Best For Real Estate Notes: Groundfloor

Groundfloor is a unique financial product that allows non-accredited and accredited investors to participate directly in real estate investment loans on a fractional basis. The platform opens the door to short-term, high-yield returns backed by real estate. Typical loans have returned 10 percent annually on a 6- to 12-month term.

The product is based on venture loans to real estate entrepreneurs that are originated and serviced by Groundfloor. Prior to offering, every loan is pre-funded by Groundfloor after a thorough vetting of the borrower’s experience, credit worthiness and business plan. An assessment of the property value on an as-is and as-improved basis is also required.

Founded in 2013, Groundfloor is headquartered in Atlanta, Georgia.

- More DetailsMore Details

Examples Of Successful Investments Made Through Apps

Many people have had success investing in stocks through apps. For example, one investor used Robinhood to purchase shares of Amazon when it was trading at $1,400 per share. After two months, the shares were worth over $2,000 per share, resulting in a profit of over $20,000.

It is important to remember that investing in stocks involves risk, and you should always do your own research before investing in any stock. Apps can be a great tool to help you get started investing in stocks, but it is ultimately up to you to make wise investment decisions.

What Is An Investment App

Investing apps make it easier to grow your money in the market, without the need to work with a traditional, human advisor. Investing apps are software that you may download on your computer, or through your device’s mobile app store, through which you can make an account. Once your information is verified, you can select a type of investment account, add funds and select an investment yourself.

Each app offers different types of accounts to hold your investments, such as retirement or trusts. Likewise, the investment products vary by app. Some specialize in singular strategies like crypto, while others let you buy, sell and trade as you wish. There are also robo-advisors, which automatically invest your funds based on your financial goals.

Many investing platforms help guide you in your investments through tools that help you identify goals, risk tolerance or values, then recommend portfolios or products that match.

Others provide less guidance, but more research, data and tools to help you make investment decisions yourself. Some even offer access to advisors for professional advice, as you make the investments yourself.

The benefits of investing apps is really the convenience. With software at your fingertips, you can buy, sell and trade almost anywhere.

Read Also: Best Banks For Heloc On Investment Property

What Apps Let You Trade Stocks For Free

Many brokers today offer commission-free trading, also known as zero-dollar commissions. Our picks for the best apps for trading stocks for free come from the following brokers in 2022:

- Fidelity – Fidelity mobile app for Android and iOS devices

- Interactive Brokers – IBKR mobile and IMPACT app for Android and iOS devices

- Charles Schwab – Schwab mobile app for Android and iOS devices

- TradeStation – TradeStation mobile app for Android and iOS devices

- TD Ameritrade – TD Ameritrade app and thinkorswim mobile for Android and iOS

- E*TRADE – E*TRADE app and Power E*TRADE mobile app for Android and iOS

Sofi Invest: Best All

SoFi Invest is a stock market app that allows you to place stock and ETF trades alongside investing in cryptocurrency.

The well-known brand in the personal finance space recently entered into the investing world by offering free trades on stocks, ETFs, cryptos and more. SoFi doesnt offer options trading nor mutual funds.

The service provides you the ability to trade actively or stand back and let its automated investing tools take over as a robo-advisor.

Therefore, this stock market app might make a good place to hold your investment accounts because youll have options of how to invest money.

The company wants to serve all customers who have an interest in improving their financial situation alongside participating in their other personal finance products like refinanced student loans, money management, and more.

You May Like: Origin Investments Opportunity Zone Fund

How Do Investment Apps Work

First, you have to install the app on your device and create an account. Most investment apps require basic personal information like your full name, social security number and address, along with some employment and financial information.

You can then choose the type of account: an individual brokerage account, individual retirement account , college savings or automated investment if the app offers robo-advisor features. Once the account is approved, you can link a bank account, transfer funds and start investing.

Many investment apps feature advanced charts that let you visualize stock price fluctuations and performance over time. Information like latest market news, historical high and lows, trading volume, dividends and price-earning ratio is also broadly available. Some apps may include stock analyst ratings as well.

Another perk is that sometimes investment apps give you a free stock when you first fund your account or when friends you recommend join the app.

