Senior Citizens Savings Scheme

SCSS is a government-backed scheme that offers a fixed return on investments. As the name suggests, this scheme is available for senior citizens i.e. people above 60 years. One can start investing in this scheme by opening an account via Post offices and banks.

Recently, the India Government has hiked the interest rates on this scheme by 20 bps for the October-December quarter. Now, it offers 7.6%, and the previous rate of interest was 7.4%.

Core Fixed Income Strategy

| Fixed Income Core Fixed Income Strategy |

| Bloomberg U.S. Aggregate Index |

The Core Fixed Income Strategy is a value-oriented fixed income strategy that invests primarily in a diversified mix of U.S. dollar-denominated investment-grade fixed income securities, particularly U.S. government, corporate, and securitized assets, including commercial mortgage-backed securities, residential mortgage-backed securities, and asset-backed securities. The strategy may also invest opportunistically in U.S. dollar-denominated, non-US government bonds. To help achieve this objective, the strategy combines top-down macro and asset allocation views with rigorous bottom-up fundamental and quantitative analysis that guides that team’s active management decisions.

The team believes that markets can be inefficient and by performing rigorous analysis the team can position portfolios appropriately to add value over time. Bond prices reflect market forecasts for a variety of factors, such as economic growth, inflation, monetary policy, credit risk, and prepayment risk yet markets tend to be poor forecasters of future events, especially when the implied market forecasts are out of line relative to historic trends. The team seeks to identify these mispricings and position client portfolios to exploit the value inherent in these opportunities.

The team believes that successful portfolio management depends on four factors:

- Global Perspective

RISK CONSIDERATIONS

OTHER CONSIDERATIONS

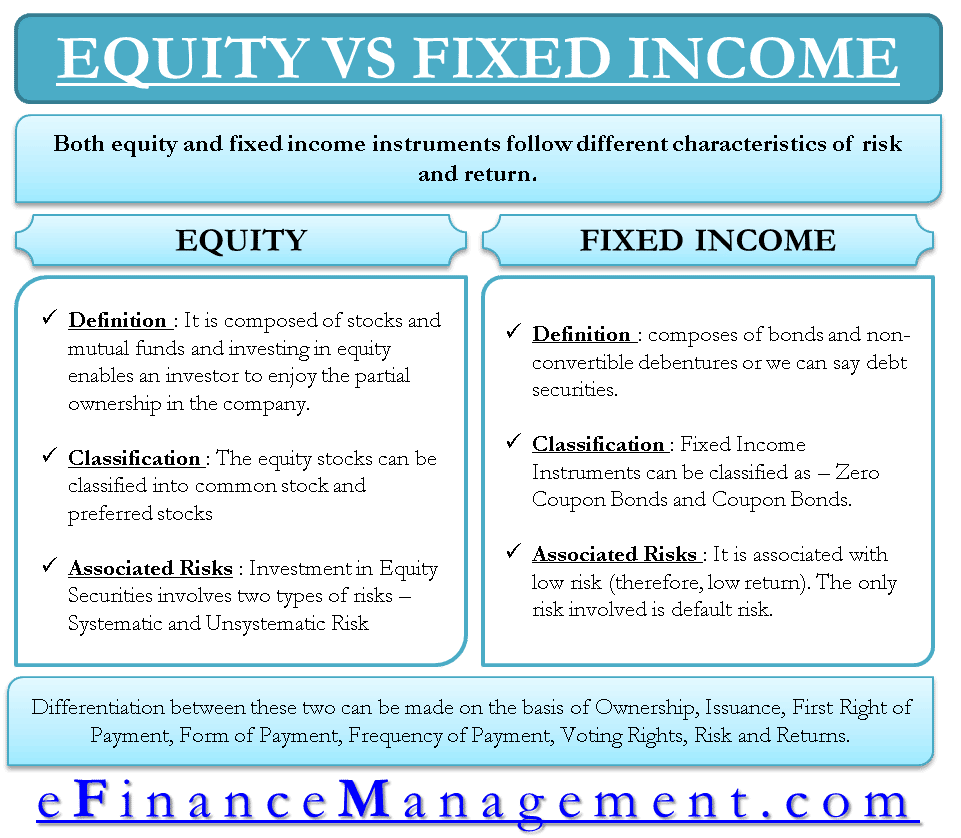

Types Of Fixed Income Products

As stated earlier, the most common example of a fixed-income security is a government or corporate bond. The most common government securities are those issued by the U.S. government and are generally referred to as Treasury securities. Fixed-income securities are offered by non-U.S. governments and corporations as well.

Here are the most common types of fixed income products:

Also Check: Companies Similar To Fisher Investments

What Is Fixed Income Investing

7 Min Read | Oct 19, 2022

When you decide to get serious about saving for your retirement, its important to know your options. And trust us, there are a lot of options out there to choose from. You need to know what to invest in and what to stay away from.

From time to time, you might hear the term fixed income investments thrown around, especially when people are talking about things like bonds and annuities. They might sound good at first, but do they really deserve a place inside your retirement portfolio? Just sit tight. We’ll walk through what fixed income investing is all about.

