Gold As An Investment

Before buying gold, it’s important to understand some of the factors that make gold unique:

- Newly-minted coins are typically 90% to 99% gold.

- Jewelry is typically 14-karat in the United States or 18-karat internationally, but other karat values can be found, all the way up to pure 24-karat

- Gold provides no income stream unless you own stocks or mutual funds that pay dividends.

- Owning gold stocks does not entitle you to possession of the metal.

- You may incur a cost to store physical gold.

- While the current supply is limited, as the price rises it makes more mining economically feasible, which could increase the supply.

- Demand is not a function of the true need for the metal, since much of it is not used for any commercial purpose other than the making of jewelry.

- Gold holdings are heavily concentrated among a limited number of governments and central banks, exposing gold to extreme price fluctuations as these institutions buy and sell.

Best Gold Coins To Buy As Investments

Disclosure: We are reader-supported. If you buy through links on our site, we may earn a small commission. Learn more.

What are the best gold coins to buy as investments? Precious metals are popular all over the world with both investors and collectors. Some are drawn to numismatics, rare, or proof coins, and others stick to bullion rounds and coins.

Whatever your preference, there are some coins that are consistently popular with both investors and collectors alike. In this article, we’ll cover nine of the best gold coins to hold as an investment in 2022.

Canadian Gold Maple Leaf Coin 1

The Canadian Gold Maple Leaf Coin has the highest value per gram of gold out of the remaining listed coins in this article. This gold bullion coin has been made by the Royal Canadian Mint and produced since 1987. The gold maple leaf coin is minted in various sizes, with each currency containing the exact weight of fine gold, representing the Canadian legal tender for all amounts. The Canadian gold coin comprises .9999 pure 24-karat gold and has been consistently ranked as one of the most popular gold coins.

Recommended Reading: Morgan Stanley Los Angeles Investment Banking

Gold Mining Companies & Stocks

Investing in gold mining companies is an interesting way to combine gold investments with traditional stocks. By purchasing shares in a company that works with gold, investors can access the profits of gold without buying or selling it themselves. This form of investing can also provide lower risks, as there are other business factors at play that can help protect investors from flat or declining gold prices. That being said, investors conduct significant research when searching for the right company to invest in. There are risks associated with the mining industry that can interfere with overall profits or even bring up ethical concerns. Always do your research when selecting a gold mining company to invest in.

Precious Metals Gold Ira Silver Ira The Entrust Group

There is dispute over the security of purchasing gold. It is very important to note that many advisors advise that gold plays a part in a portfolio however does not consist of the totality of the portfolio. Supporters of gold IRA investing claim that one of the substantial advantages of gold is that it is an effective hedge.

Historically, it is true that gold has actually been used as a hedging possession versus increasing inflation. The value of gold stays the exact same throughout economic unpredictability. The stock market falling and high inflation have essentially no result on gold costs. Even when the worth of a currency falls, gold is not affected.

In some countries, gold has cultural value. In China, for instance, gold bars are the common kind of saving, so the gold market expanded. For these reasons, numerous investors swear by gold IRA investing. Gold is an asset that functions as a safe haven. The reliability of gold is observable through golds historically constant worth.

You May Like: Charles Schwab Investment Management Inc

Bars Or Coins: Which One Is The Ideal Choice For You

Bullion bars are made with the sole aim to serve as an investment vehicle. Its minimal aesthetic appeal and workmanship ensure the premium is kept as low as possible. Designed for easy stacking and minimum space, bars come in a wide range of weights.

The lack of beauty and artistic value of bars is a deterrent for many retail investors. While bars are the preferred choice among institutional buyers, individuals seem to prefer gold bullion coins.

Though a bit high on premium, gold coins are the best choice for investment for a variety of reasons. They are easy to identify and easy to buy as well as sell. The demand has always been high for them and most probably you will be able to get back the extra premium paid for it, sometimes even more.

