Singapore Government Securities Bonds

SGS bonds are debt securities that pay a fixed interest rate. With maturities that range from two to 50 years, they are issued to develop the debt market.

There are three categories of SGS bonds SGS , SGS and Green SGS and each serve different functions. SGS is to develop the domestic debt market, SGS is to finance major, long-term infrastructure, and Green SGS is to finance major, long-term green infrastructure projects.

You can invest with just S$1,000 using cash, SRS or CPF funds. If you buy using cash, you will receive your interest in the bank account linked to your CDP account. If you buy using SRS or CPFIS funds, you will receive the interest in your SRS or CPFIS account.

At maturity, SGS bonds are redeemed at par value. Early redemption for SGS bonds is not allowed, but they can be sold or traded in the secondary market.

Which One To Invest In

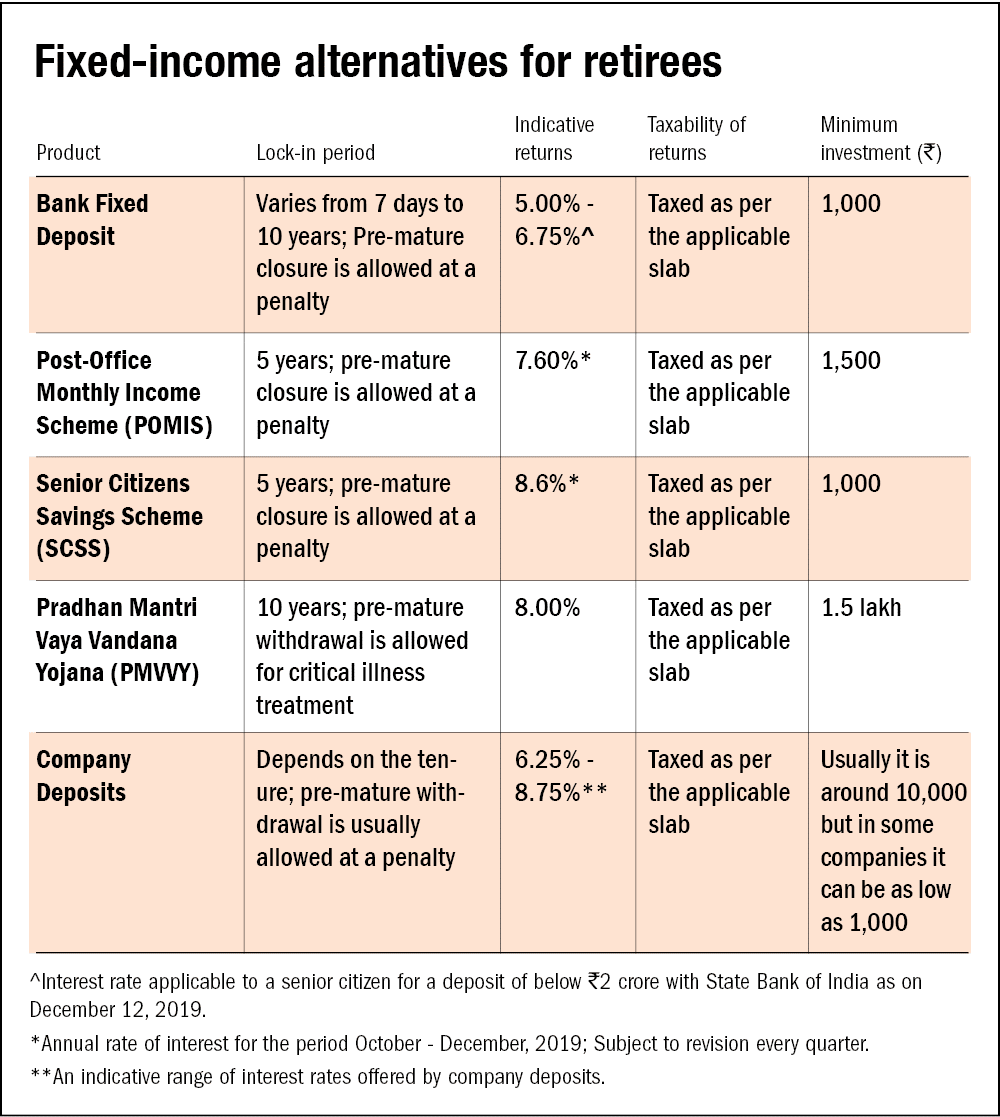

To decide what to invest in, the first thing to consider is your time horizon. The shorter the time horizon, the more you should avoid risky investments. For example, in such a case, an investment asset with a short tenure and steady returns such as T-bills and short-tenor fixed deposits would better serve your investment objectives.

