Venture Capital Investment Returns

A venture capital investment pays off when the new company being funded is successful enough to return the initial investment plus interest and the equity grows in value. Occasionally, a venture capitalist hits a home run and the resulting returns make up for a lot of losses.

The risks of investing in venture-backed companies are much greater than investing in public companies. For that reason, VC funds need to outperform the public stock markets. Also, the management fees are significant and the investors money is tied up and illiquid for longer holding periods. And, because of the failure rate of new businesses, losses can be substantial.

The National Bureau of Economic Research says the average return on a venture capital investment is 25 percent, and most venture capitalists expect to receive at least that and much more. A 2020 working paper by the bureau reported that half of all VC funds outperformed the stock market, which has made VC investing more attractive. But given the run-up in the stock market, the edge enjoyed by VCs has shrunk.

Operating A Venture Capital Fund

Venture capital investments are considered either seed capital, early-stage capital, or expansion-stage financing depending on the maturity of the business at the time of the investment. However, regardless of the investment stage, all venture capital funds operate in much the same way.

Like all pooled investment funds, venture capital funds must raise money from outside investors prior to making any investments of their own. A prospectus is given to potential investors of the fund who then commit money to that fund. All potential investors who make a commitment are called by the fund’s operators and individual investment amounts are finalized.

From there, the venture capital fund seeks private equity investments that have the potential of generating large positive returns for its investors. This normally means the fund’s manager or managers review hundreds of business plans in search of potentially high-growth companies. The fund managers make investment decisions based on the prospectus’ mandates and the expectations of the fund’s investors. After an investment is made, the fund charges an annual management fee, usually around 2% of assets under management , but some funds may not charge a fee except as a percentage of returns earned. The management fees help pay for the salaries and expenses of the general partner. Sometimes, fees for large funds may only be charged on invested capital or decline after a certain number of years.

Determining The Structure Of The Fund

Before getting into the types of entities involved, it is important to understand the timing. Most VC funds will require LPs to provide capital funds for a period of five years, followed by another five-year period where funds are harvested. In some cases, funds will include a clause allowing for the extension of this harvest period by a few years, in an effort to achieve higher returns.

When forming a new VC fund, one must first determine the type of entity it will be. This is usually based on the type and the number of investors.

You May Like: How To Invest In Currency Exchange

How Do Venture Capital Funds Help Startups

Venture capital plays an important role in a companyâs success.

According to HBR, more than 80% of the money invested by venture capitalists goes into building infrastructure required to grow the businessâin expense investments and the balance sheet .

In addition to capital, many venture fund managers provide guidance to portfolio companies.

In fact, many VC firms build reputations for helping portfolio companies with recruitment, customer acquisition, access to follow-on funding, and advice on other challenges startups encounter.

What Is The Proper Structure For Me

The first decision to make is how to approach the VC landscape. While all forms of VC investing are passive , as an investor, the structure of how you invest in VC will often be determined by how much involvement you want in the portfolio construction and your comfort level in selecting these investments.

- If you are new to VC, it might make sense to invest in a fund-of-funds, which will provide broad diversification across many funds. In this structure, the fund-of-funds manager selects several underlying VC funds, and investors get exposure to all of the underlying companies that each fund manager invests in. That said – the downside of fund-of-funds is that investors often are paying fees to both the VC fund partners and the fund-of-funds management.

- Investing in single funds is a more concentrated but still diversified approach. In this structure, you invest with a manager with a specific strategy at a particular point in time, and they invest in several companies based on their prescribed strategy. While you wonât get as much diversification as you would with a fund-of-funds, most managers invest in at least 15 companies .

- Lastly, if you have the access and the experience , you could invest directly into a single VC-backed company either directly or through a co-investment agreement.

Each has benefits and drawbacks, but each does represent an efficient way to add VC to your investment portfolio.

