Investing In Private Equity

It is possible to invest directly in privately-owned companies. Unfortunately, most investors lack the relationships, expertise, and resources necessary. Even those with access may be unable to source attractive investments, conduct due diligence, or negotiate and structure the transaction, and monitoring a private equity investment can prove challenging.

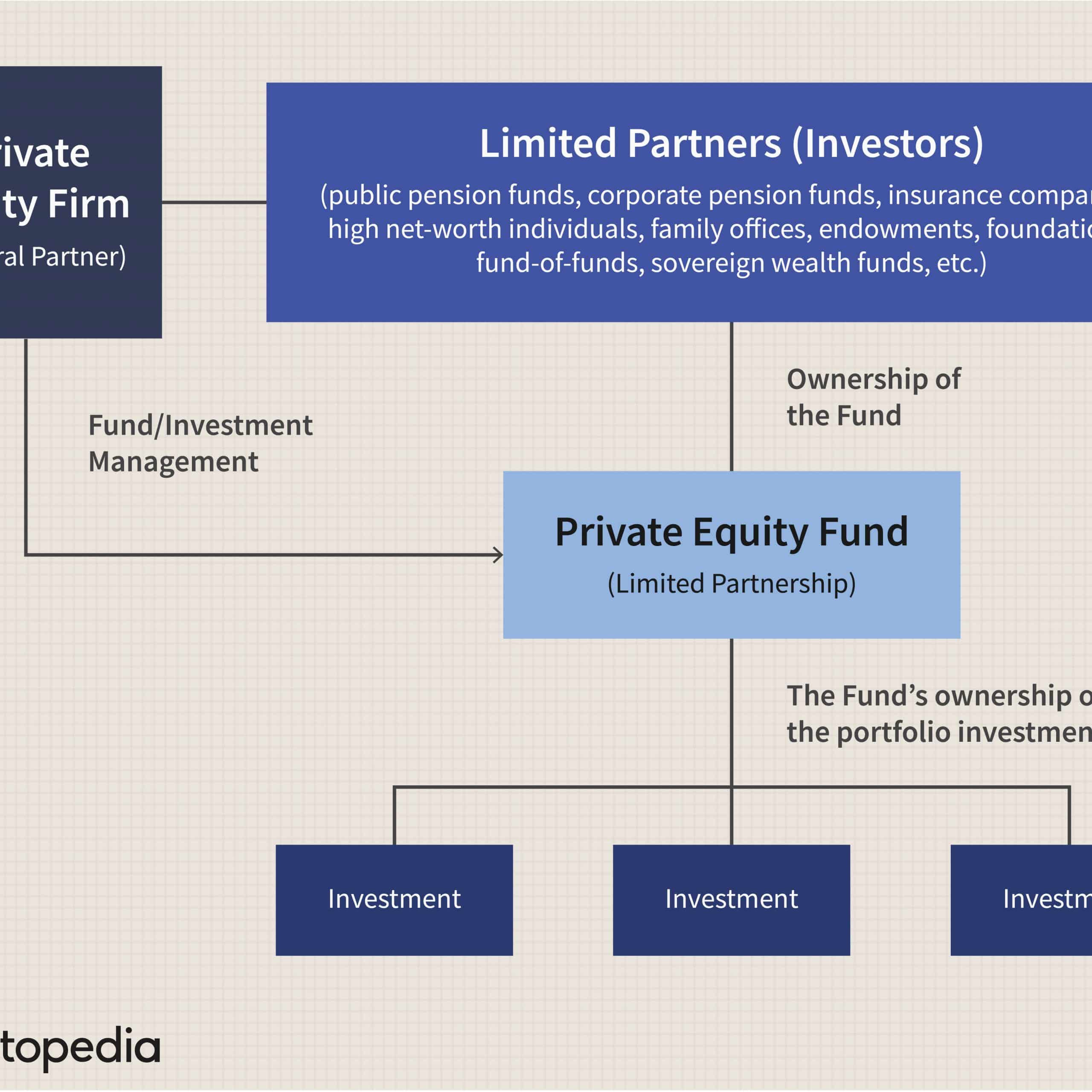

Instead, most investors gain exposure to private equity through a fund. Private equity funds offer professional management and greater diversification than a single asset .

Gaining access to private equity funds has historically been difficult for individual investors, with minimums for direct investment in private equity funds typically around $5 million. However, increasing numbers of managers have offered pooled feeder funds with lower investment minimums that typically range from $100,000 to $250,000. Minimums are even lower among the emerging universe of innovative registered funds, which allow individual investors that meet investor qualifications to access private equity funds by investing as little as $25,000.

