Why You Should Invest In Real Estate

Real estate has been the greatest wealth builder for centuries, and its one of the most reliable investments available today. Perhaps the greatest thing about investing in real estate, is that there are now more options available than ever. While this asset class used to be reserved for the select few, virtually anyone can invest in real estate with little money today.

While the benefits to real estate investing are countless, below are some of the main reasons you should consider this asset class.

Create An Online Course

Online course businesses are one of the fastest-growing online business models. Creating an online course is an awesome way to generate extra income because it allows you to monetize the knowledge you already have. More people are taking online courses every day, and the COVID pandemic has accelerated that, with some online learning platforms having seen 15-folds growth in the number of users.

Another advantage is that these new platforms are so easy to use for instructors that you don’t have to worry at all about the tech side of the business. You just need to focus on creating exciting content that is informational & engaging at the same time.

Starting an online course allows you to eliminate some of the huge costs associated with setting up a physical training facility, and it’s a great way to reach as many people.

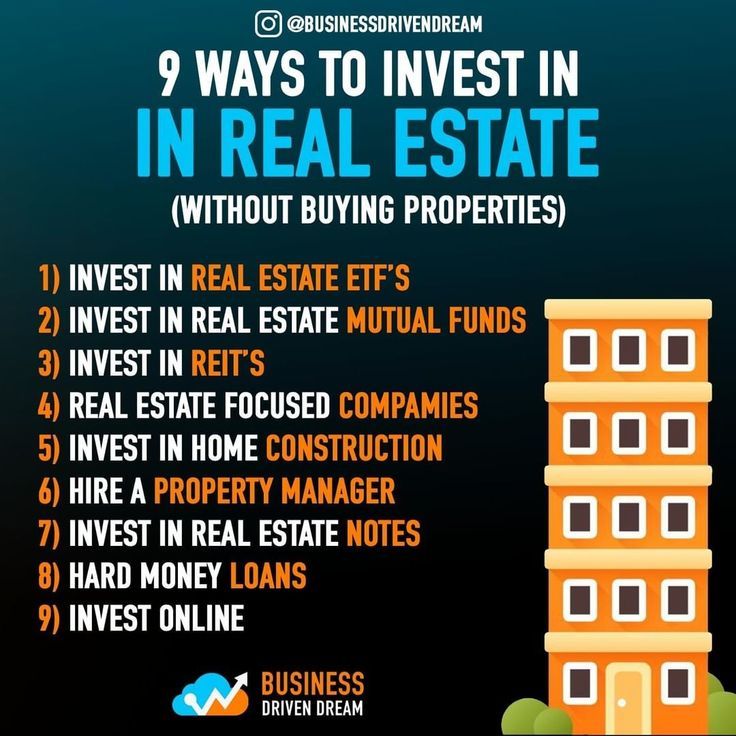

Ways To Invest In Real Estate With Little Money

Just as there are multiple types of properties you can invest in, there are also multiple ways to invest. The best way for you to invest depends on the amount of money you have available, the time and energy you can commit to managing your investment, and your level of knowledge.

Whichever way you choose to invest, there are options for investing in real estate with little money. While buying a physical property with little money can require a lot of time, energy and creativity to make a deal happen, there are also more simple options to invest with pretty much whatever cash you have available.

Also Check: Best Real Estate Investment Analysis Software

Publicly Traded Reits Etfs And Mutual Funds

REITs, real estate mutual funds and ETFs all offer beginner-friendly and low-cost ways to get started in real estate investing.

- REITs are individual corporations that generate revenue from REITs by investing directly in properties.

- Real estate mutual funds are funds that invest in REITs, real estate stocks, or real estate indices.

- ETFs are similar to real estate mutual funds except that they can be bought and sold at any time, while mutual funds are only priced at the end of each trading day.

What these methods have in common is that in each case, youre buying a security that consists of a basket of properties. Its similar to investing in a stock mutual fund, except that instead of individual stocks youre buying shares in a fund that invests in different types of real estate.

Like stock mutual funds, there are REITs, real estate mutual funds, and ETFs for different goals and investment types. While Vanguards REIT has the overall goal of tracking the real estate sector , there are other REITs that target income-generating commercial properties or a specific area of the country.

One advantage of publicly traded REITs, compared to investing through a crowdsourced platform like Fundrise, is liquidity. Shares in a publicly traded REIT can be easily sold on the open market whenever youre in need of cash, while many of the platforms mentioned here have restrictions on when and how you can sell your investment.

Best Real Estate Crowdfunding Investment Platforms Of September 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Real estate crowdfunding has transformed the real estate investing landscape. Once reserved for only the most affluent investors, many crowdfunding platforms have significantly lowered the barrier to entry for this type of alternative investment.

Low account minimums, simple fee structures and clean user interfaces make it easier than ever to include real estate in a well-diversified portfolio. Its important to note that some real estate crowdfunding platforms, including some of our picks below, are open only to accredited investors.

What’s the difference between these platforms and REITs?

