Best Global Investing Etf: Spdw

- Expense Ratio: 0.04%

- Assets Under Management: $12.0 billion

- One-Year Trailing Total Return: 1.84%

- 12-Month Trailing Yield: 3.24%

- Inception Date: April 20, 2007

The SPDR Portfolio Developed World ex-US ETF aims to track the S& P Developed Ex-U.S. BMI Index, an index composed of publicly traded companies domiciled in developed countries outside of the U.S. As of March 13, 2022, the fund has 2,409 holdings. Among the invested funds, 17.47% are allocated to financials stocks, followed by 16.07% to industrials and 10.79% to consumer discretionary names. Japan-based stocks make up 21.6% of the funds portfolio, by far the largest share, followed by the United Kingdom, Canada, France, and Switzerland.

Global investing funds help to diversify a portfolio so that an investor need not rely exclusively on the U.S. economy. If the U.S. is not doing well, investing in other countries that are growing can help a portfolio to better weather the volatility.

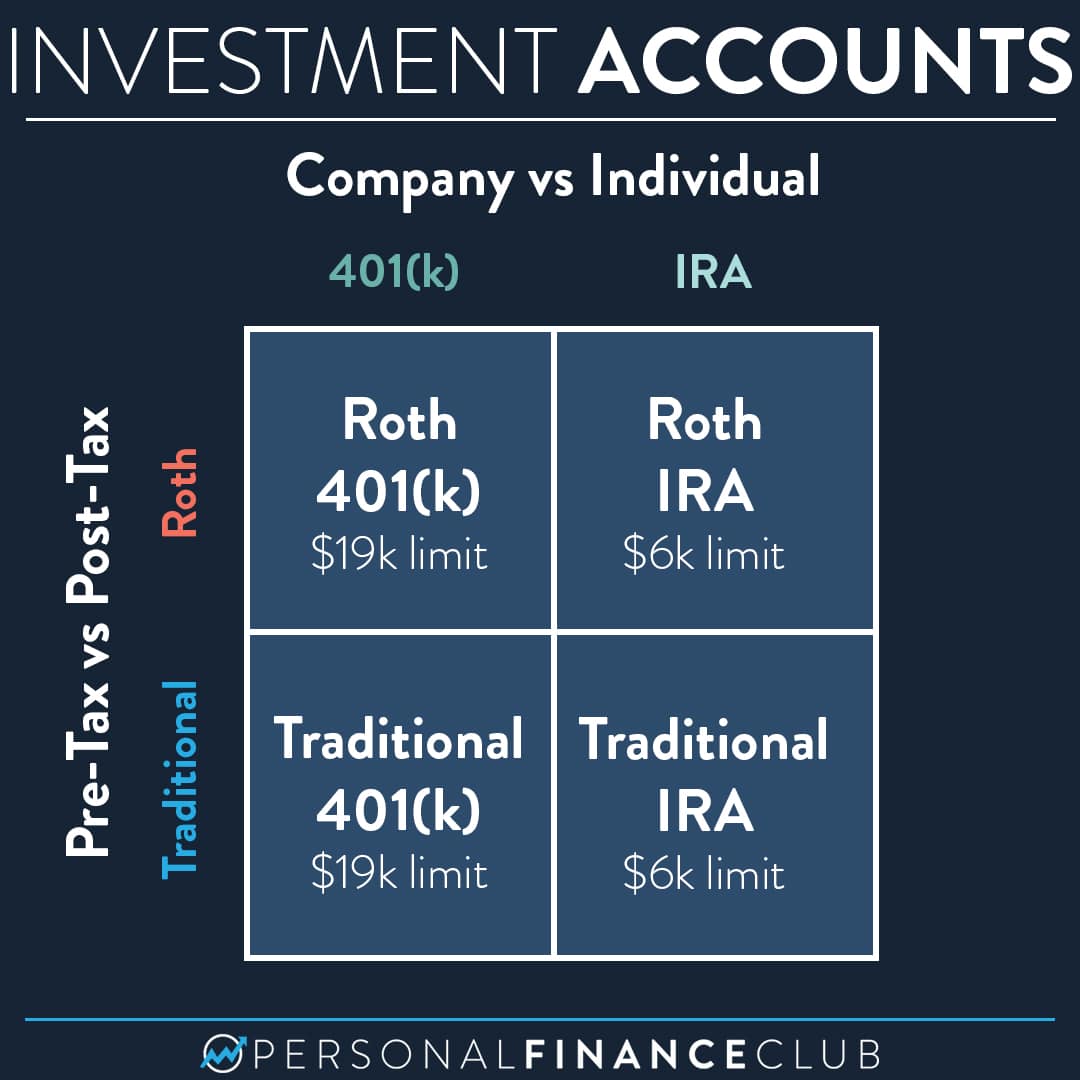

What Are The Differences Between A Roth Ira And A Traditional Ira

One of the main differences between a Roth IRA and a traditional IRA is the way contributions and withdrawals are taxed. Roth IRA contributions are made after-tax and future, qualified withdrawals are tax-free. Traditional IRAs are the opposite. Contributions to traditional IRA accounts may be tax-deductible, are tax-free and future withdrawals are taxed like income.

Another difference between these two types of accounts is the required withdrawal. If you have a traditional IRA, the IRS requires you to withdraw a minimum amount each year when you reach the age of 72. These are known as required minimum distributions . A Roth IRA has no RMDs, so you can decide when you want to withdraw money. If you dont need to make a withdrawal, your money can potentially keep growing tax-free.

Should You Open A Roth Ira

Roth IRAs arent perfect. For starters, people who work second and third gig-economy jobs can end up with big tax bills at the end of the year because payroll departments arent taking out tax withholdings proactively, and they might really need the present-year tax break a traditional IRA provides. Some taxpayers simply might really need that extra cash right now or at tax refund time.

There is even an argument that the $1,000 or so present-day tax savings generated by maxing out contributions to a traditional IRA, if invested well, can generate enough returns over several decades to balance out the later-in-life tax savings that could come from a Roth IRA. Thats an investment bet that isnt for the faint of heart, however, because of the uncertainty of any future returns.

For many taxpayers, the simple truth is that paying taxes today will be cheaper than paying taxes at retirementand thats why they should seriously consider a Roth IRA.

Read Also: How To Invest Tfsa In Stocks

Am I Eligible To Invest In A Roth