Recommended Reading: How Can I Invest In An Index Fund

Why Invest In Venture Capital

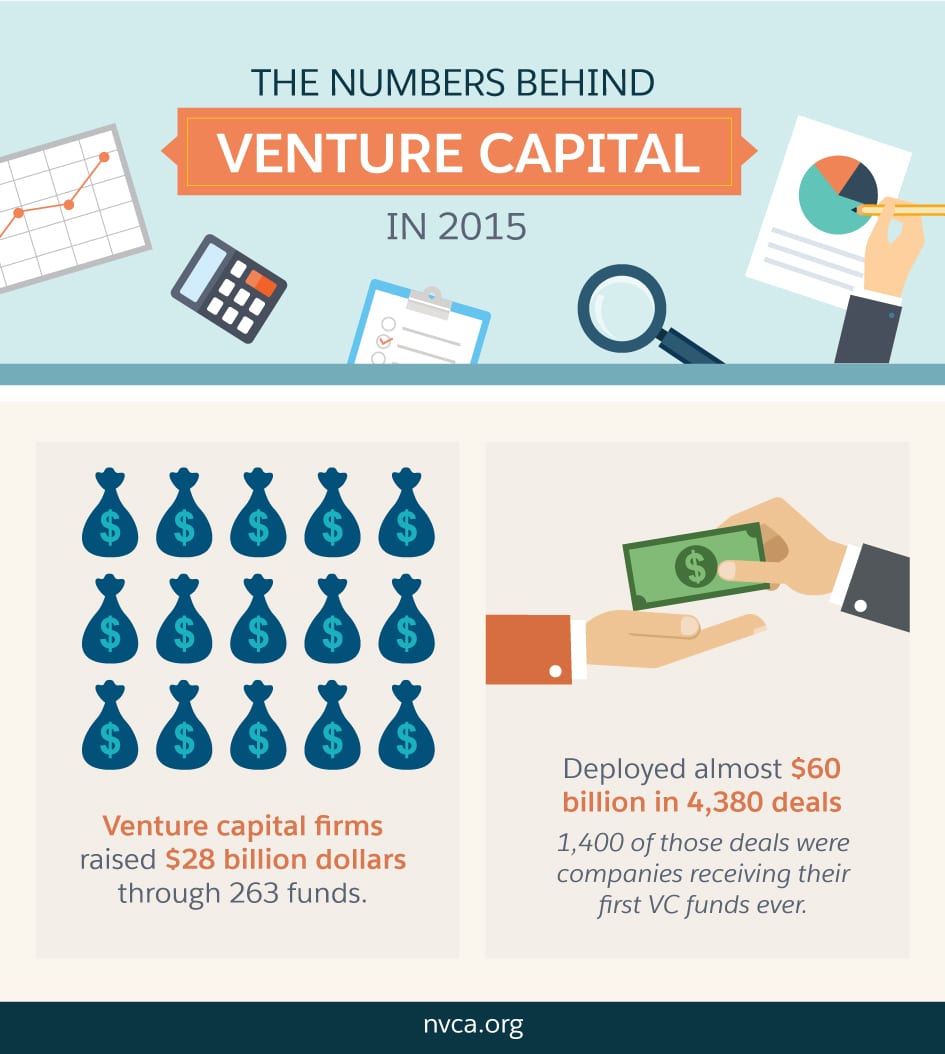

According to Pitchbook.com, $156.2 billion was invested into U.S. startups in 2020, a 13% increase from 2019. There are many reasons why investors are attracted to the venture capital industry.

As with many investments, the higher the risk, the higher the reward. This rings true when it comes to venture capital. Although many VC-backed companies fail, finding a “unicorn” a private startup company valued at $1 billion or more within your portfolio can more than make up for the others.

The earlier the stage of investment, the higher the risk and return. The Corporate Finance Institute, an online financial education and certification provider, reports that successful seed investments can return 100 times or more while later-stage VC investments generally return about 10 times.

In addition to the potential financial reward, investing in private companies augments portfolio diversification by including an asset class that has a different risk-return profile from traditional stocks and bonds.

Many investors also enjoy the excitement that comes with being involved in an early-stage startup: Often these companies are working to disrupt a particular industry and provide innovative products and services and playing a part in that evolution can be appealing.

Feeswe Believe Our Single 275% Management Fee Is More Cost

- Distribution And/Or Service Fees0.65%

- Other Expenses0.82%

Before investing you should carefully consider the funds investment objectives, risks, charges and expenses. This and other information is in the prospectus, a copy of which may be obtained here. Please read the prospectus carefully before you invest.

