Financing The New Enterprise

The business plan is a key tool for obtaining financing for a new business venture, but it is not a guarantee a financial institution will lend the necessary money to finance the capital and operating costs of the enterprise. The information acquired during the feasibility study will make the business plan more attractive to investors and lending institutions.

There will be one more “proceed or abandon” decision to be made at this stage. If several financing sources reject the business plan, the entrepreneur must re-examine the business case and decide whether to proceed with the proposal. One option is to review all sections of the feasibility analysis and determine whether improvements can be made. Another is to reject the idea completely and look for a better idea.

Criteria Considerations:

- How much funding is needed to operate the enterprise effectively?

- Should the business case be improved in order to keep trying?

- Does this proposal put too much at risk?

How Target Date Funds Work

Financial services firms manage families of target date funds, with individual versions for each year, past and future. Investors choose a fund that targets their anticipated year of retirement, and they may continue holding it until long after the target year has passed.

With target date funds, the term glide path describes how a funds asset allocation changes over time. All of the funds on this list utilize a through glide path, where the managers continue to adjust the balance of stock and bond funds after the designated target year. For some funds, the asset allocation changes end about five to seven years after the target date. For others, the changes continue for several decades.

For each target date fund in our evaluation, we focused on the 2060 version, suitable for someone looking to retire in about 40 years. In addition, we also evaluated the 2020 version, and some earlier versions, for insight on how the fund familys portfolio evolves as you enter retirement.

The author held no positions in the securities discussed in the post at the original time of publication.

Reasons Not To Borrow

The best way to have money for retirement is to fund a retirement account and forget about it, so financial experts advise against borrowing from a retirement account for most expenses. A childs wedding or college education should not be funded from a retirement account if it puts a parents retirement in jeopardy. When you take a loan from your retirement account, you lose out on any gains the funds would amass if they were invested. For example, TIAA reports that a $10,000 loan paid back over 5 years represents more than $3,500 in lost investment earnings, assuming the loan has a 6 percent interest rate and the return on investment averages 8 percent over the next 25 years.

According to TIAA, most people take out a loan against their retirement savings to pay off debt or for an emergency expense. Besides missing out on investment returns on the value of the loan, 403 and 401 borrowers often contribute less or stop contributing to their retirement savings while they are paying off their loans. Using emergency savings is usually preferable to borrowing from a retirement account.

You May Like: Foreigner Investing In Us Stocks

What Other Options Are There If You Need Cash

- If you have a Roth IRA for five years, you can withdraw your original contributions at any age, free of federal taxes and penalties.

- For education expenses, explore scholarships or student loans. You can borrow for school but not for retirement.

- You can borrow against the value of your home with a home equity loan or home equity line of credit.

Dont Miss: Can You Roll Over 401k To New Employer

Writing The Business Plan

The information that has been collected to this stage is sufficient to allow the entrepreneur to write a complete business plan. Business plan forms and electronic business plans are available wherever business books and software are sold. These may come in a variety of different formats, but all require essentially the same information.

Recommended Reading: You Invested 2300 In A Stock

Best For Teachers: Tiaa

Teachers often have somewhat unique retirement needs compared to other professions. Their needs may include a pension plan, 403 or 457 plan. TIAA has worked with educators on retirement planning for more than 100 years. And while the company has grown in recent years to include non-retirement products and accounts outside of education, TIAA has maintained its educator-friendly plans for teachers, universities, and other schools looking for retirement options.

Employees with TIAA employer-sponsored retirement plans can choose between different investment options, which may include annuities. Small businesses and self-employed business owners can look to SEP or SIMPLE IRAs at TIAA. If youre on your own, a TIAA IRA includes online commission-free stock and ETF trades in addition to a list of mutual funds with no transaction fees if you hold them for at least six months. If you like keeping your money in-house, TIAA also runs its own family of mutual funds.