Bars, on the other hand, have a lower premium but if you want to liquidate them quickly, you may lose out on the advantage. Buyers are harder to find for bars and the transaction charges are high.

What to know more?

When Should You Buy Gold

Many investors see gold as a good hedge against rising prices and a store of value. It has also historically been a strong hedge during times of financial crisis. The best times to buy gold are when concerns about inflation or economic crisis are beginning to surface since gold tends to rise during those periods.

Don’t Miss: How To Invest Online For Beginners

New Era In Gold Investments

The 1974 restoration launched a new era in gold investments. Trading in restrikes of the Mexican 50 Pesos and Austrian 100 Coronas gold bullion coins became quite popular. However, it was the introduction of South African Krugerrands that laid the foundation for todays vibrant gold bullion coin market.

Gold South African Krugerrands

The first Gold bullion coin in the world and a perennial favorite outside of the United States, the Gold South African Krugerrands is generally one of the more affordable Gold coins on the market and is notable for its unique hue and depiction of a springbok antelope. While some buyers feel it is not as detailed as other, more elaborate, Gold coin reliefs, this simple design has been around since 1967 and has proven staying power in the investment market.

More Krugerrands have been purchased thanallother 1 oz Gold coins available on the market. The Krugerrand contains .9167 fine Gold, with an alloy of 8.33% Copper to bolster the Gold durability.

Recommended as an excellent investment item for both new and experienced buyers, Krugerrands are generally liquid on the open markets worldwide. This beloved coin comes in different sizes including 1/50 oz, 1/10 oz, 1/4 oz, 1/2 oz, 1 oz, 1.85 oz and 2 oz.