Real estate investments trusts are companies that own real estate, such as hotels, malls, shopping centers or rental properties. Publicly traded REITs can be purchased through a brokerage just like individual stocks or mutual funds.

What’s the difference between these platforms and REITs?

Recommended Reading: First Republic Investment Management Inc

Strategies For Wealth Stages #1 & #2 Survival & Stability

Strategy Goal: Earn extra income, learn, and avoid losses

- Keep your day job & work to get a raise

- Instead of simply renting or stretching to buy a home, master lease a residence and rent out bedrooms or units to reduce your payment

- Bird dog for other real estate investors to sniff out good deals for them & learn the investment acquisition business in the process

- Become a buyers agent, help buyers find houses to purchase, & learn the retail housing market in the process

- Become a leasing agent, match tenants to properties for landlords or property managers, & learn the landlord business in the process

- Manage/supervise remodeling projects for other investors & learn the remodeling business in the process

Real Estate Appreciates Over Time

Well-chosen real estate appreciates over time, generally at a rate that far outpaces annual inflation. Yes, there are occasional market corrections, and people can buy the wrong type of property at the wrong time. But I’ve found there is always a chance to buy a quality property at a discount, make improvements to increase equity and eventually sell for a profit.

It’s the real estate equivalent of the stock market mantra to buy low and sell high. And real estate always has an intrinsic value. A stock can go down to zero, but a property is a tangible asset that will always have value derived from both the raw land and the improvements .

And if you can purchase real estate in up-and-coming markets, the potential for appreciation goes up even more.

You May Like: Cook Investments Northwest Oregon Llc

Read About Real Estate For Beginners

If you truly want to start a real estate business, learning as much about the industry as possible is crucial. There are countless investing books, blogs, and magazines that are a great place to start. While there are a ton of options out there, try not to overwhelm yourself at first. Instead, try grabbing a few investing books or subscribing to a real estate newsletter and designate just 15 minutes a day to reading something new. One thing all successful real estate investors have in common is that they never stop learning. This continual education mindset will serve you well throughout your career as an investor. Check out this list of real estate investing books for a few recommendations to get you started.

Real Estate Investing Has Unique Risks

Risks need to be understood and mitigated as much as possible. Following are a few of the significant risks of investing in real estate:

- Buying the wrong property at the wrong time

- Increased liability for accidents that may occur on your property

- Getting stuck with a professional renter who knows how to work the legal system at your expense

- Getting overleveraged. This is a pitfall that brings down many real estate investors. You need to be able to make monthly payments on your debt despite market dips, tenant problems, property vacancies, unexpected repairs, maintenance costs, and other expenses that are part of doing business when investing in real estate.

Real Estate crowdfunding services such as Fundrise and RealtyMogul can answer many of the issues raised above. We recommend that you check them out first.

Recommended Reading: Bank Of America Chief Investment Officer

Invest In Your Own Home

Finally, if you want to invest in real estate, look closer to home your own home. Homeownership is a goal many Americans strive to achieve, and rightfully so. Residential real estate has had its ups and downs over the years, but it generally appreciates in the long-term.

Most folks don’t buy a home outright, but take out a mortgage. Working to paying it off, and owning your home outright, is a long-term investment that can protect against the volatility of the real estate market. It’s often seen as the step that precedes investing in other types of real estate and has the added benefit of boosting your net worth, since you now own a major asset.

Investing In Commercial Real Estate

This is a variation of rental property where you invest in office, retail or warehouse/storage property. It follows the same general pattern. You purchase a property and rent it out to tenants, who pay your mortgage and hopefully generate a profit.

Investing in commercial property is generally more complicated and expensive than investing in real estate rentals on the residential side of things.

So why invest in real estate at the commercial level?

Well, the principle of risk vs. reward determines that commercial properties are thereby more lucrative. Not knowing how to invest in property, especially on the commercial level, can be a very expensive learning curve.

For someone with experience and capital, Investing in commercial real estate is one of the best ways to invest in real estate because of the remarkable gains that can be made if done right.

On the plus side, commercial real estate usually involves long-term leases. Since the property is being rented to a business, theyll want a multi-year lease. This will ensure the continuity of their business.

A lease can easily be for 10 years or more. The cash flow will be more steady since you wont be changing tenants every year or two.

Leases can be structured to give the landlord a percentage of the profits of the business as well.

On the downside, commercial property is often subject to the business cycle. During recessions, business revenues decline, and your tenant may have difficulty paying the rent.

Also Check: What’s The Best Way To Invest In The Stock Market

What Women Real Estate Investors Need To Know

Five female leaders in the real estate business share their top tips that women need to know about investing in real estateespecially if you want to start small and earn big.

According to the National Association of Realtors, across the U.S., “women brokers dominate the residential real estate market, but have yet to make a major entrance into the more lucrative commercial market.” Similarly, women have made a lot more progress in terms of property ownership, but research suggests that only 30% of real estate investors in America are women. So, while ladies are dipping their toes in the industry, very few are positioned to earn the big bucks. But it’s time for all that to change.

