Find Out If Youre Eligible And Ready

First things first. Before you can open a Roth IRA, you have to make sure you meet the income limits to contribute to a Roth IRA.

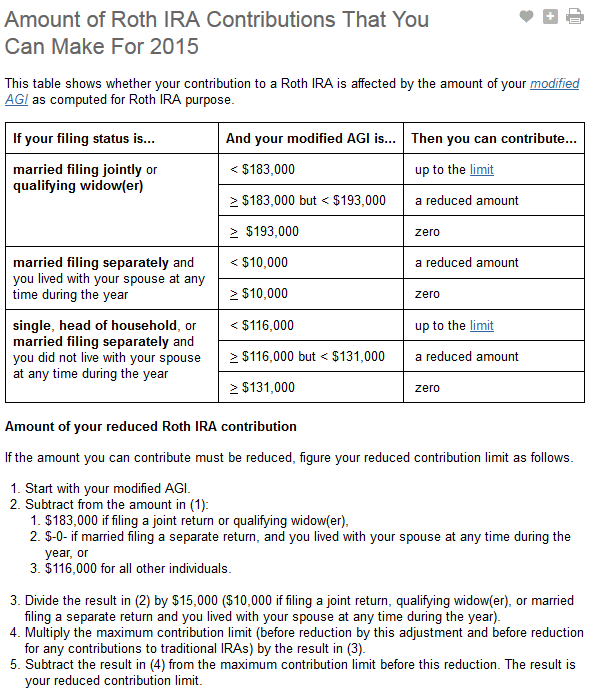

In 2022, as long as your adjusted gross income is less than $129,000 for single filers and $204,000 for married couples filing jointly, you can contribute the maximum amount to a Roth IRA.1

Remember when we said your Roth IRA has a specific place in your wealth-building plan? Heres the deal: Eligibility for an IRA isnt all you should keep in mind. You also need to make sure saving for retirement fits into your budget. That means youll need to be halfway through the Baby Steps. Baby Step 1 is saving a $1,000 starter emergency fund. Baby Step 2 is getting out of debt using the debt snowball method. Baby Step 3 is saving three to six months of expenses for a fully funded emergency fund.

And then you get to Baby Step 4investing 15% of your household income for retirement. When youre trying to figure out where to invest for retirement first, remember: Match beats Roth beats Traditional. This means you should invest in your 401 up to your match , then max out your Roth IRA. If you havent reached 15% at that point, go back and invest in your 401. And if you have a Roth 401 at work, great! You can invest your entire 15% there.

Working through the Baby Stepsand getting out of debtis the quickest right way to build wealth. So if you havent paid off all your debt or saved up an emergency fund, stop investing for now. No exceptions!

How Roth Ira Withdrawals Work In Retirement

If you’re at least 59 1/2 and you’ve had your account open for at least five years, you can withdraw your earnings without having to pay a fee or pay taxes on your earnings.

You’ll need to report it on IRS Form 8606. This form is used to keep track of your Roth distributions.

Unlike traditional IRAs and other investment options, you aren’t required to start withdrawing money from your Roth IRA. There aren’t any required minimum distributions . Instead, you can leave the money in there for as long as you’d like.

Because of this feature, the Roth IRA is a good way to pass money down to your children or grandchildren. They can take advantage of the tax-free growth.

How Experts Say You Can Maximize Roth Ira Returns

Where investors decide to open a Roth IRA can have a significant impact on the investments they select and the potential returns from those investments. For example, traditional banks may only offer a certificate of deposit Roth IRA which may have lower rates of return.

For the largest array of investment options, individuals can open a Roth IRA with a brokerage firm. Brokers allow you to select your investments based on your risk tolerance, financial objectives, and any other considerations you may have. Types of investments can include a mix of exchange-traded funds , index funds, stocks, and bonds.