To contribute to either a traditional or Roth IRA, you must have taxable compensation for that year. And Roths have additional restrictions on who can contribute: Single filers with a modified adjusted gross income less than $124,000 can contribute up to the maximum amount allowed for the year. If your MAGI is $139,000 or more , you cannot contribute to a Roth. Anything in between, you can contribute a reduced amount.

You can contribute to a traditional IRA, no matter what your MAGI is. But how much of your contributions are deductible depends on your MAGI and whether youre able to contribute to a retirement plan through your employer. If you do have a retirement plan at work, you can deduct the full amount up to the contribution limit, if your MAGI is $65,000 or less as a single filer, or $104,000 or less if youre married and filing jointly. Without an employer-sponsored option available to you, single filers have no income limits on how much they can deduct while joint filers with a MAGI of $206,000 or more get no deduction.

Other Reasons To Favor A Roth

Your tax owed on withdrawals isnt the only reason to be aware of the implications of asset location.

The tax characteristics of the investments themselves is another factor to weigh. For example, an investment that generates interest income thats already exempt from taxes doesnt need the coverage the Roth offers. Dividends paid on municipal bonds, for example, are already exempt from federal taxes.

Dividends paid out by REITs , on the other hand, are not sheltered from the IRS reach. And because REITs are known for generous dividends, the Roth makes an ideal home for this type of investment.

For active traders, a Roth IRA is ideal.

Another consideration is the frequency of trading activity that takes place within the account and within the investments held in the account.

In a regular, taxable account, investors who trade in and out of positions frequently expose themselves to capital gains taxes. Investments that are held in a taxable account for less than a year are subject to short-term capital gains, which are taxed at a higher rate than long-term capital gains.

For active traders, a Roth IRA is ideal: The IRS doesnt even require you to report capital gains taxes each year. And, of course, qualified distributions in retirement are tax-free.

For the same reason, actively managed mutual funds with high turnover rates are well-suited to the Roths tax protections.

You May Like: What Is Alternative Investment Management

What Is The Difference Between A Traditional Ira And A Roth Ira

The main differences between Roth and traditional IRAs stems from their income limits and taxes. Unlike Roth IRAs, traditional IRAs dont have income limits. And while Roth IRAs allow you to make contributions using post-tax income and to earn tax-free growth, with a traditional IRA you will use tax-free income to make contributions and will pay income taxes on withdrawals.