Types of stock orders

As with any investment platform, you can place different types of orders on an investment app. If youre new to investing, it might be useful to familiarize yourself with the three most common types of orders and know what each one means.

A is an order to buy or sell a stock immediately, at or near the current market price. Investment apps that offer fractional shares will typically let you choose between buying in dollars or in shares.

Read More About China From Cnbc Pro

China’s central bank will step up support for private firms as part of steps to shore up the economy, while easing a crackdown on tech companies, Guo Shuqing, Communist party chief of the People’s Bank of China, told state-owned CCTV on Sunday.

A restoration of apps would also signal Didi’s completion of its one year and a half-long regulatory-driven revamp, and will come after the powerful cyber watchdog Cyberspace Administration of China imposed in July a $1.2 billion fine on the company.

Didi already last year paid the fine, the largest regulatory penalty imposed on a Chinese tech firm since Alibaba Group and Meituan were fined $2.75 billion and $527 million, respectively, in 2021 by the antitrust regulator State Administration for Market Regulation, said two of the sources.

Didi did not immediately respond to a Reuters request for comment.

CAC and the State Council Information Office, which handles media queries for the government, did not immediately respond to Reuters requests for comment.

and SoftBank Group, ran afoul of the CAC when in 2021 it pressed ahead with its U.S. stock listing against the regulator’s will, sources previously told Reuters.

That move triggered regulatory woes for Didi, with its 25 mobile apps ordered to be taken down from app stores, registration of new users suspended, and it getting slapped with the fine over data-security breaches.

