Diversify With Reits And Real Estate Mutual Funds

With real estate becoming a firm part of the capital asset allocation matrix for both institutional and retail investors, real estate funds have seen steady growth recently. Due to the capital-intensive nature of real estate investing, its requirement for active management, and the rise in global real estate opportunities, institutions seeking efficient asset management are gradually moving to specialized real estate funds of funds.

The same is now true for retail investors, who can benefit from access to a much larger selection of real estate mutual funds than before, allowing for efficient capital allocation and diversification.

Like any other investment sector, real estate has its pros and cons. It should, however, be considered for most investment portfolios, with real estate investment trusts and real estate mutual funds seen as possibly the best methods of filling that allocation.

What Are The Requisites For Managing A Reit

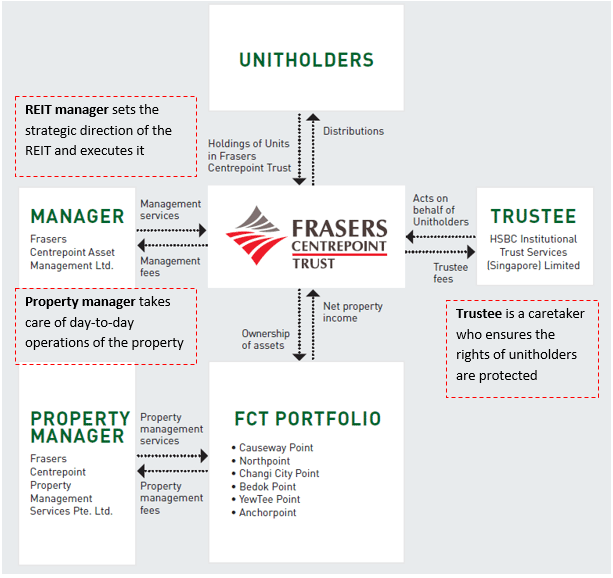

Like mutual funds, real estate investment trusts allow both small and big investors to acquire ownership in real estate ventures. It is governed by a law that intends to provide investment opportunities and strong income vehicles. In other words, it is similar to stocks traded in the market.

Reits have the following requirements:

- All REITs should at least have 100 shareholders or investors and none of them can hold more than 50% of the shares

- Must have at least 75% of its assets invested in real estate, cash, or treasuries

- 75% of its gross income must be obtained from real estate investments

- Must pay dividends equaling at least 90% of their taxable income to shareholders

- Must be managed by a Board of Directors or Trustees

Do I Have To Pay Taxes On Rental Income

If you are a landlord, yes, you will have to declare rental income and pay taxes on it. Note that rental income is often considered passive income. If you have expenses related to the property, such as utilities, repairs, or insurance, you may be able to deduct those expenses against the rental income.

Don’t Miss: Short Term Mutual Fund Investment

Pros Of Investing In Reits

- Diversification: REITs allow you to diversify your investment portfolio by investing in a new asset class. These investments can also allow you to tap new geographic markets, which is key to expanding your portfolio.

- High Dividend Yields: REITs are legally required to pay 90% of their taxable income back to shareholders, so these investments tend to have higher-than-average dividend yields.

- Liquidity: Compared to investing directly in real property, many REITs are a highly liquid investment. This can help you improve your cash flow, which would otherwise be locked up in a traditional real estate investment.

