Earn Crypto For Free Through Learning And Mining

As mentioned, you can actually earn a free trickle of crypto just by learning about crypto on sites like Coinbase with its Earn program. For example, you can earn $2 in Stellar just by watching a two minute video:

If you have a powerful computer with a gaming-capable graphics card, you can also mine crypto for free. Mining is the act of leasing your computers processing power to the blockchain and receiving a trickle of crypto in return. I wrote a guide on how how to start mining Bitcoin in 60 seconds.

Should You Invest In Valero Energy Based On Bullish Wall Street Views

When deciding whether to buy, sell, or hold a stock, investors often rely on analyst recommendations. Media reports about rating changes by these brokerage-firm-employed analysts often influence a stock’s price, but are they really important?

Let’s take a look at what these Wall Street heavyweights have to say about Valero Energy before we discuss the reliability of brokerage recommendations and how to use them to your advantage.

Valero Energy currently has an average brokerage recommendation of 1.36, on a scale of 1 to 5 , calculated based on the actual recommendations made by 11 brokerage firms. An ABR of 1.36 approximates between Strong Buy and Buy.

Of the 11 recommendations that derive the current ABR, nine are Strong Buy, representing 81.8% of all recommendations.

Brokerage Recommendation Trends for VLO

Check price target & stock forecast for Valero Energy here> > > The ABR suggests buying Valero Energy, but making an investment decision solely on the basis of this information might not be a good idea. According to several studies, brokerage recommendations have little to no success guiding investors to choose stocks with the most potential for price appreciation.

Do you wonder why? As a result of the vested interest of brokerage firms in a stock they cover, their analysts tend to rate it with a strong positive bias. According to our research, brokerage firms assign five “Strong Buy” recommendations for every “Strong Sell” recommendation.

Is VLO Worth Investing In?

How To Invest In Crypto Without Buying Coins

The easiest way to get investment exposure to crypto without buying crypto itself is to purchase stock in a company with a financial stake in the future of cryptocurrency or blockchain technology.

But investing in individual stocks can bear similar risks as investing in cryptocurrency. Rather than choosing and investing in individual stocks, experts recommend investors put their money in diversified index funds or ETFs instead, with their proven record of long-term growth in value.

Believe it or not, most individuals with a retirement plan or an investment portfolio allocated in an index fund already have some exposure to crypto, says Daniel Johnson, a CFP with ReFocus Financial Planning.

Many of the best index funds like S& P 500 or total market funds include publicly traded companies that have some involvement with the industry by either mining crypto, being involved in the development of blockchain technology, or holding significant amounts of crypto on their balance sheets, says Johnson.

For example, Tesla which holds over a billion dollars in Bitcoin and accepted Bitcoin payments in the past is included in any funds that track the S& P 500. Since its 2020 inclusion, its become one of the most valuable, and therefore influential companies in the index. And Coinbase, the only publicly traded cryptocurrency exchange, is in the ARK Fintech Innovation ETF.

Read Also: Why Work In Alternative Investments

Should I Invest In Stocks Or Cryptocurrency Reddit

Previously known as Monaco, it was one of the first platforms to attempt to build a global blockchain financial institution. The platform was an immediate success.

Notably, the company spent an undisclosed amount on this premium domain. With its well-developed ecosystem, there are now 3 million users using this platform worldwide.

Crypto.com Metal Visa Card

How To Store Cryptocurrency

Once you have purchased cryptocurrency, you need to store it safely to protect it from hacks or theft. Usually, cryptocurrency is stored in crypto wallets, which are physical devices or online software used to store the private keys to your cryptocurrencies securely. Some exchanges provide wallet services, making it easy for you to store directly through the platform. However, not all exchanges or brokers automatically provide wallet services for you.

There are different wallet providers to choose from. The terms hot wallet and cold wallet are used:

- Hot wallet storage: “hot wallets” refer to crypto storage that uses online software to protect the private keys to your assets.

- Cold wallet storage: Unlike hot wallets, cold wallets rely on offline electronic devices to securely store your private keys.

Typically, cold wallets tend to charge fees, while hot wallets don’t.

Also Check: How To Invest In Traditional Ira

Marathon Digital Holdings Inc

Marathon Digital Holdings is currently one of the largest bitcoin mining companies in the U.S. Mining enables the verification of transactions, the security of the blockchain and the addition of new coins and tokens into the market.

MARA helps people gain exposure to bitcoin without holding the asset directly and working through the complications, and it aims to build the largest bitcoin mining operation at the lowest energy cost possible. The company focuses on sustainability and environmental protection, so it uses renewable energy providers in its operations.

