High Stakes High Fees

BDCs have been around since 1980. Like real estate investment trusts , BDCs that qualify as registered investment companies dont have to pay corporate taxes as long as they distribute at least 90% of their taxable income to shareholders each year. Most were closed-end funds that trade on exchanges like the New York Stock Exchange . That changed around 2009 when interest in non-traded BDCs increased for the first time.

Industry statistics show that investors piled in more than $22 billion into non-traded BDCs since 2009.

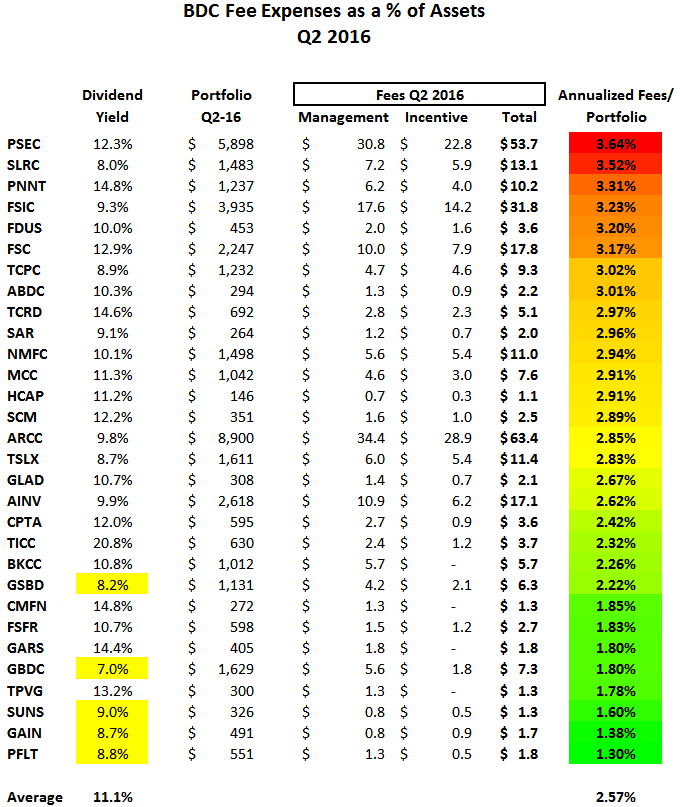

Part of what makes BDCs unique is the double-digit commissions commonly associated with this niche sector. Many investors pay their brokers a 10% commission while other BDCs are structured with a two and twenty fee structure, similar to hedge funds, whereby the BDC charges 2% annually on the total value of your assets in addition to a 20% fee on any profits. This means the returns have to be that much better than other investment opportunities to make them a smart choice.

Investors get a rare chance to invest in young, promising companies. BDCs traditionally promise higher-than-average interest income, which is why they often hold them in high regard. They generally return yields of at least 5%. That’s because they’re exposed to a great deal of credit risk and leverage. Yields on their underlying debt hovered around 7% to 10% between 2015 and 2017, according to investment analytics firm FactRight.

Business Development Companies: High Yields Big Risks

Recent statements from the Federal Reserve suggest that higher interest rates may soon be in the offingbut it could be some time before Treasury bonds and other traditional fixed income investments offer truly attractive yields. So what can income-hungry investors do now?

One potential solution is business development companies , which provide financing to fledgling or struggling companies that may be unable to obtain bank loans or raise capital elsewhere. Because BDCswhich trade like stocks but are managed like fundsinvest in higher-risk businesses, they can charge higher interest rates on their loans and, in turn, provide attractive yields for investors.

The tax structure of BDCs may also bolster yields. “BDCs can elect to be taxed as regulated investment companies, which means they’re exempt from corporate income tax so long as they distribute at least 90% of their profits, typically as dividends, to shareholders,” says Steven P. Greiner, Ph.D., managing director of Schwab Equity Ratings® at the Schwab Center for Financial Research. “The result is high-single-digit to low-double-digit yields that far outpace many traditional fixed income products and even some dividend stocks.”

As with other high-yield investments, however, BDCs should be approached with caution. “First and foremost, most BDCs are publicly traded companiesnot bondsand come with the same market risks as other equities,” Steven says. Beyond that, BDCs:

Investing In A Business Development Company Is A High

Looking for more ways to earn income from your investments while interest rates remain near zero ? Try investing in a business development company.