Don’t Miss: What Is Pitchbook Investment Banking

Why Start A Roth Ira

A Roth IRA is a great way to supplement your 401 or other workplace retirement plan. Fun fact: 8 out of 10 millionaires invested in their companys 401 according to our National Study of Millionaires. That means their boring old workplace retirement account played a huge part in their financial success! On top of that, 3 out of 4 millionaires invested outside of their company plans too.But if you dont have a retirement plan at workand lots of people donta Roth IRA isnt just a nice thing to have. Its essential.

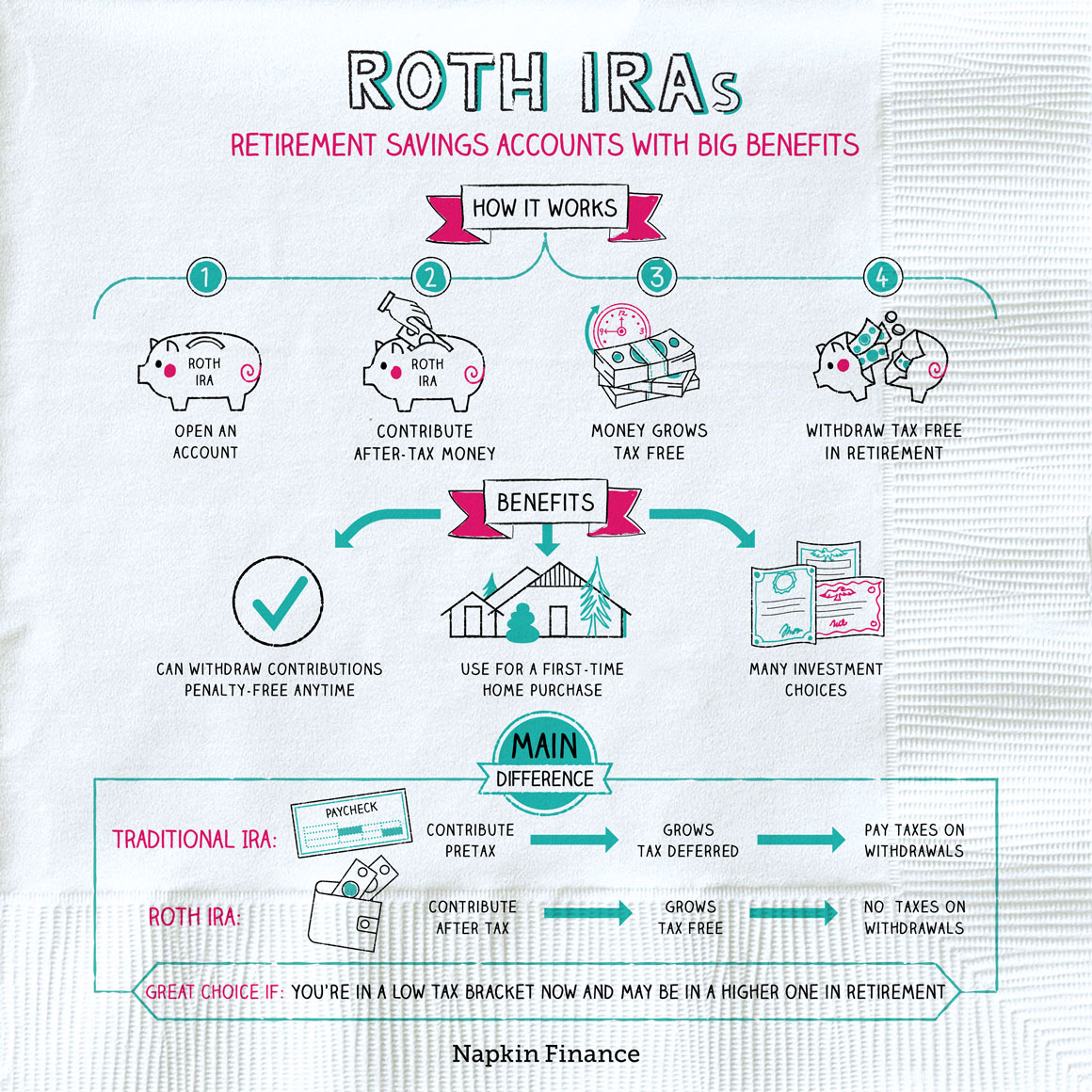

With a Roth IRA, you wont pay any taxes on the money you take out in retirement once you hit age 59 1/2. Thats because you invest in a Roth IRA with after-tax moneymeaning youve already paid taxes on it.