What Makes A Good Private Equity Chair

In the world of private equity, the role of Chair is a vital component in any investment, serving as the buffer between lead shareholder and management. In the latest in our Insights series, we asked Managing Partner Richard Daw to reflect on the qualities that make an effective private equity Chair. We also asked some of those who have held the role at past and present Phoenix partner companies to share their thoughts on the hallmarks of a great Chair.

The first time Alun Cathcart, a serial non-executive who has chaired companies including Avis, Rank and Selfridges, meets a chief executive around the Board table, he has a simple message for them: You have nothing that I want. My role is to make you more successful.

My top priority as Chair is to focus support on the CEO. It can be a lonely and challenging role and the Chair can provide counsel and encouragement, as well as challenge. If the CEO is successful, all shareholders benefit.

A good Chair is available to help on anything or nothing as the situation demands. Implication: EQ is every bit as important as IQ.

So what should an effective Chair be doing? They need to help the team focus on the right priorities and ensure that there is a well thought through strategy and set of objectives in place.

For this reason, we prefer to find Chairs who have what we might term situational experience, rather than sectoral experience.

Types Of Private Equity Investments

Following a contribution to a private equity fund, the general partner can use your contribution in different ways to generate profit. The types of investments made by a fund are typically known in advance, so you are unlikely to be surprised that a real estate fund invested in a Silicon Valley tech startup.

Heres a summary of a few common private equity investments.

Also Check: Can I Open An Investment Account For My Kid

Essential Products And Services

Companies that provide essential products or services are vital to the functioning of a market or industrymaking them resilient through various macroeconomic conditions.

Such mission-criticality is typically derived from the dynamics of the competitive landscape and position in the value chain. Often, the product or service may be a small component of the customers overall cost structure, making factors other than price most relevant.

The Key Questions

When evaluating a businesss products and services, we seek to determine its value proposition over time and the risk of product or service substitution.

Key questions we ask include:

- Why does a particular business need to exist?

- How has the core product and value proposition changed over the past decade?

- Where does the product or service fit into a customers value chain?

- What will the industry look like in 10 years? 20 years?

TWO

Getting Ready For Private Equity Investment

At a time when access to finance is proving critical to many, mid-market businesses are looking beyond traditional sources and turning to private equity to fund their growth. Our specialists explore how private equity firms are now working with their portfolios and how the mid-market can benefit from investment.

As global markets grapple with the impacts of COVID-19 and face an extended period of uncertainty, mid-market businesses have growing concerns about their ability to raise finance to invest in growth. As a result, leaders are increasingly looking to alternative finance like private equity to achieve their strategic ambitions.

PE investment has long been seen as a potential source of capital for the mid-market. Indeed, for many firms, finding the right PE partner aligned to their goals has acted as a growth catalyst and helped the firm to its next stage.

That trend may continue. The latest Global Business Pulse following the first wave of COVID-19 lockdowns, showed that 46% of global business leaders viewed a shortage of finance as a constraint on growth a jump from 37% in the previous half. Figures from H1 2019 also showed there was a considerable appetite for private equity investment in the mid-market with 37% of businesses looking at PE to fund international growth. When it came to M& A, 36% were thinking of PE while 29% of businesses aiming for organic growth expect to support their strategy via PE investment.

Don’t Miss: How To Invest In A Company Before It Goes Public

Real Estate Private Equity

Real estate private equity funds require higher minimum capital for investment as compared to other funding categories in private equity. Investor funds are also secured for several years in this type of funding. According to research firm Preqin, real estate funds in private equity are expected to grow by 50% by 2023 to reach a market size of $1.2 trillion.

Private Equity Vs Public Equity

Public markets provide investors the opportunity to invest in public equity such as stocks and bonds on a market exchange with transparency and liquidity. Public equity investments are readily available for all types of investors.

Private equity is not traded on a public exchange, often requires and long investment time commitment, and provides a low level of liquidity. Investors in private equity are accredited investors, defined by investment regulations with a specified net worth.

Investment in private equity is viewed as riskier than investing in the public marketplace as private equity investments are less regulated than public investments.

You May Like: Best Way To Start Investing In Cryptocurrency

How Has Private Equity Entered The Housing Market

As the U.S. crawled out from the Great Recession, private equity firms took advantage of very low interest rates and the appetite of investors looking for seemingly stable places to stash their cash to venture into new fields like residential real estate. Amid a nationwide affordable housing crisis, private equity has quickly become a dominant player in the apartment rental business.

