What Are The Features Of The Investment Statement Policy

A well-drafted Investment Policy Statement builds a systemized review procedure that helps the investor to remain focussed on the long-term objectives, even the economy or market changes in the short term. It contains all the current account details, current allocation, and how much has been collected and how much is presently being invested in different accounts.

Investment Policy Statements writes down the investors investment objectives, along with the time horizon. Much attention and focus are on describing the investors risk/return profile, involving naming value classes that would be avoided as well as naming preferred the asset divisions.

Investment Policy Statement Template

If you want to, you can use the investment policy statement example above as a template to write your own. Ive included links for Google Doc and Plain Text versions below.

Remember once again that this investment policy statement template is purely hypothetical and is for illustrative purposes only. It is not financial advice. It is not an indication of any sort of investing strategy. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. If using it as a template to write your own IPS, you must change the parameters to match your own personal goals, time horizon, strategy, risk tolerance, and other circumstances.

Gathering Information About Clients

Gathering information about a client is not just a legal requirement in some jurisdictions, it is critically important for formulation of a good IPS. Hence, a fact-finding exercise with the client is necessary, which should aim at obtaining information about the clients family, employment, health, current wealth level, etc.

The process may be either informal or through structured interview and analysis of data. However, all interactions and decisions must be documented because they might be needed when any aspect of the relationship come under dispute.

You May Like: Best Online Stock Investing Courses

How To Write An Investment Policy Statement Template & Example

Last Updated: 6 min. read

An investment policy statement is a formal document that defines ones investing objectives and strategy. Here well look at how to write one, the benefits of having one, a template, and an example.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

Why Do You Need Investment Policy In The Economy

The Investment Policy in an Economy is build-up as it serves various objectives for an investor. Relying on the life stage and risk tolerance of an investor, there are three primary objectives of investment: safety, growth, and income. Each investor invest funds with a certain aim in mind and investments have its own rare set of benefits and risk factor.

Safety: Whereas no investment is totally safe, there are products that are preferred by investors who are risk-tolerant. And some individuals invest with the objective of make their money safe, irrespective of the rate of return that they get on capital. Such products involve near-safe items such as fixed deposits, saving accounts, government bonds, etc.

Growth: Here safety is an important aim for every investor, a majority of these people invest to receive capital gain, which means that they wish invested money to grow. There are quite many options in the market that offers this kind of benefit.

Income: There are individuals who invest with an objective of developing a second source of income. Consequently, they tend to invest in products that give good and regular returns like bank fixed deposits, corporate or government bonds, etc.

Also Check: Fidelity Traditional Ira Investment Options

How Can You Make An Investment Policy

There are various important and more interesting things than creating an investing strategy that will assist an individual to invest with confidence and transparency regarding its own future. Constructing an investment policy needs deliberate and brief planning- a strategizing process that follows a few essential steps in it. These steps are as follows below:

Understanding The Investment Policy Statement

Investment policy statements are frequently, though not always, used by investment advisors and financial advisors to document an investment plan with a client. It provides guidance for informed decision-making and serves as both a roadmap to successful investing and a bulwark against potential mistakes or misdeeds.

An IPS lists the investors investment objectives, along with his time horizon. For example, an individual may have an IPS stating that by the time they are 60 years old, they want to have the option to retire, and their portfolio will annually return $65,000 in today’s dollars given a certain rate of inflation.

A well-conceived IPS also delineates asset allocation targets as well. For instance, it specifies the target allocation between stocks and bonds, further breaking down the target allocation into sub-asset classes, such as global securities by region. The targets should then have a minimum and maximum deviation that, when exceeded, will trigger portfolio rebalancing.

An IPS should give special attention to describing the investor’s risk/return profile. That includes naming asset classes that should be avoidedas well as those that are preferred.

Also Check: St Jude Invest In Hope

Negotiating With Financial Advisor:

One of the first things that you do is sit down with the representative of the firm looking after the assets and talk to them. It is important to learn if they have any kind of internal guidance to their suggested investment proper decision-making process. In these cases, the professional or expert makes transactions on your account for you in other cases, they can act as a legal authority of the account.

