Take Full Advantage Of Retirement Account Benefits

Make sure you’re using all the tools at your disposal. If your employer offers a 401 match, it’s probably a good idea to contribute up to the amount they’ll match. Anything short of that leaves money on the table.

Special tax treatment in retirement accounts can also be huge for your financial plan. Young professionals should consider a Roth IRA. Roth contributions won’t reduce your taxable income, but these accounts grow and can be distributed tax-free in retirement. That makes them perfect for people who haven’t hit their peak earning years and have a long time horizon to maximize growth.

Meanwhile, more experienced professionals who are near peak earnings might be more eager to find tax deductions. Contributions to a 401 or traditional IRA are generally tax deductible. Distributions from those accounts are eventually taxed as ordinary income. If you think the income tax rate down the road will be lower than your highest bracket today, you could benefit by delaying those taxes.

You don’t want to lock up all of your savings in qualified retirement accounts, but using the tools at your disposal can put more money in your pocket in the future.

Check Your Retirement Savings Progress

T. Rowe Price analysis suggests that 45-year-olds should have three times their current income set aside for retirement. This savings benchmark rises to five times their income at age 50 and seven times at age 55. Fortunately, theres still time for even modest adjustments to have a large impact down the road. If possible, aim to contribute the maximum amount to your retirement accounts. Moreover, your retirement contribution limits increase in the form of catch-up contributions once you turn age 50, allowing you to focus even more on saving what you need to reach your target.

Contribution Limits

*Additional contribution amount allowed for people age 50 or older.

How To Invest For Retirement At Age 40

In Part 1 of this article we explored investment strategies for 30 year olds. Now, in this second portion, we will examine how to invest for retirement at age 40. In this section youll discover that financial planning changes significantly in your 40s. In fact, determining how you want to invest in your 40s will require you to not only be willing to try different tactics than your 30s, but you will also need to create a strong financial plan, as well as a diverse investment strategy. Read on to discover how much you should be saving and how you can leverage powerful investment tactics to your advantage.

Don’t Miss: I Want To Start Investing In Stocks

Common Accounts In A Retirement Portfolio

- Employer-sponsored retirement plans, such as 401 plans

- Checking and savings accounts

Your investment accounts can hold different kinds of assets, including stocks, bonds, exchange-traded funds , mutual funds, futures, options, real estate and more.

A well-balanced portfolio is diversified across several asset types and classes.

Owning a variety of stocks or mutual funds is important because it keeps your portfolio from becoming too heavily weighted toward one company or sector.

Diversity also generates better returns, even when certain asset classes are underperforming.

Pay Attention To Required Minimum Distributions

According to federal tax rules, you must start taking minimum distributions from tax-deferred retirement savings accounts including 401s, 403s, 457s, traditional IRAs and SEP IRAs by April 1 after the year you reach age 72. Failure to do so will result in a penalty charge that can be as high as 50% of the distribution amount. Here are some of the key things to remember about RMDs:

- The amount that you must take out each year depends on your age, life expectancy and year-end account balance. You may take out more than the minimum.

- If you have multiple retirement accounts, you must calculate RMDs separately, but you can withdraw the total amount from one or many accounts.

- Roth IRAs and most non-qualified employee-sponsored plans do not require RMDs.

- You cant rollover RMDs into another type of tax-advantaged account.

- If you are still working at 72, you can continue contributing to your traditional 401 or 403 or Roth 401 or 403. You don’t need to take an RMD until you separate from service. However, you will be required to take RMDs from any IRA you may own even if you are still working at 72.

While you are responsible for taking distributions from your account, your retirement plan administrator may be able to help by making RMDs automatic. At TIAA, we offer the Minimum Distribution Option, which calculates and pays out RMDs automatically, helping you satisfy federal requirements while preserving your account balance.

Read Also: Roth Ira Vs Investment Account

Consider Supplementing Savings With A Taxable Account

In addition to setting money aside in your retirement accounts, consider saving in a taxable account. Setting aside money in a taxable account can provide you with flexibility for different goals and improve the tax diversification of your retirement savings, says Roger Young, CFP®, a thought leadership director with T. Rowe Price. If you are already on track in your retirement accounts, maybe your next dollar should not go to a tax-deferred account.

What Are The Best Retirement Investment Strategies

Posted by Gaurav Chaudhary | Nov 20, 2020 | PERSONAL FINANCE |

Do you have any idea of how you are going to retire rich or like a mediocre person with loads of debt?

Have you made any investments that will help you retire rich, without any financial worries?