Recommended Reading: Borrowing Money To Invest In The Stock Market

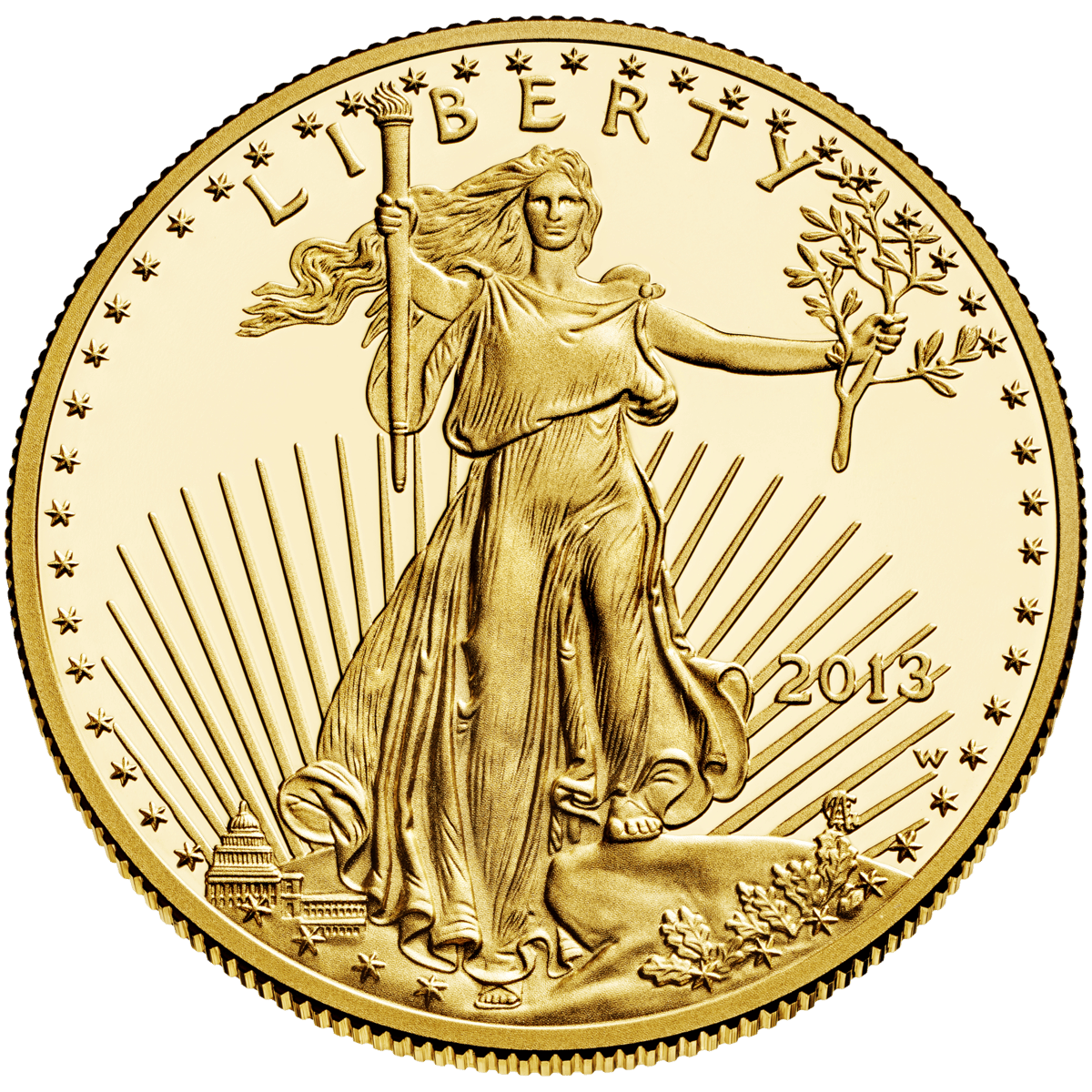

Design Background Of The Gold Eagle Series

The United States Mint chose a historic American coinage design for the American Gold Eagle. Augustus Saint-Gaudens was hand-picked by President Theodore Roosevelt in 1905 to help revitalize US gold coinage with a brilliant new design.

Saint-Gaudens crowning achievement was the Lady Liberty design that features Liberty in full-length figure, her hair and robe flowing freely in the breeze as she strides forward confidently from the nations capital. In her right and left hand are a torch for light, and an olive branch signifying peace all the things shell need to guide the nation toward a peaceful, if unknown, future.

His original design was used on the $20 Gold Double Eagle coin. In circulation from 1907 to 1933, it is considered the finest design on the greatest coin in American history. Saint-Gaudens himself never lived to see his design come to fruition on an American coin though, passing away due to complications from illness just months before the coins were released in 1907.

The reverse side of the coin features a family of nesting bald eagles, and was designed by Miley Busiek. In the image, a male bald eagle returns to the nest with branches in its talons. In the nest, a female is depicted standing vigilant guard over the young hatchlings in the nest. Busieks design was created in 1986, and is used exclusively on the American Gold Eagle.

South African Gold Krugerrand

Since its introduction in 1967, the Krugerrand has carried a storied history. The distinctly colored coin is 91.67 percent gold and 8.33 percent copper. Its name is a combination of South Africa’s first president, Paul Kruger, and the Rand Refinery, which mints the coin.

Kruger’s presidency lasted from 1883 through 1900. While he was in office, South Africa saw the founding of the Durban Deep Mine, and the Witwatersrand Gold Rush. These events eventually led to the founding of Johannesburg, one of South Africa’s largest cities.

During the 1970s and 1980s, the Krugerrand was illegal to import into the United States due to the South African nation’s apartheid laws. Before this time, the United States was one of the Krugerrand’s largest markets, because U.S. citizens were unable to own gold bullion but could own foreign coins and bullion. At its height, the Kruggerand made up 90 percent of the global gold coin exchange.

Even today, the Gold Krugerrand is one of the most frequently traded gold coins in the world.

The face of this copper-tinted coin is that of President Paul Kruger in profile. He faces left, his long beard cascading down to his chest. The reverse side of the coin features a graceful springbok mid-leap. The springbok is South Africa’s national animal, as well as the name of the country’s rugby team.

