Prepare Development Cost Estimates

Do your research and create a detailed cost analysis of the projects youre planning for. Make sure the sale price is comparable to others sold in the local area.

Also, prepare estimates for all the costs associated with the development of the property. Look at the material, labor, and overhead costs along with fees for permits and associated costs. Once you have your estimates, add a 10 15% buffer on top, commonly known as the contingency line item.

Billionaire Investments In Farmland Are Anything But Cryptic

While investments into luxury resorts are a bit perplexing, the wealthy elite buying farmland is anything but that.

There are plenty of conspiracy theories floating around the internet about why the likes of Bill Gates and Jeff Bezos are scooping up hundreds of thousands of acres of U.S. farmland, but I tend to think the explanation is much simpler. Consider the value of U.S. farmland dating back to the 1970s:

Data source: Statista.

There are few asset classes that have a better up-and-to-the-right appreciation chart. Even in the worst economies in recent history, the value of farmland only nominally declined. That’s because farmland is both scarce and a necessity. Even in recessions, people still need to eat.

Gates is now the single largest private owner of farmland in the U.S. with over 240,000 acres. Other notable wealthy individuals such as Ted Turner, founder of CNN, and Taylor Sheridan, producer of hit shows such as Sons of Anarchy and Yellowstone, have scooped up hundreds of thousands of agrarian acres in recent years.

Image source: Getty Images.

If you’re interested in exposure to this lucrative asset class but less excited about owning and operating an actual farm, you might consider Farmland Partners.

This real estate investment trust owns nearly 200,000 acres of farmland that it leases to over 100 tenants that grow 26 different crops. Talk about diversification. Farmland Partners also generates income from renewable energy such as wind and solar.

Plan For Multiple Locations

Loans may take some time to be processed, which could result in the property you wanted being sold to another buyer. Because of this, its wise to come up with a few options for where you are going to source your debt. In order to get a loan, youll need to show that you have a plan in place that will likely result in a good return on investment .

Plan for working with multiple lenders, not just your preferred lender, just you in case you have to come up with a backup plan should things take longer than you expect.

Recommended Reading: How To Invest In Stocks Without Money

Pitching To Private Investors

Now lets talk about how to raise private money for real estate investing. For example, a property with a $100,000 tax assessed value may be sold for an 80% discount, and private investors love this deal.

I think youll agree that this would look good to a prospective investor, so youll look good to the investor. The investor realizes you are a savvy entrepreneur.

So, how do you secure funding for an investment property? Ill give you a number of clear steps that need to be thought out and practiced before you ask for money.

How to Raise Private Money for Real Estate Investing:

Step 1 Rehearse Your Pitch

How do you raise private capital? First of all, you will be nervous because youre doing something you need to do, and you are aware that without money you are going nowhere. My point is practice, practice and rehearse.

You are aware the answer to your request for money could be NO! More than likely, youll get no response to your request. At this point, Ill tell you welcome to the club. You are nervous, but so is the investor.

How to Raise Private Money for Real Estate Investing:

Step 2 Do Your Homework

My second recommendation is to fail forward fast. Pay attention to what you are saying. Later, youll figure out what you said wrong.

The truth is the world is full of people who are awash in money. Theres plenty of money, but the money is going to stay in their bank accounts and pockets until someone can show them a very convincing and compelling reason to invest.

