Can You Actually Make Money With Micro Investing Apps

Yes, you can, and everyday users often do.

Because micro-investing platforms invest pooled funds on your behalf into the same open markets e.g. stocks, bonds, and property- as conventional investors, your odds for profiting are the same as the mainstream players.

Further upside for micro investors as discussed earlier- is the fact their costs are substantially lower, and typically a flat rate, when compared to the fees and brokerage payable on traditional trading accounts.

Given an identical investment type, micro investors are therefore likely to be in the money before their mainstream counterparts.

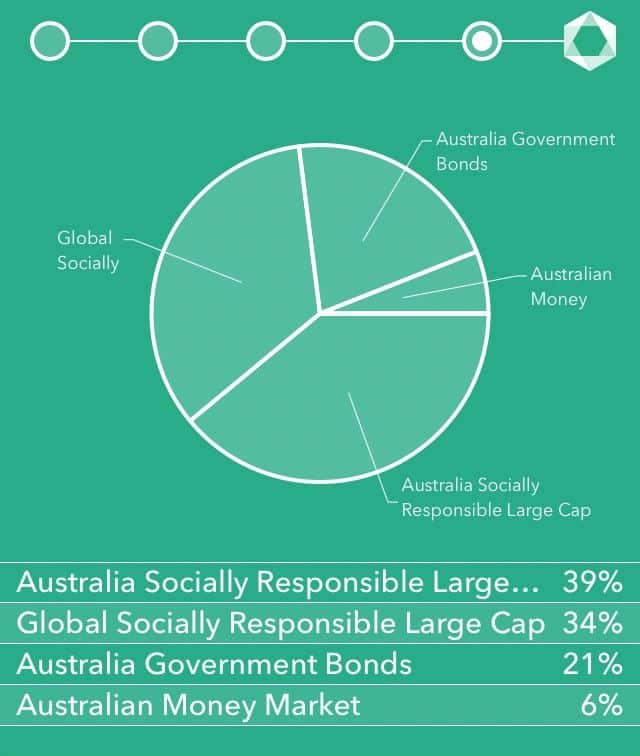

A real-life micro-investment experiment by Business Insider diversified across stocks and bonds- yielded 2.81% profit in 30 days, or 34.18% annualized.

While two other real-life experimental 3-month portfolios that we have observed, performed as follows:

- Portfolio1 profitable return on investment of 2.83% for the period

- Portfolio2 loss of 0.73% over the measured period

The potential net upside from micro-investment participation is clear from the examples quoted in the preceding paragraphs. However, portfolio profitability, or the lack thereof, is, of course, subject to prevailing market conditions during the investment period.

What About These Giant Ibuyers

How can regular people and small to medium-sized investors compete in this market against giant iBuyers and their hundreds of millions of dollars in buying power?

The awareness of this method of selling for homeowners that are coming out of all this marketing spend and PR is great for individual investors. They are doing the heavy lifting for you.

These iBuyers may be big, but they are slow-moving too, and they arent buying everything. They are still mostly concentrated in certain cities. They have very specific buying criteria. The latest statistics show that most buyers are turning down their offers.

This is a golden moment, where you can benefit from the buzz, most faster and make better offers and grab all the deals they are missing out on.

You may even ultimately find the big iBuyers some of your best customers for reselling your deals.

The Bottom Line: A Good Option For Tech Savvy Investors

Micro-flipping is a fast and convenient real estate investment, but it isnt for everyone. There are many alternatives out there for aspiring real estate investors, such as buying rental properties and fixing and flipping distressed houses.

If youre interested in financing an investment property and youre ready to get a mortgage, you can apply online now with Rocket Mortgage®.

See what youre eligible for.

Rocket Mortgage® uses information about your income, assets and credit to show you which mortgage options make sense for you.

You May Like: I Want To Invest In Mutual Funds

What Is Real Estate

Real estate is the land along with any permanent improvements attached to the land, whether natural or man-madeincluding water, trees, minerals, buildings, homes, fences, and bridges. Real estate is a form of real property. It differs from personal property, which are things not permanently attached to the land, such as vehicles, boats, jewelry, furniture, and farm equipment.

Disadvantages Of Micro Investing

Of course, micro investing also has its downsides. Here are some of the drawbacks:

-

They can lead to bad investing habits Most financial advisors recommend buying stocks and sticking with them for the medium or long term. Micro investing platforms make it easy to buy and sell on the fly, which is ultimately a losing strategy.

-

Fewer account options While youll be able to trade securities, thats about it. You wont be able to open an IRA or money market account, for example.

-

Fewer investment options Micro investing platforms dont always offer the full array of stocks and ETFs you can find on a traditional platform. Some offer ETFs exclusively, so you cant buy individual stocks.

Don’t Miss: Goldman Sachs Real Estate Investing

Best For Public Nontraded Reits: Realtymogul

RealtyMogul’s unique online platform enables investors to handle the entire commercial real estate investing process right from their RealtyMogul dashboard. With rigorously vetted property listings, expertly managed REITs, and a commitment to providing top-notch service and support to its members, RealtyMogul makes commercial real estate accessible to everyday investors.

