Robo Advisors Vs Index Funds: Key Differences

Robo-advisors and index funds both offer clients passive management-style investing. However, crucial differences might make one more suitable depending on your financial circumstances.

- Manual Input: Robo-advisors operate automatically once the client enters their financial goals and risk tolerance. Therefore, robo-advisors buy and sell stocks and bonds without manual input or oversight from a human manager or the client. Of course, clients can change their preferences and redirect a robo-advisors actions at any time. On the other hand, investors decide which index they want to buy or sell and can shift their money into a different index fund at will.

- Additional Services: Robo-advisors provide clients with services that help them define their financial goals and investment methods. Additionally, most robo-advisors can utilize tax-loss harvesting to minimize taxes owed on profitable investments. Index funds offer no additional services, only serving as investment vehicles that match specific portions of the stock market.

Should You Use A Robo

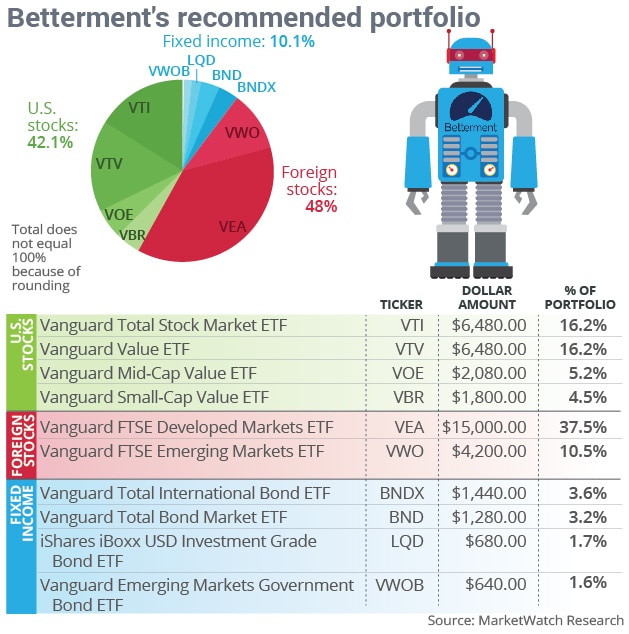

As you can see from this list, the options for low-cost, automated investment management have evolved and expanded since the U.S. leader in the space, Betterment, arrived on the scene in 2010. And the now meaningful track record of Canadian robo-advisors shows they can at least compete on a performance basis with higher-cost forms of portfolio management. The next decision is up to you.

Use the information here as a starting point in your search for the best service for your needs, then delve deeper check out the providers website and chat with a representative to determine whether its fee structure, choice of account options, investment offerings and, ultimately, performance to date satisfies your expectations and requirements.

Michael McCullough is an award-winning writer, editor and content strategist based in Vancouver. The former editor of Alberta Venture and managing editor of Canadian Business, he focuses on the subjects of business and investment.

Wealthfront Robo Advisor Performance

Wealthfront, to their credit, does not claim to be able to beat the market instead, they are a safe and effective pair of hands to trust your money with. So, do not expect outsize fund performance expect performance under the S& P 500. Many people have bought into this ethos as Wealthfront clients entrust them with over $20 billion of their money, making them the fourth-biggest Robo Advisory Service in the USA.

However, they were charged by the SEC for claiming to perform effective tax-loss harvesting for clients but failed to do so.

Also Check: Bob Diamond Real Estate Investing

Breaking Down Passive Investing

As an investing strategy, buy and hold passive investing has become increasingly popular over the last decade. Broadly speaking, passive investing revolves around the idea that it is exceptionally difficult to anticipate and subsequently beat the everyday performance of the equity market.

To avoid losing money, passive investors simply aim to track and match the returns from a particular market or sector. Although the specifics will depend on the market youre invested in, most passive investment portfolios share the following three features: low-cost fees, multi-sector diversification, and simplified rebalancing.

What Is Diy Index Investing

Index investing is the formal term for using index funds to accumulate diversified holdings across one or more major equities benchmarks. Unlike managed funds, the composition of an index fund is derived from the underlying index the fund is mimicking.

This means that index funds do not require stock pickers or fund managers, leading to ultra-low-cost management fees and expense ratios.