Business development companies are similar to venture capital funds, except that they are publicly traded on stock exchanges so that anyonenot just millionairescan enjoy the benefits of a BDC investment. They provide financing to small- and mid-sized companies that are often underserved by banks and other traditional lenders. Often this financing includes mezzanine loans that pay high interest rates and come with or can be converted into equity in the target company.

Also Check: How To Invest In Privately Held Companies

How To Invest In A Bdc

A business development company is a publicly traded firm with stocks trading on public exchanges, so you can purchase stocks through your broker.

Some BDC stocks are included in exchange-traded funds and mutual funds. For example, the VanEck BDC Income ETF is offered through many brokers and is available to retail investors.

Gov Kemp: German Robotics Company To Locate Headquarters Manufacturing In Cherokee County

Atlanta, GA Governor Brian P. Kemp today announced that Becker Robotic Equipment, a global cable and robotic machinery manufacturer specializing in individualized robotic equipment, will build a new manufacturing facility to house its North American headquarters in Canton. The new facility will deliver more than $30 million in investment and create 137 new jobs in Cherokee County.

“As the No. 1 state for business with a highly skilled workforce, reliable infrastructure, and strong trade network, Georgia continues to attract global companies like Becker to our ever-growing automotive industry,” said Governor Brian Kemp. “Last year alone, the automotive industry created more than 16,000 jobs for hardworking Georgians across the state, and we’ll continue to build on that momentum. We’re grateful for Becker’s decision to locate their North American headquarters in Georgia and look forward to their expanding impact on the Peach State.”

Headquartered in Dülmen, Germany, Becker was founded in 1993 with the aim of supplying accessories and integrated automated systems, mainly for the automotive industry.

“We are looking forward to continuing our work with Cherokee County and the City of Canton in Georgia to develop the Becker North America HQ in alignment with our global footprint to serve our customers and communities,” added Andries Broekhuijsen, Becker Robotic Equipment Global HQ in Germany.

Recommended Reading: Should I Create An Llc For My Investments

How Securities Trading Has Changed

Back when I was an institutional investment advisor we would conduct due diligence on stock managers, bond managers, hedge funds, and these would often involve visiting on-site to these asset management firms.

We would meet the people, we would take a tour of the office, look at desks, some messier than others. We would also visit the trading floor.

One of the things I noticed over the years as I made these on-site visits is the trading floor kept getting more and more cables, more electronics. Because previously, a trader at an asset management firm would call up the trading desk at one of the brokers that they worked with.

But more and more trading has moved away from traditional stock exchanges, where the trade hits the floor of the New York Stock Exchange, the order and their specialists on the floor coordinate the buying and selling of that underlying security.

Now, 40% of trades occur off-exchange, many of them using alternative trading systems that arent connected to a stock market at all. These trading systems match buyers and sellers electronically. Some even use artificial intelligence.

Many trades occur within the broker itself, where if a brokerage firm has a buyer and seller among its own clients, it might actually match those trades. Its called the internalization of order flow.

Many big institutional investors dont want others to know about their trades, particularly if theyre trading large blocks of stocks because others could front-run those trades.

Risks Associated With Non

Non-traded BDCs are even riskier than regular BDCs. These investments are only meant for sophisticated investors who can tolerate substantial risk. Non-traded BDCs offer loans to companies with especially bad credit. They do not trade on the public exchange, so if an investor wants to sell their share of a BDC, they may struggle to find a buyer. These investments are quite illiquid, meaning that you may not be able to access your investments until the company completes a liquidity event.

Non-traded BDCs may decide to limit redemptions, depending on the performance of their underlying securities. In 2016, a non-traded business development company changed its policy to only allow withdrawals twice a year rather than once a quarter. They also halted their redemptions, much to the chagrin of their shareholders.

Read Also: Online Investing And Trading Companies

Understanding Business Development Companies

The U.S. Congress created business development companies in 1980 to fuel job growth and assist emerging U.S. businesses in raising funds. BDCs are closely involved in mentoring and developing the companies in their portfolios because it is in a BDC’s best interest to help them become successful.