RealtyMogul is online property investment platform that streamlines the commercial real estate investing process and provides investors with a wide range of opportunities and products to grow their portfolio. The innovative online platform is the first of its kind to make commercial real estate investing more accessible to regular investors. With a thorough due diligence process, a full range of investing products and services, and user-friendly platform make RealtyMogul one of the most unique fintech solutions on the market.

- More Detailssecurely through Realty Mogul’s websiteMore Details

Choose The Right Software

Technology is the most critical aspect of micro flipping. Without the right tools, you wont be able to identify properties to flip. Once youve planted the seeds of growing your buyer network, its time to determine what real estate software is right for you.

You can tap on your realtors shoulder to comb the MLS, and you can also comb for distressed properties in public records.

One of the easiest ways to find properties is to use a real estate investment software. There are plenty of products out there, and many offer free trials. Youll want to test some out and find a software product that works best for you. Some helpful features to look for include advanced search filters and the availability of property data.

Also Check: How To Open A Charles Schwab Investment Account

What Is A Business Plan

A business plan is a written document that describes in detail how a businessusually a startupdefines its objectives and how it is to go about achieving its goals. A business plan lays out a written road map for the firm from , financial, and operational standpoints. Business plans are important documents used for the external audience as well as the internal audience of the company. For instance, a business plan is used to attract investment before a company has established a proven track record or to secure lending. They are also a good way for companies executive teams to be on the same page about strategic action items and to keep themselves on target toward the set goals.

Making The Sales To Buyers

Typically, micro flippers already have existing buyers before they even make the purchase. This is, perhaps, the safest way to ensure a speedy turnover. If investors donât have any buyers in line, they will end up spending more with carrying costs than they want which is not part of their computations. This means they will have a smaller profit which goes against the very idea of getting into business in the first place.

For micro flippers to get the most out of the deal, they need to sell these undervalued properties fast. And having buyers already lined up for properties makes the process faster.

You May Like: Best Online Mortgage Lenders For Investment Property

How Does Micro Investing Work

Micro-investing can work in different ways. Some apps, like Robinhood, are designed for people who prefer a hands-on approach to investing. You can buy and sell particular stocks or ETFs at will and invest in any dollar amount.

Other apps, like Acorns, are designed for more hands-off investors. You choose what you want to invest in, and they take care of the rest. Your debit card is linked to the app, which rounds up each purchase to the nearest dollars and invests the change. For example, if you spent $4.50 on a cup of coffee, youd see a $5 charge. $4.50 would pay for the coffee, and Acorns would invest the other $0.50.

The First Important Question Is: Why Do Industries Go Through This Transformation Process What Is The Overall Purpose

- One common misconception is that fear is a major driver of transformation the fear of being disrupted, the fear of becoming obsolete, the fear of losing out. Whilst it is true that fear drives action in some instances, the true driver behind digital transformation is capitalism in its most simple form otherwise known as profit. Profit drives capitalism and, within regulatory and moral frameworks, a business must logically pursue profit at all cost and real estate can not stand outside this game although it can be considered as a business has been present for a long time and very stable since the human society was formed but not so that it stopped developing.

- In addition to the traditional word of mouth marketing, consumers are increasingly accessing real estate information via the Internet. Technology has a great impact on changing consumer behavior, promoting the application of technology in real estate. When customers behavior changes, real estate businesses need to grasp this trend in order to increase access to customers, thereby increasing profits.

Also Check: National Realty Investment Advisors Reviews

The Power Of Leverage

With the exception of REITs, investing in real estate gives an investor one tool that is not available to stock market investors: leverage. Leverage means to use debt to finance a larger purchase than you have the available cash for. If you want to buy a stock, you have to pay the full value of the stock at the time you place the buy orderunless you are buying on . And even then, the percentage you can borrow is still much less than with real estate, thanks to that magical financing method, the mortgage.

Most conventional mortgages require a 20% down payment. However, depending on where you live, you might find a mortgage that requires as little as 5%. This means that you can control the whole property and the equity it holds by only paying a fraction of the total value. Of course, the size of your mortgage affects the amount of ownership you actually have in the property, but you control it the minute the papers are signed.

This is what emboldens real estate flippers and landlords alike. They can take out a second mortgage on their homes and put down payments on two or three other properties. Whether they rent these out so that tenants pay the mortgage, or they wait for an opportunity to sell for a profit, they control these assets, despite having only paid for a small part of the total value.

Think About Investing In Rental Properties

Tiffany Alexy didnt intend to become a real estate investor when she bought her first rental property at age 21. Then a college senior in Raleigh, North Carolina, she planned to attend grad school locally and figured buying would be better than renting.

I went on Craigslist and found a four-bedroom, four-bathroom condo that was set up student-housing style. I bought it, lived in one bedroom and rented out the other three, Alexy says.

The setup covered all of her expenses and brought in an extra $100 per month in cash far from chump change for a grad student, and enough that Alexy caught the real estate bug.