To get started with DIY index investing, you can either purchase units in an index tracker mutual fund, or you can begin accumulating index-mimicking shares via an ETF. For example, an investment in VOO, Vanguards S& P 500 index ETF, would give you exposure to the same 500 publicly-owned companies that currently comprise the S& P 500 stock market index.

Remember, even though the S& P 500 is the most well-known index, DIY index investors can choose from a massive range of other index fund products. Thanks to the rampant financialization of the global economy, there is an equities indexand a corresponding index fundfor almost every financial market in the world.

Also Check: Rental Real Estate Investing For Beginners

The Cons Of Index Funds

Index funds such as ETFs are instruments to invest in. Index funds track one or more indices, which could be sectorial or consolidated. The investor does not cash-in on individual stock performance and loses out on opportunities to earn better returns from liquid stocks and other short-term investment opportunities.

An index fund is much more volatile and susceptible to sharp unpredictable movements and macroeconomic changes. For instance, if a company attracts institutional buyers who usually invest large sums, the stock price of that company would gain momentum. Likewise, if there is a bankruptcy filing, then shorting the stock would be profitable. A few underperformers in an index fund can diminish the premium, thus it is important for a portfolio to be rebalanced.

What’s The Difference Between A Robo

A brokerage account is a place for you to manage your investments yourself. Robo-advisors let a computer manage it for you based on your style and preferences. Most robo-advisors usually charge a low, flat fee, around 0.25% a year on your total investments. Online brokerages tend to charge more or higher fees.

Robo-advisors are great for hands-off investing. They use your personal choices and investing approach — including your risk tolerance — to select how to invest your money and then manage it for you.

These services also offer automatic rebalancing, which means the robo-advisor buys or sells assets in your portfolio to maintain the desired level of asset allocation or risk. Some robo-advisors also perform tax-loss harvesting. That means they’ll drop securities that aren’t working their hardest for you by decreasing tax liability, and the money kept from paying less taxes will go toward your investments instead.

You May Like: Can I Invest Under 18

Index Funds Vs Stocks

Investors have many options when it comes to investing their hard-earned cash. As index funds rise in popularity, investors should understand the differences between individual stocks and index funds.

While index funds provide increased diversification for investors, many investors are drawn to individual stocks as a result of increased upside potential. Over the long term, index fund investors consistently outperform individual stock investors.

Most investors will have a strong opinion one way or the other, but it’s important to come to this discussion with an open mind and understand the pros and cons of index funds vs. individual stocks.

Give Human Advisors Time To Focus On Clients

Its becoming more common for traditional financial planning practices to white label robo-advisors platforms for their clients. This takes the cumbersome task of choosing assets out of their hands so that the financial advisor may spend more time with their clients addressing individual tax, estate, and financial planning issues.

Robo-advisors can require as little as $0 to open an account and start investing, making them perfect for a young person just starting to work and invest.

Some consumers, younger investors, or those with lower net worth may not have considered professional financial advice. Robo-advisors are growing the existing market of financial advisory clients. Because of the easy access and lower fee models for professional financial management, more consumers may choose robo-advisors professional management in lieu of the do-it-yourself model.

Also Check: How To Invest 5k In Crypto

Robo Is Not Designed To Give Personal Advice

The robo advisory industry was never designed to offer personal financial coaching, but rather low-cost portfolio management targeted to specific monetary goals. This makes the robo industry significantly different from its human counterpart. Robos strengths lie in its low fees, which can make a difference in terms of portfolio performance. For this reason, robo advisors often appeal to do-it-yourself investors who love a bargain.

Caring For Your Portfolio

Rebalancing your portfolio regularly is an important part of investing, and we’ll show you how Digital Advisor takes the time and guesswork out of it.

But first, what is rebalancing? It means making sure that the breakdown of stocks, bonds, and other assets in your portfolio stays on target. Your asset mix is important because it determines the amount of risk you take on when you invest. Too much riskor too littlecan put your investment goals in jeopardy. Everyone’s ideal mix is different, and Digital Advisor can help you find and stick to yours.

Digital Advisor typically checks on your portfolio every day that the market is open, and it will automatically rebalance for you whenever your stock and bond holdings have shifted more than 5% from the asset mix you’ve chosen.