Conversely, if youre looking for longer-term investments to reap higher returns, then SGS bonds and SSBs fit the bill.

The next thing to consider is the liquidity of the assets as they determine how easily you can access their capital if necessary and whether there are any risks in doing so. So before deciding what to invest in, be sure to look at your investment goals, plan out your timeline, and buy accordingly.

Ultimately, though, the returns from the abovementioned low-risk options are unlikely to keep up with the rate of inflation in Singapore these days, so investors hoping to grow their money may need to diversify their portfolios by including riskier assets like equities.

What Are The Benefits And Risks Of Mutual Funds

Mutual funds offer professional investment management and potential diversification. They also offer three ways to earn money:

- Dividend Payments. A fund may earn income from dividends on stock or interest on bonds. The fund then pays the shareholders nearly all the income, less expenses.

- Capital Gains Distributions. The price of the securities in a fund may increase. When a fund sells a security that has increased in price, the fund has a capital gain. At the end of the year, the fund distributes these capital gains, minus any capital losses, to investors.

- Increased NAV. If the market value of a funds portfolio increases, after deducting expenses, then the value of the fund and its shares increases. The higher NAV reflects the higher value of your investment.

All funds carry some level of risk. With mutual funds, you may lose some or all of the money you invest because the securities held by a fund can go down in value. Dividends or interest payments may also change as market conditions change.

A funds past performance is not as important as you might think because past performance does not predict future returns. But past performance can tell you how volatile or stable a fund has been over a period of time. The more volatile the fund, the higher the investment risk.

Also Check: North Oak Real Estate Investments

Treasury Notes Treasury Bills And Treasury Bonds

If you want to earn a slightly better interest rate than a savings account without a lot of additional risk, your first and best option is government bonds. Right now, treasurys are yielding 2.22% for a duration of one month, up to 2.93% for a duration of 30 years .

Bonds issued by the U.S. Treasury are backed by the full faith and credit of the U.S. government, which carries a lot of weight. Historically, the U.S. has always paid its debts. This makes government debt reliable and easier to buy and sell on secondary markets, if you need access to your cash before the debt is mature.

This stability, however, means bonds may have lower yields than you might earn from bonds where the debt was less likely to be paid back, as is the case with corporate bonds.

How To Buy And Sell Mutual Funds

Investors buy mutual fund shares from the fund itself or through a broker for the fund, rather than from other investors. The price that investors pay for the mutual fund is the funds per share net asset value plus any fees charged at the time of purchase, such as sales loads.

Mutual fund shares are redeemable, meaning investors can sell the shares back to the fund at any time. The fund usually must send you the payment within seven days.

Before buying shares in a mutual fund, read the prospectus carefully. The prospectus contains information about the mutual funds investment objectives, risks, performance, and expenses. See How to Read a Mutual Fund Prospectus Part 1, Part 2, and Part 3 to learn more about key information in a prospectus.

You May Like: Which Is The Best Blockchain To Invest

Next Steps To Consider

Past performance is no guarantee of future results.

Diversification and asset allocation do not ensure a profit or guarantee against loss.

Indexes are unmanaged. It is not possible to invest directly in an index.

Investing involves risk, including risk of loss.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Start Your Own Business

Starting your own business can be one of the most rewarding alternative investments. The important thing here is to do your homework and draft a business plan to see how much money youre going to need to get it off the ground.

A good business plan will also tell you how much you can expect to make over a three to five-year period. This can help you decide whether its worth pursuing or not.