How To Create An Investment Policy Statement

An IPS helps transition your investment collection to an investment plan.

Editor’s note: This article originally ran on Oct. 2, 2017. University of Chicago professor Harold Pollack gained some well-deserved attention for his “financial advice on an index card” concept. His basic idea was that a successful financial plan doesnt have to be–and in fact shouldn’t be–overwrought. If you can’t distill the basics onto a 4″x6″ index card, you’re probably overthinking it.

I urged investors to take up a similar challenge with their investment programs, and sketched out my own as part of this article. But investors can also benefit from fleshing out the parameters of their investment strategies a bit more by crafting investment policy statements. Financial advisors often prepare complicated investment policy statements for their clients, complete with appendixes, footnotes, and legal disclaimers. But yours needn’t be overwrought.

Rather, at its most basic and useful, the statement documents the parameters of your investment plan: the asset allocation framework, criteria for selecting securities, and the system to maintain those investments on an ongoing basis. Used in conjunction with a master directory, the statement can be an invaluable tool for keeping tabs on your investments. Such documents will also aid your loved ones if, for whatever reason, they need to be able to obtain a quick and thorough overview of your investment plan.

Don’t Miss: Qualified Real Estate Investment Trust

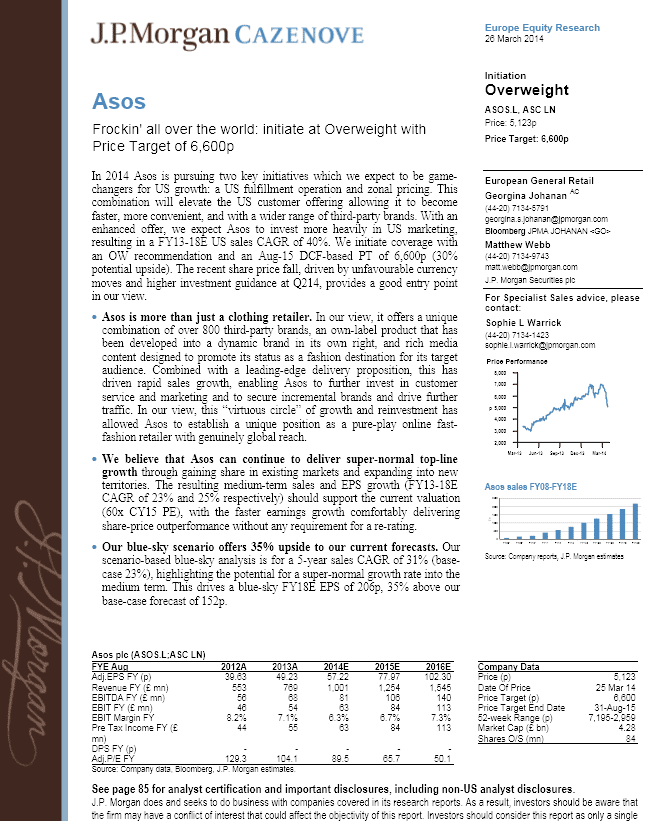

Presentation On Theme: The Investment Policy Statement Jakub Karnowski Cfa Portfolio Management For Financial Advisers Presentation Transcript:

1 The Investment Policy Statement Jakub Karnowski, CFA Portfolio Management for Financial Advisers

2 1.Client Description and Purposes 2.Risk/Return Objectives 3.Constraints 4.Asset Allocation Considerations 5.Review and Monitoring Table of contents Components of IPS

3 The investment policy statement is critical to the investment management process because it governs allocation of funds to various asset classes, the most important global investment decision 3 ! NOTE ! Portfolio Management for Financial Advisers Jakub Karnowski, CFA

4 This section includes: Description of the client Purpose of the IPS It may also address the role of the various participants 4Portfolio Management for Financial Advisers Jakub Karnowski, CFA Client Description and Purpose Every IPS must first describe the investors current situation which includes his financial status and requirements ! NOTE !