BDCs invest in private companies and small public firms that have low trading volumes or are in financial distress. They raise capital through initial public offerings or by issuing corporate bonds and equities or forms of hybrid investment instruments to investors.

The raised capital is then used to provide funding for the struggling companies. BDCs can use different financial instruments to provide capital, but in general, most issue loans or purchase stocks or convertible securities from the companies.

Here’s What You Need To Know About Business Development Companies

Among high-yielding stocks, business development companies are some of the most common income investments that few people understand. These companies can boost the yield earned from an income portfolio thanks to their outsize dividend yields, which frequently top 8% per year.

But before diving in head first, it’s important to understand the unique risks and rewards of investing in these stock market oddballs. Here’s a primer on how BDCs work, and how to analyze a BDC before investing in one.

Also Check: Should I Buy Investment Property Now

How Do Bdcs Work

Most business development companies choose to register as Regulated Investment Companies . RICs are regulated by the Investment Company Act of 1940. To qualify as an RIC, a firm has to meet specific income and diversification requirements.

First, they have to meet a 50% test, which says that more than 50% of their assets at the end of each quarter have to be in specific types of investments, including cash, government securities, or securities of other RICs.

RICs also have to meet a 25% diversification test, which says that no more than a quarter of their assets can be in securities from a single issuer or two issuers in the same trade.

In addition to the diversification requirements, investment companies also have to distribute at least 90% of their profits every year as dividends.

There are tax benefits for BDCs who meet the requirements of an RIC. As long as they distribute at least 90% of their profits, they dont have to pay corporate income taxes on those earnings. This perk is beneficial for investors, as it means the government isnt taking a cut of the profits before you get your share.

Another feature of BDCs is that they are closed-end companies. Closed-end companies offer a fixed number of shares at the time of their initial public offering . After that, they dont continue to sell shares. Instead, an investor would have to purchase them in a stock market exchange.

How To Invest In Business Development Companies

You can buy and sell BDCs just like you would a stock or exchange-traded fund . Each has its own unique ticker symbol, and you can purchase shares in a brokerage account or individual retirement account .

If youâre new to BDC investing, or simply want easy diversification, you may opt for an ETF that invests in many BDCs for you.

For instance, the VanEck Vectors BDC Income ETF , tracks some of the larger, better-known players in the BDC space, including Ares Capital , Main Street Capital and Prospect Capital . All are publicly traded companies with current dividend yields between 5% and north of 8%. BIZD delivers an 8.5% dividend yield as of late April 2021.

Don’t Miss: Invest In Us Stocks From India

Difference Between Venture Capital Funds And Bdcs

There is a distinction between venture capital funds and BDCs. While venture capital funds contain a limited number of investors who are usually accredited and high-ranking investors, BDCs are made up of unaccredited investors. BDCs serve as alternative capital funding to venture capital funds. Venture capital funds are often available to wealthy individuals while BDCs are accessible by small and medium-sized private and public firms that are struggling with finances. BDCs are also traded on major stock exchanges and are regulated.

Why Invest In Business Development Companies

What do former President George H.W. Bush, former Secretary of State James Baker, former British Minister John Major, and former-IBM Louis Gerstner all have in common?

All of these prominent and influential men, along with hosts of other recognizable names, have served as consultantsand/or investors in the Carlyle Group, an $83 billion based in Washington, D.C.

The Carlyle Group’s business is fairly simple: The company has close to 60 different private equity and under management, each with a different area of focus. Some assist management teams in leveraged deals to take their own companies private. Carlyle also lends , acquires , makes investments and provides consultation services to firms of all sizes.The firm has been enormously successful: According to a recent Washington Post article, the fund has provided investors an average annualized return of +26% net of fees over its existence. Let’s put that into perspective — a $10,000 over 21 years at a +26% annualized return would be worth nearly $1.3 million. There are few investments that can rival that return.

Unfortunately, the fund is all but closed to new investors. Unless you have an account the size of Abu Dhabi’s sovereign fund or the state of California’s pension fund, don’t hold your breath waiting to put money in a Carlyle fund.

Read Also: How To Invest In Africa Real Estate

Pennantpark Floating Rate Capital

Dividend Yield: 8.9%

Back in February, I explored a few high-yield plays that .

