Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

Your Plan May Allow You To But That Doesn’t Mean You Should

One of the biggest disadvantages of 401s is that you’re usually limited to a few investment options that have been selected by your employer and may or may not fit your needs. Historically, most workers had no other choice if they wanted to contribute to their 401s, but the rising popularity of 401 self-directed brokerage accounts is changing this.

More options aren’t always better, though, especially if you’re new to investing and are unsure what to choose. Below, I explain 401 brokerage accounts in more detail, along with who may want to consider them and who is better off staying away.

Image source: Getty Images.

Does Fidelity Sell Gold

What precious metals can I trade at Fidelity? We offer trading in bullion, bars, and coins in gold, silver, platinum, and palladium . When trading precious metals, Fidelity acts as an agent only we hold no inventory in precious metals, nor does Fidelity buy or sell by taking positions in the market.

Also Check: Best Way To Set Up A Real Estate Investment Company

How To Handle 401 Investments

A 401 plan can be a great way to help save for retirement. And while it can be a relatively low-effort way to invest, there are also a lot of moving parts to consider. You may want to consider whether the plan has automatic features, your companys policies, the applicable administrative and management fees, and which allocations might be right for you. It may be wise to consult with a financial advisor to help stay on track for your financial goals.

There are several steps you can take to manage your 401 plan to help meet your retirement goals. Start by understanding your companys matching formula, if applicable, and the potential impact that could have on your savings. Also consider whether your 401 plan has a vesting schedule, which could impact your account balance if you leave your job before a certain period. Finally, consider automating your retirement savings plan and choosing asset allocations that meet your needs.

Where Do I Invest After Ive Maxed Out My 401

5 Min Read | Sep 27, 2021

If youre asking how to invest beyond your workplace retirement plan, then youre making huge strides in building wealth for your future! Youre laser-focused, youve set your goals, and youre working toward themand thats a great accomplishment.

Once youve contributed the allowable amounts to your workplace investing program, you dont have to stop there. You still have options. Here are three investing vehicles to consider:

Recommended Reading: Can A Non Profit Invest In The Stock Market

How The Standard 401k Works

A standard 401k allows employees to set money aside in a retirement-specific investment account. In many ways, it functions similarly to investing outside of a retirement account. Often, you can select from a variety of stocks, bonds, ETFs, or mutual funds. Additionally, you can usually adjust your allocations over time, though there may be limits on the types of changes you can make.

Once a contribution is made, the requested assets are acquired. Then, those investments will grow or shift over time. While most increase in value over the long-term, economic conditions that cause stock market downturns will impact 401k portfolio values. As a result, the total value of the retirement account will fluctuate, though they generally trend upward.

