Best Vanguard Bond Etfs

- Publish date: Aug 11, 2022

At the beginning of August, the Vanguard Total Bond Market ETF passed the iShares Core U.S. Aggregate Bond ETF to become the largest bond ETF in the world. What’s impressive about this feat is that BND trailed AGG by $8 billion just at the beginning of 2022. It’s also nearly doubled up AGG on net inflows over the past 3 years, so it seems likely that BND will be there to stay.

Plus, Vanguard also owns the next four largest bond ETFs after that.

Vanguard is one of the premier issuers of fixed income ETFs. Like its suite of stock ETFs, the company builds its lineup through broad, diversified and low-cost market and sector exposures. Government or corporate, short-term or long-term, taxable or muni – Vanguard is truly a one-stop shop for filling out your bond portfolio.

The Bond Market Has Struggled In 2022 But Investors With A Longer

Coming up with a list of the best bond ETFs to buy now may at first seem like it would include only funds that can perform well in an inflationary, rising-rate environment. But this would only be partially correct.

True, we’ve seen a ton of volatility in the stock market this year and increasing talk of a global recession, driven by both rising borrowing costs and rising commodity prices thanks to inflation. This has worked well for investors holding Treasury inflation-protected securities or ultra-short-term bonds in their portfolios, but with the most recent consumer price index report showing inflation moderated in July, the time may be limited on these ideas.

Thankfully, bond ETFs cover a variety of strategies. So, it’s a good idea to not only focus on the best investments for today’s still-high inflationary environment, but also consider what the best investments could be down the road.

“We still think high-quality bonds play a pivotal role in portfolios as they have shown to be the best diversifier to equity risk,” says Lawrence Gillum, fixed-income strategist at independent broker-dealer LPL Financial. “While we expect further gains for stocks through year-end, unforeseen events happen. And it’s best to have that portfolio protection in place before it’s needed.”

- Fund category: Intermediate core bond

- Assets under management: $83.4 billion

- SEC yield: 3.1%

- Expenses: 0.03%, or $3 annually for every $10,000 invested

Etf Alternatives To This Mutual Fund

In the tables below, ETFdb.com presents recommended exchange traded fund alternatives to the mutual fund VFSTX. These recommendations are powered by ETFdb’sMutual Fund to ETF Converter tool.

How ETFdb.com has selected ETF alternatives to VFSTX:The mutual fund VFSTX has been benchmarked byVanguardagainst an index,Barclays Capital U.S. 1-5 Year Credit Bond Index,in its fund prospectus. The ETF alternatives to VFSTX listed below consist of ETFs which trackBarclays Capital U.S. 1-5 Year Credit Bond Index,and ETFs which track other indexes in the same ETFdb.com Category asBarclays Capital U.S. 1-5 Year Credit Bond Index.

Don’t Miss: How To Invest My Fidelity Roth Ira

S& p 500 Etf Trust Etf

The guru established a new position worth 3,080 shares in ARCA:SPY, giving the stock a 2.57% weight in the equity portfolio. Shares traded for an average price of $395.76 during the quarter.

On 11/18/2022, S& P 500 ETF TRUST ETF traded for a price of $394.0736 per share and a market cap of $374.92Bil. The stock has returned -14.91% over the past year.

GuruFocus gives the ETF a financial strength rating of 5 out of 10 and a profitability rating of 8 out of 10.

In terms of valuation, S& P 500 ETF TRUST ETF has a price-earnings ratio of 19.48, a price-book ratio of 3.61, a price-earnings-to-growth ratio of 2.32, a EV-to-Ebitda ratio of 14.58 and a price-sales ratio of 2.71.

The price-to-GF Value ratio is 0.00, earning the stock a GF Value rank of 6.

Vanguard Corporate Bond Etfs

We probably don’t need to spend a whole lot of time on the corporate bond ETF lineup since it’s very similar to the government bond fund list with the obvious exception of what it’s buying.