If your answer to such questions is NO, its time to convert them into YES and start making investment plans for your retirement.

A retirement investment strategy looking fruitful for a 20-year-old individual wont be equally effective for some 40-year-old person. So, while making such a strategy, confirm that it is according to your age.

Whatever be your current age, make sure you have a retirement investment strategy and are following it rigorously. You should always remember that a successful one will take all the financial burden off your shoulders when you are old and not working.

Today, with the help of this guide, you are going to learn some of the best retirement strategies by age. But before learning about them, we must know which assets are most suitable for this purpose.

Use this graphic for free, just source us with this link:

There are many more asset classes, but these are the best to include in a retirement investment strategy.

Report on the Economic Well-Being of U.S. Households in 2017 May 2018

Example 1: There is positivity in times of economic growth. Investors are very confident. They pull money out from the bond market and put it into equities.

You May Like: Investment Banking Associate Morgan Stanley Salary

How To Withdraw Money From Retirement: Determine Your Investment Mix

Before settling on a withdrawal strategy, evaluate your investment portfolio to make sure the investments are still in line with your long-term goals. Your investment mix, or asset allocation, is a crucial part of your withdrawal plan. Even as you draw from a portfolio in retirement, consider balancing your investments among those with growth potential and ones with less risk.

Yes, you read correctly. Growth. One of the common misconceptions that investors make as they near retirement is the idea that their portfolio allocation should include fewer equity and growth investments in favor of more bonds and cash-like investments. While decreasing some equity exposure can reduce market risk, moving too far into bonds and cash might open a portfolio to inflation risk that can be damaging to your long-term withdrawal strategy.

Keep in mind that retirement could last for more than 30 years. Remember how much cheaper everything was 30 years ago? Even if inflation stays low at around 3%, the value of your money could be reduced to half in about 24 years. Over that same period, very conservative investments may have a hard time keeping up. Some exposure to potential growth investments, like equities or real estate, may help your portfolio keep pace. However, it is important to keep in mind that there are risks in investing, including the loss of some or all of your investment.

Please note also that there is no guarantee that asset allocation reduces risk or increases returns.

Being At The Dawn Of A New Decade Its Advisable To Draw Up An Investment Strategy Before Allocating Funds Here Are Some Tried & Tested Tips To Guide You

Investorprofile: 25-30 years old. Minimal responsibilitiesEquity Allocation60-80%Must have: Health insuranceInvestor profile:30-45-years old. Couples with kidsEquity Allocation: 35-50%Musthave: Term insurance, goal-oriented savingsInvestor profile: 45-55, inching closerto retirement Equity allocation: 25-35%%Must have: Health andcritical illness coverSenior citizens:Age profile 60 plus Equities: < 20%Must have: Liquid investmentsto take care of emergencies

Read Also: Ai And Machine Learning In Real Estate Investment

Review Your Asset Allocation

Retirement can last up to three decades or more, meaning your portfolio will still need to grow in order to support you. Exposure to stocks should remain an important part of your allocation target, even in retirement. However, a possible need to access these assets for income in the near term means you are more susceptible to short-term risks. Thats why its important to position your portfolio to add more exposure to bonds and cash.

No matter your age, you can take steps now to ensure that you are ready for retirement. The key is to make retirement savings a priority early on and then maintain that focus throughout your working years. Even after youve retired, remain focused on a sustainable plan that will help support you through this time of your life.

Asset Allocation in Your 50s, 60s, and 70s

As you near retirement, your portfolio will move gradually from more aggressive to more conservative.

Asset Allocation Models:

Why Invest In Different Asset Classes

It is a common question asked by most people before making an investment strategy.

Do you know why?

There are often reports that XYZ asset has given a massive return, or ABC has made millions from investing in this stock. Such reports and news lead people to think that instead of investing in multiple asset classes, investment in a single asset will provide them with huge returns.

Its not right to think like this. Suppose that an asset class has given double-digit returns in the past ten years. Expecting that it will perform like this in the future, you place all your money in it.

Because of some awkward economic circumstances, that asset class tanks. Instead of getting massive returns, you will lose your capital also. This investment will make sure that you retire poor. Do you want this?

Nobody wants this. Thats why the best investment strategy should include investments in multiple asset classes. The process of investing your money in such a way is called diversification, and it helps you not to lose all your capital if one asset class tumbles.

Recommended Reading: How To Invest Fidelity Hsa

Investing Tip No : Focus On Your Retirement Goals And Achievements Not The News Headlines

Stock markets go up and down every day. News headlines tend to follow. And big changes in financial markets, even when they last just a single day, get lots of attention.