-

Long history of working with teachers

-

No transaction fees on many mutual funds if held for six months

-

Retirement options include annuities and other guaranteed-income products

How Much Can You Contribute To A Retirement Plan

The amount you can contribute to your retirement plan varies by what plans you have. For most plans, such as a 401 plan, you can contribute up to $19,500 per year as of 2021 and $20,500 for 2022. A traditional IRA has a limit of $6,000 per year, or $7,000 if youre age 50 or older, while SEP IRA limits are $58,000 , or 25% of your income. SIMPLE IRA plans come in at $13,500 for 2021 and $14,000 for 2022. These contribution limits can change from year to year and are established by the IRS.

Also Check: How Do I Take Money Out Of My Voya 401k

Recommended Reading: Bank Of America Investment Interest Rates

What Are Different Types Of Retirement Plans

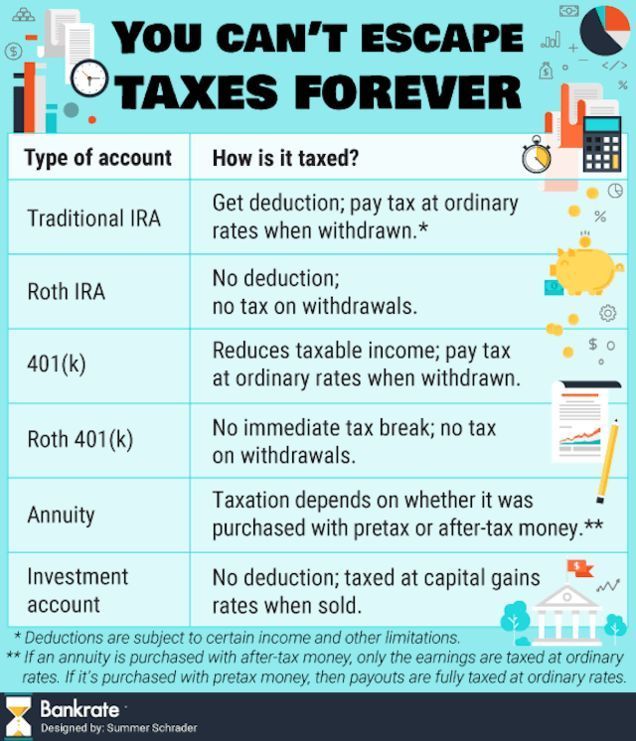

There are a number of different retirement plan options to choose from. While Traditional and Roth IRAs are among the most popular, there are other accounts more suitable for self-employed individuals such as a or solo 401. Each retirement plan comes with unique tax benefits so you can choose an account that best matches your situation to set you up for future retirement success.

How Can I Save More For Retirement In Addition To My Mandatory Contributions

All Penn State employees are eligible to open a supplemental retirement account with TIAA. You can choose either the 403 tax-deferred annuity and/or the 457 deferred compensation plan. This is in addition to and separate from the mandatory contributions you make to your Penn State retirement plan, whether you are in SERS or the Alternate Retirement Plan. You can open the new account at ANY TIME during the year, and can change or stop your contributions whenever you like. See the Supplemental Retirement page to learn more about this feature.

Also Check: When To Invest In Ira

The Feasibility Analysis Mindset

A feasibility analysis is conducted in several stages. The more complex the business proposal, the more stages of analysis needed. At the end of each stage, the business planner is required to do two things:

- set criteria by which the project will or will not proceed to the next planning phase

- make a decision to proceed to the next stage or to abandon the idea at this point

These criteria depend on the goals set at the beginning.

Example 1

If the entrepreneur sets a goal to increase profit by $50,000 per year, the criteria may be that profit must increase by at least $25,000 or it is not worth proceeding. But a market assessment shows the business is unlikely to net more than $10,000 extra from added sales, so the entrepreneur decides to abandon the project, looking for a different opportunity.

