Can You Make Money By Investing In Cryptocurrency

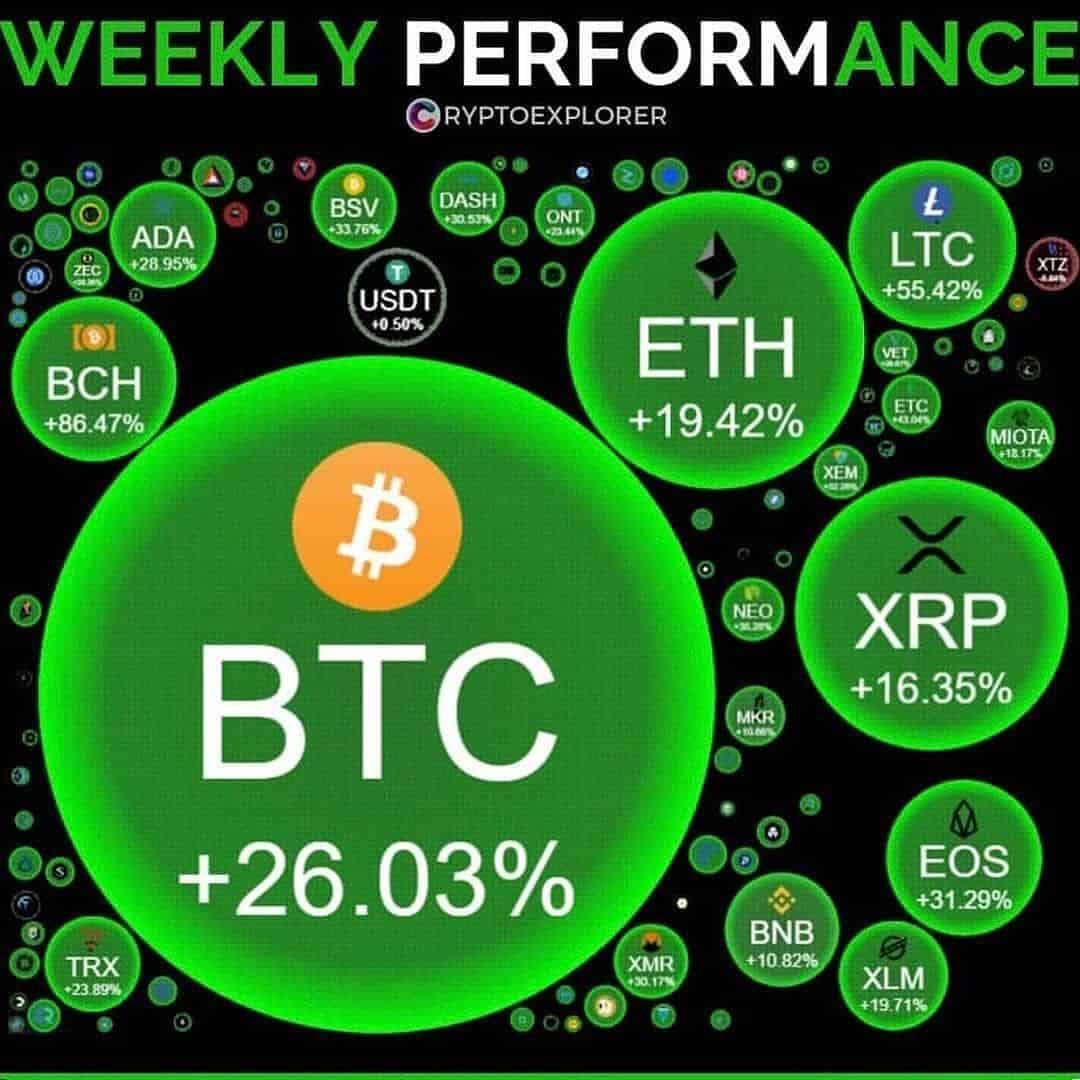

You can make a lot of money by investing in cryptocurrency. Early adopters saw Bitcoin rise from $0.0008 in 2010 to roughly $30,000. Mainstream cryptos like Bitcoin and Ethereum can still provide positive returns for investors, but investors seeking moonshot returns put their money into different cryptocurrencies. Altcoins are cryptocurrencies with smaller market caps that can significantly rally if they generate enough demand.

Some investors prefer to trade crypto to make a profit. Traders like volatility because it gives them more price fluctuations throughout the day. Bitcoins market price moves several percentage points on most days, giving traders ample opportunities to make a profit. This approach follows a buy low, sell high mentality. You can set stop-loss orders to limit your losses and limit orders to sell once a cryptocurrency hits a satisfactory price above your cost basis. Cost basis is the price you buy crypto. For example, if you purchased an asset at $100 and sold it at $102, you made a $2 profit on your $100 cost basis.