That immediacy may cause you to lose sight of what youve been working toward all along. Its normal to worry about investment losses, but dont forget about the gains youve made over the years, Winston says. Keep thinking further ahead, not just about what happened today or this week.

If you havent already done so, creating clear retirement goals with specific timelines can help. If you do have goals, check in to make sure they havent changed. A solid plan can help anchor your emotions and help keep you from making costly snap decisions, Winston says.

Adapt Your Strategy Over Time

Here’s an example of how you might adjust your asset allocation throughout retirement, if you plan to use your portfolio including principal, to support spending, rather than spending only your investment earnings and leaving your nest egg to your heirs.

Retirees who adopted this plan would have seen the following results in their portfolios*:

The key is staying invested–and that means having at least part of your portfolio allocated to stocks, but in the right balance with other investments. Why? Over time, equities historically have been an adequate defense against inflation and taxes–even better than bonds and cash.2 However, limit your exposure to stocks based on how much you’ll need from your portfolio soon, because there will be less time to recover from a bad year in the market. The key is determine the right mix for you, based on your age, needs, and time horizon.

1 Social Security Administration, Actuarial Life Table, 2017. The average life expectancy for a person age 65 is 17.89 years for males and 20.45 years for females.

2 Schwab Center for Financial Research.

Also Check: Best Investment Apps For Small Investors

Tips For Starting Retirement Savings At 40

Its never too late to start financial planning in your 40s. In fact, through the following six tips you can not only begin saving for retirement, but you can also make your money work for you.

40s Retirement Tip #1: Theres Only One Reason to Delay Saving for Retirement – Get Out of Debt

It is virtually impossible to reach your retirement savings goals if you are still in debt. In fact, being in debt might be one of the only reasons that you should delay saving for your retirement. To determine if it is more lucrative for your to save for retirement or get out of debt, you will need to make the following calculations,

To put the above calculations into perspective, lets say that each month you lose $500 on interest rates due to acquired debt. Now lets say that if you applied that money to a retirement account, you would instead earn $100 each month . With these figures in mind, it quickly becomes clear that it is far more lucrative for you to simply pay off your debt before you begin to save for retirement.

40s Retirement Tip #4: Use a Retirement Calculator

Understanding Your Investment Account Options

Now that youve made the right choice in deciding to save for retirement, make sure you are investing that money wisely.

The lineup of retirement accounts is a giant bowl of alphabet soup: 401s, 403s, 457s, I.R.A.s, Roth I.R.A.s, Solo 401s and all the rest. They came into existence over the decades for specific reasons, designed to help people who couldnt get all the benefits of the other accounts. But the result is a system that leaves many confused.

The first thing you need to know is that your account options will depend in large part on where and how you work.