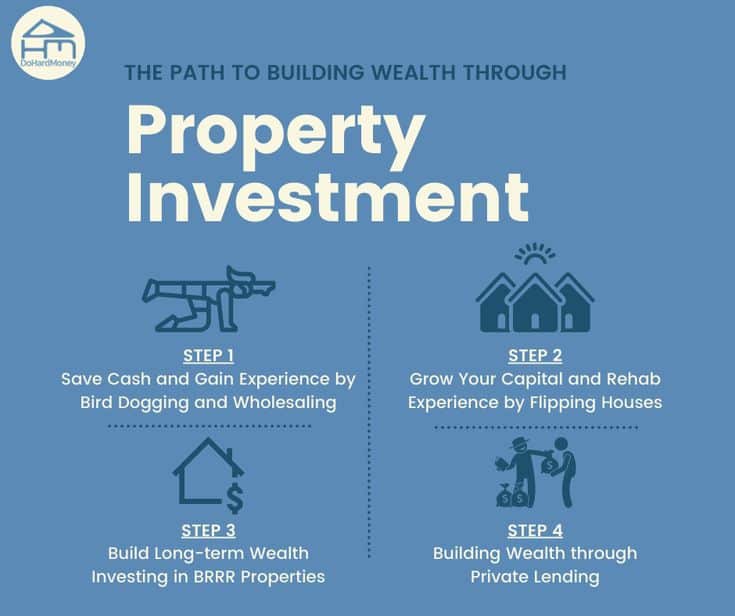

How To Raise Capital For Real Estate: 6 Different Ways

Want to know how to raise capital for real estate? There are many other ways apart from saving to buy a house. What makes property acquisition possible for other investors is Other Peopleâs Money . Experienced real estate investors have learned how to use OPM to maximize returns and reduce liability.

With that in mind, here are different ways to raise capital for real estate investing:

1. Traditional Investment Property Financing from a Bank

Bank mortgages are one of the most popular methods used to raise capital for real estate ventures. Banks usually assess applicantsâ debt to income ratios, credit histories, and assets by looking at documents such as:

- Recent payslips

- W-2 forms and tax returns

Your chances of getting approved for a mortgage or investment property loan will be high if you have a great credit score, minimal debt, and a stable income.

2. FHA Investment Loan

Related: Can You Use FHA Loan for Investment Property Financing?

3. Peer-to-Peer Loan

Crowdfunding is becoming increasingly popular as a strategy to raise money for real estate investing. According to Allied Market Research, the global peer-to-peer lending market is likely to hit over $460,312 million in 2022. This unconventional funding method is therefore worth considering when buying a house for investment.

When evaluating P2P loan platforms, be sure to check the following aspects:

- Data security features

- Privacy policies regarding personal data

4. Private Money Lenders

5. Hard Money Lenders

Don’t Miss: Investment Grade Fixed Income Securities

Keep Investors Updated Regularly

If an investor is going to invest serious amounts of capital into your real estate project, you need to be prepared to provide them updates regularly.

There are two types of updates you should provide them with. First, on at least a quarterly basis, communicate with them. Let them know the progress of construction, renovation, or leasing. If you have a heavy investor taking on an exceptionally high share of the risk for this project, or if you dont have a lot of investors, you may want to take more time to communicate with them more frequently.

Second, you should be prepared to inform your investors about a significant piece of good or bad news. It can include major events like completion of construction, licensure issues, etc. You will always want to ensure that your investors know about significant events within your real estate projects.

Top Sources Of Private Money

Private money can be found all over the real estate industry, but it may not be easy to identify if you dont know what to look for. Here are some of the top sources of private money to be aware of:

-

Business Partner: A common business arrangement is for one partner to manage the heavy lifting in terms of workload, while the other supplies the capital

-

Peer-to-Peer Lending:P2P lending is made possible through online lending platforms that partner you with other investors.

-

Crowdfunding:Real estate crowdfunding has become increasingly common over the last several years, and again allows you to utilize an online lending platform to finance investment deals.

-

Family, Friends, or Colleagues: Many private money deals are funded by sources close to the investor, such as a family member with extra capital.

-

Hard Money Lenders: It is also possible to finance a deal with an investor you havent worked with before. Ask around your network for trusted hard money lenders to learn more.

Also Check: Buy Rental Property Or Invest In Stock Market

# : Create Financial Projections

The marketing package you downloaded should contain the actual and projected financials for the property. Create your own 5- and 10-year projections in Excel and use it to calculate the potential returns for investors. I choose 5 and 10 year time frames because your investors should be committed to the deal for at least 5 years. You will need to structure the deal in such a way to achieve the desired returns for your investors and also to compensate yourself. Again, I cover all of this in detail in the course, but you can put together a pretty good Sample Deal Package without this.