Available in one-tenth-, quarter-, half-, and one-ounce coins, plus four-coin sets, the Krugerrand is a staple for many investors. It is also available in silver.

Also Check: Refinancing As An Investment Property

Buy Gold Bullion Coins From Jm Bullion

If youre looking to buy gold as an investment option, then gold bullion coins offer a great place to start. Gold coins offer beautiful designs known the world over and many come with gold purity and weight backed by central governments and issued by sovereign mints. Youll find no shortage of gold bullion coins available to purchase when you shop online. In fact, the most difficult task youll face may just be choosing which coins you want in your portfolio! Below is an overview of the some of the most popular gold bullion coins available today.

How To Invest In Gold

There are a multitude of ways to invest in gold. You can buy physical gold in the form of jewelry, bullion, and coins buy shares of a gold mining company or other gold-related investment or purchase something that derives its value from gold. Each method has its benefits and drawbacks. That can make it daunting for beginning investors to know the best way to gain exposure to this precious metal.

This guide will help you start investing money in the gold market. We’ll explore all the ways you can invest in gold and discuss their pros and cons so you can learn more about how to invest in gold.

You May Like: Invest 20k In Stock Market

Top 10 Best Gold Coins For Investing

With gold so hot right now, there are lots of gold-buying options to choose from. You could trade futures contracts. You could buy gold-mining stocks. You could buy a proxy for gold in the form of a gold ETF. There are even gold mutual funds. But almost any expert will tell you the same thing: if you want exposure to gold, nothing is better than holding the physical metal including gold coins.

Even still, there are options: You can buy bars, rounds, or coins. And even once you settle on one of them, choices still abound! This article will focus on gold coins. Coins are different from rounds in that coins are issued by governmental authorities rounds are issued by private mints. Libertarian sentiments aside, government coins are generally more widely accepted not everyone is a libertarian, after all. Thus, this added liquidity generally makes these coins more preferable to rounds.

Chinese Panda Gold Coin

The Chinese Gold Panda was China’s first gold coin and the third on the market after the American Eagle and the Canadian Maple Leaf.

Its obverse design changes yearly, spotlighting the Giant Panda in various poses. The Temple of Heaven sits on the reverse. The coin is .999 pure gold.

Initially available in the standard ounce weights, the Pandas moved to metric units in 2016. They are available in one-gram, three-gram, eight-gram, fifteen-gram, and thirty-gram coins as well as in sets.

You May Like: Hard Money Loans For Investment Property

How Is The Price Of Gold Determined

Many factors affect the price of gold. These include demand for the metal in making jewelry, for some technology applications, and for investment purposes. Other factors, such as the amount of gold in central bank reserves, the value of the U.S. dollar, and the desire by investors to hold gold as a hedge against inflation or currency devaluation, help to drive its price.

Austrian Philharmonic Gold Coin

The Vienna or Austrian Philharmonic, first released in 1989, filled the hole that the sanctions imposed on South Africa, and therefore the Kruggerand, left in the gold market. A favorite of investors and music-lovers alike, the Philharmonic was the first European one-ounce gold investment coin on the exchange. Minted by the Münze Österreich AG, the Austrian Mint, it was the best-selling gold coin in Europe by 1990.

All the Philharmonic coins display the same design, with only the mintage year changing. These coins boast 99.99 gold and come in one-tenth-, quarter-, half-, and one-ounce weights with the addition of a 1/25-ounce coin. There are also two larger weightsthe 20-ounce gold coin and a 1,000-ounce coin called “Big Phil.”

Big Phil was created to commemorate the 15th anniversary of the Vienna Philharmonic coin. It contained 31.103 kg of pure gold and had a nominal value of 100,000 or about $111,216.50 U.S. dollars. Only 15 of these coins were minted.