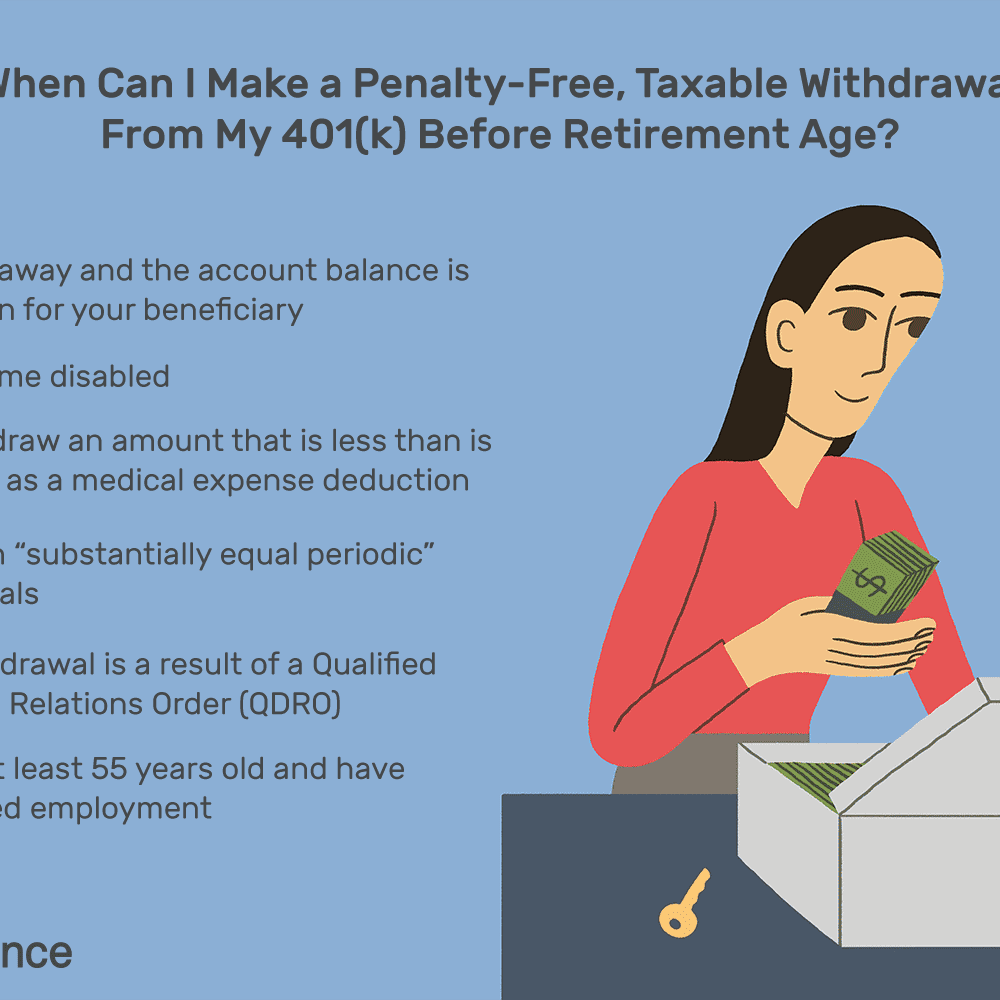

Once you reach retirement age, you can make withdrawals without incurring any financial penalties. However, those withdrawals do trigger tax obligations, as that money is treated as income by the IRS.

Early withdrawals are potentially an option, but they can trigger a financial penalty depending on how the funds are used. Plus, taking money out early means missing out on future gains, so its best to wait until your retirement whenever possible.

Investment Options: The Diy Approach

Target-date funds arent for everyone, and some prefer to adopt more of a hands-on approach. You typically cant invest in specific stocks or bonds in your 401 account. Instead, you often can choose from a list of mutual funds and exchange-traded funds . Some of these will be actively managed, while others may be index funds.

So what kinds of funds and investments can you expect to see?

You can bet that almost every plan will have large-cap stock funds. These are funds made up entirely of large-cap stocks, of stocks with a market capitalization of over $10 million. Large-cap stocks make up the vast majority of the U.S. equity market, so your 401 will almost certainly have multiple funds to choose from that invest in them. Notable large-cap funds include the Fidelity Large-Cap Stock Fund and the Vanguard Mega Cap Value ETF .

Another type of mutual fund youll likely find in your 401s catalog of option is a bond fund. A bond fund is a mutual fund that invests solely in bonds. Within this category exists several categories like corporate bond funds, government bond funds, short-term bond funds, intermediate-term bond funds and long-term bond funds. Bond funds are popular because, as a general rule, they provide the safety of investing in bonds, but theyre much easier to buy and sell than individual bonds. Still, bonds arent risk-free: Longer term bonds can be hurt by rising interest rates, and so-called junk bonds are at risk of default.

Read Also: How To Invest In Dubai Real Estate

Pick The Right Retirement Stocks Without Emotion Or Guesswork

If we could only provide one retirement investment strategy, it would be this one. One of the best ways to grow your retirement savings is to carefully pick retirement stocks. But picking stocks can be a daunting task especially if you dont have a lot of experience with investing. So many individuals have watched their retirement accounts dwindle down as theyve made poor stock choices.