Decide What To Invest In

The next step is to decide what to invest in within your Roth IRA. If you go the self-directed route, you can pick and choose your investments. This could be stocks, ETFs, or a combination of both! There are even ways to invest in Bitcoin and other cryptocurrencies within your Roth IRA if you choose to do so.

If you don’t want to be hands-on or if you’re a beginner investor, you can follow the passive strategy and invest in a portfolio of mutual funds or ETFs.

You May Like: Inexpensive Cryptocurrency To Invest In

Tax Considerations For A 401 And A Roth Ira

While saving in a Roth IRA doesnt offer you any tax advantages today, the future advantages can add up.

Keep in mind how importantor nota present-day tax break from income is to your household, says Whitney. Lets say you earn $80,000 annually. If you put $15,000 into your 401, your taxable income for that calendar year then becomes just $65,000.

However, if you contribute the maximum amount to a Roth IRA, youll still report a household income of $80,000, and the money put into a Roth is never taxed again.

Imagine years of investment compounding in action, and no mandated time to withdraw the funds, nor tax upon withdrawal, she said.

Except for a few scenarioslike a first-time home purchase or college expensesthere are tax implications for Roth IRAs if funds are withdrawn within five years of the initial contribution.

How To Open An Ira For A Child

Opening a Roth IRA for your child is pretty simple.

Schwab, Fidelity, E*Trade and many other firms offer custodial Roth IRA accounts for your kids. As the custodian on the account, you will control the funds in the IRA, making all investment decisions until your child reaches majority age.

In most states, the age of majority is 18, and others have higher ages of 19 or 21. Once your son or daughter reaches majority age as defined by your state, the Roth IRA transfers to their name, solely.

Recommended Reading: Gold Companies To Invest In

What If My Child Doesn’t Meet The Income Requirement

One of the requirements, as mentioned, is earned income. But that does not mean your child necessarily needs to have formal employment. Self-employment income also qualifies, as long as it’s reported to the IRS.

For example, if your 14-year-old child earns $1,000 mowing lawns this summer, this income could potentially be used as the basis for qualifying for IRA contributions. Other potential qualifying income sources are babysitting and even chores they do for pay.

One caveat is that if you use self-employment income as a basis for qualification, your child may also have to pay self-employment tax on his or her reported income. Even if this is the case, the long-term benefits of Roth IRA investment at such a young age can more than offset this expense. And according to the IRS, if your kid earns more than $400 for the year, he or she should be reporting self-employment income anyway.

What Does A Good Combination Retirement Strategy Look Like

The earlier you can start saving for retirement, the better, but when you start, saving a lot of money in both a 401 and a Roth IRA might not be feasible.

Start by maxing out a Roth IRA while you are in your 20s, and if there is a company 401 as well, contribute just up to the amount you need to get your employers match, Whitney says.

As your income rises, saving on income taxes might become more important to many households. At that point, contributing more aggressively to a 401 account should become more attractive.

Planning your strategy this way allows you to end up with both types of accounts in retirement that have been growing for years.

You May Like: Investing In Nasdaq Vs S& p 500

Set Up Contributions To Your Roth Ira

Ever heard the phrase, Out of sight, out of mind? You can actually use this principle in your favor! How? By automating your investing. You can set up payroll deductions, automatic bank withdrawals or direct deposits to fund your Roth IRA.