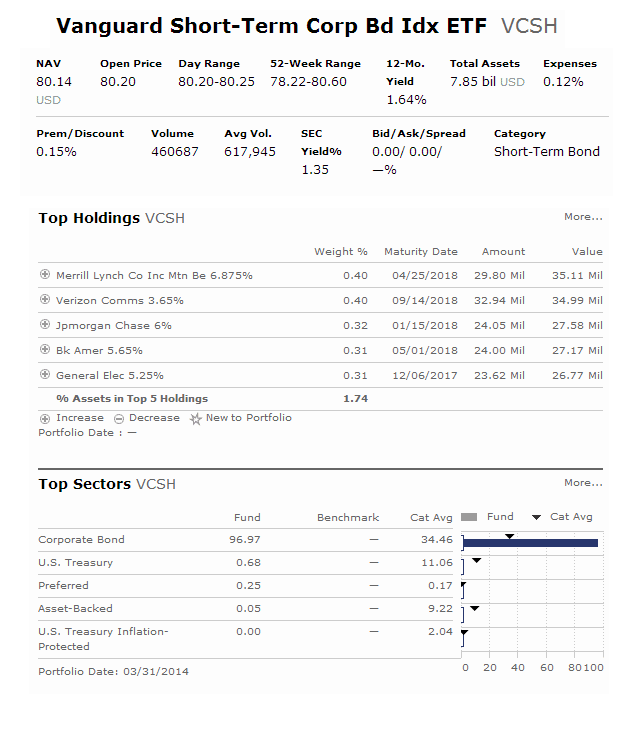

The Vanguard Short-Term Corporate Bond ETF , the Vanguard Intermediate-Term Corporate Bond ETF and the Vanguard Long-Term Corporate Bond ETF all invest in investment-grade corporates of various maturities from less than one year all the way up to 25+ years.

One unique addition to this part of the lineup is the Vanguard ESG U.S. Corporate Bond ETF . It invests in bonds of all maturities, but generally sticks in the short- to intermediate-term range. According to the fund website, it “specifically excludes bonds of companies that the index sponsor determines engage in, have a specified level of involvement in, and/or derive threshold amounts of revenue from certain activities or business segments related to the following: adult entertainment, alcohol, gambling, tobacco, nuclear weapons, controversial weapons, conventional weapons, civilian firearms, nuclear power, and thermal coal, oil, or gas.” It will also exclude the bonds of companies that don’t meet certain standards, such as diversity or other controversies.

Don’t Miss: How To Invest In Bosch

Portfolio Hedging Series Research & Insights

Part I: The Significance of Portfolio Hedging

Get the latest perspectives and updates.

For the total return table above, since inception returns are cumulative for funds less than one year old otherwise, returns are annualized. Market returns are based on the composite closing price and do not represent the returns you would receive if you traded shares at other times. The listing date is typically one or more days after the fund inception date. Therefore, NAV is used to calculate market returns prior to the listing date.

The expense ratio for certain funds includes a contractual fee waiver that results in a lower net expense ratio for some or all periods shown. For information about this ETFs fees, please see above.

Registered Investment Companies are required by the IRS to distribute substantially all of their income and capital gains to shareholders at least annually. For specific tax advice, we recommend you speak with a qualified tax professional.

Index information does not reflect any management fees, transaction costs or expenses. Indexes are unmanaged, and one cannot invest directly in an index.

There is no guarantee that distributions will not be made in the future. There is no guarantee that dividends or interest income will be paid.

There is no guarantee any ProShares ETF will achieve its investment objective.

Bonds will decrease in value as interest rates rise.

Vanguard Short Term Bond Etf List

Vanguard Short Term Bond ETFs are funds that focus on the shorter maturity and duration scale of the domestic fixed-income market. These are generally bonds with maturities of less than seven years and can include corporates, Treasuries, agencies as well as other bonds like TIPS.

As of 09/14/22

This is a list of all Vanguard Short Term Bond ETFs traded in the USA which are currently tagged by ETF Database. Please note that the list may not contain newly issued ETFs. If youre looking for a more simplified way to browse and compare ETFs, you may want to visit our ETF Database Categories, which categorize every ETF in a single best fit category.

This page includes historical return information for all Vanguard Short Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database.

The table below includes fund flow data for all U.S. listed Vanguard Short Term Bond ETFs. Total fund flow is the capital inflow into an ETF minus the capital outflow from the ETF for a particular time period. Fund Flows in millions of U.S. Dollars.