Read Also: Best Investments For Children’s Savings

More Uk Investors Plan To Invest In Venture Capital Offerings In 202: Report

By JD Alois

More UK investors are planning to invest in venture capital offerings in 2023, according to research by Digital Horizon. It is important to note the survey polled LP types last month iE home offices, asset managers, and other institutional money.

Digital Horizon states that 56% of UK investors who invest in VC intend to boost their allocation, with 1/5 planning to do so significantly.

As we all know, markets are stumbling along including private markets but as valuations decline, optimism for the future appears to be on the rise for startups and early-stage firms.

Three-in-five or 62% of those surveyed say they will increase their average VC investment cheque size next year, with 54% of respondents saying it would be mostly early-stage. A further 18% said it would be multi-stage.

35% of respondents plan to invest in the UK next year, second only to North America at 44%, which is described as a vote of confidence for the UK. Additionally, 30% are eyeing 2023 investment opportunities in the MENA region. Over a quarter intend to dedicate funds to Latin America and Europe stands at 27%. 23% say they will invest in Asia, and 14% plan to invest in Israel.

So what is stopping the VC investing market? Pretty much obvious.

- Rising interest rates and inflation

- Changes in tech companies valuations

- The Governments economic and political approach

- Weak growth forecasts

- Geopolitical turmoil

How Much Can You Earn As An Investor

It depends on several factors, but the biggest determinant is the valuation of the company or its market value.

In the example we shared earlier about an Uber VC investor, he turned his $300k investment to almost $2 billion by owning just 2.5% of the company.

And even while these types of wins are once in a blue moon, it proves that the earnings you can get are basically limitless, it all depends on how valuable the company has become.

So to answer this questiontheres basically no limit. And its common to get returns by the hundreds of thousands to several million pesos .

Read Also: Best Investment Accounts For Young Investors

What Is Venture Capital Investing

Venture capital investing is putting money into early stage companies or startup companies that show potential for long-term growth. The people who make these investments are known as venture capitalists . Venture capital investments are made when a venture capitalist buys shares of such a company and becomes a financial partner in the business.

VC investing is a subset of private equity, a form of business financing that takes place away from the glare of the publicly traded financial markets. Private equity investors raise pools of capital from limited partners. When theyve achieved their fundraising goal, they close the fund and use their money to buy an entire company or a controlling interest. Private equity is all around us: PetSmart, Ancestry.com and Arbys are among the well-known companies back by private equity.

Although venture capital is a form of private equity, they have significant differences. Private equity typically buys mature companies, while venture capital is given to younger businesses that are earlier in their growth curve. And whereas private equity takes a controlling interest in a company, venture capitalists typically hedge their bets by investing in a number of companies so that if one goes belly up, they havent lost everything.

So, what makes a venture capitalist, and how does that differ from an angel investor?

Vc Is The En Vogue Asset Class

From humble beginnings, the venture capital industry has evolved into one of the most significant, and certainly best-known, asset classes within the private equity space. Venture-backed startups have redefined entire concepts of industry, with some of the trailblazers usurping the traditional oil and banking giants to become the most valuable companies on earth. The venture capitalists backing them have also taken their spot in the limelight, with the likes of Marc Andreessen, Fred Wilson, and Bill Gurley gaining recognition far beyond the confines of Sand Hill Road. You could compare this cult of personality to that of corporate raider era of the 1980s, when Michael Milken et al catalyzed the start of the LBO and junk-bond boom.

Partly as a result of this, the venture capital space has seen an influx of participants and professionals. First-time fund managers continue to raise new VC funds at healthy clips, and the once clear lines separating venture capital from private equity, growth equity, and other private asset classes have begun to blur. Corporates have also shifted into the space, creating venture arms and participating in startup funding at ever increasing levels. And perhaps the greatest sign of the times, celebrities are increasingly throwing their hats into the startup-investment ring. As John McDuling puts it,

Read Also: Morgan Stanley Investment Banking Careers

Don’t Miss: Best Way To Borrow Money For Investment Property

What You Need To Have

If youre still interested in becoming a venture capitalist, youre one brave soul. But the list of what you need to know doesnt end there. You also need to know that experience is imperative. Without experience and a strong reputation, you wont be able to compete against other firms.

Can you answer “yes” to these questions?

- Do you have an MBA? A little over 50% of VCs do. If you do, did it come from Harvard University or Stanford University? A large portion of VCs with MBAs graduated from one of those schools.