If the marketing package you downloaded contains financial projections you can just re-use those, either by copying them into a spreadsheet or by doing a screen capture and then copying and pasting them.

Most of the time, the financials in the marketing package are gross exaggerations of the truth. So its important to create your version of the truth for any real Deal Package you create .

However, for our sample Deal Package, the accuracy of the financials is less important. What is important is that you have something to talk with your potential investors about. You dont need to do hours of due diligence to get your projections right that is not the goal of this step. Your goal with the Sample Deal Package is that it is representative of the kind of deal you want to do and that it emphasizes the terms of the investment.

A Game Changer In Raising Capital For Real Estate

Darin: I really liked that idea. And I thought about it in terms of, how do I do that and how does that concept apply to my life in different events. I tell people, sometimes I’ll pay to go to a speaking conference. There might be eight speakers and the first four speakers I’m like, waste of time. Then all of a sudden, the fifth speaker says something and I’m like, holy cow, what a great idea. If I take that and apply that to my business, that’s a game-changer. You have to sift through a bunch of maybe non-value items, but when you get that nugget, that’s just huge.

Hunter: I love it. I was just literally closing my eyes. What you’re saying is so powerful. Because of the fact that we’re living in an age where the information is not the X factor. Everyone has access to it. We have great shows such as yourself that maybe even didn’t exist a few years ago. Now everyone knows the playbook, the template, the terminology. Those tools, which are readily available, therefore are no longer the X factor. Its what you can extract from those conversations and how you can apply it to your own business.

Don’t Miss: What Investment Account Should I Open

Tips For Raising Private Real Estate Capital

The best advice for raising private capital in real estate will vary depending on who you ask. This is because over time, investors find the way of doing things that work best for their real estate businesses. However, this is not helpful to newbies. What I can say is that it takes time to develop a surefire system for raising private capital. In the meantime,here are some tips to help you get started:

Use Your Own Money First: Before you start fundraising a new project, assess how much capital of your own you can rely on. Not only will this help you frame the budget for the project, but it will also lower the amount of cash you are paying interest on should you find a private lender. To increase your personal capital, consider redoing your monthly budget and reducing expenses for a while you may even be eligible for a home equity loan.

Attention To Detail: The details included in your portfolio are going to make or break your pitch to private money lenders. Ensure you have an accurate purchase price, property value, rehab cost, and rental value wherever it applies to you. If this is your first investment deal, make sure the figures and estimates in your deal analyzer are as accurate as possible. Strong attention to detail could mean the difference between choosing a potential investment and securing enough financing.

What Is Investment Capital

Investment capital is the money used to fund a given investment deal. This can include the costs of acquiring a property, initial renovations, and upfront costs. There are generally two types of investment capital: debt and equity. Debt refers to investment capital from hard money lenders, such as banks, and often requires interest payments. An advantage of using debt investment capital is that hard money lenders will not have a say in the company. However, many investors may find it difficult to secure capital with hard money lenders. This is where equity .

Equity refers to money secured by selling ownership of a property or business. Private money lenders may invest in a company if they see the investment as potentially profitable. Using equity as a form of investment capital has different pros and cons to utilizing debts, so investors must consider both options. For entrepreneurs ready to put the work in, raising private money can offer the chance to pursue various investment opportunities and expand their portfolios.

Don’t Miss: Best Time To Invest In Crypto

Who The Investors Go To And Choose To Deal With

Hunter: We have co-invested alongside multi-billion dollar real estate companies that are doing exactly what we’re doing. It just has more zeros, meaning that they recognize the opportunity as well. They have some other partner that has a great deal flow in Texas, for example, they don’t have the deals in Texas. Theyve split with an equity partner.

They split with an operations partner and we have a great partnership. This is happening all the time. So number one, the economics aren’t necessarily less favorable. But number two, and this is also really powerful, is we start to feel like we are in this echo chamber. That everyone is like us.

