Whats Holding You Back

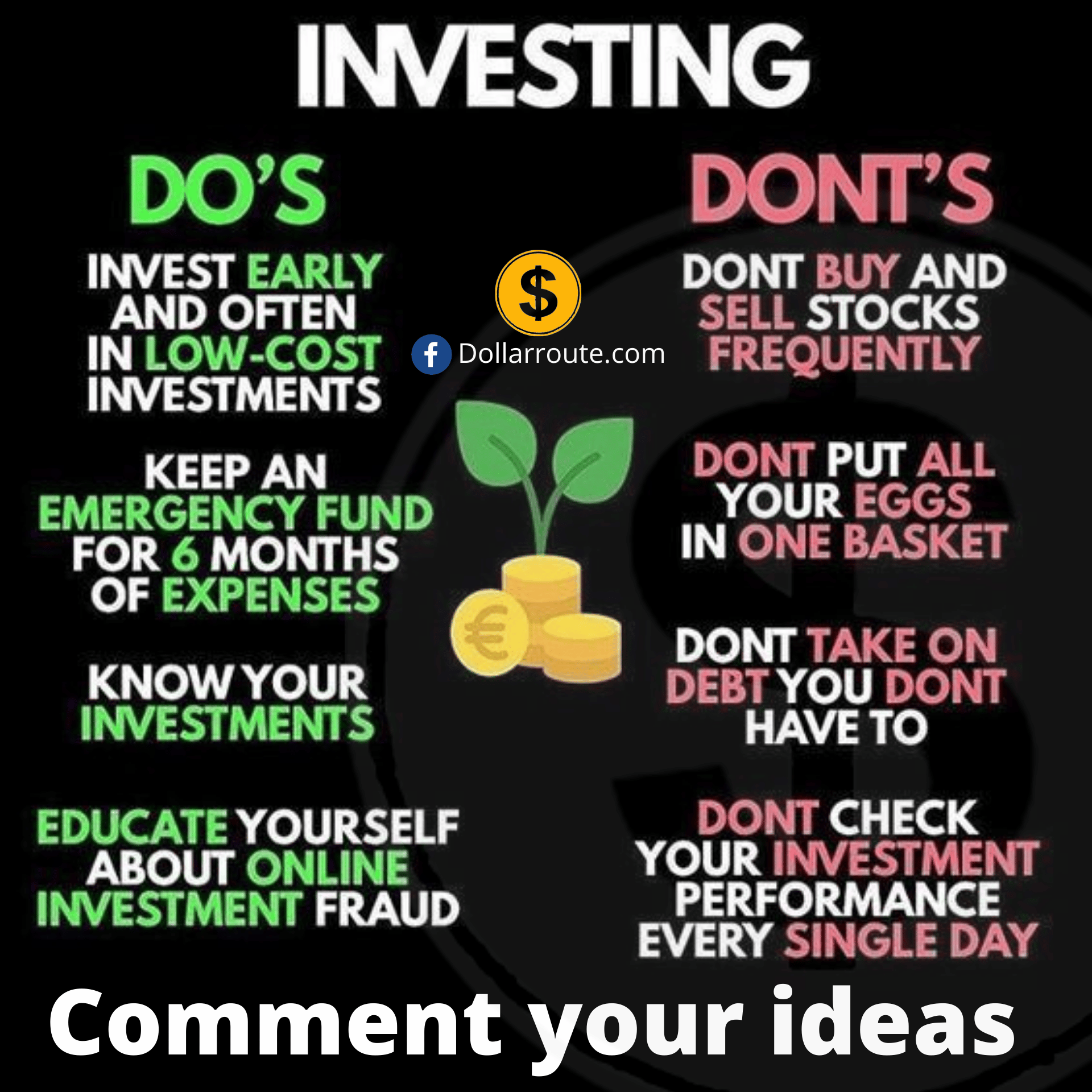

Many people opt not to invest because they overestimate the amount of money they think they need to get started, says Vale. They may also be concerned about market risk.

Investing can feel intimidating, and there are certain risks. Many conditions can negatively affect the value of your stocks or bonds, such as an unpredictable economy and financial markets. You should also consider your own personal reactions when investments rise or fall in value. You may be able to address the risk by mixing, or diversifying, investment types in your portfolio, but theres no guarantee against losses. Thats why its important to understand your tolerance for risk, time horizon and liquidity needs before you make investment decisions.

Include Saving In Your Budget

Now that you know what you spend in a month, you can begin to create a budget. Your budget should show what your expenses are relative to your income, so that you can plan your spending and limit overspending. Be sure to factor in expenses that occur regularly but not every month, such as car maintenance. Include a savings category in your budget and aim to save an amount that initially feels comfortable to you. Plan on eventually increasing your savings by up to 15 to 20 percent of your income.