- Do you have experience working for a reputable firm in technology, consulting, investment banking, media, or a startup?

- Do you have a strong social media presence? This is especially important with LinkedIn, where a large majority of venture capitalists have a presence.

- Do you have expertise in a certain technology? Do you understand this technology better than anyone? Will people go to you for answers when they have questions about this technology?

- Do you keep up with the top VC blogs and technology news sites?

- Do you have a successful investment history?

- Do you plan on working with a partner? If so, you better like that person, because you will likely spend more time with your business partner than you would with a significant other. Will you be able to agree on financial decisions with that person?

What Makes A Good Esg Investment

The most important factor in deciding how to raise capital is the impact it will have on your startup.

By looking at the ESG impact of each potential investor, you can make sure that they are committed to the same goals as you are. If a certain investor doesnt have the same goals or interests as your startup, youll have to find another investor who fits.

ESG VCs can help companies incorporate ESG factors throughout the companys early phases, embedding these performance into the culture and operating procedures as the business grows. By doing so, VCs can help companies avoid a future crisis by helping them prepare for it.

Many VC-backed companies rely on innovative, disruptive technology and business models, which often play in an unregulated sector. New regulation is likely to be introduced to control the dangers and consequences associated with these new technologies and innovations, so preparing for it is crucial. There is, therefore, value in being able to ESG properly.

ESG-oriented investors can play a pivotal role in the vision creation for startups and sharpening their missions and strategies to embrace proactively environmental and social initiatives.

Also Check: Private Banking Vs Investment Banking

What You Need To Know

Not all venture capital firms are successful. Choosing the right investments is a difficult task and 90% of startups fail. The likelihood that all of the investments that your venture capital firm chooses will be a success is small.

In 2020, the venture capital industry did well, despite the pandemic. The industry raised a new record high almost $130 billion. The total value of investments is up from 2019 but the total number of deals is down, meaning that investment capital is higher per deal.

That being said, venture capital faces competition from other capital-raising methods, such as crowdfunding. In 2019, VC funding deals were still higher in volume than crowdfunding but the annual number of deals per platform for crowdfunding was higher than the number of VC investments per firm.

Another potential negative, which depends on your personality, is that you will have to say “no” more than 99% of the time. Are you okay with crushing peoples dreams and aspirations? If so, then perhaps you stand a chance. But you also better like meetings, because the vast majority of your time will be spent in them, followed by networking at conferences and events and to a lesser extent, research. Sixty-hour work weeks are the norm.

How Esg Venture Capital Funds Work

ESG venture capital funds are essentially pools of investors, with Environmental, Social and Governance considerations, who pool money together to make investments in startups with a social mission.

ESG venture capitals indeed have a unique possibility to invest in and develop the solutions required to tackle the worlds biggest problems such as the gender gap and economic inequality.

You can think of them like a collection of angel investors all working together to make investments that, ideally, add up to a whole lot more than what any single investor could make on their own of course within the ESG themes at the forefront of investment conversations include net zero, climate change, and diversity and inclusion .

Top ESG venture capital funds investment criteria are usually some combination of the following factors:

- The impact of the businesss work

- How can the proposed idea improve the world?

- The quality of the teamin terms of experience, skills and trustworthiness

- The attractiveness of the idea and whether there there is a market for it, and is it likely to be successful

Don’t Miss: Where Can You Find Investment Information Online

How Do You Choose A Broker

Transparency Regulation

Risk Disclosure: Trading financial instruments, stocks, derivatives and other negotiable securities carries high risks, including the risk of losing some or all of your investment and may not be suitable for all investors. Prices are extremely volatile and can be affected by external factors such as financial, regulatory or political events.

Before deciding to trade financial instruments, derivative shares and other negotiable securities, be fully aware of the risks and costs associated with trading on the markets. Consider your investment goals, experience level and risk appetite and seek professional advice where needed.

Undertake SRL wishes to remind you that the data contained on this website is not necessarily real-time or accurate.

Undertake SRL and the provider of the data contained in this any website will not take any responsibility for any time wasters or damages resulting from trading or relying on the information contained on this website.

Undertake SRL may be compensated by advertisers appearing on the website, based on your interaction with the advertisers or advertisers.