But hold up. There are limits to how much money you can put into IRAs each year. For 2022, you can invest $6,000 in either a traditional IRA or a Roth IRA. If youre 50 or older and need to catch up, you can add an extra $1,000 for a total of $7,000.3

Setting up automatic IRA contributions will take extra paperwork, but its worth the time to make sure youre putting away money for retirement consistently. And because you never see that money, you wont even miss it! Plus, you wont be tempted to use it to pay for new tires or a new pair of jeans.

But dont go so far with this idea that you never check in on your investments. Youve got to make sure your investing plan is still on track so you can make changes if you need to.

How Age Affects How Much To Invest In Stocks

Why every year counts

Age can also be used as an initial guideline when determining how much to invest in stocks when youre investing for retirement. Thats because the longer the money will be invested, the more time there is to ride out any market ups and downs. That could help realize the potential for growth in your investments, which may be an important factor in saving enough for retirement. In general, the younger you are, the heavier your investment mix could tilt toward stockas much as you are comfortable with and fits with your time horizon, risk preferences, and financial circumstances. The chart shows how a $6,000 IRA investment could grow to $64,059 over 35 years.

All else equal, as you get closer to retirement, you may want to adjust your allocation. Being too aggressive could be risky as you have less time to recover from a market downturn. As a general rule, in the absence of changes to risk tolerance or financial situation, ones asset mix should become progressively more conservative as the investment horizon shortens. However, investing too conservatively could limit the growth potential of your money. So, it may make sense to gradually reduce the percentage of stocks in your portfolio, while increasing investments in bonds and short-term investments.

To learn more about building an asset mix that fits you, read Viewpoints on Fidelity.com: How to start investing

Don’t Miss: Bank Of America Sustainable Investing

Who Is Eligible For A Roth Ira

To invest directly in a Roth IRA, you have to meet a few requirements. Remember, if you exceed the income limits you can always follow the Backdoor Roth IRA strategy which we will discuss later on! These requirements are put in place by the IRS. You need to be a US Citizen with a US Address and Social Security Number. Beyond that, here are the requirements.

These requirements are for the 2022 tax year. We will do our best to update them, but you should always check with the IRS website or consult with a tax professional for the most current information.

If you make less than $125,000 as a single filer or $198,000 as married filing jointly, you can fully contribute to a Roth IRA. For those making more than $129,000 as a single filer or $204,000 as married filing jointly you cannot directly contribute to a Roth IRA. If you fall in between these figures, use this calculator to see how much you can contribute.

Whats The Difference Between A Roth Ira And A Traditional Ira

Both types of IRAs allow you to save for retirement. A Roth IRA allows you to save after-tax funds, and you must meet income requirements to continue to one. You can withdraw those funds tax-free in retirement. A traditional IRA allows you to save pre-tax funds, and you may be able to deduct your contributions depending on your income and whether you and/or your spouse have retirement plans at work. You pay taxes on withdrawals in retirements.

Also Check: How To Invest In Silver Futures

When Can I Withdraw From My Roth Ira

You can withdraw anytime from a Roth IRA, but there may be some penalties.To avoid a potential 10% early withdrawal penalty, you should withdraw after the age of 59½ or once your Roth IRA account has been open for five years. You can withdraw early and avoid penalties if you are buying a home for the first time, have college expenses to pay for, or need to cover birth or adoption expenses.

What Is A Roth Conversion Ladder

First, lets start with the Roth IRA. A Roth IRA is a retirement account that allows investors to enjoy tax-free growth and make tax-free withdrawals in retirement. Thats because you pay taxes on your money before depositing it into the Roth. You can also withdraw your contributions at any time, tax and penalty free.

Read Also: Best Investment Property Loan Rates

Why Invest Everything That You Can Today

$261,000 is the difference between someone who starts investing at 25 and waits until ten years later in this example.

Furthermore, $96,000 is the difference in lifetime amount contributed/invested by the 25-year-old and the 35-year-old.