What Fixed Income Resources And Tools Does Td Direct Investing Offer

TD Direct Investing clients have access to the following resources and tools at the TD Direct Investing Fixed Income Centre in WebBroker:

Buy, sell or request quotes for money market paper and bonds online

Search for a bond that meets your needs

Find prices, yields and credit ratings on hundreds of bonds and money market instruments

Don’t Miss: Errors And Omissions Insurance For Registered Investment Advisors

Should You Put All Money In Stocks

As a general rule of thumb, you typically want to do the exact opposite of what everyone else is doing. If your friends are talking about selling bonds and putting all that money in the stock market, it might be a good time to sell some stocks and buy bonds. When everyone is getting in, you should be getting out!

The Real Estate Fund For Safe Fixed Income

When bringing in a secure fixed income during retirement is the foundation of your financial plan, keeping risk low is paramount. Saint Investment provides safe, consistent fixed incomes through our real estate fund. Youll enjoy a steady, secure income each month without the hassle of managing real estate directly. Our team of real estate experts analyze every single property that goes into our income funds. Leverage our real estate experience by investing in our fixed income fund. Youll also get detailed reporting and full transparency, enabling you to earn income with peace of mind. today to start earning a fixed income you can count on!

Read Also: How To Start An Investment Management Firm

Considerations When Investing In Bonds

Bonds are subject to risk factors that may decrease the market value of your investment.

Interest rate risk is the risk of changing market value of an investment, up or down, due to fluctuations in interest rates in the U.S or the world. Generally, a rise in interest rates decreases market price a fall in interest rates increases market price.

As always, holding bonds to maturity assures the return of principal at par value, subject to the credit worthiness of the issuer. But, sometimes an investor needs to sell the position prior to maturity. It is then that price volatility becomes an issue. In general, the volatility of the bond equates to its duration. In oversimplified terms, modified duration is a measure of an investments sensitivity to interest rate changes. For instance, if a bond’s duration is 5, a 1 percent move in interest rates results in a 5 percent move in the bond’s price.

Default or credit risk is the risk of issuers inability to make interest payments or repay principal when due.

Liquidity risk is the level of difficulty with which a security can be sold in the secondary market. Securities, sold prior to maturity, may result in a gain or loss of principal.

A detailed overview of these and other risks is available at FINRA.org or investinginbonds.com.

Pass Your Wealth To The Next Generation

Once you have developed a plan to preserve your wealth, that plan should allow you to remain wealthy until the end of your life. That means you will have wealth until you die, and so you should have a plan for your money. This means creating documents such as a will and an estate plan.

After all, there is a lot to contemplate. For most people, giving most of their wealth to their children is the most logical choice, but perhaps you dont have children or have other plans for your wealth. There are also things you will have to keep in mind, such as estate and gift taxes.

Recommended Reading: Best Investment Apps For College Students

Definition & Examples Of Fixed Income Investing

Fixed income investing is an investing strategy that focuses on very low-risk investments that pay out consistent income.

adamkaz / Getty Images

Fixed income investing is an investing strategy that focuses on very low-risk investments that pay out consistent income. Depending on your age and your financial goals, the fixed income investment strategy may be ideal for you.

How Does Fixed Income Investing Work

Bonds and certificates of deposit are the most common fixed income investments. You purchase a bond or CD for a certain amount and earn interest at a set rate. Bonds typically pay interest twice a year CDs pay interest at maturity. A bond or CD has a set maturity date if you hold it until maturity, you’ll receive its face value .

Suppose you purchase a $1,000 bond with a 5% interest rate and 10-year maturity. For 10 years, you’d receive semi-annual interest payments of $25 . Keep the bond until maturity, and you get the $1,000 back too.

Recommended Reading: Self Directed Ira Alternative Investments

How To Invest In Fixed

Ready to start generating fixed income? Heres how.

New-issue Treasury securities. The easiest way to buy newly issued U.S Treasury securities is through treasurydirect.gov.

Municipal bonds. There are a few ways to buy municipal bonds, but the easiest would be through a brokerage account. Most major online brokerages will have municipal bonds on offer.

Corporate and high-yield bonds. Youll need a brokerage account to purchase these. Once youve set up your account, you can use the brokerages screening tools to find the bonds that best fit your situation and portfolio.

Secondary market. Youll need a brokerage account to buy or sell all bonds on the secondary market.

Disadvantages Of Fixed Income Investments

Along with the advantages of the fixed-income investment, there are some disadvantages or limitations as well of the same, which are as follows:

Read Also: Should You Invest In S& p 500

What Are The Potential Benefits Of Fixed Income

Depending on your financial goals, fixed income investments can offer many potential benefits, including:

How Does Fixed Income Work

The term fixed income refers to the interest payments that an investor receives, which are based on the creditworthiness of the borrower and current interest rates. Generally speaking, fixed income securities such as bonds pay a higher interest, known as the coupon, the longer their maturities are.