Want to read more content like this? for The Balances newsletter for daily insights, analysis, and financial tips, all delivered straight to your inbox every morning!

How Is A Roth Different From Other Iras

The major difference is how each investment account doles out the tax advantages. The Roth flavor of IRA allows you to contribute your post-tax dollars now and not worry about future taxes on that money. In other words: your money grows tax-free. On the other hand, a traditional IRA allows you to save on taxes now you can deduct your contributions from the years taxable income . But youll have to pay taxes when it comes time to withdraw those funds in retirement.

So which type is best for you depends partly on whether youre better off paying taxes now or later. If you think youll be in a lower bracket when you make withdrawals in retirementmaybe because your retirement income levels may be lowera traditional IRA may work better for you. If you expect youll be in a higher tax bracket in the futureeither because you expect your income levels to rise over time or you think tax rates are bound to go up a Roth may make more sense.

And some experts swear by the Roth IRA either way. They figure that the sum you have later, after adding in investment returns, is bound to be higher than your total contributions. That means investing in a Roth account would save you from paying taxes on the higher amount. Also, they note that some people might simply prefer the certainty of paying taxes now rather than having to guess what the tax situation could be in the future.

Read Also: Person Who Invests Your Money

Sailing Doodles Power Boat

Mar 11, 2022 · While you cannot invest in mutual funds with M1 Finance, your M1 Finance Roth IRA can contain fractional shares, a great way to diversify your investments. Minimal Fees, Flexible Service. Another reason to look closely at an M1 Finance Roth IRA is the low fees they offer..

muama ryoko amazon

Timing Is Key To Maximizing The Tax Benefits Of A Roth Ira

Investing in a Roth IRA is like sending a gift to yourself in the future. These individual retirement accounts , unlike their traditional counterparts, are funded with after-tax dollars, meaning that you pay the Internal Revenue Service up front rather than when withdrawing funds later.

Why would you want to do that? Well, for one, with a Roth, your compounding earnings grow tax free, which can make a really big difference in how much you have to live on in retirement. They also let you lock in your current tax rate, as opposed to being charged a potentially higher one that you could encounter later in life as you amass more income and wealth.

Naturally, there are other pros and cons to consider before making a decision on whether to invest in a Roth. Perhaps the most important factor is timing. Get it right and youâll be able to fully maximize the tax benefits of a Roth IRA. Get it wrong and you probably would have been better off going with another retirement account.