Hence, assuming a contribution is $400 monthly at an 8% average annual return.

The 25-year-old only contributed to their investment for ten years, while the 35-year-old did for 30 years and still couldnt meet up.

Therefore, TIME and COMPOUNDING INTEREST is whats at play here.

So, this is why you should start investing as early and often as possible. Forget the excuses, the anxiety, and procrastination. It only takes 5 minutes to open an investment account.

Besides, 5 minutes can be the difference between reaching financial independence 20 years earlier than your peers.

Don’t Forget These Important Steps

Once you get your account set up, what’s next?

For a Fidelity Roth IRA: Make your first contribution. Once your money is in your IRA, you should get it invested. This is a very important stepinvesting is how your money has the potential to grow over time.

For a Fidelity Go® Roth IRA or Fidelity® Personalized Planning & Advice Roth IRA: Make your first contribution. You don’t need to choose or manage your investmentswe do that for you based on the information you gave us.

If you use Fidelity Personalized Planning & Advice, you might also want to set up a coaching appointment and review your full financial picture. That’s why we’re here!

Recommended Reading: How Do I Invest In Cryptocurrency

Roth Ira Taxes And Penalties

With a Roth IRA, you are contributing post-tax income. There are no tax breaks or immediate tax benefits associated with a Roth IRA. Contributions to your 401 can be used to lower your taxable income. This is not the case with the Roth IRA. Since you already paid taxes on them, you can withdraw your contributions at any time penalty-free.

There are two requirements you have to meet to withdraw earnings tax and penalty-free:

1. The 5 Year Rule

The 5 Year Rule states that your Roth IRA must have been open for at least 5 years prior to withdrawing any earnings.

2. One of the following:

- Reaching age 59 1/2

- Disability of the account owner

- Death of the account owner

- First-time homebuyer

If you are over 59-1/2 and you withdraw earnings from a Roth IRA that you have had for less than 5 years, you will pay taxes but not penalties. If you are under 59-1/2 and you withdraw earnings at any time, you will pay taxes on the earnings and a penalty of 10% of the total distribution. Talk about a slap on the wrist!

There are a few other uncommon cases where you can withdraw from a Roth IRA penalty-free. You will still have to pay the taxes. This includes using the money to pay for qualified education expenses, medical bills, or health insurance if unemployed. There are also some cases where if you become disabled or pass away, you may not have to pay the penalty.

Choose Investments Within Your Roth Ira

So, once youve opened your account, your next step is to choose what to invest in. Remember: Your Roth IRA is not an investment in itselfit only holds your investments and protects them from income taxes. You can put all kinds of different investments into your Roth IRA. Choosing your investments is by far the most difficult step in starting a Roth IRA because youve got so many options.

We recommend a mix of mutual funds because they allow you to spread your investments across a lot of companies, which lowers your risk while allowing your money to grow. Thats called diversification. If you put all your eggs in one basket , at some point, youre going to end up with a mess on your hands.

Here are some other benefits of mutual funds:

- Mutual funds allow you to use the power of the stock markets long history of growth without taking on the risk of single stock investing. The stock market historically has an annual average rate of return between 1012%.2

- Mutual funds are managed by teams of investing professionals who make sure the mutual fund performs at the highest level possible. They live and breathe this stuff!

- If you decide to work with an investing professional to open your Roth IRA and choose your mutual funds, the up-front commissions pay for your pros time and expert advicenot just at the time you open your account but for as long as you invest in your Roth IRA.

Don’t Miss: How To Invest In Paxos

Determine If You Are Eligible For A Roth Ira

The first step is to determine whether or not you are eligible for a Roth IRA in the first place. We covered this earlier, but the income limits set by the IRS for 2022 are $129,000 for single filers and $204,000 for married filing jointly. If you fall below these requirements, you are good to go! If not, skip ahead to the section on the Backdoor Roth IRA.