In addition, Marathon boasted more than 57,000 active miners in October, and a total of 10,670 bitcoins, including 6,741 unrestricted bitcoins, in its holdings, with a market value of about $207.3 million and $132.9 million, respectively, as of Sept. 30. The companys growth can be attributed to its investment in miners to increase the speed of bitcoin mining to make production a lot more efficient and profitable. Marathon announced in an Oct. 6 press release that it plans to add 19,000 additional miners in the next 30 days.

Trading Crypto Vs Stocks

The basic experience of buying cryptocurrencies is not very different from buying a stock. You open an account with a crypto brokerage, transfer some money to that account, pick a cryptocurrency, and place an order with the brokerage. After a short break, youll have some cryptocurrency tokens in your crypto wallet.

The gears may turn very differently behind the scenes, but the crypto-buying procedure should feel familiar if youve ever bought a stock. There are some differences, though:

- Crypto brokers are likely to charge trading fees for each transaction — a practice that most stock brokers ended in 2018 and 2019. For example, the popular Coinbase platform charges a transaction fee of 0.6% on crypto purchases of less than $10,000.

- A stock transaction can be performed very quickly, to the point where algorithmic trading systems can close a deal in a few microseconds. Crypto trades are slower because each new transaction must be approved and verified by the digital currencys blockchain network — a process that typically takes about 15 seconds for Ethereum trades and several minutes on the Bitcoin network.

- Unless you insist on a printed stock certificate, your stock broker will act as the custodian of your stock-based holdings. Thats not always the case for cryptocurrencies, where some investors insist on removing their digital coins from the centrally managed brokerage platform in favor of a cold wallet in their own possession.

