Benefits Of Directly Owning Real Estate Over Reits

Direct investment in real estate does have some advantages, though. If you can put down a decent down payment, and you have the ability to manage the real estate effectively , direct rental property can be a great asset. It is usually best to think of owning a rental property as an investment and business. It’s not truly passive compared to owning a REIT, but the amount of direct work can be minimized.

When you own a property, you have more control over the investment. Additionally, you have something physical to fall back on. Even if the market tanks and the property loses financial value, the fact that you still have a tangible asset that you could live in , or use in some way, remains. As long as the property has tenants, you have a monthly income.

On the downside, though, directly owning real estate means you are responsible for it. You are in charge of addressing tenant problems, and you have to deal with trying to collect rent and choose tenants that aren’t going to destroy your property or rip you off.

Looking for a mortgage to buy your first home? Here are some interesting options:

How Does A Company Qualify As A Reit

To qualify as a REIT, a company has to meet specific requirements as mentioned below.

Bottomline: Which Investing Method Suits You

To conclude, both real estate investing and REITs are good investments. But if you only have to choose one:

Choose real estate investing if you think youre someone who:

- Has extensive knowledge of how the real estate market works

- Wants to have more control over your cash flow and the way you manage your assets

- Not in urgent need of liquid cash or more focused on growing your real estate business

- Has a sizable capital. Or if not, someone whos comfortable with buying properties through leveraging

Choose REITs if you think youre someone who:

- Doesnt want to exhaust a lot of time and effort into directly managing real estate investments

- Wants to earn a steady stream of cash flow through dividends and capital gains no matter how small they are

- More comfortable with a diversified portfolio of real estate assets

- Thinks of investing in real estate for your retirement fund

Recommended Reading: How To Start Investing In Oil

Rise Of The Crowdfunders

Technology has provided a way for many more investors to get involved in syndicated real estate through crowdfunded websites such as Equity Multiple, Fundrise, Realty Mogul, Crowd Street,AcreTrader and over a hundred others. They all have a different focus. Some invest on the equity side, and others on the debt side, and still others do both.

However, most of these sites, like most of the syndicated deals available before the existence of these sites, required investors to be accredited. That is, rich enough that the Securities and Exchange Commission didn’t have to babysit their investing activities. In general, this meant liquid investments of more than a million or an income of over $200,000 .

Which Reit Should I Choose

Its always a good idea to diversify your portfolio, so it would be best to invest in more than one REIT. If you do have to choose just one REIT, you might want to consider characteristics such as their size, portfolio, dividends/distributions, and stock price appreciation.

For example, 20 Canadian REITs have a market capitalization of over $1 billion. Of these 20 REITs, 12 of them had a positive return over the past five years based on their stock price appreciation.

REIT investors will also want to consider the dividends that the REIT pays, which is called their distributions. The distribution yield of a REIT can more than make up for a stock price that has decreased. For example, SmartCentres saw its share price fall 18% over the past five years.

However, they also had a large dividend yield, at 6.15%. When accounting for distributions from dividends, the total return over the past five years would be 4.83%. If these dividends were reinvested into more SmartCentres REIT shares, the total return over the same 5-year period would be 10.17%.

For some REITs, most of an investors return might be through the REITs dividend distributions rather than from stock price growth. Inovalis REIT saw virtually no change in its stock price if you were to purchase precisely five years ago and sell today. On August 19, 2016, the stock price of INO.UN was $9.58. Five years later, on August 20, 2021, the stock price was $9.56.

| REIT Type |

|---|

|

Also Check: Investing In A Small Private Company

What Does Reit Stand For

REIT stands for “Real Estate Investment Trust”. A REIT is organized as a partnership, corporation, trust, or association that invests directly in real estate through the purchase of properties or by buying up mortgages. REITs issue shares that trade stock exchange and are bought and sold like ordinary stocks. In order to be considered a REIT, the company must invest at least 75% of its assets in real estate and derive at least 75% of its revenues from real estate-related activities.

How Do I Invest In Reits

Your approach to investing in REITs depends on what type of investor you are. Some investors may want to invest in an exchange-traded fund or mutual fund that tracks a broad-based REIT index rather than investing in individual REITs. You can buy and sell REITs on your own with a Schwab One® brokerage account or call us at 877-566-0054 to talk to an experienced specialist about whether REITs are right for you.