Real Estate Investment Trusts : What They Are And How To Invest In Them

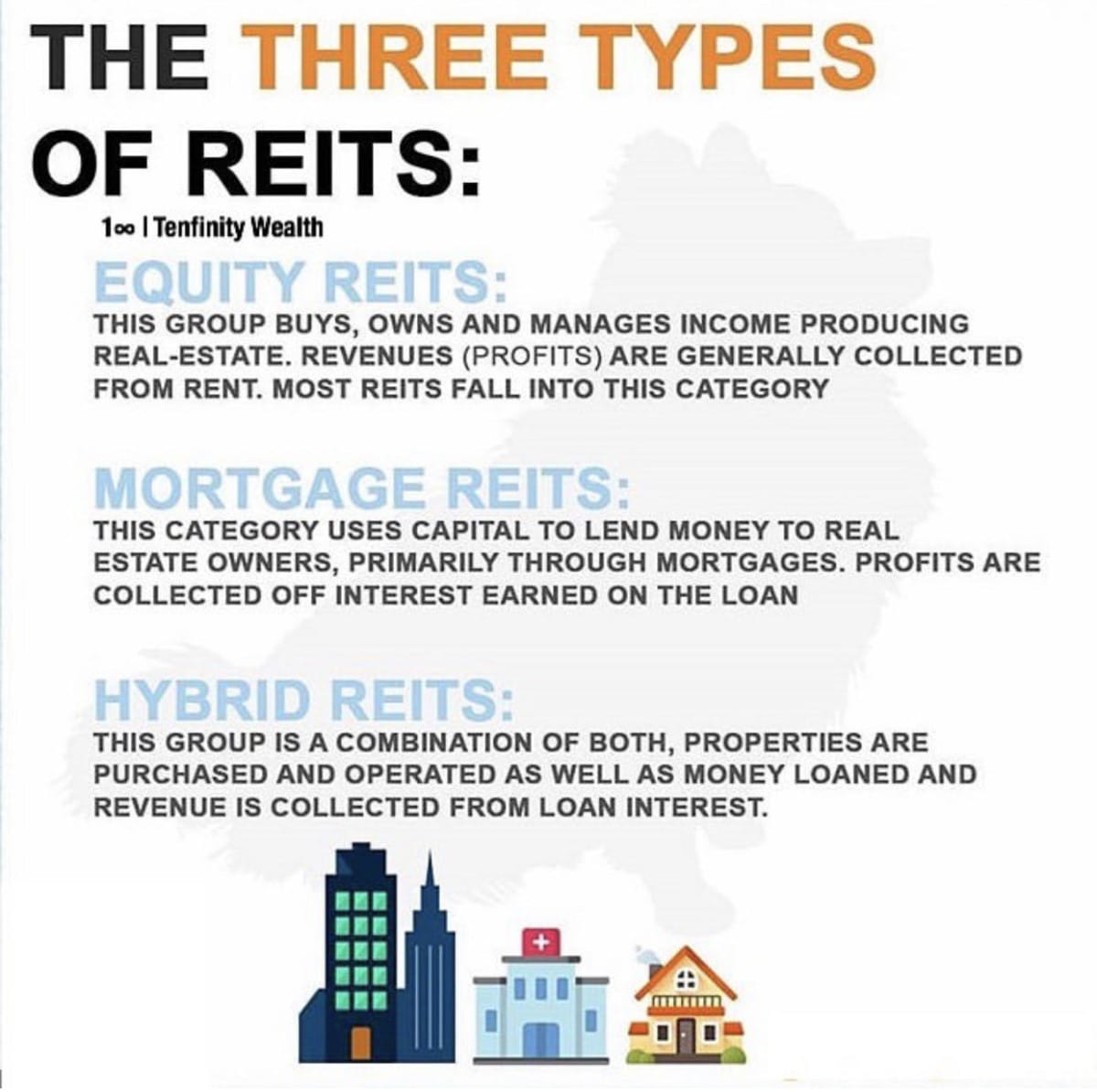

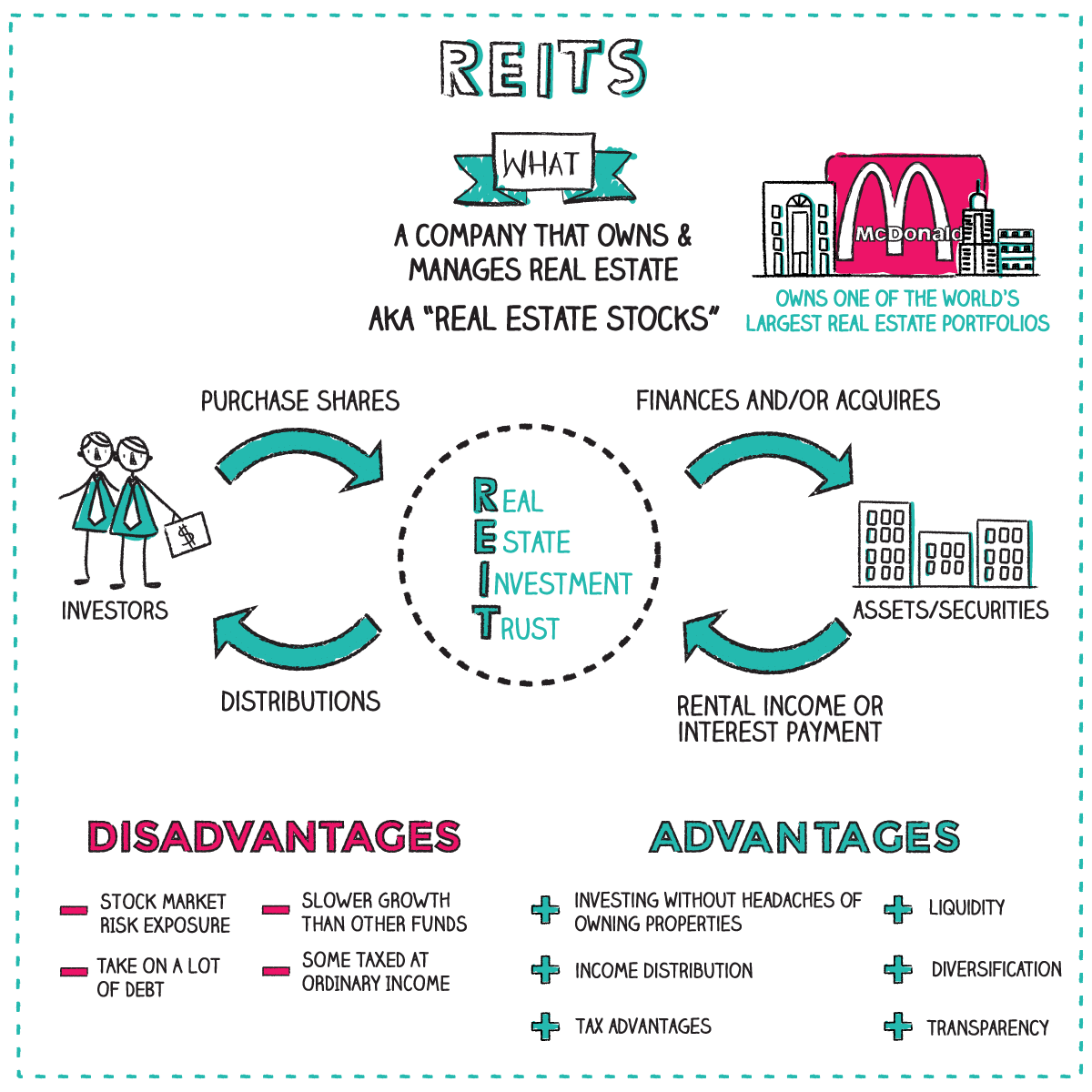

A REIT , or real estate investment trust, is an entity that holds a portfolio of commercial real estate or real estate loans. Congress created REITs in 1960 to provide all investors, especially retail investors, with access to income-producing commercial real estate. REITs combine the best features of real estate and stock investment.

This guide will walk you through everything you need to know about real estate investing through REITs. Well cover the types of REITs, REIT pros and cons, how to invest in REITs, and what qualifies a company as a REIT.

Also Check: Private Equity Firms Investing In Automotive

How Do Reits Work

REITs are structured similarly to mutual funds, pooling money from multiple investors. The trust may use that capital to buy properties outright or to finance real estate acquisitions.

Typically, a REIT company focuses on a particular type of income-producing propertyâshopping malls, hotels, infrastructure, warehouses, or moreâbut some do hold multiple types of property in their portfolios. Many REITs are traded like stocks on the major stock exchanges, so they give individual investors an opportunity to passively invest in real estate.