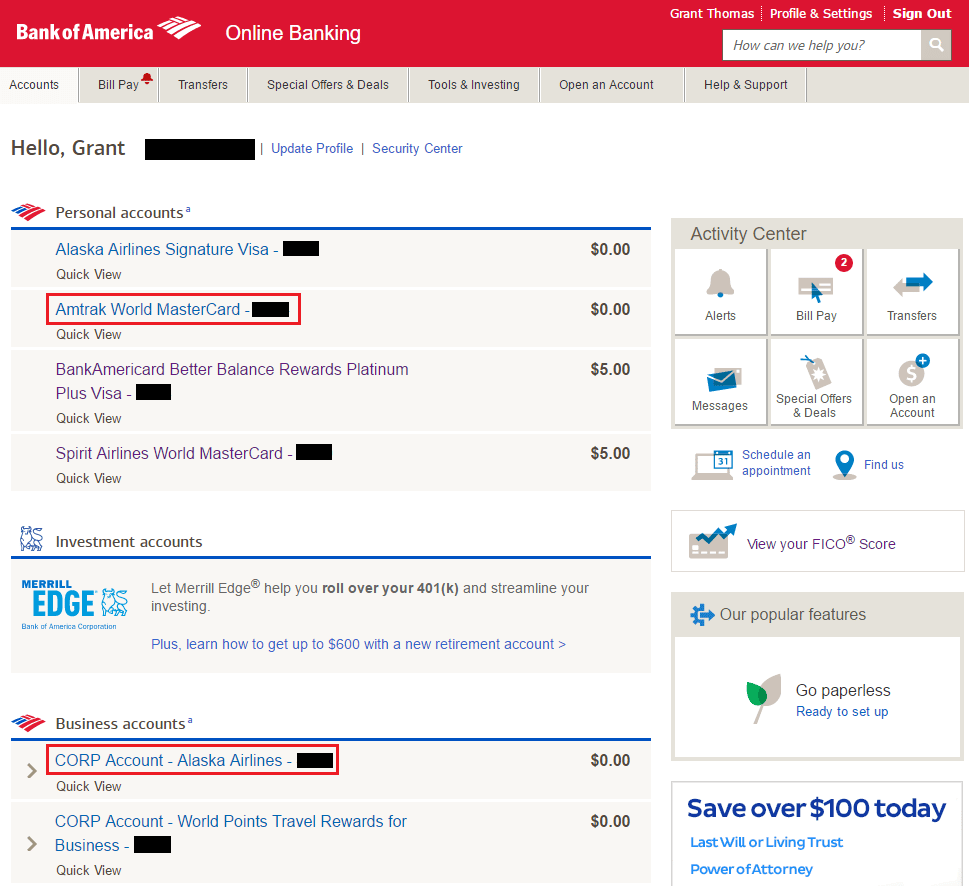

Move Your Savings To Bank Of America Or Open An Investment Account With Merrill

You have the chance of significantly increasing your Bank of America Customized Cash rewards when you open a checking or savings account with Bank of America, Member FDIC, or an investment account with Merrill. Loyalty is a big part of earning rewards on this credit card. If you have more than $20,000 across your accounts, the volume of rewards can increase by 20% to 75% because you will be eligible for the Preferred Rewards program.

When you have an account with Bank of America or Merrill, the redemption process of your rewards becomes much easier. You get the benefit of setting direct deposits into your savings or checking accounts.

Don’t Miss: A Type Of Income Investment

Its Okay To Start Small

Perhaps you assume that investing requires lots of money, and you have other important financial priorities such as maintaining those retirement contributions and creating an emergency fund that can cover at least three months of living expenses. Other needs include a plan to pay off balances on credit cards and buying life insurance, especially if you provide most of the financial support for your household.

Still, holding off on investing for longer-term goals until these needs are fully met could be counterproductive. If you delay working toward longer-term goals until you have your entire emergency fund or youve paid off all of your high-interest debt, you could miss out on important opportunities for potential growth, says Chris Vale, senior vice president of products and solutions at Merrill.

Most people have the potential to pursue multiple goals at once, which means you dont have to choose between saving and investing. Understand the difference between them and use them as they are appropriate to your needs. If progress toward your short-term financial goals permits, you may be able to invest a small amountas little as $25 to $50 a month.

How Does The Preferred Rewards Program Help In Maximizing Bank Of America Customized Cash Rewards

There are three tiers in the Preferred Rewards program which are Gold, Platinum, Platinum Honors and Diamond. These tiers are calculated based on your three-month combined average balances. Based on the tier on which you fall, you have the chance of increasing your Bank of America Customized Cash rewards.