Also Check: The Motley Fool Investment Guide

Your Rights As A Reit Unit Holder

In general, these are limited to the right to:

- Require the REIT manager or trustee to administer the REIT in accordance with the provisions of the trust deed

- Remove a REIT manager

To remove a REIT manager, unit holders have to call for a general meeting to vote on a resolution to remove the REIT manager. The call for general meeting must be made in writing to the REIT manager or trustee by at least 50 unit holders or such number of unit holders that together hold at least 10% of the REITs issued units.

The resolution to remove the REIT manager must then be passed by a simple majority of unit holders present and voting at the general meeting, with no unit holders being disenfranchised.

Investing In Reits: How To Get Started

Getting started is as simple as opening a brokerage account, which usually takes just a few minutes. Then youll be able to buy and sell publicly traded REITs just as you would any other stock. Because REITs pay such large dividends, it can be smart to keep them inside a tax-advantaged account like an IRA, so you defer paying taxes on the distributions.

If you dont want to trade individual REIT stocks, it can make a lot of sense to simply buy an ETF or mutual fund that vets and invests in a range of REITs for you. You get immediate diversification and lower risk. Many brokerages offer these funds, and investing in them requires less legwork than researching individual REITs for investment.

Former NerdWallet writer Jim Royal contributed to this article.

About the author:Kevin Voigt is a former investing writer for NerdWallet. He has covered financial issues for more than 20 years, including for The Wall Street Journal and CNN.com.Read more

Recommended Reading: Master In Investment And Financial Analysis

What Is A Reit

REIT rhymes with sweet stands for real estate investment trust, and its popularity is growing for investors who seek to expand their portfolio beyond publicly traded company stocks or mutual funds.

REITs are companies that own income-producing real estate, such as apartments, warehouses, self-storage facilities, malls and hotels. Their appeal is simple: The most reliable REITS have a track record for paying large and growing dividends. Still, that potential for growth carries risks that vary depending on the type of REIT.

Is Real Estate Investment Trusts A Good Career Path Reits In 2023

Presentation Transcript

Is real estate investment trusts a good career path| REITs in 2023 civilengineeringinstitute.com/is-real-estate-investment-trusts-a-good-career-path November 21, 2022 Real estate investment trusts are a type of investment area that allows investors to use their money to purchase, manage and trade real estate assets. REITs can be a good career path for those interested in the real estate industry, as they offer many benefits and opportunities. Here are some things to consider if youre considering pursuing a career in REITs. What are real estate investment trusts? 1/7

© 2022 SlideServe | Powered By DigitalOfficePro

Also Check: How To Start A Crypto Investment Fund

Risks Of Investing In Reits

Every form of investment comes with its own set of risks and challenges. Following are the risks of investing in REITs that you should know about:

Liquidity

While REITs are relatively more liquid than other real estate investments, it is still harder to sell a REIT unit than other equity shares. This is because the number of investors for REITs is lower than the number of investors for equity shares.

Tax Implications

Long-term capital gains exceeding 1 lakh on sale of REIT units through a recognized stock exchange will be taxable in your hands at the rate of 10% without indexation and 20% with indexation . In case your taxable income as reduced by the capital gains is below the basic exemption limit, the capital gains will be reduced to the extent of the shortfall and only the balance capital gains will be taxable. REIT units qualify as long-term capital assets if they are held for more than 3 years. Short-term capital gains will be taxable in your hands at the rate of 15%.

Tax on dividend income depends on whether the REIT had obtained special tax concession from the government. If yes, then the dividend is taxable in the hands of the investor. If not, then no tax is applicable.

Limited Investment Options

Since REITs are fairly new in India, they have low acceptance as a preferred asset class. At present, there are only 3 domestic REITs and 1 international REIT in India, making the investment options in REITs limited in nature.

What Companies Are Considered Reits

To qualify as a REIT, a company has to meet certain requirements as outlined by the Internal Revenue Code . In order to be considered a REIT, a company must:

- Be a taxable corporation that is managed by a board of directors or trustees

- Have at least 100 shareholders after the first year

- Acquire 75% of gross income from rent, interest on mortgages or real estate sales

- Invest a minimum of 75% of total assets in real estate, cash or U.S. Treasuries

- Pay at least 90% or taxable income in the form of shareholder dividends

- Have 50% or less or shares held by five or fewer people

Also Check: How To Invest In A Etf

How To Invest In Reits

You can invest in publicly traded REITsas well as REIT mutual funds and REIT exchange-traded funds by purchasing shares through a broker. You can buy shares of a non-traded REIT through a broker or financial advisor who participates in the non-traded REITs offering.