Don’t Miss: How To Open An Investment Account For A Child

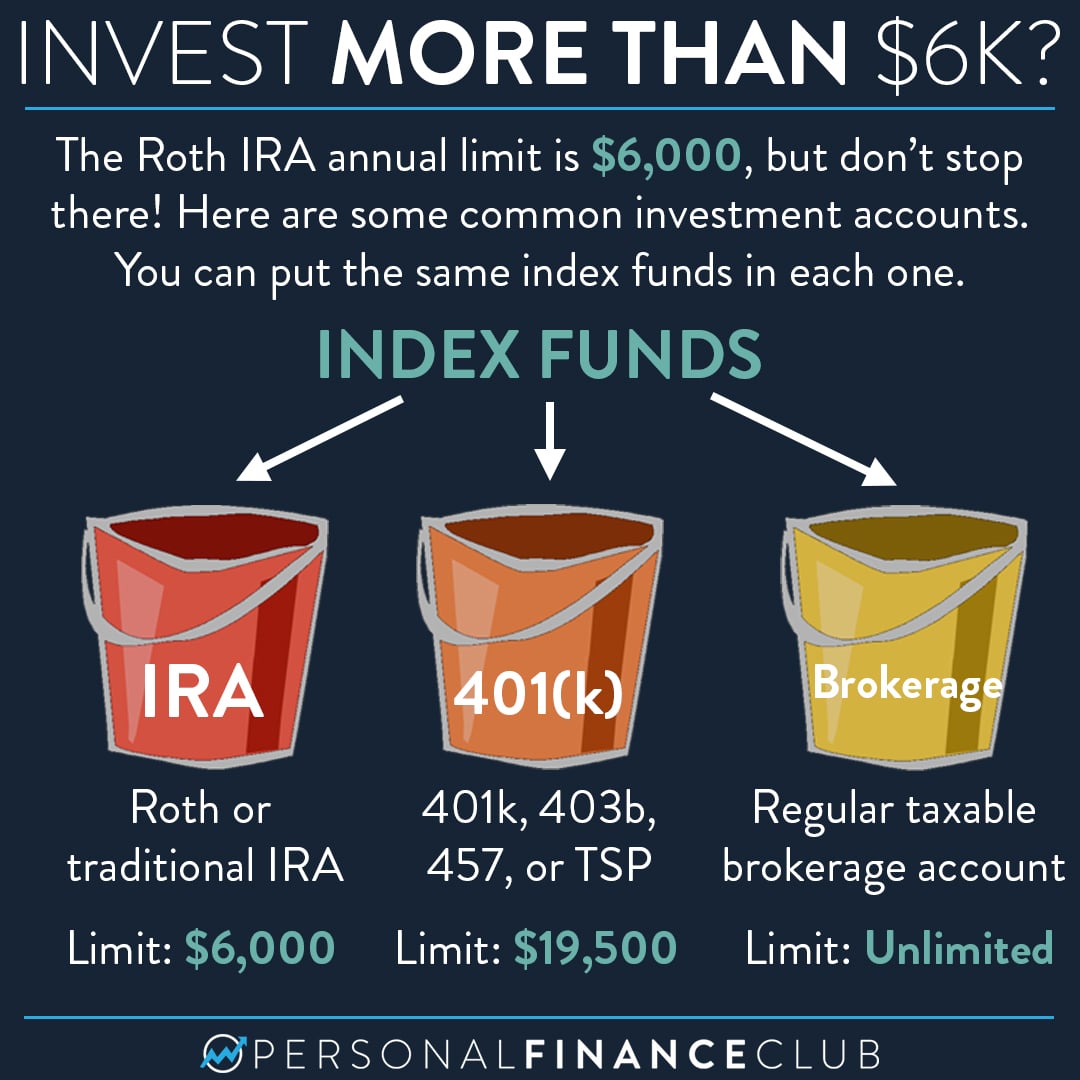

What Can You Invest In Within A Roth Ira

So now that you have this Roth IRA, what should you be investing in? With a Roth IRA, you have a lot more control over what you invest in. First of all, let’s start out with a list of what you can invest in:

If you are a hands-on investor who wants to build a portfolio from scratch, M1 Finance allows you to hold any stocks or ETFs you want within your portfolio. Gone are the days of boring mutual fund retirement investments. If you wish, you can hold technology stocks like Microsoft or Apple!

For those looking for a more hands-off approach, you can go the managed route. Betterment offers fully managed portfolios for an annual asset management fee of just 0.25%. You do not need to worry about asset allocation or rebalancing your portfolio. They take care of the entire process for you!

Ultimately, what you invest in within your Roth IRA is totally up to you! It all depends on your investing style and whether or not you want to be actively involved with your investment. What you won’t find in a Roth IRA are penny stocks that don’t trade on major exchanges. These penny stocks do not make for proper long term investments in most cases.

Roth Ira Taxes Vs Traditional Ira Taxes

With a Roth IRA, you pay taxes on your contributions upfront so you don’t have to pay them later when you withdraw money from your retirement fund .

This is the biggest difference from a traditional IRA, which lets you delay paying taxes until you withdraw funds later down the road. With traditional IRAs, your contributions are also tax-deductible, up to certain limits, so your contribution reduces the amount you owe in taxes each year.

A good rule of thumb when choosing between the two types of IRA accounts is to consider your tax bracket:

- Choose a Roth IRA if you expect that you’ll be making more money in your later years and thus in a higher tax bracket. It makes more sense to pay taxes today to take advantage of your current low tax rate before it goes up. Plus, since your withdrawals from Roth IRAs don’t count as income and aren’t taxed after 59 and a half, you can count on every dollar in your account when making withdrawals.

- Choose a traditional IRA if you expect that you’ll be making less money in your later years and thus in a lower tax bracket. In this case, it makes more sense to reduce your taxable income in the present, so in theory you’ll pay less in taxes both now and in the future when your tax rate is lower.

Use an online calculator like this one from Charles Schwab to help you decide between a Roth IRA or a traditional IRA.

Read Also: Is Interest Rate Higher For Investment Property

Who Manages A Roth Ira

The Roth IRA investor is responsible for deciding how to allocate their contributions to various investment options. However, you can only place your contributions in investment options that are provided by your custodian. In this case, the custodian can be a brokerage firm, bank, or mutual fund company.

