How To Invest In Private Equity

If you want to invest in private equity, youll need to find a private equity firm willing to take you on as an investor. This usually means meeting the private equity firms investment minimums and investor profile.

Occasionally there will be feeder fund opportunities where a fund will aggregate a bunch of high net worth individuals into a single fund and then make an investment into a larger private equity fund that may have minimum requirements that would exclude the investors individually. This approach is not without its drawbacks, as the feeder funds will add a layer of fees to the transaction.

The Biglaw Investor is helping thousands of lawyers manage and eliminate student loans and make great investment decisions. Were on a mission to help every lawyer achieve financial independence.

Dont Miss Out On Our Latest Insights In The Merrill Perspectives Newsletter

Clients should contact their Merrill financial advisor for a personalized version.

1 Impact investing and/or Environmental, Social and Governance managers may take into consideration factors beyond traditional financial information to select securities, which could result in relative investment performance deviating from other strategies or broad market benchmarks, depending on whether such sectors or investments are in or out of favor in the market. Further, ESG strategies may rely on certain values based criteria to eliminate exposures found in similar strategies or broad market benchmarks, which could also result in relative investment performance deviating.

2 Diversification does not ensure a profit or protect against loss in declining markets. Alternative investments involve limited access to the investment and may include, among other factors, the risks of investing in derivatives, using leverage, and engaging in shorts sales, a practice which can magnify potential losses or gains. Alternative investments are speculative and involve a high degree of risk and volatility.

Index definitions.

S& P 500 Total Return Index : A market-capitalization-weighted index that measures the market value of 400 industrial stocks, 60 transportation and utility company stocks and 40 financial issues.

List Of 55 Top Renewable Energy Private Equity Firms

Renewable energy private equity firms are focused on renewable energy projects globally-solar, wind, biomass, and more. This way renewable energy is getting the attention it deserves and investors are seeing a return on their money.

Renewable energy funds focus on renewable energy projects globally-solar, wind, biomass, and more. The renewable sector has been growing rapidly in recent years as governments have started to take note of its potential for mitigating climate change risks.

Renewables now account for around 18% of global electricity generation capacity with China leading the way accounting for over one-quarter of this capacity.

As well as being an important contributor to climate change mitigation efforts, renewables also offer significant economic benefits: low-cost power supply reduced dependence on imported fuel and more secure energy supply.

Recommended Reading: 30 Year Investment Mortgage Rates

How To Get Hired By A Pe Firm

People typically enter private equity from investment banking, as bankers work closely with PE firms on most of their deals, so its simply a very logical way to enter the industry.

For more information on how to break into private equity check out our Interactive Career Map, as well as our financial modeling and valuation courses that are required skill-sets for the job.

The List: The Most Pe Funds Raised In Five Years

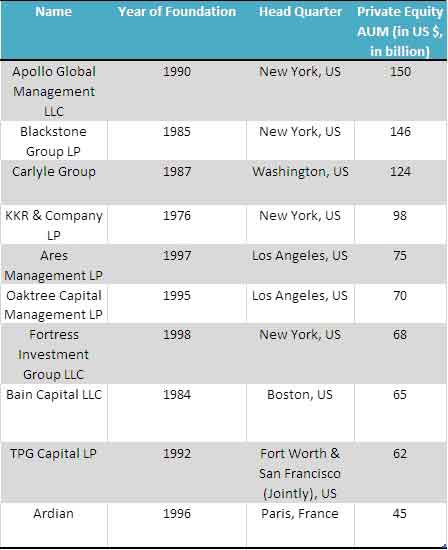

So which names should you know in private equity?

Here are the largest 25 private equity firms by their five-year PE fundraising total over the last five years, with data on funds and investments from respective firms and Private Equity International.

They include well-known private equity houses like The Blackstone Group and KKR , as well as investment managers with private equity divisions like BlackRock.

| Rank |

|---|

Don’t Miss: How To Invest In Pharmaceutical Stocks

Who Are These Funds Suited For

Equity-based funds offer highly volatile returns compared to other types of mutual fund investments. Hence, these are more suitable for the long haul, which moderates temporary market fluctuations.

Investors with a high-risk appetite and looking for long-term capital appreciation can benefit from such investments. Nonetheless, it is imperative to take specific factors into account before choosing the best equity mutual fund.

Following is a list of aspects investors need to consider when choosing from the best equity mutual funds.

Investment objective: Investment goals can vary across individuals. Some investors might prioritise capital growth over a prolonged period, while others may lean towards regular income. It is important for investors to identify and understand their financial objective before picking a fund type.

Funds past performance: Evaluating the historical performance of a fund can help investors understand its consistency, volatility, investment style, strengths and weaknesses. Thereafter, they can relate how these factors can aid in yielding maximum returns compared to other funds.