Shifts like this can happen because of normal market ups and downs, or, for example, if you add cash to your portfolio.

Digital Advisor is always looking out for you by making sure your portfolio stays aligned with your risk attitude.

Stress-free rebalancing is a beautiful thing. If only everything in life were this easy.

You May Like: Investing In A Reit Is The Same As Purchasing Property

What Should You Look For When Choosing A Robo

If youre looking for a robo-advisor, you probably want an easy, hands-off investing experience. That makes usability your primary concern: How easy is it to connect a bank account and start investing?

But usability shouldnt be your only concern. Almost all robo-advisors provide diversified portfolios of low-cost ETFs. Because their offerings are similar, their performance tends to be pretty similar, too. This makes costsboth annual advisory fees and ETF expense ratio feesthe most important thing to watch out for. You want to find a robo-advisor that balances ease of use with low fees.

That said, robo-advisors that charge zero management fee are seldom free. Some may keep a disproportionately large portion of your balance uninvested in a cash account, which the firm then lends out to earn interest. This may hinder your overall returns by forcing some of your investing dollars to remain on the sidelines.

Some robo-advisors fill your portfolio with their own proprietary ETFs. While proprietary funds arent always a bad thingVanguard and Fidelity funds, for instance, are very low costnewer companies proprietary funds may lack the historical return data and liquidity of more established funds. They also may be more likely to unexpectedly close down.

When Should You Use A Robo Advisor

Robo advisors are a good option when:

-

Youre a new investor. Since financial advisors often have high minimum investment requirements, they dont often work with new investors.

-

You have a small investment to manage. Financial advisors typically require clients to have several hundred thousand dollars to qualify for management. Many robo advisors require $500 or less.

-

Youre only interested in investment management. You have no interest or need for additional services, like financial planning.

-

You prefer to have some of your portfolio managed, but you also want to engage in self-directed investing. Robo advisors like Fidelity Go, Schwab Intelligent Portfolio, and SoFi Automated Investing also offer brokerage services for self-directed investing.

Read Also: Is Ivr A Good Investment

Td Ameritrade Robo Advisor Performance

Like many of the other Robo Advisor services, TDA will recommend a selection of exchange-traded funds based on modern portfolio theory, which seeks to minimize risk and optimize reward. The ETF selection is essentially based on the research performed by Morningstar analysts.

It is nice to see that tax-loss harvesting and automatic portfolio balancing are included and available for all accounts. Finally, as a socially responsible and environmentally aware person myself, I am glad to see that TDA offers a selection of five socially aware portfolio options so you can invest in alignment with your beliefs.

Can You Trust Passive Investing When The Global Economy Is In Shambles

As an investing methodology, passive investing allows you to bypass the fund manager middleman and reap the benefits of a historically high performing investment strategy.

Remember, when the global economy is in shambles, a passive investing strategy will not provide guaranteed returns.

However, it will save your hard-earned cash from being gobbled up by exorbitant front-end loading, expense ratios, management fees, and account fees.

Also Check: Invest In Property With Little Money

When You Have Little Money To Invest

Mutual funds have steep upfront investment minimums. Theyre at least $1,000, and often $3,000 or more. In order to be able to invest in three or four funds at a time, youd need at least $10,000. If youre a new or small investor, you probably dont have that kind of money. Maybe you dont have any money at all.

If that describes you, then robo-advisors are the perfect platforms to begin investing through.

Popular robo-advisors often require little or no money to begin investing. For example, Betterment requires no upfront investment at all, while Wealthfront requires just $500 to open an account, but you get the ability to create your own portfolio of ETFs OR choose one created by the experts over at Wealthfront.

Key Takeaways: Which Investing Strategy Performed Best During The Recent Economic Crisis

Even though theyre often exposed to the same indices, index investors and robo advisor investors will rarely record the same performance outcomes. For instance, during an economic crisis, individuals invested through a robo advisor can use their platforms portfolio rebalancing function to swap out overexposed stocks for more stable fixed interest assets. On the flip side, index funds are usually more effective at cushioning downturn losses due to their considerably lower expense ratios.