Investors can make money if the shares of a REIT they own rise in value. They can also make money through dividends on the shares. By law, REITs must pay at least 90% of their taxable income to their shareholders as dividends. By doing this, they are exempt from most federal corporate taxes.

Companies must follow several REIT requirements from the Internal Revenue Service to qualify. Structural requirements include but are not limited to:

- Must be a corporation, trust, or association

- Must be managed by one or more trustees or directors

- Must be held by 100 or more shareholders from its second tax year onward

- Would otherwise be taxed as a domestic corporation

Companies also have certain financial requirements to be considered a REIT. A company must:

Real Estate Mutual Fund Performance

Since they mainly invest in REITs, real estate mutual fund performance is closely correlated with that of the REITs they hold. Mutual funds, however, may be less liquid, be less tax-favorable, and carry higher management fees than REITs or REIT ETFs. Although real estate mutual funds bring liquidity to a traditionally illiquid asset class, critics believe they cannot compare to direct investment in real estate.

Don’t Miss: Investment Property Loan Down Payment

How Real Estate Investment Trusts Work

Since REITs return at least 90% of their taxable income to , they usually offer a higher yield relative to the rest of the market. REITs pay their shareholders through dividends, which are cash payments from corporations to their investors. Although many corporations also pay dividends to their shareholders, the dividend return from REITs exceeds that of most dividend-paying companies.

REITs have to pay out 90% of taxable income as shareholder dividends, so they typically pay more than most dividend-paying companies.

Some REITs specialize in a particular real estate sector while others are more diverse in their holdings. REITs can hold many different types of properties, including:

- Apartment complexes

- Self-storage facilities

- Retail centers, such as malls

REITs are attractive to investors because they offer the opportunity to earn dividend-based income from these properties while not owning any of the properties. In other words, investors dont have to invest the money and time in buying a property directly, which can lead to surprise expenses and endless headaches.

If a REIT has a good management team, a proven track record, and exposure to good properties, it’s tempting to think that investors can sit back and watch their investment grow. Unfortunately, there are some pitfalls and risks to REITs that investors need to know before making any investment decisions.

What Companies Are Considered Reits

To qualify as a REIT, a company has to meet certain requirements as outlined by the Internal Revenue Code . In order to be considered a REIT, a company must:

- Be a taxable corporation that is managed by a board of directors or trustees

- Have at least 100 shareholders after the first year

- Acquire 75% of gross income from rent, interest on mortgages or real estate sales

- Invest a minimum of 75% of total assets in real estate, cash or U.S. Treasuries

- Pay at least 90% or taxable income in the form of shareholder dividends

- Have 50% or less or shares held by five or fewer people

Don’t Miss: Best Short Term Investment Grade Bond Funds

Shaukat Khanum Trust: Real Estate Investments Channeled Towards Cancer Care

LAHORE: In response to the recent controversy surrounding comments made by Imran Khan in court, the management of the Shaukat Khanum Memorial Trust has clarified that a $3 million investment in an endowment fund for a real estate project in Oman was made solely for the purpose of providing quality cancer care.

The trust denied any misuse or diversion of funds by its chairman, former prime minister Imran Khan, or any other individual.

An SKMT spokesperson said that all funds, including those invested in the endowment fund, are used solely to support the mission of providing world-class care to cancer patients.

The spokesperson also emphasized that the chairman does not make investment decisions independently and that the investment committee supervises all investments made by the fund.

A Statement by the Management of Shaukat Khanum Memorial Trust Denying Misuse of Funds read full version

Shaukat Khanum

He also noted that only non-Zakat funds are invested in this manner, with all Zakat collected being used for direct patient care within the year in which it is collected.

The trust also confirmed that in 2008, $3 million was invested by the endowment fund in a real estate project in Oman and that the investment allowed for an early exit with a 100 percent capital guarantee.

In 2015, the entire amount of $3 million was recovered by SKMT.