The following table includes expense data and other descriptive information for all Vanguard Short Term Bond ETFs listed on U.S. exchanges that are currently tracked by ETF Database. In addition to expense ratio and issuer information, this table displays platforms that offer commission-free trading for certain ETFs.

| SymbolSymbol |

|---|

You May Like: Apps For Investing In Cryptocurrency

Where To Buy These Short Term Bond Etfs

All the above short term bond ETFs are available at M1 Finance. M1 has zero trade commissions and zero account fees, and offers fractional shares, dynamic rebalancing, intuitive pie visualization, and a sleek, user-friendly interface and mobile app. I wrote a comprehensive review of M1 Finance here.

Disclaimer: While I love diving into investing-related data and playing around with backtests, I am in no way a certified expert. I have no formal financial education. I am not a financial advisor, portfolio manager, or accountant. This is not financial advice, investing advice, or tax advice. The information on this website is for informational and recreational purposes only. Investment products discussed are for illustrative purposes only. It is not a recommendation to buy, sell, or otherwise transact in any of the products mentioned. Do your own due diligence. Past performance does not guarantee future returns. Read my lengthier disclaimer here.

Don’t want to do all this investing stuff yourself or feel overwhelmed? Check out my flat-fee-only fiduciary friends over at Advisor.com.

Note: Interested In Getting Periodic E

Out of 20 bond ETFs, all but three of them come with an expense ratio of 0.07% or less. Especially when it comes to retirement investing, lower expense ratios mean higher yields and that means more money in your pocket. Just as advantageous is the fact that all but 4 of the 20 have assets of at least $2 billion. In many cases, that means trading costs are also razor thin. I preach all the time about looking at the total cost of ownership of ETFs . No ETF issuer may offer a better cost advantage than Vanguard.

As I discuss with the Vanguard Stock ETF rankings, there are some disadvantages to dumping bond ETFs of all styles and target markets into one bucket. That’s less of an issue in the fixed income space since the vast majority of funds invest in hundreds, if not thousands, of individual bonds. If a low volatility stock ETF, for example, holds 50-100 names and a total stock market ETF has more than 1,000 stocks, the latter will hold a distinct diversification advantage. In the bond ETF world, diversification is less of an issue since most of them are highly diversified.

Don’t Miss: Whats A Good Investment Company

The 5 Best Short Term Bond Etfs

Last Updated: 2 min. read

Short term bonds are great for retirees and risk-averse investors. Here well look at the best short-term bond ETFs.

Disclosure: Some of the links on this page are referral links. At no additional cost to you, if you choose to make a purchase or sign up for a service after clicking through those links, I may receive a small commission. This allows me to continue producing high-quality, ad-free content on this site and pays for the occasional cup of coffee. I have first-hand experience with every product or service I recommend, and I recommend them because I genuinely believe they are useful, not because of the commission I get if you decide to purchase through my links. Read more here.

Contents

Vanguard Government Bond Etfs

Vanguard’s Treasury ETFs come in four different tenors – the Vanguard Short-Term Treasury ETF , the Vanguard Intermediate-Term Treasury ETF , the Vanguard Long-Term Treasury ETF and the Vanguard Extended Duration Treasury ETF . The first three are fairly self-explanatory, while EDV extends about as far out on the maturity spectrum as you’ll find. VGLT, for example, holds a diverse set of bonds with maturities of between 15-30 years. EDV splits its portfolio 50/50 between bonds with 20-25 year maturities and 25+ year maturities. VGLT has a duration of 17 years, but EDV’s is more than 24 years. In short, EDV is about as volatile and interest rate sensitive a Treasury bond ETF as is available anywhere.

The other is the Vanguard Short-Term Inflation-Protected Securities ETF . This tends to be on the more defensive end of the spectrum and only invests in notes with maturities of 5 years or less. Not surprisingly, it’s been a popular fund lately and has doubled in size since the beginning of 2021.

Read Also: Invest In Stock Market Or Cryptocurrency

Best Vanguard Bond Etf Rankings

More than half of the Vanguard bond ETF lineup comes with an expense ratio between 0.03% and 0.05%. That means the differences between these ETFs are razor-thin on a purely quantitative basis. Choosing a specific fund on this list will likely depend more on what kind of exposure you’re looking for, but there are a lot of great choices.

Best Vanguard Bond ETFs

Short 20+ Year Treasury

Investment Objective

ProShares Short 20+ Year Treasury seeks daily investment results, before fees and expenses, that correspond to the inverse of the daily performance of the ICE U.S. Treasury 20+ Year Bond Index.