Investing In Your Own Business:

- One of the most rewarding forms of alternative investing

- Draft a business plan to see how much capital you need

- Work on your income projections

- Has the potential to give you more flexibility

You May Like: Fidelity Traditional Ira Investment Options

Why Do People Buy Mutual Funds

Mutual funds are a popular choice among investors because they generally offer the following features:

- Professional Management. The fund managers do the research for you. They select the securities and monitor the performance.

- Diversification or Dont put all your eggs in one basket. Mutual funds typically invest in a range of companies and industries. This helps to lower your risk if one company fails.

- Affordability. Most mutual funds set a relatively low dollar amount for initial investment and subsequent purchases.

- Liquidity. Mutual fund investors can easily redeem their shares at any time, for the current net asset value plus any redemption fees.

Local & Small Businesses

When people think about investing in businesses, most people only think about publicly traded companies. Or they think about how their neighbors brothers friends roommate wants to open up a brew pub and is looking for investors. Those are typically risky operations because you have to invest a lot into a single entity.

What if you can support small businesses while making small investments in a variety of businesses? Thats where a platform like Mainvest comes into the picture you can invest in small businesses with as little as $100 and target returns from 10-25%.

When you make an investment, you participate in a revenue sharing agreement with the business. To qualify for the platform, businesses have to raise at least $10,000 from 10 people they know personally. This has helped lead to a 97% repayment rate pretty stellar.

If this interests you, our comprehensive Mainvest review has more.

Also Check: How Do I Invest In The Canadian Stock Market

Most Popular Alternative Investments

There are thousands of financial products and services out there, and we believe in helping you understand which is best for you, how it works, and will it actually help you achieve your financial goals. We’re proud of our content and guidance, and the information we provide is objective, independent, and free.

But we do have to make money to pay our team and keep this website running! Our partners compensate us. TheCollegeInvestor.com has an advertising relationship with some or all of the offers included on this page, which may impact how, where, and in what order products and services may appear. The College Investor does not include all companies or offers available in the marketplace. And our partners can never pay us to guarantee favorable reviews .

For more information and a complete list of our advertising partners, please check out our full Advertising Disclosure. TheCollegeInvestor.com strives to keep its information accurate and up to date. The information in our reviews could be different from what you find when visiting a financial institution, service provider or a specific product’s website. All products and services are presented without warranty.

Diversifying an investment portfolio means not putting all your investment dollars into the same asset.

Which Is The Least Risky Investment

The investment type that typically carries the least risk is a savings account. CDs, bonds, and money market accounts could be grouped in as the least risky investment types around. These financial instruments have minimal market exposure, which means they’re less affected by fluctuations than stocks or funds.