REITs are also included in a growing number of defined-benefit and defined-contribution investment plans. An estimated 145 million U.S. investors own REITs either directly or through their retirement savings and other investment funds, according to Nareit, a Washington, D.C.-based REIT research firm.

What Are The Benefits And Risks Of Reits

REITs offer a way to include real estate in ones investment portfolio. Additionally, some REITs may offer higher dividend yields than some other investments.

But there are some risks, especially with non-exchange traded REITs. Because they do not trade on a stock exchange, non-traded REITs involve special risks:

Recommended Reading: Oil And Gas Investment Tax Advantages

Before You Invest: Things To Note

Do not assume that REITs are low risk and that the dividend income is recurring. Read your prospectus and research reports to understand the investment objective and strategy of the REIT.

Look for information under the following three key areas:

- Information on the REIT manager their experience and track record, and, if applicable, the REITs sponsor and pipeline of assets

- Information on properties to be put in the REIT in particular, whether you are familiar with the geographical and sector exposures of the REITs you intend to invest in

- Other investment information such as dividend policy and fees and charges

REITs can have different structures, geographical or sector focus, and some REITs may carry more risk, such as political and regulatory risk, than others. You should:

- Read the Investment Approach and Risks portions of your prospectus for information on the various risks of the specific REIT you intend to invest in. Note that the risk elements may differ greatly between REITs depending on their investment objective and strategy, geographical and sector focus, quality of the underlying real estate properties, land tenure of properties , experience of the REIT manager, and the income distribution policy.

- Consider if the REITs structure and risk profile suit your risk appetite and investment time horizon.

- Do not invest in a REIT if you do not understand or are not comfortable with its investment objective and strategy.

Pros And Cons Of Owning A Real Estate Investment Trust

Owning a REIT provides an investor with benefits similar to owning real estate directly. For example, real estate can provide an income stream when renters occupy the property.

It has also traditionally performed as a hedge against rising consumer prices. During periods of rising inflation, property owners can pass along the increase in costs to those leasing. As we are currently in an inflationary environment, this can be a significant benefit and aid investors with maintaining and growing their purchasing power.

Diversification

Buying into a REIT also allows the investor an opportunity for diversification. As an alternative asset, the investment has a risk and return profile uncorrelated with conventional assets. This helps to lower the risk of the overall portfolio.

Owning a REIT instead of directly owning a property allows for diversification amongst real estate holdings as well. Direct ownership provides the investor exposure to just a few real estate properties. On the other hand, a trust exposes the investor to a basket of properties. Not only does this decrease the risk associated with a single unit, but it provides for a less volatile income stream.

Liquidity

Additionally, REITs have the significant advantage of being a liquid investment. At any time, the investor can sell their ownership stake in the trust and receive cash for the sale within days.

Risks

Along with all the benefits of owning a REIT, investors must consider the downsides.