How To Create A Digital Currency Investment Portfolio

The important and basic principle of the correct distribution of assets in an investment portfolio is to diversify the assets. A cryptocurrency portfolio should have all the tools to earn money and reduce risk in the right proportions. Most of its components should contain popular cryptocurrencies with stable growth and demand among users. Experienced investors have used many optimal strategies to create a digital currency portfolio.

For an accurate and low-risk investment, you should pay attention to the following:

- 80% of the total investment should be made in coins with a fixed exchange rate and leading positions in the ranking of invested digital currencies.

- Allocation of 15% to new currencies with high liquidity and average price.

- Leave 5% for tokens of promising projects that are in the early stages of development and have a small fee.

As you know, as the investment risk increases in the future, its profitability also increases. For the riskiest investments in the portfolio, you can consider projects that can generate amazing income with minimal investment. In this case, assets should be divided according to the following principle:

- 60% invest in major cryptocurrencies.

- Allocation of 25% to popular markets with fixed exchange rates and growth prospects.

- 15% for investing in tokens

Define The Investment Strategy

The first step that we must carry out before starting to invest in the virtual currency market will be to define the investment strategy that we will use when analyzing the type of return and investment that we want.

We must define if we are looking for an investment with high returns and high levels of volatility or on the contrary if we want to make an investment with stable returns and low levels of volatility.

After having defined the risk level of the investment, we must define the type of investment that we want to make in relation to the time of return or profit.

We can understand that the investments could be carried out with a view to a return in the long term or on the contrary in the short term.

Don’t Miss: Best App For Investing In Penny Stocks

Differences Between The Stock Markets And Crypto Markets

- Owing to its old age, the stock market is more stable and less volatile. The crypto market, on the other hand, is accustomed to wild price swings. It is pretty normal to see double-digit percentage swings in a matter of hours.

- . Age is a significant factor in trading. The stock market has been around for a long time, while the crypto market is only about a decade old. This means that market value and trade volume in the former is much larger compared to the latter. The younger age also contributes to the wild volatility experienced in the crypto market.

- . In the stock market, you invest in the publicly listed company shares by buying their stocks. In the crypto market, you invest in the idea, the technology, or the currency , but not the company behind the currency.

- Regulations. Since the stock market has been around for ages, regulators have had enough time to develop and implement rules and regulations governing the markets conduct. This contributes to the minimal volatility we highlighted earlier. In the cryptocurrency market, this is not the case. The regulators are still grappling with understanding the emerging asset class, and this lack of regulations are part of the reason for the markets wild nature.

From Robinhood To Sofi Invest Coinbase To Gemini To Etoro Here Are Some Of The Ways To Invest In Crypto And Advice On Whether You Should Dive In

Its been a hot year for cryptocurrencies, and 2021 isnt even halfway over. The total value of cryptocurrencies briefly surpassed $2.5 trillion in May as a plethora of new investors jumped in, and now approximately 14% of American adults own cryptocurrencies.

Cryptocurrencies are digital assets that are exchanged online on exchanges like Coinbase and Gemini or via online brokers like Robinhood and SoFi Invest. Cryptocurrencies are hardly new. Bitcoin, the first and largest cryptocurrency by market capitalization, was created in 2009 and has been followed by more than 7,700 others. You may have also heard of ethereum, tether, or even dogecoin, which began as a joke and now sits among the 10 largest cryptocurrencies.

While some people are investing purely to speculate, others look at cryptos as a way to store value or hedge against inflation. Heres how to invest in crypto now, whether you should get into it, and what to know before you do.

How to invest in cryptocurrencies

While investing in cryptocurrencies has gone mainstream, its not an option at many traditional online brokers yet. Here are a few brokers that allow you to directly hold cryptocurrencies alongside other assets like stocks and bonds, but fees vary and its key to do your homework:

TD Ameritrade, Interactive Brokers, and Charles Schwab offer bitcoin futures trading.

Prepare for risk and volatility

Consider risk-reward dynamics

Also see:9 mortgage mistakes too many Americans make

You May Like: Investing In Your First Rental Property

How To Invest In Cryptocurrency In 3 Steps

If youve decided that youre willing to take a risk on crypto, you might be asking yourself, How do I invest in cryptocurrency?Every cryptocurrency is a little bit different, but assuming you want to purchase for-profit, lets cover the steps for how to start cryptocurrency investing for currencies like Bitcoin and Litecoin:

Choose a cryptocurrency exchange

Store your cryptocurrency in a wallet

Create And Verify Your Account

Once you decide on a cryptocurrency broker or exchange, you can sign up to open an account. Depending on the platform and the amount you plan to buy, you may have to verify your identity. This is an essential step to prevent fraud and meet federal regulatory requirements.

