How Much Do I Need For A Down Payment On A Rental Property

Like most questions worth asking, the answer to this one is It depends. Specifically, it depends on the type of financing youre borrowing, it depends on your credit history, and it depends on how risky you look to lenders.

But thats not much of an answer, so heres a better one: between 15-30% of the purchase price of your next investment property . Where your down payment will fall in that range depends on what kind of loan you use to buy your next investment property.

Credit Cards & Business Lines Of Credit

All right, so pulling cash from credit cards is among the riskier tactics on this list. But its still an option.

The advantages to drawing on credit cards for your down payment include speed and flexibility . The enormous, hulking, elephant-in-the-room disadvantage? Its expensive.

Personal credit cards typically charge three or four points, or percent up front in the form of a cash advance fee. Then theres the interest, which typically falls in the 16-24% range.

Thats a lot.

But no one says you have to use personal credit cards. Instead, use a business credit service like Fund & Grow to open $100,000-$250,000 in combined business credit cards and lines, which you qualify for as a real estate investor. Theyll find you cards with 0% introductory APR for the first 12-18 months, saving you money on interest. Then theyll show you how to pay title companies with your business credit cards, to avoid paying a cash advance fee.

Keep in mind that credit cards are not a viable option if youre borrowing a conventional mortgage, since it involves borrowing money to cover the down payment.

Credit cards can be a fast, flexible source for funding a down payment on an investment property. Heres some further reading on how to use credit cards to buy real estate. Ive done it myself, and it worked out pretty well, actually.

When You Decide On A House Sell Immediately

Once youâve assessed your tax liabilities, signed a purchase contract, and gotten your financing approved, donât delay in selling off the stock you need. Things change fast in the stock market and itâs an awful feeling to set aside a few thousand shares to cover your down payment only to see those shares lose 5% of their value before you liquidate.

Unless youâre a very conscientious, attentive trader, you donât know what will happen to your stock in the time between signing the contract and your closing date. All it takes is one bad quarterly report to tank a portion of your down payment. So donât delay until the closing date once youâve signed the contract, sell your stock to guarantee you have the agreed-upon down payment ready.

Read Also: How To Invest In Ada

Hot Stocks For Tomorrow: Netflix

Without question, Netflix will be one of the top stocks to watch on Friday morning. The company is due to report earnings after the close on Thursday. Its the first of the FAANG stocks to report earnings and really, the first of the big-cap tech names to do so as well.

While it will be just one report among dozens when it comes to tech and just one of five when it comes to FAANG investors will be looking for Netflix to set the tone.

Analysts expect earnings of 54 cents a share on revenue of $7.85 billion. That would represent year-over-year sales growth of just 2%. However, its all about subscriber growth, which according to some, will come in low.

There is some hope that advertising will help offset slower-than-expected subscriber growth, but well have to see how Wall Street reacts to the numbers.

The Chart: Of the FAANG stocks, Netflix has traded the best over the last few quarters. However, this report could be a make-or-break situation for the recent trend. If they sell it, see that $290 holds as support. If it fails, it could set the stage for a dip back into the $250s. On a rally, NFLX stock needs to clear $335, ultimately opening the door for a pushback toward $400.

Youll Position Yourself To Market Conditions

Real estate markets are in constant flux, due to changes in market demand. For instance, you may have heard the terms buyers and sellers markets. These refer to times when the market swings in favor of buyers and sellers, respectively, due to too little or too much demand for housing.

Many external factors outside of your control can influence the value of your home such as the sudden and unexpected rise of a global pandemic. Sometimes, its better to wait until market conditions become more favorable before seeking to sell your home.

Ideally, you would have high housing demand in your area along with low inventory. Conversely, youll likely wish to avoid buying a home in a sellers market when prices are going upward. After all, real estate is a classic example of a buy low, sell high investment you dont want to make a purchase if prices are likely to go downward, not upward in the future.

Note that having a look at housing market predictions and forecasts can help you get a better sense of where the market sits at present.

Read Also: How To Invest In Sqqq

Keep Copies Of All Paperwork Related To The Closing And Settlement

Although it might be tempting to shred the paperwork or put it in storage, youll want to have it handy for April 15. When you file your taxes, youll need documentation for the expenses and proceeds of the sale. And after you file your return, youll want to keep the paperwork in case youre audited.