5 This section establishes the client risk tolerance and return goals Some IPSs may specify level of risk and return The IPS generally indicates total return measures, but this may be specified differently The IPS must specify whether the required returns are pre- or after-tax, real or nominal The advisor should establish required return versus hoped-for return The advisor should differentiate between clients willingness and ability to accept risk 5Portfolio Management for Financial Advisers Jakub Karnowski, CFA Risk / Return Objectives

An Example Of An Investment Policy Statement

An Investment Policy Statement is a strategic document used by financial advisors to outline guidelines that can help launch and manage a client’s investment program.

It can be an important and useful tool because it lays the foundation for a client-financial advisor relationship and provides an objective course of action. The IPS details include how the advisor will make investment decisions. A solid IPS is a guide to your financial future.

Many financial advisors have their own version of an investment policy statement. They can then tailor it to the specific financial and investment situations and perspectives of individual clients.

Also Check: Can You Invest Without A Broker

Legal And Regulatory Factors

Some investors, such as pension funds, endowments, etc. may be subject to legal restrictions on their investment allocations, distributions, etc. Such restrictions and limits may be imposed by the fund sponsors. Such considerations are listed under the legal and regulatory factors section of the constraints. It may also list investments which must be avoided due to the investors related party relationship, etc.

The Investment Policy Statement

Prior to constructing a portfolio for a client, an advisor should understand the clients goals, resources, circumstances, and constraints. Portfolio planning is the process of constructing a portfolio to meet a clients investment objectives. The written document governing this process is the Investment Policy Statement .

Read Also: Asset Allocation To Alternative Investments

Risk Tolerance: Ability Vs Willingness

An investors risk tolerance depends on both his ability and willingness to take risks.

If an investor has above-average ability to take risk and above-average willingness, it has above-average risk tolerance and vice versa. However, if his capacity to take risk is above-average but willingness is below-average, the difference must be reconciled, and risk tolerance should ideally be based on the lower of the two. However, the investment advisor must explain the consequences of taking a low risk to a client with low willingness but high ability to take risk. Such a conflict is not limited only to individual investors, but can also be faced by institutional investors. For example, trustees of a pension fund may be inclined to take low risk but the sponsor may want to take high risk so that he may have to contribute fewer funds in the future.

The ability to take risks can be measured based on objective factors such as time horizon, expected income, current wealth level relative to liabilities, etc., but willingness is a subjective measure based on each investors unique psychology. An assessment can be made by discussing risk with the client or through psychometric tests.

Setting Asset Allocation Limit

In this step after considering what good rates of returns is for each and every different asset class, you must set p the asset allocation in such a way that permits you to meet your objectives and goal over the specified period of the time period. The cash equivalents are the kings of domestic as well as international trade that create the backbone of the global markets.

Recommended Reading: American Funds Investment Company Of America A

Investment Policy Statement Components Objectives And Constraints

An investment policy statement provides a plan for achieving investment success. It is developed after a fact-finding discussion with the client aimed at obtaining information about risk tolerance and specific circumstances , and asset-liability management, liquidity needs, tax considerations, etc. .

A typical IPS includes a clients investment objectives and constraints. Investment objectives list return requirements and risk tolerance, while constraints refer to the overall restrictions on investments arising from liquidity requirements, taxes, laws, etc. For example, a high return cannot be achieved without allowing higher risk tolerance, etc. Constraints include factors that need to be taken into account when constructing a portfolio. These include liquidity requirements, time horizon, regulatory requirements, tax status, and unique needs.

Formulation of an IPS is a legal and regulatory requirement in some countries. It may also contain additional information, particularly in the case of institutional investors, such as details about the governance structure of the institution and its investment committee. An IPS should be reviewed and updated regularly and whenever there is a material change in a clients circumstances.