Some have likened the private equity cycle of acquire, restructure, resell, repeat to the practice known as house flipping, in which a buyer purchases a home, makes improvements, then quickly sells it at a profit. But as ProPublica reporting has demonstrated, the way private equity firms restructure the homes they purchase differs significantly from the changes a house flipper would make.

A house flippers target buyer is someone looking to purchase a home, and so the upgrades the investor makes are intended to make the property more appealing to the people who will be living in it: Getting rid of popcorn ceilings and plywood paneling, replacing the kitchen appliances, slapping on new coats of paint and improving the curb appeal. Conversely, equity firms are eventually hoping to sell their housing assets to property management firms or other investors. These buyers are much less interested in whether the flooring is real wood or laminate, so long as the units are filled and tenants are paying their bills.

A Strong Management Team

Investors place their bets on a good idea yet they also want assurance that the right people are in place to realize the ideas full potential. PE firms will especially seek this assurance if they view your business as a good platform company, which they will bolt other companies onto over time. PE investors want to know that the target companys CEO and CFO are competent to run the business today and capable of impressing investors tomorrow, when it is time to sell. If a PE group does not perceive that your current management team is up to the challenge, they will want to be ready with a plan to replace the team quickly.

Read Also: I Want To Invest In Real Estate

The Strategic Secret Of Private Equity

Reprint: R0709B

The huge sums that private equity firms make on their investments evoke admiration and envy. Typically, these returns are attributed to the firms aggressive use of debt, concentration on cash flow and margins, freedom from public company regulations, and hefty incentives for operating managers. But the fundamental reason for private equitys success is the strategy of buying to sellone rarely employed by public companies, which, in pursuit of synergies, usually buy to keep.

The chief advantage of buying to sell is simple but often overlooked, explain Barber and Goold, directors of the Ashridge Strategic Management Centre. Private equitys sweet spot is acquisitions that have been undermanaged or undervalued, where theres a onetime opportunity to increase a businesss value. Once that gain has been realized, private equity firms sell for a maximum return. A corporate acquirer, in contrast, will dilute its return by hanging on to the business after the growth in value tapers off.

Public companies that compete in this space can offer investors better returns than private equity firms do. Corporations have two options: to copy private equitys model, as investment companies Wendel and Eurazeo have done with dramatic success, or to take a flexible approach, holding businesses for as long as they can add value as owners. The latter would give companies an advantage over funds, which must liquidate within a preset timepotentially leaving money on the table.

Private Equity Offers Funds Expertise And Experience

As businesses review their strategies and where they need to make investments for growth in the wake of COVID-19, private equity is becoming a more interesting finance option. Dinesh Anand, global head of private equity and partner at Grant Thornton India, says: “There’s a lot of liquidity. Private equity funds are sitting on huge amounts of dry powder, and they have the money to invest.”

PE investors are proactively searching for the right businesses either to buy outright in the case of succession and the owner exiting or to transform the growth prospects of those assets through investing in organic and buy and build strategies.

Many owners are drawn to PE because of the expertise an investment partner can bring as part of the transaction. Anand says: “In a way, the cost is much higher because you’re giving away some equity. But while the cost is higher, so are the expectations. You’re bringing in a partner who is going to provide a high level of operating efficiency and ideally give you access to new talent and/or provide access to certain geographies you don’t yet have.”

Read Also: Best Investment Grade Municipal Bond Funds

What Public Companies Can Do

As private equity has gone from strength to strength, public companies have shifted their attention away from value-creation acquisitions of the sort private equity makes. They have concentrated instead on synergistic acquisitions. Conglomerates that buy unrelated businesses with potential for significant performance improvement, as ITT and Hanson did, have fallen out of fashion. As a result, private equity firms have faced few rivals for acquisitions in their sweet spot. Given the success of private equity, it is time for public companies to consider whether they might compete more directly in this space.

Conglomerates that acquire unrelated businesses with potential for significant improvement have fallen out of fashion. As a result, private equity firms have faced few rivals in their sweet spot.

We see two options. The first is to adopt the buy-to-sell model. The second is to take a more flexible approach to the ownership of businesses, in which a willingness to hold on to an acquisition for the long term is balanced by a commitment to sell as soon as corporate management feels that it can no longer add further value.

Pros And Cons Of Private Equity

Private equity offers several advantages to companies and startups by providing access to funding from sources like venture capital instead of using funding from traditional financial instruments, like high-interest bank loans.