Alexy entered the market using a strategy sometimes called house hacking, a term coined by BiggerPockets, an online resource for real estate investors. It essentially means youre occupying your investment property, either by renting out rooms, as Alexy did, or by renting out units in a multi-unit building. David Meyer, vice president of data and analytics at the site, says house hacking lets investors buy a property with up to four units and still qualify for a residential loan.

Of course, you can also buy and rent out an entire investment property. Find one with combined expenses lower than the amount you can charge in rent. And if you dont want to be the person who shows up with a toolbelt to fix a leak or even the person who calls that person youll also need to pay a property manager.

» Related: Understand different types of real estate investments

Recommended Reading: How To Begin An Investment Portfolio

What Is Micro Flipping

At first, you might think that micro flipping is some kind of fix-and-flip strategy, but its not. Its a type of wholesaling in which technology and data are used to find undervalued properties.

As soon as the investor identifies one or more undervalued properties, theyll purchase them, turn around, and sell them right away. The term micro describes just how quickly these transactions happen. In essence, its the day-trading of real estate.

Micro real estate investing is a volume-over-profit strategy. You should only expect to make a few thousand dollars from each deal, but you can make a lot of deals because they go so quickly. Although you can choose to make some minor cosmetic upgrades to the properties to make them more appealing to buyers, its not a requirement.

During this pandemic, you might see why micro flipping has risen quickly in popularity. Its a way to flip real estate, all from home with a click of a button. That is just one of the many benefits associated with micro flipping that has made it so popular.

Types Of Real Estate Investments

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

There are several types of real estate investments, but most fall into two categories: Physical real estate investments like land, residential and commercial properties, and other modes of investing that dont require owning physical property, such as REITs and crowdfunding platforms.

Investing in traditional, physical real estate can offer a high return, but it also requires more money upfront and it can have high ongoing costs. REITs and crowdfunding platforms have a lower financial barrier to entry, meaning you can invest in multiple types of real estate for far less than it would cost to invest in even one traditional property. These alternative real estate investments also offer the distinct advantage of not having to leave your house or put on pants to start investing.

If youre looking to invest in real estate, here are five types to consider:

Read Also: Second Home Loan Vs Investment Property

Invest In Real Estate By Flipping Properties

You donât have to buy rental properties to maximize your profit from real estate investing. Buying and flipping properties is a common strategy, although like rental properties, flipping takes lots of work. It means renovating homes and learning to identify up-and-coming neighborhoods that will let you sell your purchases at a premium.

If your home flipping strategy involves renovation and construction, it means taking on extra risk and high out-of-pocket costs. Long story short, itâs not as easy as it may look on HGTV. Youâll need building permits for renovations, and remodeling costs may run higher than you expect, especially if you hire contractors or outsource other work.

To minimize the amount of effort in flipping properties, look for homes that donât need major renovations in up-and-coming areas. This can be even more lucrative if you rent the property while waiting for home values to rise. Just remember, the neighborhood you think will become trendy might never catch on, leaving you with a property itâs hard to recoup your investment on.

Take On Multifamily Homes

If visions of apartment complexes or sprawling condo buildings come to mind when you think multifamily, think again. A modest duplex counts as a multifamily home, and any property with four units or fewer will offer ample flexibility while remaining manageable for an independent real estate investor.

Youll have several use options when investing in multifamily homes. You can live in one unit yourself and rent out the others you can allocate certain units for use as long-term rentals and offer others for short-term stays or you can simply commit to one rental strategy for every unit.

Recommended Reading: What Is Fixed Income Investment

Best For Instituional Real Estate: Cityvest

CityVest provides unique access to institutional real estate investment opportunities to accredited investors. Minimum investments start at just $25,000, compared to the typical six-figure investment usually required to access these types of deals.

CityVest is able to do this by pooling contributions from multiple investors into one bundle large enough to satisfy the minimum investment requirements of the top institutional real estate funds that are otherwise unavailable to individuals.

In addition, CityVest only works with institutional funds that have auditors and administrators. Each offering has a third-party due diligence report verifying the investment managers information to make the investment as safe as possible. Given CityVests pooled investment size of $5 million, they not only gain access to institutional private equity funds, but they also are able to negotiate better investment terms, usually in the form of a higher preferred return and a more attractive profit split.

- More Details

Must be accredited investing a minimum of $25,000.

How To Get Started With Real Estate Crowdfunding

If you want to start investing in real estate through crowdfunding, you will first need to select a crowdfunding platform to join, of which there are many. Each crowdfunding platform comes with different requirements and different areas of focus. One principal requirement that you need to consider when choosing from among the many crowdfunding platforms is the minimum investment amount. While some platforms come with a minimum investment amount of just $500, others require minimum investments of $100,000. The average is usually around $5,000.

Most of these platforms provide you with the ability to put your money into an equity investment or a debt investment. When making an equity investment, you will receive a direct stake in the property. Returns occur in the form of an equity share of the total rental income or profit if the project is sold. As for debt investments, you will be placing your investment directly into a loan. These loans are typically secured by the underlying real estate serving as collateral and will be repaid with interest on a monthly or quarterly basis, after which a percentage will be provided to each investor.

Don’t Miss: Navy Federal Investment Property Loan