Fortunately, it doesnt have to be this way. We can help you effortlessly identify the best stocks for retirement without spending all day filtering through charts and tracking technical trading indicators. Without any guesswork, without any emotion. Just tried and true investing principles with decades of results to back them up.

VectorVest is stock forecasting software that simplifies investing and eliminates emotion or guesswork from your strategy. Instead of getting overwhelmed by how complex and time-consuming technical analysis is, you just rely on three simple ratings: relative value , relative safety , and relative timing . These ratings contribute to a clear buy, sell, or hold recommendation for any given stock, at any given time.

This alone is powerful. But it gets even better as we dont make you find these stocks on your own, we bring them to you with our pre-built stock screeners. We have stocks picked out specifically for retirement, too. You can literally just pick our top retirement stocks and set yourself up for a comfortable, lucrative retirement.

What Paperwork Should Clients Handle

Clients must handle a lot of paperwork when they want to roll over their 401 k. First off, they have to fill out a gold IRA application form, a 401 k rollover form, and a form for direct deposits.

Forms are available online and via paper, so the decision is up to the client. Moreover, there might be fees that they need to pay, and trusting a professional from a specialized company is the top way to understand all this.

To roll over a 401 k into a gold IRA account, the average cost is 50 USD. At the same time, the person must transfer the money in the specific time they get if they want to avoid penalties. Fees might also vary depending on the person administering the account. Thus, the client must choose a company they can trust.

Donât Miss: How To Withdraw From 401k After Age 60

Read Also: Is Robo Investing A Good Idea

The Best Retirement Investment Strategies Regardless Of Age

As you start to take your retirement more seriously, its important to come up with a targeted action plan based on sound strategies.

Sure you can just let your savings pile up and hope you started early enough to build a sizable egg by the time you turn 60. But chances are, if youre here looking for the best retirement strategies, you want to take a more detailed, structured approach. And youre in luck. In this in-depth guide, youll discover the top investment strategies for retirement.

No matter your age, no matter your financial standing, youll find invaluable tips to help you take control of your financial future. The best part? You dont need a financial advisor! Everything were going to recommend today can be done easily on your own, helping you make the most of your retirement investments. First lets talk about what you need to consider when pondering the various investment strategies for retirement.

Convert Old 401s To Roth Iras

Lets pretend that youve changed jobs at least once in your career, and you still have a 401 from a former employer. If you have enough cash on hand, you can convert that 401 into a Roth IRA. Since the money in that 401 wasnt taxed when you first put it into the account, youll pay taxes on that money when you convert it to a Roth IRA. Doing that rollover is not complicated. Youll have to make some phone calls and fill out some paperwork.

Why would you want to convert that old 401 into a Roth IRA? There are a couple of reasons.

Remember this: converting is an option only if you have the cash on hand to pay the taxes. If you dont have enough, try Door #3.

Recommended Reading: Best Long Term Investment Accounts

Types Of 401 Investments

The most common type of investment choice offered by a 401 plan is the mutual fund. Mutual funds can offer built-in diversification and professional management, and can be designed to meet a wide variety of investment objectives. Be mindful that investing in a mutual fund involves certain risks, including the possibility that you may lose money.

Your 401 plan may offer other types of investments. Some of the more common ones include:

Contribute Enough To Max Out Your Match

Employers often match contributions you make to your own 401 plan. For example, your employer might match 50% of your contributions up to a maximum of 4% of your salary.

This is free money, but you can claim it only if you invest at least enough to max out your company’s matching funds. This is the only investment option that gives you a guaranteed 100% return on invested funds immediately with no risk, so it’s smart to always max out your match before investing in any other retirement accounts.

You May Like: Best Crypto To Invest In On Coinbase

The 411 On 401 Upsides

Retirement plans are a great way for employers to attract and retain top talent. Employers should also consider the tax benefits of offering a 401 plan, particularly the advantages of matching employee contributions. To ensure compliance, businesses must evaluate the hours of full- and part-time employees when determining who is eligible for company-sponsored retirement plans. But by following the tips above, youll reap the rewards of offering this valuable retirement benefit to your employees.

