.

You May Like: Investing In Notes And Mortgages

Safeguard Your Assets By Investing In Coins Bars And Rounds

| Live Gold Price |

|---|

12 Month Chart

Owning gold means having a valuable asset to protect your wealth and purchasing power for years to come. Investors invest in or buy gold to help guard against inflation and financial turmoil. Because it is inversely correlated to many other asset classes, it is a necessary part of any balanced investment portfolio. It is more than a commodity it is a better, more stable form of money that has been used for thousands of years. Its something everyone should own from seasoned investors to regular people looking for financial security.

Best Reputation: Golden Eagle Coins

Gold Eagle Coin

Established as a family-owned business, Golden Eagle Coins has a nearly unblemished track record with thousands of positive reviews, making it our choice as the online gold dealer with the best reputation.

-

Extensive selection of gold coins

-

Solid online reputation

-

Limited selection of gold bars

Known primarily for its vast selection of gold coins, including collectible and numismatic coins, Golden Eagle Coins’ started in 1974 and maintains a track record of customer satisfaction that is unmatched, which is why it makes our list as the most reputable online gold dealer.

You can’t help but marvel at Golden Eagle Coins’ extensive selection. In addition to the popular coins, such as American Eagles, South African Krugerrands, and Canadian Maple Leafs, investors can also find a great selection of pre-1933 coins, commemoratives, mint sets, and foreign coins from many countries. Golden Eagle Coins also sells silver, platinum, palladium, and copper coins.

Also, you won’t find too many dealers that offer historical currency, such as Confederate notes and Colonial currency. Collectors are also impressed with its selection of ancient Arabic, Greek, Roman, and medieval coins.

Golden Eagle Coins’ pricing is low and competitive, but not quite as cheap as BGASC or SD Bullion. You go to Golden Eagle Coins for its selection and service, not necessarily for its pricing.

Read Also: Home Equity Line On Investment Property

Choosing The Best Dealer Online Or Local

A good way to start is to compare prices of the same product among a few dealers.

Getting a low premium is good, of course, but price isnt the only consideration. Heres a few other important questions to ask:

Do they offer multiple forms of payment? Bank wire, credit card, cash, personal checks, money orders/cashiers checks, and PayPal are being increasingly offered in the gold industry. And you want as many options as possible for not just current orders but future ones, too.

What are total costs, including commission, shipping, insurance, and credit card or bank wire charges?

How big is the company? You want a dealer that has strong volumes, because they will have greater flexibility, bigger selection, and be more equipped to fill a large buy or sell order.

Is the dealer pushy, or educational? Do you feel comfortable with them?

Will the dealer send you a lot of marketing materials after your purchase? You may want these to learn about special offers, but you dont want to get bombarded or your name be sold.

Do they offer a buyback policy? If theyre not willing to buy back what you purchase today, thats a strike against them. We obviously want a dealer that will still be in business years from now when youre ready to sell.

What is the return policy if you receive the wrong product? Keep in mind, however, that you cant return a correctly filled order due to buyer remorse.

There are a few other places youll see gold coins for sale, including

Gold Etfs & Mutual Funds

Gold exchange-traded funds and mutual funds are accounts that purchase gold on an investors behalf. The shares that make up these funds each represent a fixed amount of gold and can be bought and sold like stocks. This is one of the best ways to invest in gold as ETFs and mutual funds allow investors to work with gold, without dealing with the costs of physical ownership . There are fees associated with buying and selling gold through ETFs or mutual funds, but they are often much lower when compared to the management of other assets.

Note that ETFs and mutual funds dealing with gold often invest in other commodities as well, meaning you will rarely find a firm that deals strictly with gold. This can be beneficial if your goal is to diversify, though it may require learning about other markets as well as gold. Be prepared to research different funds when considering ETFs or mutual funds for your gold investment.

Also Check: How Do I Invest In A Company

The Many Reasons For Buying Gold Coins

Gold offers benefits far beyond the fact that its price can rise.

Considerable all the advantages you gain by buying gold coins. Gold is

A tangible asset. You can hold $50,000 of gold coins in your hand, which you cant do with most any other investment. It cant be destroyed by fire, water, or even time. And unlike other commodities, gold coins dont need feeding, fertilizer, or maintenance.

Free of counterparty risk. Gold coins require no paper contract to be made whole. Gold is the only financial asset that is not simultaneously some other entitys liability. It doesn’t require the backing of any bank or government.

Highly liquid. Gold coins can be sold virtually anywhere in the world. There are gold dealers in just about every major city on the planet. And in a crisis, gold will be in high demand. Other collectibles, like artwork, take longer to sell, have a smaller customer base, and will likely entail a big commission.

Value dense. You can hold $50,000 in gold coins in the palm of your hand. Gold coins take up such little space that you can store more value of them in a safe deposit box than stacks of dollar bills.

Private and confidential. How many assets can you say that about in todays world? You must pay taxes on any gain, of course, but if you want a little privacy or confidentiality, just buy some gold coins!