Consider the following example to understand how the Preferred Rewards Program will help you in maximizing your rewards. Suppose you make the following purchases with your Bank of America Customized Cash Rewards credit card in a quarter:

| Category of Expenses |

|---|

| $98 |

Recommended Reading: What Does Esg Mean In Investing

Does Bank Of America Customized Cash Rewards Offer Bonus Rewards

Your Bank of America Customized Cash Rewards credit card offers several bonus rewards which you need to be aware of. For instance, you get a $200 cash rewards bonus offer when you spend at least $1,000 in purchases within the first 90 days of account opening. If you have some big purchases to make, this bonus offer will technically act as a $200 discount for you.

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

You May Like: How To Invest In Canada

Changing Investments On The Myhealth App

When managing investments on the MyHealth app, you will be able to select from these options:

- Realign portfolio: Move your investments into different funds. This will only impact the current fund balances, not new monies deposited into your investment account.

- Realign portfolio and update elections: Updates the current fund balances as well as new monies added to your investment account.

- Fund-to-fund transfer: Select specific funds to sell, then specific funds to buy. This impacts only your current fund balances, not new monies deposited into your investment account.

Chase Bank Atms Near Me

With about 16,000 ATMs, Chase allows you to get cash and make deposits to your checking and savings accounts 24/7. And just like with Chases branch locations, finding Chase ATMs is easy. You can use the banks mobile app to see where all the nearby machines are by using your location-based service. The banks website also includes all ATM listings, and Google Maps will use your location to show you the closest ATMs, too.

Read Also: How To Invest In A Specific Company

Financial Health For Strong Futures

We learn about our clients unique goals for the future, then we give them the tools to succeed.

Both with online resources and in-person service, we strive to meet individuals, families and small businesses where they are by providing relevant, helpful guidance. We focus on low- and moderate-income communities, which are home to about one-third of our banking centers. We want to see more and more people in underserved areas improve their upward mobility.

Our teams know the local landscape in community banks around the country and theyre trained on products and services that will best serve their neighborhoods.

Some examples of how we nurture knowledge and empower our clients:

- Aspiring homeowners can learn from our loan officers about budgeting, saving for a down payment and how the mortgage process works.

- Clients can get basic money skills and advice at Better Money Habits workshops held at local branches and other central community locations.

- Carefully crafted products and services, like our Advantage SafeBalance Banking, help save time and money, which is particularly helpful for LMI communities.

- Local entrepreneurs have access to capital and other business-building tools via Community Development Financial Institutions that we partner with nationwide.

- Our site is fully translated into Spanish to reach a broader audience

What Does The Collaboration With Bank Of America Offer

Bank of America offers financial services through 4, 500 branch offices that is, in fact, 10% less than the number of Chase branches and approximately 16,000 ATMs providing convenience for people in 37 states and the District of Columbia. Along with its well established online banking system, Bank of America offers an impressive mix of banking, investing, asset management and many other financial products and services.

For those looking for high earning interest, Bank of America offers many more opportunities. For example, opening a standard savings account, the bank sets 0.03% APY on all balances that is 0,02% more compared to Chase. In terms of its CD rates, the same case is observed. While starting a standard term CD account, Bank of America offers 0,03 0,75% APY depending on term and balance, which is higher than Chases rate.

The variety of credit cards specially designed to satisfy every customers needs is one of the perks while cooperating with Bank of America. Taking into account your preferences, the bank offers cash back credit cards, zero percent credit cards, airline credit cards, student credit cards, lowinterest credit cards etc. So, depending on your need, you are certain to find the right card fulfilling your requirements.

You May Like: Do You Have To Invest Your Roth Ira

Bank Of America Customized Cash Rewards Faq

- Are the Bank of America Customized Cash Rewards hard to get?

- It is fairly simple to earn rewards on your Bank of America Customized Cash Rewards credit card. You can earn cashback by simply paying for gas, and groceries, doing online shopping and making other eligible purchases.

Bank Of America’s Financials

Bank of America announced in January financial results for Q4 of its 2021 fiscal year , the three-month period ended Dec. 31, 2021. The company reported net income attributable to common shareholders of $6.8 billion, up 30.0% compared to the year-ago quarter. Revenue for the quarter rose 9.8% year over year to $22.1 billion. The bank said that net income growth partly reflected revenue growing faster than expenses.

Bank of America highlighted its strong loan and deposit growth during the quarter, fueling a $1.2 billion increase in net interest income compared to the year-ago quarter. NII is a financial metric banks use to measure the difference between interest earned on the loans they make and the interest they payout on deposits. The global economy continued to rebound from the COVID-19 pandemic shock with loan-loss rates at historically low levels, the company said. The low loan-loss rates allowed the bank to release some of its loan-loss reserves.

Read Also: What Is Esg Impact Investing

Investing In Minority Depository Institutions

As part of its $1 billion commitment, Bank of America dedicated $50 million to support minority depository institutions and community development financial institution banks. As part of these equity investments Bank of America will acquire up to 4.9% of common equity in MDIs and CDFI Banks facilitating benefits in the communities that these institutions serve through lending, housing, neighborhood revitalization, and other banking services.