Experience of the fund manager: The portfolio management of stocks has a significant impact on fund performance in the long run. This is the prerogative of a fund manager. His/her experience and skillset play an essential role in the success or failure of an investment.

What Is Sharpe Ratio

The Sharpe ratio indicates the return of an investment when compared to its risk. It shows the extra returns you make for the additional risk that you have taken.

When choosing a mutual fund, a high Sharpe ratio is preferred when compared with peers performance and implies better risk-adjusted returns of the fund.

Read Also: Unique College Investing Plan National Fidelity Managed 529 Plan

The Top 7 Private Equity Fund Of Funds

Originally posted on September 06, 2022Last updated on September 13, 2022

One of the biggest challenges faced by alternative investment sales professionals within the fund of fund channel is knowing the underlying funds area of focus, and who to call on.

As fund of funds differentiate themselves based on their skill of identifying, evaluating, and monitoring managers, they often have a large number of specialized analysts with an often global footprint.Fund of funds are often able to invest early, move quicker, and allocate larger amounts than many other allocators and should be a key area of focus for every alternative strategy across its lifecycle.

At Dakota, weve been raising capital within the fund of funds channel since 2006, and have raised over $30 billion dollars over the last fourteen years. In that time weve also established Dakota Marketplace, an institutional investor database of accounts and contacts that houses all of this information.

To help you narrow down the size of the channel, weve put together a list of the seven largest fund of fund platforms that focus on private equity strategies. By the end of this article, you will have a better idea of the channel, as well as who might be the right people for you and your team to call on.

