How Much Should You Invest In Stocks Monthly

While your budget should be a consideration for how much you invest in stocks monthly, its good to figure out your retirement number than work backward so you have a number to aim for. These are the three steps you can take to determine how much you should be investing in stocks each month.

1. Estimate Your Annual Retirement Income

Youre investing in stocks for your future and over the long term. A key component to finding out how much you should invest in stocks is determining how much you plan to live off each year in retirement.

A common starting place for finding your annual retirement income number is to take 80% of your pre-retirement annual income. For example, if you currently make $75,000 per year, then your annual retirement income estimate would be $60,000.

Once you have this initial estimate you will need to consider:

- Your cost of living for where you plan to live

- If you will have any dependents you need to care for still

- If you will still have debt, including a mortgage

Each of these items could mean your annual retirement number needs to increase.

2. Calculate Your Retirement Number

In order to find out how much you should be investing each month, you need to know the end goal. Know that there are multiple ways to estimate your retirement number, below is just one common way to find your number.

4% Rule : Annual Retirement Income x 25 = Retirement Savings Goal

Lets run the number using the estimated annual retirement income of $60,000 mentioned above.

What Are The Advantages Of Dollar

Not only does it allow you to start investing as soon as possiblerather than waiting until youve accumulated a big chunk of money to investit also helps you buy more when prices are low and less when theyre high.

Theres also a psychological benefit: While the general direction of the markets is up over long periods, you can expect plenty of downs along the way. And that natural inherent in investing can be a lot for anyone to stomach. Dollar-cost averaging can help calm any investing anxiety you may have because it forces you to follow a routine and roll with whatever market movements come each day. Just be sure that you set up automatic contributions, so youre not tempted to spend it instead.

Then try increasing the amount you save each month. Some retirement accounts may even offer an auto-escalation option, which would automatically increase your contributions. And whenever you get a raise, boost your monthly savings proportionately. Before you know it, those small boosts can add up to big savings, and youll reach that attractive model size of 20 percent a monthor even more. As you aim to increase your savings percentages, be mindful that many investment account types have annual contribution limits.

What Are Cash Investments

Cash investments typically refer to short-term investments that are FDIC-insured and offer some amount of interest paymenteven if it isn’t very much. A certificate of deposit is one example of a cash investment. Cash investments can also refer to the amount of cash that someone has invested into a venture, as opposed to a small business loan or any other form of financing.

You May Like: Investing In A Brokerage Account

What Risks Should I Know About When Investing

No matter what kind of investment you’re considering, it’s important to understand the risks involved. Here are a few things to keep in mind.

Stock prices can go up and down. The stock market is volatile, and stock prices can change rapidly. When the market is down, donât panic right away. This is a natural occurrence in stocks. If you panic and sell the moment your stocks hit a downward trend, you could lose money.

Mutual funds and UITFs can also be volatile. Like stocks, the prices of the assets inside mutual funds and UITFs can go up and down. This means that you could lose money if you sell your investment when the market is down.

Bonds are generally less volatile than stocks, but they still come with some risk. If interest rates rise, bond prices will usually fall. This means that you could lose money if you sell your bonds when interest rates are rising.

All investments come with some risk. There is no such thing as a “risk-free” investment. Even if you’re investing in something like bonds, there is still some risk involved. Before you invest, make sure you understand the risks and are comfortable with them.

Your investments can lose money. Even if you do your research and make careful investment decisions, there is always a chance that your investments will lose money. This is why it’s important to only invest money that you can afford to lose.

How Much Do I Have In Savings

If you have a substantial amount of money sitting in a checking or savings account, itâs often a good idea to invest at least some of it.

After all, savings accounts pay next to nothing in interest â while the US stock market has returned 10% per year, on average, over the last 100 years.

Of course, itâs important to consider your other options for these savings You may wish to invest some of your savings, and keep the rest in your bank account.