Mortgage Rates Will Likely Stay Low

Once you want to buy a home, its really hard to think about anything else. This is why it makes sense to invest some of your down payment in real estate. You want to participate in the upside as you build your down payment.

A drop in mortgage rates has made real estate more affordable for many. However, a rise in home prices while you wait to find the ideal home makes buying less affordable.

Therefore, its really up to you to invest your down payment wisely. You must also try and make as much money from your day job and side hustles as possible.

Don’t Miss: How To Buy Investment Real Estate

Can I Sell My Stocks Anytime

Market Trading Hours You can generally only sell stock while the market is open. The New York Stock Exchange and Nasdaq are open between 9:30 a.m. and 4 p.m. Eastern time Monday through Friday, excluding holidays. If you have an urge to sell stock on the weekend, you have to wait until the market opens on Monday.

Acquire Permanent Life Insurance

Permanent life insurance can be a valuable way to supplement your retirement planning. Combining a death benefit with a savings option that can be used for you and your dependents, permanent life insurance provides tax-free growth, savings you can draw from when your returns are low, and estate planning benefits. It is, however, more expensive and complex than term life insurance.

You May Like: Inexpensive Cryptocurrency To Invest In

Put It In A Savings Account

The benefit of parking your money in a savings account is that its a low-risk option that provides you with access to the cash without fees or penalties. The drawback is having that cash sitting in a savings account for too long risks losing overall value by not keeping pace with inflation. Ultimately, you have access to your cash, but you arent accumulating purchase power over time.

Traditional savings accounts offer safety and security, essentially guaranteeing the proceeds will be available when desired or necessary by the investor, Harrison said. However, in exchange, such investments offer very low expected returns.

Do: Think About Your Financial Goals And Make A Plan

Create a budget and stick to it. A 2017 survey conducted by CareerBuilder shows that 78% of American workers live paycheck to paycheck. Have a plan for your future finances and how this lump sum of cash will be worked into that plan.

Use these budgeting tips to start off on the right foot:

- Track your spending to identify patterns.

- Prioritize your debt.

- Find a goal and stick to it.

Its important to know what your needs are, says Wang. We want security, we want safety, we want protection, and we want this money to last forever. There are different strategies and products that we can look into based on your needs.

Read Also: Best Mutual Fund Investing App

Be Selective About What You Sell

Avoiding brutal capital gains taxes is important, but that doesnât mean you should only sell long-term holdings. Consider why you purchased specific stock in the first place. Did you buy for the long-term potential or because they were safe?

Most people construct portfolios with a balance between long-term safe stocks and bonds and short-term, riskier ones. Of course, itâs different for every portfolio, but selling off those long-term, safe holdings is a good idea not just because of the capital gains benefit. If you have shares in an established company whose stock doesnât fluctuate much, you have a great chance to sell now and buy again at the same or similar price. Itâs not like youâre selling Apple in 2001.

While some stocks in futuristic industries like self-driving cars or green technology may be volatile and concerning right now, they still likely have more growth potential than an entrenched stock like Johnson & Johnson.

Analyze your portfolio, understand what qualifies as âlong-termâ and âshort-termâ and make an educated decision to sell off stocks you can probably buy again at a reasonable price.

Buy your dream home the better way

Stay in your home until your new home is ready. While you settle in, weâll list your old home to get you top dollar.

The Tax Impact Of Ira Withdrawal For A First

Paying taxes on stock gains is unavoidable whether or not you plan to use your gains as a down payment on a house. The tax rate on long-term capital gains, the stocks you held onto for more than one year, is lower than short-term capital gains. If you’re a first-time home buyer, you may be able to take advantage of government programs to help with a down payment.