Remember: BDCs are lenders. To varying degrees, they can deal in loans with a floating-rate componentand the higher interest rates go, the higher the BDCs profits.

Enter PennantPark Floating Rate Capital .

PennantParks current portfolio is around 100 middle-market companies, scattered across 42 different industries. These firms include the likes of glass distributor American Insulated Glass, marketing service Phoenix Marketing International and veterinary hospital services provider Pathway Partners.

As the name implies, PFLT makes these investments almost entirely through floating-rate senior secured loans.

That exposure seemed like a blessing at the start of the year, when interest rates appeared poised to take off amid an unbridled economic recovery. But then they didnt. Rates turned tail, in fact, from 1.7% in March back down to 1.3% today, and PFLT has plain ol industry-matching performance to show for it.

The Advantages Of Investing In Bdcs

Its hard to overstate how valuable BDCs can be for income investors.

As you can see in the graph below, the three largest BDCs Ares Capital Corp , Owl Rock Capital Corp , and FS KKR Capital Corp each yield far more than the S& P 500. Ares yields over 10 times more.

BDCs also offer investors the chance to diversify their holdings with private equity, but theyre far more liquid than such assets usually are. Ares currently sees roughly 3.7 million shares change hands every day a higher volume than many popular stocks.

Ares also provides a shining example of another characteristic of many BDCs: their ability to outperform the major indexes during and after recessions. By investing heavily in tech startups in the years after the Great Recession, Ares set itself up to trounce the S& P 500 over the following decade…

But of course, the risky investments that can make BDCs so lucrative can also come with significant drawbacks…

Join Wealth Daily today for FREE. We’ll keep you on top of all the hottest investment ideas before they hit Wall Street. Become a member today, and get our latest free report: “How to Make Your Fortune in Stocks”It contains full details on why dividends are an amazing tool for growing your wealth.

Don’t Miss: Best Investment For 3000 Dollars

Business Development Company Taxes

As Regulated Investment Companies, BDCs arent considered taxable entities. Because of this favorable tax treatment, a BDC must distribute at least 90% of its taxable income to shareholders as ordinary dividends each year. Therefore, BDCs do not retain a lot of their earnings and are taxed at the shareholder level.

The Bdc’s Operating Structure

BDCs employ one of two basic operational structures. The vast majority of BDCs are externally managed, which means their investment portfolios are managed by an external company that makes investment decisions for the BDC and collects a fee for its services. A minority of BDCs are internally managed, and thus employees whom the BDC pays directly make the investment decisions.

- Ares Capital is an example of an externally managed BDC. It’s managed by an affiliate of Ares Management, which collects a fee equal to 1.5% of its assets each year, plus an incentive fee equal to 20% of its pre-incentive fee returns in excess of 7% each year.

- Main Street Capital is an example of an internally managed BDC. Its employees collect a cash salary directly from the BDC, plus stock-based compensation. The payroll expenses are taken directly off the income statement.

There are advantages and disadvantages with either model, and we could spend all day debating which is better for investors. Ultimately, though, the best operational structure is one that fairly distributes a company’s earnings power between insiders and outside shareholders.

Some other factors worth exploring:

Also Check: Personal Loan To Invest In Business

Business Development Company Pros And Cons

A BDC investment is a good hedge against raging market volatility. BDCs typically borrow funds at much lower interest rates than those paid by the smaller companies, so investors reap the rewards of the spreadalthough it does make a BDC investment fairly interest rate-sensitive.

On the bright side, business development companies can have very high yieldsfrequently in the double digitsbut those payouts often reflect the high risk of lending to speculative, development-stage companies. BDCs that make loans primarily to more mature businesses with positive cash flows will be safer, while BDCs that make more speculative loans to smaller businesses will be riskierbut they may also have more growth potential, especially if they take equity positions in a lot of their portfolio companies.

Looking at a business development companys filings should give you a sense of how risky or safe their loan portfolio is. Some BDCs mostly make higher quality loans that have a better chance of getting paid back, while others will make more speculative loans that have higher interest rates but also carry a greater chance of default. You can check the interest rates on the loans for a sense of the borrowers creditworthiness. If the BDC is able to charge higher interest rates than its peers, its probably making riskier investments.