If youâre concerned about investing a lot all at once, you can consider dollar-cost averaging by buying small amounts each month. This helps even out fluctuations in the stock market, and can be less intimidating if youâre just getting started.

Key takeaway: Investing extra savings that you donât need for a specific purpose is a great starting point.

You May Like: Best Custodial Investment Accounts For Minors

Everything You Should Consider Before You Put Your Money To Work

Investing is an exciting but daunting concept. Putting your savings to work earning more money for you sounds great, but most people don’t have a spare $1,000 just lying around. Can you still invest in stocks with a more modest sum?

Good news! You don’t need a lot of money to start investing. In fact, you could start investing in the stock market with as little as $10, thanks to zero-fee brokerages and the magic of fractional shares.

Here’s what you need to know about how to transform even a small amount of money into the beginnings of an investment empire.

Give Yourself Some Grace

Perhaps Kapustas best advice is what she would have liked to tell her younger self:

Things change, and while your salary and goals for the next 10 years are bound to fluctuate over time, the most important thing is feeling confident and informed about where your money is coming from, and where its going.

After taking care of these simple steps, anything extra you make can go towards investingand you can feel better about it, knowing your bases are covered. Happy adulting!

Recommended Reading: Investing In Sacramento Real Estate

Then What How Do I Save And Invest Even More

Youll want to take advantage of inertia. That first step to start saving and investingeven just a small amountcan be the hardest. So once you get going, let your momentum propel you even further. Consider setting up recurring contributions to your savings and investment accounts to make it as easy as possible. Setting up regular investments also lets you take advantage of something called dollar-cost averaging.

Focus On Broad Index Funds If You’re Starting Small

You don’t need $10,000 to start investing. You don’t even need $100. You can get started with investing for less than $10 at several major brokerages. With fractional shares and commission-free stock and ETF trades, you can often invest with as little as $5.

If you are starting with a small portfolio, it may be a wise strategy to focus on broad index funds with low management fees. S& P 500 ETFs, which mimic the performance of 500 of the biggest stocks in the US, often come with fees of less than 0.10% per year and are supported by fractional investing brokerages.

As you can afford to add more to your portfolio, you can diversify into additional funds and may consider other, more focused investments.

Read Also: How To Invest In Gta Stocks

So How Much Should An Age 60+ Person Put In Stocks Now

If you are 60 or older in 2020, you need to abandon the old way of thinking. Putting 40% or less of your money in stocks is just no longer going to cut it.

As a result, financial planners have adapted the traditional formula to more recent times. For example, instead of subtracting from 100, you could subtract your age from 110 or 120. Lets take an example using 120:

Percent of Your Money in Stocks = 120 60 = 60

If you are age 60 and subtract this number from 120, the new formula will reveal that you should have 60% of your money allocated to stocks. That means that, unlike before, you would now have the majority of your money in stocks.

Considering how low bond yields are and your expected life span, this formula makes much more sense. However, even the adapted formula doesnt work for everyone.

There are other questions to consider when determining how much money you should have in stocks, including:

- what is your current lifestyle like?

- what are your major retirement goals?

- how much risk tolerance do you have?

- how much wealth do you currently have?

- do you want to leave some money for your children?

All of these factors can help you determine how much money you should have in stocks at age 60. Your retirement planning should take all of them into account.

How Much Money Do You Need To Start Buying Stocks

by Matt Frankel, CFP® |Updated Aug. 27, 2021 – First published on Feb. 14, 2019

Image source: Getty Images

The answer is more complicated than you might think.Image source: Getty Images.

Technically speaking, theres no minimum amount of money required to start buying stocks, as most of the best online brokerages dont have a minimum deposit requirement to open an account.

While there are some apps that will allow you to own fractional shares of stock, these generally arent the best bet for investors looking to build a portfolio. So, for our purposes, the minimum you need to start buying stocks is the price of one share of whatever stock you want to buy, plus whatever commission they charge.