What Happens To My Retirement Plan When I Leave University Employment

A faculty or staff member who is leaving University employment may be able to port their retirement benefits to the retirement system of the new employer. They should contact the appropriate retirement plan provider listed below regarding possible benefits or the withdrawal of contributions.

You May Like: How To Invest In The Right Cryptocurrency

Apply For Direct Transfer From New Investment Company

You can also apply to transfer your funds from your TIAA-CREF IRA to your new investment company, provided you have opened a compatible retirement account with them. In such a case, you should call the representative, tell them what you need and they will provide you with all the relevant instructions.

For example, suppose you want to perform a transfer or TIAA-CREF rollover to Fidelity to a new employer-sponsored plan. In that case, you will contact the latters representatives and request the appropriate form.

Ensure you fill in the transfer form with all the needed details and return it to Fidelity by mailing it physically or uploading it digitally, depending on what options are available. Your new custodian will process the transfer by sending the request to TIAA, who will then send your check together with the transfer request.

Once the transfer or rollover of TIAA to Fidelity process is complete, Fidelity will invest your IRA funds based on your instructions.

References

Take Required Minimum Distributions

TIAA and Fidelity pay you the minimum amount of income you are legally required to take each year by the IRS under this payment program. The balance of your accumulations remains tax-deferred and continues to experience the investment returns of your chosen funds.

Questions About Your Benefits?

Limitations

The University of Michigan in its sole discretion may modify, amend, or terminate the benefits provided with respect to any individual receiving benefits, including active employees, retirees, and their dependents. Although the university has elected to provide these benefits this year, no individual has a vested right to any of the benefits provided. Nothing in these materials gives any individual the right to continued benefits beyond the time the university modifies, amends, or terminates the benefit. Anyone seeking or accepting any of the benefits provided will be deemed to have accepted the terms of the benefits programs and the universitys right to modify, amend, or terminate them. Every effort has been made to ensure the accuracy of the benefits information in this site. However, if any provision on the benefits plans is unclear or ambiguous, the Benefits Office reserves the right to interpret the plan and resolve the problem. If any inconsistency exists between this site and the written plans or contracts, the actual provisions of each benefit plan will govern.

Benefits Office

Recommended Reading: How To Tell Which Cryptocurrency To Invest In

How Do You Start Investing For Retirement

One of the best strategies to invest for your retirement future is setting up automatic, ongoing contributions into a retirement plan. You can keep the investment strategy simple yet effective by investing in low-cost index funds. Once you have these factors in place, consider increasing your deposits as youre able over time to set even more money aside for retirement.

Why Are The Expenses And Fees For Variable Annuities Higher Than Those For Mutual Funds

While annuities and mutual funds incur similar expenses for things such as portfolio management, variable annuities are basically contracts between insurance companies and individuals. There are expenses associated with creating and maintaining many of the insurance guarantees offered by annuities, such as mortality and expense risk charges and other administrative charges, which cover the operating costs of the insurance company. There is also a cost associated with having the ability to convert the annuity into payments when you retire, known as “annuitization.” These insurance protections and features are not available through investment products, such as mutual funds. It is important to understand the costs and features annuities offer before investing to ensure they are the best fit for your situation.

Also Check: Wealth Management And Investment Services

Apply For A Direct Transfer From Tiaa

Before applying for a transfer, you need to contact your employer and find out what you need to do. And if you have a new employer and want a different plan, find out if the employers plan accepts rollovers.

TIAA does offer online forms that allow you to transfer your IRA to another financial institution directly. However, the document does not allow for transfers from a TIAA traditional account.

When you elect to use the direct transfer form, you should fill in all the details. These include your name, TIAA and CREF numbers, the date and amount of funds you would like to transfer and the name and address of the new financial institution you would like to move your IRA assets to.

Once you sign the form digitally, you can upload it according to the instructions. Alternatively, you can print the form, fill in the details by hand and mail it to the address the form provides.

Processing will take up to seven business days after your forms have been received.