Read Also: What Is Real Property Investment

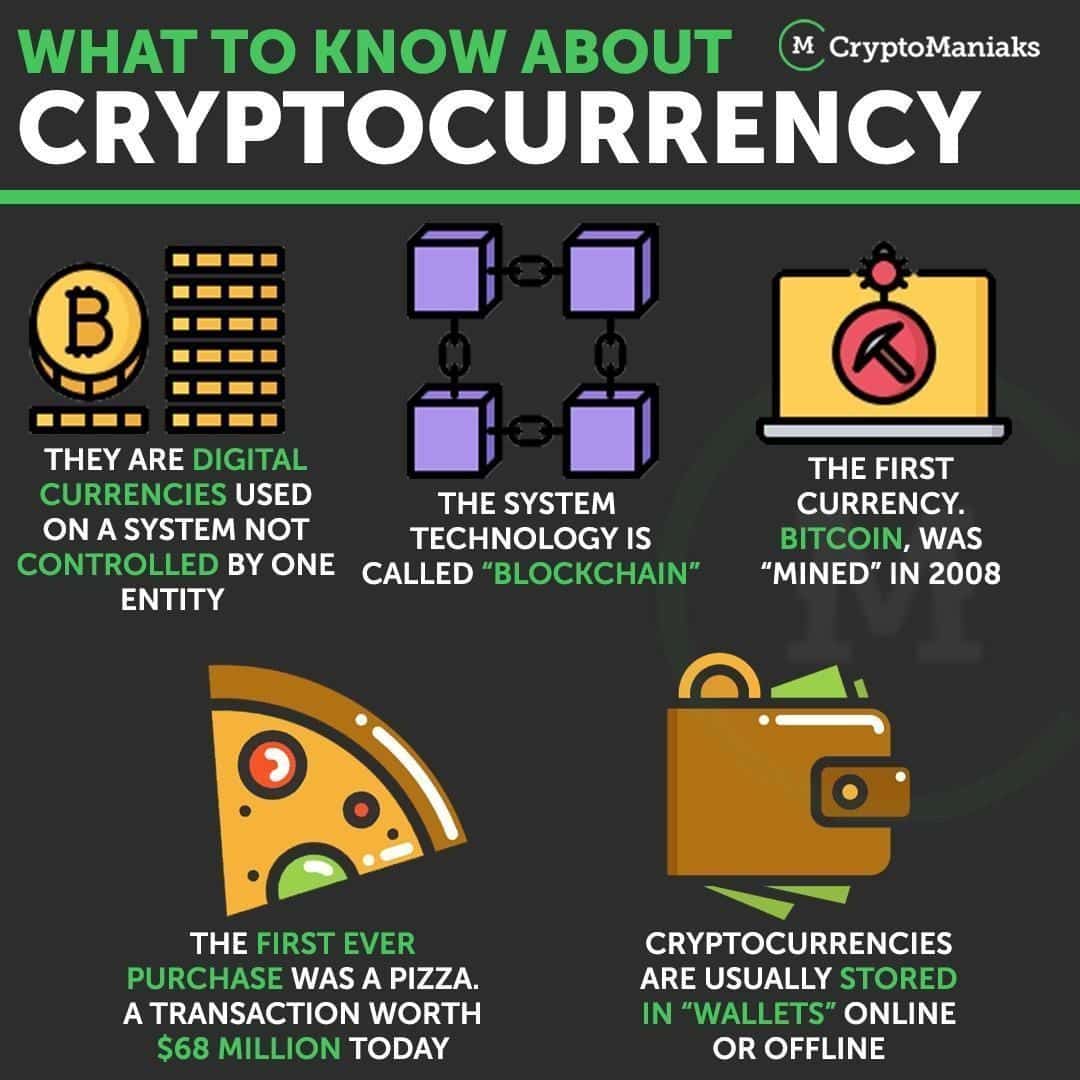

How Does Cryptocurrency Work

Bitcoin and most other cryptocurrencies are supported by a technology known as blockchain, which maintains a tamper-resistant record of transactions and keeps track of who owns what. The creation of blockchains addressed a problem faced by previous efforts to create purely digital currencies: preventing people from making copies of their holdings and attempting to spend it twice

Individual units of cryptocurrencies can be referred to as coins or tokens, depending on how they are used. Some are intended to be units of exchange for goods and services, others are stores of value, and some can be used to participate in specific software programs such as games and financial products.

What Is Bitcoin And How Does It Work

The concept of digital money that you use online is not that complicated in itself. After all, most of us will be familiar with transferring money from one online bank account to another.

Cryptocurrencies like bitcoin are digital assets that operate like normal currency, but with notable differences. They use peer to peer payment methods, without the banks taking a cut with every transaction. There are no physical versions of the coins either.

Each bitcoin is created using an encrypted code, which is a string of numbers and letters. The same equation used to create the code can unlock it .

Other important points about bitcoin:

- Cryptocurrencies, like bitcoin, ethereum and cardano, are a form of payment that uses blockchain technology to send data in cyberspace

- Each bitcoin must be mined

- It is finite: only 21 million bitcoins that can be mined in total

- Cryptocurrencies are decentralised meaning they are not regulated by a financial authority, like a government or central banks

- Most platforms will allow bitcoin purchases using credit cards

Also Check: Guide To Investing In Gold And Silver

Crypto Vs Stocks: What Should You Invest In

Although investors have always had many choices of financial instruments, the crypto bubble of 2017 has given them one more. If youâve been asking yourself: should I put my money in cryptocurrencies instead of traditional stock options, this article is for you. While the answer to this question may not be straightforward, we help you explore the pros and cons of both options to help you decide.

Key takeaways

- Stocks are considered to be more stable and less volatile than cryptocurrencies. This is because they are based on the company’s earnings and not subject to as much speculation.

- Cryptocurrencies, on the other hand, have the unique benefit of being decentralized, which means they are not subject to government interference or manipulation.

- Stocks have been the go-to choice of investors for most of the 20th and the 21st centuries. And even though cryptocurrencies are riskier in comparison, they do offer the chance of earning high rewards.

How Can I Invest In Bitcoin

You can invest in Bitcoin directly by using one of the major cryptocurrency exchanges, such as Coinbase or Binance. Another way to gain investment exposure to Bitcoin is to buy shares in a company with significant Bitcoin exposure, such as a Bitcoin mining company. A third option is to invest in a Bitcoin-focused fund such as an exchange-traded fund .

Recommended Reading: What To Invest Money In As A Teenager

Need A Loan Get One In 3 Simple Steps

If you are considering applying for a personal loan, just follow these 3 simple steps.

Apply

Apply online for the loan amount you need. Submit the required documentation and provide your best possible application. Stronger applications get better loan offers.

Accept

If your application meets the eligibility criteria, the lender will contact you with regard to your application. Provide any additional information if required. Soon youll have your loan offer. Some lenders send a promissory note with your loan offer. Sign and return that note if you wish to accept the loan offer.

Repay

The loan then gets disbursed into your U.S. bank account within a reasonable number of days . Now you need to set up your repayment method. You can choose an autopay method online to help you pay on time every month.

About Stilt

Stilt provides loans to international students and working professionals in the U.S. at rates lower than any other lender. Stilt is committed to helping immigrants build a better financial future.

We take a holistic underwriting approach to determine your interest rates and make sure you get the lowest rate possible.

Learn what others are saying about us on , Yelp, and or visit us at . If you have any questions, send us an email at

Will Bitcoin Go Back Up

It is impossible to say whether bitcoin will recover back to the heights we saw at the end of 2021.

The price of crypto is based purely on speculation, making it difficult to predict what the future holds for this volatile asset. In other words, bitcoins performance will depend on how the rest of the crypto crowd is feeling.

Bitcoin previous performance might give some investors confidence of a full recovery. In 2018 bitcoin plunged by 83% before going on to reach fresh record highs in 2020 and 2021. The price was propped up by people having some built up some savings during lockdown.