For example, if you want to invest in company XYZ which is currently trading for $100 per share, and your chosen brokerage charges $6.99 trading commissions, youll need at least $106.99 in order to invest in that company.

You May Like: Buy And Sell Investment Properties

You’ve Recently Updated Your Payment Details

It may take a few minutes to update your subscription details, during this time you will not be able to view locked content.

If you are still having trouble viewing content after 10 minutes, try logging out of your account and logging back in.

Still having trouble viewing content?

Please contact Member Services on or

Ongoing Events In China Will Have Negative Effects

China is one of the centers of gravity in the global economy, and anything that significantly affects its economic output will cause cascading consequences pretty much everywhere else.

Enter the country’s zero-COVID policy, wherein the public health initiatives being pursued with the aim of minimizing its coronavirus caseload come at the cost of temporarily shuttered factories and disrupted workplaces. Frequently, those stalled factories are intended to be making high-tech goods for companies like Apple, which maintains major manufacturing partners in China.

The closures have already led to Apple being able to ship fewer iPhones than it planned this year, and it’s far from the only business affected. As the market hears more about exactly how much damage to expect to Apple’s sales, it could become a problem for shareholders.

In the short term, there’s not too much that investors can do, other than to be aware that there’s likely more turbulence to come. In the long term, it might make sense to invest in companies that are less exposed to the risk of disruption in China, though it’s presently unclear whether the zero-COVID policy will continue indefinitely or not.

SPONSORED:

10 stocks we like better than Walmart

When our award-winning analyst team has an investing tip, it can pay to listen. After all, the newsletter they have run for over a decade, Motley Fool Stock Advisor, has tripled the market.*

Stock Advisor returns as of October 26, 2022

Read Also: Best Short Term Investment Strategy

You End Each Month With Extra Money

Your emergency fund is looking good. You pay all the bills and any high-interest debt. You have enough to cover your expenses. Still some left over? It doesnt have to be a lot. Investing is all about starting small and growing those dollars over time . The key is to stick with it so the money invested can work for you.

Having trouble balancing your budget? Read 3 steps to allocate a paycheck when you want to get ahead with your money.

The Signs Say You’re Ready To Start Investing You Can Go In Small

Can you invest an extra $100 a month? Even small amounts can add up over time.

In fact, your investments have the potential to multiply. Stuffing $100 a month in a jar for 30 years would get you $36,000. Invest that same amount at a 6% annual rate of return, and through the power of compounding, that investment could grow to nearly $100,000 in the same time.1

Lets say you invest through a retirement account, such as a 401 or IRA. Theres big opportunity there, too. If you had a $35,000 annual income and bumped your pre-tax contributions up just 1%, thats only about $10 off your bi-weekly take-home pay.

Later, in retirement, that could add up to another $150 per month to spend.2

Read Also: How To Invest In Ico Crypto

Am I Comfortably Covering My Monthly Expenses

Around 54% of Americans live paycheck-to-paycheck.

If you find yourself struggling to meet your standard monthly expenses, now might not be the best time to invest.

Make sure youâre staying on top of bills, and not adding debt, before you start investing.

This doesnât mean that you canât rearrange your spending to prioritize investing, however.

If you spend a lot on optional items , you could certainly shuffle your budget to make room for extra investing money.

Key takeaway: Investing should come after you feel comfortable meeting all your monthly required expenses.

Create A Flexible Budget

Rigid budgets dont work. Theyre clunky and put pressure on you to cut out on things that make you happy . Thats why Kapusta and her team have a flexible budget breakdown in place. Its more about being mindful about where your hard earned money is going instead of the old grin-and-bear-it mantra where you wince every time you check your bank accountweve been there.

Instead, she says to strive for: 50 percent of your income towards essential expenses, 15 percent towards retirement, and five percent towards savings. That way, youre left with 30 percent of your paycheck to save or spend as you need. That can go towards paying down you loans, adding to your goal-oriented savings accounts, or, lets face it, in a big city, towards your rent . This way, theres some breathing room tailored to your personal needs and lifestyle.