You may not be able to buy or sell cryptocurrency until you complete the verification process. The platform may ask you to submit a copy of your drivers license or passport, and you may even be asked to upload a selfie to prove your appearance matches the documents you submit.

Don’t Miss: Why Is It Important To Invest At An Early Age

Investing In Digital Currency 5 Factors To Consider

by TradingStrategyGuides | Last updated Mar 22, 2021 | Advanced Training, All Strategies, Cryptocurrency Strategies |

To understand how investing in digital currency works, you also need to be clever in understanding the fundamentals of digital currency. Like fiat money, cryptocurrencies are mediums of exchange, units of measurements and last but not least, a store of value.

The value of fiat money is mostly determined by how sound the central banks monetary policy is and inflationary pressures. When it comes to buying digital cryptocurrency, investors should educate themselves with the laws that govern the blockchain technology and how these tokens are created.

Generally, all the information you need can be found in the white papers of each individual project.

So, before learning how to invest in cyber currency, you need to understand the top 5 fundamentals of a digital asset.

Many people demonstrate a fundamental lack of understanding about the way cryptocurrencies work.

Moving forward, were going to show you how to invest in cyber currency.

How To Choose The Right Cryptocurrency To Invest In

Its easy to jump on any bandwagon just because someone said it was a worthy investment. However, it would behoove you to conduct your own research. When you buy cryptocurrency, know that it holds zero intrinsic value. Instead, it represents ownership of a digital asset. Its price is simply determined by public perception of its value, so you need to believe in the value of the cryptocurrency you choose to invest in. How do you develop these beliefs? By conducting your own research. Put in the work by reading white papers and come to an understanding of which cryptocurrencies may increase in value in the future before making an investment decision.

Read Also: Etrade Cash Available For Investment

Important Factors Of Choosing A Digital Currency For Investing

To choose a cryptocurrency to invest in, several factors are considered. The first factor is the history and age of digital currency. Of course, emerging digital currencies may have a good position one day, but we cannot recommend investing in them anytime soon. Another factor is the performance of the digital currency development team against problems, which somehow guarantees its stability in the future. During the lifetime of digital currencies, there are many ups and downs. Paying attention to how the people responsible behind them have dealt with these problems, along with checking the price stability of that digital currency, can make us more confident about its future.

Another factor is technical and technological. Many digital currencies are actually tokens for a specific project, so as long as the technology used in a project is advanced and secure, a bright future can be imagined for that cryptocurrency. Acceptability of cryptocurrencies is another factor in this choice.

Risks of investing in cryptocurrency

Some Tips Before Investing In Digital Currency:

The field of digital currencies is new. A very large percentage of the community still does not properly understand what Cryptocurrency is and how it works. Most of these people think digital currencies are a profitable investment, but the point is that many of these people invest their wealth in digital currencies without really knowing what they are doing. So before investing in this field you must be prepared to accept what youll get.

Recommended Reading: Start Investing With 50 Dollars

Why Has Bitcoin Dropped

The price of bitcoin and several other leading cryptocurrencies have been on a downward trajectory in 2022.

Rising inflation and interest rates have caused cryptocurrency to fall along with stocks and shares as investors dial down the level of risk they are taking on.

In June, the price of bitcoin fell below $20,000 and has remained around that level since then, according to data from Coinbase*. Thats a long way from the all-time high of $69,000 seen in November.

The recent turmoil has been caused by:

- Uncertainty around rising interest rates in the US and UK, causing a sell-off in risky assets

- A cost of living crisis caused by rising inflation means that investors have less disposable income to spend on buying bitcoin and other cryptocurrencies

- China making cryptocurrency transactions illegal

- Suggestions that Russia could ban cryptocurrency trading and mining, causing prices to plummet

- There have also been threats of further regulation for cryptocurrency investments in the future

We go into more detail about the causes of the crypto crash.

How To Invest In Cryptocurrencies: The Ultimate Beginners Guide

Cryptocurrencies are seeing a massive surge in popularity. While they used to attract a very niche audience just a few years ago, today, everyone and their grandmother wants to learn how to invest. You probably cant avoid seeing a news article about the latest Bitcoin price or stumbling upon investment advice on social media.

