Figure Out Your Finances

Take an honest look at your entire financial situation what you own and what you owe. This is a net worth statement. On one side, list what you own. These are your assets. On the other side, list what you owe. These are your liabilities or debts. Subtract your liabilities from your assets. If your assets are larger than your liabilities, you have a positive net worth. If your liabilities are larger than your assets, you have a negative net worth.Youll want to update your net worth statement every year to keep track of how you are doing. Dont be discouraged if you have a negative net worth — following a financial plan will help you turn it into positive net worth.The next step is to keep track of your income and expenses. Write down what you and others in your family earn and spend each month, and include a category for savings and investing. If you are spending all your income, and never have money to save or invest, start by cutting back on expenses. When you watch where you spend your money, you will be surprised how small everyday expenses can add up. Many people get into the habit of saving and investing by paying themselves first. An easy way to do this is to have your bank automatically deposit money from your paycheck into a savings or investment account.

Create A Spending Plan

A spending plan, also known as a budget, is a list of your monthly income and expenses. It can help you see how much money is being devoted to both necessary and discretionary spending, and you can make changes as you see fit. A budget can be made using an app, a spreadsheet or cash envelopes, says Charlie Bolognino, ChFC, CFP, and founder of Side-by-Side Financial Planning.

Both regular and one-off expenses should be accounted for in your budget, Bolognino says. Proactively identifying even just a few top one-off expenses through the year such as property taxes, car registration, tuition, back to school shopping, etc. and incorporating those can make a big difference in your plan accuracy and confidence.

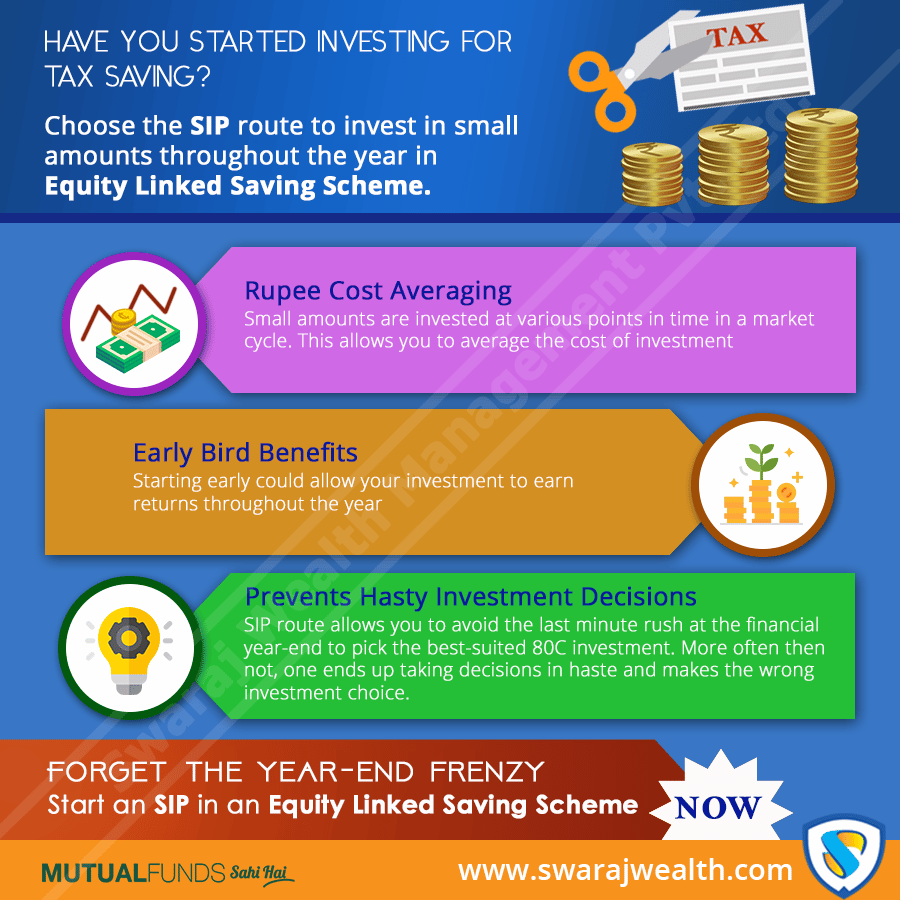

The Importance Of Starting Early

You dont have to start by investing a lot of money, but you do have to start. The earlier you start, the better off you are, even if you start with less and increase your savings as your income increases.

To further the example above, if Joe had waited just five years to start investing his $5,000 a year, his retirement savings would be $1,490,634. Still a tidy sum, but nearly one million dollars less than he would save if he started at age 26 instead of 31.

If you start investing for retirement with your first job, you can increase the amount you save with each pay raise you get. Try this trick: every time you get a raise, split it with yourself. If you get a 4% raise, add 2% of your salary to your retirement savings and keep the other 2% for yourself. If you do this as soon as the raise takes effect, youll never miss that 2%.

Also Check: How To Invest Money In Us Stock Market

Why Spending Saving And Investing Are Important

n explanation of why spending, saving, and investing are important.