But there are no guarantees that bitcoins price will return to the levels seen in November 2021 when it reached $69,000.

If youre currently invested in bitcoin, its probably worth holding onto your hat for the time being. However, if youre waiting for bitcoin to bounce back, you might need to be very patient.

Don’t Miss: Best Way To Invest In Fixed Income

Considering Whether To Buy Crypto Or Stocks Investing In Top Stocks Makes A Lot More Sense Than Buying Crypto And We Explain Why In This Article

Are you interested in investing in crypto or stocks? I still cant think of anything that would make me optimistic on bitcoin or any cryptocurrency, even after the deep slump the whole sector has gone through recently. The best thing I can say about bitcoin is that it will probably remain volatile, rather than vaporizing like the worst crypto performers.

Please dont misunderstand. I respect and agree with the many investors who have high expectations for the future of blockchain. Some investor/digital gurus think blockchain will change the world. They may be right. However, bitcoin is simply the earliest and most widely known blockchain user.

Earn 20% Pa By Staking Cro On Exchange

The staking benefits that allow users to earn 20% per annum is available to users that stake a minimum of 5,000 CRO for at least 6 months. For example, if you staked 5,000 CRO for 180 days you would receive roughly 2.7397 CRO every day as interest.

Staking CRO will bring you more benefits except 20% p.a. included:

- Trading fees discount up to 100%

- Access to The Syndicate

- Pay reward from using Crypto.com Pay via mobile app

- New user sign-up bonus

Also Check: Grubb Real Estate Investment Company

Can You Lose All Your Money In Bitcoin

Yes you certainly can. Crypto is very risky and not like conventional investing in the stock market.

Bitcoins value is based purely on speculation. This is different to company stocks where the share price will move depending on how the business is performing.

Important: cryptocurrencies are unregulated by the UK watchdog, the Financial Conduct Authority. Crypto platforms are only regulated for anti-money laundering purposes.

There are three main ways to lose all you money with bitcoin:

- The value plummetsand you sell: crypto is volatile with its price determined by sentiment. Though technically you only lose money if you sell an investment for less than you bought it for. This is known as crystallising your losses.

- Your memory: experts estimate 20 per cent of all cryptocurrency has either been forgotten about or lost with a current value of around $140billion, according to Crypto data firm Chainalysis

- Cyber crime: hackers and scammers are thought to steal around $10million worth of cryptocurrency every day, according to Atlas VPN

Some people choose to take their holdings offline and store it in a physical device called a cold wallet, otherwise known as a hardware wallet or cold storage that is similar to a USB stick. While this protects from online attacks you risk losing your holdings.

As with any investment, do your due diligence and dont pin all your hopes on one company or one cryptocurrency.

Should You Invest In Cryptocurrency

You might consider investing in crypto if:

- Youd like to add very high-risk to your portfolio: If youve already assessed your risk tolerance and are actively looking to add higher risk into your portfolio, crypto certainly fits the bill.

- You believe in the mission of crypto and blockchain: Maybe you believe in the positive aspects of crypto and blockchain technology, and perceive it as a form of ESG investing.

You may want to pass on crypto if:

- Youre risk-averse: Cryptocurrency is extremely risky, volatile and unpredictable. If that gives you more anxiety than excitement, it may not be a fit for your portfolio.

- Its your first form of investing: To echo Varun Marneni, a certified financial planner with Atlantas CPC Advisors, its best to have $100,000 in safe investments first before you invest in crypto. Check out our article Safe Investments With High Returns.

- Youre feeling FOMO: Fear is not an investment strategy. FOMO shouldnt be a motivator for buying crypto, or any investable asset for that matter. Besides, you dont need crypto to get rich.

Want free crypto? > > > The Best Crypto Sign-Up Bonuses.

Read Also: Banks That Offer Investment Services

Cryptocurrency Vs Stocks Which Is Better

Investing in stocks is the established choice and crypto is a novel form of investment.& nbsp

It& rsquo s a fierce debate among investors. Stocks have been around for centuries and have achieved a certain status of reliability, while cryptocurrencies have only come into inception in recent years.& nbsp

For seasoned investors, it& rsquo s not so much about which one is better but which form of investing aligns with their goals. What kind of results do they want to achieve over what period of time?& nbsp

Stocks are backed by company assets or physical money, but this is not the case with crypto. The crypto market is young and growing rapidly which means there is great volatility. The question, & ldquo Which is better?& rdquo is difficult to answer objectively, as it depends on personal motives.& nbsp

CNBC found in 2021 that half of the millionaires already invested at least 25% of their wealth in crypto. Should you invest in stocks or cryptocurrency? That& rsquo s all up to you.