Investment & Contribution Elections

What investment options are available?Vanderbilts plan includes three tiers of investment choices so you can easily create an investment mix to suit your investment style and preferences. You can choose among the following tiers of investments:

- Tier 1: Target Date Funds. These funds offer an allinone approach to simple investing. The Vanguard Target Retirement Funds are designed for investors expecting to retire around the year indicated in each fund’s name. The funds are managed to gradually become more conservative over time as you get closer to retirement. The funds are subject to the volatility of the financial markets, including the volatility of equity and fixed income investments in the United States and abroad, and may be subject to risks associated with investing in highyield, smallcap, commodityrelated, and foreign securities. Principal invested is not guaranteed at any time, including at or after the funds’ target dates.

How do I select investments and manage my account? Log on to Fidelity NetBenefits at www.netbenefits.com/vanderbilt or call Fidelity at 1.800.343.0860, Monday through Friday from 7 a.m. to 11 p.m., Central time to speak with a representative. Refer to these instructions to set up your account and complete transactions.

Are individual stocks and ETFs available through BrokerageLink?No, federal law prevents individual stocks and ETFs from being offered in a 403 plan.

Don’t Miss: How To Invest In Ada

Looking For A Financial Advisor

Get In Touch With A Pre-screened Financial Advisor In 3 Minutes

0.64%

The T. Rowe Price 2060 Fund allocates 90% to equities and 10% to cash and bonds. While the cost of this target date fund is on the high side at 64 basis points, its five-year performance comes in at 6.78%.

T. Rowe Prices target date fund owns more than 20 different mutual funds to implement its investment strategy.

Of the funds that made our list, T. Rowe Price takes the most aggressive approach at retirement. Its 2020 fund has a 60% weighting in stocks. While some would argue that 60% is too aggressive for a retiree, its consistent with research on the 4% rule. The fund, however, continues to reduce equities in retirement, ending with an equity allocation of about 35%.

How Can I Have Tiaa Conduct A Seminar Or Workshop At My Location

Workshops and seminars can be done at your college or campus location, or even at an alternate site. TIAA will take care of all the details. All you need to do is provide an appropriate space. Possible topics include everything from making and maintaining a personal budget, to a mid-career retirement checkup, to transitioning from career to life after retirement. If you would like to learn what opportunities are available or to schedule an event, please contact TIAA at 278-5000, or Penn State HR Services at 865-1473.

Don’t Miss: Wall Street Oasis Investment Banking Guide

The Best Retirement Plans Of 2021

Fidelity stands out as a top provider of retirement plans to large companies, small companies, and individuals. Fidelity offers 401 plans for large and small businesses SEP-IRA, SIMPLE IRA, and Self-Employed 401 for small businesses and individual retirement accounts including traditional, Roth, and rollover IRAs. While most people will probably manage their accounts online, Fidelity offers more than 200 retail locations for in-person help.

Unique retirement-focused offerings from Fidelity include its suite of retirement planning calculators and tools including the useful Fidelity Retirement Score, which helps you assess your retirement preparedness, and four mutual funds with no fees at all. For individual account holders, you generally wont pay any recurring account fees or have to worry about account minimums.

Stock and ETF trades are commission-free at Fidelity, which also offers more than 3,400 mutual funds with no transaction fees.

Putting it all together, Fidelity offers an excellent package of retirement accounts that can help you achieve your long-term retirement investing goals.

-

Wide variety of retirement accounts

-

Retail locations

Recommended Reading: How To Find Out If Someone Has A 401k

How Do Retirement Plans Work

A retirement plan is an investment account in which you can contribute funds, and in many cases tax-free funds, to be invested in a variety of ways. The goal is to grow the total value of the account. Some retirement plans, like 401s, allow you to invest tax-free funds for tax-deferred investments. Other accounts, like a Roth IRA, allow you to grow your account after youve paid taxes and withdraw tax-free once you reach the age of retirement.

Recommended Reading: Best Small Cryptocurrency To Invest In