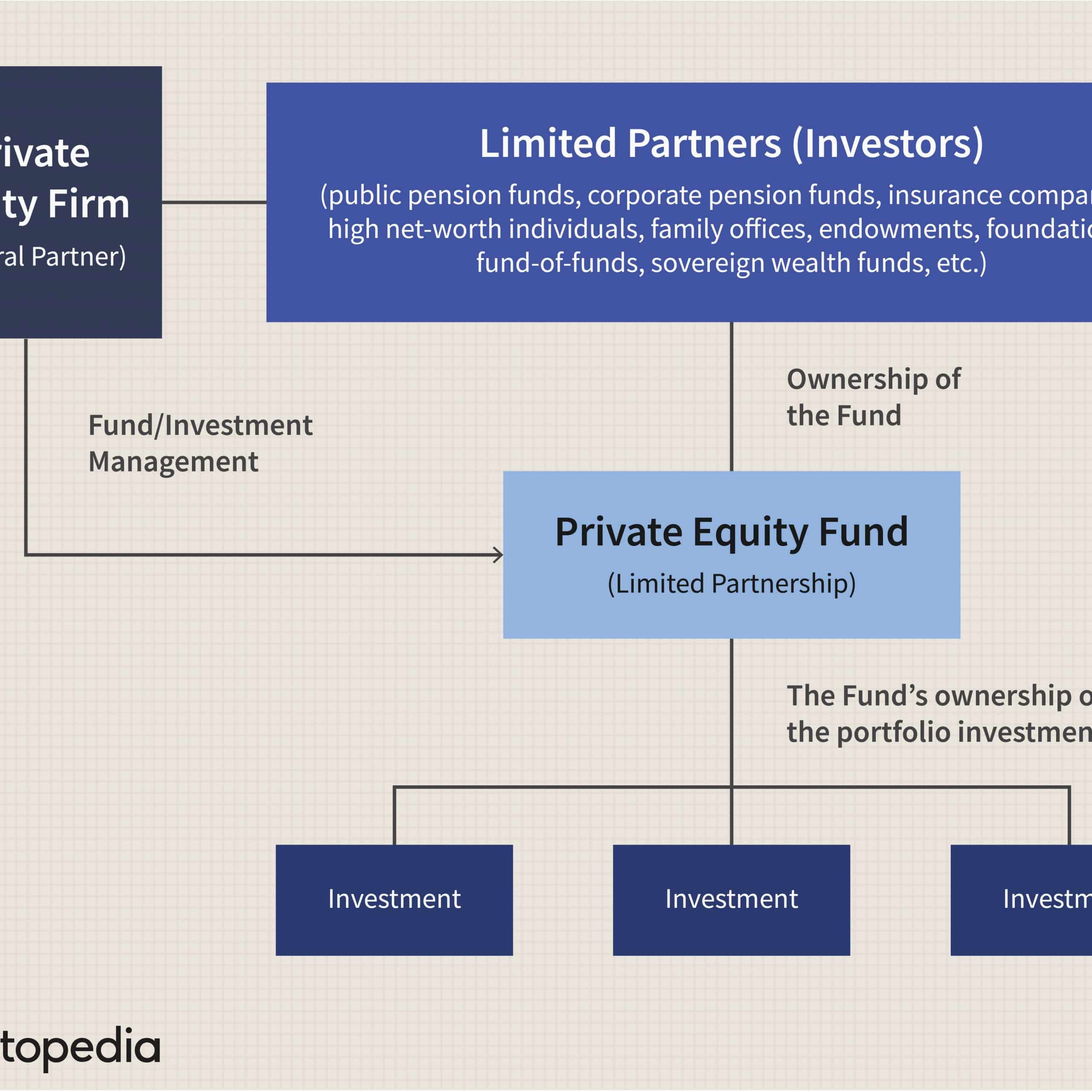

How Is A Private Equity Fund Structured

PE firms are created when investment partners join to form a fund. Typically, general partners and a management companytogether considered the financial sponsorraise capital from limited partners, or outside investors, who are usually high-net-worth individuals, public or corporate pension funds, endowments, or foundations. These limited partners own the most shares, have limited liability, and pay a management fee to the GPs. The general partner, on the other hand, owns minority shares with full liability, and manages the fund. This arrangement is known as a limited partnership, or LP, and is the most common structure for a private equity fund.

Once reaching their fundraising goal, the partners close the fund and invest the capital into their portfolio of companies. Private equity funds are known as closed-end investments because there is a limited period to raise funds, and once that time has expired, investors may not make any more contributions or withdrawals. Investors will only be able to withdraw their capital and any earned profits when the fund divests from its portfolio company through a sale or initial public offering .

A PE fund may also be structured as a limited liability company , which can have many active members managing the business while still retaining limited personal liability.

Recommended Reading: Is An Ira An Investment Account

The Private Equity Fund Of Funds: Compelling Career Or A Dinosaur Awaiting The Meteor

If you’re new here, please click here to get my FREE 57-page investment banking recruiting guide – plus, get weekly updates so that you can break into investment banking. Thanks for visiting!

Everyone reading this site still wants to get into private equity, but related opportunities, such as the private equity fund of funds, are a different story.

While they share some elements with traditional private equity firms, funds of funds differ in terms of the job itself, careers, compensation, and exit opportunities.

Theres a lot of negative sentiment online about these firms, and while some of it is justified, I dont think the situation is quite as dire as some people argue.

But funds of funds are more specialized opportunities that appeal to a narrower set of candidates than traditional IB/PE roles.

Before delving into the pros and cons, well start with the industry overview:

Private Equity Vs Other Asset Classes

When it comes to introducing a new asset into a portfolio, the most basic consideration is the risk-return profile of that asset.

Historically, private equity has the highest annualised return compared with all other asset classes, public or private. Combined with a volatility that is far lower² than any asset class that gets even close to the same return, the result is a compelling risk-return profile.³

Don’t Miss: Best App For Investing In Penny Stocks

Etracs Wells Fargo Mlp Ex

According to Investopedia, FMLP is a top recommendation that blends features of bonds and ETFs. The EFT note offers investors results similar to the Wells Fargo Master Limited Partnership Ex-Energy Index. The index provides a measure of all non-energy master limited partnerships on the Nasdaq and NYSE, performance. The index is comprised of companies that exclude the energy industry with capitalization weighting. The included companies require a $100 million minimum market cap. The notes are issued by UBS. Investors receive broad exposure to private equity businesses. The expense ratio is 0.85%. The dividend yield is 5.96%.

What Public Companies Can Do

As private equity has gone from strength to strength, public companies have shifted their attention away from value-creation acquisitions of the sort private equity makes. They have concentrated instead on synergistic acquisitions. Conglomerates that buy unrelated businesses with potential for significant performance improvement, as ITT and Hanson did, have fallen out of fashion. As a result, private equity firms have faced few rivals for acquisitions in their sweet spot. Given the success of private equity, it is time for public companies to consider whether they might compete more directly in this space.

Conglomerates that acquire unrelated businesses with potential for significant improvement have fallen out of fashion. As a result, private equity firms have faced few rivals in their sweet spot.

We see two options. The first is to adopt the buy-to-sell model. The second is to take a more flexible approach to the ownership of businesses, in which a willingness to hold on to an acquisition for the long term is balanced by a commitment to sell as soon as corporate management feels that it can no longer add further value.

Recommended Reading: Safe Cryptocurrency To Invest In

How To Choose An Equity Mutual Fund

To choose an equity mutual fund, investors need to bear in mind the cost that they are willing to pay to own a fund, its performance over a considerable period of time, its risk-adjusted returns and the volatility of the fund. When choosing an equity mutual fund, investors need to shortlist peers to compare the mutual fund performance on key metrics that need to be analyzed before choosing a fund:

Look For Private Equity Exchange

You can also take part in private equity investments without going through a traditional firm through private equity exchange-traded funds, or ETFs.

Private equity ETFs offer exposure to publicly listed private equity companies. This is one approach for those who want to take part in private equity but arent accredited investors or cant meet the minimums required by private equity funds. By investing in ETFs that track these companies, their success is also yours, and you wont have to front a hefty minimum investment to get in on it.