The borrower is willing to pay more interest in return for being able to borrow the money for a longer period of time. At the end of the securitys term or maturity, the borrower returns the borrowed money, known as the principal or par value.

Recommended Reading: Investment Management Firms In Florida

Should You Include Fixed Income Investments In Your Portfolio

Heres the deal. People have this idea that fixed income investments are safe and reliable. But the truth is, their values actually fluctuate the way that stocks do, and you could lose money investing in bonds. And besides, the return youre getting with these types of investments are usually terrible, especially compared to growth stock mutual funds. We don’t recommend investing in bonds, annuities or other types of fixed income investments.

So, what do we recommend? You should invest 15% of your gross income in good growth stock mutual funds, which will offer you better returns and are more suited for long-term investing. A quarter of your portfolio should include growth and income funds, which are made up of stocks from big, stable companies that should provide your portfolio with predictable returns that are still better than most fixed income investments.

Drawbacks Of Fixed Income Investments

The main drawbacks of fixed income investments include:

- Lower opportunity for growth. Generally, fixed income securities offer a much lower opportunity for growth compared with other types of securities such as stocks.

- May not match inflation. Depending on the yield, the income you generate through fixed income investing may or may not keep pace with inflation.

- Interest rate risk. Bonds are particularly sensitive to interest rate risk. As rates rise, bond prices usually fall. While this is not a cause for concern if you hold your bonds until maturity, if you wish to sell them ahead of schedule it may lead to a loss of capital.

- Prepayment risk.When the borrower returns the principal to you early, they no longer have to make interest payments on that principal. You, as the investor, must then reinvest the principal at the current market rate which may result in lower interest payments going forward because borrows are more likely to prepay or refinance when interest rates are lower.

Don’t Miss: How To Invest In Stocks Without Fees

What Are The Risks Associated With Fixed Income

There are four major risks associated with fixed income:

You can manage these risks by diversifying investments within your fixed income portfolio.

The #1 Forex Trading Course Is Asia Forex Mentor

There are so many ways to invest your money and make some good returns. From investing in stocks, currencies, and real estate, there always seems to be so many options. But one area that has become very popular among retail investors is fixed-income investments.

For so many years, fixed income securities were seen as an option only for big institutions and high net worth individuals. But things are now changing. Even the average investor can buy and benefit from corporate bonds and other investment-grade bonds.

So, if you are thinking of trying your hand in the fixed income market, this guide will be perfect for you. We will give you details about what these assets are about, how they work, how to buy them, and the kind of benefits they offer to the average investor.

Recommended Reading: Is Buying Gold Bars A Good Investment

What Are The Disadvantages Of Fixed

While fixed income securities are safe and offer stability, they dont have nearly the upside potential of riskier securities like growth stocks and options. With lower risk come lower potential gains.

Additionally, some fixed-income securities like bonds are prone to interest rate risk. If an investor purchases a bond and then interest rates go up, that bond loses resale value. Inflation risk works similarly. If inflation outpaces a bonds interest during its term, its relative return can be reduced. Thus, the longer a bonds term, the more it stands to become devalued by inflation.

Pros And Cons Of Fixed Income Investments

So, should you consider having fixed income investments as part of your investing strategy? Lets take a look at the pros and cons.

An advantage to fixed income investing is that it offers investors a steady stream of income over the life of a bond while giving the recipientlike a businessaccess to immediate cash or capital. Having a stable income allows investors to plan out their spending, which is why fixed income investments are tempting additions to many retirement portfolios.

Some fixed income investments get special tax treatment that could take the sting out of Tax Day each yearespecially municipal bonds, which are usually tax-free at the federal, state and local levels. Treasury bonds, while subject to federal taxes, are also free from state and local taxes. Some experts also say fixed income investments add healthy diversification to your investing portfolio, balancing the highs and lows of investing in stock mutual funds.

But does the good outweigh the bad? Lets take a look at some of the drawbacks of fixed income investing:

- Lower return on investments

- Bonds lose their value as interest rates rise and bond prices fall

Read Also: How To Invest With Ally

Examples Of Fixed Income Securities

Many examples of fixed income securities exist, such as bonds , Treasury Bills, money market instruments, and asset-backed securities, and they operate as follows:

1. Bonds

The topic of bonds is, by itself, a whole area of financial or investing study. In general terms, they can be defined as loans made by investors to an issuer, with the promise of repayment of the principal amount at the established maturity date, as well as regular coupon payments , which represent the interest paid on the loan. The purpose of such loans ranges widely. Bonds are typically issued by governments or corporations that are looking for ways to finance projects or operations.

2. Treasury Bills

Considered the safest short-term debt instrument, Treasury bills are issued by the US federal government. With maturities ranging from one to 12 months, these securities most commonly involve 28, 91, and 182-day maturities. These instruments offer no regular coupon, or interest, payments.

Instead, they are sold at a discount to their face value, with the difference between their market price and face value representing the interest rate they offer investors. As a simple example, if a Treasury bill with a face value, or par value, of $100 sells for $90, then it is offering roughly 10% interest.

3. Money Market Instruments

4. Asset-Backed Securities