Description For : Real Estate Investment Trusts

Division H: Finance, Insurance, And Real Estate | Major Group 67: Holding And Other Investment Offices | Industry Group 679: Miscellaneous Investing

6798 Real Estate Investment TrustsEstablishments primarily engaged in closed-end investments in real estate or related mortgage assets operating so that they could meet the requirements of the Real Estate Investment Trust Act of 1960 as amended. This act exempts trusts from corporate income and capital gains taxation, provided they invest primarily in specified assets, pay out most of their income to shareholders, and meet certain requirements regarding the dispersion of trust ownership.

- Mortgage investment trusts

- Real estate investment trusts

- Realty investment trusts

Don’t Miss: 15 Year Mortgage Rates Investment Property

Is It Better To Do My Own Investing And Not Invest In Real Estate Investment Trusts

With Real estate investment trusts, you have no landlord responsibilities because the REIT does everything for you. With a REIT, you have no landlord responsibilities. They buy the property, manage it, and do the accounting, so there’s no responsibility when investing in a REIT. Also, a REIT is liquid, so if you don’t like what the management is doing, you can sell and get out.

On the other side, if you do your own investing and purchase your own commercial real estate, you are in control to buy whatever you want, wherever you want, whenever you want. You can refinance or improve cash flow by increasing your income, whenever you want. Because you are completely in control of your property, you can even choose to sell it. You will receive a greater cash flow and greater returns, and also reap all of the tax benefits. When you invest in a REIT that is a huge property with huge depreciation, as a shareholder, you do not get to experience that benefit. But if you buy your own property, you get the full benefits of depreciation.

If you invest on your own you can also use leverage. You can take $100,000 and purchase $100,000 worth of shares in a REIT

You can leverage by using your $100,000 as a down payment on a $400,000 mortgage, to purchase a $500,000 property.

What Is A Triple Net Reit

A triple net REIT is an equity REIT that owns commercial properties utilized triple net leases. The triple net lease means that the costs of structural maintenance and repairs must be paid by the tenantin addition to rent, property taxes, and insurance premiums. Because these additional expenses are passed on to the tenant, the landlord generally charges a lower base rent. This absolves the REIT of the most risk of any net lease.

Read Also: Private Equity Firms Investing In Food And Beverage

Reits Vs Real Estate Mutual Funds: An Overview

Real estate investment trusts and real estate mutual funds both offer diversification and an easy, affordable way for individual investors to invest in various segments of the real estate market. They also represent a more liquid vehicle for investment in this sector than owning or investing in real estate directly.

There exists a wide variety of REITs and real estate sector mutual funds to choose from. Before considering either type of instrument, you need to understand the key differences between the two, as well as their pros and cons.

What Is A Real Estate Investment Trust

A real estate investment trust is a company that owns, operates, or finances income-generating real estate.

Modeled after mutual funds, REITs pool the capital of numerous investors. This makes it possible for individual investors to earn dividends from real estate investmentswithout having to buy, manage, or finance any properties themselves.

You May Like: Where Should I Invest In Cryptocurrency

What Is A Reit Or Real Estate Investment Trust

A real estate investment trust is a type of company that either owns, operates or finances income-generating real estate. REITs can be privately held or publicly traded companies.

REITs can be specialized, focusing on just one or two types of real estate, or diversified, owning, operating or financing many different types of real estate. Virtually any type of real estate capable of generating income, typically in the form of rent, can be owned, operated or financed by a REIT. Popular real estate categories owned by REITs include:

- Apartment complexes

Reit Vs Real Estate Fund

A REIT is an individual business that owns, operates or finances real estate in order to generate income for investors.

A real estate fund, by comparison, is a type of mutual fund that specifically invests in a variety of REITs and other businesses related to real estate. Some real estate funds may also invest directly in real estate. This makes investing in real estate funds a more diversified option compared with investing in individual REITs.

While real estate funds may provide investors with dividend payments, they are not required to do so by law, and yields tend to be lower than investing directly in REITs. Real estate funds instead aim to provide value to investors through price appreciation.

You May Like: What Is A Tfsa Investment

Pros And Cons Of Investing In A Reit

Like any other investment, there are some advantages and disadvantages that go along with purchasing shares in a REIT. The most obvious plus is that its an easy way for investors to get involved in real estate investing. Unless you have a substantial amount of cash or other investors backing you up, buying multiple properties and trying to rent them out or sell them for a profit usually isnt a realistic plan. With a REIT, you get to reap the rewards of a thriving real estate investment without needing to invest a lot of time and money upfront.