Recommended Reading: Can I Invest In Sequoia Capital

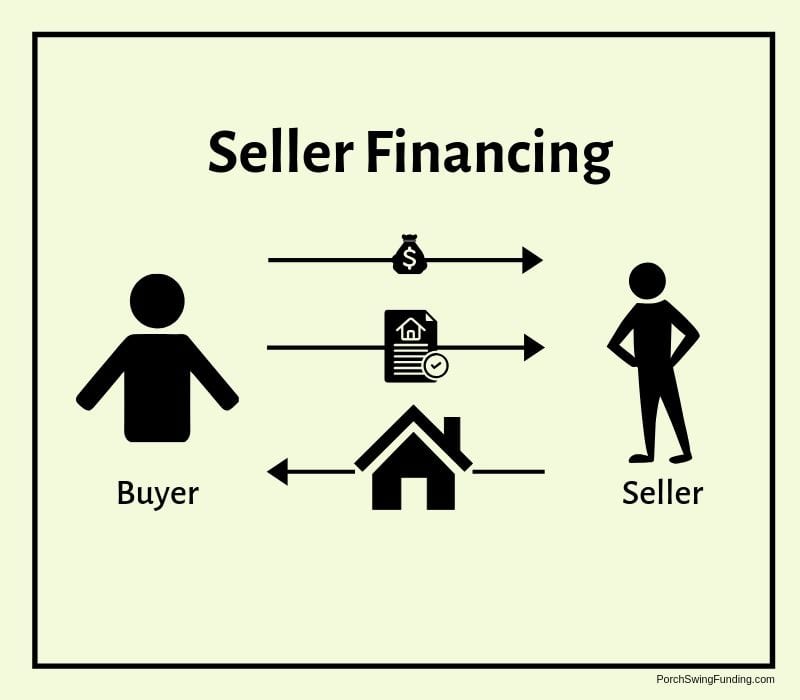

Ask For Owner Financing

In the days when almost anyone could qualify for a bank loan, a request for owner financing used to make sellers suspicious of potential buyers. But now its more acceptable because credit has tightened and standards for borrowers have increased.

However, you should have a game plan if you decide to go this route.

You have to say, I would like to do owner financing with this amount of money and these terms, Huettner says. You have to sell the seller on owner financing, and on you.

This game plan shows the seller that youre serious about the transaction and that youre ready to make a real deal based on the practical assumptions that youve presented.

Sourcing Down Payments Is Tough

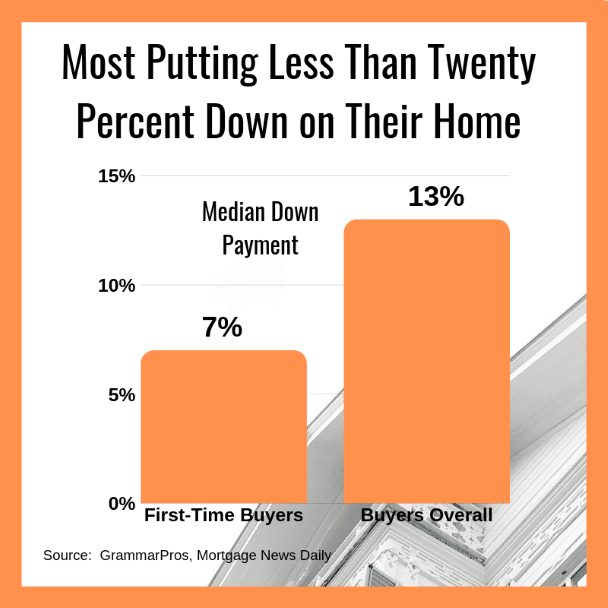

Just because some buyers are able to put more than 20 percent down doesnt mean they dont struggle coming up with the money. According to a Zillow survey, 68 percent of renters cite saving for a down payment as the biggest hurdle to buying a home.

Nearly one-third of buyers struggle saving up money for a down payment. Most do it by saving up the old-fashioned way. But nearly one-quarter are getting more creative and combining two or more sources to finance their down payment.

Some buyers have found luck using more creative ways to fund their down payment by receiving gifts from family or friends, selling stocks or other investments, using retirement funds, asking for a loan from family and friends or using leftover money from the sale of a previous home.

Because repeat buyers can often put some of the money from their previous home sale towards their down payment, theyre more likely than first-time buyers to put down larger lump sums. First-time buyers, however, are more likely to put down between 3 and 9 percent. According to a Zillow survey, only 37 percent of first-time buyers pay 20 percent or more.