Also Check: Where Can I Invest My Money To Make More Money

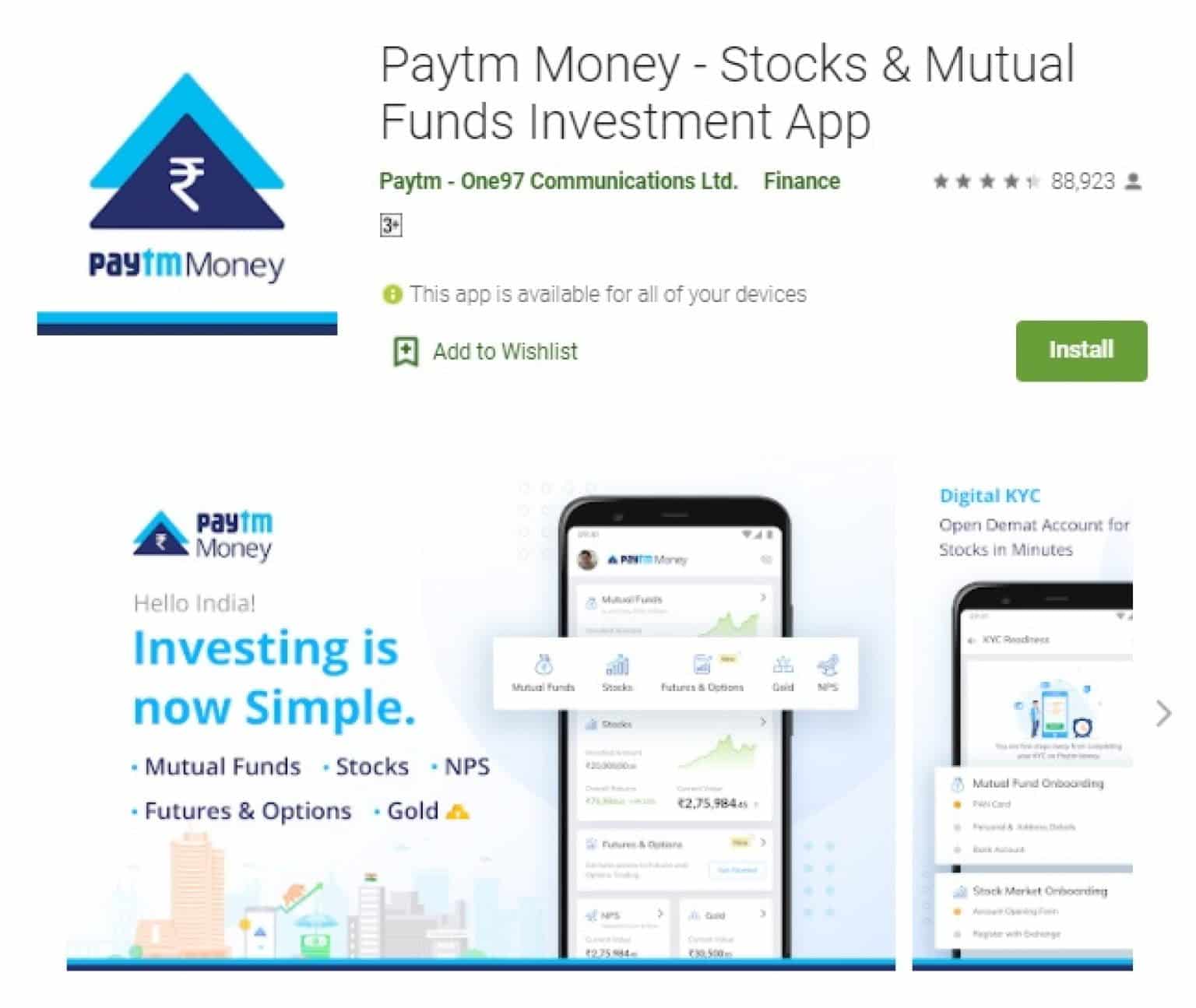

Apps To Invest In Indian Stock Market

- Universal search tool to find simple and complex stocks.

- Charts of multiple intervals, types and drawing styles

- Apply 100+ technical indicators on real-time charts

- Trade directly from charts with the Trade From Charts feature

- Set unlimited number of price alerts for instant updates

- Create unlimited number of customized watchlists

- Historic data for last 10 years

Upstox currently waiving off the account opening fee. You can open your account free of cost. Use below button to avail the offer.

Stash: Best Approachable Stock Market Investment App For Beginners

- Available via desktop, Apple iOS and Android App on Google Play

Stash is a mobile-friendly personal finance app that comes paired with investing options and a checking account. Stash acts as a low-cost, all-in-one financial platform and gets included in this list as a result.

While the app primarily caters to hands-off investors looking to automate their investing, you can also actively select stocks to trade. You can do all of this as you spend money and make recurring deposits into your account.

Stash offers custodial accounts for real beginners , or those under the age of 18. Getting started early on your investing journey can build real long-term wealth over time as your returns compound.

Stash comes with a recurring monthly fee but justifies this with a full-service personal finance platform.

Of note, while it does charge a monthly account service fee for its full-suite of products, it does not charge trading commissions for your investment holdings nor does it have an account minimum.

Also Check: How To Record Investment In Quickbooks

Other Investment Apps We Considered

- Doesn’t offer short selling

- Has been involved in multiple data breaches

Robinhood is a trading app thats popular among beginners. Its game-like design is accessible and user-friendly. Like most apps, Robinhood has no minimums and no fees, offering commision-free trades on stocks, options, crypto, ETFs and IPOs.

Despite its popularity, Robinhood has faced strong criticism for restricting users access to securities like GameStop during the latest meme stock swing. The app has also been involved in multiple data breaches in the past, the most recent in 2021. Additionally, it was charged by the Securities and Exchange Commission for misleading customers on how it makes money from order flows.

- Advisory fees for managed accounts of $10,000 or more

- Can’t invest in cryptocurrency

- Doesn’t offer tax-loss harvesting

Fidelity is one of the few major brokerages that allows investors to trade fractional shares. It has no minimum account requirements and doesnt charge commissions on stocks, ETFs and options trades. Its mobile app gives access to a wide selection of securities and robo-investing.

Fidelitys robo-advisor is free for accounts under $10,000. However, if the account balance exceeds this amount, the company charges a $3 monthly advisory fee or a 0.35% yearly fee. Additionally, Fidelity doesnt allow investors to trade cryptocurrency nor does it offer access to tax-loss harvesting tools.

- Only offers two investment portfolios

- Charges a monthly subscription fee

Our Top Picks For Best Investment Apps

- Stocks, ETFs, Crypto, Options, ADRs

- Automated Investing

- No

Why we chose it:Webull is our choice for beginners and active traders because it offers extended market hours, advanced charting and enough educational resources.