Read Also: How To Invest Without Being An Accredited Investor

Finding The Balance Between Investment And Reserves

Chip Stapleton is a Series 7 and Series 66 license holder, passed the CFA Level 1 exam, and is a CFA Level 2 candidate. He, and holds a life, accident, and health insurance license in Indiana. He has eights years’ experience in finance, from financial planning and wealth management to corporate finance and FP& A.

New investors often want to know how much cash they should keep in their portfolio, especially in a world of low or effectively 0% interest rates.

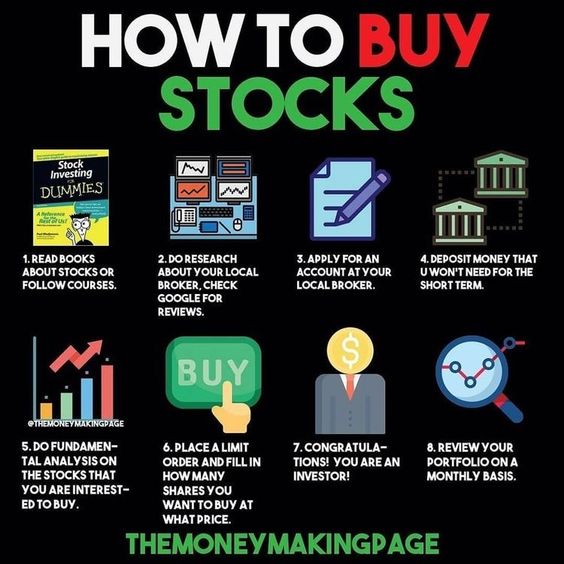

Choose How You Want To Invest

These days you have several options when it comes to investing, so you can really match your investing style to your knowledge and how much time and energy you want to spend investing. You can spend as much or as little time as you want on investing.

Heres your first big decision point: How will your money be managed?

- A human professional: This do-it-for-me option is a great choice for those who want to spend just a few minutes a year worrying about investing. Its also a good choice for those with limited knowledge of investing.

- A robo-advisor: A robo-advisor is another solid do-it-for-me solution that has an automated program manage your money using the same decision process a human advisor might but at a much lower cost. You can set up an investment plan quickly and then all youll need to do is deposit money, and the robo-advisor does the rest.

- Self-managed: This do-it-yourself option is a great choice for those with greater knowledge or those who can devote time to making investing decisions. If you want to select your own stocks or funds, youll need a brokerage account.

Your choice here will shape which kind of account you open in the next step.

Recommended Reading: How To Invest In Stocks Without Fees

Please Click On The Activate Button To Finalise Your Membership

Unsuccessful registration

Registration for this event is available only to Eureka Report members. View our membership page for more information.

Registration for this event is available only to Intelligent Investor members. View our membership page for more information.

- You are already registered for this event.

- This event is already full.

- Please select a quantity for at least one ticket.

Please enter your email address below to request a new password

- Indepth analysis of ASX listed shares

- BUY, Hold and Sell Recommendations

- Alan Kohlers Weekend Briefing

- Interviews with CEOs & top influencers

- Money Cafe and Talking Finance

- Super Advice and Q& A with Ask Alan

Ask any financial advisor how much money you need to start investing and the standard answer is usually $5,000 – sometimes $10,000 or even $20,000.

The reason is simple: from a financial perspective, those amounts make perfect sense. Every time you buy and sell a stock, you’ll lose money in brokerage expenses, which usually run at $10-30 per trade before switching to a percentage for larger trades. So let’s assume you lose $40 in transaction fees on each new investment. If you bought $500 worth of stock and sold it the following year, you would need an 8% capital gain just to break even. On small sums, brokerage takes a meaningful bite out of your return.

If you want to minimise fees and risk, stick to the standard advice of waiting until you have at least $5,000 before taking the plunge.