Important Considerations

This short ProShares ETF seeks a return that is -1x the return of its underlying benchmark for a single day, as measured from one NAV calculation to the next.

Due to the compounding of daily returns, holding periods of greater than one day can result in returns that are significantly different than the target return, and ProShares’ returns over periods other than one day will likely differ in amount and possibly direction from the target return for the same period. These effects may be more pronounced in funds with larger or inverse multiples and in funds with volatile benchmarks.

Investors should monitor their holdings as frequently as daily. Investors should consult the prospectus for further details on the calculation of the returns and the risks associated with investing in this product.

Common uses for inverse exposure

-

Seek to profit from a market decline

-

Help to hedge against an expected decline

-

Underweight exposure to a market segment

Documents & Downloads

You may order paper copies by contacting ProShares Client Services at 866-PRO-5125

Also Check: Top Mba For Investment Banking

Vanguard Total Market Bond Etfs

Total MarketLet’s start with the total bond market ETFs first. As mentioned above, BND just became the largest bond ETF in the marketplace and comes in at #2 on this list. While this ETF would be a top-shelf choice for broad U.S. bond market coverage, it’s important to call out a few minor nitpicks about it. First, BND is comprised of about 2/3 U.S. Treasuries. If you’re looking for more diverse coverage, you might want to tilt a little more towards 50/50. BND would be a great position, but you could consider augmenting it with a fund, such as the Vanguard Total Corporate Bond ETF . Two other areas it doesn’t cover include foreign bonds and high yield bonds. Again, you’d need to add another ETF if you want to add that exposure in.

The first problem can be addressed with the Vanguard Total World Bond ETF . It’s a 50/50 split between BND and the Vanguard Total International Bond ETF . BNDX’s exposure consists mostly of bonds from developed markets, but has a minor allocation to emerging markets bonds. Like BND, it includes no junk bonds.

Vanguard also offers investors the ability to control the maturities of their bond holdings as well. The Vanguard Long-Term Bond ETF , the Vanguard Intermediate-Term Bond ETF and the Vanguard Short-Term Bond ETF come with varying degrees of yield and duration risk. It’s worth noting also that the longer-term bond ETFs offer more corporate bond exposure mixed with Treasuries.

Ready To Choose Your Bond Etfs

Search for a specific bond ETF by name or ticker symbol:

For more information about Vanguard mutual funds and ETFs, visit Vanguard mutual fund prospectuses or Vanguard ETF prospectuses to obtain a prospectus or, if available, a summary prospectus. Investment objectives, risks, charges, expenses, and other important information are contained in the prospectus read and consider it carefully before investing.

You must buy and sell Vanguard ETF Shares through Vanguard Brokerage Services or through another broker . See the Vanguard Brokerage Services commission and fee schedules for limits. Vanguard ETF Shares are not redeemable directly with the issuing fund other than in very large aggregations worth millions of dollars. ETFs are subject to market volatility. When buying or selling an ETF, you will pay or receive the current market price, which may be more or less than net asset value.

All investing is subject to risk, including the possible loss of the money you invest. Diversification does not ensure a profit or protect against a loss.

You May Like: What Can You Invest In With A Self Directed Ira

How Much Risk Are You Comfortable With

Different types of bonds will expose you to different types and levels of risk. Knowing the general terms used to describe specific bond characteristics can help you assess how comfortable you are with the risks involved with investing.

For example, maturity helps gauge how much the price of a bond will go up or down when interest rates change. The general rule is to align the average maturity of a bond ETF with the length of time that you’ll have your money invested in that ETF.

helps gauge the likelihood that the bond will default. Obviously, the better the credit quality, the less risk there is to your investment.

Schwab Us Dividend Equity Etf

SevenOneSeven Capital Management reduced their investment in ARCA:SCHD by 18,075 shares. The trade had a 3.01% impact on the equity portfolio. During the quarter, the stock traded for an average price of $72.31.

On 11/18/2022, Schwab US Dividend Equity ETF traded for a price of $76.62 per share and a market cap of $42.87Bil. The stock has returned 0.60% over the past year.

There is insufficient data to calculate the stocks financial strength and profitability ratings.

In terms of valuation, Schwab US Dividend Equity ETF has a price-earnings ratio of 14.71 and a price-book ratio of 3.56.

Recommended Reading: How To Invest In P2p Lending