Also Check: Single Family Real Estate Investment Firms

Top Private Equity Etfs

Private equity exchange-traded funds hold companies that can be financially complicated because they use leverage and are strongly transaction-oriented. However, they provide investors with exposure to private equity investments and can offer significant and attractive returns on investment.

Who Should Consider Private Equity Investing

Private equity funds are out of reach for many investors because they tend to have substantial minimum contribution requirements.

How substantial? Let’s put it this way: Some private equity funds will allow you to buy in for as little as $250,000. Others have capital contribution requirements that reach up into the millions.

Many private equity funds are only available to institutional and accredited investors, who are thought to be more experienced and thus able to take on the risk of investing in securities not regulated by the SEC. An accredited investor is one with a net worth exceeding $1 million who’s earned an income above $200,000 or $300,000 if filing jointly for the past two years.

Recommended Reading: Best Investment Banks For Private Equity

The Net Worth Qualification:

Proving you have a net worth of $1 million also works. However, the task isnt simple, requiring presenting a combination of audited assets and liabilities statements that should include:

- Recognized consumer credit reports.

- Property deeds with the latest appraisals.

- CPA verified equity valuations.

- The income IRS documents under the income qualification above .

The Downsides Of Private Equity

- Private equity funds carry a lot of fees. Since these investments are unregulated, there’s no limit to the amount that private equity firms can charge. Performance fees are paid to the general partners/fund managers for producing positive returns, and the “2 and 20” annual fee structure is common: a firm charges an annual management fee of 2% of the assets being managed and a 20% performance fee on profits generated.

- Private equity investments are illiquid. Private equity firms often require investors to keep their money in the fund for at least three to five years.

- Private equity investments can be high-risk. The companies are untried or troubled, and they may not live up to their potential.

Don’t Miss: How To Invest In Debentures

Invesco Global Listed Private Equity Portfolio Psp

PSP is currently the largest ETF in the private equity classification. The total asset value is more than $151 million. The fund is comprised of 78 private equity companies throughout the world publicly-listed including financial institutions and business development companies. The PSP fund tracks the Red Rocks Global Listed Private Equity Index. The dividend yield is high at 3.95% with an expense ratio of 1.8%.

How Are Equity Funds Taxed

Any profit you make when you sell an equity mutual fund is taxable. You may also owe taxes on any dividends you receive from the fund.

If the investment is held for a period of up to one year, capital gains are termed as short term in nature and are subject to tax at the rate of 15%. If the investment is held for more than a year, capital gains are termed long term, and a long-term capital gains tax rate of 10% is applicable if the gains exceed INR 1 lakh per annum. Long-term capital gains are exempt from tax up to the threshold limit of INR 1 lakh.

Dividends are taxed as per the income slab of the investor and are deducted at source, which means the mutual fund automatically deducts the tax applicable on the dividends prior to disbursing it to the investor. Shareholders could claim dividend income without tax deducted at source , for which they need to submit form 15G or 15H to the mutual fund.

Recommended Reading: Financial Analysis For Commercial Investment Real Estate

Who Can Invest In Private Equity

Traditional private equity funds have very high minimum investment requirements, potentially ranging from a few hundred thousand to several million dollars. As such, most private equity investing is reserved for institutional investors or high-net-worth individuals.

In addition to meeting the minimum investment requirements of private equity funds, youll also need to be an accredited investor, meaning your net worth alone or combined with a spouse is over $1 million or your annual income was higher than $200,000 in each of the last two years.

The Private Equity Sweet Spot

Clearly, buying to sell cant be an all-purpose strategy for public companies to adopt. It doesnt make sense when an acquired business will benefit from important synergies with the buyers existing portfolio of businesses. It certainly isnt the way for a company to profit from an acquisition whose main appeal is its prospects for long-term organic growth.

However, as private equity firms have shown, the strategy is ideally suited when, in order to realize a onetime, short- to medium-term value-creation opportunity, buyers must take outright ownership and control. Such an opportunity most often arises when a business hasnt been aggressively managed and so is underperforming. It can also be found with businesses that are undervalued because their potential isnt readily apparent. In those cases, once the changes necessary to achieve the uplift in value have been madeusually over a period of two to six yearsit makes sense for the owner to sell the business and move on to new opportunities.

How Private Equity Works: A Primer

To clarify how fundamental the buy-to-sell approach is to private equitys success, its worth reviewing the basics of private equity ownership.

With large buyouts, private equity funds typically charge investors a fee of about 1.5% to 2% of assets under management, plus, subject to achieving a minimum rate of return for investors, 20% of all fund profits. Fund profits are mostly realized via capital gains on the sale of portfolio businesses.

Read Also: The Motley Fool Investment Guide For Teens