Also Check: How To Invest In Adidas Stock

Companies Believe They Can Tackle The Affordability Crisis By Fronting The Money For Down Payments

Home-equity investments only recently gained broad acceptance as a legitimate asset class after companies proved their viability through years of successful returns. Down-payment products could follow a similar trajectory, Point’s Matthews said. His own company will offer investments of up to 15% of the purchase price of a home, or a maximum amount of $250,000, he said.

Buyers typically are required to get private mortgage insurance when they put down less than 20% of the purchase price for their home. Down-payment investments could help them avoid those costs, which can amount to hundreds of dollars a month.

Jim Riccitelli, the CEO of Unlock, estimated some buyers could improve their purchasing power by as much as 30%, which he called “a huge boost.”

“The affordability problem is, unfortunately, not going away anytime soon. So we’re gearing up for that,” Riccitelli said, adding that down-payment investments represented “a massive opportunity.”

HomePace, which was founded in September 2020, is another proponent of down-payment investments, and is developing such a product in partnership with Lennar, the nation’s second-largest homebuilder. In December, the company closed on a $7 million Series A funding round led by LenX, Lennar’s corporate venture arm.

The wait list for the company’s planned offering includes buyers from 35 states and Washington, DC, Joe Cianciolo, HomePace’s CEO, said in an email.

Saving For A Down Payment: Where Should I Keep My Money

Saving for a down payment is the first major step toward buying a home. It obviously requires discipline, to put aside the money. But it also requires some considerable thought as to the best place to park those funds. Whether to use a bank, an online bank, or the stock market to stash those tens of thousands of down-payment dollars depends on your timeline for becoming a homeowner.

Read Also: Investing In Blue Chip Art

Decide Whether Or Not To Buy & Set Your Budget

Because buying a house is such a big financial move, it may not be for you. Theres nothing wrong with continuing to rent for a while.

For one, rather than being the investment many people assume a house is: a house is actually just one big expense. You have high-cost payments on it every single month, youre responsible for all upkeep and repairs, youll pay taxes on ownership, etc. Yes, it may increase in value, but thats usually not the best way to grow your money if investing is your goal.

Lets say you bought a slightly cheaper-than-average house for $1.3 million. In 55 years, a 3.96% rate of return will make the house worth $9,890,271. But if you invested that same $1.3 million in cash into the stock market at 9.6% growth for 55 years, thatd be a massive $108,620,554 nest egg.

Life isnt all about money though, so if you want a house to call home, need it for a growing family, or other life reasons, buying is a totally valid choice.

Shop Around For A Mortgage

When you finally are able to come up with a large enough down payment, shop around for the lowest mortgage rates online. Youll get multiple real quotes with no-obligation to sign in minutes.

You should also also contact your main bank and check their latest rates. Perhaps they can give you a loyalty discount or multi-account opening discount. If you have a lot of assets with the one bank, you may get relationship mortgage pricing as well.

Best of luck with your house hunt! Remember, your down payment is meant to be used as a down payment for a home. Dont use it as a stock trading account! How To Invest Your Down Payment is a Financial Samurai original post.

You May Like: How To Invest 1 Dollar

What Are Home Loans

A home loan is a secured loan offered by banks or other financial institutions. It enables you to make payments for your new home. After a house is purchased using the loan, the principal amount along with the interest must be paid to the lender through EMIs. The purchased house serves as the collateral till the loan is completely paid off.

The interest rate on the loan may differ from institution to institution. At present, banks charge interest at around 6%-9%.

How Long Does It Take To Save For A Down Payment

If you can set aside 5% of your income towards the purchase of a home, it will take about two years and four months to save for this low of a down payment. If you can set aside 2.5%, it will take around four years and eight months. Retire With Money brings the latest retirement news, insights, and advice to your inbox.

Also Check: Best Bank To Open An Investment Account

Reasons For Availing Of Home Loans

The good thing about home loans is that it allows people with relatively low incomes to afford a house as well. This is because loan repayments are in the form of EMIs. This is a nominal charge paid every month. Whats more? Consistent and timely payment of EMIs increases your creditworthiness.

Moreover, the Interest rate is lower compared to personal loans, gold loans, and loans of other types.

In the long run, you also benefit from the appreciation of property value. While, in the short term, you benefit from provisions regarding deductions while paying income tax. This reduces your overall tax liability.