Below, five well-established women with decades of experience in various aspects of the real estate business share the advice that female investors must know if they want to start small and earn big.

How To Invest In A Real Estate Business With No Money Four Types Of Real Estate

There are four types of real estate. Real estate agents assist homeowners, businesses and investors buy and sell all four types of properties

- Residential real estate

This kind includes both new construction and resale homes. The most common category is single-family homes. There are also condominiums, co-ops, townhouses, duplexes, and triple-decker, high-volume homes, multi-generational, and vacation homes.

- Commercial real estate

Shopping centers and strip malls, medical and educational buildings, hotels, and offices belonging to this category. Apartment buildings are often considered commercial, even though they are using for residences. That is because they own to produce income.

- Industrial real estate

Manufacturing buildings and property, as well as warehouses. The structures can use for research, production, storage, and distribution of goods. Some buildings that distribute products are considered commercial real estate.

The classification is important because the zoning, construction, and sales are handled differently.

The vacant land, working farms, and ranches belong to this section. The subcategories within vacant land include undeveloped, early development or reuse, subdivision, and site assembly.

Also Check: Best Bank Of America Hsa Investment Options

Invest In Rental Properties

If youâre looking to make a major commitment to investing in real estate, consider purchasing rental properties. Rentals can offer steady cash flow as well as the possibility of appreciation over time, but they are one of the most labor-intensive methods of real estate investing.

There are two main ways to make money with rental properties:

- Long-term rentals. These properties are generally designed to be rented for at least a year and in theory provide a steady monthly cash flow, though this depends on your tenants being reliable. You might buy a multi-unit property or a single-family home that you rent to others.

- Short-term rentals. These properties cater to rotating tenants whose stays might be as short as one night, like Airbnb. You might list your entire home or apartment when youâre away, or you could invest in a separate property meant only for short-term rentals.

While investing in real estate with rental properties offers greater profit potential, it also requires a great deal of effort on your part. You need to find and vet tenants, pay for ongoing maintenance, take care of repairs and deal with any other problems that arise.

You can reduce some of these headaches by hiring a property management company, but this will cut into your returns. When it comes to financing rental properties, the resources and low interest rates available to primary residences may not be available. This can make buying rental property more expensive.

| Partner Offer |

|---|

Strategies For Wealth Stage #4 Growth

Strategy Goal: Grow your smaller net worth into a much bigger net worth

- Fix-and-Flip houses to generate big chunks of cash. Remember to save & reinvest your profits!

- Build & grow an income property portfolio using one of these plans:

- The All-Cash Plan no debt, pay 100% cash for each property

- The Debt Snowball Plan borrow on a small number of properties, then accelerate debt pay down one property at a time

- The Buy 3-Sell 2-Keep 1 Plan buy 3 rentals, hold, then sell 2 and pay off debt on the third

- The Trade-Up Plan use 1031 tax-free exchanges to build a portfolio with strong equity and income

- Self-Directed Retirement Account Plan use a self-directed IRA or 401k to invest tax-free in private loans , rentals, or flips

Read Also: Financial Planning Vs Investment Management

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

At Bankrate we strive to help you make smarter financial decisions. While we adhere to stricteditorial integrity,this post may contain references to products from our partners.Heres an explanation forhow we make money.

Real Estate Profits Through Appreciation

For residential properties, the biggest factor that attributes to appreciation is location. An evolving neighborhood that adds better schools, new shopping centers, playgrounds, or anything that makes the area a more desirable place to live adds value to the home. Home improvements, whether interior or exterior, can also add a significant amount of value. In turn, your real estate business can make large amounts of profit through house flipping or rehabbing. Commercial properties work similarly to residential by gaining profit through developments in location and improving the property.

In terms of underdeveloped land, profits are also generated through development. As a city expands, the land outside its limits becomes more desirable to those who wish to develop it. Once a developer starts to build houses or commercial buildings, the value of the land increases even higher.

Recommended Reading: Advantages Of Investing In Gold

Is Investing In The Metaverse The Best Way To Invest In Digital Real Estate

Selling digital real estate seems like a tough task when you are starting but the good thing is that the global economy is likely to enter a recession. Therefore, you may have started buying digital real estate.

If you have made the right moves, you will find buyers for your digital real estate valuable because youll be driving the business that they need straight to their phones.

In this period, youve probably heard of people buying virtual land in the metaverse. It is one of the major trends in this day and age but if you scratch beneath the surface, a virtual world or virtual worlds are not there yet in terms of being a viable investment.

Digital land is not something that you can make money from if you start investing right now.

Digital assets like crypto are also not doing well despite the performance in 2021. Therefore, these are not the kinds of virtual real estate you should be investing in.

If you want to start making money now, you will be better off if you purchase digital real estate in the form of websites that drive business today. Real digital real estate that brings you real money is the one that connects the buyer to the seller.

Digital real estate exists, but not in crypto or virtual land. A full virtual reality world is not the investment you want to make if you want to start making money now.