Read Also: Easiest Way To Invest Online

Average Retirement Savings Statistics

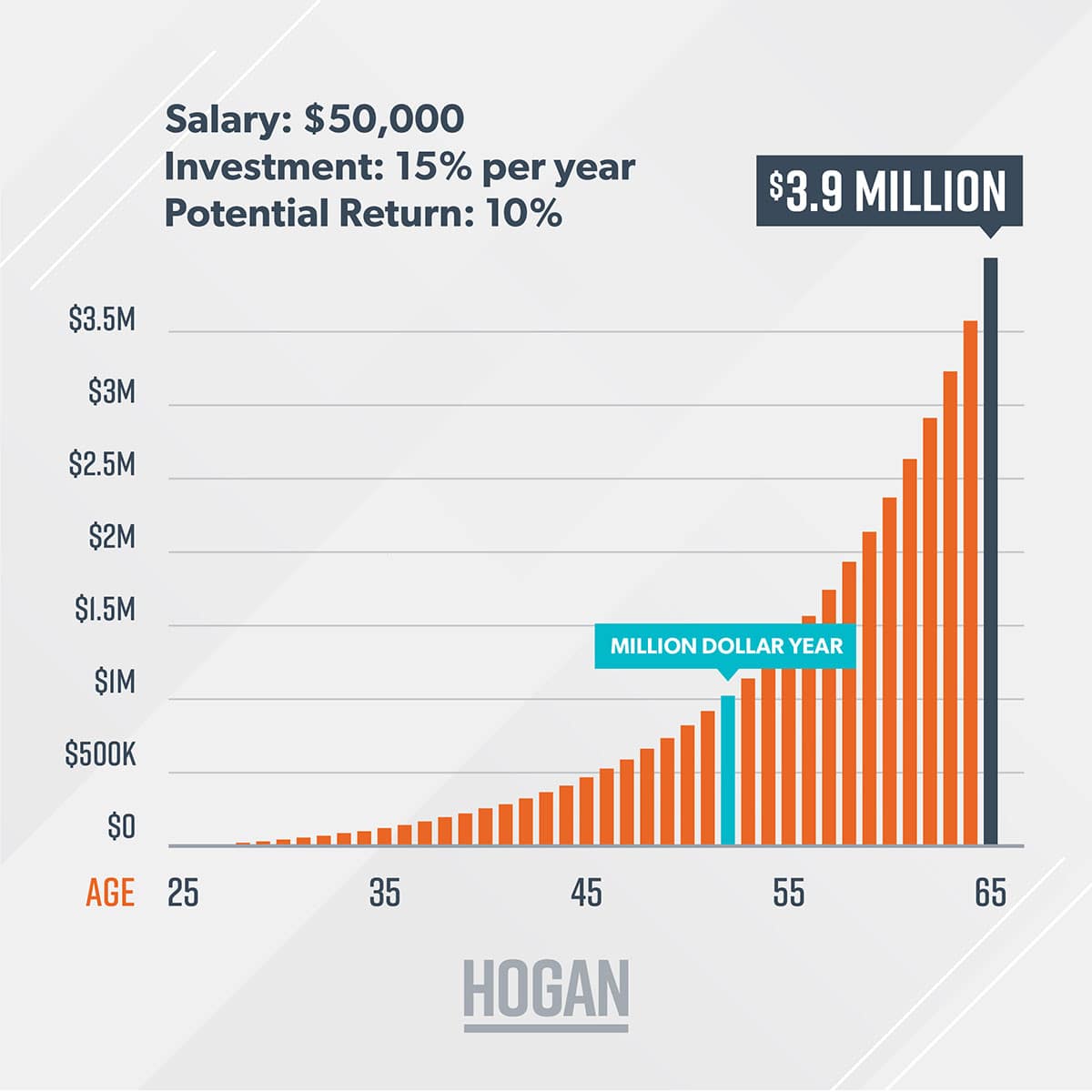

Did you know that approximately half of all American households have no retirement accounts? With this unfortunate statistic in mind, it is important that you dont find yourself in a bind, especially as you enter the most lucrative years of your chosen career. In fact, for many people, their 40s are the decade when they make career advances and start to earn higher wages. As a general rule of thumb, you should plan on saving 10 to 15 percent of your salary every year from the time that you are 30.

Keep in mind that the aforementioned funds should ideally be placed in a retirement account, and should not be confused with the rainy day savings fund that you keep for unexpected emergencies. While you might be able to dip into your savings account for unexpected emergencies, in the ideal situation you shouldnt pull funds from your retirement account until you are actually retired. Not only will you potentially pay hefty early withdrawal fees, but pulling from your retirement accounts will make it that much harder for you to retire when and at the lifestyle that you want to enjoy.

Related article: How to Retire Early at 40 Through 60+ Years Old

Fund Your 401 To The Max

If your workplace offers a 401or a similar plan, such as a 403 or 457and you arent already funding yours to the max, now is a good time to rev up your contributions. Not only are such plans an easy and automatic way to invest, but youll be able to defer paying taxes on that income until you withdraw it in retirement.

Because your 50s and early 60s are likely to be your peak earning years, you may also be in a higher marginal tax bracket now than you will be during retirement, meaning that youll face a smaller tax bill when that time comes. This applies, of course, to traditional 401s and tax-advantaged other plans. If your employer offers a Roth 401 and you choose it, youll pay taxes on the income now but be able to make tax-free withdrawals later.

The maximum amount you can contribute to your plan is adjusted each year to reflect inflation. In 2021, its $19,500 for anyone under age 50, rising to $20,500 in 2022. But once youre 50 or older you can make an additional catch-up contribution of $6,500 for a grand total of $27,000. If you have more than the maximum to sock away, either a traditional or Roth IRA could be a good option.

Read Also: Roth Ira Invest In Stocks

Catch Up If You Need To

Saving as much as you can should be a top priority as you near retirement. Make sure you’re maxing out contributions to your retirement accounts as much as you can, including making any available “catch-up” contributions to your 401 and IRA. If youre between 50 and 64 years old, you may be able to tuck away extra 401 catch-up money to help you meet your retirement goals.