The custodian holds your retirement assets and ensures that your investments comply with the IRS guidelines. However, the custodian cannot dictate what investments to invest in. You can change the investment allocation at any time, and even change custodians by rolling over your Roth IRA to a new custodian.

Tags

So What Is The Best Roth Ira

The idea that a Roth IRA is just a vessel for your investments doesnt mean that all Roth IRAs are created equal. Where you open your Roth IRA has a big impact on the investments youre able to access. In addition, the fees you pay for maintaining the account and purchasing those investments may vary widely.

If you want access to the widest range of investments, youll want to open your IRA at a broker. There, you can manage your account yourself, picking and choosing investments based on your goals and risk tolerance. Most brokers will offer access to individual stocks, bonds some of which do pay a fixed interest rate and mutual funds, including index funds and exchange-traded funds.

If youd rather be hands-off and dont mind a more limited investment selection, you can open a Roth IRA at a robo-advisor. These computer-aided investment services will manage your account for you, building a portfolio that aligns with your goals and adjusting it as needed. Most robo-advisors use index funds or ETFs.

» See all of our top picks for best Roth IRA accounts

Read Also: Alternative Investments For Accredited Investors

Roth Ira Withdrawals Can Help Your Taxes In Retirement

When you decide to dip into your Roth IRA funds in retirement, withdrawals are tax-free. These tax-free withdrawals can help you to put off the need to take cash out of other accounts that could increase your AGI, income taxes or other costs.

Heres an example: Consider a retiree who needs $10,000 to pay for a big vacation or $30,000 for a new car. They might decide the best way to avoid debt is to take the cash out of a retirement account. A retiree who withdrew the sum from a traditional IRA would owe income taxes on the entire amount, starting a negative chain reaction. They might bump themselves into a new tax bracket or even trigger an increase in Medicare premiums. But a retiree who withdrew that amount from a Roth IRA would face no such problems.

For Sale By Owner St Augustine

Expense Ratio: 0 Let’s take a look at a few of Fidelity ‘s most popular mutual fund classes If you exceed the income limits for a Roth IRA , you can have your Roth contribution and any earnings morphed into a nondeductible traditional IRA For those who want other options, Fidelity and iShares also have very similar products with an.

Fidelity .com * Online trading, ETFs, Mutual Funds, IRAs , & Retirement for Individual Investors 401 Participants & Employees of Corporations * Account balances, investment options , contributions, tools, and guidance. 403 & 457 Participants & Employees of Non-Profits * Account balances, investment > options< /b> , contributions, tools, and guidance. Set up your RothIRA with M1Finance: https://trufinancials.com/m1finance Earn a $30 Bonus when you deposit $1,000 while opening your account (offer su.

bridgecom plus

Recommended Reading: What To Invest In Real Estate

The Benefits Of A Roth Ira

There are several benefits associated with investing in a Roth IRA. While most are tax-related, not all are. The Roth IRA allows a method of retirement savings without locking up your money. It also can be a way for you to leave money for your loved ones when you do pass on. Let’s break it all down!

How To Open An Ira

You can open an IRA with any bank or broker. You may already have a brokerage account with Fidelity, Schwabb, or Merryl Lynch, for instance. If so, simply open an IRA via your current account. If you dont have a brokerage account yet, choose a reputable company that resonates with you and open one today.

Read Also: Is Robo Investing A Good Idea

Additional Perks Of Roth Iras

If the savings power, flexibility, and tax-free status aren’t enough to persuade you of the Roth’s virtues, Uncle Sam throws in a few extra perks, making the Roth an indispensable tool in a young adult’s financial life.

You can take money out in a pinch. Although the purpose of a Roth is to save for retirement, and your money can grow only if you leave it in the account, you can withdraw your contributions at any time, tax free and without penalty. Of course, it’s best to leave your money in the account so you can earn more money, and you really should have a separate emergency fund on standby, but it’s nice to know the Roth is there for you if you need it.

Notice we said you can take out your contributions at any time not your earnings. If you withdraw any of your earnings before age 59½, you’ll trigger a tax bill on the money, plus you’ll have to pay a 10% penalty. Ouch! On the bright side, the way the IRS looks at things, the first money that comes out of a Roth is your contributions. So it’s tax and penalty free. Only after you’ve drained the account of every penny you have contributed do you begin to dip into earnings and have to worry about taxes and penalties.