And the growth is not even close to being over. The global cryptocurrency market was valued at 332 million US dollars in 2017, has risen to 3.67 billion in 2020, and is projected to reach 394.60 billion by 2028 .

So what does this all mean? Should you get involved? How do you get started investing in cryptocurrencies?

If youre looking to get a better understanding of what cryptocurrencies are, how they work, and how to invest in cryptocurrency, then this guide to trading cryptocurrency is for you. Read on to find out how it works, what your options are, and the best and safest way to invest in digital currency.

While the decision to invest in cryptocurrency is ultimately up to you, it is our hope that youll walk away from this guide feeling more educated, empowered, and confident that you have everything you need to start investing.

Contents

Read Also: American Enterprise Investment Services Inc Website

Investing In Virtual Currency Has Produced Jaw

It is possible to get filthy rich by investing in cryptocurrency — but it is also very possible that you lose all of your money. Investing in crypto assets is risky, but can be a good investment if you do it properly and as part of a diversified portfolio.

Cryptocurrency is a good investment if you want to gain direct exposure to the demand for digital currency. A safer but potentially less lucrative alternative is buying the stocks of companies with exposure to cryptocurrency.

Let’s examine the pros and cons of investing in cryptocurrency.

Advantages Of Investing In Cryptocurrency

Investing in cryptocurrency is popular because it provides several advantages, such as diversification, return potential, and utility. Investors like to diversify portfolio as a way to spread risk, but also to increase the odds of striking gold. Crypto is a popular option for diversification because it has offered strong returns, as especially the number of crypto uses and applications increase. Finally, its an investment that you can actually use. Investors can use crypto to pay for goods and services, for example.

Read Also: Best Place To Invest Online

Which Of The Bitcoin Gold And Dollar Assets Are Better To Invest In In 2022

Finally, one of the greatest cryptocurrencies to invest in 2022 is Bitcoin. If we pay attention to the above information and the fact that digital currencies have a lot of room for improvement, we will realize that in 2022 or even several years after that, it is beneficial to invest in Bitcoin and other digital currencies. So carefully analyze the profit of Bitcoin with gold and dollars. Considering all the points presented in the above material, it can be said that this method of investment is a smart method of investment.

Crypto investors

How To Start Investing In Digital Currency

Brown states that by the time 5G reaches mass adoption worldwide when as much as 250 million devices will be acquired, the odd company might see its revenue reach $3. 5 billion or more. Jeff declares, as the creator of Brownstone research, that in the new economy there will be 5 stocks that will soar.

Editor, Exponential Tech Financier & the Near Future Report.

Jeff Brown and his team at The Future Report launched a brand-new report discussing billionaires buying a new pattern. Jeff Brown declares Warren Buffett, Jeff Bezos, and Elon Musk are “putting cash” into a prospective $30 trillion market yet normal investors are unaware of this market. What’s the story with Jeff Brown’s new research report? Should you sign up for The Future Report to learn more? Learn everything you require to understand about this new trend and how it works today in our evaluation.

Read Also: Ways I Can Invest My Money

Cryptocurrency What Is It All About

The term cryptocurrency comes from an alliance of the terms encrypting and currency. Cryptocurrencies are currencies built using blockchain technology. Crypto uses highly developed and highly complex mathematics to secure the currency by ensuring that no one else can access it. Crypto also secures the user’s identity. It does it so successfully that, to this point, no one ever figured out the identity of the person who invented the first cryptocurrency.

Choose Where You Want To Invest

Once you’re ready to buy your first cryptocurrency, you’ll need to decide whether you want to use a centralized or decentralized exchange.

For-profit companies create centralized exchanges that can be simple to use but come with fees that can eat into the value of your coins and may be vulnerable to hackers. These companies, like Crypto.com, Coinbase and Gemini, make it easy to create an account and invest in any cryptocurrency that the platform supports in your area.

Alternatively, you can create a cryptocurrency wallet you control, add funds and buy crypto with it. You can then connect the wallet to a decentralized exchangepopular options include Curve, Sushiswap and Uniswapto buy others.

In either case, you may be able to add funds with a bank transfer, debit card or credit card. The fees for depositing money and each trade can depend on the platform, funding source and how much you’re trading.

In general, a centralized exchange is the safest and easiest way to start. The company will hold the cryptocurrency for you and can help you reset your password if you forget it. They may also have insurance or guarantees that can help keep your money safe from hacks. But using a centralized exchange means you don’t have total control over your cryptocurrency, which can be a downside.

Also Check: Chuck Hughes Investment Software Systems Inc