- Spending is important because it helps stimulate the economy

- Saving is important because it helps build financial stability

- Investing is important because it builds financial security

At least three tips on spending.At least two tips on saving and a brief explanation of available savings options.

At least two tips on investing and a brief explanation of available investment options.

Any other creative touches or information that might be of value to your clients.

Types Of Investment Assets

Investing is very closely related to risk which is an indicator of the return that you would expect from investing in a specific asset. Generally, the higher the risk of an asset, the higher the return that is expected by an investor. For example, the risk from investing in a stock is generally higher than that of a bond so the return expectation is also higher from stock than a bond.

There is a wide spectrum of investment assets each of which has a different risk profile. Some of the common types of assets are stocks, commodities, fixed income, gold, real estate, art, derivatives and alternative investments such as venture and private equity capital.

You May Like: How To Start Investing In Real Estate With Little Money

Gauge Your Risk Tolerance

What are the best saving and investment products for you? The answer depends on when you will need the money, your goals, and whether you will be able to sleep at night if you purchase a risky investment .For instance, if you are saving for retirement, and you have 35 years before you retire, you may want to consider riskier investment products, knowing that if you stick to only the savings products or to less risky investment products, your money will grow too slowly. Or, given inflation and taxes, you may lose the purchasing power of your money. A frequent mistake people make is putting money they will not need for a very long time in investments that pay a low amount of interest.On the other hand, if you are saving for a short-term goal, five years or less, you dont want to choose risky investments, because when its time to sell, you may have to take a loss.

Save For Your Emergency Fund

It’s important to have an emergency fund set aside to cover unexpected expenses. Studies show that four in 10 adults in the U.S. would need to put an unexpected $400 expense on a credit card or would need to borrow money from family or friends to pay for it.

That emergency might be an unexpected car repair, expensive medical bills, or a sudden job loss. If you were to lose your job, you’d be thankful you socked away a good amount of money into your emergency fund to tide you over until you found a new job.

Ideally, your emergency fund should contain enough money to cover three to six months of expenses. The Bureau of Labor and Statistics estimates the average household spending in 2020 was $61,334, or $5,111 per month. Using that as an example, an emergency fund that covers six months’ worth of expenses should hold about $30,000.

That’s just an example. Save as much as you can to get started, and over time your fund will grow. If you are working to get out of debt, save what you can until you bring your emergency fund up to even just one month’s worth of income. If you are single or living on just one income, you may want to consider a larger emergency fund, since you might not have a buffer if you lose your job.

Also Check: Is Fundrise A Good Way To Invest

How Are Saving And Investing Similar

Saving and investing have many different features, but they do share one common goal: theyre both strategies that help you accumulate money.

First and foremost, both involve putting money away for future reasons, says Chris Hogan, financial expert and author of Retire Inspired.

Both use specialized accounts with a financial institution to accumulate money. For savers, that means opening an account at a bank, such as Citibank, or credit union. For investors, that means opening an account with an independent broker, though now many banks have a brokerage arm, too. Popular online investment brokers include Charles Schwab, Fidelity and TD Ameritrade.

Savers and investors both also realize the importance of having money saved. Investors should have sufficient funds in a bank account to cover emergency expenses and other unexpected costs before they tie up a large chunk of change in long-term investments.

As Hogan explains, investing is money that youre planning to leave alone to allow it to grow for your dreams and your future.

What’s The Difference Between Saving And Investing

The key difference is that investing can better help you achieve your long-term financial goals like living the retirement you desire or helping with the costs of a child’s post-secondary education by giving you the opportunity to grow your money faster than saving alone. Saving, on the other hand, is the behavior of putting money aside and storing it. Investing has the power to give your savings a boost to be able to reach your financial goals.

To get started, explore our savings and investing products.

Don’t Miss: Best Investment Apps For College Students

Is Spending Good For The Economy Should We Save Or Invest

Money has always been the prime driving factor of any economy since human settlements started to be sophisticated. From the barter system to the current complicated transactions, the value of services and objects has always been a determining factor. And this value is satisfied today largely through the use of money.

As our economy goes through its highs and lows, it is inevitable that people get confused as to whether they should spend money or save money. This is also because of the fact that there is an unending cycle caused due to the necessity to save money to buy services and to spend money to buy services.

We have always been taught to save money as much as we can. The more we save and the less we spend, the better will be the financial security and stability of our economy. This is something that is constantly fed on to us.

However, Economists across the world have a different opinion in this regard. They say that consumers should strike a balance between spending and saving. It will be harmful either for the individual or the economy if this balance goes off.

How To Invest Money

The purpose of making an investment is to have the money grow exponentially over a period of time. For instance, if you invest money in mutual funds or shares, you can expect greater returns than the original investment made. Similarly, if you invest money in gold, then you can expect a return when the value of holding increases over a period. Gold also helps in giving you a financial support in time of monetary emergencies, without liquidating the asset, as several financial institutions are prepared to offer a loan against gold asset.

- There are other investment products other than gold as well that can be used to take a loan against such as life insurance policies, mutual funds, equity shares, NSC , KVP , etc.