Don’t Miss: Cash Out Refinance Investment Property Ltv

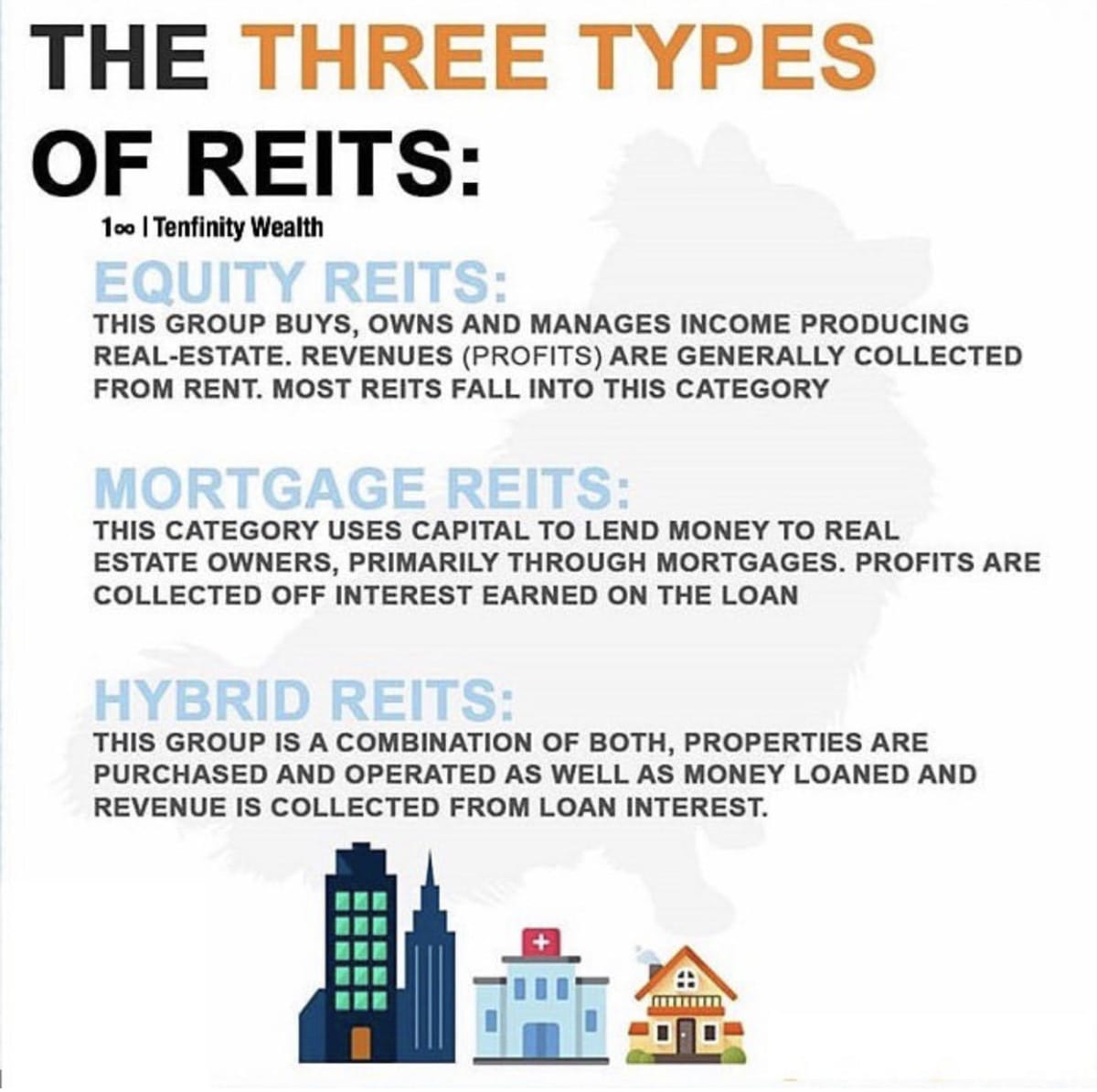

Types Of Real Estate Investment Trust

In a broader sense, the types of business REITs are involved with tend to help classify them better. Also, the methods devised to sell and purchase shares further help classify REITs.

The following is a list of the different types of REITs.

This type of REIT is among the most popular ones. Typically, it is concerned with operating and managing income-generating commercial properties. Notably, the common source of income here is rents.

Also known as mREITs, it is mostly involved with lending money to proprietors and extending mortgage facilities. Further, REITs tend to acquire mortgage-backed securities. Mortgage REITs also generate income in the form of interest accrued on the money they lend to proprietors.

This option allows investors to diversify their portfolio by parking their funds in both mortgage REITs and equity REITs. Hence, both rent and interest are the sources of income for this particular kind of REIT.

These trusts function as private placements, which cater to only a selective list of investors. Typically, private REITs are not traded on National Securities Exchanges and are not registered with the SEBI.

- Publicly traded REITs

Typically, publicly-traded real estate investment trusts extend shares that are enlisted on the National Securities Exchange and are regulated by SEBI. Individual investors can sell and purchase such shares through the NSE.

- Public non-traded REITs

Benefits Of Investing In Reits

REIT is a comparatively newer form of investment tool in India, but they come with many benefits if invested wisely.

Here are some of the benefits they offer:

- Diversification: Investing in REITs allows diversification of your investment portfolio. You can invest in real estate without the burden of buying or renting properties.

- Regular income: Most REITs earn from continuous rentals, lease payments or loan instalments. 90% of these incomes are distributed among the investors as dividends on a regular basis. Therefore, you can receive regular income by investing in REITs.

- Capital gains: REITs are listed on the stock exchanges. You can trade them just like any other stock market share and generate income in the form of capital gains.

- Affordability: Compared to other real estate investments, you can invest in REITs with smaller capital as low as 300. Since they are listed on the stock exchanges, you can also buy additional units to grow your investment.

- Liquidity: Compared to other real estate investments, REITs offer high liquidity as you can trade REIT units on the stock exchanges.

- Safety: As REITS come under the purview of SEBI, investing in REITs in India offers added security.

Also Check: New York Digital Investment Group Llc