One downside of REITs, particularly mortgage REITs, is their susceptibility to interest rate fluctuations. Since changes in interest rates can significantly alter the value of mortgages on the resale market, REITs are particularly vulnerable to those changes in a way that typical stocks and bonds arent. REITs, as measured by the MSCI U.S. REIT index, have boasted higher annual returns than the S& P 500 since 2010, but that doesnt mean theyre inherently better investments. Just two years earlier, many REITs suffered extreme losses due to the financial crisis and the key role that the real estate market played in it.

The Difference Between Publicly Traded Reits Vs Non

REITs are classified by how they are bought, held and sold. Publicly Traded REITs are available to buy and sell on a national securities exchange. While public Non-Traded REITs are not traded, making them less liquid. However, they arent impacted by changes in the market, which brings additional stability to non-traded REITs. The SEC regulates publicly traded and non-traded REITs, while Private REITs are not.

Also Check: Is Bat A Good Investment

How Do I Invest In Reits

Your approach to investing in REITs depends on what type of investor you are. Some investors may want to invest in an exchange-traded fund or mutual fund that tracks a broad-based REIT index rather than investing in individual REITs. You can buy and sell REITs on your own with a Schwab One® brokerage account or call us at 877-566-0054 to talk to an experienced specialist about whether REITs are right for you.

When Aggregators Are Also Originators

Mortgage originators often become aggregators, as securitizing a pool of mortgages can be seen as a natural extension of their business. When the originator acts as an aggregator, they usually create a special purpose vehicle as a walled-off subsidiary for pooling and selling loans. This removes some liability and frees up the originators aggregator arm to purchase loans from other institutions as well as from the parent entity, as is sometimes necessary for the creation of a tailored MBS.

In theory, the originator-owned aggregators operate the same as third-party aggregators even though they are dealing with a majority of the mortgages from a single customer, which is also the owner. In practice, there could be situations that would not exist with a third party. For example, the aggregator could be subtly encouraged to not seek as steep a discount on secondary market mortgages to help the parent companys balance sheet, shifting any overall loss to the aggregator. Of course, the MBS market leading up to the mortgage meltdown had more significant issues than the possibility of an aggregator and originator colluding.

Read Also: Mitzli Jen Gem And Mine Investments Management Ltd

What Is A Reit

A REIT is a company that owns, operates, or finances income-producing real estate such as apartment buildings, office parks, hotels, and healthcare facilities.

Investors can buy and sell shares of publicly traded REITs on the major stock exchanges, and shareholders can profit from any price gains while also receiving dividends. Itâs a type of passive real-estate investing because someone else purchases and manages the properties.

Reit Types By Trading Status

Publicly traded REITs: As the name suggests, publicly traded REITs are traded on an exchange like stocks and ETFs, and are available for purchase using an ordinary brokerage account. There are more than 200 publicly traded REITs on the market, according to the National Association of Real Estate Investment Trusts, or Nareit.

Publicly traded REITs tend to have better governance standards and be more transparent. They also offer the most liquid stock, meaning investors can buy and sell the REITs stock readily much faster, for example, than investing and selling a retail property yourself. For these reasons, many investors buy and sell only publicly traded REITs.

Public non-traded REITs: These REITs are registered with the SEC but are not available on an exchange. Instead, they can be purchased from a broker that participates in public non-traded offerings, such as online real estate broker Fundrise. . Because they arent publicly traded, these REITs are highly illiquid, often for periods of eight years or more, according to the Financial Industry Regulatory Authority.

Non-traded REITs also can be hard to value. In fact, the SEC warns that these REITs often dont estimate their value for investors until 18 months after their offering closes, which can be years after youve invested.

Several online trading platforms allow investors to purchase shares in public non-traded REITs, including Modiv, the Diversy Fund and Realty Mogul.

You May Like: Buying Investment Property For Airbnb