If a company is de-listed or removed from an exchange, private equity financing provides growth strategies away from the public markets without the pressure to sustain earnings for investors.

Private equity has unique challenges as it can be difficult to liquidate holdings in private equity. Unlike a transaction on an exchange, a firm must search for a buyer to sell its investment or company.

Pricing of shares for a company in private equity is determined through negotiations between buyers and sellers and not by market forces. The rights of private equity shareholders are decided on a case-by-case basis through negotiations instead of a broad governance framework that typically dictates rights for their investors in public entities.

Read Also: I Want To Start Investing In Stocks

Choosing And Executing A Portfolio Strategy

As we have seen, competing with private equity offers public companies a substantial opportunity, but it isnt easy to capitalize on. Managers need skills in investing and in improving operating management. The challenge is similar to that of a corporate restructuringexcept that it must be repeated again and again. There is no return to business as usual after the draining work of a transformation is completed.

Competing with private equity as a way to create shareholder value will make sense primarily for companies that own a portfolio of businesses that arent closely linked. In determining whether its a good move for your company, you need to ask yourself some tough questions:

Do you have the skills and the experience to turn a poorly performing business into a star? Private equity firms typically excel at putting strong, highly motivated executive teams together. Sometimes that simply involves giving current managers better performance incentives and more autonomy than they have known under previous ownership. It may also entail hiring management talent from the competition. Or it may mean working with a stable of serial entrepreneurs, who, although not on the firms staff, have successfully worked more than once with the firm on buyout assignments.

Mapping Potential Portfolio Strategies

If you can comfortably answer yes to those three questions, you next need to consider what kind of portfolio strategy to pursue.

Drawbacks Of Private Equity

Although private equity can be a lucrative investment option for high-net-worth individuals, it is not the only alternative asset class that provides attractive returns. Investors interested in private equity, venture capital, or other alternatives should be aware that their potential for higher returns also comes with higher risk. A high degree of risk tolerance and the ability to handle substantial illiquidity are necessary for success in private equity markets. In some cases, it can take a year or more to sell investments in private equity.

Don’t Miss: Merrill Lynch Socially Responsible Investing

Which Strategy Is Best

The answer to this question is the same as many in business: it depends.

As with anything, the success of any investment strategy is contingent upon an excess of external factors such as the economy and social or technological trends.

Comparing VC and PE firms, both have the potential to generate substantial profits.

âHowever, PE firms are capable of paying out more than venture capital firms largely due to factors like bigger fund sizes.

Many large buyouts may not be as lucrative since debt with a high yield does not come cheap, but middle market buyouts remain attractive even now.

Overall, there is a greater amount of opportunities for seeing growth in emerging markets than in developed markets.

The availability of greater profits nationwide has fuelled the growth behind PE firms.

Useful Links

What Role Is Private Equity Playing In The Fishing Industry

One way private equity firms try to generate greater returns is to acquire similar assets and operate them under the same umbrella, allowing firms to take advantage of economies of scale by sharing costs. That often means putting a greater burden on workers, whether its nurses having to make due with fewer vital supplies, apartment employees having to work at multiple buildings or fishing vessels seeing their earnings chiseled away by equity owners who have shifted the costs of doing business onto individual operators.

Tell me how I can catch 50,000 pounds of fish yet I dont know what my kids are going to have for dinner, asked fisherman Jerry Leeman in a recent ProPublica-New Bedford Light investigation into how private equity has taken over the New Bedford, Massachusetts, fishing industry.

While Leeman and his crew are not struggling to catch fish, their deal with equity-owned Blue Harvest leaves them responsible for much of their working expenses. Theyre charged for fuel, gear, leasing of fishing rights and maintenance on company-owned vessels. While some of the fish they catch typically sell for $2.28 per pound at auction, Leeman has netted only about 14 cents per pound. Each of his crew members earns about half that amount.

Their situation is a result of a race in recent years by investors to snatch up as much of the regional fishing industry as possible.

You May Like: Modern Investment Management An Equilibrium Approach

How We Can Help

As the largest growth investor in the UK and Ireland, BGF has invested in more than 400 small and medium-sized businesses, deploying a total of around £2.5 billion of investment. Our teams are spread across the UK and Ireland in a network of regional offices.

We have broad sector expertise, investing in everything from high-growth online businesses to advanced manufacturing companies and start-ups developing life-saving medicines. If youre interested in what we have to offer, please contact us today.