How Does The Investment Policy Statement Work

The Investment policy is needed under virtually all investors, with the exception of individual investors. The presence of a policy statement assists in efficiently communicates to all the relevant Advisorant parties, the process, investment philosophy, guidelines, and constraint to stick by the other parties. It is seen as a thing from the client to the investment manager about how money is managed.

But the investment policy statements must provide guidance for all the investment decisions and responsibility of each party. It is a policy document other than an implementation directive, and statements provide guidance for how investment decisions are made and therefore should not be a list of the certain securities to be utilized.

And the presence of the Investment statements assists in creating an environment of clarity and transparency in the relationship among the client and the advisor. The statements offer the client a better understanding of what you can expect from the advisor. And that clarity usually helps to establish a much higher position of the trusts and respect as it helps assure the investments manager is familiar with the expectation of the client.

Read Also: Charles Schwab Investment Management Reviews

Example Of An Investment Policy Statement

Napa Valley Wealth Management, an investment advisory firm located in Walnut Creek and Saint Helena, Calif., prepares investment policy statements for individual clients that might run about a dozen pages. “Your IPS helps ensure were both on the same page, and it serves as a roadmap for ongoing investment decisions about your portfolio,” the document’s introduction reads.

A Napa Valley IPS then summarizes the client’s investment policy in a table:

| STATEMENT OF YOUR FINANCIAL OBJECTIVES |

|---|

Investment Policy Statement Example

An investment policy statement for an institutional portfolio manager or between an advisor and a client will probably be polished and complicated and at least several pages long. For our purposes as DIY investors, it doesnt need to be anything fancy we can keep things pretty short and sweet and simple. This will save you time both writing it and revisiting it later to reference or update. So heres a relatively simple example of what that might look like for the average investor.

Note that the following example is purely hypothetical and is for illustrative purposes only. It is not financial advice. It is not an indication of any sort of investing strategy. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned.

Don’t Miss: How To Invest In Trulieve

Selecting The Investing Option

The individual investments are picked up on the basis of some parameters of asset allocations strategy. The certain investment type selected relies on a large portion of investors preference for active or passive management. Individual investments are selected based on the parameters of the asset allocation strategy. An investor might construct passively handled a portfolio with funds selected from various economic sectors.

Components Of An Investment Policy Statement

Referencing a document published by the CFA Institute, the components of an investment policy statement are as follows:

1. Scope and Purpose

- Establishing and building context regarding the investors source of wealth

- Identifying and defining the investor

- Setting forth roles and responsibilities of the portfolio manager

- Identifying a risk management structure

- Assigning responsibility for portfolio monitoring and reporting

2. Governance

- Specifying responsibilities in determining, executing, and monitoring the results of the implementation of the investment policy statement

- Describing the process related to reviewing the updating the IPS

- Describing authority in the hiring and firing of vendors associated with the portfolio

- Assigning responsibility in determining the asset allocation of the portfolio, including inputs used and the criteria used to develop the inputs

- Assigning responsibility for risk management monitoring and reporting

3. Investment, Return, and Risk Objectives

- Describing the overall investment objective

- Stating the return, risk, and spending assumptions

- Defining the investors risk tolerance

- Describing relevant constraints

- Describing any other considerations that may be relevant to the investment strategy

4. Risk Management

- Establishing performance measurements and reporting accountabilities

- Specifying metrics used to measure and evaluate risk

- Defining the process for portfolio rebalancing and target asset allocations

Read Also: Best Investment Gold Or Silver

Planning Of Investment Strategy

In finance, planning investment strategy is a brief set up of rules, behavior or procedures, made to guide an investors selection of an investment portfolio. The individual has different profit objectives and their individual creates different tactics and strategies. There are some choices that are involved a tradeoff between, some risk factors for high returns.

Defining Objectives And Risk Level

You must begin by sitting down and becoming honest with yourself about the goals and the objectives. Think about how much risk you want to take on in the investment process. Always make sure that the speculative investments have much higher returns but you are at risk level of losing the capital amount invested.

You May Like: Stocks To Invest In Motley Fool