Given their assorted pros and cons, its exceedingly difficult to give a definitive answer regarding the contemporary performance benefits of index investing vs robo advisor investing. Firstly, and perhaps most importantly, its unclear where we are on the timeline of coronavirus-induced economic downturn. If countries like the U.S. are unable to suppress or eliminate persistent COVID-19 infection clusters, it could lead to a second round of lockdowns, an outcome that would likely trigger a longer-term pullback in rallying equity indices.

Alternatively, if early vaccine trials prove particularly promising, index funds and robo advisor portfolios are expected to benefit from a surge in retail enthusiasm and speculative capital.

Read Also: How To Invest In Pakistan Stock Market

What Is A Target

A target-date fund is a lot like a robo-advisor in that its a one-stop-shopping solution to building an instant diversified portfolio.

While youll answer a questionnaire to determine your investments with a robo-advisor, target-date funds are much simpler, providing the same diversified asset allocation strategy for everyone based on how many years they have until they reach retirement age.

When youre young, a target-date fund takes on a more aggressive strategy with a higher percentage of stock-based investments. But as you near retirement, it adjusts its holdings to become more conservative with its holdings so youre less likely to wreck your retirement plans if something cataclysmic happens in the stock market.

Because it is one fund that holds many other funds, a target-date fund is known as a fund-of-funds in the investment world. In addition to the standard stock and bond funds, some target-date funds also invest in real estate and commodity funds.

As with robo-advisors, investors pay an annual expense ratio that reflects the fee charged by each of the underlying funds in the portfolio. According to Morningstars annual target-date report, the average asset-weighted expense ratio for target-date funds is 0.52%. The lowest-cost target-date funds have an average fee of 0.12%

Who’s Eligible To Enroll In Vanguard Digital Advisor

To enroll, you’ll need to meet the following requirements:

- You have a retail Vanguard Brokerage Account with a balance of at least $3,000.

- You’re a United States resident, or you have an APO/FPO/DPO mailing address.

- Youre at least 18 years of age.

- You’re notor live in the same household asa board member, executive, or someone whos able to influence policy in a publicly traded corporation.

If you have a Vanguard-administered 401 retirement account, you may also be eligible to enroll.7 Restrictions may apply to certain organization members.

Vanguard Brokerage Option accounts offered by plan sponsors aren’t eligible for management by Digital Advisor. Special notice to non-U.S. investors

Recommended Reading: Best Stock Market Index To Invest In

Q: I’m Considering Using A Robo

It’s true that simply buying index funds would be the cheaper way to go. Generally, robo-advisors invest your money in index funds and charge a management fee on top.

For example, TD Ameritrade‘s Essential Portfolios robo-advisory platform invests your money in ETFs with expense ratios of 0.07%-0.08%, and then charges a management fee of 0.30% of your assets on top of this. So it’s only natural to ask, “Why don’t I just buy those ETFs myself instead?”

However, it’s important to realize that there are certain things a robo-advisory service does for you. For example, they’ll rebalance your portfolio over time and make adjustments to your investment mix as deemed necessary. This is nothing you can’t do yourself, but it takes time and knowledge to do it right and it’s an absolutely essential part of a smart long-term investment strategy.

You’ll also have other features such as tax optimization, which can be tricky for even experienced investors to do on their own. Plus, most robo-advisors give investors access to some sort of live help to answer questions you have.

The point is that buying ETFs can certainly be a smart option for investors who don’t mind doing their own portfolio maintenance, but it’s important to realize that robo-advisors truly put your investment plan on autopilot and can be worth the extra cost to many people.

% Betterment Account #1

38% Goldman Sachs Active Beta US Large-Cap 1.1% Vanguard Small Cap ETF 9.8% iShares Core MSCI EAFE ETF 11.7% Goldman Sachs Emerging Markets Equity 9.6% iShares MSCI EAFE Small Cap ETF 0.5% iShares TIP ETF 3.0% Goldman Sachs Treasury Access ETF 9.9% Vanguard Long Term Corporate Bond 0.8% Goldman Sachs Access Investment Grade Corporate ETF 2.4% Goldman Sachs Access High Yield Corporate Bond 5.7% iShares Emerging Markets USD Bond ETF 7.2% Market Vectors JP Morgan EM Local Currency Bond

Don’t Miss: How To Invest In Darpa