Webull is a trading app that offers commission-free stocks, ETFs and options, with no minimum deposits. It also supports IRAs and allows investing in crypto and some foreign companies .

Although Webulls research tools and charts can seem overwhelming at first, we believe its a great choice for beginners who dont mind taking some time to learn.

It has a learning center full of video explainers and how-tos, alongside a training camp that can be customized based on your investing experience.

Beginners can learn and practice how to trade through a simulator where they can place orders using paper money.

Active traders can benefit from Webulls advanced charting and real-time data to place orders and do market research. Another great perk is that it offers access to extended market hours, so you can trade before and after the market closes from 4:00 a.m. to 9:30 a.m. ET, and 4:00 p.m. to 8:00 p.m.

Do note, Webull has a $5 minimum for fractional share orders. This might be a drawback for some traders, considering apps like Robinhood let you buy shares for just $1.

- Automated Investing

- Yes

- Automated Investing

- Yes

- Stocks, Fractional Shares, ETFs, Crypto

- Automated Investing

- No

Don’t Miss: Where To Invest Index Funds

How We Make Money

The offers that appear on this site are from companies that compensate us. This compensation may impact how and where products appear on this site, including, for example, the order in which they may appear within the listing categories. But this compensation does not influence the information we publish, or the reviews that you see on this site. We do not include the universe of companies or financial offers that may be available to you.

Documents Required For Opening Up A Trading Account App

- Address proof: Landline bill / Electricity bill / Bank statement / Ration card/ Passport / Voters ID

- Income Proof : last six months bank statement/ three months salary slips/Income tax return .

- Bank Proof: Canceled cheque/ bank passport/account statement.

- Registered lease or sale agreement / Driving license.

- One passport size photograph.

- Signature on a piece of paper.

Also Check: Where To Invest In Safemoon

How Do I Choose The Best Stock Trading App

Now that all stock apps offer $0 stock trades, we recommend comparing other features to choose the best stock trading app. The most widely used stock app features are watch lists, stock charts, and order tickets, so make sure those are great. To help readers, we include full screenshots of each stock trading app in our broker reviews.

Fun fact: Not all stock trading apps offer real-time streaming quotes. Instead, some apps only refresh stock quotes every few seconds or longer. Watch lists aside, apps like TD Ameritrade and TradeStation provide excellent stock chart tools and stock alerts functionality. Both brokers offer traders access to several hundred technical indicators in addition to endless customization options.

Can You Have Multiple Investment Apps

Theres no limit on how many investment apps you can use.

And given the growing, expansive range of investment offerings and niches, theres a chance multiple investment apps may be needed to fulfill your portfolio vision.

You may decide to test out a variety of options to ensure you find one or more platforms that align with your needs.

However, it can be challenging to efficiently manage your investing strategy with multiple apps, so typically fewer apps are better than many.

Don’t Miss: Commercial Real Estate Analysis And Investments

Why We Like Coinbase:

Coinbase was an early pioneer in the crypto space and now serves more than 103 million users worldwide. More than 150 different coins are available to trade on the platform, providing one of the most extensive marketplace options in the industry.

The app is user-friendly, so its easy to quickly find coins youre looking to trade and invest in. Educational prompts, though limited, encourage you to learn more about different types of coins and blockchain technology.

The fee structure relies on a variety of factors to determine the amount charged, including transaction fees based on the transaction amount. The platforms premier experience, Coinbase Pro, follows a more traditional tiered pricing structure depending on how much you have invested.

While its easy to get started on Coinbase, crypto continues to be a rapidly growing, volatile industry, still in its early stages.