Kimberlee Leonard contributed to the writing and reporting in this article. Source interviews were conducted for a previous version of this article.

You May Like: Is There A Fee To Rollover 401k To Ira

Is An Rrsp Worth It

Now that you know what is an RRSP, youre likely wondering if an RRSP is worth it. In most cases, opening an RRSP is a great idea. Not only will it help you save for your future, but youll also get a tax deduction for your contributions. To maximize your RRSP, you should contribute regularly and invest your money. Over time, your savings will grow which will fund your retirement years.

Recommended Reading: Investments With High Compound Interest

Down Markets Are Efficient For 401 Investors

Since the advent of public stock trading, stock prices have moved up and down in waves. While the stock market goes up more than it goes down, those down cycles can feel more pronounced. Time flies when your 401 balance is growing, but it drags when your balance is shrinking.

Image source: Getty Images.

The thing is, continuing to invest in your 401 gives you a better chance of robust long-term growth. Here are two reasons why:

Potential Risks In 401 Investments

- Being too conservative: Some people may think that the best way to manage risk is not to take any, but being too conservative with your investments can be a risk, too. Many investors dont allocate enough of their retirement portfolios to stocks, which will likely have the highest returns over the long term. Instead, they stick to assets perceived to be low-risk investments such as bonds. While stocks are volatile, they should be an important part of investing for goals like retirement.

- Paying too much in fees: Fund expenses eat into the return you earn as an investor, so pay special attention to the fees associated with the funds you invest in. If a fund has an annual expense ratio above 0.50 percent, its likely you can choose something cheaper. Most index funds cost less than 0.10 percent each year.

- Investment losses: This is what most people think of when it comes to investment risk. Stocks and bonds can decline in value, especially over short periods of time. Stocks tend to rise over the long term, though, making them ideal assets for goals far in the future like retirement.

Recommended Reading: Fidelity Investments Money Market Government Portfolio Institutional Class

Be Aware Of The Fees Associated With Your Plan

The goal of investing in a 401 plan is to grow your money over time through investments. Because its an active investment , there are fees included. Your plan negotiates these fees on your behalf. They can include amounts needed to cover administrative costs and management expenses. While you dont have complete control over the fees in your 401 plan, its important to be aware of what youre paying. If youre choosing your own investments, look at fees and returns to ensure that you get what you pay for.

How To Transfer A 401k

People have to evaluate all the options they have when theyre near retirement age. A gold IRA rollover might be possible in some cases, which means that they must assess their alternatives from early on.

Fortunately, clients can transfer their 401 k into a gold IRA, and it doesnt cost them any fees. However, the process is often challenging, so having expert help is the best way to go. First of all, the person should understand the difference between a 401 k rollover and a transfer.

A 401 k rollover happens when the client takes the funds from one account and puts them into another. Thus, they might get their 401 k and deposit the money into an IRA account.

Alternatively, transfers occur when a custodian deposits the money where it needs to be. Consequently, clients never really see it. Transferring is not expensive, but the person must have a trustee or custodian to be able to do it. Moreover, they should get expert help to make sure the process is straightforward.

Read Also: Financing Commercial Real Estate Investments

Can You Invest In Alternative Assets Inside A 401

Alternative assets include crypto, real estate, precious metals, wine, whiskey, and more. These alternatives tend to have low correlation to the stock market so they may outperform other investments during a recession.

Unfortunately, most 401 plans don’t allow you to invest in alternative assets. In fact, most don’t even allow you to invest in individual stocks and ETFs.

However, if you’re self-employed, you may want to consider opening up a self-directed Solo 401. Money that’s held inside self-directed retirement accounts can be invested in almost anything. Also, if you have a 401 from a previous employer, you can roll it into a self-directed IRA.

Just keep in mind that alternative assets are often riskier and more volatile than traditional investments like index funds. We recommend that investors limit their alternative investments exposure to 5% of their overall portfolios.