Portable. You can take gold coins with you wherever you go in the world.

The Ethical Concerns Of Buying Gold

More and more investors are worried about the social and environmental impact of their investments. Gold mining can take a significant toll on the environment and mining practices have raised concerns around human rights, as many gold mines are located in conflict-affected areas.

In 2019, the World Gold Council took steps to implement guidelines for member companies, as did the International Council on Mining and Metals. Both require that participating mining companies publish information on their progress publicly, making it easier for consumers to find.

Don’t Miss: How To Invest Money In Real Estate Business

How To Choose A Gold Dealer

In the gold dealing business, the best thing to look for is a good reputation. Consistently positive customer reviews should be a good indication that the dealer you’re looking at is a respectable one. And the more reviews a dealer has, the better.

Make sure that any gold dealer you choose has physical offices or walk-in stores. If a dealer only lists a P.O. Box rather than an address, you should consider it a red flag.

They should have transparent pricing, ideally without commissions or extra fees, which you’ll need to check for before you make any purchases. And since the price of gold changes from moment to moment, you’ll want to be sure their prices are current.

Try to find a gold dealer with payment options that match your preferences. In general, you’ll be able to pay via credit card, wire transfer, PayPal, check, money orderâand sometimes even Bitcoin.

Certain payment methods, like credit cards, may incur a fee that you should watch out for.

And last, you’ll want to know what their return and buyback policies are. It’s normal to accept returns within three days of purchase, but look out for restocking fees. Since most good dealers will also buy gold back from you, look for their listed buyback prices.

The Best Gold Coins To Buy For Investment

The coins resemble each other greatly in appearance. They will be different from conventional coins because they are not actual money. A round essentially has collectible value and, despite not being recognized as legal tender, has monetary value because of the precious metal it contains. In general, coins are accepted as a form of payment by most individuals. Of course, there are a lot more ways to buy gold besides coins and rounds.

Here is a list of the best gold coins to buy for investment for both coin collectors and investors, ranked by the international scales, so you can learn more about best bullion coins to buy:

Read Also: The Best Way To Invest In Real Estate

Should You Invest In Gold

If youâre concerned about inflation and other calamities, gold may offer you an investing safe haven. Though in the shorter term it can be just as volatile as stocks, over the very long term, gold has held its value remarkably well.

Depending on your own preference and aptitude for risk, you may choose to invest in physical gold, gold stocks, gold ETFs and mutual funds or speculative futures and options contracts. Regardless of the form of gold you choose, most advisors recommend you allocate no more than 10% of your portfolio to it.

Any form of investing carries risks. Gold is no different. But the idiosyncratic gold market isnât forgiving and takes a long time to learn. This makes gold ETFs and mutual funds the safest choice for most investors looking to add some of goldâs stability and sparkle to their portfolios.

Gold Coin Prices Explained

Gold can either be traded in bars or bullion coins. Bullion gold coins are usually more expensive because they are considered more valuable. This is due to their heritage, mintage and the fact many have previously been used as currency and become novelty items because they are no longer in circulation. Numerous gold bullions coins have been created to mark special one-off events too, such as the 50 oz Krugerrand, making them even more precious. Gold coins have high liquidity and re-sale value if they are kept in good condition. The price of gold largely depends on supply and demand. Unlike paper money, gold has limited availability and demand outweighs supply, making it a highly sought-after metal that maintains its value through financial hardship. Now used in medical devices and electronics manufacturing as well as investment and jewellery, theres no sign of the demand for gold slowing down. Its ever-increasing popularity is one of the main reasons why it is more expensive than other materials. A safe investment in tough economic times, gold typically increases in price when the economy is suffering and falls when the economy is in a stable position. To see gold prices, take a look at our gold price index for real-time updates. We update our prices at one-minute intervals, so you can be assured youre always getting the most current spot metal price.

You May Like: What Is The Best Gold Stock To Invest In

Why & How You Should Purchase Gold Bullion

Some of the most successful individuals and financial firms around the globe invest in gold. For centuries, it has been one of the most valued commodities. It provides value and benefits to savers and investors. The price of gold in all currencies has been rising dramatically over the last two decades. Because it is not correlated to many other assets and because it is the ultimate form of money it makes sense to diversify by holding at least 10 to 15 percent of your assets in precious metals. It is a viable hedge against inflation and often grows in value during tough economic periods. Because it is priced in volatile and unstable paper currencies, it appears to be a significant risk. However, its long-term trend is most definitely up when compared to all currencies!

Gold and gold bullion come in various forms. An investor can buy bars, coins, and rounds in almost any size and quantity. Buyers typically get a discount for buying in large quantities or bulk. The yellow metal is produced by mints in various sizes, shapes, and weights. It can be purchased from a local merchant or you can order online from a reputable dealer like Money Metals Exchange. Most buyers opt for the security, convenience, and safety of buying from respected online dealers because they frequently have the best prices and usually are not required to charge sales taxes.