Read Also: Investment Firms In Los Angeles

How Can Alternative Investments Be Useful To Investors

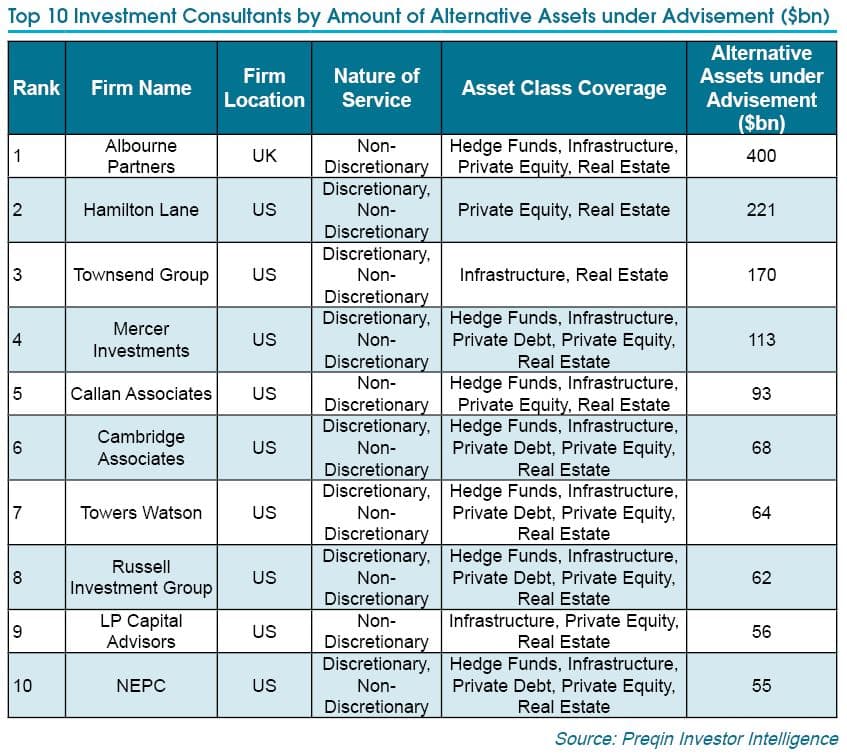

Some investors seek out alternative investments because they have a low correlation with the stock and bond markets, meaning that they maintain their values in a market downturn. Also, hard assets such as gold, oil, and real property are effective hedges against inflation. For these reasons, many large institutions such as pension funds and family offices seek to diversify some of their holdings in alternative investment vehicles.

Money Market Mutual Funds

Money market mutual funds invest in overnight commercial paper and other short-duration securities. Even the best money market funds typically offer next-to-no yield. Unlike Treasury products and corporate bonds, however, money market funds do offer investors absolute liquidity: They experience virtually no volatility, and you can pull your money out at any time.

Its also worth noting that many banks also offer money market mutual funds. If you dont have or dont want to set up a brokerage account, you still may be able to invest money market funds through your bank.

Don’t Miss: What Are Investment Mortgage Rates

A Means Of Improving Diversification

To understand the diversification benefits of alternatives within a portfolio context, we explored historical return correlations across asset classes between 2005 and 2021. While Treasuries were the only assets with a negative average correlation with the others, among the alternatives we studied, hedge fund strategies, private real estate, and late-stage venture capital had among the lowest average correlations with the other asset categories.

Past performance is no guarantee of future results

How Much Should You Invest In Alternatives

After reviewing some major details about alternative investments and reviewed some alternative options, you might still wonder, How much should I invest in alternatives? As with all things investing-related, the answer will depend on several different variables.

Alternative investments help to protect you against a market crash, have high potential returns, and many tend to have less volatility than some traditional investments.

Today, many investment opportunities that used to be reserved only for the very wealthy are available to people with more moderate amounts of money to invest.

If you want to diversify your portfolio and are considering alternative investments, decide carefully what the best option for you are. You may choose to try out a few investments for even more diversification. Just make sure never to invest more than you can afford.

Financial advice varies, but a common amount to consider for your overall portfolio is around 10%.

Finally, you should also remember that alternative investments comprises a very broad term. Many of these investments have little to no correlation with each other or with other traditional investments.

Following Asness advice, you want liquid alts which can provide positive, non-market correlated returns. Whichever allocation you feel accomplishes this amount for you successfully would be your suggested allocation to alternative investments.

Recent Posts

Don’t Miss: I Want To Invest 1000 In The Stock Market

How Can I Grow My Money

Let’s dive into the best tips to show you how to make your money grow!

Higher Potential Expected Returns

Given the long-term nature of many alternative investments, their illiquidity offers a premium investors expect in exchange for losing immediate access to their funds.

For the disciplined, long-term oriented investors, some alternative investments appear attractive simply because they offer higher expected returns which might not come from other investing strategies.

You May Like: Home Loan Investment Bank Customer Service

The Potential For Enhanced Returns

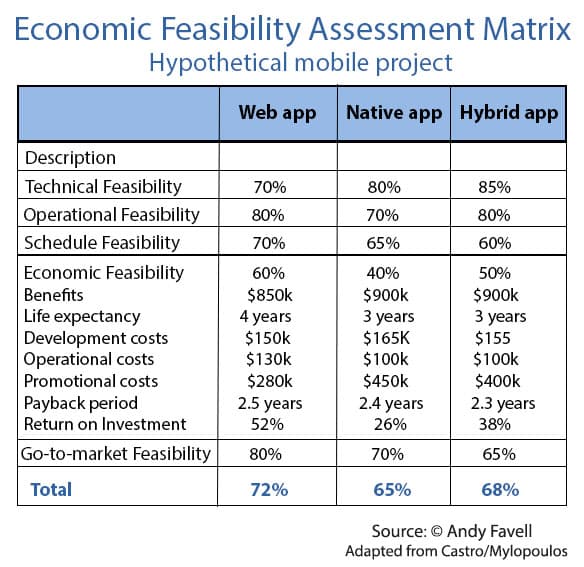

Our research indicated that private equity outperformed all other traditional and alternative asset categories over the period studied.