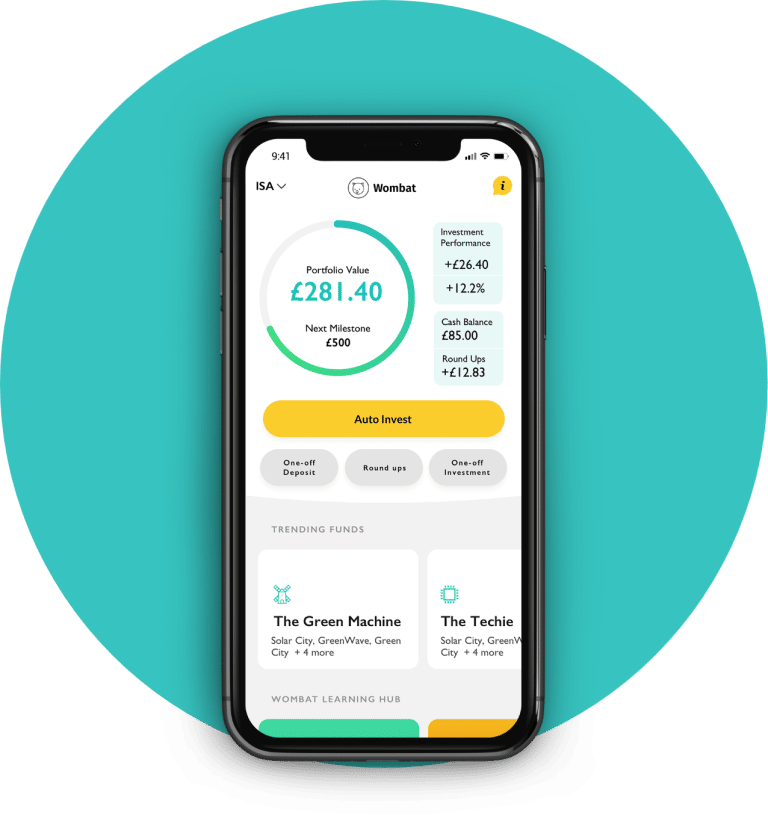

Build Your Portfolio And Track How It Performs

Invest on auto-pilot with recurring buys

Buy a little at a time on a regular basis so you can gradually increase the amount of stocks and bitcoin you own.

Make informed decisions with metrics and insights

Now you can access earnings data, news, key stats and much more to help you decide on whats worth buying or holding.

Set your target price with custom orders

You decide how much you want to buy or sell for. Then set custom orders that only go through if stocks or bitcoin reach those price ranges.

Stay up to date with investing notifications

Get notified when bitcoin or the stocks youre interested in experience price surges or dips.

Don’t Miss: Chase Investment Property Mortgage Rates

How Much Money Do I Need To Open An Investment App

Nearly all investment apps have no minimum balance requirements, letting you get started with just a few dollars. Keep an eye out for any requirements specific to apps youre interested in, though, because some may require higher opening balances or require you to buy whole shares of stocks or funds.

Publiccom: Best Investing App For Beginners To Avoid Pfof

- Available via desktop, Apple iOS and Android App on Google Play.

Public.com is a commission-free investment app for beginners that allows stock and ETF trades. The stock market app targets Millennials and Gen-Zers who have attuned their senses to social media and have interest investing in the stock market.

While the company previously followed the lead of apps like Robinhood with monetizing Payment for Order Flow , or receiving kickbacks from clearinghouses for routing trades to them, theyve recently abandoned this practice.

Instead, they now rely on other revenue streams as well as a tipping system.

This places this beginner investing app firmly on the side of retail investors and not pledging allegiance to Wall Street clearinghouses.

Why is Public.com the Best Investing App for Beginners to Avoid PFOF?

What Public.com is really about is making investing like an investing social network, where members can own fractional shares of stocks and ETFs, follow popular creators, and share ideas within a community of investors.

What Public.com aims to do above all else is make the stock market an inclusive and educational place, with social features that make it easy to collaborate as you build your confidence as an investorfor free.

For younger investors who want to align their investing with their social preferences, as well as keep good company to socialize and learn from others, Public.com might be the app for you.

Recommended Reading: Mortgage Rates For Investment Property Nj

What Are The Pros And Cons Of Using A Trading App

Pros:

- Can invest and check your portfolio on the go.

- No need for elaborate trading setups.

- Setting up trade alerts can allow you to react quickly when the market moves.

Cons:

- Charts and research are often hard to read on a smaller screen.

- Many apps have far fewer features than whats available on the brokers websites or desktop platforms.

- Connectivity can be an issue.