The front of the coin depicts the world-famous pipe organ of the Vienna Musikverein’s Golden Hall, where some of the best musicians in the world perform. The Musikverein is the main stage for the Vienna Mozart Orchestra and is the permanent seat of the world-renowned Vienna Philharmonic.

The reverse side of the coin shows a plethora of instruments, featuring the bassoon, Vienna horn, harp, and four violins, all surrounding a cello.

Read Also: Can Nonprofits Invest In For Profit Companies

Investing In Gold In 2022 You Might Want To Look At The Auspicious Days For It

Gold has been a highly sought-after commodity since time immemorial. It has been used as a form of currency, an ornament and even as a symbol of power and status. Gold is considered auspicious in Hinduism because it is believed to be the metal that represents the Sun.

In addition to its value as an investment, gold has a traditional significance. Many people purchase gold not only for personal use but also to offer to the Gods, accumulate for their daughters, and other purposes. The best days to buy gold are during the Akshaya Tritiya, Makar Sankranti and Dhanteras festivals. These are auspicious days for Hindus because they believe that these days bring good luck.

Be sure to buy gold on these days to ensure your wealth and well-being in the coming year.

A good day to buy gold is generally considered on Makara Sankranti, Ugadi, Akshaya Tritiya, Navaratri and Dusshera, Onam, Pushyami, and Diwali. Best days to purchase gold in 2022 are listed below.

| Days |

Celebrations are as follow:

Friday, 14 January 2022- Makar Sankranti

One of the most distinctive festivals observed in India is Makar Sankranti. Its also known as Pongal and Bihu in various Indian states. Every year on January 14, Makar Sankranti falls to signal the start of the harvest season. The 13th of January is observed as Lohri in Punjab, and it is thought to be lucky for buying gold.

Saturday, 2 April 2022- Ugadi and Gudi Padwa

Monday, 2 May 2022- Akshaya Tritiya

26 September 2022 to 4 October 2022 Navaratri

How & Where To Buy Gold Coins

Jeff Clark, Senior Analyst, GoldSilver

Theres nothing quite like holding a gold coin in your hand. And owning some real gold offers a number of advantages you simply cant get with other investments. And since gold is a natural hedge against the stock market, its an excellent way to diversify, too.

This article will cover the basic dos and donts of buying gold coins, including the advantages of owning them, the best gold coins to buy, the best places to buy , and how to avoid getting ripped off. With a few simple guidelines youll be on your way to owning one of mankinds longest-living assets.

This guide to investing in gold coins will seek to answer some of the common questions we hear including:

- Why buy gold coins?

- Which gold coins should you buy?

- Should you invest in numismatic gold coins?

- What are the most popular gold coins?

- Can you purchase gold coins from a bank?

- Whats the best place to buy? Can you trust online dealers?

Lets start with something about gold coins that many investors arent aware of

You May Like: Master’s Degree In Investment Management

Is It A Good Idea To Buy Gold Coins Or A Gold Bar

Although the decision to invest in either gold coins or gold bars is often based on personal preferences, you should consider other factors such as tax implications, your investment strategy, and more importantly, what might give you a better deal when selling.

For centuries, gold has proven to be a stable, wise, and lucrative investment choice for both individuals and institutions. In addition to avoiding risks that come with relying on the unstable paper-based currency, investing in gold is a sure guarantee that you won’t be affected much by inflation or currency devaluation. This is why smart investors turn to such precious metals to protect their wealth and diversify their portfolios.

You’ll, however, have to choose between gold coins and gold bars or go for both. And as with any investment option, investing in gold coins or gold bars has its advantages and disadvantages.

It’s important to note that there’s no right or wrong answer when it comes to choosing between gold coins and gold bars. The decision to invest in either gold coins or gold bars should be generally influenced by your objective as an investor. After all, they’re both lucrative investments and probably much better than paper currency.

In this brief article, we’ll take a look at how gold coins and gold bars compare as an investment vehicle. At the end of this read, you should be in a much better position to make a sound decision.