Past performance is no guarantee of future results

Based on our analysis beginning in 2005, the returns of private equity and private real estate were superior to all other traditional and alternative investment categories over the period studied. Importantly, private equity outperformed US small and large cap equities, illustrating the return premiums that investors expect when they sacrifice liquidity by owning private versus public equities.

Pros Of Alternative Investments

As mentioned briefly above, alternative investments carry a number of positive elements for why you should consider making them part of your overall strategy on how to build wealth.

Read below to see the primary reasons for including alternative investments in your portfolio and also keep in mind the various details related to each alternative investment differ. Therefore, not all of these elements will apply in each situation.

Read Also: How To Invest In Paxos

Blackrock Is Tomorrows Alternatives Platform

BlackRock can look beyond public markets and traditional investments to find solutions in real estate, infrastructure, private equity, , hedge funds and multi-alternatives. We seek to deliver outperformance with true partnership. BlackRock is well-equipped to meet your needs on this journey. We provide you:

What To Lookout For List At Least Four Investment Alternatives

There are some drawbacks to investing in gold IRAs. The main drawback is that the IRA cannot hold both platinum and palladium. Another limitation is that the IRA cannot hold bullion or silver in amounts higher than $100. Investors interested in these types of investments must diversify their portfolios so that they are invested in gold IRAs with smaller amounts of each metal. It would be impractical to attempt investing in more than one type of investment through a self directed IRA.

As gold has become more valuable, so has the demand for IRAs that hold precious metals. Because of this, the IRS has implemented several rules that restrict where precious metals can be deposited and taken out of the country. When considering your retirement planning objectives, this rule should be the first thing you look into.

When you take advantage of a self-directed gold IRA you do not have to pay taxes on the gains. You do have to pay taxes on your regular income from your job, however, since the gains are in your own funds you do not have to report them to the IRS. If you choose an IRA that allows for direct transfer of funds, you will have to pay taxes on the full amount of the transactions even if they take place outside of your retirement account. For example, if you sell a product you made in your home town to purchase a new one, you will need to report the full sale amount as income to your tax return.

Also Check: How To Become An Sec Registered Investment Advisor

Are Alternative Investments High

Not all alternative investments are high-risk but no investment is completely risk-free.

Property is an alternative investment that is not considered high risk, for example. The important thing to understand is your risk appetite and your risk tolerance. This can help you decide which alternative investment is best for you.

Some Alternative Investments Require A High Minimum Investment

As with all investments, certain minimums could apply. Mutual funds, target date funds, and other common types of investment vehicles often present hurdles in the form of minimum initial contributions before gaining access to investing in their funds.

While index funds on Robinhood or the best Robinhood alternatives do not require minimum investments , alternatives present different rules in some cases.

Some platforms present minimum investment thresholds before allowing you to invest in their asset, platform or service. Despite these hurdles, some of the alternatives addressed later in this article do not require a lot of money to start investing.

Options exist for everyone, but the more money you have, the more likely you are to have access to invest in more assets.

Read Also: Good Cheap Coins To Invest In

Investment Alternatives To Equities

In general, many investors are reactionary. They tend to pull out of investments after the bottom has dropped out of them, or buy into something that has already had a pretty good run.

These last six months are perfect example. Pre-election, many investors felt skittish and moved to cash with part or all of their portfolio. There was a bit of dip with the post-election low for the Dow showing on November 15th at 12,542. However, the market closed on February 21, 2013 at 13,880. The cash is flowing back into the markets, but is it too late?

The clichéd line is: âTime in the market, not timing the market.â While an obvious hedge against the equity market is fixed income, there are other ideas that help investors protect against the down-side of the market because of their non-correlation to equities.