Today the company also announced investments in two additional MDIs, bringing the total to 12:

- Broadway Financial Corporation 1

- CNB Bancorp, Inc.

- CSB& T Bancorp, Inc.

- First Independence Corporation

- SCCB Financial Corp.

- Southern Bancorp, Inc.

- Unity National Bank of Houston, N.A.

These equity investments are in addition to approximately $100 million in deposits from Bank of America in MDIs. The company also operates a $1.6 billion CDFI portfolio with 255 partner CDFIs across all 50 states, providing access to capital to thousands of individuals and small businesses who do not qualify through traditional lenders.

Account Balance And Performance

You can see a snapshot of your account balance and year-to-date performance on the Investment Summary tab.

You can find more detailed performance information by selecting the View details link.

Portfolio Performance will be reflected in a chart that represents how your investments are performing quarterly, year-to-date, for the prior year and overall. You can also view a graph thats shows your personal rate of return, period return, or contributions vs. market value, each giving you the option to filter by date, funds or asset class.

To view investment performance on the MyHealth app:

Read Also: How To Properly Invest In Real Estate

Do More With The Mobile Banking App

- Set customizable alerts

- Snap a photo to deposit a check, and get instant confirmation

- Use your fingerprint or Face ID for quicker access on the go

Get the Mobile Banking app

Get it on the App Store

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Get it on the App Store

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can send you a link by email

Apple, the Apple logo, iPhone, iPad, Apple Watch and Touch ID are trademarks of Apple Inc., registered in the U.S. and other countries. App Store is a service mark of Apple Inc.

Get it on Google Play

Before you leave our site, we want you to know your app store has its own privacy practices and level of security which may be different from ours, so please review their policies.

Or we can text a download link directly to your phone

Android is a trademark of Google Inc. Samsung is a registered trademark of Samsung Electronics Co., Ltd.

Our mobile app isn’t available for all devices

What Is The Bank Of America Customized Cash Rewards Credit Card

This is a unique credit card that allows users to earn cash back in their selected categories throughout the year. There are no annual fees and users have the option of earning bonuses as well. Since there are no annual fees, the user gets to make the most of the rewards they earn on their purchases.

Cardholders have the benefit of saving money at 0% introductory APR for the first 18 billing cycles and for any balance transfers made within the first 60 days of opening their account. After the introductory period is over, users will be subject to a variable APR which is currently between .

Read Also: Private Lenders For Investment Properties

Bank Of America’s Business Segments

Bank of America’s four business segments are categorized predominantly according to the types of customers utilizing each area. The Consumer Banking segment is focused on consumers and small businesses, while the Global Wealth and Investment Management segment addresses the needs of individual clients with over $250,000 of total investable assets.Global Banking provides investment banking services and related products, while Global Markets focuses on institutional clients. The data shown in the pie charts above excludes negative revenue and the net loss from the company’s “All Other” segment, which is outlined in further detail below.

Important Disclosures And Information

- Are Not Insured by Any Federal Government Agency

- Are Not a Condition to Any Banking Service or Activity

MasterCard is a registered trademark of MasterCard International Incorporated, and is used pursuant to license. Visa is a registered trademark of Visa International Service Association, and is used pursuant to license from Visa U.S.A. Inc.. Touch ID is a registered trademark of Apple Inc., registered in the U.S. and other countries.

Bank of America Advantage SafeBalance Banking, Bank of America Advantage Plus Banking and Bank of America Advantage Relationship Banking, Get More Rewards With Your Everyday Banking, Merrill Edge, Merrill Lynch, Keep The Change, Bank of America and the Bank of America logo are registered trademarks of Bank of America Corporation.

Don’t Miss: How To Invest In Fixed Income Bonds

Chase Vs Bank Of America: What Should You Consider When Opening A Bank Account

Whether you open a bank account to simply make everyday purchases, book flights, engage in investing or you firmly search for earning interest, Bank of America and Chase alike are at your disposal with plenty of advantageous offers. Chase is more likely to fit your needs if your card is mainly intended for paying bills or some other financial transactions. As compared to Bank of America, having only two checking account offers, Chase is more beneficial in this regard offering three options plus two student checking accounts. Now, if you are excited about accrued interest Bank of America services are certain to meet your needs. Although you can open only one saving account with Bank of America in contrast to Chases two, the interest rate out there is much higher. Besides, in terms of CD rates, Bank of America has got two supplies a Standard term CD and Term CD accounts, unlike Chase having a basic one.

In addition, Bank of America offers three various options of IRAs having a flexible retirement savings plan with $100 minimum opening deposit.

The tables depicted below are just for you to watch a detailed comparison of Chase and Bank of America basic accounts with their terms and conditions and make a conclusion of yours.