No one is like us is the reality. Remember that presentation I gave where everyone had their money in the CDs and such. That’s the reality of the 12 million accredited investors in the United States right now. Theyre overwhelmingly not nearly invested in real estate as they should be.

They don’t even know about these types of deals, nor do they want to. Theyd much rather defer to your expertise, defer to your strategic partners. Defer to you flying around the country looking at these properties.

Do you think my investors want to go and do a mobile home park property visit all across the Midwest? No, but I’ve done a couple. They would much rather not. Even if the economics weren’t as comparable, then they would certainly want to defer to my expertise. Are there going to be investors that, as you work your way up in terms of scalability?

About Tax Defaulted Property

The tax defaulted property auction is a government-mandated and administered process thats been in use in local counties for over 200 years.

It works like this. All property owners are required to pay their fair share of operating the local government. Its a very small tax to support the county employees, emergency services, and buy the books for the library.

Thousands of property owners run into problems, and they end up delinquent on property taxes which the county government will not tolerate.

If the property taxes arent collected, the county will seize the property and resell it to pay the taxes.

How to Raise Private Money for Real Estate Investing:

Tax Lien Certificates vs Tax Deeds

The county will do one of two things about unpaid property taxes.

If its a benevolent state, the county will issue a tax lien certificate, sell it at the auction and use the revenue to pay all the county bills. Approximately, half of the states sell tax lien certificates.

Not so with the tax deed states, like California and New York. In those states, the county will seize the property and evict the resident or tenant.

How to Raise Private Money for Real Estate Investing:

Tax Defaulted Auction Bargains

The treasurer will sell the seized property at a tax defaulted auction. The starting bids will be very close to the delinquent back taxes and could be 70%, 80% or 90% below the tax assessed value.

Savvy bargain hunters buy these mortgage-free tax deed properties.

Recommended Reading: Millennium Investment And Retirement Advisors Llc

Raising Capital For Real Estate Requires A Different Skill

Hunter: That capital raising is a different skill set than operating real estate, raising money is about the top of the funnel. Raising money is about attracting attention, nurturing that attention. Then turning that attention into $100,000+ repeat investors. That’s a very different skill set from underwriting assets.

Managing property visits, talking to brokers, which by the way I do, but it’s important to be known in this space. Half of my time is focused on real estate, half my time is focused on the side of the things of marketing. It’s a really good mix when you have a partner who’s only focused on operations. It is what we do when we have our partners and strategically partner with them.

Darin: I really like how you structured the economics such that your end customer, the investor that’s investing with your company, you’re putting that money into another deal. Had that person gone direct, they’re getting the same economics. How do you protect and nurture that relationship? I’m an investor, I invest with you. Now you put me in the XYZ deal and now I’m like, next time, I’m just going to go to XYZ. Even if the economics are the same, there’s a piece that says, well, why deal with the middleman?

How To Raise Money For Multi

Multi-family properties are great ways to create a recurring income thats less risky than single-family homes. By having multiple renters in a single property, youre able to shield yourself from taking a loss on the property the way you would if you were relying on a single renter. You can also recoup your costs and generate profits faster thanks to the multiple rent payments every month. But multi-family homes come with significant price tags that are usually millions of dollars. That kind of money can be difficult for even the most seasoned of investors to come up with. So lets discuss how to raise money for multi-family property investing.

The most common method for raising money for multi-family properties is to get a mortgage from a bank, though theyll usually fund only around 70% of the purchase price. To make up the difference, you can fund the purchase through your personal savings, retirement accounts, or private financing like hard money lenders. Theres also the method of bringing outside investors through an LLC as either limited or general partners.

Lets dive into first defining what a multi-family property is and the different ways you can raise the capital to buy one. Ill also discuss how you can fund the purchase yourself or what youll need to consider when bringing on outside investors.

Summary

Don’t Miss: Cbiz Investment Advisory Services Llc