- Some of the places where you can invest other than ones already mentioned are: real estate, bank deposits, public provident fund, national pension scheme, stocks, bonds, derivatives, etc.

- To begin with an investment, firstly, define your financial objectives and goals. Understand your risk capacity, and how much you are willing to invest, keeping aside money for existing financial liabilities.

- Analyse and determine the tenure of investments. Are you looking for a short-term or a long-term gain, and understand the associated tax implications.

Don’t Miss: The Only Guide To Alternative Investments You Ll Ever Need

Make A Plan And Stick To It

There are many different ways to save money to meet your needs and goals. Some examples would include automatic saving, saving coins, banking savings on coupons or refunds. Just think about what works best for you. One suggestion is, that when you receive money, pay yourself first,” as a way to plan ahead to save money over time. When you pay yourself first, you put an amount of money away first into savings, before spending on other items.

Once you have saved money to meet emergency needs, consider investing other savings to grow your money. Think about your short and long-term goals. It is especially important to take time to think about your long-term saving goals as money saved can grow over time. Your savings can grow over time if you leave it in savings for many years. There are benefits to long-term savings. Long-term savings can be invested to further grow your funds. Look at investment choices that are appropriate for your goals and risk levels. By investing, you are deciding where to put your money, where it will grow and provide additional funds to help you achieve your goals.

To Make Compounding Work For You:

Start early.

The younger you start, the more time compounding can work in your favour and the wealthier you can become. If you didnt start early, dont despair, there is still time. Put away as much as you possibly can. Federal regulations allow older workers to put more money into retirement plans to catch up.

Make regular investments.

Remain disciplined and make saving for retirement a priority. Do whatever it takes to maximize your contributions. If you work for a company that provides a match, make sure that you enrol are eligible for the highest match from the company.

Be patient.

Do not touch the money compounding only works when you allow your investment to grow. The results will seem slow at first, but persevere. Most of the magic of compounding comes at the very end.

Recommended Reading: Positive Cash Flow Property Investment

Save For A Down Payment On A House

Save money for a down payment on a house. If you can save up 20% of the purchase price, you can avoid paying private mortgage insurance and receive better interest rates on a home loan. It can also reduce the amount you need to borrow, making your mortgage payments more affordable.

If you don’t think you can save enough to put 20% down, you can still buy a home. Certain government-backed programs such as the Department of Veteran Affairs , Federal Housing Authority , and U.S. Department of Agriculture loans accept lower down payments, and sometimes even no down payment at all.

You can determine how much to save toward a home each month based on your circumstances and other savings goals.

Why You Should Save Money

The importance of saving money is simple: It allows you to enjoy greater security in your life. If you have cash set aside for emergencies, you have a fallback should something unexpected happen. And, if you have savings set aside for discretionary expenses, you may be able to take risks or try new things. Pretty good reasons to save money, right?

If youre convinced as to why you should save money, you can get in a savings groove by opening an online savings account. And good news: It doesnt take a lifestyle overhaul to become a saver. There are simple ways to save money, which you can start practicing today. Once youre in the habit of saving, youll forget there was ever a time when you didnt save.

Articles may contain information from third-parties. The inclusion of such information does not imply an affiliation with the bank or bank sponsorship, endorsement, or verification regarding the third-party or information.

You May Like: Can Nonprofits Invest In For Profit Companies

How Much You Should Invest Vs Save In Cash

“This year has been a great example of why money for short-term needs should be held in cash in a high-yield account, not invested in the stock market,” says Tony Molina, a CPA and Product Evangelist at Wealthfront. “Take your emergency fund, for example. That’s money you’re keeping for a rainy day say an unexpected medical bill, house or car repair, or job loss so you don’t want that money to be subject to market volatility. No one wants to receive an unexpected medical bill only to find that your emergency fund is now less than you expected because the market had a bad day.”

At the same time, Molina cautions against over-saving. It’s important to ensure that a sizable chunk of your net worth is able to outpace inflation and typically, only keeping money in a savings account won’t allow you to do that.

“Beware that there is such a thing as saving too much in cash,” he says. “If you don’t invest enough of your money, you won’t be able to keep up with inflation. But you should only invest money that you don’t expect to need in the next three to five years.”

This way, you have a longer time horizon to rebound from any short-term market dips.

Our best selections in your inbox. Shopping recommendations that help upgrade your life, delivered weekly. Sign-up here.

-

Annual Percentage Yield

-

No minimum balance requirement after $100.00 to open the account

Pay Off Credit Cards Or Other High Interest Debt

No investment strategy pays off as well as, or with less risk than, eliminating high interest debt. Most credit cards charge high interest rates — as much as 18% or more – if you dont pay off your balance in full each month. If you owe money on your credit cards, the wisest thing you can do is pay off the balance in full as quickly as possible. Virtually no investment will give you returns to match an 18% interest rate on your credit card. Thats why youre better off eliminating all credit card debt before investing. Once youve paid off your credit cards, you can budget your money and begin to save and invest.Here are some tips for avoiding credit card debt:

Don’t Miss: Investors Who Invest In Startups